Vivad Se Vishwas Scheme 2024 (VsV 2.0) – Advantages | Relevant Provisions | Applicability

- Blog|Income Tax|

- 8 Min Read

- By Taxmann

- |

- Last Updated on 15 January, 2025

The Vivad Se Vishwas (VsV) 2.0 Scheme is an initiative introduced by the Indian government under the Finance Act, 2024 to resolve pending direct tax disputes. This scheme provides taxpayers and tax authorities with a structured mechanism to settle disputes amicably and avoid prolonged litigation. The VsV 2.0 Scheme is a continuation of the government’s efforts to foster a taxpayer-friendly environment by resolving disputes in a transparent and efficient manner while encouraging compliance and trust.

By CA. Sailee Gujarathi – Partner | Vipin Gujarathi and Associates

Table of Contents

- Vivad Pe Vishwas?

- Attempts in the Recent Past

- Advantages of VsV

- Relevant Provisions

- VsV 2.0 – Applicability

- Amount Payable Under the Scheme

- Disputed Tax

- VsV 2.0 Ineligible Disputes/Persons

- Procedural Aspects

- Refunds

- Other Matters

- TDS Issues

- Client Interactions on VsV – Practical Considerations

- Cases Suitable for VsV 2.0

1. Vivad Pe Vishwas?

Aata dal ka bhaav toh sabko pata hai, par dispute ka kya?

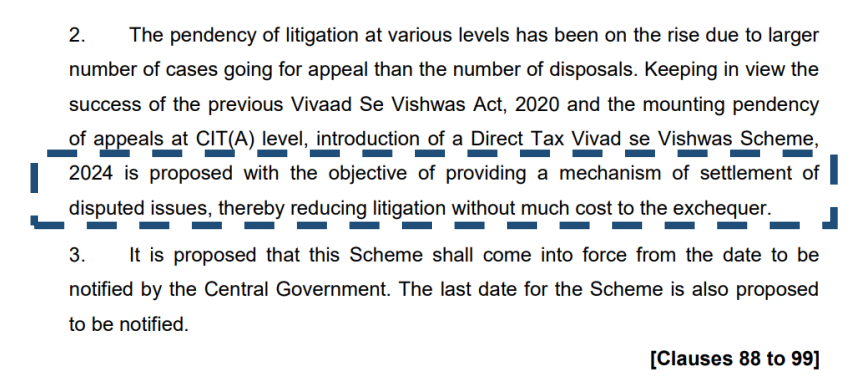

Memorandum to Finance Bill, 2024

2. Attempts in the Recent Past

- Revenue involved – ~INR 10.5 lakhs crores

- No. of cases involved – ~6 lakhs

- Reduction in scrutiny cases

- Increasing monetary threshold for appeal filing

-

- 2016: Direct Tax Dispute Resolution Scheme 2016

- 2019: Sabka Vishwas (Legacy Dispute Resolution) Scheme -2019 Applicable only for the Indirect Taxes dispute under pre-GST era

- 2020: The Direct Tax Vivad se Vishwas Act – 2020

- 2024: The Direct Tax Vivad se Vishwas Scheme -2024

3. Advantages of VsV

- Immunity from proceedings

- Not conceding the tax position

- Dispute withdrawal

- Conclusive

- Another Opportunity

4. Relevant Provisions

- Finance (No. 2) Act, 2024

- Direct Tax Vivad se Vishwas Rules, 2024 Notification 104/2024

- CBDT Circular 12 of 2024 (15 October 2024)

- CBDT Circular 19 of 2024 (16 December 2024)

5. VsV 2.0 – Applicability

- Appeal or writ or special leave petition filed either by appellant or income tax authority or by both before any appellate forum viz Commissioner (Appeals) or Income Tax Appellate Tribunal or High Court or Supreme Court, and such appeal is pending as on 22 July 2024, or;

- Objections have been filed before the Dispute Resolution Panel (“DRP”) and no directions have been received on or before 22 July 2024, or;

- DRP has issued directions under Section 144C(5) of the Act, but the Assessing Officer (“AO”) has not completed the assessment as on 22 July 2024, or;

- Application for revision has been filed and is pending before the Commissioner of Income-Tax as on 22 July 2024

- Also covers disputes relating to Tax Deducted as Source (“TDS”) and Tax Collected at Source (“TCS”)

VSV 2.0 Applicability Scenarios

- Appeal was pending on 22 July 2024, got disposed before filing of declaration

- Appeal not filed, but timeline to file appeal is pending on 22 July 2024

- Selective grounds of appeal

- Multiple Appeals for Same Year

- Appeal filed before 22 July 2024 along with condonation of delay

- Additional ground of appeal filed before 22 July 2024

6. Amount Payable Under the Scheme

Appeals filed after 31.01.2020 but on or before 22.07.2024

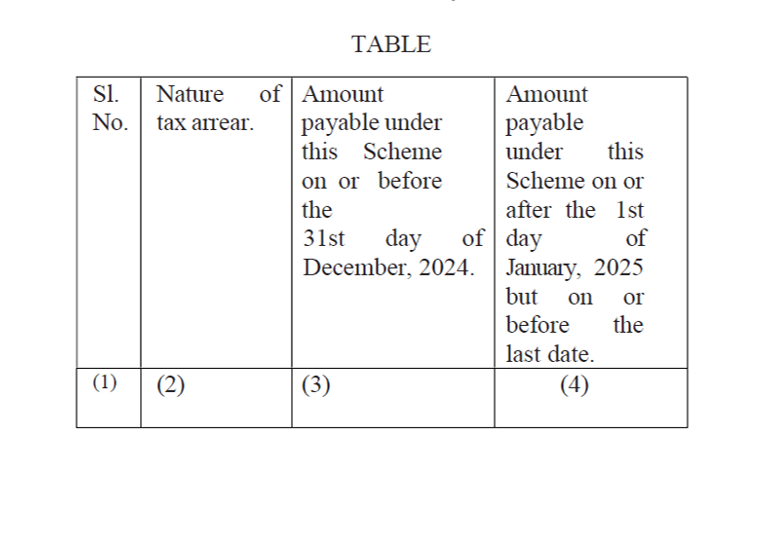

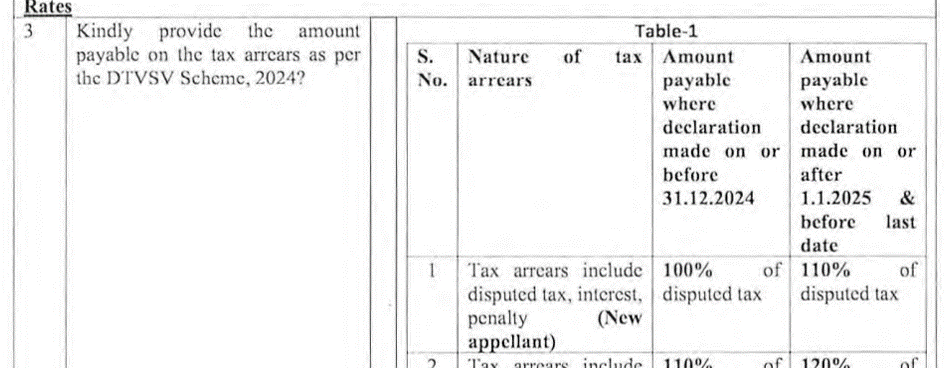

| Sr No | Nature of tax arrear | Amount payable on or before the 31st day of the December, 2024 | Amount payable on or before the 01.01.2025 but before *** |

| 1 | Disputed Tax including Interest and Penalty thereon | Amount of Disputed tax (100% of Disputed tax) | Amount of Disputed Tax + 10% of Disputed Tax (110% of Disputed tax) |

| 2 | Disputed Penalty, Disputed interest or Disputed Fee | 25% of Disputed Penalty, Disputed interest or Disputed Fee | 30% of Disputed Penalty, Disputed interest or Disputed Fee |

*** End date not notified

Case Study

- New Appellant

- Declaration for VsV in Form 1 done on 25 December 2024

- Tax not paid upto 31 December 2024

- Whether tax to be paid equivalent to 100% of disputed tax or 110% of disputed tax?

Finance Act (No. 2), 2024

CBDT Circular

Appeals filed on or before 31.01.2020

| Sr No | Nature of tax arrear | Amount payable on or before the 31st day of the December, 2024 | Amount payable on or before the 01.01.2025 but before *** |

| 1 | Disputed Tax including Interest and Penalty thereon | Amount of Disputed Tax + 10% of Disputed Tax (110% of Disputed tax) | Amount of Disputed Tax + 20% of Disputed Tax (120% of Disputed tax) |

| 2 | Disputed Penalty, Disputed interest or Disputed Fee | 30% of Disputed Penalty, Disputed interest or Disputed Fee | 35% of Disputed Penalty, Disputed interest or Disputed Fee |

*** End date not notified

Appeal by Department/Covered Issues

| Sr. No. | Nature of tax arrear | Amount payable | Condition, if any |

| 1 | Appeal/Writ/SLP by Department | 50% of amount payable (as determined in earlier slides) | |

| 2 | Appeal pending before CIT(A) or JCIT(A) and favorable order received from ITAT or High Court on such issue | Decision not reversed by higher forum | |

| 3 | Appeal pending before ITAT and favorable order received from High Court on such issue | Decision not reversed by Supreme Court |

Favourable Order at Same Forum = Favorable orders at SC

7. Disputed Tax

Situation

- Where appeal is pending before Appellate Forum on 22 Jul 2024

- Objection filed by appellant before DRP is pending as on SD

- DRP has issued directions but final order of AO is pending as on SD

- Revision petition u/s 264 is pending as on SD

Disputed Tax

- Tax that is payable if the appeal/petition/SLP was to be decided against him

- Amount of Tax payable if DRP was to confirm the variation proposed in draft assessment order

- Amount of Tax payable as per Asst. Order to be passed by AO as per the directions of DRP

- Amount of Tax payable as if the revision application will not be accepted

Disputed Tax Proviso

Where the dispute relates to reduction of MAT credit or AMT credit or reduction of loss or depreciation

Appellant has option to

- Include the amount of tax related to tax credit or loss or depreciation

- Carry forward reduced tax credit or loss or depreciation in the manner to be prescribed

7.1 Case Study 1 – For Computation of Disputed Tax

| Particulars | AY 2018-19 | AY 2019-20 | AY 2020-21 |

| Additions during assessment u/s 143(3) | |||

| (i) Unexplained cash credits | 25,000 | 20,000 | 60,000 |

| (ii) Disallowance of cash payments | 30,000 | 50,000 | 40,000 |

| (iii) Disallowance for TDS defaults | 50,000 | 40,000 | 70,000 |

| (iv) Disallowance u/s 40A(2) | 25,000 | 60,000 | 90,000 |

| Total Addition by AO | 1,30,000 | 1,70,000 | 2,60,000 |

| Tax on assessed income | 50,000 | 60,000 | 105,000 |

| Interest u/s 234B/234C | 10,000 | 15,000 | 20,000 |

| Penalty | 30,000 | 45,000 | 80,000 |

| Additions Affirmed by CIT(A) and Pending before ITAT Before 22/7/24 | 1,30,000 | 1,70,000 | 2,60,000 |

| Questions | |||

| What is the tax payable in VsV (before 31 December 2024 case)? | 50,000 | 60,000 | 105,000 |

7.2 Case Study 2 – For Computation of Disputed Tax

| Particulars | AY 2018-19 | AY 2019-20 | AY 2020-21 |

| Additions Affirmed by ITAT | |||

| (i) Unexplained cash credits | 60,000 | ||

| (ii) Disallowance of cash payments | 30,000 | 50,000 | |

| (iii) Disallowance for TDS defaults | 50,000 | 70,000 | |

| (iv) Disallowance u/s 40A(2) | 60,000 | ||

| Total Additions Confirmed by ITAT | 80,000 | 1,10,000 | 1,30,000 |

| Tax on income after ITAT Additions | 24,000 | 33,000 | 66,000 |

| Interest u/s 234B/C | 4500 | 11,000 | 12,000 |

| Penalty u/s 270A | 12,000 | 40,000 | 55,000 |

| Additions Deleted by ITAT | 50,000 | 60,000 | 130,000 |

| Tax on deletions | 26,000 | 27,000 | 39,000 |

| Assessee and Department have filed appeals against all adjustments before High Court | |||

7.3 Case Study – For Carry Forward of Loss/UD

| Particulars | Computed by Assessee in ITR | Recomputed by AO | Remarks |

| Year 1 | |||

| Long term capital loss on sale of shares | (10,00,000) | NIL | This is reduction of loss as determined during assessment |

| Year 2 – Long term capital gain (without loss) | 10,00,000 | As per return of income – Tax paid on Nil (after set off of 10,00,000 from year 1) |

| Year 1 | |

| Tax at 20% on loss reduced (10,00,000*20%) | 2,00,000 |

| Year 2 | |

| Long term capital gain | 10,00,000 |

| Less: Loss from Year 1 | (10,00,000) |

| Tax on Balance Income | NIL |

Option 1 – Pay the tax in year 1 itself

No tax was paid originally in ITR due to loss situation. Now entire loss is ignored and tax is paid in first year itself.

7.4 Case Study 2 – For Carry Forward of Loss/UD

| Particulars | Computed by Assessee in ITR | Recomputed by AO | Remarks |

| Year 1 | |||

| Long term capital loss on sale of shares | (10,00,000) | 0 | This is reduction of loss as determined during assessment |

| Year 2 – Long term capital gain (without loss) | 10,00,000 | As per return of income – Tax paid on Nil (after set off of 10,00,000 from year 1) |

| Year 1 | |

| No tax paid – Loss situation | Nil |

| Year 2 | |

| Long term capital gain | 10,00,000 |

| Less: Loss set off | NIL |

| Tax on Balance Income | 2,00,000 |

Option 2 – Not Pay Tax in Year 1

Tax carry forward will reduce for year 2. Interest u/s 234B on enhanced income for year 2 will apply.

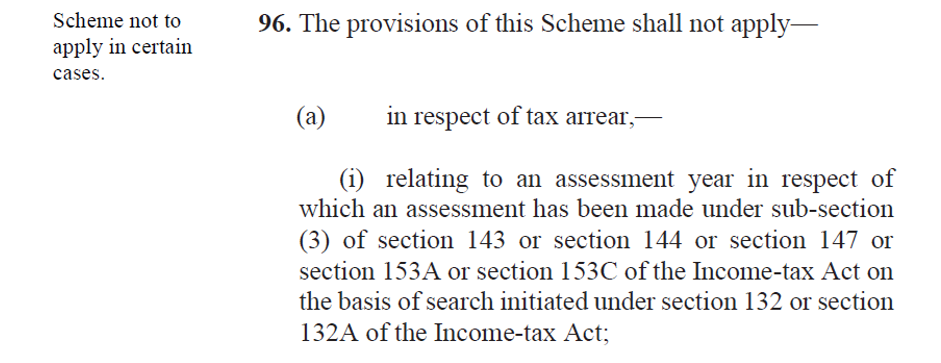

8. VsV 2.0 Ineligible Disputes/Persons

In respect of tax arrears

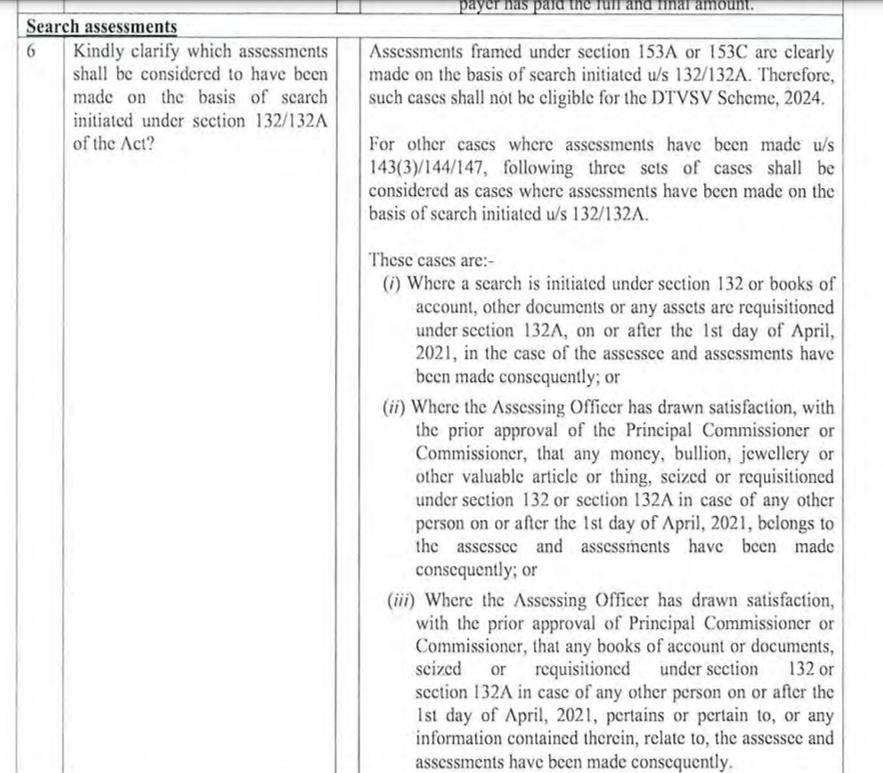

- Relating to an assessment year (“AY) of which an assessment or reassessment has been made under section 143(3), 144, 147, 153A or 153C on the basis of search

- Relating to an AY in respect of which prosecution has been instituted on or before the date of filing of declaration

- Relating to an undisclosed income from a source outside India or undisclosed asset located outside India

- Relating to an assessment or reassessment made on the basis of information received under tax information exchange agreements

Following Persons

- Detention order (not revoked or set aside) under Conservation of Foreign Exchange or Prevention of Smuggling Activities Act, 1974

- Prosecution/Convicted for any punishable offence:

-

- Unlawful Activities (Prevention) Act, 1967

- Narcotics Drugs and Psychotropic Substances Act, 1985

- Prohibition of Benami Property Transactions Act, 1988

- Prevention of Corruption Act, 1988

- Prevention of Money Laundering Act, 2002

- Prosecution instituted by an income-tax authority; or convicted under provisions of Bhartiya Nyaya Sanhita, 2023/enforcement of any civil liability under any law

- Person notified under section 3 of the Special Court (Trial of Offences Relating to Transactions in Securities) Act, 1992

8.1 Case Study – Ineligible Disputes

- An appeal is filed by assessee for multiple issues as below before CIT(A)

-

- Addition of house property income – Rs. 1,00,00,000/-

- Addition of salary income – Rs. 10,00,000/-

- Addition of undisclosed income from a source located outside India – Rs. 2,00,000/-

- Whether taxpayer can opt for VsV 2.0?

-

- No

8.2 Case Study – Search Cases

- Taxpayer has filed appeal on 1 January 2020

- Assessment reopened on the basis of documents found during search on another person on 1 January 2017

- Assessment order was passed under section 147 r.w.s. 143(3) of the Act

- Whether taxpayer is eligible to opt for VsV?

Finance Act (No. 2), 2024

Circular 12/2024

8.3 Case Study – Prosecution

Prosecution not instituted on 22 July 2024

Prosecution Instituted on 22 December 2024

Whether eligible to opt for VsV 2.0?

Prosecution instituted in Year 1

Same issue in year 2, but prosecution not instituted

9. Procedural Aspects

Four separate forms have been notified for the purpose of DTVSV Scheme

Form 1: Form for filing declaration and Undertaking by the declarant

Form 2: Form for Certificate to be issued by Designated Authority

Form 3: Form for intimation of payment by declarant

Form 4: Order for Full and Final Settlement of tax arrears by Designated Authority

Successful VSV

Single form qua an order -> Withdrawal of Appeal

10. Refunds

- Adjustment of payment made earlier

- Amount not refundable

- Excess amount paid refundable without interest

11. Other Matters

- Settling issues in part

- AR for foreign entity or deceased taxpayers

- Secondary Adjustment

- Conceding position

- Settling penalty appeal while continuing to litigate the associated quantum appeal?

- Protective v Substantive Additions

- Multiple Appeals

- Rectification of order by designated authority

12. TDS Issues

Delay in deposit of TDS/TCS

Covered under the Scheme

Credit of TDS to deductee

- Credit allowed

- On date of settlement of dispute. Hence, deductee to bear interest

Deductee settles the appeal under VsV

- Deductor not required to pay tax

- Interest u/s 201(1A) will continue to apply

13. Client Interactions on VsV – Practical Considerations

- Understanding the Merits and updated Legal Position

- Availability of records and documentation

- Immediate Fund Availability

- Interest and Penalty Exposures

- Group Dynamics/Past Restructurings

- Lapsing Losses

- IPO Listing or Fund Raising Plans

- Taxpayer Sentiments

14. Cases Suitable for VsV 2.0

- Cost of Litigation > Tax payable

- Weak records/documentation

- Adverse Rulings of High Court and Supreme Court

- Losses are lapsing in future

- Examples – MFN Clause, Penny Stock (if Scrip is reported)

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA