Cross Border Valuation – Key Requirements | Strategies | Regulatory Insights

- Blog|FEMA & Banking|

- 10 Min Read

- By Taxmann

- |

- Last Updated on 17 October, 2024

Cross-Border Valuation refers to the process of determining the financial value of a business, asset, or entity involved in a transaction between parties located in different countries. This type of valuation is critical in international mergers and acquisitions (M&A), joint ventures, investment decisions, and other cross-border financial transactions. Key aspects of cross-border valuation include: – Currency Considerations – Country Risk Premium – Valuation Methods – Regulatory and Tax Considerations – Pricing Guidelines

By CA. Niki Shah – Partner | SN & Co.

Table of Contents

- Requirements of Cross Border Valuations

- Strategic Objective for Cross Border Transaction

- Types of Merger and Acquisition Transaction

- Valuation Process – Key Steps

- Valuation Methods and Approaches

- International Valuation and Key Considerations

- Choice of Currency

- Country Risk Premium

- Pricing Guidelines

- Regulatory Considerations

1. Requirements of Cross Border Valuations

1.1 Cross Border Valuation

Transactions

- Merger and acquisitions

- Strategic Alliances

- Joint Ventures

- Divestitures and Spin-offs

Corporate

- Goods and Services Transactions

- Property Transactions

- Cross Border Investments

- Intellectual Property and Technology Transfers

- Intra-Company Transfers

- Cross Border Restructuring

- Art, Antiques, and Collectibles Transactions

2. Strategic Objective for Cross Border Transaction

- Portfolio Diversification

- Cost synergies

- Securing new product technology

- International Business expansion

- Mitigating Political, Financial, Compliance Risk, etc

- Ease supply chain Logistics

- Adding distribution network

3. Types of Merger and Acquisition Transaction

Cross-border Transaction – M&A transaction between a domestic company with an International company. These can be either

3.1 Inbound Merger

Walmart and Flipkart

- In May 2018, Walmart Inc., an American retail giant, acquired a significant stake in Flipkart, an e-commerce company originally incorporated in Singapore but with its primary operations in India, for $16 billion

3.2 Outbound Merger

Tata Steel and Corus

- In January 2007, Tata Steel, an Indian multinational steel producer, acquired Corus Group, a UK-based steel manufacturer, for $12.1 billion

3.3 Amalgamation

Tata Steel and Tata Steel Europe

- In 2021, Tata Steel announced the amalgamation of its Indian operations with Tata Steel Europe, creating a unified European business.

3.4 Joint Venture (JV)

Mahindra & Mahindra and Renault

- In 2007, Mahindra & Mahindra (India) and Renault SA (France) formed a joint venture to produce small cars in India, resulting in the Mahindra Renault Logan

3.5 Divestiture

GlaxoSmithKline Consumer Healthcare and HUL

- This is when a company sells off a part of its business

- In December 2018, HUL acquired the Indian business of GSK

- This transaction involves international business operations and the need to evaluate a significant foreign-owned business in India.

4. Valuation Process – Key Steps

Steps of Valuation as prescribed by ICAI Valuation Standard

- Define the valuation base, premise of the value and valuation date

- Analyze the asset to be valued and collect the necessary information

- Identify the adjustments to the financial and non-financial information the valuation

- Consider and apply appropriate valuation approaches and methods

- Arrive at a value or a range of values

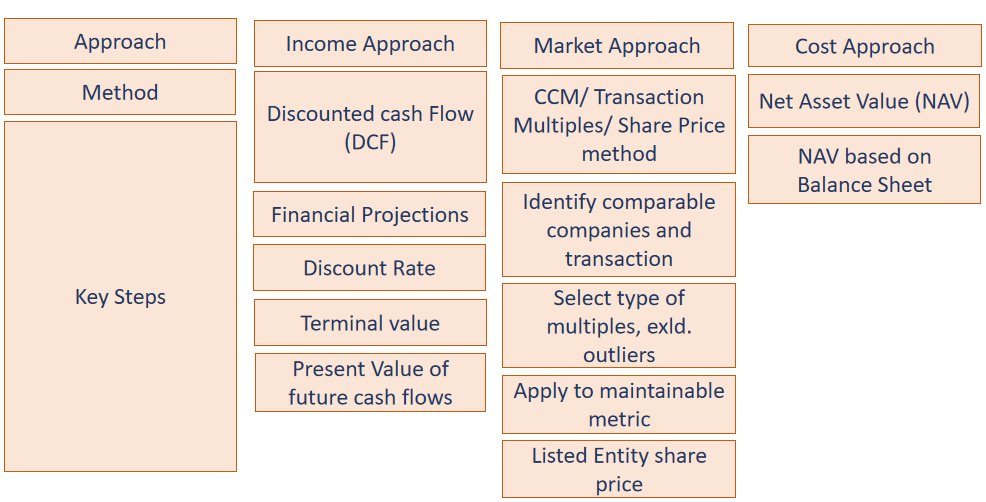

5. Valuation Methods and Approaches

These methodologies remains same for domestic and International transactions but with certain key differences and associated considerations.

5.1 Income Approach

Discounted Cash Flow Method

- Discounted cash flow analysis is based upon the theory that the value of a business is the sum of its expected future free cash flows, for several periods (unstable growth period) and terminal value after expiry of that period (stable growth period).

- A discount rate is employed to convert those future values back to a present value.

- The business life is divided into two phases: unstable growth period and stable growth period – it is also known as the two-stage model of cash flow discounting. It can be extended to a three or four-stage model.

Capitalization Method

- Estimates the fair market value of a company by converting the future income stream into value by applying a capitalization rate.

- This method is usually employed when a company is expected to experience steady financial performance for the foreseeable future and when growth is expected to remain fairly constant. (Based on Gordon growth model)

Income Approach requires a lot more deeper insights to shortlist the key valuation parameters

- Company Background

- Management Business Plan

- Free Cashflows

- Discount Rate

- Business Cycle/Key sensitivities

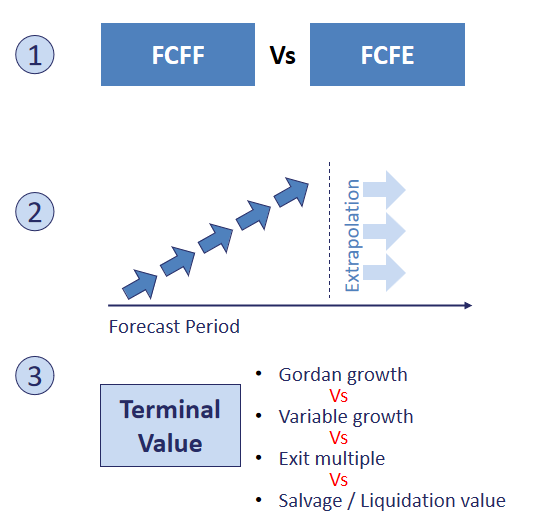

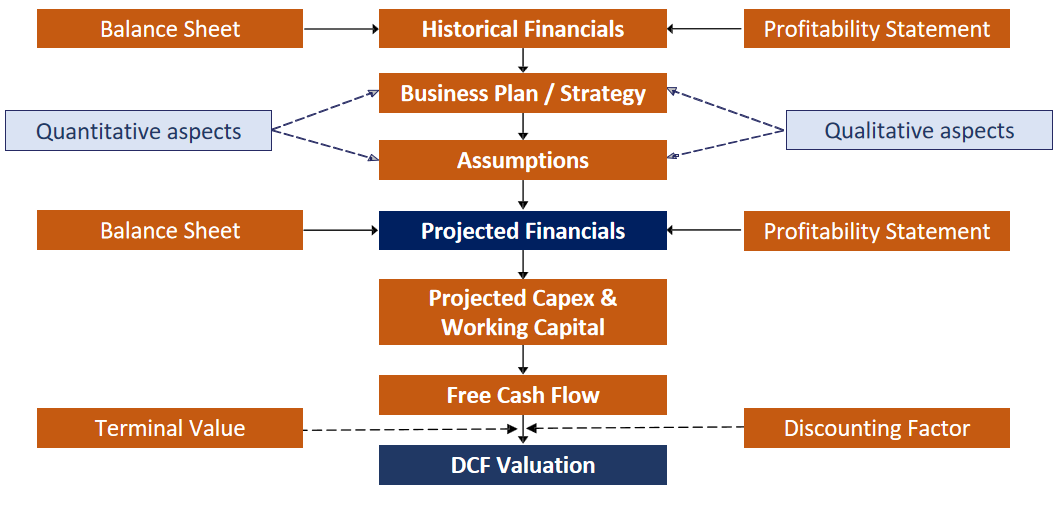

5.2 Discounted Cash Flow Method

5.2.1 Process

- Projections – Consider the projections to determine the future cash flows expected to be generated by the asset

- Analysis – Analyze the projections and its underlying assumptions to assess the reasonableness of the cash flows

- Cash flows – Choose the most appropriate type of cash flows for the asset, free cash flows to equity or free cash flows to firm

- Discount Rate – Determine the discount rate

- Growth Rate – Determine beyond the explicit forecast period

- Present Value and Terminal Value – Apply the discount rate to arrive at the present value of the explicit period cash flows and for arriving at the terminal value.

- Enterprise to Equity Value – Adjustment in Enterprise Value to arrive at Equity Value

5.2.2 Key Steps

5.2.3 Key Parameters

- Free Cash Flows

- Discounting factor

- Terminal Value

5.2.4 Projections – FCFF Vs FCFE

Free Cash Flows to Firm

FCFF refers to cash flows that are available to all the providers of capital.

- Excludes interest expenses

- FCFF is discounted by Weighted average cost of Capital

- Measures free cash flow to firm before all financing costs

- EBIT×(1−Tax Rate)+Depreciation−Changes in Working Capital−Capital Expenditures

Free Cash Flows to Equity

FCFE refers to cash flows available to equity shareholders.

- Accounts in interest expenses

- FCFE is discounted by Required return on Equity

- Used to determine the equity value of the firm (focuses on equity shareholders)

- FCFF−Interest Payments×(1−Tax Rate)+Net New Debt

5.2 Market Approach

5.2.1 Market Price Method

- Consider the traded price observed over a reasonable period while valuing assets which are traded in the active market

- Provides Value Indication on a non-controlling, marketable basis

5.2.2 Comparable Companies Multiple Method

- Involve valuing an asset based on market multiples derived from prices of market comparable traded on active market

- Provides Value Indication on a non-controlling, marketable basis

5.2.3 Comparable Transaction Multiple Method

- Involve valuing an asset based on transaction multiples derived from prices paid in transactions of comparable assets

- Provides Value Indication on a controlling, marketable basis

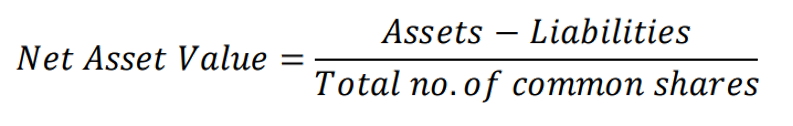

5.3 Cost Approach

The cost approach, also known as the asset-based approach

It is specifically useful for asset intensive firms, valuing holding companies as well as distressed entities that are not worth more than their overall net tangible value.

Two Common Valuation methods under the Cost Approach for Business Valuation

- Replacement Cost Method

- Reproduction Cost Method

NAV Method

It values a business based on what it would cost to replace the assets owned by a business.

Sum of the Parts Method

Sum of the Parts Method

This method is used to adjudge the value of a company based on the sale value of the different parts or divisions of a business.

![]()

Cost Approaches are normally sanity checkpoint in many situations unless company is in a Startup phase or liquidation scenario

5.3.1 Book Value/Historical Cost

Cost incurred by the Business till date to bring the asset to the current state.

5.3.2 Replacement Cost

Replacement Cost Method refers to valuing an asset based on the cost that a market participant shall have to incur to recreate an asset with substantially the same utility (comparable utility) as that of the asset to be valued, adjusted for obsolescence.

5.3.3 Reproduction Cost

Reproduction Cost Method refers to the cost that a market participant shall have to incur to recreate a replica of the asset to be valued, adjusted for obsolescence.

6. International Valuation and Key Considerations

Key Considerations

- Calculating the Beta

- Identifying the Comparable Companies

- Tax Rate

- Treatment of Country Risk Premium

- Choice of Currency

- Compliance with foreign laws

7. Choice of Currency

- Cash flows have to be in the same currency as your Discounting Rate.

- It can be either the home or the foreign currency in determining cash flows.

- If you do your analysis in dollars, your cash flows have to be in nominal dollars.

- Forward or expected exchange rates (and not the current spot rate) to be taken to make the conversion.

- If you want to preserve consistency, your expected exchange rate has to be computed from either interest rate or purchasing power parity.

7.1 Beta

- Measure of an investment’s systematic risk relative to a market index, indicating how much the investment’s returns move with market changes.

- It affects the WACC by changing Cost of Equity component.

Question: When considering tax impacts, is it more prudent to use the statutory tax rate or the effective tax rate: Statutory or Effective?

Effective Tax Rate

The effective tax rate provides a more accurate reflection of the actual tax impact on the company’s cash flows and valuation, as it accounts for various deductions, credits, and tax planning strategies.

7.2 Tax

- Corporate Income Tax Rates – Distinction between statutory and effective tax rates.

- Withholding Taxes – Taxes on dividends, interest, and royalties paid to foreign investors. – Affects net cash flow and valuation.

- Capital Gains Tax – Varies by country on asset disposals. – Impact of exemptions and rollovers.

- Tax Holidays and Incentives – Temporary tax relief affecting cash flows. – Consider expiration and clawback conditions.

- Currency Exchange and Tax Implications – Tax on foreign exchange gains and losses. – Currency translation differences for tax reporting.

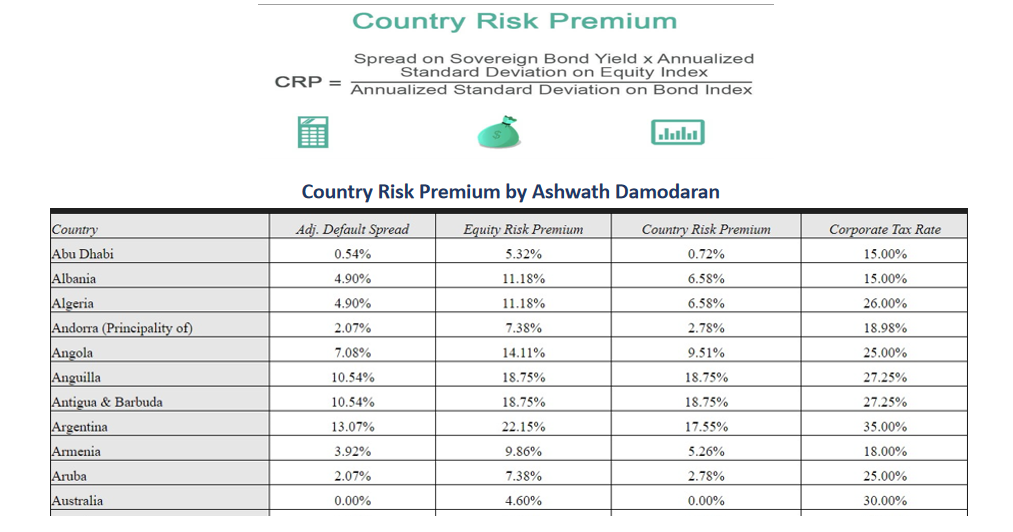

8. Country Risk Premium

The Country Risk Premium (CRP) is the incremental return an investor anticipates to assume the investment risk in foreign markets compared to the domestic country.

- The inclusion of the country risk premium (CRP) is intended to adjust the cost of equity for the potentially adverse effects that stem from a particular country’s geopolitical environment and economic conditions.

- The country risk premium is generally higher for developing markets than for developed nations

- The majority of practical models are based on the CAPM (Capital Asset Pricing Model).

8.1 Factors to Consider While Estimating Country Risk Premium

- Macroeconomic Factors are those that have a broad impact on the national economy, such as population, income, unemployment, investments, savings, and the rate of inflation, and are monitored by highly professional teams governed by the government or other economists.

- Currency fluctuations

- Fiscal deficit refers to the situation where the total budget expenditure exceeds the total budget receipts, excluding the government borrowings in a given fiscal year. It determines the amount the government needs to borrow for meeting its excess expenditure.

- Political Factors

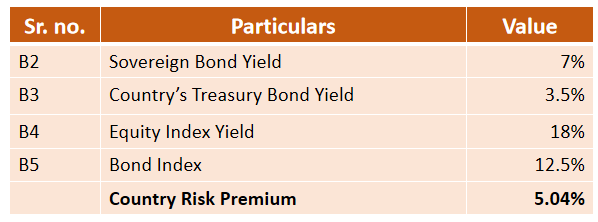

8.2 Country Risk Premium

- If a country has an standard deviation of 18% and 12.5% on equity and bond index, respectively, over 5 years, what is the country’s risk premium? The country’s treasury bond has yielded a 3.5% return. In contrast, the sovereign bond has a 7% yield in a similar period.

Using Country Risk Premium Formula = (B2-B3) * (B4/B5)

Question: Would you adjust the cash flows or the discount rate when considering a company’s exposure to high-risk markets: Cash Flows or Discount Rate?

Discount Rate

Adjusting the discount rate to reflect high-risk market conditions is a common approach. However, cash flows may also be adjusted depending on the specific risks and market conditions.

8.3 Treatment of Country Risk Premium

Alternative 1: Scenario Analysis

- Country risk is directly reflected in the projected Cash Flow

- And Profitability Assessment of each scenario

- No CRP is reflected in WACC

- While this approach is more specific to situation, it is very time consuming and costly

- Most Importantly it is difficult , if not impossible to derive

Alternative 2: Country Risk Premium

- Country risk is reflected in the cost of Equity and debt capital

- And in weighted Average cost of Capital (WACC)

8.4 Country Yield Spread Model – Country Risk Premia (CRP)

Where:

- Ke, foreign country = Cost of equity capital in the foreign country (denominated in the home country currency)

- Rf, home country = Risk free rate on government-issued bonds (in the home country currency)

- Β home country = Beta appropriate for a company located in the home country in a similar industry as the foreign country’s subject company ( i.e., beta is measured using returns expressed in the home currency)

- ERP home country = Equity risk premium of home country

- CRP = Country risk premium, determined as the difference between the yield-to-maturity on a foreign country government bond (issued in the home country’s currency) and the yield-to-maturity on a home country government bond with a similar maturity, adjusted for relative market equity.

9. Pricing Guidelines

| Particulars | Guidelines | Listed Company | Unlisted Company |

| Issue by company to person resident outside India | Price not less than | The rule prescribes that the price must be worked out in accordance with SEBI guidelines. | The fair value worked out as per any internationally accepted pricing methodology for valuation on an arm’s length basis, duly certified by a Chartered Accountant

or A SEBI-registered Merchant Banker or A practicing Cost Accountant. |

| Transferred from a person resident in India to a person resident outside India | |||

| Transferred by a person resident outside India to a person resident in India | Price not more than |

| Particulars | Methodology |

| Swap of Equity Instruments | Irrespective of the amount, valuation involved in the swap arrangement shall have to be made by a Merchant Banker registered with the SEBI or an investment banker outside India registered with the appropriate regulatory authority in the host country. |

| Subscription to MOA | Such investments shall be made at Face Value subject to entry route and sectoral caps |

| Share Warrants | Their pricing and the price or conversion formula shall be determined upfront. |

| Company going through delisting Process | Pricing as per SEBI (Delisting of Equity Shares) Regulations, 2009. |

| CCPS/CCDs | Issue Price/Formula to be specified upfront at time of issue Price @ Conversion Date > FMV @ Issue Date |

*Note that these pricing guidelines shall not be applicable for investment in equity instruments by a person resident outside India on a non-repatriation basis.

10. Regulatory Considerations

| Law | Incidence | Method | Who can do |

| Companies Act | Preferential Issue –Unlisted Co. Sec 62 & Sec 42 | Internationally accepted Valuation methods | Registered Valuer |

| S/230 to 231 & 234 – Arrangement/Merger/Demerger | Internationally accepted Valuation methods | Registered Valuer | |

| RBI/FEMA | Inbound/Outbound |

|

MB/CA |

| SEBI | Takeover Regulation |

|

|

| Preferential Issue (ICDR) |

|

|

|

| Income Tax | Unquoted Shares – Sec 50CA & 56(2)(x) r.w. Rule 11 UA | Co in which public are not substantially interested

|

MB/CA as the case may be |

| IBC | Asset Valuation – Regulation 35 | Fair Value & Liquidation Value – IAVM | Registered Valuer |

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA