[Analysis] Demystifying Investment Banking – Financial Modeling | Valuation | M&A Strategies

- Blog|FEMA & Banking|

- 10 Min Read

- By Taxmann

- |

- Last Updated on 25 October, 2024

Investment banking is a specific division of banking related to the creation of capital for other companies, governments, and other entities. Investment bankers advise and assist their clients in raising funds in the capital markets, by issuing debt or selling equity in the companies. Other services include assisting in the sale of securities, facilitating mergers and acquisitions (M&A), reorganizations, and broker trades for both institutions and private investors. Investment banks also provide guidance to issuers regarding the issue and placement of stock.

by CA. Anurag Singal – Valuation Professional

Table of Content

- What is Investment Banking

- Emerging Trends in Investment Banking

- Dealflow Recent History

- What is Financial Modelling?

1. What is Investment Banking

It is the segment of the financial industry which deals in raising capital, providing financial advice, and facilitating complex financial transactions of entities. They at times also act as intermediaries between the entities and the investors.

1.1 Core Functions of Investment Banks

- Raising Capital – Investment banks help companies access public capital markets via initial/secondary public offerings, collateralized loan obligations and complex structured financing.

- Mergers & Acquisitions – Advising corporations on buying, selling or merging entire businesses demands intricate financial modeling, negotiation tactics and regulatory navigations to drive shareholder value.

- Strategic Advisory – Consultative guidance on financial restructurings, spin-offs and other complex strategic endeavors relies on investment bankers’ insights into global macroeconomic forces and industry trends.

- Institutional Client Services – By facilitating client trades, prime brokerage, new issue distribution and bespoke research, banks enable asset managers and hedge funds to implement targeted investment strategies.

- Proprietary Activities – Banks use own capital to profit from principal transactions, arbitrage, derivatives trading and other investments leveraging specialized risk management competencies.

2. Emerging Trends in Investment Banking

Generative AI – GenAI is anticipated to be a major player in investment banking, much like any other industry. It can improve a wide range of things, such as customer service, investment decision-making techniques, and operational efficiency.

Furthermore, job automation—particularly for complicated computations— will reduce errors and improve the accuracy required for decision-making.

3. Dealflow Recent History

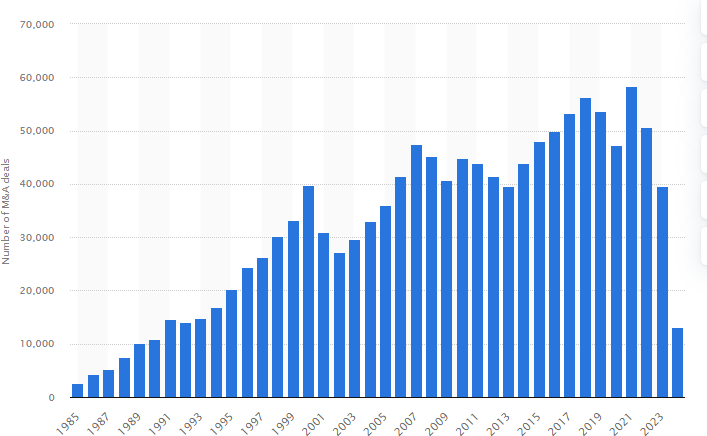

- M&A dealflow worldwide has seen a rise over the years from just 2676 deals in 1985 to a huge 39,603 deals in 2023

- As of May 2024, 13,176 deals have been executed

- Rothschild & Co., Goldman Sachs, and JPMorgan advised on the largest number of M&A deals in 2022 & 2023.

- In 2022, Goldman Sachs was the leading M&A financial advisor in terms of the value of M&A deals, while Rothschild was leading in terms of the number of deals. While Goldman Sachs dominated the M&A scene in terms of deal value, J.P. Morgan surpassed them as the world’s leading bank in terms of revenue from investment banking in 2022.

- The value of M&A deals worldwide fluctuated significantly recently. A peak value of over 5.2 trillion U.S. dollars was recorded in 2021. So-called mega-deals – M&A deals worth one billion U.S. dollars or more – have a great influence on the market performance: In 2021, nearly 1,000 megadeals were worth a combined 3.7 billion U.S. dollars.

3.1 M&A Activity in India – For 2023

- 2023 recorded over 1,500 deals totalling around USD 53 billion, showing a 23% decrease in volumes and a 59% decrease in values compared to the previous year.

- While there was a slight increase in cross-border transactions from around 120 to 140 in 2023, their collective value sharply declined from USD 21 billion to USD 11 billion. This indicates a noticeable shift towards smaller deals.

- PE deal activity continued to be low, recording around 1,000 deals worth USD 27 billion on the back of cautious investor sentiment and the prevailing funding winter across the globe.

3.2 M&A Activity in India – For 2024

- In Q1 2024, there were promising early signs of a rebound in deal activity, with 427 deals amounting to USD 20.4 billion. The surge in deal values was primarily driven by the mega merger of Reliance and Disney, valued at USD 8.5 billion, which constituted 42% of the total values in Q1 2024.

- PE activity registered an uptick recording the highest quarterly deal volumes in the last six quarters and the second-highest deal values since Q2 2023, with the quarter witnessing two billion dollar deals and eight high-value deals (≥ 100 mn) contributing to 70% of the total PE values. India minted two unicorns, Krutrim SI Designs and Perfios, in the first quarter of the year. Traditional sectors, such as telecom and infrastructure, contributed with high-value deals, joining retail and media to dominate deal values, while Retail, IT, and Banking led the volumes.

- The second quarter of 2024 witnessed a record-breaking 501 deals valued at $21.4 billion, marking the highest quarterly volume since Q2 2022. Mergers & Acquisitions (M&A) and PE deals together stood at 467, valued at $ 14.9 billion. This translates to a 9% increase in volumes but a 28% decrease in values compared to the previous quarter, primarily due to the absence of mega-mergers like the Reliance- Disney deal in Q1 2024.

- The quarter saw a significant rise in high-value deals (over USD 100 million), with 30 transactions compared to only 19 (including three billion-dollar deals) in Q1 2024, reflecting a 58% increase.

3.3 M&A Activity in India – The Top Recent Deals

- Reliance’s Media Merger with Disney India – Reliance’s media companies have initiated a landmark merger with Disney India, valued at around $8.5 billion combined. This consolidation is poised to expand Reliance’s foothold in the Indian media landscape, blending Disney’s rich content portfolio with Reliance’s distribution networks.

- Tech Mahindra’s Internal Consolidation – In a move to streamline operations, Tech Mahindra’s board approved the merger of three wholly-owned subsidiaries, namely Perigord Premedia (India) Private Limited, Perigord Data Solutions (India) Private Limited, and Tech Mahindra Cerium Private Limited. This internal consolidation aims to improve operational efficiency and reduce redundancies.

- Future Group and Reliance Industries – Reliance Industries Limited (RIL) completed its $3.4 billion acquisition of Future Group’s retail, wholesale, logistics, and warehousing businesses. This acquisition enhances Reliance Retail’s dominance in the Indian market, significantly expanding its physical and logistics footprint.

- Tesla and Tata Motors Partnership – In a groundbreaking collaboration, Tesla acquired a 20% stake in Tata Motors’ electric vehicle (EV) division for $2 billion. This move is expected to accelerate the adoption of EVs in India, with Tesla’s cutting-edge battery and autonomous technology being integrated into Tata’s lineup.

- Tata Group’s Acquisition and Merger of Air India and Vistara – Tata Group’s acquisition of Air India for $2.4 billion is a monumental deal in India’s aviation sector. The subsequent merger with Vistara, which involves Singapore Airlines holding a 25.1% stake in the merged entity, is likely to create a dominant player in the Indian skies.

- Adani Group’s Acquisition of NDTV – Adani Group’s acquisition of NDTV, following its purchase of an additional 27.26% stake, reflects the conglomerate’s growing interest in the media space. Valued at Rs. 602.30 crore, this deal raises questions about editorial independence given Adani’s significant business interests across industries.

- Zomato and Blinkit Merger – The all-stock deal between Zomato and Blinkit, valued between $700 million and $750 million, marks a significant consolidation in India’s fast-growing food and grocery delivery space. This merger allows Zomato to expand into the instant grocery delivery market, enhancing its service portfolio.

- Brookfield’s Investment in Rostrum Realty – Brookfield Asset Management’s purchase of a 51% stake in Rostrum Realty for Rs. 5,000 crores is part of its broader strategy to expand its presence in India’s real estate market. This acquisition gives Brookfield control over key assets in a joint venture with Bharti Enterprises.

3.4 Top Investment Banks in India

Global Firms

- J.P. Morgan

- Goldman Sachs

- Bank of America Merrill Lynch

- UBS

- Societe Generale

- Morgan Stanley

- Deutsche Bank

- Barclays

- BNP Paribas

Domestic Firms

- ICICI Securities

- Axis Capital

- Edelweiss Financial Services

- Avendus Capital

- O3 Capital

- Kotak Investment Banking

- IIFL Investment Banking

- Centrum Capital

3.5 The Outlook for the Near Future

The daunting combination of high interest rates, current valuations and political uncertainty has been a showstopper for many deals. Nevertheless, the strategic need for M&A continues to grow stronger, creating pent-up demand which will be unleashed as these uncertainties resolve.

3.6 The Outlook – A Fast Bounce Back

- PE portfolios are ripe for sale – At the beginning of the year, according to PitchBook, PE firms held more than 27,000 portfolio companies globally, about half of which had been on the books for at least four years—typically the length of time at which they are primed for exits. Fast-forward to mid-2024, and the majority of those investments have aged another six months. Many PE firms in the process of raising new funds are being questioned by investors about the limited realisation of returns, increasing the pressure to sell. PE funds that fail to make distributions from existing fund investments may find it more challenging to raise new capital.

- Corporates are focused on transactions to accelerate growth and achieve business transformation – Corporates are operating in a more disruptive, complex and uncertain environment, with macroeconomic factors, geopolitical issues and technological disruption—now heightened by AI—all of which create a need for companies to innovate and reinvent their businesses. Companies with well-thought-through M&A strategies for optimising their portfolios by acquiring the right capabilities, talent and technology or divesting non-core assets will be the best placed to succeed.

- Inorganic growth is required to overcome anaemic organic growth. Macroeconomic factors and monetary policy actions in many countries have created an environment of low economic growth in which organic revenue growth will be much harder to achieve. Consequently, companies may need to turn to M&A as part of their inorganic growth strategies to fire up their top lines.

- AI could be a catalyst for all sorts of transaction types. AI—particularly generative AI—has the ability to disrupt companies, from corporate behemoths to startups, as well as sectors and even entire industries. AI has the capability to create massive cost efficiencies, enable new revenue streams, open new channels to customers, and enhance the value proposition on the one hand and commoditise it on the other.

4. What is Financial Modelling?

A financial model is an analytical tool designed to forecast a company’s future financial performance based on its historical data, assumptions about future conditions, and strategic decisions. This is typically done using a 3-statement model, which includes:

- Income Statement – Shows revenue minus expenses to derive profit.

- Balance Sheet – Outlines the company’s financial position, including assets, liabilities, and equity.

- Cash Flow Statement – Tracks cash inflows and outflows, showcasing liquidity

4.1 Key Components

- Historical Data – Information from past financial statements to build assumptions and trends

- Assumptions – Hypothetical inputs regarding sales growth, costs, and market conditions

- Projections – Future performance metrics calculated based on these assumptions

4.2 Types of Financial Models

- Discounted Cash Flow (DCF) – values a company based on future cash flows discounted to the present value

- Leveraged Buyout (LBO) – analyzes acquisition financing through significant debt

- Mergers & Acquisitions (M&A) – estimates synergies and impacts of corporate transactions

- Sensitivity Analysis – tests how outcomes change with variations in key assumptions

4.3 KIIs – Key Informant Interviews

- Information Exchange –Documentation exchange. Investors will share their DD Q&A for response

- Site Visit – Site visit and KIIs with customers, suppliers and other key stakeholders

- KIIs with Management – Interviews will be set up with the management teams and a sample of employees

- Investor/Investee Discussions – Discussion on the risks arising and any mitigation strategies

- Investor Internal Discussion – Discussion on risks arising and procedural issues

- Negotiations based on the DD findings – Discussion with the investee based on the findings and the risk level the investor is willing to bear

- Investment Decision

4.4 Due Diligence

Due diligence (DD) refers to a detailed investigation by a potential investor on the investee company (business) before deploying capital into the company, DD is done to verify the information shared by the investee company and to also assess the potential risks that the business is exposed to, so that the investor can make an informed investment decision. There are three main components of a DD process. They Include:

- Legal Due Diligence – Covers a wide scope of legal matters, including proper incorporation and ownership, contractual obligations, ownership of assets, compliance, and litigation. It seeks to confirm the validity of the rights being acquired by the investor and the absence of legal risks which could undermine the value of the investment

- Commercial Due Diligence – It seeks to obtain an independent perspective on the sales forecast as the most critical component of the target’s business plan. The investors investigate the market positioning and market share, including its drivers and future divers

- Financial and Tax Due Diligence – This due diligence seeks to

-

- Validate the investor’s valuation assumptions by looking at historical performance, and concluding on its consistency with projections and

- identify financial risks and uncertainties and exposures.

Tax due diligence seeks to evaluate and asses whether the company has been compliant with its tax obligations by looking at documents such as tax compliance certificates and identifying potential additional tax liabilities arising from non-compliance or errors

The Due diligence (DD) process varies from investor to investor. The risk appetite for various investors also vary. As such, some investors may consider some risks to be less weighty compared to others especially if they are risk loving. Further, depending on the objectives of the investors, they may assess more elements than what is listed below. However, the most common elements that are assed during the DD process include:

- Key Risks – The Investor asses the risk exposure they have and the key areas that are likely to be of risk in future and affect their returns. At the DD stage, they make the decision of whether the risk exposure is too high to significantly affect their investments. Risks include, regulatory, PEP, environmental, social, legal etc.

- Alignment – The Investor evaluates whether the company’s goals and their objectives align. They asses the vison alignment. This is especially for equity investors. Remember, equity investors are coming in to be shareholders and they would have rights such as voting and board rights. They therefore need to ensure that they are aligned.

- Funding Strategy – The Investor evaluates the strategy of attracting long-term funding strategy for the company and how attractive it is to other potential investors. This is done to understand the exit opportunities that the investors can utilize to exit. Investors would ideally speak to other investors in the market to get a sense of why they would invest or not

- Team – The Investor conducts reference checks to ascertain the industry and sector experience. They also assess the management team to understand their vision and whether the team can provide a return on investments. They also assess the corporate governance structures that have been set up within the team.

- Financials – The Investor evaluates whether the growth and cost drivers assumed in the financial model translates into the operations of the company. They evaluate the feasibility of the company hitting the assumed valuation and revenue targets. Investors seek to understand the burn rate and the runway their investment will give the company.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

CA | CS | CMA

CA | CS | CMA