SEBI’s New Guidelines on Grant of Rewards to Informants

- Blog|Advisory|Company Law|

- 7 Min Read

- By Taxmann

- |

- Last Updated on 25 April, 2024

Table of Contents

- Eligibility criteria for rewarding informants providing information on “difficult to recover” dues

- Limits for Interim and Final stage reward to Informants for providing information

- Parameters for categorizing dues as ‘Difficult to Recover’

- Format for reporting of ‘difficult to recover’ dues for claiming reward

- Informants seeking reward for information must provide an undertaking

- Procedure for verification and processing of original information from Informant

- Competent Authority to Grant Reward

- Authorities empowered to grant rewards at their discretion, as ex-gratia payments

- Mandatory constitution of Informant Reward Committee for determining reward eligibility

- Factors to be considered by Informant Reward Committee in recommending reward amount

- Prohibition on grant of reward in certain cases

- Nodal Officer to maintain Informant Records and communication with Informants

- Informant Rewards to be paid out of IEPF

- Conclusion

The SEBI has recently issued the SEBI (Grant of Reward to Informant under Recovery Proceedings) Guidelines, 2023, dated March 8, 2023 with the aim of promoting a culture of honesty and accountability in the financial sector.

Under these guidelines, individuals who provide original information related to the assets of defaulters with certified ‘difficult to recover’ dues will be rewarded, thereby encouraging more people to come forward and share information. These guidelines are effective immediately.

Some of the key highlights of the guidelines include the

(a) Eligibility criteria for rewarding informants providing information on dues certified as ‘difficult to recover’;

(b) prescribes various parameters for categorizing dues as ‘difficult to recover’;

(c) mandates informants seeking reward to provide an undertaking etc.

By establishing clear and concise guidelines, SEBI is taking a major step towards creating a transparent and accountable financial system. This article discusses in detail the key highlights of the guidelines as hereunder-

1. Eligibility criteria for rewarding informants providing information on “difficult to recover” dues

The guidelines state that a person can be considered as an eligible informant for reward if he furnishes original information regarding the asset of a defaulter related to the dues that have been certified as ‘Difficult to Recover’.

However, rewards will only be granted in cases where the information provided by the informant leads to the recovery of dues. The information provided must be specific, actionable, and supported by relevant facts and documents.

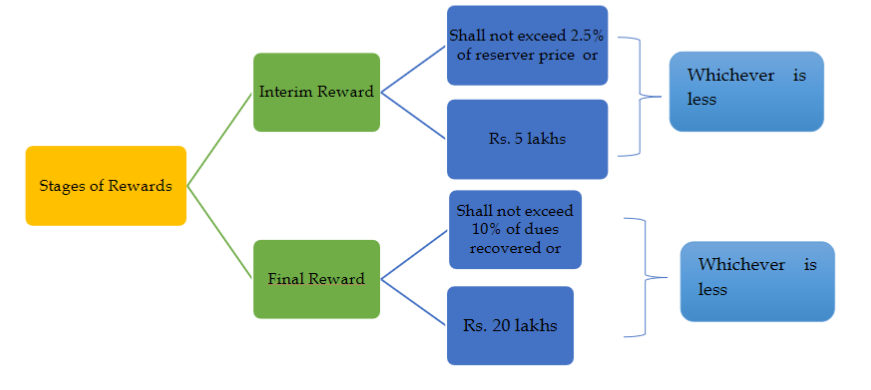

2. Limits for Interim and Final stage reward to Informants for providing information

The reward can be granted in two stages, – Interim and Final. Both the type of rewards can be distinguished as follows:

-

- The interim reward is granted before the finalisation of the Final reward. It shall not exceed 2.5% of the reserve price of the asset regarding which information was furnished or Rs. 5,00,000, whichever is less.

- The final reward is granted after the completion of all the proceedings. It shall not exceed 10% of the dues recovered, directly attributed to the original information supplied by the informant or Rs. 20,00,000, whichever is less.

3. Parameters for categorizing dues as ‘Difficult to Recover’

The ‘difficult-to-recover’ dues are the ones which could not be recovered even after exhausting all the modes of recovery. The dues can be certified as ‘Difficult to Recover’ on any one of the following parameters:

3.1 Criteria for identifying ‘difficult to recover’ dues in case of an individual defaulter

The criteria for identifying ‘difficult to recover’ dues in case of an individual who is a defaulter is as follows –

-

- defaulter is alive but has no attachable assets;

- defaulter is not traceable;

- defaulter has become insolvent; or

- defaulter has died leaving behind no assets.

3.2 Criteria for identifying ‘difficult to recover’ dues in case defaulter is a company / body corporate / firm–

-

- An Indian entity- which is defunct and whose directors (if such directors are also defaulters along with company jointly or severally) have no attachable assets;

- A foreign entity-

-

-

- which has no presence/ place of business/ management in India;

- who has no representative in India;

- who has no attachable assets in India

-

3.2.1 Meaning of Defaulter

“defaulter” means an entity against whom recovery proceedings are initiated under section 28A of the Securities and Exchange Board of India Act, 1992, section 23JB of the Securities Contracts (Regulation) Act, 1956 or section 19-IB of the Depositories Act, 1996.

4. Format for reporting of ‘difficult to recover’ dues for claiming reward

In order to be eligible for a reward for providing information on difficult to recover dues, the informants shall submit their information in Form A.

The information must be sent to a Recovery Officer designated as the Nodal Officer, in a sealed envelope marked as ‘Information for grant of reward under Recovery Proceedings” or can be submitted through the designated email ID or online at the SEBI Intermediaries Portal (https://siportal.sebi.gov.in/)

5. Informants seeking reward for information must provide an undertaking

The informant who provide any information or documents in exchange for a reward must submit an undertaking in Form Part-B along with Form Part-A. The undertakings include acknowledging that providing information or documents does not automatically entitle the informant to a reward, and that the amount of reward is dependent on the quality and usefulness of the information and documents provided.

The informant must also agree to provide further documents or information or render assistance, if required and understand that the reward would pertain only to the dues recovered/realized directly resulting from the information supplied by him.

6. Procedure for verification and processing of original information from Informant

Upon the receipt of original information, the Nodal Officer is responsible for verifying that the information is comprehensive and submitted in the specified format. If the details are complete and submitted in the specified format, the Nodal Officer shall enter the information into a register kept for this purpose.

If the information is incomplete or not submitted in the specified format, the Nodal Officer shall notify the informant within one week from the receipt of such incomplete details and request him to furnish the complete details as specified.

The Recovery Officer having jurisdiction shall examine the complete information to determine if it is actionable. The informant may be required to provide further documents or assistance to the Recovery Officer. The original information and associated documents shall be kept in safe custody as required by the Recovery Officer.

If an informant expects a reward for their information, then he must appear before the Nodal Officer or Recovery Officer to sign the required Forms A and B for verifying their identity and the accuracy of their information. If the informant refuses to appear or provide the required information, no reward shall be given.

7. Competent Authority to Grant Reward

The Executive Director in-charge of the Recovery and Refund Department shall be the Competent Authority to grant the reward by passing an order. The Competent Authority shall pass the order based on the recommendation made by the Informant Reward Committee.

8. Authorities empowered to grant rewards at their discretion, as ex-gratia payments

The reward given under these guidelines is discretionary. It shall be given in the nature of ex-gratia payment and granted at the discretion of the authority competent to grant reward.

The decision made by the Competent Authority on the reward claim cannot be challenged in any Court of law by the informant or any other person on his behalf.

Further, the informant cannot assign the reward to anyone else. However, in case of the informant’s death before receiving the reward, the Competent Authority may grant the reward to their heirs or nominees.

9. Mandatory constitution of Informant Reward Committee for determining reward eligibility

For the purpose of recommending the eligibility of reward, the SEBI has provided for the constitution of an Informant Reward Committee comprising of:

-

- The Chief General Manager of Recovery and Refund Department,

- The concerned Recovery Officer having jurisdiction in the matter,

- Another Recovery Officer nominated by the Chief General Manager of Recovery and Refund Department and

- An officer in the grade of Deputy General Manager or higher, of the Office of Investor Assistance and Education nominated by the Chief General Manager in charge of Investor Protection and Education Fund.

Further, the Informant Reward Committee shall give its recommendations to the Competent Authority on the eligibility of Informant for reward and determination of amount of reward payable to Informant.

10. Factors to be considered by Informant Reward Committee in recommending reward amount

In recommending the reward amount, the Informant Reward Committee shall consider the following:

-

- The accuracy of the information given by the informant;

- The extent and nature of the assistance rendered by the informant;

- The risk and trouble undertaken and the expense incurred by the informant in securing and furnishing the information / documents;

- The quantum of work involved in utilizing the information; and

- The quantum of dues recovered which is directly attributable to the information and documents supplied by the informant.

11. Prohibition on grant of reward in certain cases

There are some instances where no reward shall be granted to the informant. They are as follows:

-

- The informant is a government servant who furnishes information or evidence obtained by him in the course of his normal duties as a Government Servant;

- The informant is required by law to disclose the information; or

- The informant has access to the information on the basis of a contract with the Board; or

- Information has already been provided by any other informant.

12. Nodal Officer to maintain Informant Records and communication with Informants

The Nodal Officer is responsible for maintaining a record of each informant, including the details of the cases in which he has furnished information, the reliability and usefulness of the information, past rewards paid, etc.

The Nodal Officer is also responsible for recording the outcome of approval or rejection of the information and the reward amount, if any in a register. They may communicate with the informant regarding the suitability or rejection of the information, along with brief reasons.

13. Informant Rewards to be paid out of IEPF

The amount of reward granted to the informant under these Guidelines shall be paid from the Investor Protection and Education Fund.

14. Conclusion

SEBI’s guidelines are designed to incentivize whistle-blowers to disclose any securities-related illegal activities and help investors recover their funds. The well-defined process for granting rewards can potentially boost the number of informants coming forward to report suspicious activities, ultimately enhancing market integrity. By increasing the reporting of such activities, regulators can take quick and effective measures to investigate and prevent fraudulent behavior, ultimately contributing to a more equitable and transparent securities market. Overall, these guidelines can contribute to the development of a fair and transparent securities market.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA