What is Borrowing Cost? A Complete Guide on Ind AS 23

- Blog|Account & Audit|

- 9 Min Read

- By Taxmann

- |

- Last Updated on 8 July, 2022

Table of Content

4. Recognition of borrowing costs

5. Borrowing Costs Eligible for Capitalisation

6. Commencement of capitalization – Conditions

7. Suspension of capitalization

8. Cessation of capitalization

9. Accounting of borrowing costs

11. Convergence with IAS/IFRSs (Compansion with IAS 23)

13. Ind AS Transition Facilitation Group (ITFG) Clarification

13.1 Processing charges amortised upto capitalisation date to form part of the asset cost

Check out Taxmann's Illustrated Guide to Indian Accounting Standards (Ind AS) which provides a comprehensive commentary on Ind AS as amended by the Companies (Indian Accounting Standards) (Amendment) Rules 2021 & thorough analysis of amended Schedule III of the Companies Act 2013. It features process flow diagrams of major Ind ASs, charts, illustrations, and case studies, along with the definitions and application guidance to help the reader understand and comprehend the nuances of each Ind AS in its simplest form.

1. Core principle

Borrowing costs that are directly attributable to the acquisition, construction or production of a qualifying asset form part of the cost of that asset. Other borrowing costs are recognised as an expense.

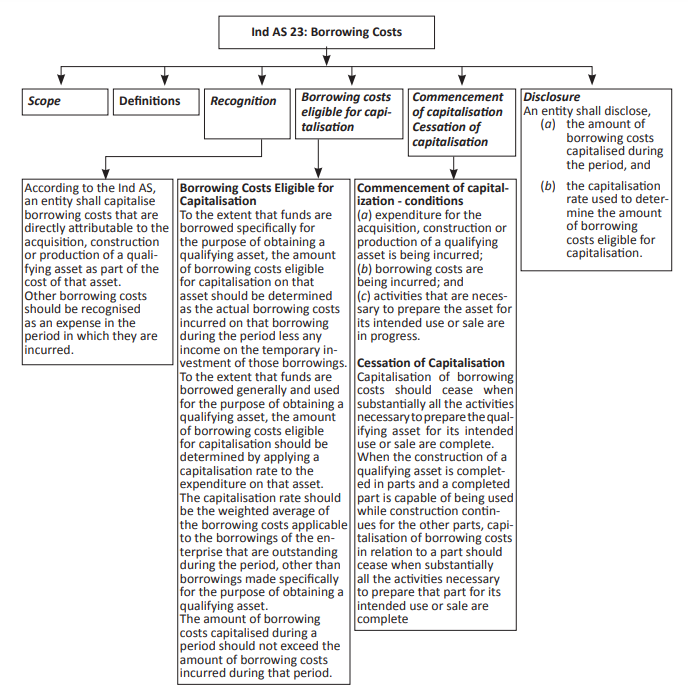

2. Scope

An entity shall apply this Standard in accounting for borrowing costs

The Standard does not deal with the actual or imputed cost of equity, including preferred capital not classified as a liability.

An entity is not required to apply the Standard to borrowing costs directly attributable to the acquisition, construction or production of:

(a) a qualifying asset measured at fair value, for example, a biological asset with in the scope of Ind AS 41, Agriculture or

(b) inventories that are manufactured, or otherwise produced, in large quantities on a repetitive basis.

3. Definitions

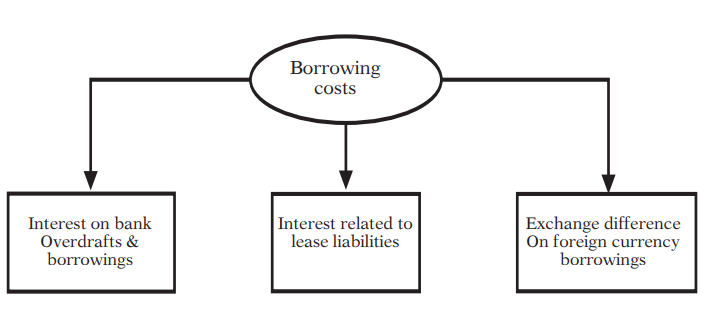

Borrowing costs are interest and other costs incurred by an enterprise in connection with the borrowing of funds. (para 5)

Borrowing costs may include:

-

- interest expense calculated using the effective interest method as described in Ind AS 109, Financial Instruments,

- interest in respect of lease liabilities recognised in accordance with Ind AS 116, leases, and

- exchange difference arising from foreign currency borrowings to the extent that they are regarded as an adjustment to interest costs

Details of borrowing costs are explained in the chart below.

Ind AS 23 : Borrowing costs

Borrowing costs include

-

-

- interest on bank overdrafts and borrowings

- interest related to lease liabilities

- exchange difference on foreign currency borrowings as adjustment to interest costs

-

A qualifying asset is an asset that takes substantial period of time to get ready for its intended use or sale.

Depending on the circumstances, any of the following may be qualifying assets:

(a) inventories

(b) manufacturing plants

(c) power generation facilities

(d) intangible assets

(e) investment properties

(f) bearer plants.

Financial assets, and inventories that are manufactured, or otherwise produced, over a short period of time, are not qualifying assets. Assets that are ready for their intended use or sale when acquired are not qualifying assets.

According to para 6A, with regard to exchange difference required to be treated as borrowing costs, the manner of arriving at the adjustments stated therein shall be as under:

(I) the adjustment should be of an amount which is equivalent to the extent to which the exchange loss does not exceed the difference between the cost of borrowing in functional currency when compared to the cost of borrowing in a foreign currency

(II) where there is an unrealised exchange loss which is treated as an adjustment to interest and subsequently there is a realised or unrealised gain in respect of the settlement or translation of the same borrowing, the gain to the extent of the loss previously recognised as an adjustment should also be recognised as an adjustment to interest.

4. Recognition of borrowing costs

According to para 8, an entity shall capitalise borrowing costs that are directly attributable to the acquisition, construction or production of a qualifying asset as part of the cost of that asset.

Other borrowing costs should be recognised as an expense in the period in which they are incurred.

5. Borrowing Costs Eligible for Capitalisation

To the extent that funds are borrowed specifically for the purpose of obtaining a qualifying asset, the amount of borrowing costs eligible for capitalisation on that asset should be determined as the actual borrowing costs incurred on that borrowing during the period less any income on the temporary investment of those borrowings.

To the extent that an entity borrows funds generally and uses them for the purpose of obtaining a qualifying asset, the entity shall determine the amount of borrowing costs eligible for capitalisation by applying a capitalisation rate to the expenditures on that asset.

The capitalisation rate shall be the weighted average of the borrowing costs applicable to all borrowings of the entity that are outstanding during the period. However, an entity shall exclude from this calculation borrowing costs applicable to borrowings made specifically for the purpose of obtaining a qualifying asset until substantially all the activities necessary to prepare that asset for its intended use or sale are complete.

The amount of borrowing costs that an entity capitalises during a period shall not exceed the amount of borrowing costs it incurred during that period.

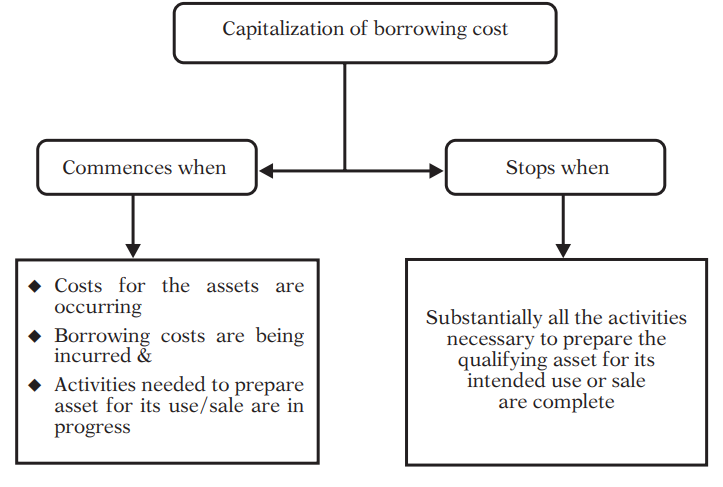

6. Commencement of capitalization – Conditions

An entity shall begin capitalising borrowing costs as part of the cost of a qualifying asset on the commencement date. The commencement date for capitalisation is the date when the entity first meets all of the following conditions:

(a) it incurs expenditures for the asset;

(b) it incurs borrowing costs; and

(c) it undertakes activities that are necessary to prepare the asset for its intended use or sale.

7. Suspension of capitalization

Capitalisation of borrowing costs should be suspended during extended periods in which active development is interrupted.

An entity may incur borrowing costs during an extended period in which it suspends the activities necessary to prepare an asset for its intended use or sale. Such costs are costs of holding partially completed assets and do not qualify for capitalisation. However, an entity does not normally suspend capitalising borrowing costs during a period when it carries out substantial technical and administrative work.

An entity also does not suspend capitalising borrowing costs when a temporary delay is a necessary part of the process of getting an asset ready for its intended use or sale.

For example, capitalisation continues during the extended period that high water levels delay construction of a bridge, if such high water levels are common during the construction period in the geographical region involved.

8. Cessation of capitalization

Capitalisation of borrowing costs should cease when substantially all the activities necessary to prepare the qualifying asset for its intended use or sale are complete.

When the construction of a qualifying asset is completed in parts and a completed part is capable of being used while construction continues for the other parts, capitalisation of borrowing costs in relation to a part should cease when substantially all the activities necessary to prepare that part for its intended use or sale are complete.

A business park comprising several buildings, each of which can be used individually, is an example of a qualifying asset for which each part is capable of being usable while construction continues on other parts.

An example of a qualifying asset that needs to be complete before any part can be used is an industrial plant involving several processes which are carried out in sequence at different parts of the plant within the same site, such as a steel mill.

The process of capitalization of borrowing cost is explained in the chart below.

9. Accounting of borrowing costs

Borrowing costs defined as interest and other costs incurred by an entity in connection with the borrowing of funds. Ind AS 23 allows two methods of accounting borrowing costs:

(a) Borrowing costs should be recognized as expense in the period it is incurred or

(b) Borrowing costs directly attributable to acquisition, construction or production of a qualifying asset can be capitalized when

-

-

- it is probable that they will result in future economic benefits of the entity and

- the costs can be measured reliably (effective interest rate method as per-Ind AS 109)

-

10. Disclosure

According to para 26, an entity shall disclose,

(a) the amount of borrowing costs capitalised during the period, and

(b) the capitalisation rate used to determine the amount of borrowing costs eligible for capitalisation.

11. Convergence with IAS/IFRSs (Compansion with IAS 23)

IAS 23 provides no guidance as to how the adjustment prescribed in paragraph 6(e) is to be determined. Paragraph 6A is added in Ind AS 23 to provide the guidance as under:

(i) the adjustment should be of an amount which is equivalent to the extent to which the exchange loss does not exceed the difference between the cost of borrowing in functional currency when compared to the cost of borrowing in a foreign currency.

(ii) where there is an unrealised exchange loss which is treated as an adjustment to interest and subsequently there is a realised or unrealised gain in respect of the settlement or translation of the same borrowing, the gain to the extent of the loss previously recognised as an adjustment should also be recognised as an adjustment to interest.

12. Case studies

- W is constructing a stadium. As on 31 October 20X7 the Construction of the stadium is completed to large extent. The Ticket booking office and the doors of the stadium are the only remaining parts to be completed. The auditor of W insists that capitalization of borrowing costs should be stopped at 31 October 20X7.

Required:

As an accountant give your opinion on this issue.

Solution:

The stadium cannot be used unless the Ticket booking office and the doors of the stadium are completed. We cannot say that it is substantially ready for its intended use. Thereof, capitalization of borrowing costs need not be stopped, according to the provisions of Ind AS 23 until these final areas are completed.

- Z Ltd has a building under construction being financed with ` 8 mil of debt, ` 6 mil of which is a construction loan directly on the building. The rest is financed by the general debt of the company. Z Ltd would the building when it is completed. The debt structure of the firm is as under:

| ` ’000 | |

| Construction loan @ 11% | 6000 |

| Long term debenture @ 9% | 9000 |

| Long term subordinated debenture @ 10% | 3000 |

The debentures and subordinated debentures were issued at the same time.

Determine:

(a) interest payable during the year

(b) the capitalized interest cost to be recorded as an asset on the balance sheet

(c) amount of interest expense to be reported on the income statement

Solution

Calculation of interest payable during the year

= 0.11 × (` 6000000) + 0.09 × (` 9000000) + 0.10 × (` 3000000) = ` 1770000

Capitalised interest cost to be recorded as an asset on the balance sheet will be:

-

- Effective interest rate on debentures and subordinated debentures

(9000000/12000000) × 9% + (3000000/12000000) × 10% = 9.25% - Effective interest rate on construction loan = 11%

- Capitalised interest rate would be

⇒ = (` 6000000×0.11) + (` 2000000×0.925)= ` 660000 + ` 185000= ` 845000Amount of interest expense to be reported in Income statement := ` 1770000 – ` 845000= ` 925000

- Effective interest rate on debentures and subordinated debentures

13. Ind AS Transition Facilitation Group (ITFG) Clarification

13.1 Processing charges amortised upto capitalisation date to form part of the asset cost

Query

A company, say B Ltd. has borrowed loan specifically for the purpose of construction of its factory building. B Ltd. has incurred processing charges to borrow the said loan. As per the management of the Company, construction of the building will take more than 2 years. So, the factory building is a qualifying asset.

Whether B Ltd. should capitalise entire processing charges or only that portion which will be amortised up to the period of capitalisation of building costs?

Answer

As per para 1 of Ind AS 23, Borrowing Costs, borrowing costs that are directly attributable to the acquisition, construction or production of a qualifying asset form part of the cost of that asset. Other borrowing costs are recognised as an expense. Borrowing costs may include interest expenses calculated using the effective interest method as described in Ind AS 109, Financial Instrument.

Appendix A of Ind AS 109 defines effective interest rate as the rate at which the present value of estimated future cash payments through the expected life of financial liability equals to the amortised cost of the liability. The calculation of the effective interest rate includes all fees paid that are integral part of the effective interest rate of a financial instrument. So, an entity needs to identify such type of fees.

Para B5.4.1 of Ind AS 109 provides that fees that are an integral part of the effective interest rate of a financial instrument are treated as an adjustment to the calculation of effective interest rate, unless the instrument is measured at fair value through profit & loss. Further, as per para B5. 4.2 of Ind AS 109 such type of fees include origination fees paid on issuing financial liabilities measured at amortised cost. These fees are an integral part of borrowing loan or other financial liability.

In accordance with the above provisions, in the given case processing charges should be treated as an integral part of effective interest rate and shall be included while calculating the same. Thus, only that portion of the processing charges should form part of the cost of building which will be amortised up to the period of capitalisation of building costs.

Relevant extracts

Para B5.4.1 of Ind AS 109: In applying the effective interest method, an entity identifies fees that are an integral part of the effective interest rate of a financial instrument. The description of fees for financial services may not be indicative of the nature and substance of the services provided. Fees that are an integral part of the effective interest rate of a financial instrument are treated as an adjustment to the effective interest rate, unless the financial instrument is measured at fair value, with the change in fair value being recognised in profit or loss. In those cases, the fees are recognised as revenue or expense when the instrument is initially recognised.

Para B5.4.2 of Ind AS 109: Fees that are an integral part of the effective interest rate of a financial instrument include:

(c) Origination fees paid on issuing financial liabilities measured at amortised cost. These fees are an integral part of generating an involvement with a financial liability. An entity distinguishes fees and costs that are an integral part of the effective interest rate for the financial liability from origination fees and transaction costs relating to the right to provide services, such as investment management services.

Reference

-

- Issue 1 of Ind AS Transition Facilitation Group Clarification Bulletin 14.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA