Comprehensive Guide to SEBI (LODR) Amendments – Key Changes | Impacts | Best Practices

- Blog|Company Law|

- 21 Min Read

- By Taxmann

- |

- Last Updated on 16 December, 2024

SEBI (LODR) Amendments refer to the changes or updates made to the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015. These regulations provide a comprehensive framework for listed entities to ensure timely and transparent disclosures, corporate governance, and adherence to listing obligations. The amendments aim to strengthen corporate governance, enhance transparency, improve disclosure practices, and protect investors' interests. They cover various aspects, including material event disclosures, timelines for announcements, shareholder approvals, sustainability reporting, and compliance with market rumors. These changes reflect SEBI's continuous efforts to align the regulatory framework with evolving market dynamics and global best practices.

Table of Contents

- Background

- Timeline

- Key Amendments in SEBI (LODR)

- Understanding the Matrix of Regulation 30 – Amendments & Impact

- Understanding the Materiality – Regulation 30(4)

- Identifying the Material Events/Information

- Identification & Disclosure of Continuing/Existing Events or Information

- Disclosure of Continuing Event

- Deemed Material Events (Part A of Para A of Schedule III)

- Tightening the Timelines

- Following the Timelines

- Harmonization of Timelines – Reg. 29(1)

- Mainstream Media {Definition u/ Reg 2(1)(ra)}

- Market Rumours – Defining Boundaries

- Market Rumours – Confirm, Deny or Clarify

- Insertion of New Proviso-30(11)

- UPSI or Not?

- Drafting Materiality Policy

- SMPs (Senior Management) (Reg. 16)

- Case Studies

- Amendments Related to Shareholder Approvals

- Enhanced Corporate Governance

- Evolution of BRSR in India

By CA. Kuldeep Kothari – Co-founder | Adwin Advisory Pvt. Ltd.

1. Background

- Introduction: Concept of listing agreement was inserted in Securities Contract (Regulation) Act, 1956; The section made it mandatory for every listed entity in India to comply with the Listing Agreement;

- Listing Agreement: The Listing Agreement prescribed various initial and continuous disclosure norms to be made by the listed companies with the stock exchanges;

- SEBI (LODR), 2015: With a view to consolidate and streamline the provisions of existing listing agreements for different segments of the capital market, SEBI (LODR) Regulations, 2015 was introduced on September 02, 2015.

- SEBI (LODR) (Second Amendment), Regulations 2023: It is the major step taken by the regulator towards making disclosure practices in line with the global best practices and removal of asymmetry of the information.

2. Timeline

- 12 Nov. 2022: Review of disclosure requirements for material events or information consultation paper

- 20 Feb. 2023: Consultation paper on streamlining disclosure by Listed entities and strengthening compliance

- 21 Feb. 2023: Consultation paper on strengthening corporate governance at listed entities by empowering shareholders

- 29 Mar. 2023: SEBI approved amendments in board meeting

- 14 June 2023: Notification of amendments to listing Regulations

- 11 July 2023: Master circular for compliance with LODR

- 12 July 2023: Framework for assurance and ESG disclosure for value chain – BRSR Core

- 17 May 2024: Guidelines for disclosure of material events/information/rumour

3. Key Amendments in SEBI (LODR)

- Disclosure of Material Events

- Shareholder Approvals

- Corporate Governance

- Related Party Transactions

- Market Rumors

- Other Mandatory Disclosures

- Director Permanency & Casual Vacancies

4. Understanding the Matrix of Regulation 30 – Amendments & Impact

Key Changes

- Qualification Criteria: Materiality Threshold Based on Turnover, Net Worth & Profits.

- Revision of Disclosure Timelines: For Disclosure of Material Events/Information

- Amendments in Policy: To Determine of Material Events/Information Based

- Verification of Market Rumors and Disclosure of Various Communications

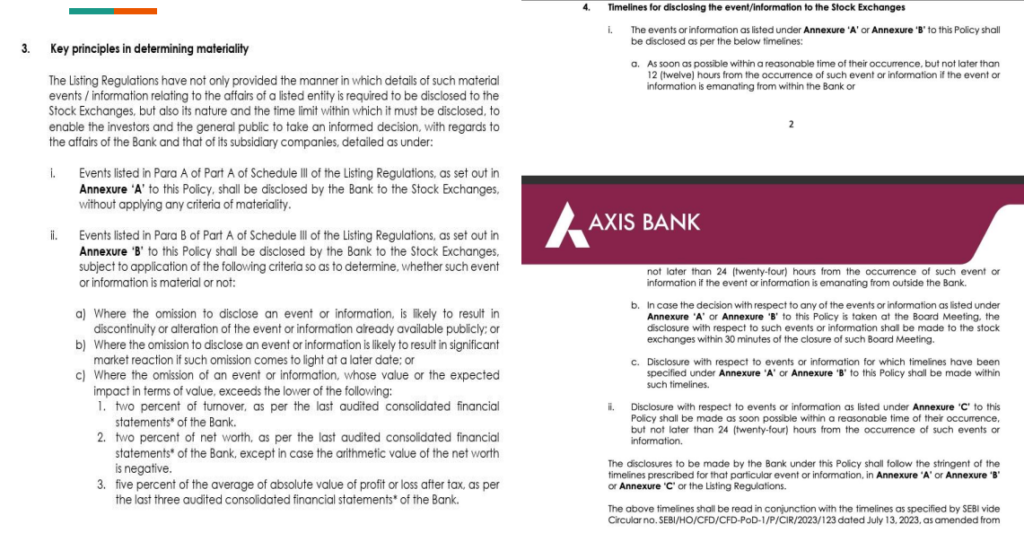

5. Understanding the Materiality – Regulation 30(4)

5.1 Existing Disclosure Norms

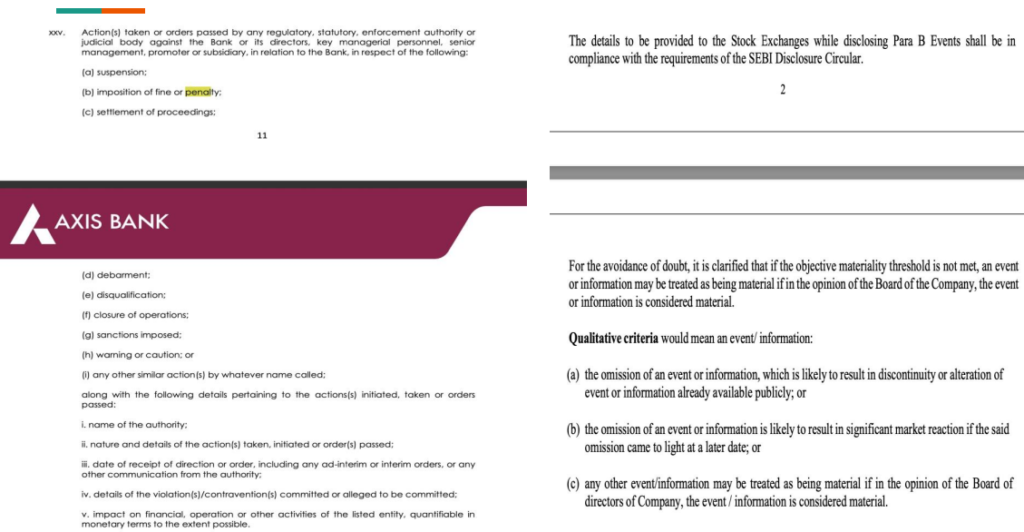

- The omission of an event or information, which is likely to result in discontinuity or alteration of event or information already available publicly; or

- The omission of an event or information is likely to result in significant market reaction if the said omission came to light at a later date;

- Event/information be treated material if in the opinion of the BOD, it is material.

5.2 Amended Regulations

Reg. 30(4)(1)(c): The omission of an event or information, whose value or the expected impact in terms of value, exceeds the lower of the following:

- two percent of turnover, as per the last audited consolidated financial statements of the listed entity;

- two percent of net worth, as per the last audited consolidated financial statements of the listed entity, except in case the arithmetic value of the net worth is negative;

- five percent of the average of absolute value of profit or loss after tax, as per the last three audited consolidated financial statements of the listed entity

6. Identifying the Material Events/Information

- Deemed Material Events As per Para A of Part A of Schedule III or As per Materiality Policy of the company, If not than:

- Calculate Quantitative Threshold as per prescribed criteria

- Determining the Value or Expected impact in terms of value

- Value or expected impact in terms of value to be compared with Quantitative threshold

7. Identification & Disclosure of Continuing/Existing Events or Information

If Any Continuing event or Information which Becomes Material Pursuant to notification of these amendment regulations shall be disclosed by the listed entity within 30 Days from the date of coming into effect of the SEBI (LODR)(Second Amendment) Regulations, 2023 {Reg. 30(4)(i)(d)}

8. Disclosure of Continuing Event

9. Deemed Material Events (Part A of Para A of Schedule III)

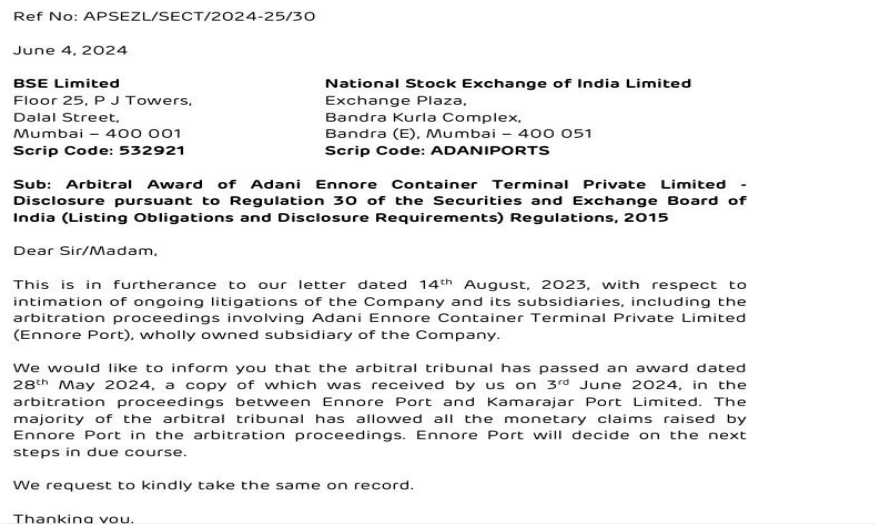

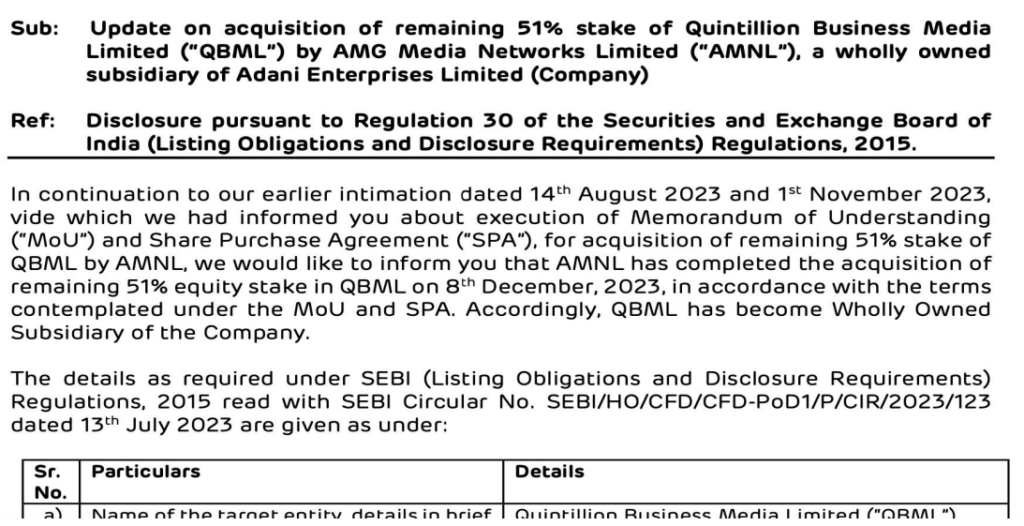

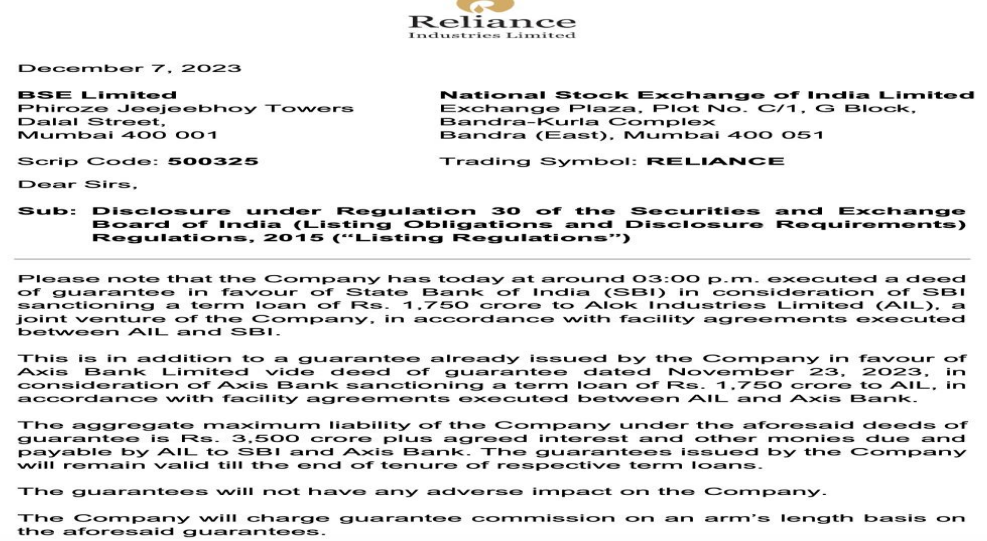

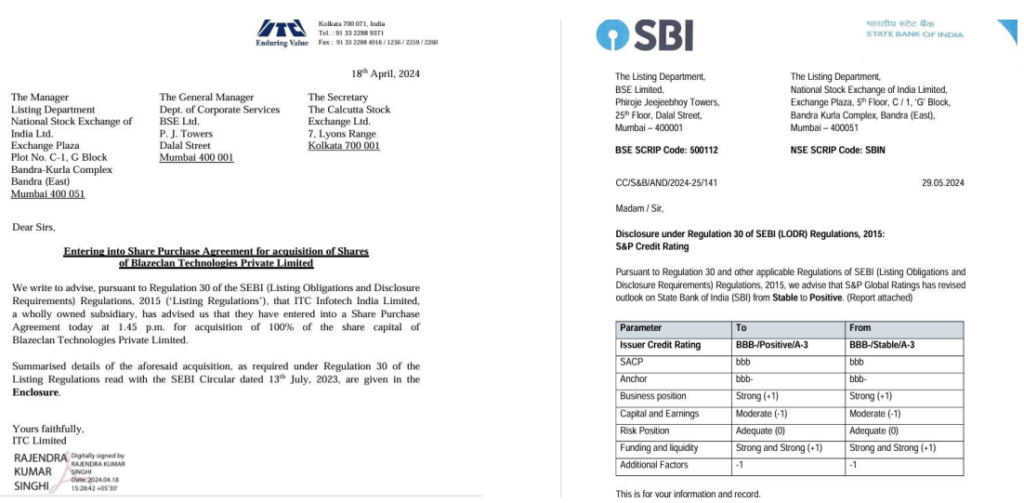

- Acquisition including agreement to acquire

- Scheme of arrangement

- Sale or disposal of any unit, division

- Sale or disposal of whole or substantially the whole of undertaking

- Sale or disposal of subsidiary of the listed entity

- Sale of stake in associate company of the listed entity

- Any other restructuring

- Issuance or forfeiture of securities

- Split or consolidation of shares

- Buyback of securities

- Any restriction on transferability of securities

- Alteration in terms or structure of existing securities

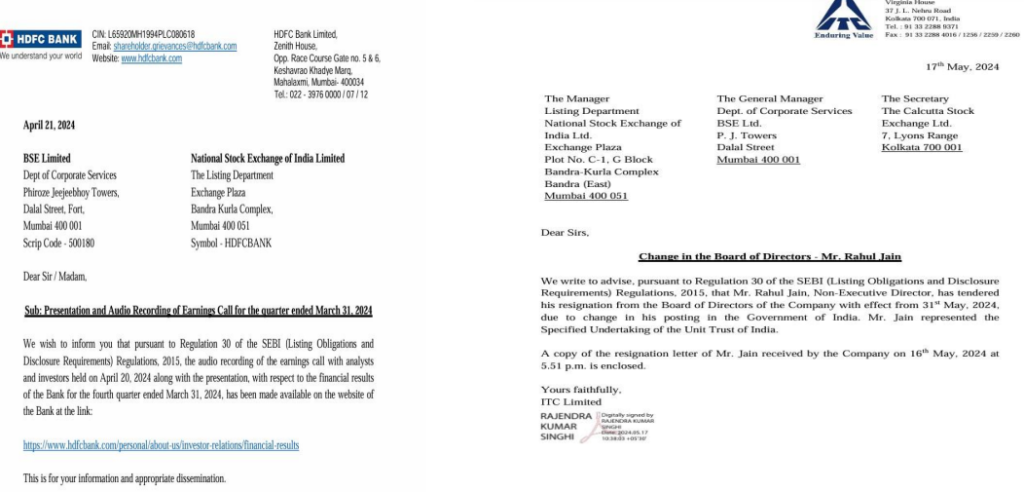

- New Ratings (newly added) or Revision in Ratings (disclosure shall be made even if it was not requested for by the listed entity or the request was withdrawn)

- Outcome of meetings of the board of directors

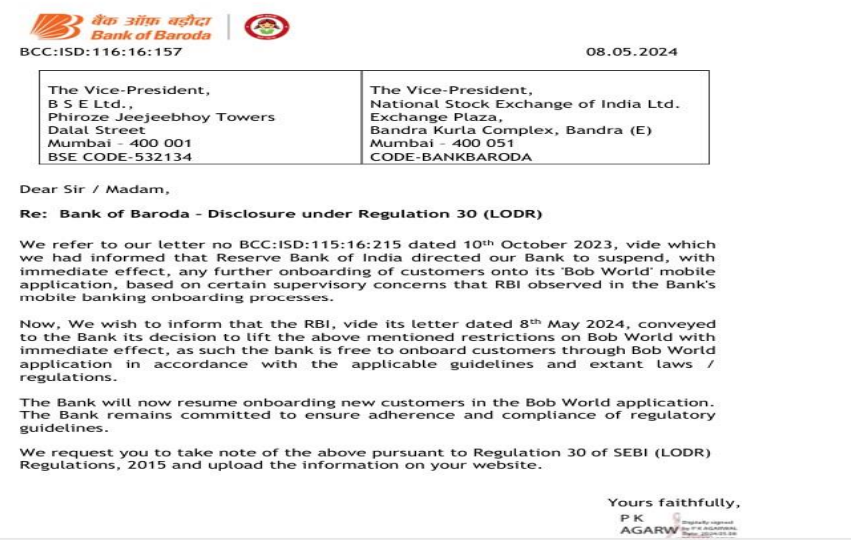

- Agreements which are binding and not in normal course of business such as shareholder agreement, joint venture agreement, family settlement agreement, contracts with media companies and revisions, amendments, terminations

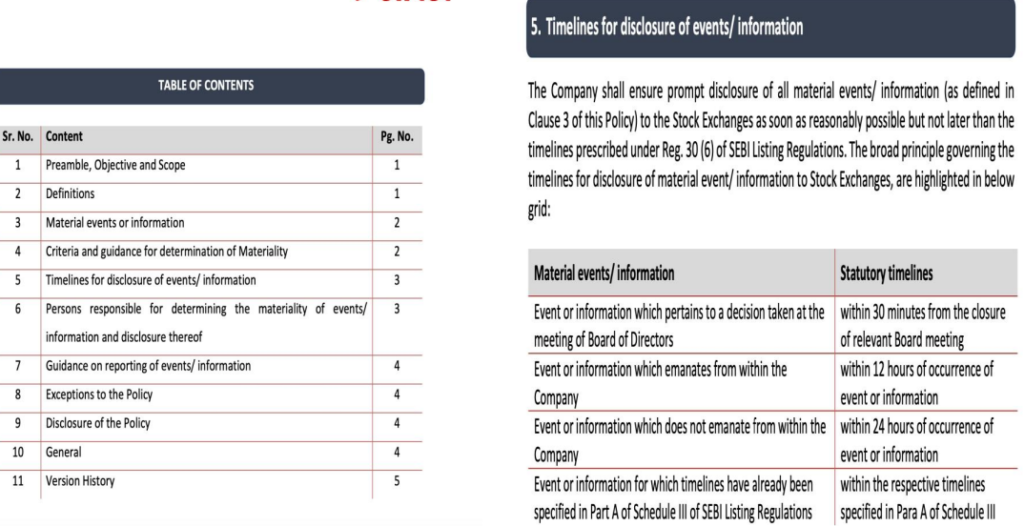

10. Tightening the Timelines

10.1 Existing Disclosure Norms

- Within 24 hours from the occurrence of the event or information

- If not made in 24 hours, provide an explanation for the delay

- Within 30 meeting – conclusion of Board meeting in case of para 4 of para A of part A events

10.2 Amended Regulations

- Within 24 hours – If events or information not emanating from within the entity

- Within 12 hours – if events or information emanates from within the entity

- within 30 minutes from the closure of the meeting of board of directors in which the decision pertaining to the event or information has been taken

- Events for which timelines have been specified in Part A of Schedule III shall be made within such timelines

- In case of delay from the given timeline, the entity shall, along with such disclosure provide the explanation for the delay.

11. Following the Timelines

12. Harmonization of Timelines – Reg. 29(1)

12.1 Existing Disclosure Norms

At least 2 working days in advance excluding the date of the intimation and date of meeting: 1) For declaration/recommendation of dividend/declaration for Bonus Issue/Buy Back/Voluntarily Delisting/Raising of fund by way of Public Issue/Right Issue/ADR/GDR etc.;

At least 5 days in advance excluding the date of the intimation and date of meeting: Financial Results;

At least 11 working days in advance: Alteration in the form or nature of listed securities/rights or privileges of holders/alteration in the date of payment of interest on debenture/bond/redemption amount.

12.2 Amended Regulations

Timeline for prior Intimation: At least 2 working days in advance excluding the date of the intimation and date of meeting for:

- For declaration/recommendation of dividend/declaration for Bonus Issue/Buy Back/Voluntarily Delisting/Raising of fund by way of Public Issue/Right Issue/ADR/GDR etc.;

- Financial Results;

- Alteration in the form or nature of listed securities/rights or privileges of holders/alteration in the date of payment of interest on debenture/bond/redemption amount.

13. Mainstream Media {Definition u/ Reg 2(1)(ra)}

Mainstream media shall include print or electronic mode of the following:

- Newspapers registered with the Registrar of Newspapers for India;

- News channels permitted by Ministry of Information and Broadcasting under Government of India;

- Content published by the publisher of news and current affairs content as defined under the Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules, 2021; and

- Newspapers or news channels or news and current affairs content similarly registered or permitted or regulated, as the case may be, in jurisdictions outside India;

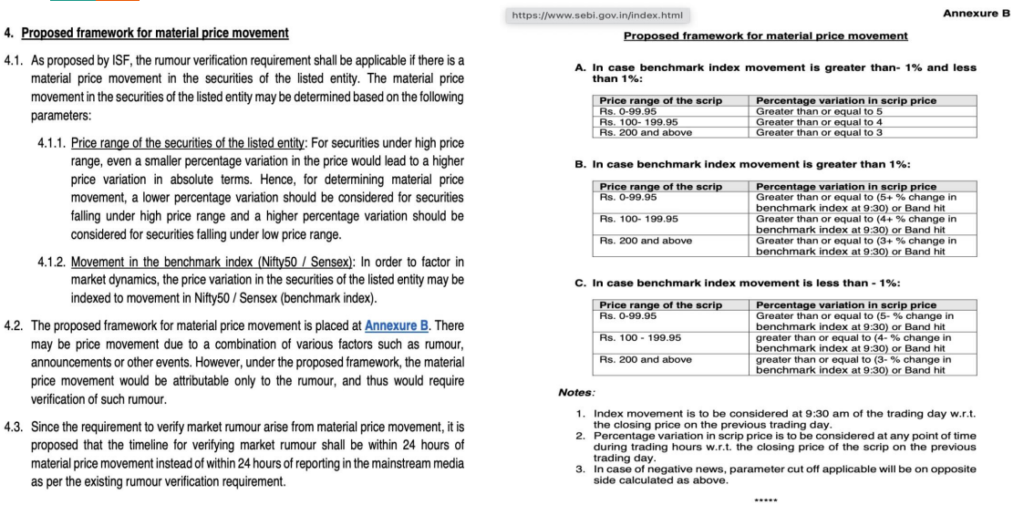

14. Market Rumours – Defining Boundaries

How to define significant market reaction as it will help to define material rumors?

15. Market Rumours – Confirm, Deny or Clarify

15.1 Existing Disclosure Norms

In addition to EARLIER, Proviso added

- Top 100 w.e.f. 01.06.2024 & 250 listed entities w.e.f. 01-12-2024 as per market capitalization as at the end of the immediately preceding financial year to mandatorily confirm or deny or clarify any event or information reported in mainstream media, whether in print or digital mode, which indicates rumors of an impending specific material event/information and is not general in nature within 24 hours of such reporting.

15.2 Amended Regulations

In addition to EARLIER, Proviso added

- Top 100 w.e.f. 01.06.2024 & 250 listed entities w.e.f. 01-12-2024 as per market capitalization criteria defined by the stock exchange to mandatorily confirm or deny or clarify upon material price movement as may be specified by the stock exchange in relation to any event or information reported in mainstream media, whether in print or digital mode, which indicates rumor of an impending specific event/information and is not general in nature as soon as reasonably possible but in any case within 24 hours of such reporting.

16. Insertion of New Proviso-30(11)

Consideration of unaffected price for a transaction where pricing norms have been prescribed by SEBI provided the rumor pertaining to such transaction has been confirmed within 24 hours from the trigger of material price movement.

- When the listed entity confirms within 24 hours from the triggering of material price movement, any reported event or information on which pricing norms provided under Chapter V or Chapter VI of the Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2018 or pricing norms provided under Regulation 8 or Regulation 9 of the Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations, 2011 or pricing norms provided under Regulation 19 or Regulation 22B of the Securities and Exchange Board of India (Buy-back of Securities) Regulations, 2018 or any other pricing norms specified by the Board or the stock exchanges are applicable, then the effect on the price of the equity shares of the listed entity due to the material price movement and confirmation of the reported event or information may be excluded for calculation of the price for that transaction as per the framework as specified by SEBI.

What measures would you take to verify the authenticity of a market rumor before taking any action or communicating it to stakeholders?

As a compliance officer, how do you differentiate between legitimate market information and baseless rumors circulating in the market?

Insiders often argue that if the company itself has not identified any information as UPSI, how are they expected to do so?

17. UPSI or Not?

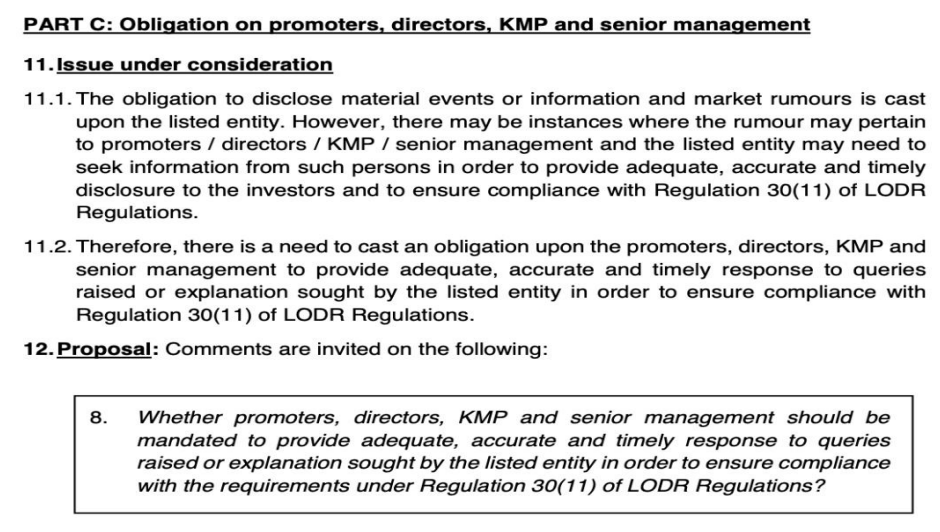

PART D: Classification of information which was not verified by listed entities as UPSI

13. Issue under consideration

13.1. There may be instances where a rumour pertaining to a listed entity is circulating in the market but doesn’t result in material price movement in the scrips of the entity.

13.2. In case the listed entity has classified certain information as UPSI and the entity neither confirms, denies or clarifies market rumour pertaining to such information published in the media, then such media reports should not be used later by an insider as a defence that the information was ‘generally available’.

Some Case Studies related to Market Rumors

- A leading retail corporation XYZ ltd, faces a situation where a person with 5000 followers on YouTube is spreading rumors regarding a potential acquisition of a rival company. Under the new SEBI guidelines will it be considered a rumour?

- Do XYZ ltd need to take any steps as per new SEBI LODR amendments?

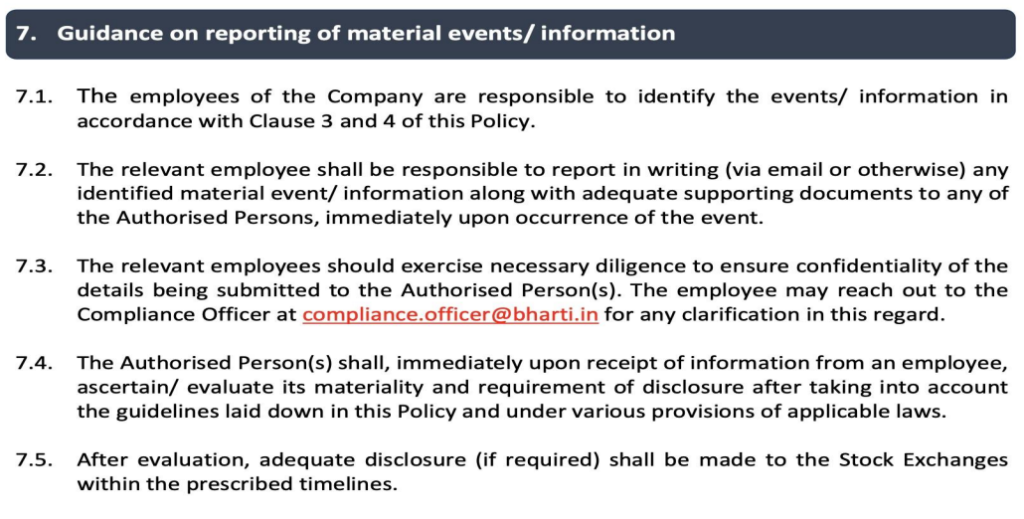

18. Drafting Materiality Policy

- Listed entity shall frame a policy duly approved by its board of directors and the same shall be disclosed on its website.

- Such policy shall not dilute any requirement specified under SEBI LODR.

- Such policy shall assist the relevant employees in identifying any potential material event or information and reporting the same to authorized KMP for determining the materiality and for making the necessary disclosures.

- Management may consider following additional parameters in determining materiality:

-

- Impact on cash flow

- Credit worthiness

- Goodwill of entity

- Operational impact

- Employee retention and attrition

- Worker’s agitation

- Factors affecting the market price or volume of securities listed

18.1 Amendment in Materiality Policy

- Not to dilute any requirements specified under provisions of these regulations (Reg. 30(4)(u)).

- Disclosure of information to be made if such information is material.

- Policy shall have the mechanism to assist the relevant employees to identify & report the same to KMP in terms of Sub-Reg. 5 (Reg. 30(4)(ii)).

- Deny/verify/clarify the rumour along with stage of information/event.

18.2 Defining the Policy Matrix

A policy for determination of materiality shall assist the relevant employees of the listed entity in identifying any potential material event or information and reporting the same to the authorized KMP, in terms of sub-regulation (5), for determining the materiality of the said event or information and for making the necessary disclosures to the stock exchange(s) [Reg 30(4)(ii)]

- Identification of Relevant Employees

- Process to handle such information

- Escalation Mechanism

- Authorized KMP

- Dissemination to Exchanges

18.3 Redefined Materiality Policy

18.4 Redefined Materiality Policy – How the change looks

19. SMPs (Senior Management) (Reg. 16)

Existing Disclosure Norms

- “senior management” shall mean officers/personnel of the listed entity who are members of its core management team excluding board of directors and normally this shall comprise all members of management one level below the [“chief executive officer/managing director/whole time director/manager (including chief executive officer/manager, in case they are not part of the board) and shall specifically include company secretary and chief financial officer.]”

Amended Regulation

- senior management” shall mean the officers and personnel of the listed entity who are members of its core management team, excluding the Board of Directors, and shall also comprise all the members of the management one level below the Chief Executive Officer or Managing Director or Whole Time Director or Manager (including Chief Executive Officer and Manager, in case they are not part of the Board of Directors) and shall specifically include the functional heads, by whatever name called and the Company Secretary and the Chief Financial Officer.]

19.1 Interpretation

- Now functional head (by whatever name called) are part of the senior management revised definition.

- No where functional head is defined in SEBI LODR Regulations/Companies Act, 2013. Therefore, general definition considered.

- It is different from KMP as defined in sec 2(51 ) of Companies Act, 2013 as it does not include core management team one level below including functional heads.

- Functional heads are individuals who hold leadership positions within their respective functional areas. They are typically responsible for managing teams, setting strategies, making decisions, and ensuring the efficient operation of their functional departments.

- Examples of individuals who may be included as functional heads are: Chief Financial Officer (CFO) or Finance Director, Chief Human Resources Officer (CHRO) or HR Director etc

19.2 Tightening the Norms

19.3 Tightening the Promoter Disclosures Norms (Reg. 30 A)

Existing Disclosure Norms

- All Shareholder agreements/JV agreements/Family Settlements etc. were required to be disclosed if they were binding and not in the ordinary course of business, to the extent that they impact the management and control of the listed entity.

Amended Regulation

- Shareholders, promoters, promoter group entities, director, KMP, related parties of: the listed entity/its holding/subsidiary/Associate;

- To disclose to the stock exchange(s), agreements entered into by them – inter se or with third party;

- Which directly/indirectly/potentially impacts or the purpose and effect of which is to impact, change in management and control of the listed entity; or

- Impose a restriction/liability on the listed Entity.

19.4 Tightening the Promoter Disclosures Norms

- Any understanding/arrangements between promoters/KMPs & employees

- Family Constitutions, agreements & understanding etc.

- MoU on governance principles for future generations

- Succession of business to next generation Family Charter

- Appointment of KMPs (Key Managerial Personnel)

- Any decision-making on matters of listed companies

- Allotting shares to third parties

- All agreements binding or non-binding with wider applicability as per amended regulations need disclosure of next-generation

20. Case Studies

20.1 Kirloskar Brothers Limited

Kirloskar Brothers is the first company to disclose its promoters’ entire ‘deed for family settlement’ (DFS)- an agreement between the family members regarding the distribution of assets and properties as per the Securities and Exchange Board of India’s new disclosure requirements.

In an exchange filing, the company disclosed the DFS dated September 11, 2009, signed by Atul, Rahul, Sanjay, Gautam, and Vikram Kirloskar. The agreement includes the change in ownership of various group entities, transfer of shares, and execution of the deed, among other aspects.

Last month, Sebi made it mandatory for promoters of all listed companies to disclose to the stock exchanges all their active family settlement agreements or arrangements that have a bearing or influence on management control of the company.

20.2 Chandniram’s

- The most prominent dispute revolves around the coveted brand name Chandniram’s. Various members of the Agarwal family are embroiled in legal conflicts, each vying for the right to claim the brand’s name and associated legacy. These intense legal battles highlight the complexity and competitiveness within the family, where the stakes are high, and control over the Chandniram’s brand represents not only financial value but also pride and recognition.

- The question arise do they need to go back and disclose the family arrangement they had back then to comply with amended SEBI (LODR) requirement?

20.3 Some Questions Arising Out of Enhanced Disclosure Norms for Promoters Transactions

- A NDA signed by a companies promoter is it required to disclose?

- Can the new LODR amendments affect the shareholders relationship with the companies?

21. Amendments Related to Shareholder Approvals

Periodic Shareholders’ Approval

- For directors continuing for more than 5 years as on March 31, 2024

- Approval to be obtained in the first general meeting held after March 31, 2024

- Fresh approval of shareholders once in every 5 years

- Exemption: WTD, MD, Manager, Independent Director or a Director retiring by rotation

21.1 Need for Amendment

Reason and Case Study

- The shareholders of listed entities do not get an opportunity to evaluate the performance of such directors appointed. This allows them to serve on the board of a listed entity as long as they desire, thereby enjoying “board permanency”, disregarding the intent of shareholders on the continuation of such directors on the board of a listed entity.

- Recently, the issue of a few promoters of listed entities enjoying permanency on the board thereby giving them an undue advantage, prejudicial to the interest of the public shareholders, was highlighted in the media.

The spotlight fell on this matter when Diageo plc (Diageo) sought to remove Vijay Mallya from the board following its acquisition of control over United Spirits Limited (USL).

However, Mallya contested the decision, claiming his legal entitlement to remain on the board. Complicating matters further, USL’s Articles of Association (AoA) granted Mallya the position of board chairman, a claim he maintained even as he evaded India’s law enforcement authorities. Therefore in the interest of good corporate governance at listed entities, all directors appointed to the board of a listed entity need to go through periodic shareholders’ approval process, thereby providing legitimacy to the director to continue to serve on the board.

21.2 Vacancies in Key Positions

| Relevant Regulations | Key Positions |

| Reg 26A(1) | CEO, MD, WTD, Manager |

| Reg 26A(3) | CFO |

| Reg 6(1A) | Compliance Officer |

| Reg 17(1E) | Director |

| Vacancies arising in the above offices must be filled up within a period of three (3) months from the date of such vacancy subject to the case where the entity is required to obtain any regulatory approval, approval of government or statutory authorities where the timelines shall be of 6 months. | |

Will it be applicable on Vacancy cause by expiry of tenure?

Vacancy cannot be filled by appointing a person in an interim capacity. In case a person is appointed in an interim capacity, such appointment will be required to be carried out in compliance with the provisions applicable in case of fresh appointments.

21.3 Cyber Security Incident & Quarterly CG Report

“Details of cyber security incidents or breaches or loss of data or documents shall be disclosed along with the report mentioned in clause (a) of sub- regulation (2), as may be specified. [Reg 27(2) (ba)]”

- “Cyber security breaches” means unauthorized acquisition by a person of data or information that compromises the confidentiality, integrity or availability of information maintained in a computer resource;

- Cyber Security Incident” means any real or suspected adverse event in relation to cyber security that violates an explicitly or implicitly applicable security policy resulting in unauthorised access, denial of service or disruption, unauthorised use of a computer resource for processing or storage of information or changes in data, information without authorisation.

- Indian Computer Emergency Response Team to serve as national agency for incident response-To disclosure of information is necessary for prevention of cyber security incidents, such disclosures are already mandated under the Information Technology (The Indian Computer Emergency Response Team and Manner of Performing Function and Duties) Rules, 2013 (“CERT-In Rules”)

21.4 Reporting of Frauds or Defaults by Key Persons

24 Hours

Arrest

- KMP

- Director

- Senior Management

- Subsidiary

Fraud/Default

- Listed Entity

- Promoter

- Director

- KMP

- Senior Management

- Subsidiary

FRAUD OR DEFAULTS by a listed entity, its promoter, director, key managerial personnel, senior management or subsidiary or arrest of key managerial personnel, senior management, promoter or director of the listed entity, whether occurred within India or abroad:

For the purpose of this sub-paragraph:

- ‘Fraud’ shall include fraud as defined under Regulation 2(1)(c) of Securities and Exchange Board of India (Prohibition of Fraudulent and Unfair Trade Practices relating to Securities Market) Regulations, 2003.

- ‘Default’ shall mean non-payment of the interest or principal amount in full on the date when the debt has become due and payable.

Explanation 1: In case of revolving facilities like cash credit, an entity would be considered to be in ‘default’ if the outstanding balance remains continuously in excess of the sanctioned limit or drawing power, whichever is lower, for more than thirty days.

Explanation 2: Default by a promoter, director, key managerial personnel, senior management, subsidiary shall mean default which has or may have an impact on the listed entity

21.5 Announcements/Communications Not Available in Public Domain

Announcement or communication through social media intermediaries or mainstream media by directors, promoters, key managerial personnel or senior management of a listed entity, in relation to any event or information which is material for the listed entity in terms of regulation 30 of these regulations and is not already made available in the public domain by the listed entity.

Explanation – “social media intermediaries” shall have the same meaning as defined under the Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules, 2021.

Material event/information -> Not already made available in the public domain by the listed entity

- Director

- Promoter

- KMP

- Senior Management

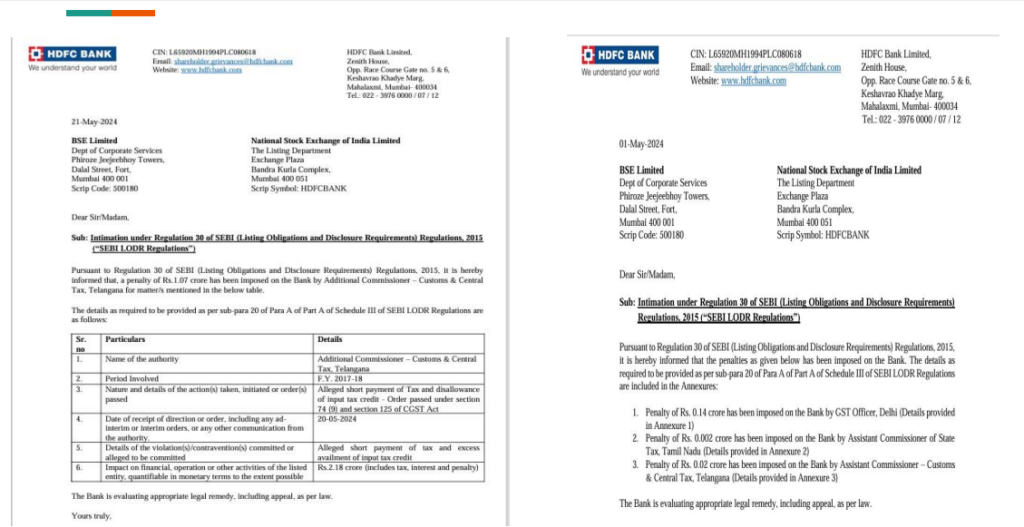

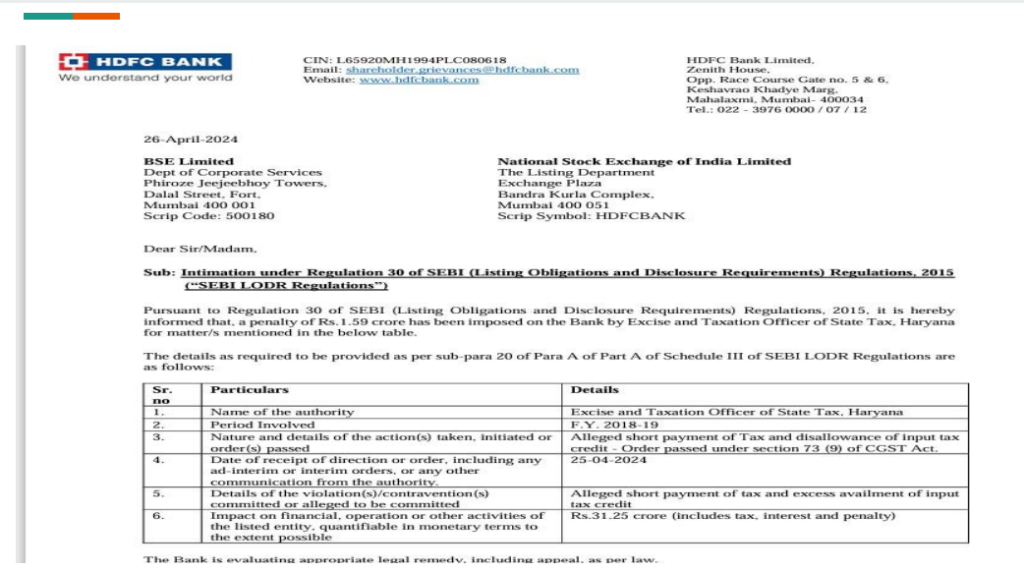

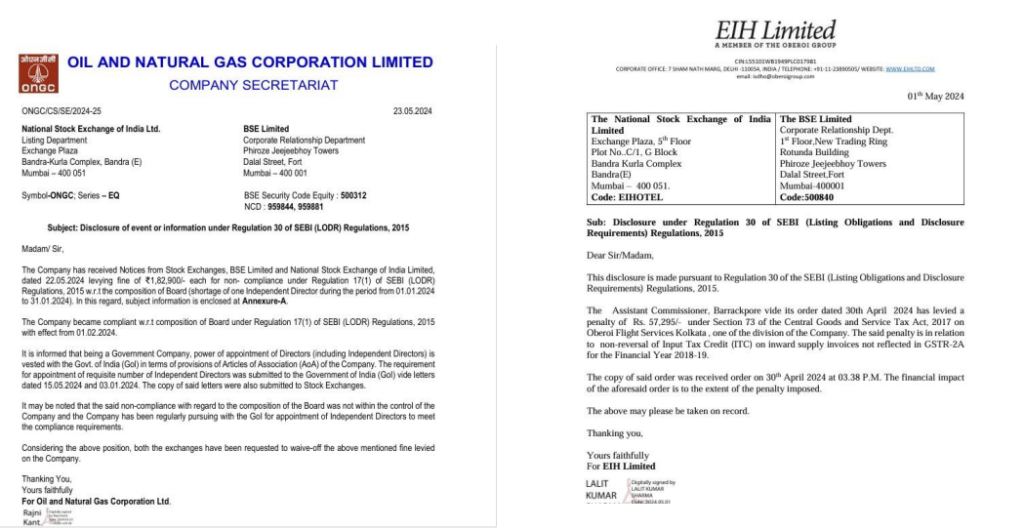

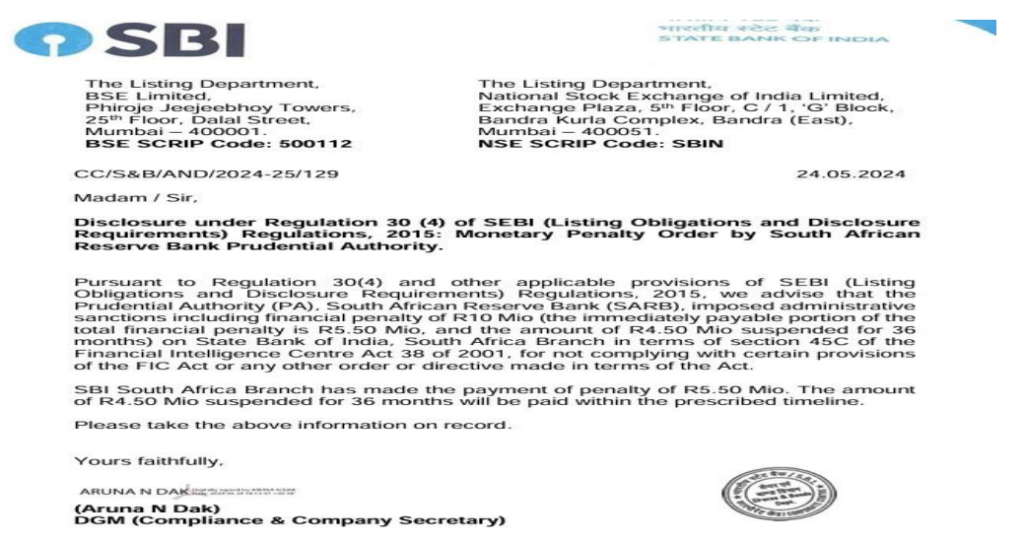

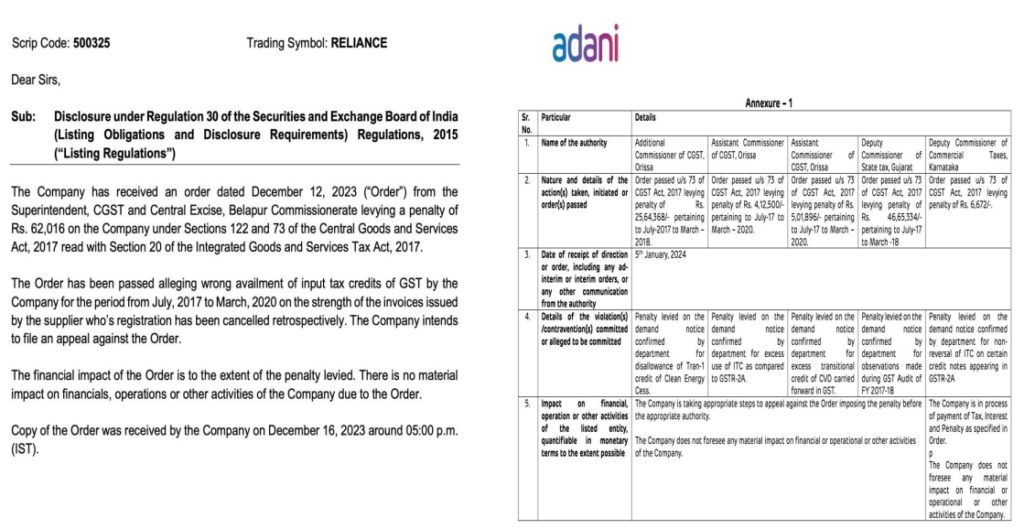

21.6 Regulatory Actions & Disclosure Requirements

Action initiated/order pased

- Listed Company

- Director

- KMP

- Senior Management

- Promoter

- Subsidiary

24 Hours

Action(s) taken or orders passed by any regulatory, statutory, enforcement authority or judicial body against the listed entity or its directors, key managerial personnel, senior management, promoter or subsidiary, IN RELATION TO THE LISTED ENTITY, in respect of the following:

- suspension;

- imposition of fine or penalty;

- settlement of proceedings;

- debarment;

- disqualification;

- closure of operations;

- sanctions imposed;

- warning or caution; or

- any other similar action(s) by whatever name called

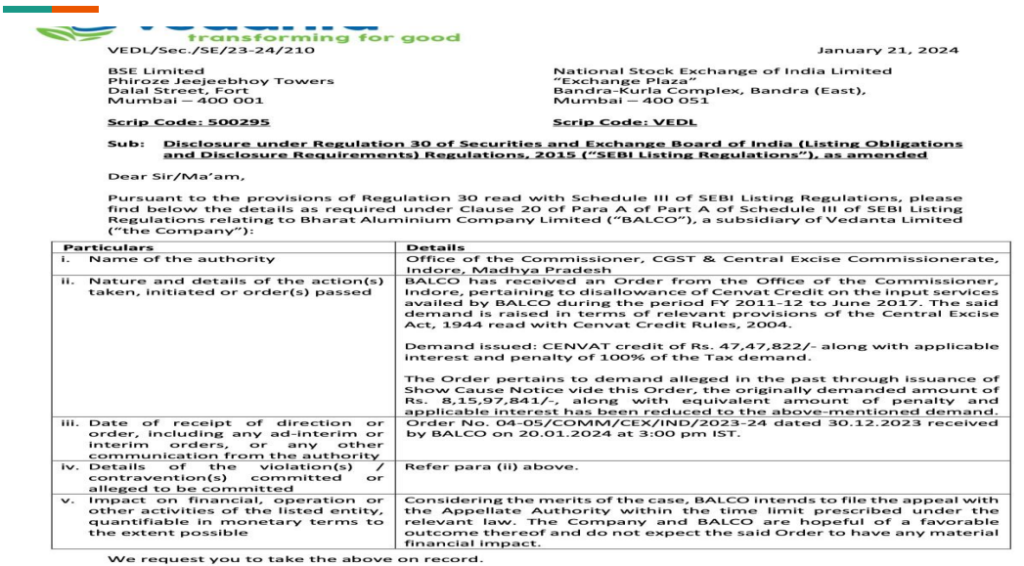

21.7 Receipt of Communication

Receipt of communication In case an event or information is required to be disclosed by the listed entity in terms of the provisions of this regulation, pursuant to the receipt of a communication from any regulatory, statutory, enforcement or judicial authority, the listed entity shall disclose such communication, along with the event or information, unless disclosure of such communication is prohibited by such authority.

Material event/information -> Not prohibited by relevant authority

- IT demand

- Action order, etc

21.8 Timing the Timelines

- Frauds or defaults by employees of the listed entity which has or may have an impact on the listed entity. 24 Hours

- Pendency of any litigation(s) or dispute(s) or the outcome thereof which may have an impact on the listed entity. 24 Hours

- Delay or default in the payment of fines, penalties, dues, etc. to any regulatory, statutory, enforcement or judicial authority. 12 Hours

- Agreements (viz. loan agreement(s) as a borrower or any other agreement(s) which are binding and not in normal course of business) and revision(s) or amendment(s) or termination(s) thereof. 12/24 Hours

21.9 Material or Not?

22. Enhanced Corporate Governance

High Value Debt Listed Entity (HVDLEs)

- Ensure that it complies with the provisions of regulations 15 to 27 of the SEBI LODR or within six months from the date of reaching the above threshold.

- SEBI has now extended the period for one year till 31 March 2024, wherein the provisions of Regulations 15 to 27 will be applicable on high-value debt listed entities on a ‘comply or explain’ basis, and thereafter, on a mandatory basis.

Cyber Security Insecurities

A new provision has been added to Regulation 27, which requires listed entities to disclose the details of cybersecurity incidents or breaches in their quarterly compliance reports to stock exchanges, to be made within 21 days from the end of each quarter.

Business Responsibility and Sustainability Report

- Annual report by the top 1000 listed entities

- Market capitalization shall be calculated as on 31st March of every financial Year.

- Key performance indicators as specified by the board

- Value chain of the listed companies shall also as be specified by the board

23. Evolution of BRSR in India

- 2023: BRSR Core extended to the Value Chain Partners of the Top 250 Listed Companies

- 2021: BRSR made mandatory for the top 1000 Listed Companies

- 2019: NVG evolved to NGRBC Business Responsibility Reporting extended to the Top 1000 Listed Companies

- 2017: Voluntary Reporting using Integrated Reporting introduced for the top 500 Listed Companies

- 2012: Business Responsibility Reporting Introduced for Top 100 Listed Companies

- 2011: National Voluntary Guidelines Introduced by MCA

23.1 What is BRSR?

- Business Responsibility and Sustainability Reporting framework aims to enhance transparency and encourage companies to adopt responsible and sustainable business practices. Business Responsibility and Sustainability Reporting framework aims to enhance transparency and encourage companies to adopt responsible and sustainable business practices.

- The BRSR framework is based on the principle of “comply or explain”. Listed entities must either disclose their ESG-related information according to the specified format or provide a substantiated reason for nondisclosure.

- The BRSR framework comprehensively addresses sustainability across governance, environment, social, customer, supply chain, and human rights dimensions. The BRSR reporting requirement is aligned with global sustainability reporting frameworks, such as the Global Reporting Initiative (GRI) and the United Nations Global Compact (UNGC). It aims to enhance the quality of sustainability reporting by listed entities in India.

Key Hurdles in BRSR Implementation

- Comprehensive Data oriented Disclosures: 180+ Quantitative inputs

- Complex Calculation: GHG emissions/Waste/Water/Energy

- Precise and prescriptive reporting format

23.2 “SEBI’s July 2023 Circular – Key Points to Note”

The provisions of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (“LODR Regulations”) in this regard, have been amended vide Gazette notification no. SEB/LADNRO/ON/2023/131 dated June 14, 2023

SEBI released a circular on 12 July 2023 addressing to all listed entities to introduce BRSR CORE-Framework for Assurance and ESG disclosures for value chain.

BRSR Core Framework for Assurance Annexure I: Subset of BRSR for Reasonable Assurance provided for 9 ESG Attributes Mandatory Reasonable assurance for top 150 companies for FY 23-24 (by market capitalization) FAQs from SEBI on BRSR Core assurance.

New BRSR format for Reporting Annexure II: Top 1000 listed entities to report as per new BRSR format for FY23-24 New format Incorporating new KPI’s & attributes of BRSR Core from 9 ESG attributes Intensity ratios based on revenue adjusted for Purchasing Power Parity (PPP) to enable global comparability.

ESG Value Chain disclosures: Disclosures for the value chain partners on BRSR core format Value chain shall encompass top 75% (of its purchases or sales by value) upstream and downstream partners of a listed entity Applicable to the top 250 listed entities (by market capitalization), on a comply or-explain basis from FY 2024-25comply-or-explain

23.3 “Exploring the Updated BRSR Format – Annexure 2 Unveiled”

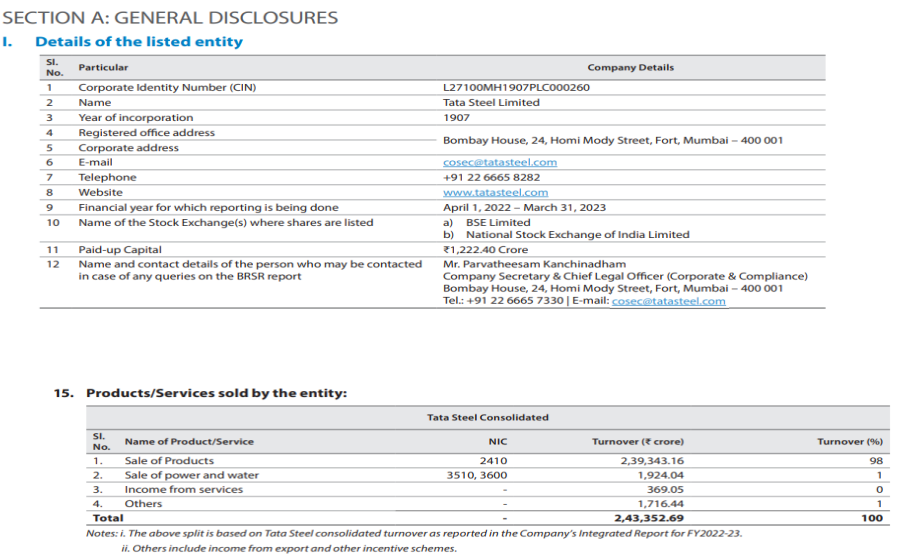

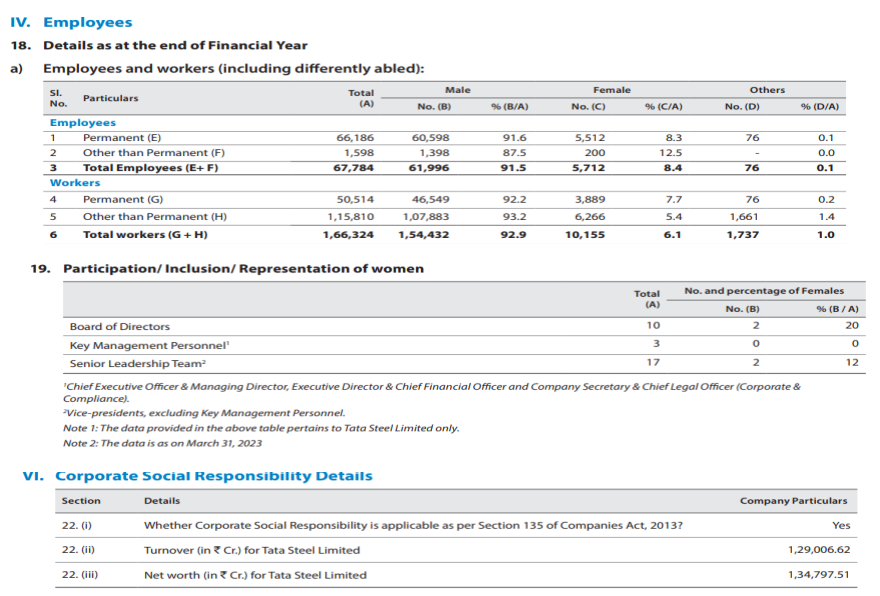

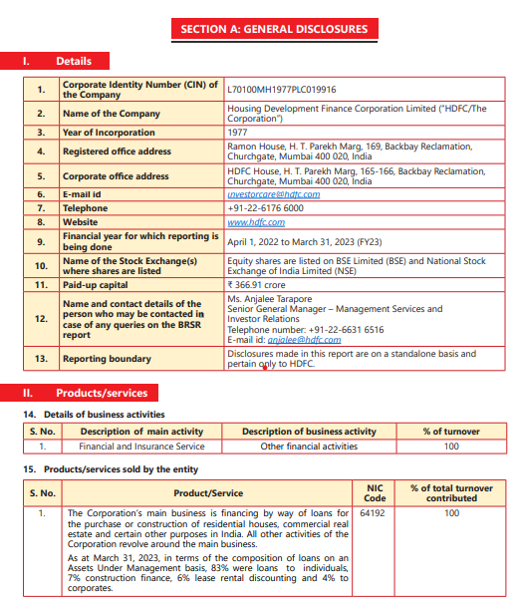

Section A: General Information of the Company

- Details of Entity

- Products & Services

- Operations

- Employees

- Holding, Subsidiary, and Associate Companies (including joint ventures)

- CSR

- Transparency & Disclosure Compliances

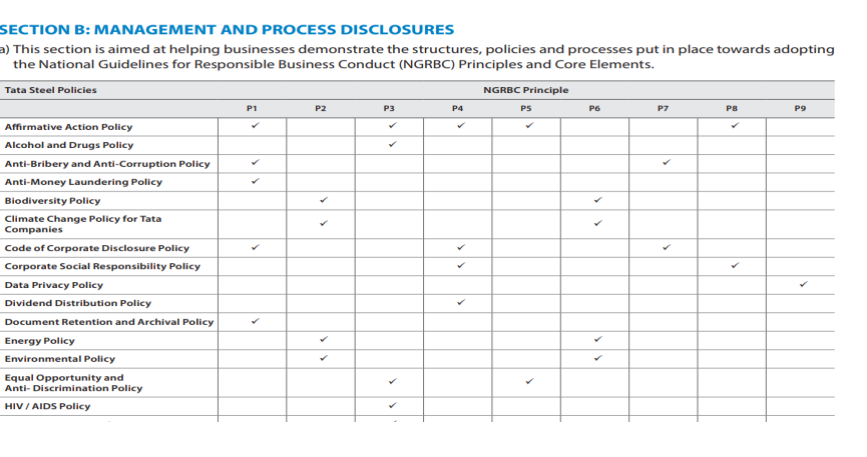

Section B: Management & Process Disclosure

- Policy & Management Process (NGBRC Principles)

- Leadership & Oversight

Section C: Principle-wise Performance Disclosure

- Ethics Transparency & Accountability

- Sustainable and safe Goods & Services

- Promote Employee Wellbeing being

- Respectful towards stakeholders

- Uphold ad Advance Human Rights

- Protect and Restore the Environment

- Influence Public Policy

- Inclusive Growth & Equitable Development

- Responsible Consumer Engagement

23.4 Transition from Voluntary to Mandatory Principles – Navigating the Shift

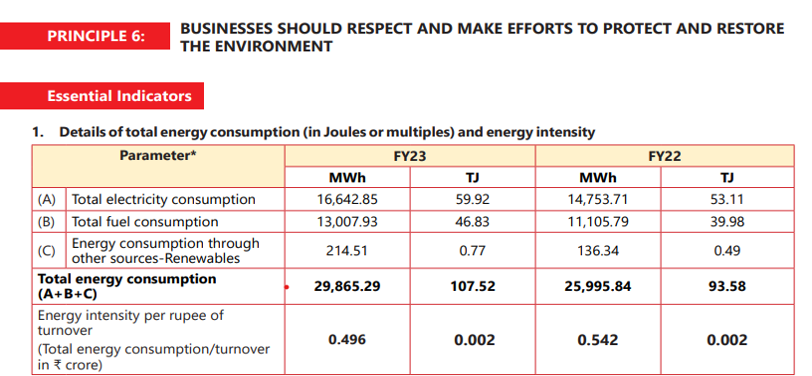

Principle 6

- Protect and Restore the Environment

- Detail of total energy consumed in Joules or multiples from renewable and non-renewable sources, Energy intensity per rupee of turnover adjusted for Purchasing Power Parity (PPP) and Energy Intensity output – Mandatory (Earlier Voluntary)

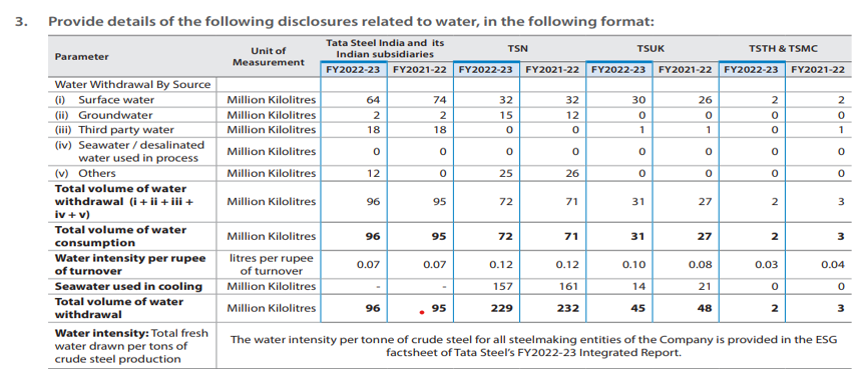

- Detail related to water discharged for the current and previous financial year – Mandatory (Earlier Voluntary)

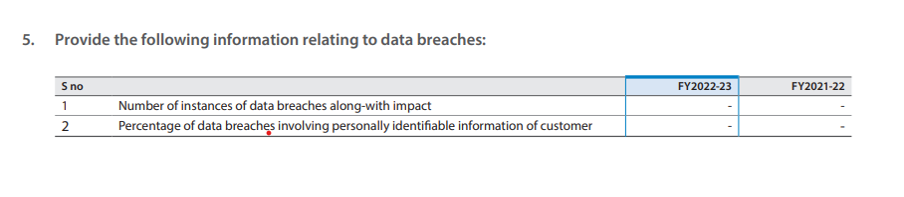

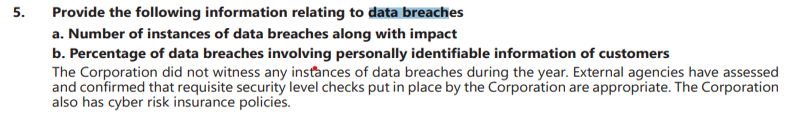

Principle 9

- Responsible Consumer Engagement

- Information relating to data breaches – Mandatory (Earlier Voluntary)

23.5 BRSR – Navigating New Requirements for Continued Excellence

| Principles | Parameters |

| Ethics Transparency & Accountability |

|

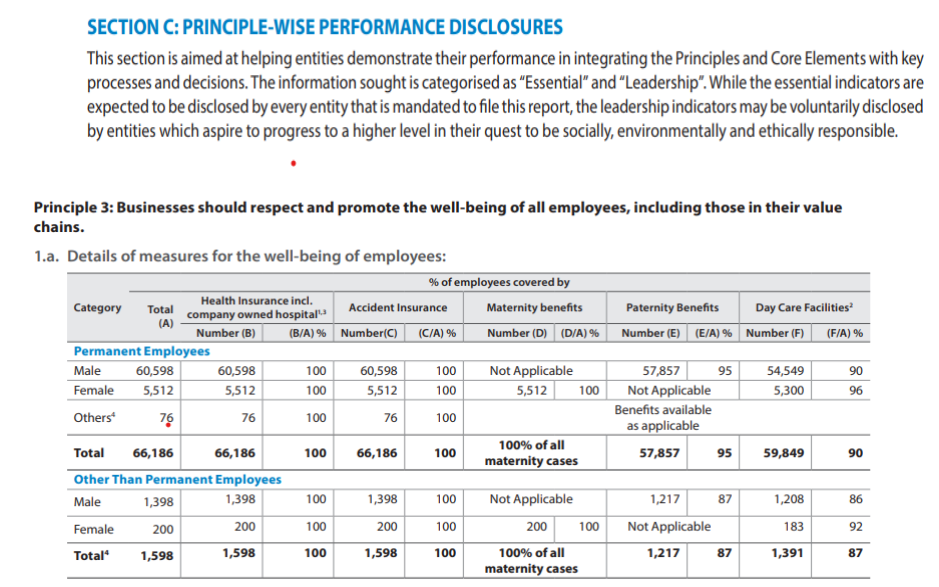

| Promote Employee Wellbeing |

|

| Uphold and Advance Human Rights |

|

| Protect and Restore the Environment |

|

| Inclusive Growth & Equitable Development |

|

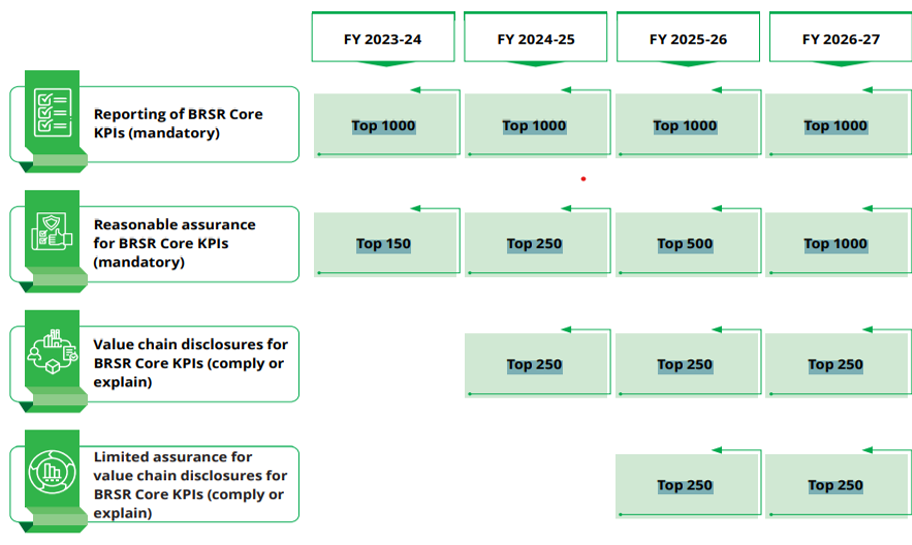

23.6 BRSR Core – Timelines for Disclosure and Assurance

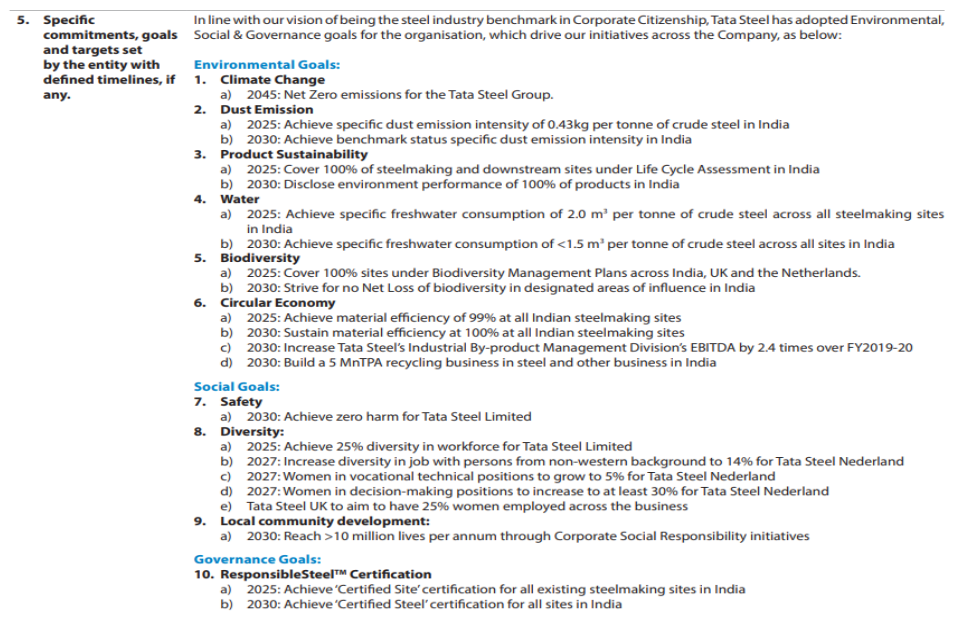

23.7 TATA Steel 2022-2023 BRSR Report

Details related to water discharged for the current and previous financial year. Mandatory (Earlier Voluntary)

Information relating to data breaches: Mandatory (Earlier Voluntary)

23.8 HDFC Bank BRSR 2022-2023

Mandatory (Earlier Voluntary): Details of total energy consumed in Joules or multiples) from renewable and non-renewable sources Energy intensity per rupee of turnover adjusted for Purchasing Power Parity (PPP) and Energy Intensity output

PRINCIPLE 9: Responsible Consumer Engagement : Information relating to data breaches – Mandatory (Earlier Voluntary)

23.9 Journey Towards Excellence

- Analyze & Assess

- Identify & Embed

- Review & Improve

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA