Taxation and Other Aspects of Private Trusts – Overview | Strategic Considerations | Types

- Blog|Income Tax|

- 6 Min Read

- By Taxmann

- |

- Last Updated on 3 June, 2024

A Private Trust is a legal arrangement where one party, known as the trustor or settlor, transfers property to another party, the trustee, to be held and managed for the benefit of specific individuals or entities, known as beneficiaries. Here's a concise overview: Key Elements of a Private Trust: – Trustor (Settlor): The individual or entity who creates the trust and transfers property into it. – Trustee: The person or entity responsible for managing the trust property according to the terms set out in the trust deed. – Beneficiaries: The individuals or entities who will benefit from the trust. – Trust Property: The assets transferred into the trust by the trustor, which can include cash, real estate, stocks, bonds, or other assets. – Trust Deed: The legal document that outlines the terms and conditions under which the trust will operate. Purposes of a Private Trust: – Asset Protection: Protecting assets from creditors or lawsuits. – Estate Planning: Ensuring the orderly transfer of assets to beneficiaries. – Tax Planning: Minimizing estate and gift taxes. – Wealth Management: Providing professional management of assets. Types of Private Trusts: – Revocable Trust: The trustor retains the right to alter or terminate the trust during their lifetime. – Irrevocable Trust: The trustor cannot modify or dissolve the trust once it has been established. – Discretionary Trust: The trustee has the discretion to decide how the trust income and assets are distributed among the beneficiaries. – Fixed Trust: The trust deed specifies the exact distribution of income and assets to the beneficiaries.

By Rohan Sogani

Table of Contents

- Trust Structure

- Overview of Indian Trust Act, 1882

- Strategic Considerations

- Roles of Settlor/Trustee/Beneficiary

- Type of Trusts

- Private Trusts vs. Will

- Taxation of Private Trusts

- Gift Received by Private Trusts

- Declaration of Beneficial Ownership

- Ring-Fencing of Assets

- Fema Aspects of Trusts – Overview

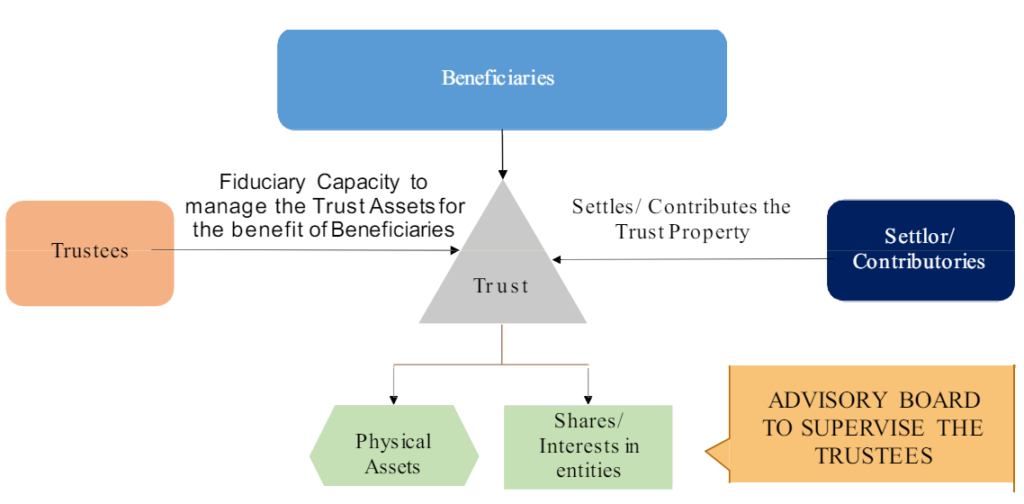

1. Trust Structure

2. Overview of Indian Trust Act, 1882

- Section 3 of the Indian Trust Act, 1882 defines ‘Trust’ as:

“an obligation annexed to the ownership of the property, arising out of a confidence reposed in and accepted by the owner, or declared and accepted by him for the benefit of the another, or of another and the owner”.

- Trust is not a separate legal entity. It is an obligation casted on the trustee by the settlor to employ the trust assets for the benefit of the beneficiaries.

- Settlor/Author is the person who settles the trust. He can be a trustee or a beneficiary as well.

- Trustees are the persons who are bestowed with the responsibility of managing the assets of the trust and rights and powers for wealth distribution.

- Beneficiaries are the persons for whom the trust has been settled.

| Sections |

Particulars |

| 1 to 3 | Preliminary & Title and Definitions |

| 4 to 10 | Creation of Trust – Conditions |

| 11to 30 | Duties and Liabilities of Trustees |

| 31 to 45 | Rights & Powers of Trustees |

| 46 to 54 | Disabilities of Trustees |

| 55 to 69 | Rights and Liabilities of Beneficiaries |

| 70 to 76 | Vacating the office of Trustees |

| 77 to 79 | Cessation of Trust |

| 80 to 96 | Certain Obligations – A Trust |

3. Strategic Considerations

- Controlled Succession Planning

- Biz Managed Professionally

- Asset protection

- Creating single pool of investment

- Maintenance of the Family

- Passing of wealth from generation to generation

4. Roles of Settlor/Trustee/Beneficiary

4.1 Role of the Settlor

- Settlor has no role to play in the operations of the trust

- Settlor to decide on the Original Trustee, the trust framework and initial beneficiaries of thrust

4.2 Duties & Powers of the Trustee

- To operate the trust as per the objects of the trust

- To buy/sell property and invest the trust money and monitor the investments

- To distribute income/assets of the trust

- To get reimbursement of expenses incurred while executing objects of the trust

- To add or remove beneficiary

- To add further Trustees

4.3 Entitlements to the Beneficiary

- Enjoy profits of the trust property

- To expect the trustee to properly protect and administer Trust property

- To compel the trustee to perform his duty properly

5. Type of Trusts

- Revocable Trust v. Irrevocable Trust

- Oral Trust v. Written Trust

- Testamentary Trust v. Non-testamentary Trust

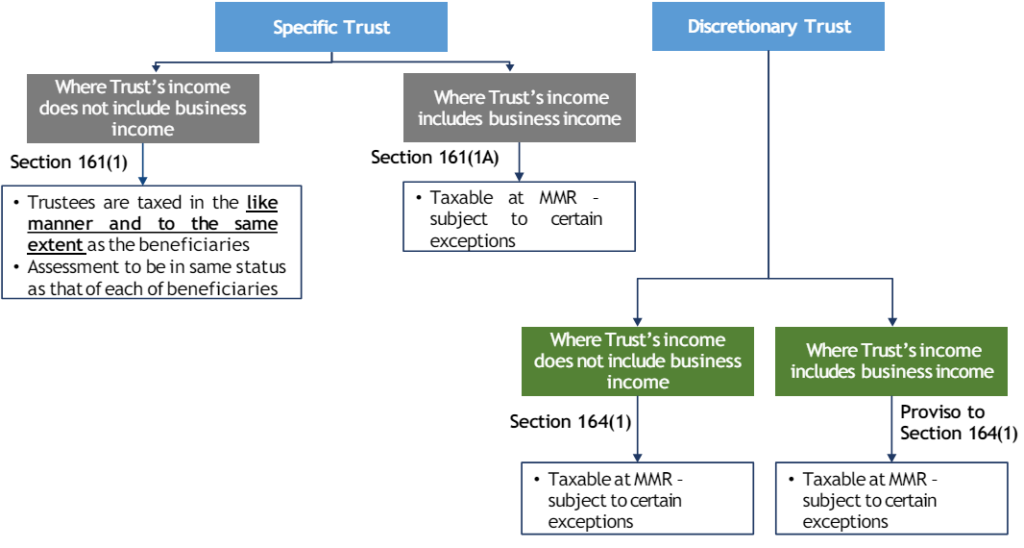

- Specific Trust v. Discretionary Trust

6. Private Trusts vs. Will

|

Particulars |

Private Trust |

Wills |

| Possibility of Succession Planning |

✓ |

|

| Name beneficiaries for property |

✓ |

✓ |

| Leave property to young children |

✓ |

✓ |

| Revise your document |

✓ |

✓ |

| Avoid probate |

✓ |

|

| Attracts stamp duty on transfer of Immovable Property |

✓ |

|

| Comes into effect after death |

|

✓ |

7. Taxation of Private Trusts

Rates applicable to individuals will be charged if all the following conditions are satisfied:

- Trust is declared by a settlor by way of a Will; and

- Trust is declared exclusively for the benefit of any dependent relative; and

- Such Trust is the only trust so declared by him

Rates applicable to AOP will be charged in a case where:

- None of the beneficiaries:

-

- has taxable income exceeding the Basis Exemption Limit; or

- is a beneficiary under any other private Trusts

Or

- Where the relevant income or part of the relevant income is receivable under a trust declared by any person by Will and such trust is the only trust so declared by him;

8. Gift Received by Private Trusts

- Taxability in the Hands of Donor: Section 47(iii) – Transaction Not regarded as “Transfer”

- Taxability in the Hands of Trust/Donee:

- “Relative” in case of Trust

- Section 56(2)(x): Provided that this clause shall not apply to any sum of money or any property received— (I) from any relative; or…

(X) from an individual by a trust created or established solely for the benefit of relative of the individual; - Clause (i) of proviso – Relationship to be tested from recipient’s perspective i.e. it needs to be tested whether the donor qualifies as a ‘relative’ from the perspective of recipient

- Clause (x) of proviso – For trusts, relationship needs to be tested from donor’s perspective and not from recipient’s perspective i.e. it needs to be tested whether beneficiaries for whose benefit the trust is settled qualify as ‘relative’ from the perspective of donor

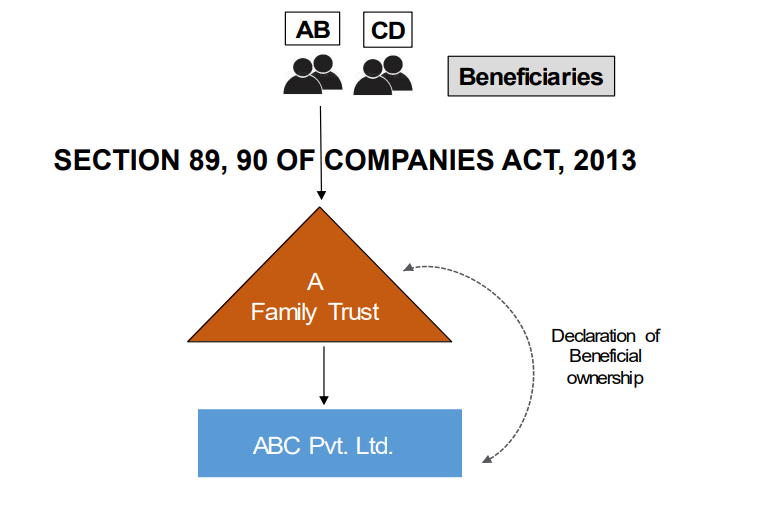

9. Declaration of Beneficial Ownership

Where the member of the reporting company is a trust (through trustee), and the individual:

|

S. No. |

Intimation to Company | Type of Trust |

| 1 | Trustee |

Discretionary Trust or Charitable Trust |

|

2 |

Beneficiary | Specific Trust |

| 3 | Author or Settlor |

Revocable Trust |

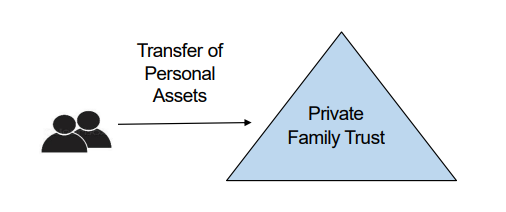

10. Ring-Fencing of Assets

- Private Trusts has emerged as an effective vehicle for succession planning for BUSINESS HOUSES.

- Transfer of Personal Assets to Trust, so that these assets can be insulated against possible future defaults of the businesses.

- Insolvency and Bankruptcy Code, 2016 has ushered new framework which provides easier mechanism for lenders to initiate recovery proceedings.

- Supreme Court in Lalit Kumar Jain vs. Union of India [2021] 127 taxmann.com 368 (SC) held that

“Guarantors obligation is not absolved for the balance amount dues due to involuntary process, i.e. by operation of law or due to liquidation or insolvency proceedings”

IBC – Impacting Transfer of Assets to Trust

- Section 164 states that any transaction entered by the bankrupt during the period of 2 years, ending the filing of application for bankruptcy, which causes bankruptcy process triggered, shall be considered as an undervalued transaction.

“In such scenario there would be heavy onus on such individual, to prove that transfer of assets/property by him to private trust was out of a bonafide arrangement.”

11. Fema Aspects of Trusts – Overview

| NRI Settlor with Resident and Non-Resident beneficiaries – Trust in India | |||

| S. No. | Particulars | Gift to NR | Gift to resident |

| 1 | Settlement of Assets

a. From NRO b. From NRE |

a. Ntf. 13(R) – USD 1 million repatriation from NRO

b. Freely permitted from NRE |

Permitted |

| 2 | Settlement of Currency (FCY) by way of remittance from abroad | FEMA not applicable as there is no change of assets in India for NR | FEMA not applicable as there is no change of assets in India for NR |

| 3 | Settlement of Shares in Indian Companies | FEM NDI Rules, 2019 – Permitted | FEM NDI Rules, 2019 – Permitted |

| 4 | Settlement of Immovable Property in India | FEM NDI Rules, 2019 – Permitted | FEM NDI Rules, 2019 – Permitted |

| Resident Settlor with Resident and Non-Resident beneficiaries – Trust in India | |||

| S. No. | Particulars | Gift to NR | Gift to resident |

| 1 | Settlement of Currency (INR) | LRS Scheme – Permitted to NRI relatives | FEMA not applicable |

| 2 | Settlement of shares in Indian companies | FEM NDI Rules, 2019 – Approval Route, subject to conditions | FEMA not applicable |

| 3 | Settlement of Immovable Property in India | FEM NDI Rules, 2019 – Permitted to NRI relatives | FEMA not applicable |

| NRI Settlor with Resident and Non-Resident beneficiaries – Trust outside India | |||

| S.No. | Particulars | Gift to NR | Gift to Resident |

| 1 | Settlement of Foreign Currency | FEMA not applicable | Permitted |

| 2 | Settlement of shares in Foreign companies | FEMA not applicable | FEM OI Rules, 2022 – Permitted |

| 3 | Settlement of Immovable Property outside India | FEMA not applicable | |

| Resident Settlor with Resident and Non-Resident beneficiaries – Trust outside India | |||

| S.No. | Particulars | Gift to NR | Gift to Resident |

| 1 | Settlement of currency (INR) under LRS scheme | LRS Scheme – Permitted to any NRI | LRS Scheme – Not permitted |

|

2 |

Settlement of shares in Foreign companies | FEM OI Rules, 2022 – Not permitted | FEM OI Rules, 2022 – Permitted |

|

3 |

Settlement of Immovable Property outside India | FEM OI Rules, 2022 – Not permitted | FEM OI Rules, 2022 – Permitted |

|

4 |

Settlement of assets held outside India u/s. 6(4) of FEMA | FEMA not applicable | General permission under OI Rules |

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA

I am a Resident Individual who has created a Charitable Trust. My most assets are in Shares & Mutual Funds. Currently, I make Lump sum donations to the Trust based on the yearly estimate of the Trust’s expenses.

But, I want that my Shares & Mutual Funds should keep growing in value even when I am not alive and a certain part of the value growth or corpus is cashed yearly so that Trust’s activities continue unabated for a long time.

Should I transfer total of my assets at one time to the Charitable Trust or keep this money outside in a Private trust or give suitable instructions in the Will.