Nuances of Customs Valuation – Rules | Methods | Practical Insights

- Blog|GST & Customs|

- 8 Min Read

- By Taxmann

- |

- Last Updated on 19 December, 2024

Customs Valuation refers to the process of determining the value of goods for the purpose of levying customs duties and taxes. It establishes the taxable base for imports and exports, ensuring compliance with domestic and international trade regulations. The valuation is governed by the Customs Valuation Agreement under the World Trade Organization (WTO), which sets out principles for a fair, uniform, and neutral system of determining the value of imported goods, avoiding arbitrary or fictitious valuations.

Table of Contents

- Customs Valuation

- Acceptance of Declared Invoice Value

- Related Party

- Circumstances of Sale

- Custom Valuation and Transfer Pricing

- Test Value

- Methods of Valuations

- Intricacies – Deductive and Computed Value Method

- Rule 10 – Additions to Value of Goods

- Issues Pertaining to the Inclusion of Condition of Sale

- Royalties and License Fees [WCO Technical Advisory]

- SVB Process

- Critical Documents

- Rules of Customs Valuation

By Adv. Ritesh Kanodia – Partner & Adv. Meetika Baghel – Associate Partner | Aurtus Legal LLP

1. Customs Valuation

- What is Customs Valuation? – Customs Valuation is the process for determining the taxable base for imports and exports

- Customs Valuation Agreement – GATT Code on Customs Valuation 1981 – Article VII – the concept of “Actual Value” – charged in the ordinary course of trade

- Need for the Agreement – The Agreement sets out a fair, uniform and neutral system for determining the value of imported goods and has been adopted by countries across the globe to frame the jurisdictional customs valuation rules

- The WCO – The WCO develops international standards and best practices in customs procedures. The Technical Committee on Customs Valuation provides guidance on Customs Valuation issues through

-

- Advisory opinions

- Commentaries

- Explanatory Notes

- Case Studies

- Studies

- Indian Rules – In India, the rules are called the Customs Valuation (Determination of Value of Imported Goods) Rules, 2007 providing the various methods for valuation along with the interpretative Notes

2. Acceptance of Declared Invoice Value

Price actually paid or payable to be accepted

- No restrictions on disposition and use of goods

Exceptions:

-

- Imposed by law

- Geographical limitations

- No effect on value of goods – No fixed criteria as dependent on nature of restriction, goods, industry etc.

- No conditions for which value cannot be determined

Value not be accepted, where condition precedent influence the price – for e.g., value influenced by purchase of other goods from the same supplier.

No rejection – Conditions on production and marketing – activities undertaken for self

- No part of the proceeds from sale/disposal/use of goods accrues to the seller

Rule 10 inclusions

- Relationship of buyer and seller has not influenced the price

Mere existence of a relationship is not ground for rejection – Examination of value necessary where Customs doubts the acceptability of price

3. Related Party

Business Management

- Officer or director of one another’s business

- Legally recognised partners

- Employer or employee

Control

- Person* owns, controls or holds 5% or more of the outstanding voting stock or shares or both

- Controls each other

Common Control

- Third person controlling both the persons

- Both person controlling the third person

Family

- Members of the same family

Agency

- Sole Agent

- Sole Distributor

- Sole Concessionaire

*Person includes all legal persons

** Transaction value is acceptable where the relationship does not influence the price and importer is able to demonstrate it [Rule 3(3)(a) – Circumstances of sale]

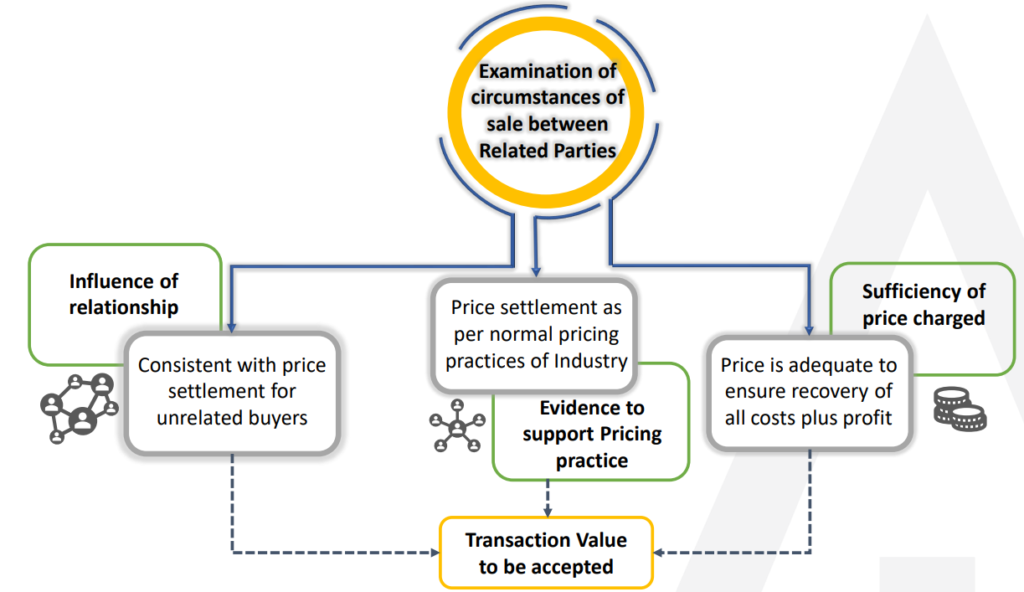

4. Circumstances of Sale

5. Custom Valuation and Transfer Pricing

5.1 Transfer Pricing Authorities

Will want to fix a lower value of imported goods for higher potential profits to enable a collection of higher income tax

WCO Guidance – Transfer Pricing Study a good source of information – only where it contains the information about circumstances of sale

Indian Jurisprudence/View – Where prices are arms-length and confirming with the Transfer pricing OECD Guidelines – value to be accepted [Gemplus India Pvt. Ltd. [(2005) 185 ELT 269] Volvo India Private Ltd. [2005 (180) E.L.T. 489] and Hindustan Unilever [2023 (5) TMI 616]]

5.2 Custom Authorities

Will want to fix a higher value of imported goods to collect higher duties of customs

WCO Guidance – Where there are significant differences in method prescribed by WCO and OECD for arriving at value – TP study may not be relevant/adequate

“the use of a transfer pricing study as a basis for examining the circumstances of the sale should be considered on a case by case basis”

Indian Jurisprudence/View: Arms’ length discounted prices rejected where circumstances prove that there is flow back from the importer to the related supplier in other forms [Sun Microsystems India Pvt. Ltd. [2016(339)ELT475]]

6. Test Value

6.1 Availability of a Test Value

What is a “Test Value” – Its an alternative to Circumstance of sales test and means a value [in unrelated sales] previously accepted by Customs that closely approximates with the value of imported goods for e.g., identical or similar goods

6.2 Which value can be a “Test Value”

Relevant factors to decide – Nature of goods imported, nature of industry, season in which goods are imported, similar commercial/quantity levels, requirement to undertake adjustments etc.

6.3 Where Value does not approximate with Test Value

Earlier determination – Computed value or deducted value not “Test Values” where such values do not correspond to values earlier appraised and upheld by Customs for unrelated transactions. Where no “Test Value” found circumstance of sale test to be satisfied

7. Methods of Valuations

7.1 Identical Goods

- Same in respect of physical characteristics, quality, and reputation – Minor differences in appearance not relevant

- Produced in the same country by the same person

- Same commercial levels and same quantity – if not same, reasonable and accurate adjustments to be made for difference in commercials and quantity

7.2 Similar Goods

- Goods though not alike have like characteristics and like component materials; and

- Perform same function and are commercially interchangeable – consideration to be given to the quality of the goods, their reputation and existence of trademark

- Produced in the same country and by the same person [where not available goods produced by different person

- Adjustment for commercial and quantity level difference to be undertaken

7.3 Deductive Value

- Also known as the retail minus method – value of imported goods determined based on the selling price in the country of importation [within 90 days of the import]

- Applicable to the goods where the cost of value addition is accurately determinable

- The selling price of imported goods [in the country of importation] is adjusted by deducting cost of transport, duties and taxes, and profit margin

7.4 Computed Value

- This method also known as cost plus refers to the value by identifying the costs incurred by the supplier in the production and delivery of the goods

- These costs include material costs, labour costs, and any other direct or indirect costs attributable to the production of the goods along with an appropriate markup to account for the supplier’s profit margin – determined by reference to the gross profit margin earned in comparable uncontrolled transactions between independent parties.

Does not include goods incorporating or reflecting engineering, development, artwork, design work, and plans and sketches undertaken in the country of importation.

8. Intricacies – Deductive and Computed Value Method

8.1 Deductive Value

- Difficulty in determining highest quantity sold at a particular price

- Difficulty in determination of commission or profit and general expenses

- Deriving product specific margin and accurately allocating costs to specific products

- Sale of products where manufacturer does not value valuable intangibles

- Difficulty in determining the value addition for any further process

8.2 Computed Value

- Explaining discrepancies between global profit margin (as per TP report) and product wise profit margin

- Fluctuations in value owing to market conditions

- Different profit margin for traded and manufactured products

- Foreign suppliers reluctant to disclose product level profit margin owing to data confidentiality

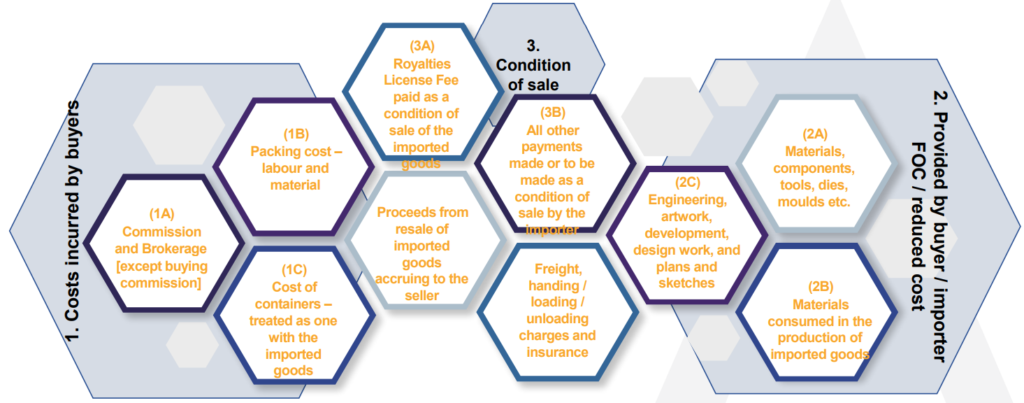

9. Rule 10 – Additions to Value of Goods

Guidance tools on valuation – Interpretative Notes to the Valuation Rules and WCO Advisory Opinions [Avaya Global Connect Ltd – 2016 (337) ELT 402 & Mahindra & Mahindra – 2014 (312) ELT 545]

10. Issues Pertaining to the Inclusion of Condition of Sale

Royalties or license fee paid or payable as ‘condition of sale’ by the importer on imported goods

Royalty or license fee paid for a post importation process includible in assessable value

- Commissioner of Customs (Port), Kolkata V.J.K. Corporation Ltd. [2007] taxmann.com 1681 (SC)

- Amendment to Rule 10

‘Condition of sale’ Pre-conditions of the sale – fee for usage of trademark/brand

- ACC Ltd V. Commissioner of Customs [2001] taxmann.com 1102 (SC)

- Collector of Customs (Preventive), Ahmedabad V. Essar Gujarat Ltd. Surat [1996] taxmann.com 136 (SC)

- Living Media Limited [2011 (271) ELT 3 (SC)].]

- Reliance Industries Ltd [2007 (207) ELT 412 (Tri.)]

Royalty/license fee/know-how paid in respect of goods manufactured and sold in India

Bridgestone India Private Limited [2012 TIOL 166 CESTAT MUM]

License Fee paid or payable – Addition of notional fee where fee not actually paid

- Eicher Tractors Ltd V. Commissioner of Customs, Mumbai [2000] 2000 taxmann.com 53 (SC)

- Shri Atul Kaushik Shri Krishnan Dhawan M/s Oracle India Private Limited [2015 (330) ELT 417 (Tri.-Delhi)] – affirmed by SC

Pre-loaded software/Software license fee enables usage – packaged media

- Shri Atul Kaushik Shri Krishnan Dhawan M/s Oracle India Private Limited (330) ELT 417 (Tri.-Delhi)] – affirmed by SC

- United Telecom/PCS technology – Negative

- Vodafone Essar (Mumbai Tri) – Positive

11. Royalties and License Fees [WCO Technical Advisory]

![Royalties and license fees [WCO Technical Advisory]](https://www.taxmann.com/post/wp-content/uploads/2024/12/Capture-8-1024x495.png)

12. SVB Process

12.1 Importer files BOE & Annexure A

- Proper Officer to submit a report to the commissioner within 3 days of filing of BoE

- Prima facie opinion by the Commissioner

- No RD/EDD to be deposited

- Continuity Bond/BG

12.2 Provisional Assessment and SVB Proceedings

- Provisional assessment

- Matter referred to SVB (Annexure B)

- Additional information/documents to justify transaction value w.r.t Rule 3(3)(a) and Rule 3(3)(b) of Customs Valuation Rules

- Debit of Bond for duty

12.3 Final assessment of BOEs filed with Customs

- Upon approval from Principal Commissioner/Commissioner, SVB to prepare investigation report.

- Favorable report: Investigation Report issued

- Report not accepted: SCN issued and followed by adjudication order

13. Critical Documents

13.1 Identical Goods

- Statement containing value of identical goods

- Supplier invoices supporting the identical values

13.2 Similar Goods

- Statement containing value of similar goods

- Supplier invoices supporting the similar values

13.3 Deductive Value

- CA certificate certifying the deductive value.

- Documents/details to substantiate the method of cost appropriation and method for deriving profit margins as reflected in the computation/certificate.

- The transfer pricing report, if the retail minus method is used to arrive at the arm’s length price.

13.4 Computed Value

- Statement showing a breakdown of various costs along with profit recovered on each product.

- Trend analysis of imports to substantiate that appropriate profit margins have been maintained across financial years.

- In the case of traded items, supporting invoices showing the price at which goods were purchased by the supplier.

13.5 Common Documents

- Annexure A & B – with accurate details

- Written submissions on the method applied for arriving at the value of Goods

- Statement of goods imported during the period under investigation

- Summary of high value imported goods.

- Financial Statements/Form 3CEB/Details on payments made to Suppliers [other than for supply of imported goods]/Transfer pricing report/APAs

- Agreements entered into with Supplier

14. Rules of Customs Valuation

Agreement on implementation of Article VII of the GATT

Section 14 of the Customs Act & Customs Valuation (Determination of Value of Imported Goods) Rules

- Transaction value – price paid or payable for the goods/actual value – not influenced by the relationship of parties

- Identical goods – goods same in respect of physical characteristics, quality, and reputation

- Similar goods – goods that are not alike but have like characteristics and component materials – perform the same functions and are commercially interchangeable

- Deductive value – Unit price at which goods are sold in the country of importation to third parties after deducting commission, operational expenses, duties etc.

- Computed value – The sum of the cost of materials and processing of imported goods, profits, general expenses, transportation, insurance, etc.

- Residual/fallback mechanism

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA