Recent Financial Reporting Developments & Accounting for Compulsory Convertible Preference Shares (CCPS)

- Blog|Account & Audit|Company Law|

- 11 Min Read

- By Taxmann

- |

- Last Updated on 18 July, 2024

Compulsory Convertible Preference Shares (CCPS) are a type of preferred stock that will automatically convert into equity shares (common stock) of the issuing company after a predetermined period or upon the occurrence of certain specified events. CCPS offers a hybrid financial instrument that provides the stability of fixed income through dividends and the potential for equity participation upon conversion. This structure is particularly useful for investors looking for a balance between risk and return, and for companies that want to raise capital without immediate dilution of ownership.

By Madhu Sudan Kankani – Partner | Deloitte India and Archana Bhutani – Subject Matter Expert

Table of Contents

- Compulsory Convertible Preference Shares (CCPS)

- International Financial Reporting Interpretations Committee (IFRIC) Updates

1. Compulsory Convertible Preference Shares (CCPS)

1.1 CCPS – Nature of the Instrument

- Key element of funding specially for E-commerce/startup ecosystem.

- Assurance to the investors of a fixed rate of return plus the opportunity for capital appreciation.

- CCPS holder typically may have more rights than other investors.

- Helps investors to maintain their stake and have a say even if their stake gets diluted later.

- Helps founders to keep control of a company even if their stake is lower than that of investors.

- Under Companies Act 2013, CCPS are considered as preference shares which holds preferential rights over equity shareholders. While in accounting, these could be classified as equity, liability or both.

1.2 Compulsory Convertible Preference Shares – Key Terms (Indicative)

B Ltd has issued 1000 CCPS on 31 December 20X0. Below are some key terms of the agreement:

- Conversion options: Each CCPS shall be compulsorily convertible into 10 Equity Share of the Company. Each holder of CCPS may convert CCPS held by it in whole or part into Equity Shares at any time not later than 20 years from the date of issuance.

- Dividend rights: CCPS carries a pre-determined 0.01% p.a. cumulative dividend. Subject to Applicable Law, CCPS shall be entitled to receive prorata in any dividends paid on the Equity Shares on an “As if” converted basis.

- Anti dilution: In the event that the Company undertakes any form of Capital Restructuring, the number of Equity Shares that CCPS converts into shall be adjusted on a proportionate basis after giving effect to the Capital Restructuring. “Capital Restructuring” shall mean any form of restructuring by the Company of its share capital including consolidation, sub-division or splitting of its shares or issue of any bonus shares or issue of shares pursuant to any scheme of arrangement, including merger, amalgamation, or de-merger or any classification of shares or variation of rights into other kinds of securities.

- Contingent settlement options: The investor intends to exit its investment in the company when the company makes an initial public offer (IPO) for its ordinary shares, which is expected to occur in three years. The preference shares therefore provide for automatic conversion into 12 equity shares of INR10 each for each INR100 preference share when the IPO takes place, provided the IPO takes place within three years. If the company does not complete an IPO within three years, the issuer is obliged to redeem the preference shares in cash for an amount equal to the amount invested plus a return of 13 per cent per annum.

1.3 Compulsory Convertible Preference Shares – Key Accounting and Reporting Complexities

- Complex terms and conditions mentioned in the agreement:

- Exit clause

- Multiple option on cash flows

- Linkages to IPO at times

- Evaluation of substance over legal form

- Probability of different scenarios

- Genuineness of the clauses

- Economic substance

- Ensure regulatory compliances with Companies Act 2013, SEBI, FEMA

- Modification of terms and conditions – will have prospective impact

- Classification issues – Equity, Liabilities or Compound Financial Instruments and its consequential impact on

-

- Income statements

- Key financial metrics and business impact such as equity structure, debt equity ratio, EPS, borrowing limits

- Track record of profitability (for e.g. IPO)

- Periodic fair valuation of liabilities and its impact on the financial statement

- Other business-related considerations such as future IPO, Tax implications, Cap table

1.4 Some Key Concepts

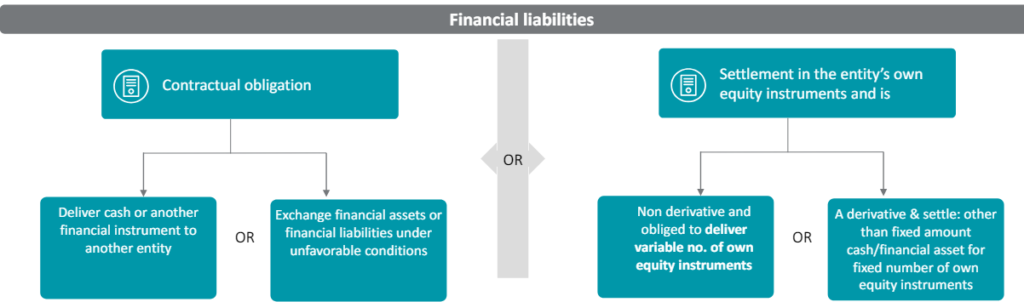

Ind AS 32, Financial Instruments: Presentation establishes principles for the classification of financial instruments, from the perspective of the issuer, into financial assets, financial liabilities and equity instruments.

Equity – A residual interest in the assets of an entity after deducting all of its liabilities.

Compound financial instrument – Financial instrument which contains both a liability and an equity component

1.5 Equity v/s Liability

Due to complex structure and clauses in the agreement classification of CCPS may be complex determination. The determination of whether it should be classified as debt or equity requires careful evaluation of all terms and conditions of Compulsory Convertible Preference Shares.

Liability characteristics

- No unconditional right to avoid delivering cash or another financial asset

- Settlement in entity’s own (variable number) equity instruments

- Delivering or receiving fixed number of its own equity instruments for a variable amount of cash or financial asset

- Contingent settlement provisions (with some exceptions)

- One party has a choice over how it is settled

Equity characterisitics

- Discretionary dividends

- Settlement in entity’s own (fixed number) equity instruments for fixed amount of cash/another financial asset

- Unconditional right to avoid delivering cash or another financial asset

- Puttable instrument (with some specific characteristics)

- Contingent settlement provisions (with some exceptions)

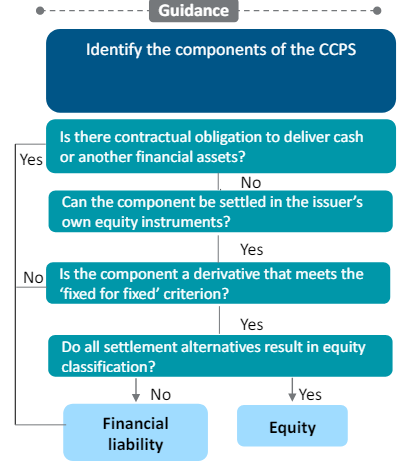

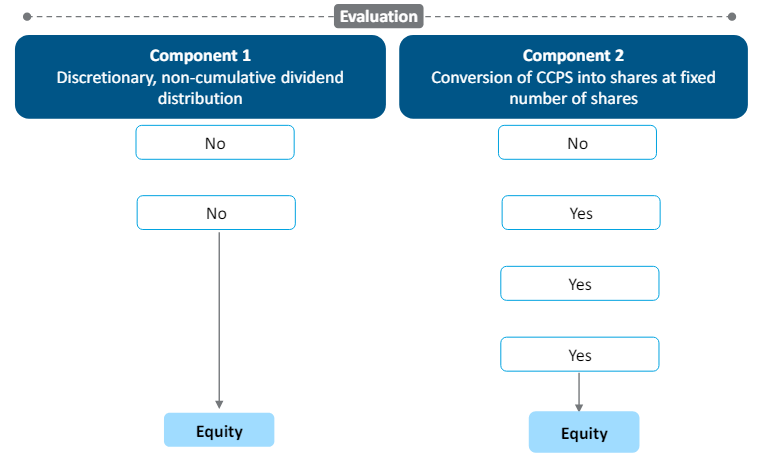

1.6 Evaluation of Ind AS 32 Guidance – Compulsory Convertible Preference Shares

X ltd (issuer) has issued non-cumulative, 4% p.a. Compulsory convertible preference shares to Y Ltd. (holder) for a consideration of Rs. 40 lakhs. These preference shares are convertible to a fixed number of equity instrument of the issuer anytime up to a period of 3 years. The dividend payment is at the discretion of the issuer.

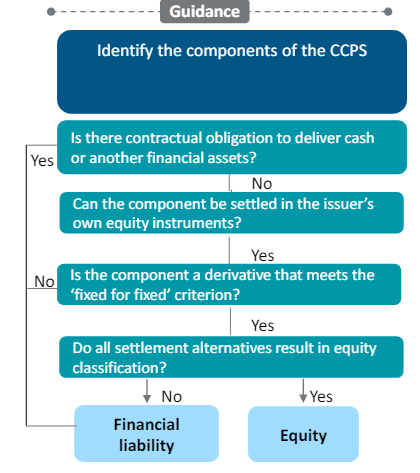

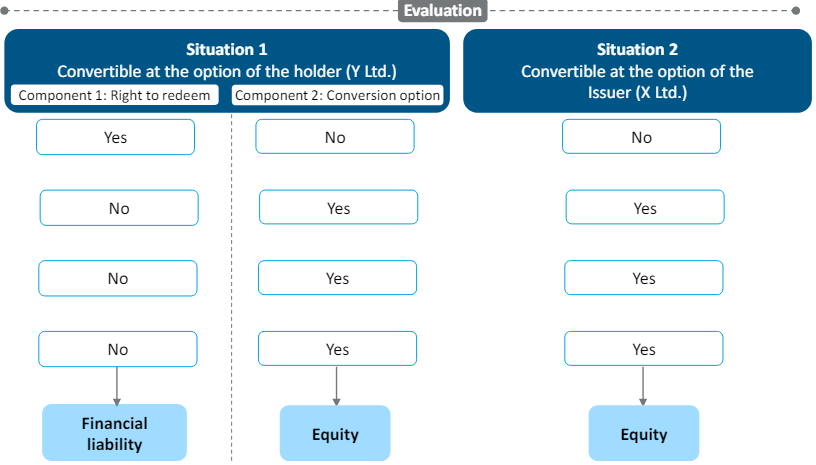

1.7 Evaluation of Ind AS 32 Guidance – OCPS

X ltd (issuer) has issued 6% p.a. Optionally convertible preference shares to Y Ltd. (holder) for a consideration of Rs. 40 lakhs. These preference shares are convertible to a fixed number of equity instrument of the issuer anytime up to a period of 3 years. If the option is not exercised, the preference shares are redeemed at the end of 3 years. Ignore dividend for ease of understanding.

1.8 Key Clauses for Consideration

| S. No. | Particulars | Gift to NR | Gift to resident |

| Cumulative Dividend | It gives assurance of receiving dividend before equity shareholders | Discretionary | Mandatory |

| Contingent Settlement Provision |

This gives the investors benefit of pre-determined timeline for exit and provides clarity on investment liquidity | If certain conditions are satisfied | Obligation to settle the instrument on happening of the event |

| Anti-Dilution | To protect the value of investment of the investors in case of subsequent down-round |

Maintaining existing conversion ratio in situations like Stock split, bonus, amalgamation, merger, etc | Protection from down round |

| Conversion option | This gives the investors opportunity to convert their investment into equity shares | Conversion into fixed number of equity shares | Conversion into variable number of equity shares |

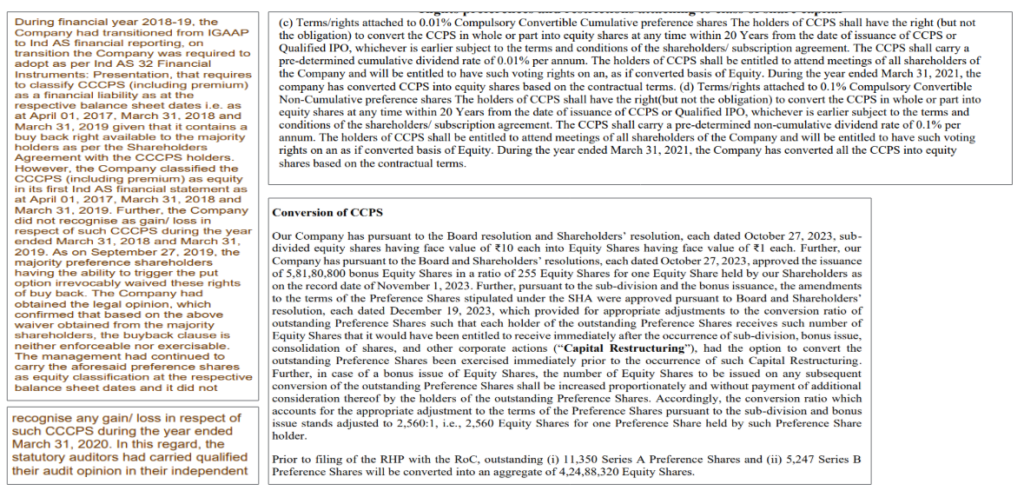

1.9 Illustrative Disclosures Provided by Some Companies (Extracts)

1.10 Key Takeaways

- Understanding of the terms and conditions of the agreement entered and its implication on the income statement and balance sheet

- Favorable or unfavorable conversion terms can affect company’s capital structure and decision-making process

- Comply with regulatory requirements and notified accounting standard to ger rid of any intricacies

- Consult with accounting expert and statutory auditors to make informed decisions

2. International Financial Reporting Interpretations Committee (IFRIC) Updates

2.1 March 2024 Closing Out

Key Takeaways

Amendments effective for annual reporting periods beginning on/after 1 April 2023:

- Deferred Tax related to Assets and Liabilities arising from a Single Transaction narrowed the scope of the initial recognition exemption in Ind AS 12 so that it does not apply to transactions that give rise to equal amounts of taxable and deductible temporary differences.

- Disclosure of Accounting Policies requires entities to disclose material accounting policy information instead of significant accounting policies. Information is material if users of financial statements need it to understand other material information in financial statements.

- Definition of Accounting Estimates defines accounting estimates as “monetary amounts in financial statements that are subject to measurement uncertainty.”

Amendments correspond to those in IFRS

IFRS Amendments effective for annual reporting periods beginning on/after 1 January 2023:

International Tax Reform—Pillar Two Model Rules includes a mandatory exception where an entity neither recognizes nor discloses information about deferred tax assets and liabilities related to Pillar Two income taxes.

The amendments require an entity to disclose:

- The fact that it has applied the exception;

- Its current tax expense (income) related to the Pillar Two income taxes; and

- Known or reasonably estimable information that would help users of financial statements to understand the entity’s exposure to Pillar Two income taxes arising from that legislation.

2.2 IFRS – 2024 amendments

Key Takeaways

Amendments to Accounting Standards/Sustainability Disclosure Standards effective for annual reporting periods beginning on/after 1 January 2024:

Together, Non-current Liabilities with Covenants and Classification of Liabilities as Current or Non-current:

- Introduce a definition of “settlement;”

- Clarify classification of liabilities as current or non-current;

- Specify that classification is unaffected by expectations about an entity’s right to defer settlement of a liability for at least twelve months;

- Specify the impact of covenants on an entity’s right to defer settlement for at least 12 months; and

- Introduce a requirement to disclose information which enable to understand the risk that non-current liabilities with covenants may become repayable within 12 months.

Lease Liability in a Sale and Leaseback requires a seller-lessee to subsequently measure lease liabilities in a way that does not result in recognition of a gain or loss that relates to the right of use it retains.

Supplier Finance Arrangements:

- Describes the characteristics of a supplier finance arrangement;

- Introduces additional disclosure requirements, in particular to require an entity to disclose information about the effects of supplier finance arrangements (liabilities and cash flows) and the entity’s exposure to liquidity risk.

New standards – Annual reporting period beginning on or after 1 January 2027; earlier application permitted

IFRS 18 – Primary Financial Statements

IFRS 19 – Subsidiaries without Public Accountability

2.3 IFRS Interpretations Committee – Agenda Decision

Selected agenda decisions of IFRS Interpretations Committee in 2023/2024:

|

Date of Issue |

Standard | Topic |

| Apr 2024 | IAS 37 |

Climate-related Commitments |

|

Apr 2024 |

IFRS 3 | Payments Contingent on Continued Employment during Handover Periods |

| Jan 2024 | IAS 27 |

Merger between a Parent and Its Subsidiary in Separate Financial Statements |

| Oct 2023 | IFRS 9 |

Guarantee over a Derivative Contract |

| Oct 2023 |

Homes and Home Loans Provided to Employees |

|

| Jan 2023 | IFRS 17

IFRS 9 |

Premiums Receivable from an Intermediary |

| Apr 2023 | IFRS 16 |

Definition of a Lease—Substitution Rights |

Complete list of IFRS Interpretations Committee agenda decisions can be found on IFRS Foundation website

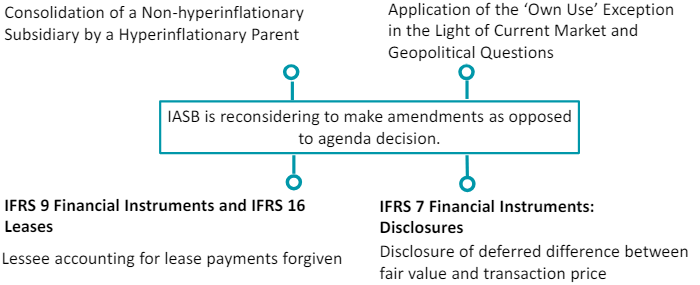

2.4 IFRS Interpretations Committee – Tentative Agenda Decision

Tentative agenda decisions of IFRS Interpretations Committee in 2023/2024:

IFRS 8 Operating Segments

Disclosure of Revenues and Expenses for Reportable Segments

- IAS 21: The Effects of Changes in Foreign Exchange Rates and IAS 29 Financial Reporting in Hyperinflationary Economies

- IFRS 9 Financial Instruments

2.5 Climate-Related Commitments

Companies are making voluntary climate-related commitments. Issues are emerging on the related financial reporting implications – in particular, when does a liability arise

Constructive obligation + Recognition criteria = Liability

- Has the company made a public statement about its climate related commitments?

- Has the public statement created a valid expectation?

-

- Language of the statement

- Specificity and status of plans

- Timing of actions to fulfil commitment

- Publicly available evidence of progress

Fact pattern

- In 20X0, an entity publicly states its commitment:

-

- to reduce its future greenhouse gas (GHG) emissions by at least 60% of their current level by 20X9; and

- to offset its remaining emission in 20X9 and thereafter, by buying carbon credits and retiring them.

- The entity also publishes a detailed transition plan.

- Management is confident that the entity can make all these modifications and continue to sell its products at a profit.

- In addition, the entity takes a number of other actions that publicly affirm its intention to fulfill its commitments.

Accounting issue

- Whether an entity’s commitment to reduce or offset its greenhouse gas emissions creates a constructive obligation for the entity?

- If so, should a provision be recognised?

- Is the amount recognised as an asset or expense when the provision is recognised?

Accounting treatment

- Whether an entity’s statement of its commitment creates a valid expectation that it will fulfill its commitment depends on the facts of the commitment and the circumstances.

- If the statement creates a constructive obligation:

-

- the entity does not recognise a provision when it makes the statement in 20X0 – the constructive obligation is not a present obligation as a result of a past event.

- the entity does not recognise a provision between 20X0 and 20X9 as it does not have a present obligation as a result of a past event until it emitted GHG it has committed to offset.

- as the entity emits GHG in 20X9 and in subsequent years, it will incur a present obligation to offset these past emissions. If the entity has not yet settled that obligation and a reliable estimate can be made of the amount of the obligation, the entity recognises a provision.

- If a provision is recognised, the amount is recognised as expenses, rather than assets, unless it give rises to or forms part of the cost of an item that qualifies for recognition of an asset.

2.6 Definition of a Lease – Substitution Rights

Fact pattern

- 10-year contract for use of 100 batteries in electric buses.

- Supplier has practical ability to substitute alternative assets.

- If battery is substituted, supplier compensates customer for revenues lost/costs incurred.

- It is expected that supplier benefits economically from substituting a battery used for three years or more.

Accounting issue

- At which level customer evaluates whether contract contains a lease when contract is for use of more than one similar asset.

- How to assess whether contract contains a lease when supplier has particular substitution rights.

Accounting treatment

- Each battery is specified.

- Battery would be implicitly specified at time it is made available for customer’s use.

- Conditions in IFRS 16:B14 for substitution right to be substantive:

-

- Supplier has practical ability to substitute alternative assets throughout period of use; and

- Supplier would benefit economically from exercise of its right to substitute asset.

- Supplier is not expected to benefit economically from exercising its right to substitute.

- Condition in paragraph B14(b) does not exist.

- Supplier does not have substantive right to substitute throughout period of use, as it does not meet both conditions in paragraph B14.

- Whether supplier’s substitution right is substantive throughout period of use can require judgment.

- Each fact pattern needs to be carefully considered.

2.7 Disclosure of Revenues and Expenses for Reportable Segments

Accounting issue

- Whether an entity is required to disclose the specified amounts in IFRS 8 Operating Segments paragraph 23 for each reportable segment if those amounts are not reviewed separately by the CODM?

- How does an entity determine ‘material items’ in IFRS 8.23(f)?

Accounting treatment

- Paragraph 23 of IFRS 8 requires an entity to disclose the specified amounts for each reportable segment when those amounts are included in the measure of segment profit or loss reviewed by the CODM, even if they are not separately reviewed by the CODM, or when those amounts are regularly provided to the CODM, even if they are not included in the measure of segment profit or loss.

- In applying paragraph 23(f) of IFRS 8, an entity:

-

- applies paragraph 7 of IAS 1 and assesses whether the disclosure of information is material in the context of its financial statements taken as a whole;

- applies the requirements in paragraphs 30–31 of IAS 1 in considering how to aggregate information in the financial statements;

- considers both qualitative and quantitative factors, representing the nature or magnitude of information, or both, in assessing whether an item of income and expense is material; and

- considers an item of income and expense for disclosure without regard to whether that item is presented or disclosed applying a requirement in IFRS Accounting Standards other than paragraph 97 of IAS 1.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA