Taxmann’s Analysis | Intangible Assets Under Ind AS 38 – FRRB Observations and Guidance

- Blog|Advisory|Account & Audit|

- 6 Min Read

- By Taxmann

- |

- Last Updated on 28 March, 2025

This article highlights the importance of intangible assets in financial reporting under Ind AS 38, emphasising their role in company valuations and the need for accurate disclosure. Real-world cases involving major tech companies demonstrate both the benefits of proper intangible asset reporting and the risks of non-compliance, including investor scepticism and regulatory scrutiny. Key observations by the Financial Reporting Review Board (FRRB) cover issues such as goodwill disclosure, R&D expense classification, reconciliation of carrying amounts, and clarity on whether intangible assets are internally generated or acquired. Adhering to best practices in disclosure and compliance not only ensures transparency but also strengthens corporate governance, investor trust, and overall financial integrity.

Table of Contents

- Inadequate Disclosure of Goodwill

- Misclassification of Research and Development Expenditure

- Non-disclosure of Reconciliation of Intangible Assets

- Omission of Amortization Method and Useful Life

- Lack of Clarity on Internally Generated vs. Acquired Intangible Assets

- Conclusion

Intangible assets play a vital role in financial reporting, offering insights into a company’s intellectual and creative wealth. However, accurate recognition, measurement, and disclosure of these assets remain a challenge. The Financial Reporting Review Board (FRRB) of ICAI has identified several discrepancies in the financial statements of various companies regarding compliance with the Indian Accounting Standards (Ind AS), particularly Ind AS 38 on intangible assets.

Real-life instances have demonstrated the importance of proper reporting. For example, technology giants like Infosys and TCS have successfully leveraged intangible assets, such as proprietary software and patents, to boost their valuations. Conversely, companies failing to provide adequate disclosures have faced regulatory scrutiny and investor scepticism. Lack of proper disclosures on intangible assets can lead to financial misstatements, impacting stock valuations and stakeholder trust. This article presents key observations by the FRRB and guides ensuring compliance.

1. Inadequate Disclosure of Goodwill

1.1 Observation

A company’s financial statements reflect a substantial amount of goodwill. However, they fail to disclose the source of goodwill. If the goodwill was internally generated, it should not have been recognised as an asset under Ind AS 38. If acquired in a business combination, relevant disclosures as per Ind AS 103 were required but missing.

1.2 Relevant Provisions

Ind AS 38, Intangible Assets

Paragraph 48 – “Internally generated goodwill shall not be recognised as an asset.”

Ind AS 103, Business Combination

Paragraph B67 – “To meet the objective in paragraph 61, the acquirer shall disclose the following information for each material business combination or in the aggregate for individually immaterial business combinations that are material collectively –

(d) a reconciliation of the carrying amount of goodwill at the beginning and end of the reporting period showing separately”

1.3 Implication & Guidance

Companies must clearly disclose the source of goodwill and comply with the impairment testing requirements under Ind AS 36. If the goodwill was internally generated, it should not have been recognised as an asset under Ind AS 38. On the other hand, if goodwill arises from a business combination, Ind AS 103 mandates specific disclosures, which should be incorporated in the financial statements to ensure transparency and compliance.

The extract of notes forming part of consolidated financial statements of TCS Limited for the year ended 31.03.2024 showing the appropriate goodwill disclosure, i.e. acquired under business combination, is as follows –

2. Misclassification of Research and Development Expenditure

2.1 Observation

The financial statements classified research and development (R&D) costs into revenue and capital expenditure rather than distinguishing between the research phase and development phase. As per Ind AS 38, research expenses (revenue or capital) should be immediately expensed, while development costs may be capitalised only if recognition criteria are met.

2.2 Relevant Provision

Ind AS 38, Intangible Assets

Paragraph 54 – “No intangible asset arising from research (or from the research phase of an internal project) shall be recognised. Expenditure on research (or on the research phase of an internal project) shall be recognised as an expense when it is incurred.”

Paragraph 57 – “An intangible asset arising from development (or from the development phase of an internal project) shall be recognised if, and only if, an entity can demonstrate all of the following –

(a) the technical feasibility of completing the intangible asset so that it will be available for use or sale.

(b) its intention to complete the intangible asset and use or sell it.

(c) its ability to use or sell the intangible asset.

(d) how the intangible asset will generate probable future economic benefits. Among other things, the entity can demonstrate the existence of a market for the output of the intangible asset or the intangible asset itself or, if it is to be used internally, the usefulness of the intangible asset.

(e) the availability of adequate technical, financial, and other resources to complete the development and to use or sell the intangible asset.

(f) its ability to measure reliably the expenditure attributable to the intangible asset during its development.”

2.3 Implication & Guidance

Companies should classify R&D expenses correctly, i.e. research expenses must be expensed, and development costs should only be capitalised if all conditions under Ind AS 38 are satisfied. Companies should clearly mention in their accounting policy about R&D expenses in the annual reports. Misclassification can lead to misrepresentation of financial performance and asset values.

3. Non-disclosure of Reconciliation of Intangible Assets

3.1 Observation

A company reported ‘Intangible Assets Under Development’ with a significant increase in closing balance. However, it failed to disclose a reconciliation of carrying amounts at the beginning and end of the year as mandated by Ind AS 38.

3.2 Relevant Provision

Ind AS 38, Intangible Assets

Paragraph 118 – “An entity shall disclose the following for each class of intangible assets, distinguishing between internally generated intangible assets and other intangible assets –

(e) a reconciliation of the carrying amount at the beginning and end of the period showing:

(i) additions, indicating separately those from internal development, those acquired separately, and those acquired through business combinations.

(ii) assets classified as held for sale or included in a disposal group classified as held for sale in accordance with Ind AS 105 and other disposals;

(iii) increases or decreases during the period resulting from revaluations under paragraphs 75, 85 and 86 and from impairment losses recognised or reversed in other comprehensive income in accordance with Ind AS 36 (if any);

(iv) impairment losses recognised in profit or loss during the period in accordance with Ind AS 36 (if any);”

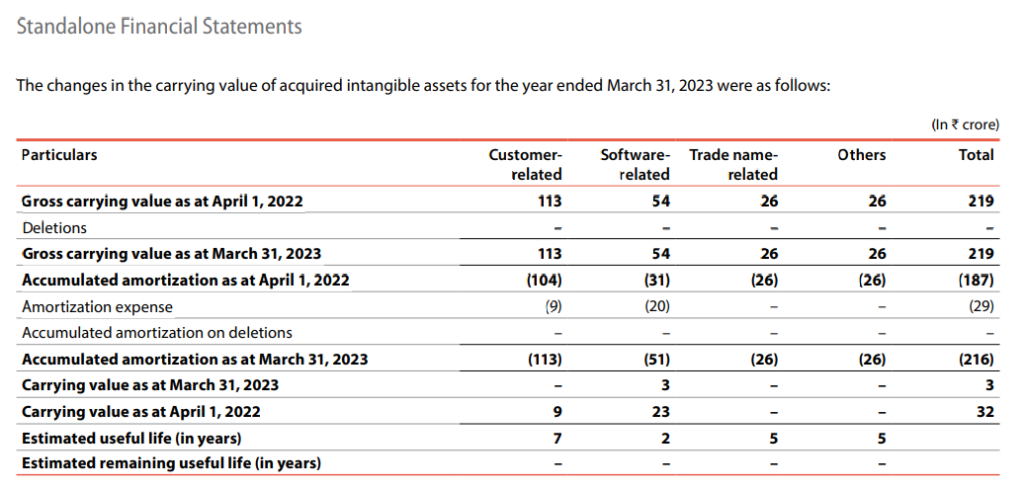

An extract from the Standalone Financial Statements of Infosys Limited for the year ended 31.03.2024 reflecting the reconciliation of intangible assets at the beginning and end of the year is as follows –

3.3 Implication & Guidance

Companies should ensure proper reconciliation of intangible assets in financial statements, clearly distinguishing between internally generated and acquired assets. This transparency aids investors and stakeholders in understanding asset movements and valuation changes.

4. Omission of Amortization Method and Useful Life

4.1 Observation

A company recognised computer software as an acquired intangible asset but failed to disclose the amortisation method and useful life of the intangible asset, contrary to Ind AS 38 requirements.

4.2 Relevant Provision

Ind AS 38, Intangible Assets

Paragraph 118 – “An entity shall disclose the following for each class of intangible assets, distinguishing between internally generated intangible assets and other intangible assets –

(a) whether the useful lives are indefinite or finite and, if finite, the useful lives or the amortisation rates used;

(b) the amortisation methods used for intangible assets with finite useful lives.”

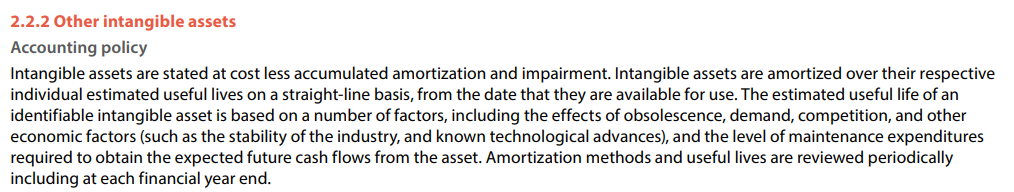

The extract of accounting policy from the annual report of Infosys Limited for the year ended 31.03.2024 reflecting the amortisation method and useful life is enclosed under –

4.3 Implication & Guidance

To ensure compliance, companies must disclose the amortisation method and useful life of intangible assets in financial statements. This information is crucial for assessing asset valuation and future financial performance.

5. Lack of Clarity on Internally Generated vs. Acquired Intangible Assets

5.1 Observation

It was noted by the FRRB that the company has recognised ‘computer software’ and ‘model designs’ as Intangible Assets. However, the company has not provided a clear distinction of whether these intangible assets were internally generated or acquired, as required by Ind AS 38.

5.2 Relevant Provision

Ind AS 38, Intangible Assets

Paragraph 118 – “An entity shall disclose the following for each class of intangible assets, distinguishing between internally generated intangible assets and other intangible assets….”

5.3 Implication & Guidance

Companies should explicitly state whether their intangible assets are internally generated or acquired. This disclosure ensures compliance with Ind AS 38 and provides investors with clarity on the nature of the assets, which is crucial for financial analysis and decision-making.

6. Conclusion

The FRRB’s observations highlight widespread lapses in the financial reporting of intangible assets. These gaps can lead to financial misstatements, non-compliance penalties, loss of investor confidence, and reputational damage. Ensuring proper classification, disclosure, and valuation of intangible assets is not just a regulatory requirement but a critical aspect of sound corporate governance.

To address these issues, companies must establish strong internal controls, conduct periodic reviews, and implement rigorous financial reporting practices. Adopting best practices in intangible asset reporting enhances transparency, boosts investor trust, and strengthens compliance with Ind AS provisions. By proactively addressing these concerns, organisations can mitigate risks, ensure financial statement reliability, and maintain credibility in the eyes of regulators and stakeholders.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA