Law of Demand & Elasticity of Demand

- Blog|Competition Law|

- 13 Min Read

- By Taxmann

- |

- Last Updated on 14 March, 2023

Table of Contents

- Meaning of Demand

- Determinants of Demand

- Demand Function

- The Law of Demand

- Exceptions to the Law of Demand

- Expansion and Contraction of Demand

1. Meaning of Demand

-

- In ordinary speech, the term demand is many times confused with ‘desire’ or ‘want’.

- Desire is only a wish to have anything.

- In economics demand means more than mere desire.

- Demand in economics means an effective desire for a commodity i.e. desire backed by the ‘ability to pay’ and ‘willingness to pay’ for it.

- Thus, demand refers to the quantity of a good or service that consumers are willing and able to purchase at different prices during a period of time.

- Thus, defined, the term demand shows the following features:

-

-

- Demand is always with reference to a PRICE.

- Demand is to be referred to IN A GIVEN PERIOD OF TIME.

- Consumer must have the necessary purchasing power to back his desire for the commodity.

- Consumer must also be ready to exchange his money for the commodity he desires.

-

-

- E.g. Mr. A’s demand for sugar at ` 15 per kg. is 4 kgs. per week.

2. Determinants of Demand

For estimating market demand for its products, a firm must have knowledge about—

(a) the determinants of demand for its product, and

(b) the nature of relationship between demand and is determinants.

The various factors on which the demand for a product/commodity depends are as follows:

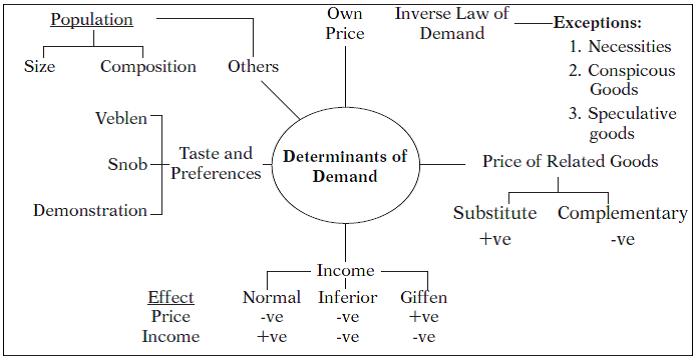

- Price of the commodity:

-

- Other things being equal, the demand for a commodity is inversely related with its price.

- It means that a rise in price of a commodity brings about fall in its demand and vice versa.

- This happens because of income and substitution effects.

- Price of the related commodities:

-

- The demand for a commodity also depends on the prices of related commodities.

- Related commodities are of two types namely—

a. Substitutes or competitive goods, &

b. Complementary goods.

-

- Substitute goods are those goods which can be used with equal ease in place of one another.

- E.g.Essar Speed Card and Airtel Magic Card; Coke and Pepsi; ball pen and ink pen; tea and coffee; etc.

- Demand for a particular commodity is affected if the price of its substitute falls or rises.

- E.g. If the price of Airtel Magic card falls, its demand will increase and demand for Essar Speed Card would fall and vice versa.

- Thus, there is a POSITIVE RELATIONSHIP between price of a commodity and demand for its substitutes.

- Complementary good are those goods whose utility depends upon the availability of both the goods as both are to be used together.

- E.g. a ball pen and refill; car and petrol; a hand set and phone connection; a tonga and horse, etc.

- The demand for complementary goods have an INVERSE RELATIONSHIP with the price of related goods.

- E.g. If the price of Scooters falls, its demand will increase leading to increase in demand for petrol.

- Income of the consumers

-

- Other things being equal, generally the quantity demanded of a commodity bear a DIRECT RELATIONSHIP to the income of the consumer i.e.with an increase in income, the demand for a commodity rises.

- However, this may not always hold true. It depends upon the class to which commodity belongs i.e.necessaries or comforts and luxuries or inferior goods:

a. Necessaries (E.g. Food, clothing and shelter). Initially, with an increase in the income, the demand for necessaries also rises upto some limit. Beyond that limit, an increase in income will leave the demand unaffected.

b. Comforts and Luxurious (E.g. Car; Air-Conditioners; etc.) Quantity demanded of these group of commodities have a DIRECT RELATIONSHIP with the income of the consumers. As the income increases, the demand for comforts and luxuries also increases.

c. Inferior goods (E.g. Coarse grain; rough cloth; skimmed milk; etc.). Inferior goods are those goods for which superior substitutes are available Quantity demanded of this group of commodities Have an INVERSE RELATIONSHIP with the income of the consumer. E.g. A consumer starts consuming full cream milk (normal good) in place of toned milk (inferior good) with an increase in income.

Therefore, it is essential that business managers must know—

(a) the nature of good they produce,

(b) the nature of relationship between the quantities demanded and changes in consumer’s income, and

(c) the factors that could bring about changes in the incomes of the consumers.

- Tastes and Preferences of the consumers

1. Tastes and preferences of consumers generally change over time due to fashion, advertisements, habits, age, family composition, etc. Demand for a commodity bears a direct relationship to those determinants.

2. Modern goods or fashionable goods have more demand than the goods which are of old design and out of fashion.

E.g. People are discarding Bajaj Scooter for say Activa Scooter.

3. The demand of certain goods is determined by ‘bandwagon effect’or ‘demonstration effect’. It means a buyer wants to have a good because others have it. It means that an individual consumer’s demand is conditioned by the consumption of others.

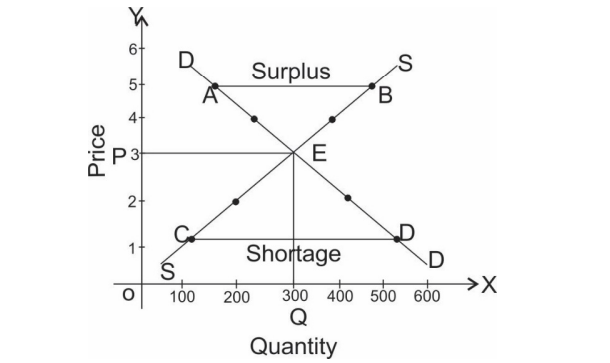

| Price of Good-X (`) | Quantity Demanded of Good-X (units) | Quantity Supplied of Good-X (units) | Effect on Price |

| 5 | 100 | 500 | Downward |

| 4 | 200 | 400 | Downward |

| 3 | 300 | 300 | Equilibrium |

| 2 | 400 | 200 | Upward |

| 1 | 500 | 100 | Upward |

-

- Equilibrium is struck a point E where the demand and supply curve intersect each other.

- At E, equilibrium price is OP i.e. ` 3 and equilibrium quantity is OQ i.e. 300 units.

- When the price is ` 5 per unit, the quantity demanded is 100 units and quantity supplies is 500 units. It is situation where market demand < market supply and there is excess supply i.e., surplus supply. At a given price, sellers are willing to sell more than what buyers are ready to buy. As a result of pressure of excess supply the market price falls to ` 4.

- At a price of ` 4, the pressure of excess supply still continues and hence the price falls further to ` 3.

- At a price of ` 3, the market is CLEARED as the quantity demanded and supplied are equal to each other. There, is no SURPLUS.

- Thus, we can conclude that pressure of excess supply (surplus) reduces the price.

- Similarly, if the price is ` 1, the quantity demanded is 500 units and quantity supplied is 100 units. It is a situation where market demand > market supply and there is excess demand or SHORTAGE of supply. As a result of excess demand or SHORTAGE of supply the market price will rise. So long as pressure of excess demand continues price will rise i.e. till point E. At point E, excess demand is eliminated and quantity demand and supplied are equal to each other. The market has CLEARED.

- Thus, we can conclude that pressure of excess demand (shortage of supply) increases the price.

- The equilibrium price is determined by the intersection between demand and supply therefore, it is also called as the MARKET EQUILIBRIUM.

4. Taste and preferences may also undergo a change when consumer discover that consumption of a good increases his prestige.

E.g. Diamonds, fancy cars, etc.

A good loses its prestige when it becomes a commonly used good. This is called ‘snob effect’.

Status seeking rich people buy highly priced goods only. This form of ‘conspicuous consumption’ or ‘ostentatious consumption’ is called ‘VEBLEN EFFECT’ (named after American economist THORSTEIN VEBLEN)

Tastes and preferences of people change either due to external causes or internal causes.

Therefore, knowledge about tastes and preferences is important in production planning, designing new products and services to suit the changing tastes and preferences of the consumers.

5. Other Factors: Other things being equal demand for a commodity is also determined by the following factors:—

-

-

-

- Size and composition of Population:

Generally, larger the size of population of a country, more will be the demand of the commodities. The composition of the population also determines the demand for various commodities.E.g. If the number of teenagers is large, the demand for trendy clothes, shoes, movies, etc. will be high.

- Size and composition of Population:

-

-

-

-

-

- The level of National Income and its Distribution:

National Income is an important determinant of market demand. Higher the national income, higher will be the demand for normal goods and services.If the income in a country is unevenly distributed, the demand for consumer goods will be less.If the income is evenly distributed, there is higher demand for consumer goods.

- The level of National Income and its Distribution:

-

-

-

-

-

- Sociological factors:

The household’s demand for goods also depends upon sociological factors like class, family background, education, marital status, age, locality, etc.

- Sociological factors:

-

-

-

-

-

- Weather conditions:

Changes in weather conditions also influence household’s demand.E.g. – Extraordinary hot summer push up the demand for ice-creams, cold drinks, coolers etc.

- Weather conditions:

-

-

-

-

-

- Advertisement:

A clever and continuous campaign and advertisement create a new type of demand.E.g. Toilet products like soaps, tooth pastes, creams etc.

- Advertisement:

-

-

-

-

-

- Government Policy:

The government’s taxation policy also affects the demand for commodities. High tax on a commodity will lead to fall in the demand of the commodity.

- Government Policy:

-

-

-

-

-

- Expectation about future prices:

If consumers expect rise in the price of a commodity in near future, the current demand for the commodity will increase and vice versa.

- Expectation about future prices:

-

-

-

-

-

- Trade Conditions:

If the country is passing through boom conditions, demand for most goods is more. But during depression condition, the level of demand falls.

- Trade Conditions:

-

-

-

-

-

- Consumer-credit facility and interest rates:

If ample credit facilities with low rates of interest is available, there will be more demand specially of consumer durable goods like scooters, LCD/LED televisions, refrigerators, home theatre, etc.

- Consumer-credit facility and interest rates:

-

-

3. Demand Function

Mathematical/symbolic statement of functional relationship between the demand for a product (the dependent variable) its determinants (the independent variables) is called demand function

Dx = f (Px, M, Ps ; Pc, T, A)

Where—

Dx = quantity demanded of product ×

Px = the price of the product ×

M = money income of the consumer

Ps = the price of its substitute

Pc = the price of its complementary goods

T = consumer’s tastes and preferences

A = advertising effect measured through the level of advertisement expenditure.

4. The Law of Demand

The Law of Demand expresses the nature of functional relationship between the price of a commodity and its quantity demanded. It simply states that demand varies inversely to the changes in price i.e. demand for a commodity expands when price falls and contracts when price rises.

“Law of Demand states that people will buy more at lower prices and buy less at higher prices, other things remaining the same.”

~Prof. Samuelson

It is assumed that other determinants of demand are constant and ONLY PRICE IS THE VARIABLE AND INFLUENCING FACTOR.

Thus, the law of demand is based on the following main assumptions:—

-

- Consumers income remain unchanged.

- Tastes and preferences of consumers remain unchanged.

- Price of substitute goods and complement goods remain unchanged.

- There are no expectations of future changes in the price of the commodity.

- There is no change in the fashion of the commodity etc.

The law can be explained with the help of a demand schedule and a corresponding demand curve.

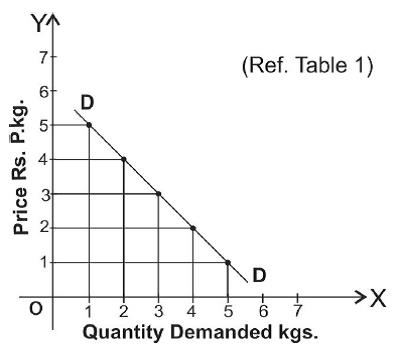

Demand schedule is a table or a chart which shows the different quantities of commodity demanded at different prices in a given period of time.

Demand schedule can be Individual Demand Schedule or Market Demand Schedule.

Individual Demand Schedule is a table showing different quantities of commodity that ONE PARTICULAR CONSUMER is willing to buy at different level of prices, during a given period of time

Table 1: Demand Schedule of an Individual Buyer

| Price of sugar ` per kg. |

Quantity Demanded kgs. per month |

| 1 | 5 |

| 2 | 4 |

| 3 | 3 |

| 4 | 2 |

| 5 | 1 |

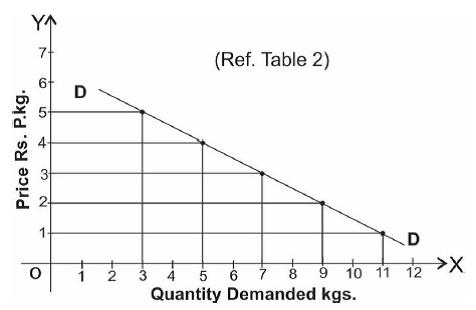

Market Demand Schedule is a table showing different quantities of a commodity that ALL THE CONSUMERS are willing to buy at different prices, during a given period of time.

Table 2: Market Demand Schedule

| Price of sugar ` per kg. | Quantity Demanded p.m. kgs. |

Market Demand A + B |

||||||

| Consumer A | Consumer B | |||||||

| 1 | 5 | 6 | 5 + 6 = 11 | |||||

| 2 | 4 | 5 | 4 + 5 = 9 | |||||

| 3 | 3 | 4 | 3 + 4 = 7 | |||||

| 4 | 2 | 3 | 2 + 3 = 5 | |||||

| 5 | 1 | 2 | 1 + 2 = 3 | |||||

(Assumption: There are only 2 buyers in the market)

Both individual and market schedules denotes an INVERSE functional relationship between price and quantity demanded. In other words, when price rises demand tends to fall and vice versa.

A demand curve is a graphical representation of a demand schedule or demand function. A demand curve for any commodity can be drawn by plotting each combination of price and demand on a graph.

Price (independent variable) is taken on the Y-axis and quantity demanded (dependent variable) on the X-axis.

Figure: Individual Demand Curve

Figure: Market Demand Curve

Individual Demand Curve as well as Market Demand Curve slope downward from left to right indicating an inverse relationship between own price of the commodity and its quantity demanded.

Market Demand Curve is flatter than individual Demand Curve.

The straight line demand curve where we hold everything else constant is described as:

Q = a – bP

Where a is the vertical intercept and b is the slope.

For example: for a demand function Q=100-2P,

P = a/b – Q/b

= 100/2 – Q/2

= 50 – Q/2

Reasons for the law of demand and downward slope of a demand curve are as follows:

-

- The Law of Diminishing Marginal Utility:

According to this law, other things being equal as we consume a commodity, the marginal utility derived from its successive units go on falling. Hence, the consumer purchases more units only at a lower price.

A consumer goes on purchasing a commodity till the marginal utility of the commodity is greater than its market price and stops when MU = Price i.e. when consumer is at equilibrium.

When the price of the commodity falls, MU of the commodity becomes greater than price and so consumer start purchasing more till again MU = Price.

It therefore, follows that the diminishing marginal utility implies downward sloping demand curve and the law of demand operates.

-

- Change in the number of consumers:

Many consumers who were unable to buy a commodity at higher price also start buying when the price of the commodity falls.

Old customers starts buying more when price falls.

-

- Various uses of a commodity:

Commodity may have many uses. The number of uses to which the commodity can be put will increase at a lower price and vice versa.

-

- Income effect:

When price of a commodity falls, the purchasing power (i.e. the real income) of the consumer increases.

Thus he can purchase the same quantity with lesser money or he can get more quantity for the same money.

This is called income effect of the change in price of the commodity.

-

- Substitution effect:

When price of a commodity falls it becomes relatively cheaper than other commodities.

As a result the consumer would like to substitute it for other commodities which have now become more expensive.

E.g. With the fall in price of tea, coffee’s price remaining the same, tea will be substituted for coffee.

This is called substitution effect of the change in price of the commodity.

Thus, PRICE EFFECT = INCOME EFFECT + SUBSTITUTION EFFECT as explained by Hicks and Allen.

5. Exceptions to the Law of Demand

According to the law of demand, other things being equal, more of a commodity will be demanded at lower prices than at higher prices. The law of demand is valid in most cases; however there are certain cases where this law does not hold good. The following are the important exceptions to the law of demand.

(i) Conspicuous goods: Articles of prestige value or snob appeal or articles of conspicuous consumption are demanded only by the rich people and these articles become more attractive if their prices go up. Such articles will not conform to the usual law of demand. This was found out by Veblen in his doctrine of “Conspicuous Consumption” and hence this effect is called Veblen effect or prestige goods effect. Veblen effect takes place as some consumers measure the utility of a commodity by its price i.e., if the commodity is expensive they think that it has got more utility. As such, they buy less of this commodity at low price and more of it at high price. Diamonds are often given as an example of this case. Higher the price of diamonds, higher is the prestige value attached to them and hence higher is the demand for them.

(ii) Giffen goods: Sir Robert Giffen, a Scottish economist and statistician, was surprised to find out that as the price of bread increased, the British workers purchased more bread and not less of it. This was something against the law of demand. Why did this happen? The reason given for this is that when the price of bread went up, it caused such a large decline in the purchasing power of the poor people that they were forced to cut down the consumption of meat and other more expensive foods. Since bread, even when its price was higher than before, was still the cheapest food article, people consumed more of it and not less when its price went up.

Such goods which exhibit direct price-demand relationship are called ‘Giffen goods’. Generally those goods which are inferior, with no close substitutes easily available and which occupy a substantial place in consumer’s budget are called ‘Giffen goods’. All Giffen goods are inferior goods; but all inferior goods are not Giffen goods. Inferior goods ought to have a close substitute. Moreover, the concept of inferior goods is related to the income of the consumer i.e. the quantity demanded of an inferior good falls as income rises, price remaining constant as against the concept of Giffen goods which is related to the price of the product itself. Examples of Giffen goods are coarse grains like bajra, low quality rice and wheat etc.

Inferior goods have inverse relationship between income and demand, but not necessarily the positive relationship between price and demand.

In case of giffen goods there is inverse relation between income and demand and positive relation between price and demand.

(iii) Conspicuous necessities: The demand for certain goods is affected by the demonstration effect of the consumption pattern of a social group to which an individual belongs. These goods, due to their constant usage, become necessities of life. For example, in spite of the fact that the prices of television sets, refrigerators, coolers, cooking gas etc. have been continuously rising, their demand does not show any tendency to fall.

(iv) Future expectations about prices: It has been observed that when the prices are rising, households expecting that the prices in the future will be still higher, tend to buy larger quantities of such commodities. For example, when there is wide-spread drought, people expect that prices of food grains would rise in future. They demand greater quantities of food grains as their price rise. However, it is to be noted that here it is not the law of demand which is invalidated but there is a change in one of the factors which was held constant while deriving the law of demand, namely change in the price expectations of the people.

(v) The law has been derived assuming consumers to be rational and knowledgeable about market-conditions. However, at times, consumers tend to be irrational and make impulsive purchases without any rational calculations about the price and usefulness of the product and in such contexts the law of demand fails.

(vi) Demand for necessaries: The law of demand does not apply much in the case of necessaries of life. Irrespective of price changes, people have to consume the minimum quantities of necessary commodities.

Similarly, in practice, a household may demand larger quantity of a commodity even at a higher price because it may be ignorant of the ruling price of the commodity. Under such circumstances, the law will not remain valid. For example Food, power, water, gas.

(vii) Speculative goods: In the speculative market, particularly in the market for stocks and shares, more will be demanded when the prices are rising and less will be demanded when prices decline.

The law of demand will also fail if there is any significant change in other factors on which demand of a commodity depends. If there is a change in income of the household, or in prices of the related commodities or in tastes and fashion etc., the inverse demand and price relation may not hold good.

6. Expansion and Contraction of Demand

Expansion and Contraction of Demand means changes in quantity demanded or movement along a demand curve.

The law of demand, the demand schedule and the demand curve all show that

-

- when the price of a commodity falls its quantity demanded rises or expansion takes place and

- when the price of a commodity rises its quantity demanded fall or contraction takes place.

Thus, expansion and contraction of demand means changes in quantity demanded due to change in the price of the commodity other determinants like income, tastes, etc. remaining constant or unchanged.

When price of a commodity falls, its quantity demanded rises. This is called expansion of demand.

When price of a commodity rises, its quantity demanded falls. This is called contraction of demand.

As other determinants of price like income, tastes, price of related goods etc. are constant, the position of the demand curve remains the same. The consumer will move upwards or downwards on the same demand curve.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA