Transfer Pricing Specified Domestic Transaction

- Blog|Transfer Pricing|

- 9 Min Read

- By Taxmann

- |

- Last Updated on 18 June, 2022

Transactions between related parties have always been suspected as a tool to shift profits and thereby reduce the overall tax liability of a company or a group operating from multiple locations having different tax laws. Even before the concept of Specified Domestic Transaction was introduced in the Indian tax laws, several other provisions existed to curb the tax avoidance by inter-company transactions between domestic companies of the same group.

Concept of Tax Neutrality and Tax Arbitrage:

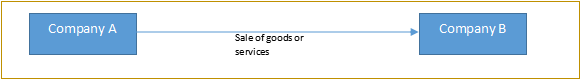

Transactions between two entities located in the same tax jurisdiction do not have any impact on the revenue base of tax authorities. The same can be understood by way of below example.

In the above example, Company A and Company B are both located in the same tax jurisdiction. In case Company A charges more than fair market value for the goods or services provided by it to Company B, then although the income of Company B decreases, the same is compensated by an equal increase in the income of Company A. Vice versa is the case when Company A undercharges for the goods and services in which case the income of Company B is increased by an equal amount. From the standpoint of tax authorities, it is getting the same amount of tax irrespective of the fact as to who is paying the tax. This phenomenon is called Revenue Neutrality wherefrom the standpoint of tax authorities, inter-group transactions do not have any impact.

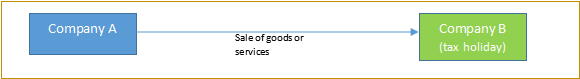

However, the tax impact changes where one of the parties to such transaction is either loss-making or is liable to pay taxes at a lower rate. In such cases, profits can be deliberately shifted to such entity to reduce the overall tax burden of the group or company. Consider the below example:

In the above example, Company A and Company are part of the same group/substantially controlled by the same group of shareholders. However, Company B is an eligible unit enjoying tax holidays under the Income-tax laws. In such a case, when providing services to Company B, Company A can undercharge for such services, thereby reducing its profits and increasing the income of Company B by the same amount. However, since Company B is enjoying a tax holiday, such profits escape the tax net. Consequently, the overall tax paid by the group is reduced. This is called Tax Arbitrage. The term tax arbitrage has not been defined in the tax laws. In common parlance, the term is used to refer to the practice of profiting because of the difference in ways in which income and expenses are treated for the purpose of calculating taxes.

The objective of the introduction of transfer pricing provision to Specified Domestic Transactions is to curb Tax Arbitrage and to ensure that the revenue base of tax authorities is not affected by such malpractices.

Meaning of Specified Domestic Transactions:

The definition of Specified Domestic Transactions was inserted in the Income-tax Act, 1961 by the Finance Act, 2012 wherein certain transactions between domestic companies were considered as specified domestic transactions being subject to domestic transfer pricing regulations.

Following are the specified conditions that are required to classify transactions as a specified domestic transaction:

-

- The transaction should not be an international transaction;

- The transaction should be covered under any of the limb (ii) to (vi) of section 92BA;

- The aggregate of such transactions entered into by the taxpayer should exceed the threshold limit of INR 20 cores (from the assessment year 2016-17).

As per the provisions of the Act, once a transaction falls under Specified Domestic Transaction, all the compliance requirements relating to transfer pricing documentation, accountant’s report, etc. shall apply to it in the same manner as they apply for international transactions.

Transfer of Goods or Services to or from eligible Units:

Section 92BA(ii) covers transactions referred to in Section 80A which applies to deductions to be made in computing total income under Chapter VI-A. The intent of the legislation was to cover merely sub-section (6) of Section 80A since the other sub-sections regulates the quantum of deductions and do not involve any fair pricing of the transactions. This viewpoint is corroborated by the amendment to the definition of market value by the Finance Act, 2012, which provided that in the case of SDTs, the market value shall be computed at arm’s length price.

The following transactions are covered under Section 80A(6): – where any goods or services held for the purpose of the unit or undertaking or eligible business are transferred to any other business carried on by the taxpayer; or – where any goods or services held for the purpose of any other business carried on by the taxpayer are transferred to the unit or undertaking or eligible business. As per section 80A(6), in case of any of the above transactions, if the value at which such transactions are recorded in the books of accounts is different from the market value of such goods and services, then for the purpose of calculation of the income of such unit or undertaking or eligible business, the transfer shall be deemed to have been made at the market value of such goods and services. The term market value has been defined as the price which such goods and services command in the open market. The definition of the term ‘market value’ has been expanded by a corresponding amendment by Finance Act, 2012 to include the arm’s length price where the transactions are covered under specified domestic transactions. Also, this clause covers income as well as expenditure of the eligible unit/undertaking. Various provisions of the Income-tax Act, 1961 which grant profit linked tax holiday deductions and are therefore covered by section 80A(6) are as follows:

|

Section |

Deduction |

|

80-IA |

Deduction in respect of profits and gains from industrial undertakings or enterprises engaged in infrastructure development, etc. |

|

80-IAB |

Deduction in respect of profits and gains by an undertaking or enterprise in the development of Special Economic Zone. |

|

80-IB |

Deduction in respect of profits and gains from undertakings other than infrastructure development undertakings. |

|

80-IC |

Special provisions in respect of certain undertakings or enterprises in certain special category States. |

|

80-ID |

Deduction in respect of profits and gains form business of hotels and convention centres in the specified area. |

|

80-IE |

Special provisions in respect of certain undertakings in the North-Eastern States. |

|

8JJA |

Deduction in respect of profits and gains from the business of collecting and processing of bio-degradable waste. |

|

80JJAA |

Employment of new workmen. |

|

80LA |

Deduction in respect of certain incomes of Offshore Banking Units and International Financial Services Centre. |

|

80P |

Co-operative Societies |

It is pertinent to note the words ‘eligible business’, ‘undertaking’, ‘unit’, and ‘enterprise’ are not defined in section 80A. However, section 80A(6) refers to sections 10A, 10AA, 10B, 10BA, and Chapter VIA under the heading ‘C-Deductions in respect of certain incomes. Under heading ‘C-Deductions in respect of certain incomes’, only section 80-IA, 80-IAB, 80-IB, 80-IC, 80-ID, and 80-IE uses the words ‘undertaking’, ‘enterprise’ and ‘eligible business’. Accordingly, it can be argued that the provisions of section 92B(ii) would not apply to deductions under Section 80JJA, 80JJAA, 80LA, and 80P. However, since ICAI’s Guidance Note on Transfer Pricing mentions these sections for the purpose of applicability of provisions for SDTs, as a matter of caution, the taxpayer may consider transactions under this section for the purpose of Section 92BA(ii).

Transfer of Goods and Services referred to in Section 80-IA(8)

Section 80-IA(8) is similar to section 80A(6) and covers the inter-unit transfer of goods and services. Section 80-IA(8) provides that for the purpose of deduction under section 80-IA, where any goods or services earlier held for the purpose of eligible undertaking are transferred to any other business carried on by the taxpayer or vice versa, then such deductions shall be computed as if such transfers have been made at the market value of such goods and services. In line with the amendment brought to section 80A(6), the definition of ‘market value’ for the purpose of section 80-IA(8) has also been amended to provide that the market value shall include the arm’s length price in case of SDTs. Further, proviso to Section 80-IA(8) provides that “where, in the opinion of the Assessing Officer, the computation of the profits and gains of the eligible business in the manner hereinbefore specified presents exceptional difficulties, the Assessing Officer may compute such profits and gains on such reasonable basis as he may deem fit.”

An alternate viewpoint which emerges from the plain reading of this proviso is that it implies that wherein the opinion of the AO, the computation of the income of the eligible business as per arm’s length principle present exceptional difficulties, he can compute such income or profits on any such reasonable basis as he may deem fit. Such an interpretation gives overriding powers to the AO and accordingly is contentious. Therefore, such interpretation needs to be clarified by the tax authorities.

Business transacted with any other person under Section 80-IA(10):

Subsection (4) of Section 92BA refers to transactions between the taxpayer and any other person referred to in sub-section (10) of section 80-IA. Section 80-IA(10) shall apply when: i. There is a transaction between the taxpayer and any other person; ii. Such transactions result in more than ordinary profits in the hands of taxpayers; iii. Such excessive profit is a result of close connection with the other person or for any other reason. The section provides the AO sweeping powers to recalculate the value of any transactions undertaken by the taxpayer which is an eligible unit where it appears to him that unreasonable profits have accrued to such eligible units. The section covers all the transactions which include income as well as expenditure.

Further, it covers transactions with any other person. The use of the word “any other person” implies that such other entity need not be a specified person under section 40A(2) or an associated enterprise as per section 92A. Since the memorandum to the Finance Act, 2012 provided that transfer pricing provisions have been extended to transactions between ‘domestic-related parties’ or ‘ related resident parties’, it can be concluded that such ‘any other person has to be a resident for the purpose of application of transfer pricing provisions.

Any other transaction referred to in any other section of chapter VI-A or section 10AA:

Specified Domestic Transactions have also been defined to include any transaction, referred to in any other section under Chapter VI-A or section 10AA, to which provisions of section 80-IA(8) and section 80-IA(10) are applicable. It appears that this sub-section covers transfers between units eligible for profit-linked deduction with other units also enjoying similar profit-linked deductions, albeit under different sections.

In such a case, it is possible to take a stand that since the motive of tax avoidance is absent in transfers from one exempt unit to another, transfer pricing provisions shall not apply to such transactions. However, the value of such transactions shall be considered while determining the threshold limit of INR 20 crores from the assessment year 2016-17 onwards.

Threshold limit:

For a transaction to be covered under the definition of Specified Domestic Transaction, the aggregate value of all the specified transactions under various limbs of Section 92BA should exceed the threshold limit of INR 20 crores with effect from Assessment year 2016-17. The stated threshold ensures that taxpayers having minimal transactions with related parties are not burdened by the compliance requirements of transfer pricing provisions. The threshold limit further ensures that the compliance cost and administrative burden of such provisions do not exceed the benefit derived from it.

The threshold limit for SDTs can be computed on a gross basis or net basis. If the taxpayer is availing input credits for indirect tax levies such as service tax, VAT, etc. then such threshold limit shall be computed excluding such indirect taxes. However, where the taxpayer is not availing such credits, then such computation shall be made on gross basis i.e. including the amount of such taxes.

Amendment brought in by Finance Act, 2017:

The inclusion of transactions with parties specified under section 40A(2)(b) within the purview of Domestic Transfer Pricing resulted in increased compliance on part of taxpayers as all the transactions with related enterprises above a threshold limit were subjected to scrutiny and documentation from the transfer pricing perspective. Further, benchmarking of certain resultant items provided in Section 40A(2)(b), such as managerial remuneration posed practical difficulties to the taxpayers as no suitable comparable data are ordinarily available in the public domain.

To ease out the compliance burden, Finance Act, 2017 has omitted the transactions with persons referred to in sec. 40A(2)(b) from the ambit of domestic transfer pricing regulations. As a result, the provisions of SDT shall apply only in cases where one of the parties to the transactions is claiming specified deductions/exemptions as per the relevant sections. The amendment shall be applicable from Assessment Year 2017-18 onwards.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

%20Title%202019_L.jpg)

%20Title%202019_L.jpg)

CA | CS | CMA

CA | CS | CMA