Opportunities at GIFT City – Your Gateway To Finance | Technology | Tax Benefits

- Blog|FEMA & Banking|

- 31 Min Read

- By Taxmann

- |

- Last Updated on 4 July, 2024

GIFT City, short for Gujarat International Finance Tec-City, is a planned business district in the Indian state of Gujarat. Located between Ahmedabad and Gandhinagar, it aims to serve as a global financial and IT services hub. Key features of GIFT City include: – Integrated Development: It offers a blend of commercial, residential, and social infrastructure, designed to provide a high-quality urban living and working environment. – Special Economic Zone (SEZ): GIFT City includes a Multi Services SEZ with International Financial Services Centre (IFSC) status, which allows businesses to operate in a tax-efficient environment. – Financial Services Hub: It aims to attract financial services and technology firms from around the world, providing a platform for banking, insurance, capital markets, and asset management companies. – State-of-the-Art Infrastructure: The city features advanced infrastructure, including high-speed internet, reliable power supply, water management systems, and efficient transportation networks. – Regulatory Framework: GIFT City operates under a conducive regulatory environment, with policies and regulations designed to facilitate international business operations. – Smart City Initiatives: It incorporates smart city concepts, utilizing technology to enhance the quality of life and improve urban services. – Employment Opportunities: By attracting global firms and fostering economic activities, GIFT City aims to create numerous job opportunities in finance, IT, and related sectors. GIFT City is envisioned as a modern financial hub that integrates best practices in urban planning, business operations, and sustainability.

By Vipul Gandhi – Director [Corporate and Transaction Advisory Services] | Khandhar Mehta & Shah (KMS)

Table of Contents

- Overview of GIFT CITY and IFSC

- Permissible activities in IFSC

- Key Fiscal Benefits of setting up units in GIFT IFSC

- Government of Gujarat IT/ITes Policy | 2022-2027

- Opportunities for Professionals

- Opportunities for Corporates

- Process for setting up unit in IFSC/GIFT City

- IFSCA (Book-keeping, Accounting, Taxation and Financial Crime Compliance Services) Regulations, 2024 (BATF)

- Interim Budget 2024 – Highlights

1. Overview of GIFT CITY and IFSC

1.1 Hon’ble Prime Minister of India Vision for GIFT City

“Another special feature of GIFT City is that it is the main pillar of the tri-city approach. Ahmedabad, Gandhinagar and GIFT City, all three are just 30 minutes away from one another. And all three have their own special identity. Ahmedabad boasts of a glorious history. Gandhinagar is the centre for administration and the main hub of policy and decisions. GIFT City is the main centre of the economy. That is, if you go to any of these three cities, then you are only thirty minutes away from the past, present and future.”

– Hon’ble Prime Minister of India

Shri Narendra Modi

1.2 About GIFT City

“GIFT City IFSC– Gujarat, ranked 1st amongst top 15 Global Financial Centre that will become more significant and 1st in Reputational Advantage”

based on the report issued by The Global Financial Centres Index, 28 September 2020 Issue

- A Greenfield Smart City developed on 886 Acres of land

- Developed by Government of Gujarat and supported by Govt. of India

- The financial gateway of India for inbound & outbound investment

- Government of India operationalized GIFT City as an IFSC in 2015

-

- Global Benchmarking

- Integrated Development

- Strong Promoters

- Central Business Hub

- India’s 1st IFSC

- State of the Art Infrastructure

- Strategic Location

- Ease of Doing Business

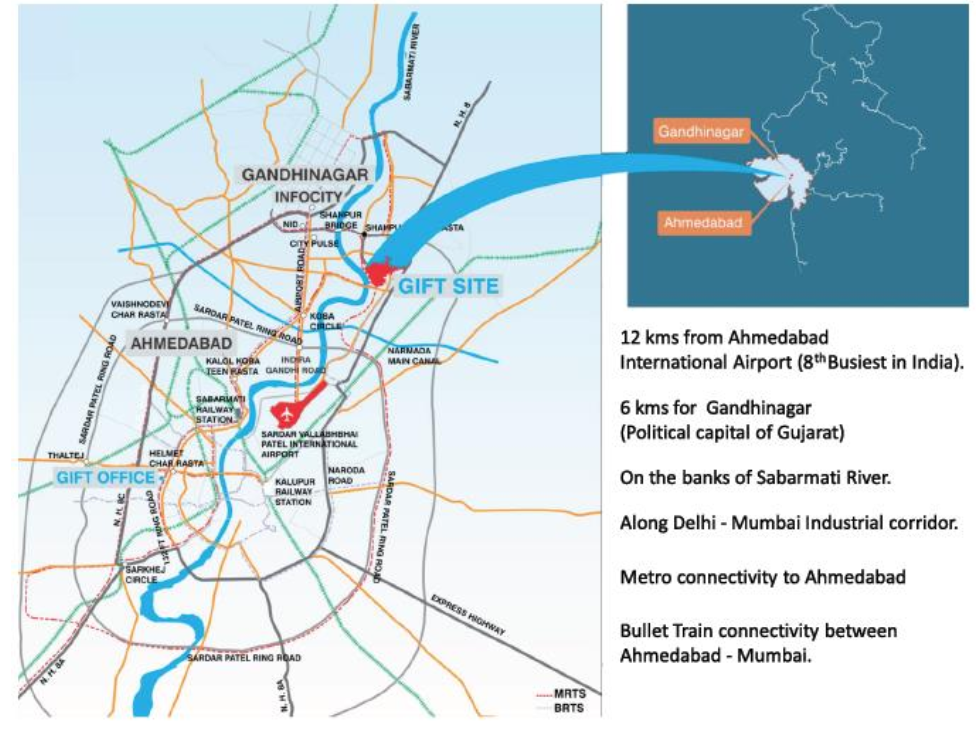

1.3 Strategic Location

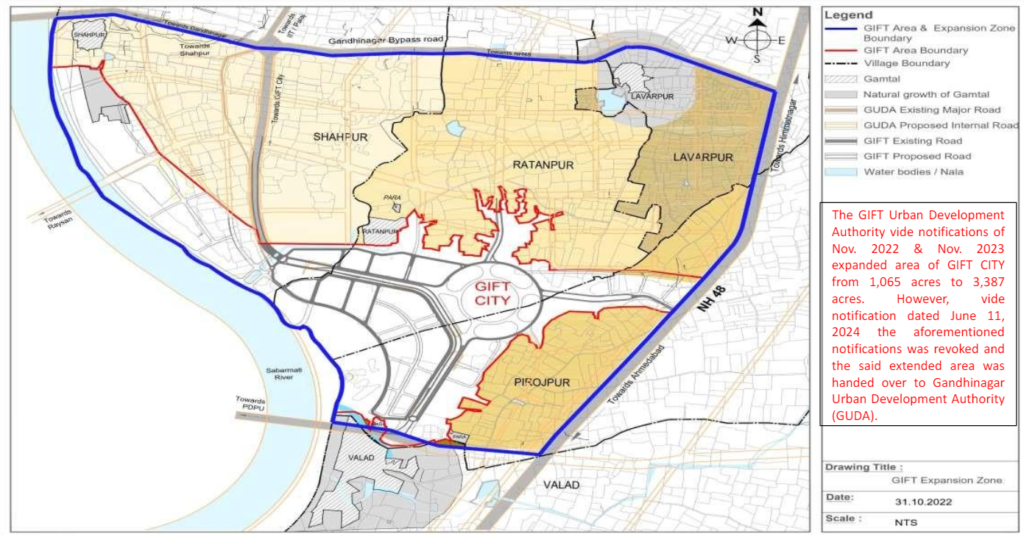

1.4 GIFT City – Extended City limit

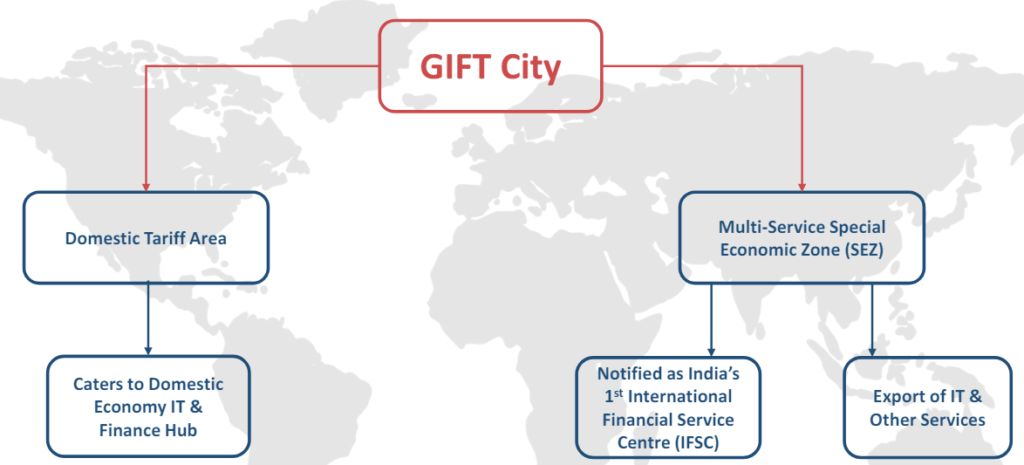

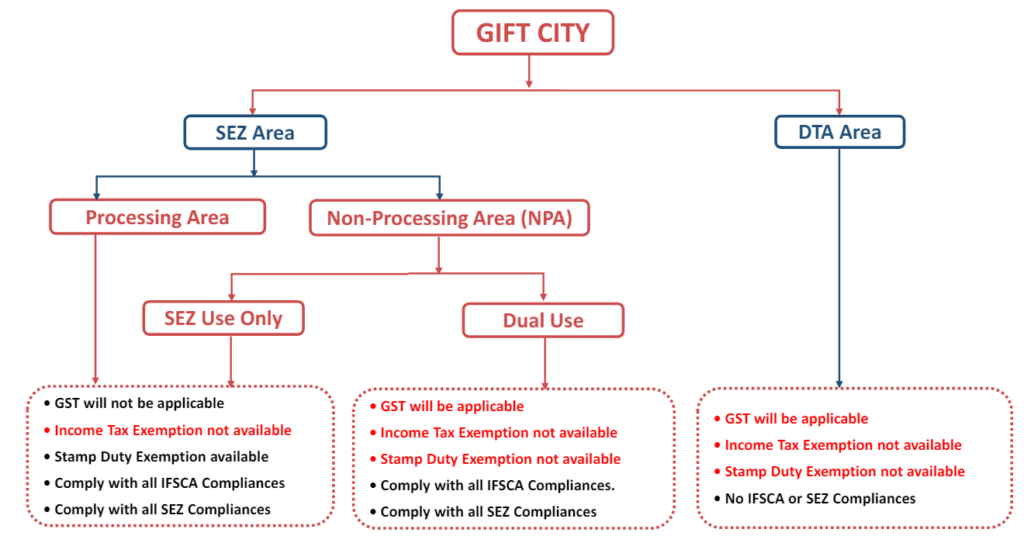

1.5 GIFT City – Structure

GIFT City – SEZ

- Processing Area

-

- International Financial Service Centre (IFSC)

- International Techno Park & International Market Zone

- Commodity Exchanges

- Global Trading Exchanges

- Insurance

- Offshore Banking

- IT/ITeS

- BATF Services

- Non-Processing Area

-

- Related Commercial and Office Buildings

- Service Apartments & Residential Flats

- Hostels, Restaurants and Food Court

- Business Hotel, Shopping Centre, Retail Stores and Banks

- Training Center for Financial Services

- Medical Centre

- Entertainment Centre/Theatre

- Regulators Offices

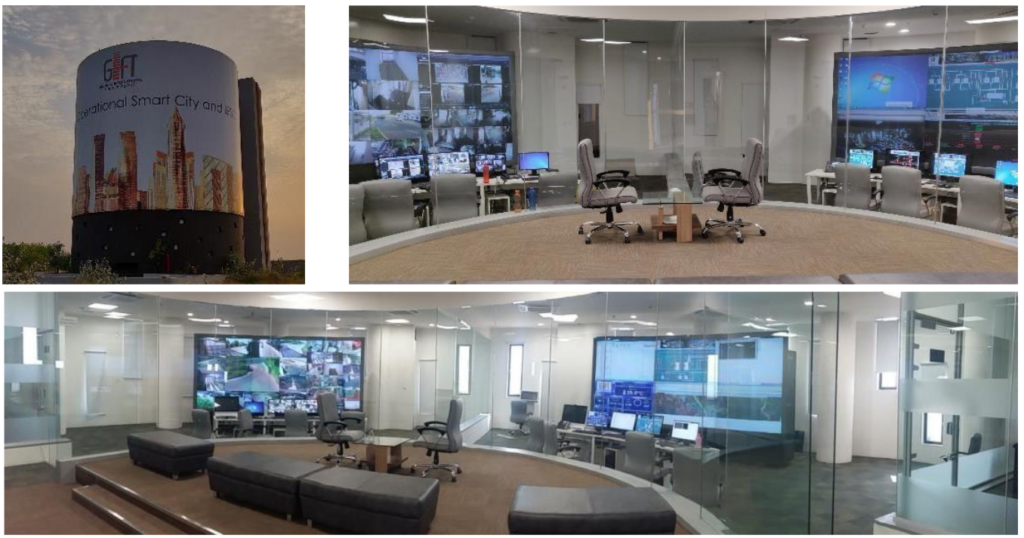

1.6 State of Art Infrastructure

1.7 City Command and Control Centre (C4)

1.8 Operational Buildings in Domestic Area

1.9 Commercial Developments in GIFT SEZ – IFSC

1.10 Social Facilities

1.11 Vision for IFSC

“To enable Indian firms to compete on an equal footing with offshore financial centres”

“Regulations comparable to any other leading international finance centres”

“To become price setter for at least few of the largest traded financial instruments in the world (commodities, currencies, equities….)”

“Companies from Asia, Africa and Europe should be able to raise funds from IFSC”

Hon’ble Prime Minister of India

January 2017

1.12 International Financial Service Centre (IFSC)

What is IFSC?

- An IFSC caters to the customers outside the jurisdiction of domestic economy. Such centers deal with the flow of finance, financial products and services across the borders.

- IFSC as envisaged under the Indian context

“is a jurisdiction that provides financial services to nonresidents and residents (Institutions), in any currency other than Indian Rupee (INR)”.

- IFSC is set-up to undertake financial services transactions that are currently carried on outside India by overseas financial institutions and overseas branches/subsidiaries of Indian financial institutions.

IFSC in India

- In India, an IFSC is approved and regulated by the Government of India under the Special Economic Zones Act, 2005.

- Government of India has approved GIFT City as a Multi Services Special Economic Zone (‘GIFT SEZ’) and has also notified this zone as India’s IFSC.

- The launch of the IFSC at GIFT City is the first step towards bringing financial services transactions relatable to India, back to Indian shores.

- IFSC unit is treated as a non-resident under extant Foreign Exchange Management regulations.

1.13 International Financial Services Centre Authority

- Insurance Regulatory Development Authority of India

- Reserve Bank of India

- Securities & Exchange Board of India

- Pension Fund Regulatory & Development Authority of India

2. Permissible activities in IFSC

2.1 Business Opportunities at GIFT IFSC

- Banking, Insurance & Capital Market

- Fintech

- Global In-House Center

- Aircraft Leasing and Financing

- International Bullion Exchange

- Global/Regional Corporate Treasury Centre

- Ancillary Services

- Ship Acquisition, Financing and Leasing

2.2 Key Business Activities

2.2.1 Capital Markets

Activities:

- Listing and issuance of securities

Entities

- Stock/Commodity Exchanges

- Clearing Corporation

- Depository

- Broker Dealer

- Trading Members

- Segregated Nominee Account Providers

- Clearing Corporations, Depositories, other intermediaries

2.2.2 Offshore Banking

Activities

- Corporate Banking

- ECB Lending

- Servicing JV/WOS of Indian companies registered abroad

- Factoring/Forfaiting of export receivables

Entities

- Indian banks

- Foreign banks

- Finance Cos and NBFCs

2.2.3 Offshore Insurance

Activities

- General/Life Insurance

- Co-Insurance

- Reinsurance

- Captive Insurance

Entities

- Indian Insurer

- Indian Reinsurer

- Indian Broker

- Foreign Insurer

- Foreign Reinsurer

2.2.4 Offshore Asset Management

Activities

- Portfolio Management Services

- Wealth Management Services

- Custodial Services

Entities

- Alternative Investment Funds

- Mutual Funds

- Investment Advisors

- Portfolio Manager

2.2.5 Emerging Activities

- Global Fintech Hub

- Global In-house Centres

- International Bullion Exchange

- Aircraft Leasing & Financing

- Ship Leasing & Financing

- Foreign University

- Book Keeping, Accounting, Taxation, Financial Crime Compliance (BATF)

2.2.6 Ancillary Services

- Legal services, Compliance & Secretarial Services

- Accounting, Auditing, Bookkeeping & Taxation Services

- Professional and Management Consulting Services

- Administration, Assets Management Support Services and Trusteeship Services

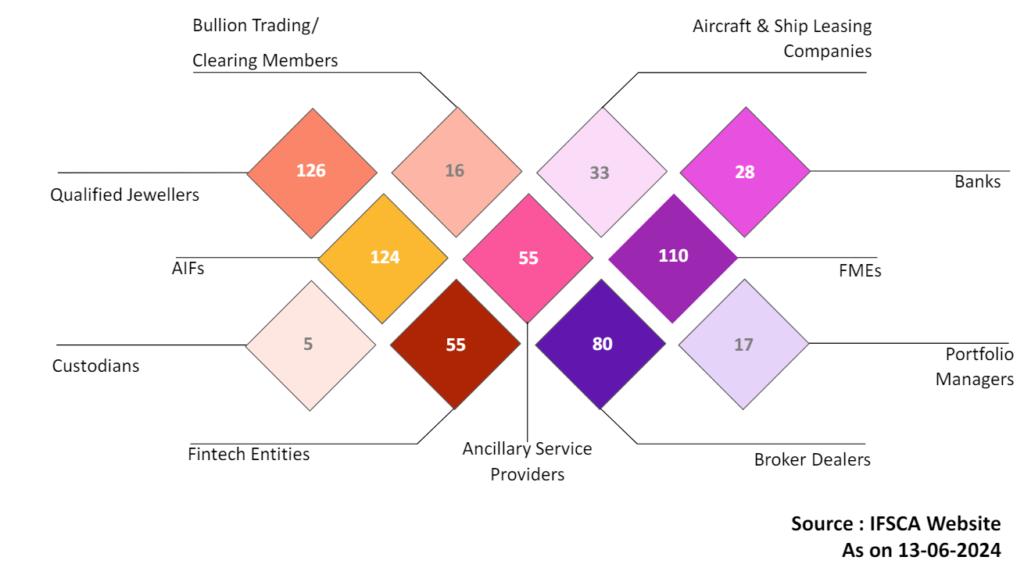

2.3 IFSC Ecosystem and Business Growth

2.4 Key Institutions at GIFT IFSC

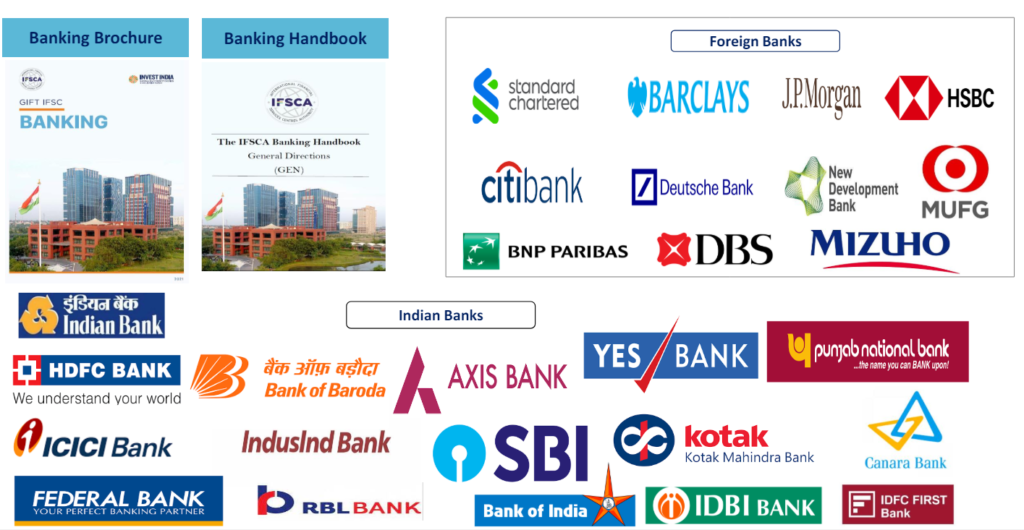

2.5 Banking Sector Highlights

2.6 Capital Market Highlights

Key Developments

- Retail Indian Investors provided with opportunity to trade in select US Stocks on NSE IFSC platform via Unsponsored Depository Receipts

- India INX Global Axis subsidiary of India INX has been granted approval to access all global markets through international brokers

- NSE IFSC-SGX Connect:

-

- Potential to onshore $ 4.9 Bn daily open interest

- Market Data Connect established

- From 3rd July, 2023 SGX Nifty renamed as GIFT Nifty

- Multi-product Exchange: Equity, Currency, Commodity, Index and Debt Securities (operates for 22 Hrs/day)

Issuance and Listing of Securities (Regulations) 2021

- Listing by SMEs and Start-Ups

- Initial Public Offering (IPO) by Indian & Foreign Cos

- Listing of Depository Receipts (DRs)

- Listing of Debt Securities

- Environmental, Social, and Governance (ESG) Debt Securities

- Listing by Special Purpose Acquisition Company (SPACs)

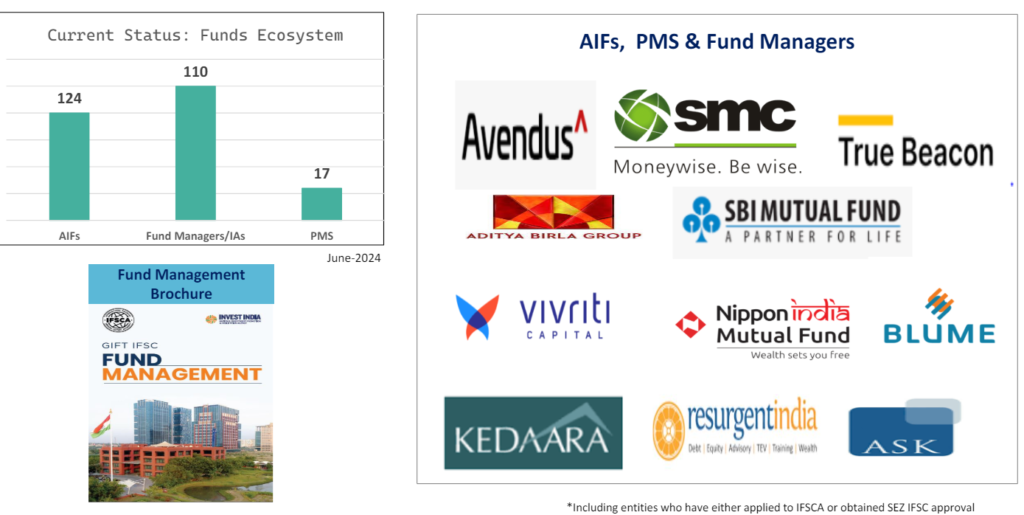

2.7 Fund Industry Highlights

2.8 Aircraft Leasing and Finance

Aircraft Leasing Potential in India:

- Aircraft leasing activity expected to generate annual lease financing opportunity of $ 5 Bn

- Leasing is a preferred choice in India – 80% of total fleet size

- India has the 3rd largest aircraft order book globally

- Report “Rupee Raftaar” released by MoCA

- Finance Ministry notifies “Aircraft Lease” as a Financial Product

- Budget announcements on tax incentives for the aircraft leasing industry

- IFSCA issues “Framework for Aircraft Operating Lease”

- India Aircraft Leasing Summit held at New Delhi

- 1st Aircraft leased from GIFT IFSC arrives in India

Target: All Aircraft Leasing requirement of Indian Aviation to be met from GIFT IFSC in next 3 years. (Atma Nirbhar Bharat)

*Including entities who have either applied to IFSCA or obtained SEZ IFSC approval

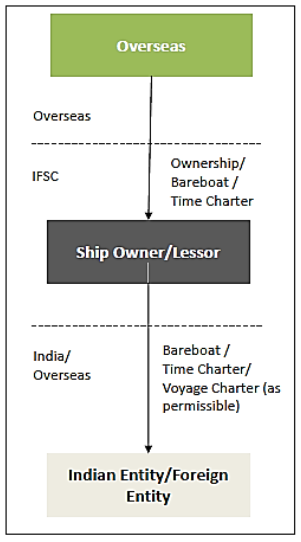

2.9 Ship Leasing and Finance

2.9.1 IFSCA (Finance Company) Regulations, 2020

Form of Set-up

- For Performing core activities – Company form permitted.

- For Performing non-core activities – Company form permitted. Additionally, branch, LLP or trust form also permitted if only non-core activity is performed.

- Applicant entity and/or its promoters shall be from a FATF compliant jurisdiction

- FC/Parent of FU to maintain a minimum owned fund – USD 0.2 Mn for non-core activities and USD 3 Mn for core activities

- To comply with Merchant Shipping Act, 1958 (“Shipping Act”) or other applicable statutes

2.9.2 Prudential Norms (For Finance Lease e.g.: Bareboat charter cum demise)

General prudential requirements

As specified by the IFSCA

Capital Ratio

Minimum 8% of regulatory capital to risk-weighted assets or at such percentage as may be specified by the IFSCA

Liquidity Coverage Ratio

IFSCA prescribed LCR on stand-alone basis at all times

Exposure Ceiling

The sum of all the exposures of a FC/FU to a single counterparty or group of connected counterparties shall not exceed 25% of its available eligible capital base without the approval of the IFSCA

2.9.3 Operating lease

- Operating lease including sale and leaseback, purchase, novation, transfer, assignment, and other similar transactions in relation to ship lease;

- Asset Management Support Services for assets owned or leased out by the entity or by its wholly-owned subsidiary(ies) or by the branch of its wholly owned subsidiary set up in IFSC;

- Further, for carrying out asset management support service, the third party! the service provider shall require to be registered under ancillary services framework as an ancillary service provider,

- Any other related activity with the prior approval of the IFSCA.

2.9.4 Financial lease

- Financial lease or a hybrid of a financial and operating lease;

- Permitted activities under the Ship Operating Lease framework;

- Any other related activity with the prior approval of the IFSCA.

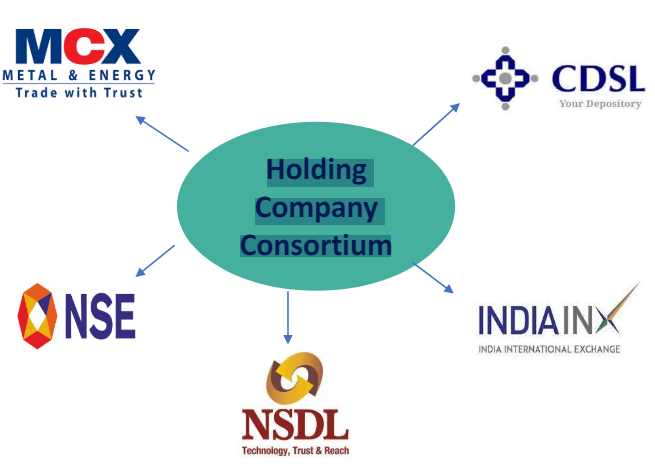

2.10 India International Bullion Exchange (IIBX)

- Bullion Exchange Regulations, 2020 notified

- Operating Guidelines for Bullion MIIs and Bullion Intermediaries issued

- Holding Company for IIBX incorporated

- Subsidiary Company for exchange and clearing incorporated

- CDSL-IFSC, designated as Bullion Depository

- IIBX inaugurated in July-2022

- Satellite vaulting in FTWZ enabled

- Import of Gold through IIBX by Qualified Jewellers notified

- Sequel Logistics and other two onboarded as Vault Manager

- RBI has enabled remittance of Forex for import of Bullion through IIBX

- Import Duty on Silver is @ 8% (as compared to Mainland @ 15%, cleared through IIBX, by virtue of CEPA with India and UAE

The IIBX to emerge as the “Gateway for Bullion Imports into India”

2.11 FinTech Hub in GIFT IFSC

Key initiatives by IFSCA for Development of FinTech Hub

- “Regulatory & Innovation Sandbox framework” notified

- Eight entities approved under the Regulatory Sandbox regime

- 1st FinTech Accelerator- Finx Labs operational

- IFSCA-Bloomberg Lab for FinTech innovators set up

- “I-Sprint’ 21” Four FinTech Hackathons launched: BankTech, Quant Camp, InsureTech & MarketTech

- IFSCA FinTech Incentive Scheme 2021

- IFSCA became member of Global Financial Innovation Network (GFIN)

- Inter-Regulatory Cooperation Agreement (Dialogue with 11 Overseas regulators)

- IoRS – IFSCA to become Principal Regulator

- MoU with Domestic FinTech Hubs underway

Position IFSC as global laboratory for Next-Gen FinTech Innovation

- Artificial Intelligence

- Open Finance

- GreenTech & RegTech

- Blockchain & DTL

2.12 Campus of Foreign Universities

Permissible Institutions

- Foreign universities which are ranked within Top 500 in global overall ranking and/or subject ranking in the latest QS World Universities ranking

- A reputed foreign educational institution in its home jurisdiction

Key Regulatory Requirements

- Foreign universities at GIFT City are required to offer courses or programmes identical to those offered by the parent entity in its home jurisdiction, with the same degree and diploma or certificate being conferred, thus enjoying “the same recognition and status as if they were conducted by the parent entity in its home jurisdiction”

- Foreign universities are granted registration for a period of five years, being renewable for an additional period of 5 years

- The IFSCA has defined Foreign Educational Institution as an “Educational institution outside India, which is not a university and is duly authorised to offer courses including research programmers within and outside its home jurisdiction”

- In the scenario wherein an institution desires to withdraw or discontinue a programme, the institution would be mandated to offer a suitable alternative to the affected students, and this may or may not include reallocation

Permissible Subject Areas

Courses including research programmes in Financial Management, FinTech, Science, Technology, Engineering and Mathematics shall be permitted in the GIFT IFSC

2.13 Professional Service Providers: Ancillary Framework

- IFSCA issued Ancillary Services Framework 2021 to enable Professional Services from IFSC

- GIFT IFSC is being developed as a regional hub for specialist Professional Service Providers on the lines of leading International Financial Centres like UK, Dubai, Singapore and Qatar

- Ancillary services include Legal Service, Asset Managers, Auditing & Accounting Firms, Management Consultancy Service, Trusteeship Services, Secretarial Services, etc.

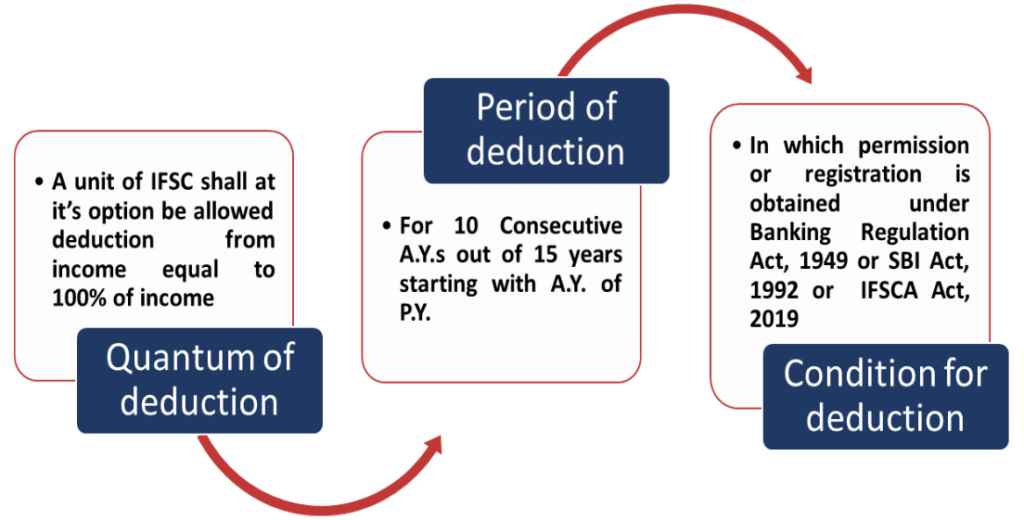

3. Key Fiscal Benefits of setting up units in GIFT IFSC

3.1 Competitive Tax Regime – Direct Tax

Units in IFSC

- 100% tax deduction for 10 years out of 15 years (flexibility to select any 10 years out of 15 years block) (S. 80LA)

- Income specified shall be from following (S. 80LA):

-

- From an offshore banking unit in a SEZ

- From business specified in Section 6 of the Banking Regulation Act, 1949 with unit located in SEZ or any unit that either develops, operates, or maintains a SEZ or all

- From a unit of IFSC from its business for which it has been approved for setting up in such a centre or SEZ

- Arising from the transfer of an aircraft or ship that was leased by the unit if such unit has started operation before March 31, 2025

- Conditions for claiming deductions under S. 80LA:

- Report provided by CBDT from an accountant certifying that deduction has been claimed in compliance with section 80LA; and

- A copy of permission received under the Banking Regulation Act, 1949, or a copy of permission or registration received under the IFSCA Act, 2019 along with its return of income.

- MAT/AMT @ 9% of book profits applies to Company/others setup as a unit in IFSC

- MAT not applicable to companies in IFSC opting for new tax regime (S. 115BAA)

- Ship leasing entities in IFSC can opt for tonnage tax scheme (S. 115VP) within a period of three months from the end of their tax holiday period (S. 80LA)

- The deemed gift rules outlined in Section 56(2)(viib) do not apply to excess share premium received by an Indian Company from a Category I or Category II Alternate Investment Fund regulated under the IFSC Act

- Any capital gains arising from transfer of aircraft or aircraft engine leased by IFSC unit to a domestic company are 100% exempt, as per the terms of Section 80LA(2)(d), provided that the unit commences its operations in the IFSC before 31st March, 2024. (now extended to 31st March, 2025)

- Exemption from tax withholding obligations on dividend payments in the case of IFSC units primarily engaged in the business of leasing aircraft

- Dividend income of a unit of IFSC, primarily engaged in the business of leasing of aircraft, from a company being a unit of any IFSC, which is also primarily engaged in business of leasing of aircraft, is exempt from tax (S.10(34B))

- Distribution of Profit by LLP to Partners – Exempt from Tax

- Fund Management Entity

-

- Tax Holiday for block of 10 years out of 15 years

- MAT/AMT @ 9%

- AIF – CAT I and II

-

- Business income of AIF subject to tax holiday

- AIF to withhold tax on income to Indian Resident Investor (10%) and NR Investor (applicable rate as per Treaty)

- AIF – CAT III

- Taxation at Fund level subject to nature of investment by Fund

- AIF with Indian Resident and NR Investor – taxable in the hands of Trust as representative Assessee of Investors

- Income from India Investment

- Indian Investor not allowed (round tripping)

- Income attributable to NR Investor – as per treaty benefits (status of Fund) – Dividend and Interest @ 20%, Capital Gain/Transfer of AIF Units – 10% to 40% (STT paid/Unlisted)

- Income from Offshore Investment

- Income attributable to Indian Resident Investor – at ordinary rate

- Income attributable to NR Investor – Not taxable

- Income from India Investment

- AIF with NR Investor – taxable in the hands of Trust/Fund, NR Investor exempt

- Income from India Investment

- Transfer of ‘securities’ (other than Indian Company), specified securities listed on IFSC Exchange – Exempt

- Interest and Dividend – 10%

- Capital Gain – 10% to 30% (STT paid/Unlisted)

- Income from Offshore Investment/Transfer of AIF Units

- Income attributable to NR Investor – Not taxable

- Income from India Investment

- Notification no. 28/2024 dated March 7, 2024

-

- On March 7, 2024, CBDT issued a notification stating that, now, on specified payments made to units in the International Finance Service Centre (IFSC), tax deduction at source (TDS) shall not be made.

- As per the above notification, no TDS will be required to be deducted while making specified payments to the specified units in IFSC, which are eligible and have claimed the benefit under Section 80LA of the Act.

- This notification shall come into force on April 1, 2024.

- On the Specified payments towards IFSC unit there is no requirement to deduct tax at source.

- Specified Payments

The specified payments on which no TDS shall be deducted are as follows:

| Sr. no. | IFSC unit (payee) | Nature of Receipt | Relevant TDS Section |

| 1. | Banking Unit | Interest income on ECB/Loans | Section 195 |

| Professional fees | Section 194J | ||

| Referral fees | Section 194H | ||

| Brokerage income | Section 194H | ||

| Commission income on factoring and Forfaiting Services | Section 194H | ||

| 2. | IFSC Insurance Intermediary office | Insurance Commission | Section 194D |

|

3. |

Finance Company |

Interest income on ECB/Loans | Section 195/194A |

| Dividend income | Section 194 | ||

| Commission income on factoring and Forfaiting Services | Section 194H | ||

|

4. |

Finance Unit |

Interest income on ECB/Loans | Section 195/194A |

| Dividend income | Section 194 | ||

| Commission income on factoring and Forfaiting Services | Section 194H | ||

| 5. | Fund Management Entity | Professional Fees | Section 194J |

| 6. | Broker Dealer | Dividend | Section 194 |

| 7. | Investment Advisor | Investment advisory fee | Section 194J |

| 8. | Registered Distributor | Distribution fee and commission fee | Section 194H |

| 9. | Custodian | Professional fee | Section 194J |

| Commission fee | Section 194H | ||

| 10. | Credit rating agency | Credit rating fee | Section 194J |

| 11. | Investment Banker | Investment Banker fee | Section 194J |

| 12. | Debenture trustee | Trusteeship fee | Section 194J |

| 13. | International Trade Finance Services or “IFTS” | Commission income | Section 194H |

| 14. | FinTech Entity | Technical fee/Professional fee | Section 194J |

| Commission income | Section 194H |

- Conditions for claiming such benefits of notification

- The ‘payee’ (IFSC Unit) has to –

-

- Provide “Statement-cum-Declaration in Form No. 1”, stating the 10 A.Y.s that he chooses and for which the payee wants to apply for a deduction under 80LA; and

- Such “Statement-Cum-Declaration” must be provided and verified in the way specified in Form No. 1 for every P.Y. that corresponds to the ten A.Y.s that the payee chooses for deduction u/s 80LA.

- The ‘payer’ shall –

-

- On Payments made to or credited to the payee after the date on which a copy of the “statement-cum-declaration in Form No. 1” from the “payee” is received should not have TDS deducted from them.

- Provide the details of every payment made to the “payee” on which TDS has not

been deducted in view of this notification in the tax deduction statement.

- Statement-cum-Declaration (Form No. 1)

To be furnished by a Unit of International Financial Services Centre (‘payee’) to the ‘payer’:

- Name of the assessee

- Permanent Account Number

- Name and address of the Unit of International Financial Services Centre

- Date of permission obtained under Banking Regulation Act, 1949 or permission or registration obtained under SEBI Act, 1992 or IFSCA Act, 2019

Statement-Cum-Declaration

I ………… son/daughter of………….. in capacity ……………… , do hereby declare that the above-mentioned Unit is engaged in the business of ………… and is eligible for deduction under sub-section (1A) and sub-section (2) of section 80LA of the Income-tax Act, 1961. I further declare that the above-mentioned International Financial Services Centre Unit has opted to claim the said deduction for the period from the previous year…… relevant to assessment year…. to the previous year…. relevant to assessment year…… I further declare that the above mentioned Unit continues to be a unit working in International Financial Services Centre and continues to be engaged in the business of ………… during the year ……… (relevant to Assessment Year ………..….) in which this statement-cum- declaration is being submitted.

Verification

I………………….son/daughter of ……………..in capacity………. do hereby certify that all the particulars furnished above are correct and complete.

Signature of the declarant

(to be signed by a person competent to sign the return of income as provided in section 140 of the Income-tax Act)

Investors

- Interest income payable to a non-resident arising on long-term bonds or rupee-denominated bonds listed only on a recognised stock exchange in an IFSC is chargeable at the reduced rate of 4% (S. 194LC), till 30 June 2023. On or after 1 July 2023, it is chargeable at the rate of 9% (S. 194LC(1))

- Transfer of specified securities* listed on IFSC exchanges by a non-resident not treated as transfer – Gains accruing thereon not chargeable to tax in India (*Investors: Exemption from Security Transaction Tax (STT), Commodity Transaction Tax (CTT), stamp duty in respect of transactions carried out on IFSC exchanges.)

- Section 10(15)(ix) provides that the interest income of a non-resident in respect borrowing by a unit in SEZ is exempt

- Dividend income received by a non-resident from a unit in an IFSC is taxable at the rate of 10%. (S. 115A(1))

- Any royalty income of a nonresident on account of lease of aircraft which is paid by a unit located in an IFSC is exempt from tax (S. 10(4F))

- A non-resident is not required to obtain PAN, if it does not earn any other income in India during the previous year (Rule 114AAB)

- Long Term Capital Gain exempt on transaction undertaken on a recognized stock exchange at IFSC in Foreign Currency, even no STT is payable (S. 112A)

- Short Term Capital Gain @ 15% on transaction undertaken on a recognized stock exchange at IFSC in Foreign Currency, even no STT is payable (S. 111A)

- Investor – AIF – CAT I and II

- Investment income taxable in the hands of investor through ‘pass through status’

- Dividend/Interest/Capital Gain

-

-

- Indian Resident Investor – as per ordinary rate applicable to respective income

- NR Investor – subject to Treaty else rate as per Indian IT Act

-

- Investor – AIF – CAT III

- Exempt as it is taxable at Fund level

3.2 Competitive Tax Regime – Indirect Tax

Units in IFSC

- Zero-rated inward supplies

- Nil Basic Customs Duty (‘BCD’)

- Custom duty draw-back on exports

- Nil GST on services rendered – Provided to IFSC/SEZ Units or overseas clients

- Supply deemed as export by EOU/STP

Investors

- No GST on security transactions

3.3 Competitive Tax Regime – Other Taxes & Duties

- Units in IFSC: State Subsidies – Lease rental, PF contribution, electricity charges

- Investors: Exemption from Security Transaction Tax (STT), Commodity Transaction Tax (CTT), stamp duty in respect of transactions carries out on IFSC exchanges.

3.4 Operational Benefits

- Exemption from currency control regulations to IFSC Units: Under SEZ Act, a unit set up in IFSC is treated as a non-resident. Exemption from currency control regulations to IFSC Units: Under SEZ Act, a unit set up in IFSC is treated as a nonresident. Even under Foreign Exchange Management Act, 2002 (“FEMA“), units in IFSC enjoy the benefits of a non-resident under exchange control provisions.

- Liberalized currency control regime for Indian residents: Under the new OI Rules 2022, any person resident in India is allowed to make contribution in an investment vehicle in GIFT IFSC as an OPI. This enables Indian residents to setup and provide sponsor contribution towards the funds in GIFT City.

4. Government of Gujarat IT/ITes Policy | 2022-2027

4.1 Benefits to IT/ITeS Units

- Capital subsidy – 25% of Eligible CAPEX (one-time)

-

- Upto INR 200 crs with GFCI > INR 250 crs (Mega Project)

- Upto INR 50 crs with GFCI < INR 250 crs

- 15% of OPEX (available for 5 years)

-

- Upto INR 40 crs with GFCI>INR 250 cr

- Upto INR 20 crs with GFCI<INR 250 cr

- Atmanirbhar Rojgar Sahay (ARS) – Reimbursement of employer contribution to PF upto 12% (5 years)

- Employment Generation Incentive (EGI) – 50% of one month employment cost to company (one-time)

- Reimbursement of 100% electricity duty paid (5 years)

- Interest subsidy of upto 7% on term loan or actual interest paid, max INR 1cr per annum (5 years)

- Early mover advantage to first three eligible IT/ITeS units – Limit for Mega project reduced to INR 100 crs

- ARS and EGI benefit available even for employees working from home within Gujarat

- Provision of direct benefit transfers of up to INR 50,000 for courses in information and communication technology

- Skill development of students and working professionals throughAI schools, COEs and digital literacy

4.2 Incentives under Gujarat IT/ITeS Policy (2022-27)

Non-Fiscal Incentives

| Sr. No. | Incentive Category | Description of Support |

| 1 | Facilitation of allotment of land |

|

| 2 | Self – certification |

|

| 3 | Investor Facilitation centre |

|

| 4 | Preferential Market Access |

|

4.3 Gujarat IT/ITeS Policy (2022-27) – FAQs

FAQ 1. What is the meaning of Gross Fixed Capital Investment (‘GFCI’)?

GFCI means the expenditure made in the construction of the building, computers, software, networking related hardware and other related fixed assets, excluding the cost of land and expenditure on purchase of the building required to produce products or services by the eligible unit. Also, it is to be noted that expenditure incurred under GFCI towards the construction of new buildings shall be capped at INR 3,000/sq. ft. of built-up area (applicable for a total built-up area computed at 60 sq. ft. of built-up area per employee on the payroll of the eligible IT/ITeS.

FAQ 2. What will be the Operative Period of the Policy?

The Policy is effective from the date of G.R. and will remain in force till 31st March 2027 or till the declaration of a new or revised Policy. Only eligible entities who have applied for assistance on or before 31st March 2027 and who have commenced operation on or before 31st March 2028 will be eligible for incentives being provided through the Policy.

FAQ 3. What does Expansion of an Unit means as per the policy?

An expansion unit means an existing unit in Gujarat undertaking expansion such that the headcount of employees on its payroll increase by 50 per cent of the existing or by 1,000 employees, whichever is lower, during the operative period.

FAQ 4. What are IT enabled Services (‘ITeS’) and who all are covered under the Policy?

The ITeS can be defined as any service, which results from the use of any IT software over a system of IT products for realizing the value addition service rendering through the application of IT.

The following services are covered under the Policy:

- Call centers

- Medical transcription

- Back Office Operation/Business Process Outsourcing (BPO)

- Knowledge Process Outsourcing (KPO)

- Revenue Accounting and other ancillary operations

- Insurance claim Processing

- Web/Digital Content Development/ERP/Software and Application Development

- Financial and Accounting Processing

- HR & Payroll Processing

- Bio-informatics

- GIS – Enabled services

- IT support centers

- Website services and

- Emerging Technologies such as Cyber security, Big data, Artificial Intelligence, Block Chain, Machine Learning etc.

FAQ 5. What is the eligible CAPEX expenditure?

- Capital expenditure as per GFCI: GFCI made during the operative period of the Policy and up till two years after the date of commencement of commercial operations/production;

- Stamp duty and registration fees paid to the government for lease/sale/transfer of land and office space; and

- Renewable energy expenditure: Expenditure incurred on the purchase of equipment for setting up of captive renewable energy plant.

FAQ 6. What is the eligible OPEX expenditure?

Eligible OPEX expenditure include:

- Lease rental expenditure;

- Bandwith expenditure;

- Cloud rental expenditure;

- Power tariff expenditure; and

- Patent expenditure

FAQ 7. What are some special incentives provided under the Policy for IT/ITeS Units?

The special incentives that are provided under the policy are:

- Employment Generation Incentive (‘EGI’): One-time support for every new local employees hired and retained for a minimum period of one year at 50 per cent of one month’s CTC up to INR 50,000 per male and INR 60,000 per female employee.

- Interest Incentive: Interest subsidy at 7 per cent on term loan or the actual interest paid, whichever is lower with a ceiling of INR 1 cr. per annum will be provided to the eligible IT/ITeS units.

- Atmanirbhar Gujarat Rojgar Sahay: Reimbursement of the employer’s statutory contribution under Employees’

Provident Fund will be provided for a period of five years made upto:

- 100 per cent reimbursement in case of female employee;

- 75 per cent reimbursement in case of male employee;

- There will be a per employee ceiling of 12 per cent of the basic salary plus Dearness Allowance and retaining allowance;

- In case of expansion unit, this assistance will be available for incremental employee count beyond that existed before undertaking expansion.

- Electricity Duty Incentive (‘EDI’): Eligible units will be allowed to claim the entire amount of electricity duty paid by them to the government of Gujarat for a period of five years.

FAQ 8. What is the monthly rental support provided to the eligible IT/ITeS units opting to start their operations under Co-working space model?

The government has incentivized eligible IT/ITeS units opting to start their operations under Government facilitated/empanelment Co-working space model for the following fiscal support for a period of five years from the date of start of commercial operations/in-principle approval, whichever is later:

Monthly rental support to IT/ITeS units (per seat basis) with Fiscal incentive limit

50 per cent of monthly rental for First 2 Years per seat per month INR 10,000

25 per cent of monthly rental for Three to five years per seat per month 5,000

5. Opportunities for Professionals and Corporates

Framework for Ancillary Service Providers

(Circular No. F. No. 206/IFSCA/Anc.Aux/2020-21 dated 10.02.2021,

F. No. 206/IFSCA/Anc. Aux/2020-21 dated 10.06.2021 &

F. No. 206/IFSCA/Anc. Aux /2020-21 dated 06.04.2023)

5.1 Permissible Ancillary Services

- Accounting, Auditing, Bookkeeping & Taxation Services

- Legal services, Compliance & Secretarial Services

- Professional and Management Consulting Services

- Administration, Assets Management Support Services and Trusteeship Services

5.2 GIFT IFSC – Opportunities for Professionals (CA)

- Providing advice, consultancy, assistance or other related services, for fulfilling legal obligations/compliances under various laws for the time being in force;

- Bookkeeping services consisting of classifying and recording business transactions in terms of money or some unit of measurement in the books of account.

- Financial auditing services: Examination of the accounting records and other supporting evidence of an organization for the purpose of expressing an opinion on financial statements.

- Accounting review services: Reviewing services of annual and interim financial statements and other accounting information.

- Compilation of financial statements services: Compilation of financial statements from information provided by the client. This service shall also include the preparation services of business tax returns, when provided as a bundle with the preparation of financial statements for a single fee.

- Other accounting services: Attestations, valuations, preparation services of proforma statements, etc.

- Advisory Services to companies/entities outside India in relation to their business, capital raising, merger & acquisition or capital restructuring or investment activity including in India, outside India or in IFSC.

- Asset Management support services to Aircraft & Ship Leasing entities in terms of their leasing agreements, funding, structuring of SPVs.

6. Opportunities for Corporates

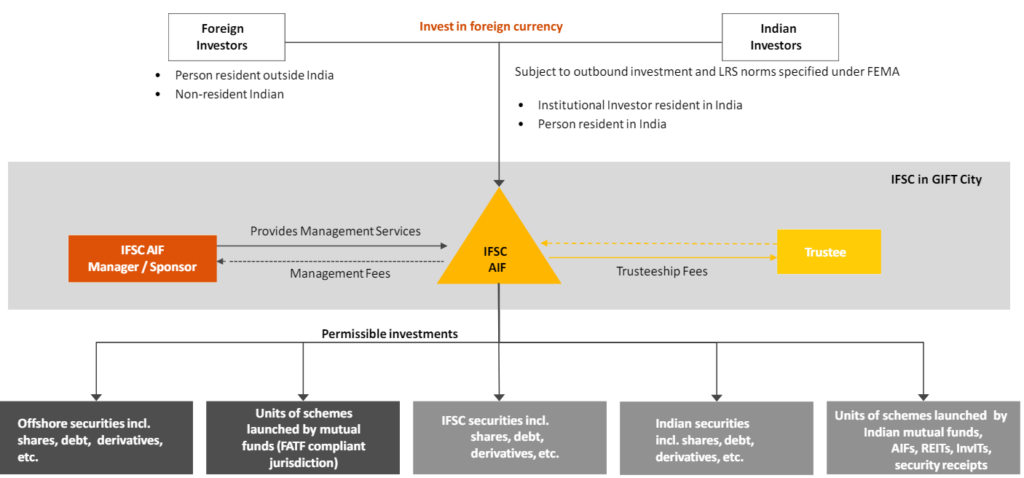

6.1 AIF Structure in GIFT IFSC

6.1.1 AIFs in IFSC – Regulatory Relaxations

Borrowing and Leverage

- Permission to borrow funds and engage in leveraging activities subject to:

-

- Consent of investors

- Disclosure in PPM – Max. leverage, methodology for calculation of leverage

- Comprehensive risk management framework appropriate to the size, complexity and risk profile of the AIF

Co-investment

- Co-investment through segregated portfolio by issue of separate class of units subject to:

-

- Terms not to be more favorable than common portfolio of AIF

- Disclosure in PPM regarding creation of segregated portfolio

- AIF in IFSC is permitted to invest in AIF registered with SEBI in India, alongside other permissible investments

Investment Diversification Norms

- Restriction with respect to investment up to 10% in single investee company (for Cat III AIF) and 25% (for Cat I and Cat II AIF) to not apply provided:

-

- Investments are in line with risk appetite of investors

- Disclosure in PPM

6.1.2 Indian party making sponsor contribution under automatic route

Sponsor contribution under automatic route of RBI

- Recently, RBI has issued a circular permitting remittance by Indian party towards sponsor contribution to AIF in IFSC

- Any sponsor contribution from sponsor Indian Party to AIF in IFSC, as per the laws of host jurisdiction, shall be treated as ODI

- Accordingly, Indian Party can set up AIF in IFSC, under automatic route provided it complies with Regulation 7 of the ODI Regulation

Conditions prescribed under regulation 7 of the ODI Regulations

- Indian party has earned net profit during the preceding 3 financial years from financial services activities

- Indian party is registered with the regulatory authority in India for conducting financial services activities

- Indian party has obtained approval from regulatory authorities in India and abroad, for venturing into such financial sector activity

- Indian Party has fulfilled the prudential norms relating to capital adequacy as prescribed by the concerned regulatory authority in India

6.2 Snapshot of key guidelines for AIFs

Other conditions like minimum corpus, investment, continuing interest

- Like domestic AIFs except that thresholds are designated in USD

Overseas Investment

- Existing conditions on outbound investments by AIF not to apply to AIFs in IFSC

Registration Process

- AIF registration can be granted to Trust, Company, LLP, Body Corporate

- Existing sponsors/Manager can set up as a branch, company or LLP

- New sponsors/Manager need to set up a company or LLP

Investment Conditions

- FPI, FVCI or FDI routes permitted for investment in India

- Investments in units of other AIFs

- Any other securities in which a domestic AIF can invest

6.3 Financial Ecosystem for AIFs in GIFT IFSC

Fund Ecosystem at GIFT IFSC

- Banking Operations at GIFT City

- Trusteeship services

- Accounting Firms

- Legal Firms

- Fund administrator

- Custodians

6.4 Family Investment Fund in GIFT IFSC

Meaning of FIF: A Family Investment Fund is a self-managed fund that pools money only from a single family and is set up in accordance with the IFSCA (Fund Management) Regulations, 2022.

Single-family: A single family means a group of individuals who are the lineal descendants of a common ancestor and includes their spouses (including widows and widowers, whether remarried or not) and children (including stepchildren, adopted children, and ex nuptial children) include entities such as a sole proprietorship firm, partnership firm, company, LLP, trust, or a body corporate, in which an individual or a group of individuals of a single family exercises control and directly or indirectly holds substantial economic interest (90%).

A FIF shall not seek money from individuals or entities outside of the single family. However, a FIF may share economic interests with its employees, directors, FME, or other persons providing services to the FIF, as per its internal policy to reward the persons providing services to the FIF or to align the interests of such persons with those of the FIF. In this regard, wherever required, the FIF may accept contributions from the aforementioned persons for the limited purpose of granting economic interest to them, which in no case shall exceed an aggregate of 20% of the FIF’s profits.

Allowable Constitutions: Company, Trust (Contributory Trust only), LLP or any other form as may be permitted by IFSCA

IFSCA fees: Authorised FME with FIF: USD 2500 -IFSCA Registration Fee: USD 15,000

Permissible activities: Family investment fund may invest money only in:

- Securities issued by the unlisted entities;

- Securities listed or to be listed or traded on stock exchanges in IFSC, India or foreign jurisdictions;

- Money market instruments;

- Debt securities;

- Securitised debt instruments, which are either asset backed or mortgage-backed securities;

- Other investment schemes set up in the IFSC, India and foreign jurisdiction;

- Derivatives including commodity derivatives;

- Units of mutual funds and alternative investment funds in India and foreign jurisdiction;

- Investment in Limited Liability Partnerships;

- Physical assets such as real estate, bullion, art, etc.; or

- Such other securities or financial product/assets or instruments as specified by the Authority.

Investment limit:

- Individual: USD 2.5 Lakhs (LRS limit applicable)

- Non-Individual: upto 50% of net worth

Borrowing & Leverage: Allowed, FIF can borrow funds or engage in leveraging activities as per their risk management policy.

Corpus: USD 10 million within 3 years from obtaining RC

Type: May be open-ended or closed-ended

KMP: Need to appoint principal officer in case of an authorised FME

FME Networth: Not required if FME serves to only FIF

Family Investment Fund in GIFT IFSC (Article in Mint)

6.5 Finance Company

Permitted Core activities:

- Lend in the form of loans, commitments and guarantees, credit enhancement, securitisation, financial lease, and sale and purchase of portfolios;

- Factoring and forfaiting of receivables;

- Undertake investments, including subscribing, acquiring, holding, or transferring securities or such other instruments, as may be permitted by the Authority;

- Buy or Sell derivatives;

- Global/Regional Corporate Treasury Centres; and

- Any other core activity as may be permitted by the Authority.

Permitted Non-core Activities:

Subject to specific registration requirements, wherever applicable, permitted noncore activities for a Finance Company or a Finance Unit, as the case may be, shall include following activities:

- Merchant Banking;

- Authorised person;

- Registrar and Share Transfer Agent;

- Trusteeship Services;

- Investment Advisory Services;

- Portfolio Management Services;

- Operating lease of any products, including aircraft lease, ship lease or any other equipment as may be specified by the Authority from time to time;

- International Trade Financing Services Platform;

- Distribution of financial products (including mutual fund units and insurance products);

- Function as trading and clearing members or professional clearing member of exchanges and clearing corporations set up in IFSCs;

- Asset Management support services permitted under the Framework for Enabling Ancillary Services as specified by the Authority;

- Undertaking to act as facilitators of permissible activities as and when permitted by the Authority;

- Any other activity without involving a customer interface, as may be permitted with the prior approval of the Authority, that is classified as a non-core activity by the Authority, under these regulations; and

- any other activity, as may be permitted and classified as a non-core activity by the Authority, under these regulations.

6.6 Builder/Co-Developer and Units in GIFT City

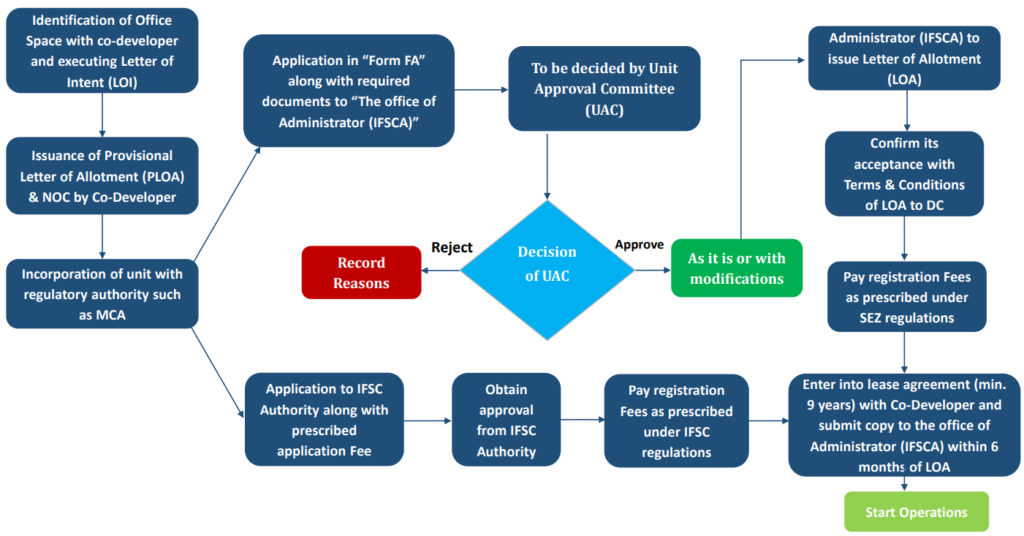

7. Process for setting up unit in IFSC/GIFT City

7.1 Process for setting up unit in GIFT City

8. IFSCA (Book-keeping, Accounting, Taxation and Financial Crime Compliance Services) Regulations, 2024 (BATF)

8.1 BATF – Opportunities for Professionals

Book-Keeping Services

Classifying and recording transactions including payroll ledgers in terms of money or any other unit of measurement in the books of account and other related documents;

Explanation: Book-keeping Services do not include payroll and taxation services.

Taxation Services

Services of tax consultation, tax preparation or tax planning and includes providing advice and guidance concerning taxes as well as preparing and filing of tax returns of all kinds;

Explanation: ”taxes‘ shall include all forms of direct or indirect taxes, cesses, duties or levies.

Accounting Services

- reviewing annual and interim financial statements or other accounting information without any attestation or assurance thereof;

- compilation of financial statements from information provided by the client, without giving any attestation or assurances regarding the accuracy of the resulting statements;

- preparation of financial statements;

- compilation of income statements, balance sheets or other financial information;

- analysis of financial statements;

- other related accounting support services in relation to any of the above including valuation support services.

Explanation: Accounting Services don’t include auditing services.

Financial Crime Compliance Services

Services rendered in relation to compliances of Anti-Money Laundering (AML)/Countering the Financing of Terrorism (CFT) measures and Financial Action Task Force (FATF) recommendations, and other related activities

8.2 Definitions

“group entities” means an arrangement involving two or more entities related to each other through any of the following relationships:

- parent-subsidiary (as per IndAS 110/AS 21);

- joint venture (as per IndAS 28/AS 27);

- associate (as per Ind-AS 28/AS 23);

- common brand name; or

- investment in equity shares of 20 per cent and above;

“Non-resident” means a person resident outside India as defined under Section 2 of The Foreign Exchange Management Act, 1999 (42 of 1999) and shall also include Units in International Financial Service Centre;

8.3 Registration

- An applicant desirous of providing all or any of the BATF Services shall submit an application to the Authority, for grant of certificate of registration, in the format and in the manner, as may be specified by the Authority

- No person, except an Ancillary Service Provider, shall provide BATF Services in an IFSC without obtaining certificate of registration from the Authority, in accordance with these regulations.

- The applicant desirous of providing BATF Services shall be required to be set up in IFSC either in the form of a Company or LLP.

8.4 Existing Ancillary Service Provider

- An Ancillary Service Provider, intending to provide BATF Services shall, within a period of sixty (60) days from the date of commencement of these regulations, communicate its willingness to operate under these regulations to the Authority, in such form and manner as may be specified.

- An Ancillary Service Provider, who has received a letter of continuation from the Authority, may continue to provide BATF services in its existing legal form for a period of three (3) years from the date of commencement of these regulations.

- Such Ancillary Service Provider shall seek registration under these regulations within the said period of three (3) years from the date of commencement of these regulations, failing which it shall not be permitted to undertake BATF Services from IFSC.

- Such Ancillary Service Provider shall comply with the conditions regarding appointment of Principal Officer and Compliance Officer and minimum office space within a period of six (6) months from the date of commencement of these regulations.

8.5 Service Recipient

The BATF Service Provider shall ensure that the service recipient is a non-resident and is not from a jurisdiction which has been identified in the public statement of Financial Action Task Force as “High Risk Jurisdiction- subject to call for action”

8.6 Minimum office space criteria

The entity shall ensure office space in IFSC of minimum built up area computed at 60 sq. ft. per employee

8.7 Key Managerial Personnel

Principal Officer and Compliance Officer must be appointed having following criteria:

- Professional qualification such as CA/CS/CMA/CPA/CFA etc. (for financial crime compliance relevant qualification from a reputed foreign or domestic institution in financial crimes compliances required)

- Principal Officer shall have an experience of at least 5 years in relevant field; and the Compliance officer shall have an experience of at least 3 years in relevant field.

8.8 Fit & Proper Requirement

- The entity and its principal officer, directors/partners/designated partners, key managerial personnel and controlling shareholders are fit and proper persons.

- The person is deemed to be fit and proper person if he has a record of fairness and integrity and has not incurred any of the following disqualifications:

-

- person has been convicted by a court for any offence involving moral turpitude or any economic offence;

- a recovery proceeding has been initiated against the person by a statutory body or financial regulatory authority and is pending;

- an order for winding up has been passed against the person for malfeasance;

- the person has been declared an undischarged insolvent;

- an order, restraining, prohibiting or debarring the person from accessing, providing or dealing in financial products or financial services, has been passed by any regulatory authority, and a period of three (3) years from the date of the expiry of the period specified in the order has not elapsed;

- any other order against the person, has been passed by the Authority or any other regulatory authority, and a period of three (3) years from the date of the order has not elapsed;

- the person has been found to be of unsound mind by a court of competent jurisdiction and the finding is in force;

- the person is financially not sound or has been categorised as a wilful defaulter;

- the person has been declared a fugitive economic offender; or

- any other disqualification as may be specified by the Authority.

8.9 Safeguarding Conditions

New Business: The applicant shall ensure that their business in IFSC is not set up either by –

- splitting up of business already in existence in India;

- reconstructing of business already in existence in India; or

- reorganising of a business already in existence in India. Explanation: For the purpose of determination of splitting up, reconstruction and reorganization of any business already in existence in India, the applicant shall adhere to the following requirements:

- Workforce Requirement: The number of employees transferred/relocated from any of its Group Entities in India as at the end of the financial year do not exceed 20% of the total employees employed with the BATF Service Provider.

- Asset Requirement: There should not be any transfer of assets from any of the Group Entities in India to the BATF Service Provider.

Existing Contracts: The BATF Service Provider shall not offer BATF Services by way of transferring or receiving of existing contracts or work arrangements from their Group Entities in India.

Explanation: Contracts or work arrangement between a BATF Service Provider with its service recipients shall be construed as “transferring or receiving of existing contracts or work arrangements from their group entities in India‖, in the following scenarios:-

- Transferring of existing contracts or work arrangements in India: When an existing contract or work arrangement, by whatever name called, between any of the Group Entities of BATF Service Provider in India with its non-resident client is shifted or transferred to the BATF Service Provider during the subsistence of such contract or work arrangement.

- Termination of existing contracts or work arrangements in India: When an existing contract or work arrangement, by whatever name called, between any of the Group Entities of the BATF Service Provider in India with its non-resident client is prematurely terminated and a new contract or a work arrangement is signed between the BATF Service Provider with the same service recipient, directly or indirectly.

- Other scenarios, as may be specified by the Authority, from time to time

8.10 Reporting Requirements

- The BATF Service Provider shall furnish information relating to its operations to the Authority, in such manner, interval and form, as may be specified by the Authority.

- Any financial reporting by the BATF Service Provider to the Authority shall be in US Dollar, unless otherwise specified by the Authority.

- The BATF Service Provider shall submit a certificate, issued by an independent third party practicing professional namely, CA, CS or CMA, certifying compliance of the requirements specified in these regulations including that of regulation 8 and 9, within ninety (90) days from the closure of each Financial Year.

9. Interim Budget 2024 – Highlights

9.1 Tax Rates

No change in tax structure and rates (including surcharge and health and education cess)

9.2 Extension of Sunset Clause – Exemptions

The sunset clause has been extended from March 31, 2024 to March 31, 2025 in the following cases:

- Section 10(4D) – commencement of operations by an investment division of offshore banking unit located in IFSC;

- Section 10(4D) – commencement of operations by a ‘specified fund’ being an investment division of an offshore banking unit registered as a Category-I FPI;

- Section 10(4F) – commencement of operations by an IFSC unit paying royalty or interest on account of lease of an aircraft or a ship to a non-resident; and

- Section 10(23FE) – making of investment by a specified person such as wholly owned subsidiary of Abu Dhabi Investment Authority, sovereign wealth funds, pension funds, etc.

9.3 Extension of Sunset Clause – Tax Holiday

- Section 80LA(2) – In order to claim deduction of income arising from the transfer of an aircraft or ship which was leased by the unit, condition for commencement of operations by an IFSC unit is extended from 31-03-2024 to 31-03-2025.

- Section 80-IAC – In order to be an eligible startup, the condition for date of incorporation of the entity has been extended from 01-04-2024 to 01-04-2025.

9.4 Extension of Time Limit to issue directions

The time limit accorded to the Central Government to issue directions to give effect to any schemes under the Income-tax Act has been extended from 31-03-2024 to 31-03-2025, in following cases:

- Section 92CA(9): for determination of the arm’s length price;

- Section 144C(14): for issuance of directions by DRP;

- Section 253(9): for the purposes of appeal to ITAT; and

- Section 255(8): for the purposes of disposal of appeals by ITAT.

9.5 TCS on LRS and Overseas Tour Package

The amendments notified by CBDT vide Press Release dated 28th June 2023 for TCS on remittance under LRS are proposed to be enacted (LRS for capital contribution in IFSC unit should be exempted)

- No TCS for remittance under LRS upto ₹ 7 Lakh.

- For remittances above ₹ 7 lakhs,

-

- 5 % if for the purpose of medical treatment and education and

- 20 % in other cases

- TCS at 5 % on overseas tour package upto ₹ 7 Lakh and 20 % above ₹ 7 lakhs

9.6 Old Income Tax Demands

FM announced that to end petty, nonverified, non-reconciled or long-pending disputed direct tax demands, it is proposed to withdraw outstanding demands upto:

- ₹ 25,000 for period upto FY 2009-10; and

- ₹ 10,000 for period from FYs 2010-11 to 2014-15

Note: Scheme yet to be notified in this regard

9.7 Mandatory Registration as Input Service Distributor (ISD)

- In the 50th GST Council meeting held on 11th July 2023, it was recommended to make ISD mechanism mandatory prospectively for distribution of ITC of common input services procured from third parties for or on behalf of distinct persons (GST registrations under same PAN in one or more State/Union Territory).

- To give effect to above recommendation, definition of ISD and section 20 which relates to manner of distribution of ITC by ISD is substituted.

- It is now proposed to mandatorily obtain registration as an ISD and distribute the ITC of common input services including services liable to tax under RCM among such distinct persons

- Current mechanism for distribution of ITC by an ISD will be substituted. New manner and time limit for distribution of ITC, subject to restrictions and conditions, will be prescribed in due course.

9.8 Failure to Register Packing Machines Used in Manufacture of Specified Goods

- CBIC had notified special procedure to register details of packing machines used in manufacture of pan masala, tobacco products and furnish records of inputs procured and utilized along with machine wise production record and waste generation

- It is now proposed to levy penalty of Rupees One Lakh under CGST and SGST each per machine which are not so registered. This penalty will be in addition to any other penalty which is payable under the GST law.

- In addition to the above penalty, every machine not so registered shall be liable for seizure and confiscation except where both the following conditions are satisfied:

-

- The penalty so imposed is paid, and

- Such machine is registered within three days from the receipt of the penalty order

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA