Cost Audit – Documentation | Process | Execution

- Blog|Account & Audit|

- 6 Min Read

- By Taxmann

- |

- Last Updated on 30 October, 2025

Cost audit is the verification and examination of cost records and accounts of a company to ensure their accuracy, propriety, and compliance with the prescribed cost accounting standards and rules. It involves checking that the cost statements reflect a true and fair view of the cost of production, operations, or services and that the company is maintaining proper cost records as required under the law.

Table of Contents

Check out Taxmann's Cost & Management Audit (CMAD) | CRACKER which is an exam-focused guide for CMA Final – Group IV | Paper 17 (Dec. 2025/June 2026). It comprehensively covers statutory cost audit under the Companies Act, along with management, internal, operational, and forensic audits, fully aligned with the ICMAI syllabus. Enriched with solved past papers till June 2025, module-wise trend analysis, tabular summaries, and study material mapping, it ensures complete exam readiness. Authored by CA. Tarun Agarwal & CA. Leena Lalit Parakh, the book balances theory with practical insights, supported by diagrams, flowcharts, and practice sets for effective learning, quick revision, and confident exam performance.

1. Cost Audit Documentation

Audit Documentation – Audit documentation means the material including working papers prepared by and for, or obtained and retained by the cost auditor in connection with the performance of the audit.

Audit File – Audit file means one or more folders or other storage media, in physical or electronic form, containing the records that comprise the audit documentation for a specific assignment or audit.

Audit Working Papers – Audit working papers are the documents which record all audit evidence obtained during audit. Such documents are used to support the audit work done in order to provide assurance that the audit was performed in accordance with the relevant Cost Audit and Assurance Standards.

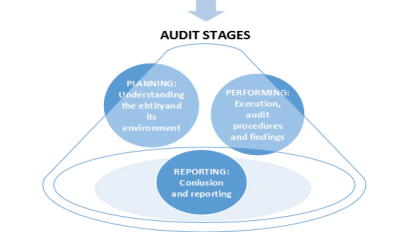

Audit Stages

Figure below gives a pictorial view of these three stages.

2. Audit Process

The Processes of Cost Audit can be explained through the connection between

Activity –> Purpose –> Documentation at the planning, performing and reporting phases.

3. Audit Stages

Planning – The planning stage involves determining the audit strategy as well as identifying the nature and the timing of the procedures to be performed. This is done to optimise efficiency and effectiveness when conducting an audit. Efficiency refers to the amount of time spent gathering audit evidence. Effectiveness refers to the minimisation of audit risk. A well-planned audit will ensure that sufficient appropriate evidence is gathered to minimise risk of material misstatement at the cost statement level. The planning stage involves:

- Gaining an understanding of the client,

- Identifying factors that may impact the risk of a material misstatement in the cost statements,

- Performing a risk and materiality assessment, and

- Developing an audit strategy.

Performing – The performance, or execution, stage of the audit involves detailed testing of internal controls, material consumptions, cost accumulation, allocation, apportionment, and absorption. If an auditor plans to rely on their client’s system of internal controls, they will conduct tests of controls. Cost auditor will conduct detailed substantive tests of audit procedures for the period and detailed substantive tests of consumptions and balances recorded at the period end. This detailed testing provides the evidence that the cost auditor requires to determine whether the cost statements have been fairly presented. The execution stage (or performing stage) of the audit involves the:

- Performance of detailed testing of internal controls, and

- Substantive testing of cost accounting policies & procedures.

Reporting – The final stage of the audit involves drawing conclusions based on the evidence gathered and arriving at an opinion regarding the fair presentation of cost statements. The cost auditor’s opinion is expressed in the cost audit report. At this stage of the audit, a cost auditor will draw on their understanding of the client, their detailed knowledge of the risks faced by the client, and the conclusions drawn when testing the entity’s controls, transactions, cost heads, item of cost and related disclosures.

The reporting stage involves evaluating the results of detailed testing in light of the cost auditor’s understanding of the entity and forming an opinion on the fair presentation of the entity’s cost statements as a whole.

4. Practical Steps of Audit Process

Step I – Objectives of Audit and Management Outlook

The cost auditor should understand whether the audit is meant only for meeting with the statutory requirements or the management does have any other expectations or outcomes in its mind from the cost audit, such as:

- Cost optimisation or cost reduction

- Checking parameters of operational efficiency of a unit or any utility or any other function or department

- Suggesting product diversification or changed product-mix

- Identifying profit making or loss making products

- Suggesting changed marketing strategies; market expansion; market diversification

- Complete review of business strategies

Step II – Pre-conditions

The cost auditor should fully understand the:

- Objectives of cost audit

- Area, nature and scope of audit

- Number of cost auditors appointed

- The applicable reporting framework

- The reporting period

- The statutory deadlines

The auditor should as certain whether the Management understands its scope of work and responsibilities for:

- Maintenance of cost records & producing them to the cost auditor;

- Preparation & presentation of cost statements & other details as per the applicable reporting framework, and in compliance with the cost accounting standards;

- Selection and consistent application of appropriate cost accounting policies;

- Allowing access to the auditor all information, including the books of account, vouchers, cost records, other records, documents, and other matters of the company, which are relevant to the preparation of the cost statements;

- Providing additional information that the cost auditor may request from the management for the purpose of cost audit;

- Allowing unrestricted access to persons within the company from whom the cost auditor determines and obtains cost audit evidence; and

- Giving proper management representation.

The auditee and the cost auditor decides the audit fee and payment schedule; and finally, the cost auditor gets an engagement letter. All these are called pre-conditions of audit.

Step III – Understanding the Company’s Business

The cost auditor is required to understand the company’s business, its corporate structure and various systems followed. The company related details and other general details include:

- The company, its nature of activities, its size, product profile, unit locations, ownership structure, management structure, organisational structure, marketing set-up, accounting set-up, etc.

- The nature of the industry or the sector in which client company operates

- The applicable regulatory framework, financial reporting framework and cost reporting framework

- The company’s production process, product details, joint or by-products, outsourcing, if any

- Details of subsidiaries, associates and joint ventures

- Key personnel in all departments including in Finance, Accounts, Costing, IT, Administration, Production, Purchase, Sales, etc.

- Purchase policy, sales policy, pricing policy, export/import policy

- Inventory receipt, storage, issue & pricing policies; physical verification system; inventory management system

- Related parties and nature of transactions with them

- Indirect tax structure, as applicable

- Internal Control Systems followed by the company

- Internal Audit System, its scope & adequacy of coverage as well as effectiveness

- Accounting Systems & Policies followed by the company

- Cost Accounting System & Policies followed by the company

- Company’s MIS system, risk identification & management system

- IT structure followed for financial accounting and for cost accounting, IT policy, control checks, authorization checks, IT data security policy

- Previous auditor’s report

Step IV – Planning the Audit

Planning the audit include:

- Timing [dates] and duration [no. of days] of audit period including plan to visit the unit(s)

- Level and number of audit personnel to be deployed including supervision and review of work done by the audit team

- Audit partner to be deployed and his expected days & dates

- Drawing up an overall audit plan and audit strategy – this will act as guide to the audit team

- Deciding the materiality levels & sampling levels

- Formulating appropriate audit procedures:

-

- Management Representation

- Management Assertion

- Test of Controls

- Test of Details

- Substantive procedures

- Analytical procedures

- Formulating risk assessment strategies & procedures i.e. methodology to measure material misstatements

- Planning for discussions with key personnel of the company, previous cost auditor, statutory financial auditor, and internal auditor

- Key inputs for planning are:

-

- Results of preliminary activities as specified above

- Knowledge from previous audits and other engagements with the company

- Knowledge of business

- Nature and scope of the audit

- Statutory deadlines and reporting format

- Relevant factors determining the direction of the audit efforts

- Nature, timing and extent of resources required for the audit

- Documenting the Audit Plan and sharing it with the company

- Ensuring adherence to the Guidance Manual for Audit Quality

Step V – Execution of Audit

- Performing the audit checks and procedures, as planned

- Collecting all required audit evidence enabling the auditor to form his opinion

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA