Tax on Interest earned on PF – A Shot Hits the Bull’s Eye

- Blog|Income Tax|

- 7 Min Read

- By Taxmann

- |

- Last Updated on 15 December, 2025

There are only a few investment opportunities which operate in a complete Exempt-Exempt-Exempt Category (EEE). An Investment with EEE status that too without any threshold limit is a goldmine for the taxpayer but a landmine for the revenue. Possibly, contribution to employee provident fund is the only investment which has a EEE status without any threshold limit. The Govt. has attempted many times in the past to allow the EEE status for the EPF only up to a certain extent. But it failed. However, from the last two years, the Govt. has been successful to hit the bull’s eye.

In the Union Budget 2016, the Finance Minister, late Sh. Arun Jaitley, proposed a tax-free monetary limit of Rs. 1.5 lakh per annum for the employer’s contribution to the recognized provident fund. Further, it was proposed to tax 60 per cent of the corpus of the provident fund at the time of withdrawal, on a prospective basis. This proposal was, however, subsequently rolled back. The Finance Minister said in the Lok Sabha that “In view of the representation received, the government would like to do a comprehensive review of this proposal and therefore I withdraw this proposal.” The government finally withdraw the proposal to tax withdrawal from EPF after facing a strong backlash from salaried taxpayers.

For the first time, the Finance Act, 2020 introduced a composite ceiling of Rs. 7,50,000 for a previous year in respect of employer’s contribution to recognised provident fund, NPS and approved superannuation fund. Thus, the employer can continue to contribute to the said funds/scheme without any monetary restrictions. However, the aggregate contribution(s) over Rs. 7,50,000 in a previous year to the said Funds would be treated as perquisite and taxable under the head ‘salaries’, in employee’s hand. Further, annual accretion to such funds by way of interest, dividend or any other amount of similar nature during the previous year to the extent it relates to the perquisite under section 17(2)(vii) (i.e. amount over Rs. 7,50,000), shall also be treated as perquisite.

Now, the Finance Bill, 2021 proposes that no exemption shall be available for the interest income accrued during the previous year in the recognised and statutory provident fund to the extent it relates to the contribution made by the employees over Rs. 2,50,000 in a previous year. This amendment is applicable from the assessment year 2022-23. Currently, interest on the contribution made to statutory provident fund, recognised provident fund and the public provident fund is exempt from tax at the time of accrual as well as withdrawal. This amendment has been proposed as the Government noticed that some employees have been contributing a huge amount to these funds. Thus, to curb this practice, the Government has proposed such amendment to Section 10(11) and Section 10(12).

The Finance Act, 2020 introduced the upper cap on the contribution by the employer, any contribution above such limit and interest thereon shall be taxable in the hands of the employees. The Finance Bill, 2021 introduces the upper cap on the contribution by the employee himself. In phase manner, the Govt. has restricted the exemption towards the provident fund up to a certain extent.

To understand the impact of this amendment, it is imperative to first understand the meaning and types of provident fund. In this article, all your questions about the Provident Fund and its taxability have been answered.

- What is a Provident Fund?A provident fund can be either an Employee Provident Fund (EPF) or Public Provident Fund (PPF).

The Employee Provident Fund is a retirement saving plan in which both employee and employer contribute a fixed sum every month. The amount accumulated in the funds and interest earned thereon is paid to the employee on his retirement. However, an employee, in certain circumstances, is allowed to withdraw a sum from his provident fund account even before his retirement.The Public Provident Fund (PPF) is a tax-free investment avenue which is open to all individuals. The Government had brought the scheme to encourage saving and investment habits among the individuals. Originally the scheme was notified vide GSR 1136, dated 15-06-1968. The Government has notified a new PPF scheme vide G.S.R. 915(E), dated 12-12-2019. - What are the types of Employee Provident FundAn Employee Provident Fund can be categorized into the following:

- 2.1 Statutory Provident FundStatutory Provident Fund is set up under the Provident Fund Act, 1925, which is meant only for employees working in Government or Semi-Government organizations, local authorities, universities, recognized educational institutions or railways.

- 2.2 Recognized Provident FundIt is a provident fund which has been and continues to be recognized by the Commissioner of Income-tax as per the rules contained in Part A of the Fourth Schedule to the Income-tax Act. It also includes a fund established under the Employees’ Provident Fund Act, 1952. Such a fund is maintained in banks, insurance companies, factories and business houses in the private sector.

- 2.3 Unrecognized Provident FundUnrecognized Provident Funds are those funds which have not been recognized by the Commissioner of Income-tax as per the rules contained in Part A of the Fourth Schedule to the Income-tax Act. It can be maintained by any institution in the private sector.

- Who contributes to a Provident Fund?In employees’ provident fund both the employer and the employee contributes 12% of the basic salary and dearness allowance. These contributions are made every month and deposited into the EPFO. However, the employee can contribute more than 12% of the basic salary.The contribution made by the employee is invested completely in the PF and the contribution made by the employer is divided into different parts – 8.33% towards the Employee Pension Scheme (EPS) and the remaining 3.67% to the PF account of the employee. This EPS component is calculated on the basic pay of Rs 15,000, or actual basic pay, whichever is lesser.Example, the basic salary of an employee is Rs. 40,000. His contribution shall be Rs. 4,800 (12% of Rs. 40,000) and the employer contribution shall be Rs. 1,250 (8.33% of Rs. 15,000) towards EPS and balance amount of Rs. 3,550 (Rs. 4,800 – Rs. 1,250) towards EPF1.

- What is the taxability of contribution made by the employer in the PF?The contribution by the employer to the account of an employee in a recognized provident fund is chargeable to tax if such contribution exceeds 12% of salary. Further, there is an upper limit of Rs. 7,50,000 per annum in respect of employer’s contribution to NPS, superannuation fund and recognized provident fund. Any contribution above Rs. 7,50,000 is chargeable to tax in the hands of the employee as a perquisite. Consequently, any annual accretion by way of interest, dividend or any other amount of similar nature during the previous year, to the extent it relates to the employer’s contribution in excess of Rs. 7,50,000, is also treated as perquisite.

- What is the taxability of contribution made by the employee towards his PF?Any contribution by the employees to his Provident Fund is deductible up to Rs. 1,50,000 under Section 80C. Interest credited every year in the EPF or SPF account is also exempt from tax. At present, deposits in EPF fall under the EEE (Exempt, Exempt, Exempt) tax category. It means an employee is not liable to pay tax at all three levels – investment, earning and withdrawal. Section 10(11) and 10(12) of the Income Tax Act provides an exemption for the statutory provident fund and recognized provident fund respectively.The Finance Bill 2021 proposes to insert Proviso to Section 10(11) and 10(12) providing that the provisions of these clauses shall not apply to the interest income accrued during the previous year in the account of the person to the extent it relates to the amount or the aggregate of amounts of the contribution made by the person exceeding Rs. 2,50,000 in a previous year. This amendment shall apply only to the contribution made on or after 01-04-2021. Thus, any interest corresponding to the employee’s contribution in excess of Rs. 2,50,000 shall be taxable from the assessment year 2022-23.

- How it will impact me?The amendment is proposed with a purpose to remove disparity among contributors and to ensure that the High Net worth Individuals (HNI) who park huge sums to misuse and game the provision of assured high interest are checked and do not distortedly earn at the cost of other honest taxpayers’ money. There are more than 4.5 crore contributors’ accounts to EPF. Out of these more than 1.23 lakh accounts are of the HNIs who contribute monthly very huge sums to their EPF accounts. Their total contribution is to the tune of Rs. 62,500 crore as of now and the government is owing or paying an assured interest at the rate of 8% with tax exemptions to these veryhigh-income category persons at the cost of honest low and middle income, salaried class and other taxpayers.The proposed amendment will impact only HNIs who were misusing this welfare facility and earn wrongfully tax-free income as assured interest return. Average normal EPF or GPF contributor would not be affected by this amendment.If your employer allows you to plan your CTC with a cap on the basic salary, this amendment will not affect you if your CTC is Rs. 41.67 lakhs or less with the basic salary of 50% of CTC and if the basic salary is 40% of the CTC, you will not be impacted as long as your CTC is up to Rs. 52.09 lakhs.

- Under which head, this income will be taxable?The interest income accruing in respect of the employee’s contribution over Rs. 2,50,000 shall be taxable under the head ‘Income from other sources’. Such income should be taxable as a residuary income as it is not accruing from a source emanating from an employer-employee relationship.

- When it shall be taxable?The income under the head other sources is to be computed as per the cash or mercantile system of accounting regularly employed by the assessee. However, the amendment proposed by the Finance Bill, 2021 provides that the exemption shall not be available to the income by way of interest accrued during the previous year in the account of a person. As interest on the PF balance gets accrued every year on March 31, it shall be taxable in the year of accrual itself and the method of accounting followed by the employee will not make any difference.

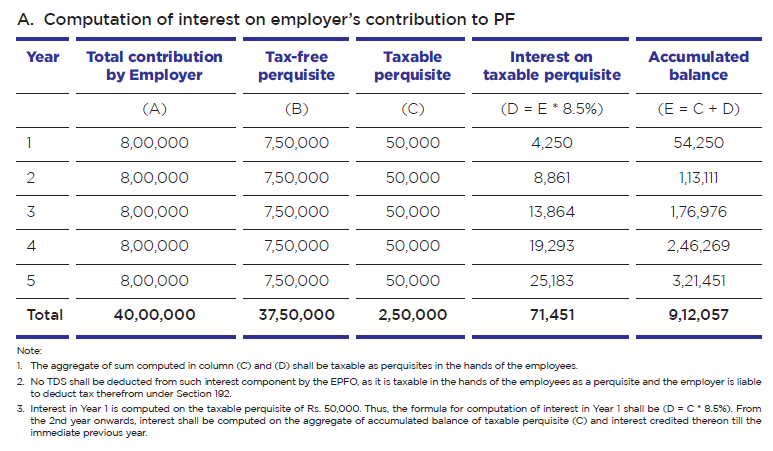

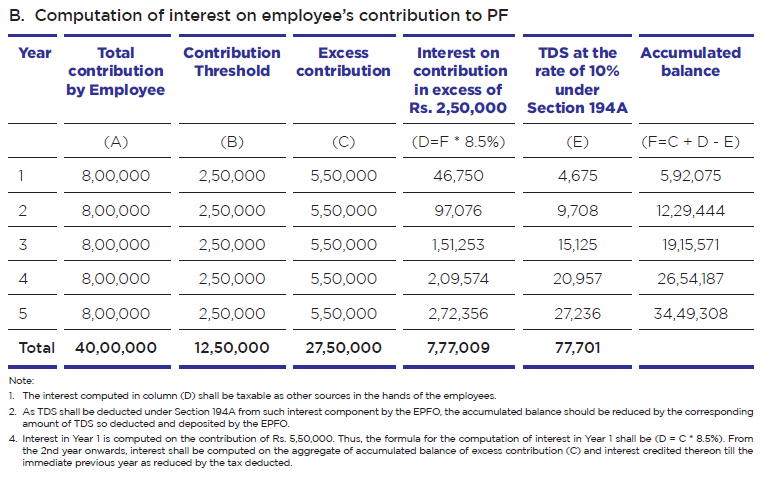

- How to compute the taxable amount?The amendment proposed that the taxable component shall be computed in such manner as may be provided by rules. Therefore, the CBDT shall come with rules for the computation of the taxable amount of interest on contribution exceeding Rs. 2,50,000 in a financial year. Possibly, such interest component shall be subject to TDS under Section 194A by the EPFO.Although the CBDT has to notify the rules for computation of the taxable interest, the following example may suggest a computation mechanism. Example, Mr A joined the EPF on 1st April 2021. He and his employer made the contributions of Rs. 8,00,000 each every year to the EPF account in next 5 financial years. Assuming the rate of interest on EPF is 8.5% per annum.

- What shall be the rate for taxability of such interest income?This interest income will become part of the total taxable income of the taxpayer. There are no special rates for taxability of this interest. Hence, such income shall be taxed at the prevailing income tax rates.

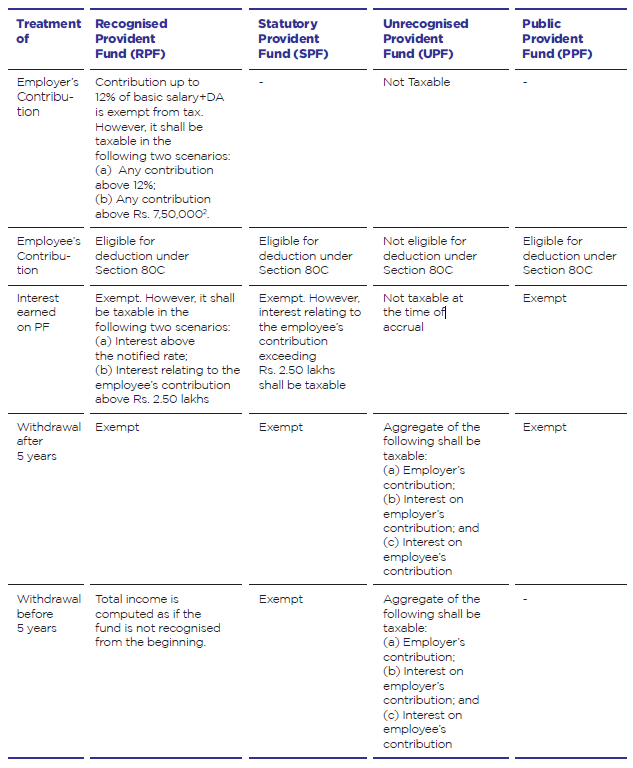

- Summary of taxation of PF from Assessment Year 2022-23The tax treatment of contribution and income earned in the provident fund from the assessment year 2022-23 shall be as follows:

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA