Preparation for Litigation Arena & GSTAT – Background | Structure | Appeal Process

- Blog|GST & Customs|

- 11 Min Read

- By Taxmann

- |

- Last Updated on 18 July, 2024

GSTAT stands for the Goods and Services Tax Appellate Tribunal. It is a specialized appellate body mandated by the Central Goods and Services Tax (CGST) Act, 2017, under Section 109. The GSTAT is designed to resolve disputes related to the Goods and Services Tax (GST) in India. It consists of a principal bench located in New Delhi and multiple state benches across the country. Despite being mandated in 2017, the establishment of GSTAT faced delays due to various administrative and procedural challenges. The tribunal is finally being set up to streamline the dispute resolution process for GST-related issues.

By Sunnay Jariwala – Practising Chartered Accountant

Table of Contents

- Background of Appellate Tribunals

- Advantages of Approaching the Tribunal

- Structure of GSTAT

- Appeal Process – Digitisation

- Provision vs Rules

- Section 107(1) of CGST Act

- Section 112(1) of CGST Act

- Doctrine of Judicial Precedents

- Judgement

- Drafting 101

- The ABCs of Legal Drafting

- Basics and Check List Before Drafting

- Essentials While Drafting

- Points to be Taken in Drafting Grounds

- Some Types of Grounds

- Drafting of Submissions

- Wrongly Availed Credit but not Utilized

- Drafting

- Procedures Estimated By Law

- Case Laws (Violation of Natural Justice)

- Practical Tips

- Miscellaneous Points

1. Background of Appellate Tribunals

The Customs Excise and Service Tax Appellate Tribunal (CESTAT) was constituted originally as Customs, Excise & Gold (Control) Appellate Tribunal (CEGAT) Although it has been created under the Customs Act, it is mandated to decide appeals under the following 4 Acts.

- Customs Act, 1962

- Central Excise Act, 1944

- Finance Act, 1994

- Customs Tariff Act, 1975

1.1 CESTAT Introduction

- Established: 1982

- Purpose: Adjudicate disputes related to customs, excise, and service tax.

Structure

Principle Bench: New Delhi

Regional Benches: 8 Benches

Composition: Judicial & Technical Members

Jurisdiction

- Customs

- Excise

- Service Tax

1.2 GSTAT

GST Council approved the formation of GST Appellete Tribunal (GSTAT).

Justice (Retd.) Sanjaya Kumar Mishra is appointed as first president of GST Appellate Tribunal in New Delhi. His appointment marks the beginning of the operationalisation of the GSTAT, a crucial body for resolving GST-related disputes.

As per GST Council approval, Government has notified the Principle Bench, to be located at New Delhi, and 31 State Benches at various locations across the country.

Process for Appointment of Judicial Members and Technical Members is already in progress.

1.3 Benefits from formation of GSTAT

Since the tribunal will have a bench in every state, it will ensure

- Lower pendency and faster disposal of cases, while highlighting that tribunals will clarify the provisions of GST law, which in turn, will reduce the scope for future litigation.

- Swift, fair, judicious and effective resolution to GST disputes, besides significantly reducing the burden on higher courts.

2. Advantages of Approaching the Tribunal

2.1 Precedent Setting

- Specialized Adjudication: GST Tribunal consists of experts. They can provide deeper understanding related to GST disputes, leading to more informed and fair decisions.

- Faster Resolution: Help business avoid prolonged litigation processes, saving time and resources.

- Cost Effectiveness: Generally involve lower costs compared to traditional court litigation, making it more accessible for smaller businesses and individuals to seek redressal.

- Informal Procedure: Follows less formal procedure as compared to traditional courts, making it easier for parties, without being overwhelmed by complex legal processes.

- Specific Expertise: Tribunal members specialized knowledge and experience in GST matters, ensures fair and consistent decisions.

- Appeal Mechanism: Parties dissatisfied with the tribunal, can appeal to higher courts.

3. Structure of GSTAT

3.1 What is GST Appellate Tribunal?

- It represents a specialised authority formed to resolve GST-related disputes.

- It will be the forum of second appeal under GST laws.

- It is a common forum to ensure uniformity in dispute redressals and quicker resolution of cases.

3.2 GST Appellate Tribunal Composition

National Bench (New Delhi)

- President (Head)

- Judicial Member

- Technical Members

-

- 1 from State

- 1 from Centre

3.3 Sec 110(1)

- President

-

- Must be supreme court judge, or

- Have served High Court as the Chief Justice

- Max Age: 70 years

- Judicial Member

-

- High Court Judge, or

- Served as Additional District Judge, or

- District Judge for period of 10 years.

- Max Age: 65 years

- Technical Member (Centre)

-

- Indian Revenue Service member belonging to Group A, or

- Member of All India Service with 3 years of experience in administering GST in the Central Government.

- Also Technical Member (Centre ) should have completed 25 years in Group A services.

- Max Age: 65 years

- Technical Member (State)

-

- Government Officer, or

- All India Service officer with the rank above Additional Commissioner of Value Added Tax.

- Rank should be above First Appellate Authority.

- Technical Member (State ) should have completed 25 years in Group A services and 3 years administering GST or Finance & Taxation in State Govt.

- Max Age: 65 years

3.4 GST Appellate Tribunal Rules, Powers and Duties

The Tribunal:

- Is not bound by the Code of Civil Procedure, 1908.

- Possesses powers similar to a civil court under the Code of Civil Procedure, 1908.

- Can requisition public records, issue commissions for witness examination, and dismiss or decide representations for default.

3.5 Application to Appellate Tribunal under GST

- A person unhappy with the decision of the First Appellate Authority or the Revisional Authority or the Revisional Authority – can appeal against the decision to the National Appellate Tribunal (Appellate Tribunal).

- They must appeal within 3 months from the date on which the order sought to be appealed against is communicated to the person preferring the appeal, along with the Form GST APL – 05 and Fees.

3.6 GST Appeal Fees

Every Appellant require to pay:

- Full Amount from the original order that he agrees to (Including tax, interest, fine, fee and penalty).

- If any dispute, to pay 20% amount of tax in dispute as GST appeal fees.

3.7 Will all appeals be accepted?

- The Appellate Tribunal can refuse to admit any appeal where the amount involved (tax/input tax credit/fine/fee/penalty) is lower than Rs. 50000 [Sec 112(2)]

- If this committee is of the opinion that the order was not legal or not properly passed then it can direct any officer to apply to the Appellate Tribunal within 6 months from the appeal date (extendable by 3 months) [Sec 112(3)]

4. Appeal Process – Digitisation

- GST Appeal process to be fully digitized.

- New e-portal to be ready before all benches of appellate tribunal go on stream.

- Tax experts say the digital portal would result in streamlining of appeals by enabling electronic filing.

- The Portal would help in faster disposal of appeals, quicker liquidation of revenue.

Source: Media

4.1 Appeal may not be admitted by CESTAT due to several reasons

- Limitation Period: If appeal filed beyond prescribed time limit without satisfactory explanation for the delay, CESTAT may reject it.

- Jurisdiction Issues: If matter falls outside the jurisdiction of CESTAT, appeal may not be admitted.

- Pre-Deposit Requirement: As per Section 35F of the Central Excise Act, 1944, and Section 129E of the Customs Act, 1962, appellants are required to deposit a certain percentage of the disputed tax amount before filing an appeal. Failure to comply with this requirement can result in non-admission of the appeal.

- Non-compliance with Procedures: Appeals must adhere to specific procedural requirements, including submission of necessary documents and proper format. Non-compliance with these procedural norms can lead to rejection.

- Inadequate Grounds: If the grounds for appeal are found to be frivolous or not substantial enough to warrant a re-examination of the case, CESTAT may dismiss the appeal.

- Lack of Authorization: If the appeal is filed without proper authorization or by an unauthorized person, it may not be admitted.

- Deficient Fee Payment: Appeals must be accompanied by the prescribed fee. Inadequate payment of the fee can result in non-admission.

5. Provision vs Rules

The distinction between provisions and rules is crucial in legal contexts, as it can affect the interpretation and application of laws

- Provision: Specific clause within a statute or regulation that stipulates a requirement, condition, or stipulation

- Rules: Often derived from statutory provisions and are more detailed guidelines that govern how the provisions should be implemented or followed

In the legal context, there are instances where something may be mentioned in a provision but not explicitly detailed in the rules, and vice versa. This can lead to ambiguities or conflicts in the application of the law. Courts often have to interpret these situations, and various case laws provide insights into how these interpretations are made.

Case Laws

Suraj Lamp & Industries (P.) Ltd. v. State of Haryana [2011] 14 taxmann.com 103 (SC): The Supreme Court of India dealt with the interpretation of provisions under the Registration Act, 1908, and rules regarding the transfer of property.

The court emphasized that the statutory provision must prevail in case of a conflict with subordinate rules.

CIT v. Anjum M.H. Ghaswala [2001] 119 Taxman 352 (SC): The Supreme Court interpreted provisions of the Income Tax Act, 1961, and the rules framed thereunder.

The court held that in case of inconsistency between the statutory provision and the rules, the statutory provision would prevail.

When a statutory provision exists without a corresponding detailed rule, or a rule exists without a clear statutory provision, courts often engage in statutory interpretation. The principles of statutory interpretation include:

- Literal Rule: Where the words of the statute are clear and unambiguous, they should be given their ordinary meaning.

- Golden Rule: If the literal interpretation leads to an absurdity, the courts can modify the meaning to avoid the absurdity.

- Mischief Rule: Courts look at the “mischief” or problem that the statute intended to remedy and interpret the provision in a way that suppresses the mischief.

6. Section 107(1) of CGST Act

6.1 Appeal to Appellate Authority

Any person aggrieved by any decision or order passed against him under CGST Act or SGST Act or UTGST Act or IGST Act by an adjudicating authority, may appeal to such Appellate Authority as may be prescribed within 3 months from the date on which such decision or order is communicated to him.

7. Section 112(1) of CGST Act

7.1 Appeal to Appellate Authority

Any person aggrieved by an order passed against him under section 107 or 108 of CGST Act or SGST Act or UTGST Act may appeal to the Appellate Tribunal against such order within 3 months from the date on which the order sought to be appealed against is communicated to the person preferring the appeal.

8. Doctrine of Judicial Precedents

2 Rules that apply to the Doctrine of Judicial Precedents

- Court which is lower in hierarchy is completely bound by the decisions of courts which are above it.

- Higher Courts are bound by their own decision in general in matters of related to precedence.

High Court

- The decisions of the high court are binding on all subordinate courts. In case of a conflict between two benches of similar authority, the latter decision is to be followed.

- The more the number of judges on a bench, the higher their authority.

- The decision of 1 high court is not binding on other high courts.

Supreme Court

- The Supreme Court is the highest authority and its decisions are binding on all courts of the country.

- Article 141 states all courts are legally bound to the Supreme Court judicial decisions with the exception of Supreme Court itself. The Supreme Court is not bound by its own decisions.

- However, the Supreme Court recognizes that its earlier decisions cannot be deviated from, except in case of extenuating circumstances. If an earlier decision is found to be incorrect the Supreme Court will deviate from it.

Source URL: https://www.toppr.com/guides/business-laws/introduction-tolaw/principle-sources-of-indian-law-judicial-decisions/

9. Judgement

Section 2(9) of the Civil Procedure Code, 1908 defines term ‘Judgement’ to mean

“The statement given by the Judge of the grounds of a decree or order “

10. Drafting 101

“Drafting is not only an art, but there’s a degree of science as well.”

– John Dorsey

- Use clear, straightforward language.

- Effectively explain and break down complex legal matters.

- Prioritize the reader’s understanding and perspective.

- Focus on the writer’s viewpoint.

- Follow these three steps: Planning, Execution, and Review.

11. The ABCs of Legal Drafting

Accuracy

- Language

- Content

- Grammer

Brevity

- Avoid repetition

- Use minimum words

Clarity

- To the Point

- Pass the Message

12. Basics and Check List Before Drafting

- Crafting appeals is a skillful practice.

- Verify if the appeal is applicable.

- Refrain from filing unnecessary appeals.

- Diligently review the orders eligible for appeal to spot inconsistencies and factual discrepancies.

- Determine the time frame within which the appeal must be filed.

13. Essentials While Drafting

- You can appeal a penalty even if you didn’t appeal the assessment order.

- Check if any claims were missed and if new pleas can be introduced.

- Ensure that any missed claims can be brought up as new arguments.

- Confirm that the authority issuing the order had the proper jurisdiction.

- Verify that the assessment or appeal order was issued within the allowed time frame.

14. Points to be Taken in Drafting Grounds

14.1 Do’s

- Keep grounds clear, concise, simple, and free of ambiguity.

- Always include a prayer with specific requests at the end.

- Ensure grounds are broad and not restrictive.

- Use plain and simple language, avoiding jargon.

- Determine the order of priority for grounds if there are multiple issues.

- The last ground should request permission to add, amend, or withdraw grounds.

- Ensure all grounds are addressed in the order and avoid repetition.

- Highlight the nature of the dispute and the relief sought.

- Carefully review the order to identify any hidden grounds.

- Explicitly mention if the opportunity to be heard was not provided.

14.2 Dont’s

- Avoid listing multiple grounds for a single issue unless each ground is unique.

- Refrain from using lengthy sentences.

- Do not make the grounds argumentative.

- Do not include decisions in the grounds unless they are essential.

15. Some Types of Grounds

- Technical grounds

- Jurisdictional grounds

- Natural Justice grounds

- Legal grounds based on merits of the case

- Alternate grounds/Without Prejudice grounds

- Consequential Grounds

- Additional grounds

16. Drafting of Submissions

- Be well-versed with the Assessment & Appeal order and case details.

- Include the general facts of the case and assessment history at the beginning.

- Ensure belief in the strength of the case.

- Support written submissions with a paper book containing documentary evidence.

- Collect all relevant evidence and documents.

- Clearly distinguish between additional grounds and additional submissions.

- Organize submissions by grounds and make unbiased submissions.

- Present any new facts as additional evidence.

- Detail special facts related to each ground in the submissions.

- Address the assessment officer’s allegations with specific comments and submissions.

- Submissions should start with the facts and then provide judicial references.

- Highlight the history of previous assessment years if relevant.

- Pay attention to formatting and presentation.

- Order your arguments from strongest to weakest.

17. Wrongly Availed Credit but not Utilized

- Reverse through ITC.

- Argue on the base that it is availed but not utilized.

18. Drafting

Skill: Convey client’s facts, position clearly to Revenue Department.

Art

- Knowledge of multi–laws, a 360 degree overview of the subject matter & which laws can affect the same or can come in aid of the same.

- Language – Clarity – Pointwise

- Maintain timeline of events – Analytical skills.

- Think about counter Questions coming up & be prepared with the some content of the same.

- A well organized law typically begins with a statement of what the law is, what it does & what it covers.

- Explicit or Implicit cross references must be clearly mentioned.

- Logical interpretation among provisions are intricate.

19. Procedures Estimated By Law

Due Process of Law

- It Developed from Clause 39 of Magna Carta in England. It means ‘no man of what state or Condition be brought out to be punished without following the due process of Law.

- Latin maxim – lex terrae – Law of Land.

Legal – Taxation Framework

- Whatever tax is being changed has to be Backed by the Law passed by the legislature or the Parliament.

- Kar – Means taxes

- Danda Sanskrit Word.

-

- Litigation Aspects

- Lis – Latin

- Whatever tax is being charged has to be Backed by the Law passed by the legislature or the Parliament

- Criminal Trial

- Movie Example

- Compulsory trial

Natural Justice

No one should be a judge in his own case.

- Latin maxim – Nemo Judex in Causa Sua.

- Audi Alteram Partem – To hear the other party.

- Case Laws coming up.

- Case Law – Chuharmal Mohanani vs. CIT AIR 1988 SC 1384, Important Evidence Act vis a vis Taxation Matters.

- Recent Condonation of Delay ITAT Mumbai, more than 2200 days.

Legal Framework

- Read the Order First

- Ignore the Contents for First Reading

- Sec 160(2)

- Defects in Notice is Fatal to Demand. It cannot be sustained.

Evidence Act

- Proved

- Disproved

- Not Proved

- Undisputed Allegations

- Admitted Facts

- Judge point….

- RCM Liability

- Person Making Allegation needs to prove

- Dept alleges rate as 18% instead of 12%

- Dept needs to prove the same

Sec 58 – Facts admitted, need not be proved.

- Final Audit Report – Practical Case

- Sec 101 – Burden of Proof

- A person is bound to prove the existence of any fact it is said that the burden of proof lies on that person

- New Material Introduced

Established Rules of Natural Justice:

- Article 14 – Equality in General

- Article 21 – Guarantees to Life and Liberty

- Right to “adequate notice“

- Right to “hearing”, Adjournment

- Right to “rebut adverse evidence“

- Right to “legal representation”

- “Reasoned decision”

20. Case Laws (Violation of Natural Justice)

- Fino Paytech Ltd. V. Union of India [2024] 161 taxmann.com 416 (Bom) Where assessee had changed their address on GST portal twice, but show-cause-notice was sent to old address.

- Menaka Gandhi V. Union of India (1978) The judgement deals with various aspects related to the expansive interpretation of Article 21, including peripheral rights, the right to travel abroad, the relationship between Articles 14, 19 and 21, as well as the difference between due process of law and procedure established by law.

21. Practical Tips

- Which Milk?

- Dealer Classification

- Tonic Water

- Query on Phone

- Classification Tips

- Importance of Classification in IDT – Topline

- DT vs IDT Law

- Types Of Opinions

- Expert Advise

- Golden Opportunity

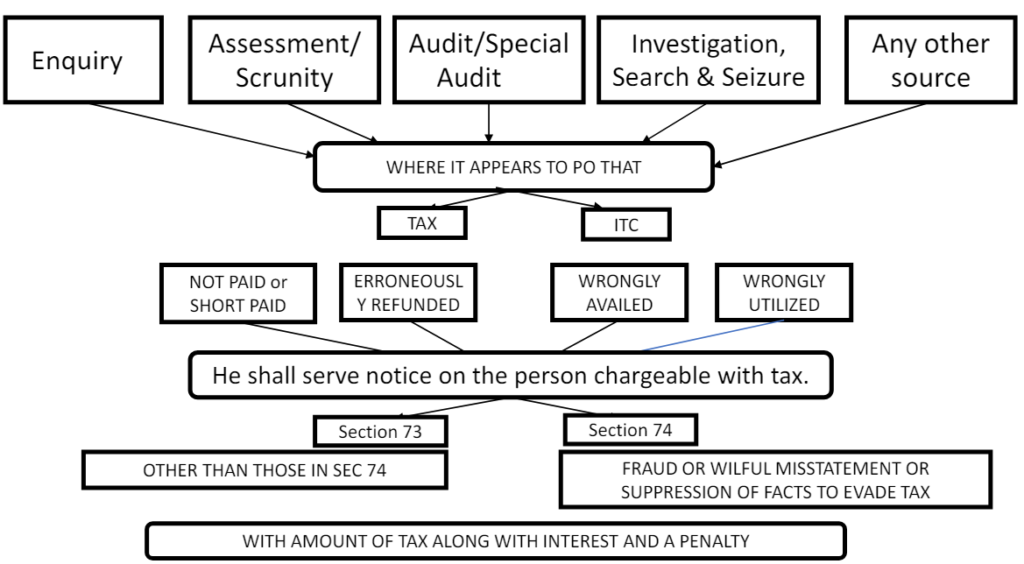

- What is a Notice?

- Why we get a Notice?

- What to do once we get a Notice?

22. Miscellaneous Points

- Belated Claim vs Belated Return Eg: Club & Association 1/1/2022

- Law needs to be read harmoniously & absolutely.

- Intent of Law maker is to be seen in statutes.

- RCM not paid under sec 9(3) 1. Incidence 2. Non–payment 3. Findings.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA