Time & Value of Supply of Goods under GST

- Blog|GST & Customs|

- 9 Min Read

- By Taxmann

- |

- Last Updated on 18 June, 2022

Table of Contents:

1. Time of Supply

2. Value of Supply

GST Practitioners' Question Bank with Quick Exam Guide is a ‘do-it-yourself’ guide for aspiring GST Practitioners, where legal provisions are provided in a concise & precise manner, without tampering with the intent and spirit of the GST Laws.

1. Time of Supply (Sections 12 to 14 of the CGST Act, 2017)

- Time of supply (TOS) is very important concept of GST as it helps you identify the time at which liability to pay tax to the Government arises.

- The liability to pay CGST/SGST on the goods and services shall arise at the time of supply of goods and services, as determined in accordance with the provisions of section 12 of the CGST Act (TOS of goods) and section 13 of CGST Act (TOS of services).

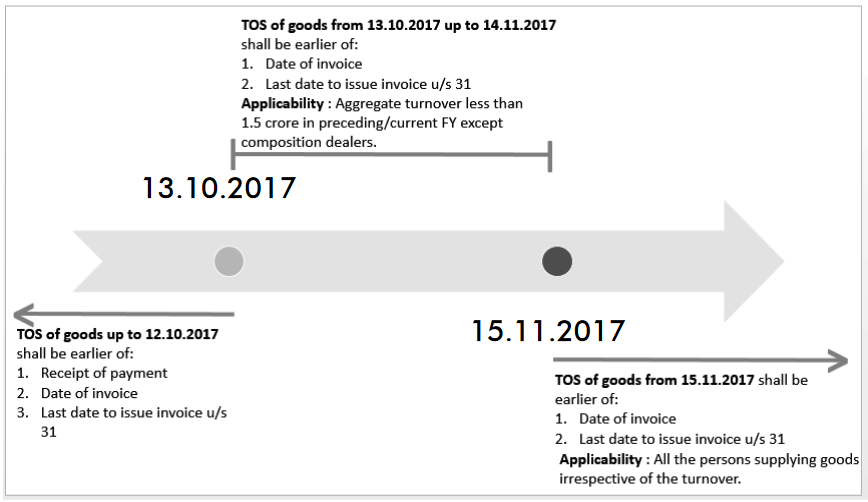

There were frequent changes in the provisions determining the time of supply in case of receipt of advances in respect of supply of goods and services. Earlier, advances received in case of goods were also made taxable. But post the notifications which were being issued on 13th October 2017 & 15th November 2017, advances in case of goods were not required to be taxed. But till date any advance received in case of services is taxable.

- A registered person is required to issue tax invoice before or at the time of removal of goods for the supply to the recipient or delivery of goods or making goods available to the recipient.

- Supplier shall mean the person supplying the goods and services and shall also include an agent acting on behalf of such supplier.

- Recipient means:

- Person liable to pay consideration for such goods or services, if consideration is payable.

- Person to whom goods are delivered or possession is given, if consideration is not payable.

- Person to whom the services is rendered, if consideration is not payable.

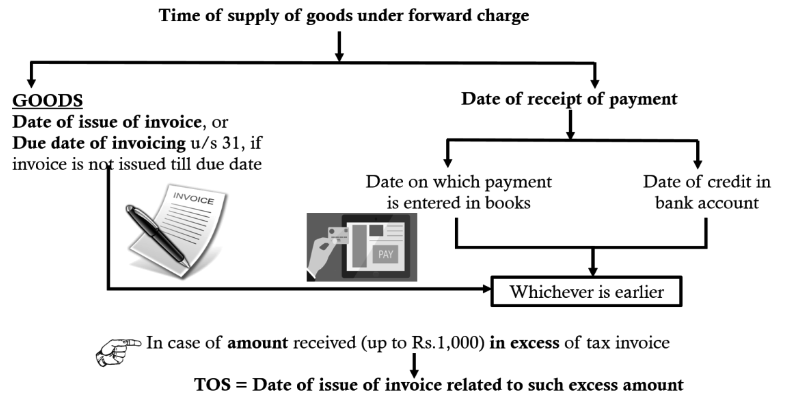

- Time of Supply of Goods is explained in the below diagram:

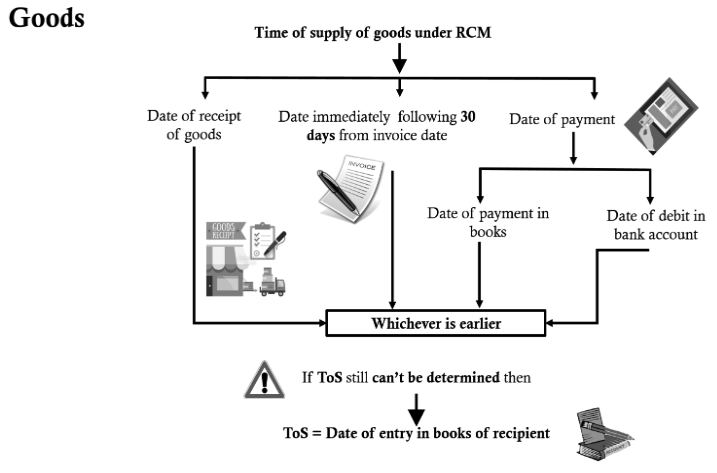

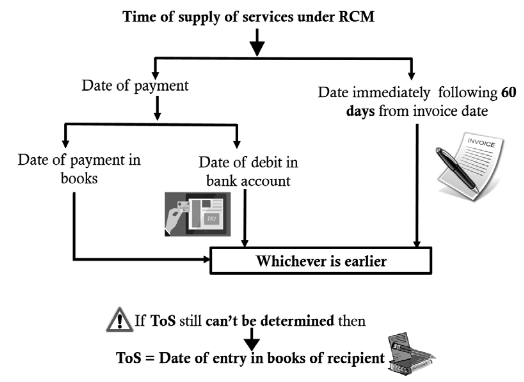

- The time of supply in respect of reverse charge mechanism of supply of goods shall be determined as per the provisions of section 12(3) of CGST Act, 2017. It clearly states that, time of supply of goods under reverse charge shall be earlier of the following:

- Date of receipt of goods, or

- Date of the payment. It shall be deemed that the payment has been made on earlier of:

- Payment details are entered into books of account (say cash book, bank book etc.) of recipient of supply.

- Date of debit in his bank account

- Day immediately following 30 days of issue of invoice by the supplier.

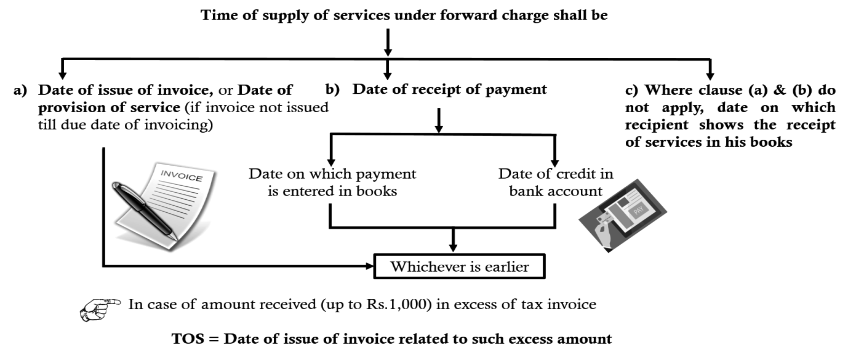

- Time of Supply of Services is explained in below diagram:

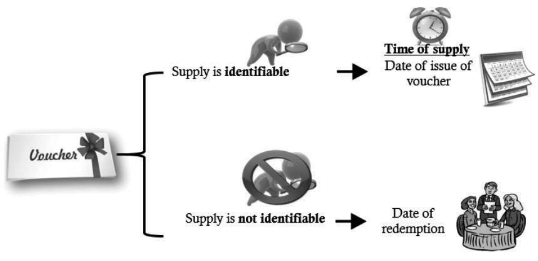

- As per Section 2(118) of the CGST Act, Voucher means the instrument which can be accepted as a consideration or part consideration against the supply. It may or may not specify the potential supplier. Such vouchers do not have universal acceptance but has limited acceptance & that too is subject to certain terms & conditions.

- Time of supply in respect of vouchers shall be determined as per the provisions of section 12(4) of the Act & it states that time of supply shall be:

- Date of issue of voucher, if supply which it covers is identifiable at that point of time, or

- Date of redemption of vouchers, in all other cases.

- There are 4 kinds of voucher:

- Single purpose vouchers

- Multi-purpose vouchers

- Monetary voucher

- Non-monetary voucher

- In case some additional payment is received by the supplier on account of:

- Interest, or

- Late fees, or

- Penalty for delayed payment of consideration

- Then in such cases, time of supply shall be the date on which the supplier receives such amount.

- In case the services are taken from the associated enterprises, where it is being located outside India, in such cases time of supply shall be earlier of:

- Date of entry in the books of account of recipient, or

- Date of payment

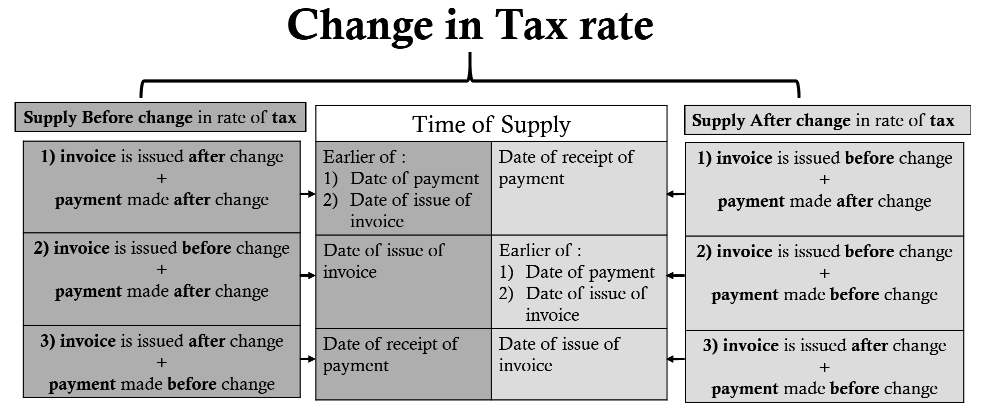

- If there is change in tax rate of supply of goods or services, TOS shall be determined as given in the diagram:

2. Value of Supply (Section 15 of the CGST Act, 2017 r/w rules 27 to 35 of the CGST Rules, 2017)

- Any transactions taking place around us are subject to valuation that makes basis for taxation under Pre or Current regime of GST. Valuation is a subject matter dealt with in section 15 of the CGST Act, 2017.

- Section 15(1) of the CGST Act, 2017, supply of goods under normal course of business are valued at their transaction value. The concept of transaction value follows two fundamental aspects:

- Parties to supply are not related persons

- Price is the sole consideration for such supply

- The transaction value means the price actually paid or payable for the supply of goods and/or services.

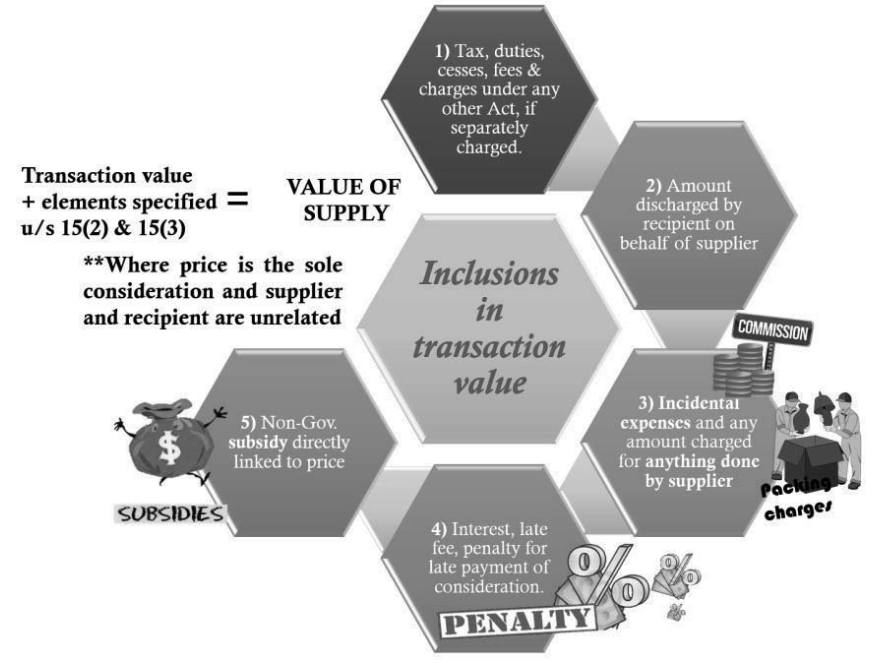

- As per the provisions contained under section 15(2) & (3), following inclusions and exclusions have been provided herein while deriving transaction value of supply

- Any taxes, duties, cess, fees, and charges levied under any Act, except GST. GST Compensation Cess will be excluded if charged separately by the supplier.

- Any amount that the supplier is liable to pay which has been incurred by the recipient and is not included in the price.

- The value will include all incidental expenses in relation to sale such as packing, commission etc.

- Subsidies directly linked to the price except subsidies provided by CG & SG will be included.

- Interest/late fee/penalty for delayed payment of consideration will be included

- Discount is a commercially accepted measure that can be resorted by any supplier for a variety of reasons like stock clearance, increasing foot fall in its store etc. Such discounts shall not form part of the taxable value in cases mentioned below:

- Discounts are allowed before or at the time of supply & shown in the invoices.

- Discounts are allowed after the supply is made but are in conformity with the agreement that existed at the time of supply & the proportionate input tax credit is reversed by the recipient.

- Valuation rules shall be made applicable in below mentioned cases:

- Price is not the sole consideration

- Transaction between the related parties

- Supplies between principal & agent

- Pure agent transactions

- Value of supply, where consideration for such supply are not made fully in money, shall be:

- open market value of such supply;

- if the open market value is not available, the value shall be the sum total of consideration in money and any such further amount in money as is equivalent to the consideration not in money, if such amount is known at the time of supply;

- if the value of supply is still not determinable, then the value shall be the value of supply of goods or services or both of like kind and quality;

- Still if the value is not determinable, then the same shall be determined by the application of rule 30 or rule 31 in that order.

- Value of supply of goods or services between distinct or related persons other than through an agent shall be,

- open market value of such supply;

- if the open market value is not available, then the value shall be the value of supply of goods or services of like kind and quality;

- if still the value is not determinable, then the same shall be determined by the application of rule 30 or rule 31, in that order;

Provided that where the goods are intended for further supply as such by the recipient, the value shall, at the option of the supplier, be an amount equivalent to ninety per cent of the price charged for the supply of goods of like kind and quality by the recipient to his customer not being a related person.

- Value of supply made through an agent shall be,

- be the open market value of the goods being supplied, or at the option of the supplier, be ninety per cent of the price charged for the supply of goods of like kind and quality by the recipient to his customer not being a related person, where the goods are intended for further supply by the said recipient

- where the value of a supply is not determinable, the same shall be determined by the application of rule 30 or rule 31 in that order.

- Value of supply of goods or services or both made on cost shall be, [Residual rule]

- Where the value of a supply of goods or services or both is not determinable by any of the preceding rules of this Chapter, the value shall be one hundred and ten per cent of the cost of production or manufacture or the cost of acquisition of such goods or the cost of provision of such services.

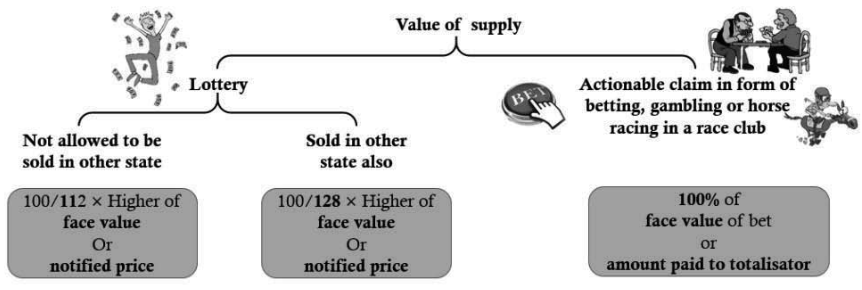

- Value of supply in case of lottery, betting, gambling & horse racing:

- The value of supply of services in relation to the purchase or sale of foreign currency, including money changing, shall be determined by the supplier of services in the following manner, namely:-

- for a currency, when exchanged from, or to, Indian Rupees, the value shall be equal to the difference in the buying rate or the selling rate, as the case may be, and the Reserve Bank of India reference rate for that currency at that time, multiplied by the total units of currency:

- Provided that in case where the Reserve Bank of India reference rate for a currency is not available, the value shall be one per cent of the gross amount of Indian Rupees provided or received by the person changing the money.

- The value of the supply of services in relation to booking of tickets for travel by air provided by an air travel agent shall be deemed to be an amount calculated at the rate of five per cent of the basic fare in the case of domestic bookings, and at the rate of ten per cent of the basic fare in the case of international bookings of passage for travel by air.

- The value of supply of services in relation to life insurance business shall be,

- the gross premium charged from a policy holder reduced by the amount allocated for investment, or savings on behalf of the policy holder, if such an amount is intimated to the policy holder at the time of supply of services.

- in case of single premium annuity policies other than stated above, 10% of single premium charged from the policy holder; or

- in all other cases, 25% of the premium charged from the policy holder in the first year and 12.5% of the premium charged from the policy holder in subsequent years.

- Further, the above stated clauses shall not apply where the entire premium paid by the policy holder is only towards the risk cover in life insurance.

- Value of supply of services in relation to second hand goods:

- a person dealing in such goods may be allowed to pay tax on the margin e. the difference between the value at which the goods are supplied and the price at which the goods are purchased.

- If there is no margin, no GST is charged for such supply.

- In case any other value is added by way of repair, refurbishing, reconditioning etc., the same shall also be added to the value of goods and be part of the margin.

- Intra-State supplies of second hand goods purchased from unregistered dealer & received by a registered person, dealing in buying and selling of second hand goods and who pays the Central tax on the value of outward supply of such second hand goods is exempted.

- Sometimes, the goods taken on loan are being repossessed by the lender in case of default in repayment of the principal amount. The purchase value of such repossessed asset shall be:

| Status of defaulting borrower | Purchase price in hands of lender i.e. person repossessing such goods |

| If the defaulting borrower is unregistered | Purchase price of such goods from the defaulting borrower Less 5% for every quarter or part thereof (between date of purchase & date of disposal by person repossessing such goods) |

| If the defaulting borrower is registered | The person repossessing shall discharge liability at supply value without reduction from actual/notional purchase value. |

- In case of any voucher, token or coupon is used, then the value shall be the money value of the goods or services against which it is being redeemed.

- Where value of supply is inclusive of tax, then tax amount will be determined as follows:

| Tax amount = | Value inclusive of tax | × Tax rate in % |

| 100 + Tax rate in % |

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA