How to Access Form 26AS from the New Income-tax Website?

- Blog|Income Tax|

- 3 Min Read

- By Taxmann

- |

- Last Updated on 15 October, 2022

The income-tax department has launched a new e-filing portal www.incometax.gov.in on 7th June 2021. The new e-filing portal is aimed at providing taxpayer convenience and a modern, seamless experience to taxpayers.

The new website has various interesting features such as all interactions and uploads, or pending actions will be displayed on a single dashboard for follow-up action by the taxpayer, free software is provided for filing of ITR-1 and ITR-4.

Further, the manner of downloading Form 26AS is also simplified under the new portal.

Form 26AS is a tax passbook that contains the following information:

- Information relating to tax deducted at source;

- Information relating to tax collected at source;

- Information relating to Specified Financial Transactions (SFT);

- Information relating to the payment of taxes;

- Information relating to demand and refund;

- Information relating to pending proceedings;

- Information relating to completed proceedings; and

- Information received from any officer, authority, or body performing any functions under any law or information received under an agreement referred under section 90 or section 90A or information received from any other person to the extent it may be deemed fit in the interest of the revenue.

Introducing Taxmann.com | Practice – Always Updated Income-tax Law on your Fingertips! Start your search on any concept of the Law using keywords or section no. 10,000+ Free Trials already taken in the last week ! Start yours Now !

Watch the Video!

For downloading Form 26AS, a taxpayer needs to follow the following steps:

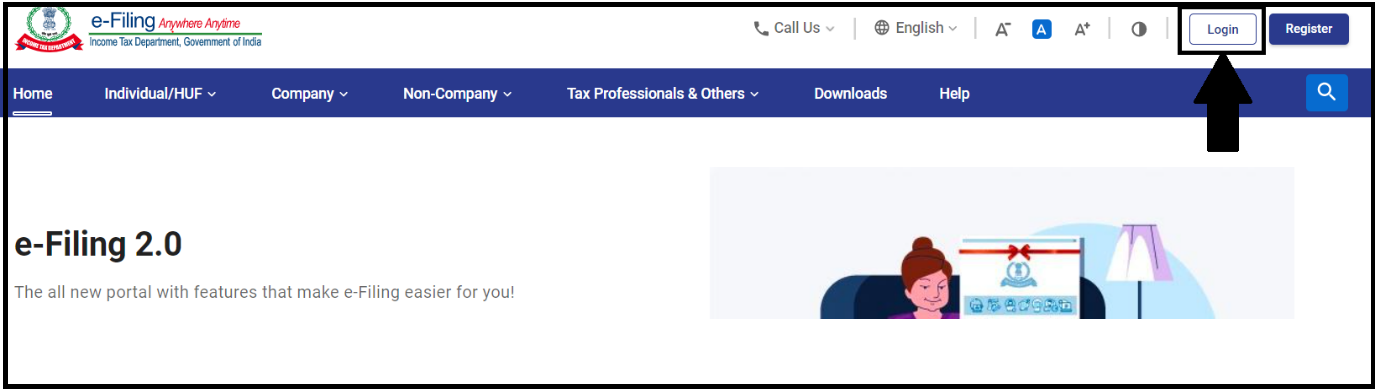

- Log in to income tax new website incometax.gov.in;

- Click on Login on the top right of the home page;

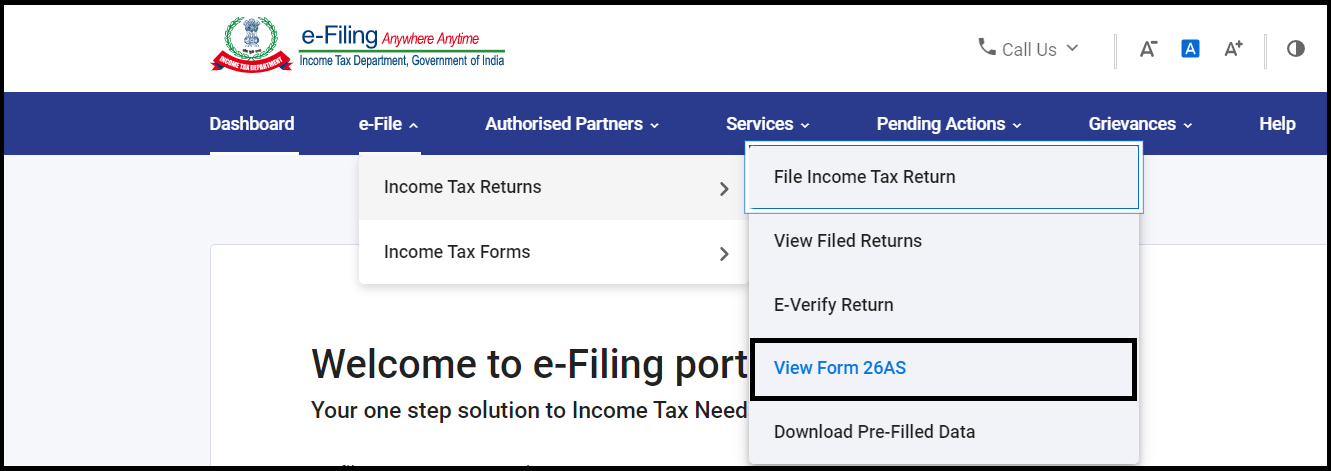

- Go to the ‘e-file’ menu> click on Income tax returns> Select ‘View Form 26AS ‘

- Read the disclaimer and click on the ‘Confirm’ button;

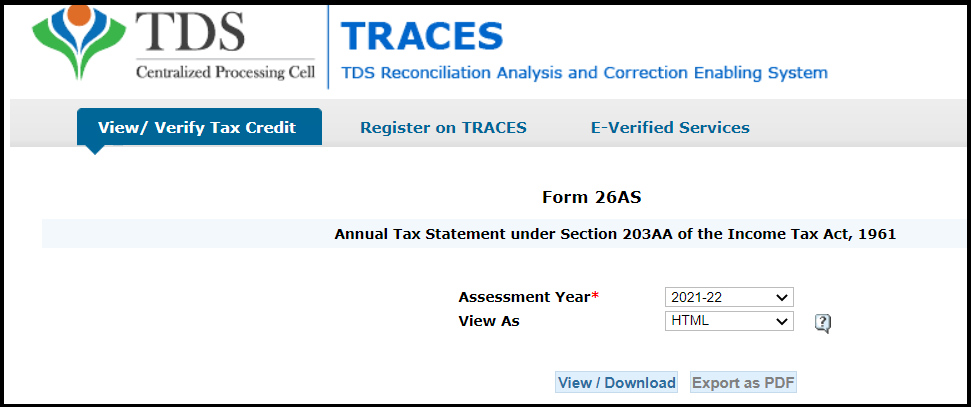

- After confirming, you will be redirected to the TDS-CPC website;

- At the TDS-CPC website, agree to the acceptance and usages of Form 16 / 16A generated from TRACES and click on ‘Proceed’;

- Click on the ‘View Tax Credit (Form 26AS)’ option;

- Select the relevant assessment year for which Form 26AS is required and Select ‘View Type’ (HTML or Text);

- Click at ‘View/Download’; and

- Your Form 26As will be displayed

If you want to download Form 26AS in PDF, click on Export as PDF and save the Form 26 AS for future use.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA

Sir, Till today the main menu as shown in the guide do not appear to me. And the Form 26 As could not be found out. please rectify at the earliest.

Hi

pls follow the following steps

1. Open https://eportal.incometax.gov.in/

2.log in to your account

3. click E-file options in the menu bar

4. then click income tax return under e-file

5. under income tax return click 26 AS

Sir, I have also tried to view form 26AS but the TDS-CPC portal is not appearing thus I could not see 26AS, please help how I can see & check 26AS before filing ITR1 The old portal till last FY 2019-20 was very easy for us (senior Citizen) to view and filing ITR as I file ITR myself. Kindly do the needful early to view 26AS & file ITR1 like earlier years.

I am not able to access form 26AS through new income tax portal. It is asking me to register with traces. I talked to INCOME TAX GENERAL QUERIES at 18001801961, where I was tola that there is no need for registration. BUT I am still facing the problem. After Loging in to the new portal, and clicking —> income tax return —-> view form 26AS , I am redirected on registration page.

Please help me

In old portal , it was very easy to view / down load the form 26AS.

SIR- Forn 26AS is not opened immediate so I am not download form 26AS. help me

26AS download

unable to download 26AS. Please help

Very Candidly Speaking, this New Format makes the Work More Cumbersome, for Ordinary Citizens. 26AS viewing is a Himalayan Task and End up in Failure. Thereby people are made to go to CAs/Tax Counsels.

Formats are to be Made Simple for Even any Common man use for E-Filing, if they are Really Made for Helping Citizens.

In Feed Backs how many gave Positive Comment???

I am unable to download Form 26 As Through the new income tax portal. Please Help Me.

Sir,I am not able to access my 26AS form,kindly guide me.

I AM TRYING TO REACH THE SITE FOR VIEWING TDS ON INTEREST PAYMENT BUT THIS IS NOT APPEARING IN NEW INCOMETAX SITE. REQUEST THE DEPARTMENT TILL THE NEW SITE BECOME FULLY OPERATION FOR EVERYONE, THE OLD INCOMETAX SITE SHOULD ALLOWED TO BE CONTINUED.

I COULD NOT SUBMIT MY ITR ONLINE FOR WANT OF TDS ON INTEREST PAYMENT.

THE NEW SITE INSTEAD OF SOLVING THE PROBLEMS OF THE TAX PAYERS, HAS BECOME CUMBERSOME

Non working of this site leads us to click many Fake options over the Net, If its not working let the Govt pay the price we dont want to file returns and pay tax, will file RTI if this site is not working by the evening

After Logging in to the new portal, and clicking —> income tax return —-> view form 26AS , I am redirected to the below page to register and stays there itself, but it’s NOT auto redirecting to the actual page as like previous years.

https://services.tdscpc.gov.in/serv/view26AS.xhtml

At least they should provide an option to click manually if auto redirection doesnt work .

I am not able to open 26AS where is the question of

download?

Not able to download the 26AS form after following the above instructions.When I click the “View for 26AS” it is not redirecting to the site…..instead nothing happening

26AS are not visible. Either it does not take you to site for viewing 26AS or at times indicate server under maintenance .

I am on vacation in US AND IT SAYS THAT YOU ARE NRI AND GO TRACES SITE.

I am also having this problem. Did you get any solution to it?

Same problem – redirecting to NRI traces and my old registration isn’t working!

pathetic . it doesnt work

Not able to view or download 26AS

Not able to download the 26AS form after following the above instructions.When I click the “View for 26AS” it is not redirecting to the site.

Complete Mess !

Whose idea to revamp the good old one ?

Sorry. Not able to even view/download 26as. The old one was fine.

Unable to download Form 26AS. It is redirecting to TRACE, where it ask to register as new user. Is anyone able to register with TRACE to view the form 26AS?

i am having the same problem…when go to submit to traces it goes to login pages..on view form 26 AS

Sir

i have been trying to view Form 26AS for quite a long time but i am not able to get it . after doing all actions as guided , it goes back to the login page.

Please help.

Bank recovered excess pension paid by them Rs.1, 82,644/- from December Seventh.to Feb 2021. I have paid taxes on it.

Now how can I recover the taxes which I have already paid to Income tax authority on Rs.1,82,644/-.

You may offer the net pension received during the year to tax by relying on the order of Ahmedbad Tribunal in the case of Vrajeshwari B. Parikh (61 taxmann.com 235)

Sir

i have been trying to view Form 26AS for quite a long time but i am not able to get it . after doing all actions as guided , it goes back to the login page.

Please help

Not able to access 26AS form

Not able to view and download form AS-26 as redirected to traces but don’t show anything. Kindly resolve the issue.

Please contact CPC on toll free number 18001801961

Try with another browser like microsoft edge

not able to download form 26as. CPC toll number 18001801961 not working