Comprehensive Guide to Overseas Direct Investment (ODI) – Key Statistics | Regulations | Insights

- Blog|FEMA & Banking|

- 11 Min Read

- By Taxmann

- |

- Last Updated on 16 January, 2025

Overseas Direct Investment (ODI) in India refers to investments made by Indian entities or individuals in foreign businesses, either through equity capital, loans, or guarantees, with the objective of establishing a significant interest or control in those entities. Governed by the Foreign Exchange Management Act (FEMA) and associated rules, ODI aims to promote Indian participation in global markets. It includes financial commitments such as acquiring shares, subscribing to the Memorandum of Association (MoA), or extending loans, subject to limits like 400% of net worth for Indian entities. Specific guidelines, restrictions, and reporting requirements ensure compliance and transparency in cross-border investments.

By CA. Niki Shah – Partner | SN & Co.

Table of Contents

1. Statistics

ODI Destinations (April 2023 – December 2023)

| Country | Amount (In USD Mn) | Percentage |

| Singapore | 3,191.06 | 20.72% |

| Netherlands | 2,632.09 | 17.09% |

| UAE | 2,339.41 | 15.19% |

| USA | 2,223.82 | 14.44% |

| UK | 1,520.51 | 9.87% |

| Switzerland | 464.99 | 3.02% |

| Mauritius | 336.87 | 2.19% |

| Cayman Island | 288.42 | 1.87% |

| South Africa | 219.69 | 1.43% |

| Others | 2,183.74 | 14.18% |

ODI Destinations (April 2023 – December 2023)

| Country | Amount (In USD Mn) | Percentage |

| Singapore | 3,191.06 | 20.72% |

| Netherlands | 2,632.09 | 17.09% |

| UAE | 2,339.41 | 15.19% |

| USA | 2,223.82 | 14.44% |

| UK | 1,520.51 | 9.87% |

| Switzerland | 464.99 | 3.02% |

| Mauritius | 336.87 | 2.19% |

| Cayman Island | 288.42 | 1.87% |

| Others | 2,403.42 | 15.16% |

ODI Destinations (April 2020 – July 2022)

| Country | Amount (In USD Mn) | Percentage |

| Singapore | 7,654 | 23% |

| USA | 6,370 | 19% |

| UK | 3,415 | 10% |

| Mauritius | 2,880 | 9% |

| Netherlands | 2,871 | 9% |

| UAE | 1,481 | 5% |

| Russia | 1,085 | 3% |

| British Virgin Islands | 683 | 2% |

| Others | 1,185 | 3% |

Increase in Overseas Investment in the Netherlands & UAE

Decrease in Overseas Investment in Mauritius

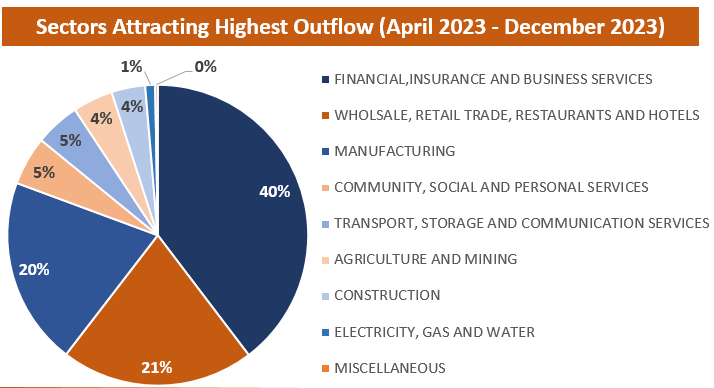

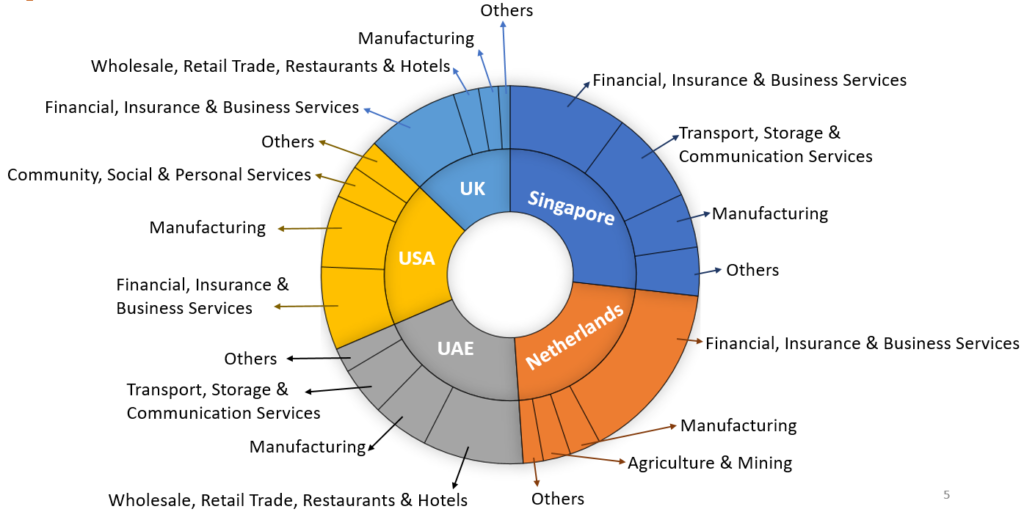

Country wise major sectors

Surge in Buying Immovable Property Abroad

2. Background & Overview

In keeping with the spirit of liberalization and promoting ease of doing business in India, the Central Government and the Reserve Bank of India (RBI) have notified the new overseas investment framework on 22 August 2022.

- RBI/FED/2024-25/121 FED Master Direction No.15/2024-25 on Overseas Investment dated July 24, 2024

- Foreign Exchange Management (Overseas Investment) Rules, 2022 (OI Rules) notified by the Central Government vide Notification No. G.S.R. 646(E) dated August 22, 2022

- Foreign Exchange Management (Overseas Investment) Regulations, 2022 (OI Regulations) notified by the Reserve Bank vide Notification No. FEMA 400/2022-RB dated August 22, 2022.

2.1 Who are Eligible to do ODI?

- Companies incorporated in India

- Bodies created under an Act of Parliament

- Partnership firms registered under the Indian Partnership Act, 1932

- Limited Liability Partnerships (LLPs)

- Registered Trusts and Societies (under restricted conditions and with RBI approval)

- Resident Individual

3. Indian Entity

3.1 How Much They Can Do?

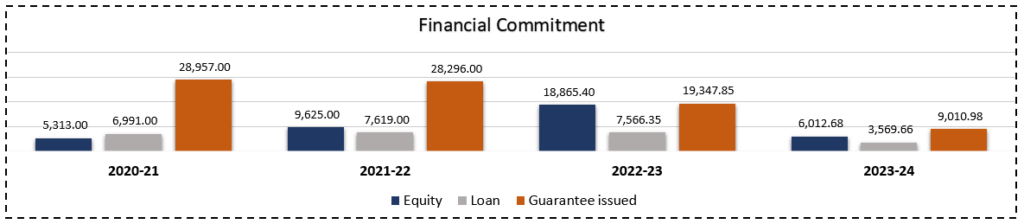

Financial Commitment: It comprises of:

- FC made by an Indian Entity in FE shall not exceed 400% of its Net Worth as on the date of last audited balance sheet.

- FC by Indian Entity can be made by way of equity capital, debt, non-fund based financial commitment (guarantee, pledge or charge)

- Guarantee

-

- 100% jointly or severally by two or more Indian Entity

- No fresh guarantee treated for Roll-over guarantee

- 50% of Performance Guarantee

Note: A person resident in India who has made a financial commitment in a foreign entity in accordance with the Act or rules or regulations made thereunder, shall not make any further financial commitment, whether fund-based or non-fund-based, directly or indirectly, towards such foreign entity or transfer such investment till any delay in reporting is regularised.

3.2 In What Ways Overseas Investment Can Be Done?

Overseas Direct Investment

- Acquisition of Unlisted equity capital of a Foreign Entity (FE), or

- Subscription to the MoA of a FE, or

- Investment > 10 % of the equity capital or control in a listed FE where investment < 10%

Debt/Non-fund based facilities

- Debt other than OPI – subject to control and arms-length interest on debt/loans

- Debt/non-fund based facilities such as guarantees/pledge – subject to control

- Lend or Invest in debt instrument issued by FE, including SDSs of IE

Overseas Portfolio Investment

- Investment other than ODI, in foreign securities

- Not in any Unlisted debt instruments

- Not in any securities issued by a person resident in India who is not in an IFSC

- Deemed OPI even after delisting

3.3 ODI by Indian Entity – Key Restrictions

Restrictions and prohibitions

Restricted sectors/activities for ODI are as under

- Real estate activity: ‘Real estate activity’ means buying and selling of real estate or trading in transferable development rights but does not include the development of townships, construction of residential or commercial premises, roads or bridges for selling or leasing.

- Gambling in any form

- Dealing in financial products linked to INR (without prior RBI approval).

- Approval Route – Investment/FC in Pakistan (permissible under approval route) or any jurisdictions as may be advised/notified by the Central Government

- Financial Commitment by a PRII in a foreign entity that has invested or invests into India at the time of making such FC or at any time thereafter, either directly or indirectly, resulting in a structure with more than two layers of subsidiaries is not permitted.

3.4 Debt and Non-debt Instruments

OI Rules defines debt and non-debt instruments – not previously defined and distinguished

Definition of non-debt instruments aligned with FEMA NDI Rules issued for FDI

Debt Includes

- Redeemable Debentures and Preference Shares

- Optionally Convertible Debentures and Preference Shares

Debt Instruments

- Government Bonds

- Corporate Bonds

- Securitization structure tranches that are not equity tranches

- Borrowings by firms through loans

- Depository receipts whose underlying securities are debt securities

Non-Debt Instruments

- Investments in units of mutual funds and ETF which invest more than 50% in equity

- Acquisition, sale or dealing directly in immovable property

- Equity tranche of securitization structure

- Contribution to Trusts

- Depository receipts issued against equity instruments

- Investment in units of AIFs, REITs and InVITs

- Investment instruments recognized in the FDI policy

- Capital participation in LLP’s

- Investment in equity of incorporated entities (public, private, listed, unlisted)

4. Resident Individual

4.1 Liberalised Remittance Scheme

- Two Routes for Outbound Investments by Resident Individuals – LRS (Liberalised Remittance Scheme) and ODI

- Investment is limited to USD 2,50,000 per Financial Year

- The Scheme is available to all resident individuals including minors

- Permissible capital a/c transactions by an individual under LRS are:

-

- opening of foreign currency account abroad with a bank;

- Acquisition of immovable property abroad, (ODI) & (OPI)

- extending loans including loans in Indian Rs. to (NRIs) who are relatives as defined in Co. Act, 2013

- A limit of USD 2,50,000 per FY under the Scheme also includes/subsumes remittances for current account transactions: viz.

-

- Private visit;

- gift/donation;

- going abroad on employment;

- emigration;

- maintenance of relatives abroad;

- business trip;

- medical treatment abroad;

- studies abroad) available to resident individuals

4.2 Overseas Investment by Indian Entity

| Overseas Direct Investment | Overseas Portfolio Investment | |

| General Permission | FC in all foreign entities < 400% of net worth as per the latest audited balance sheet | OPI in all foreign entity < 50% of net worth as per the latest audited balance sheet |

| Net Worth | Net Worth definition linked with the Companies Act

|

Net Worth definition common for ODI & OPI |

| Approval | Prior Approval: FC > USD 1 Bn in FY, even if within 400% limit (same as previous regime) | Listed IE may invest or reinvest |

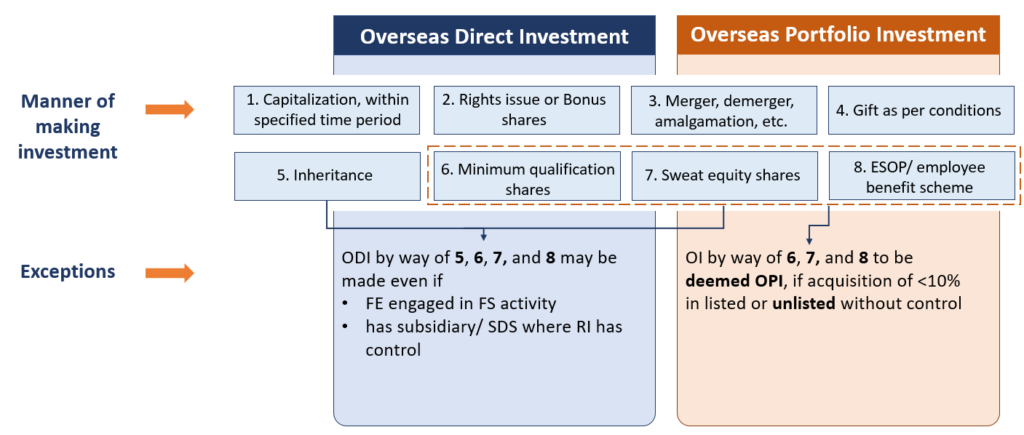

| Manner for making investment |

|

|

| Investment Limit | ODI + OPI to be within LRS ceiling of $ 250,000 | ODI + OPI to be within LRS ceiling of $ 250,000 |

| General Permission | Allowed only in Operating FE

|

|

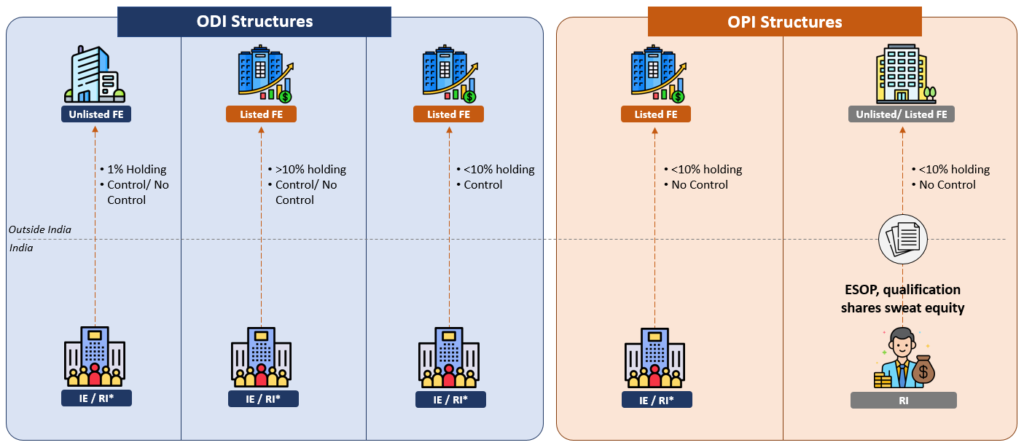

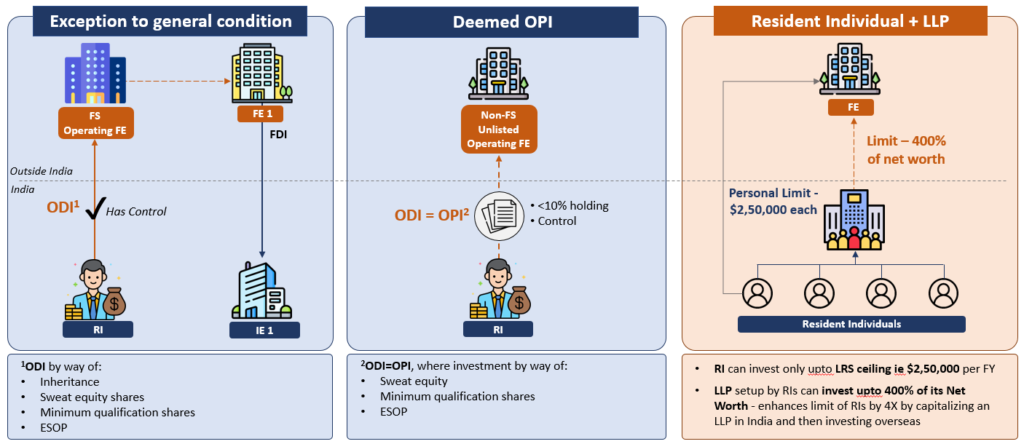

4.3 Illustration – ODI/OPI Structures

* In case of RI, FE needs to be a non-FS, operating entity

4.4 Overseas Investment by Resident Individual

5. Other ODI Terms

5.1 Pricing Guidelines

- Issue or transfer of equity capital of a foreign entity from PROI or PRI to PRI who is eligible to make such investment or from PRI to PROI shall be subject to a price arrived on an arm’s length basis.

- AD bank before facilitating a transaction to ensure compliance with ALP taking into consideration the valuation as per any internationally accepted pricing methodology for valuation.

5.2 Reporting Requirements

Form ODI

- Form FC to be submitted for undertaking FC/disinvestment/restructuring.

- First ODI not permitted before filing Form FC and obtaining UIN from RBI.

- Scope of statutory auditor’s certificate for ODI significantly widened.

Annual Performance Report

- APR filing now exempted in below scenarios

-

- Where PRI is holding < 10% of equity without control in the FE and no other FC other than equity; or

- FE is under liquidation

- APR shall certified by CA/CPA where the statutory audit is not applicable and is based on audited financial statements and where laws of the host country/jurisdiction, do not provide for mandatory auditing of accounts.

- Except PRII does not have control in the FE

Reporting of OPI

- Form OPI introduced for reporting of OPI for PRII (other than Individuals) making/transferring any OPI.

- To be reported on half yearly basis.

Others

- Share certificate to be submitted in 6 months, else funds to be repatriated.

- Dues receivable from the FE with respect to investment in such FE to be repatriated within 90 days from date of becoming due.

| Particulars | Reporting |

| Unique Identification Number (UIN) | To be applied through Form FC before initial FC |

| Submission of evidence of investment to AD Bank | Within 6 months. If not, amount remitted to be repatriated to India within said 6 months |

| Repatriation of dividend, royalty, technical fees, etc from FE | All receivables with respect to investment to be repatriated within 90 days |

| Repatriation of dividend/other entitlements from subsidiary credited to foreign currency account | All receivables with respect to investment to be repatriated within 90 days |

| Repatriation of proceeds of transfer/Disinvestment | Within 90 days of it falling due |

| Reporting Financial Commitment | In Form FC – At the time of making FC or sending outward remittance, whichever is earlier |

| Reporting restructuring of balance sheet | In Form FC – Within 30 days of restructuring |

| Reporting Disinvestment | In Form FC – Within 30 days of receipt of proceeds |

| Reporting OPI by IE or transfer of OPI | In Form OPI – Half yearly reporting within 60 days of September or March-end, including ESOP issued to employees |

| Annual Performance Report | IE/RI to report on or before December 31 of every year in case of multiple IE/RI, person with higher stake

Person excluded form reporting:

|

| Foreign Assets and Liabilities Report | IE to submit by July 15 of every year |

5.3 Delay in Reporting

Delay post date of publication of these rules:

- Submission can be made subject to payment of Late Submission Fees (LSF). However, the facility of payment of LSF can be availed within a period of 3 years from the due date of such submission.

Delay – Pre-date of publication of these rules:

- Submission can be made subject to payment of Late Submission Fees (LSF). However, the facility of payment of LSF can be availed within a period of 3 years from the date of publication of these regulations in the Official Gazette i.e. 22nd August 2022.

- LSF mechanism/calculation provided by RBI vide the directions issued in this regard.

Restriction of Further Investment/Transfer

- PRI who has made a financial commitment in a foreign entity shall not be permitted to make any further financial commitment, whether fund-based or non-fund-based, directly or indirectly till any delay in reporting is regularized.

5.4 Late Submission Fees

- In case of delay in filing/submitting the requisite form/return/document – Pay the Late Submission Fee (LSF)

- The LSF for delay in reporting overseas investment-related transactions shall be calculated (per return) as per the following matrix:

| Sr. No. | Type of Reporting delays | LSF Amount (INR) |

| 1. | Form ODI Part-II/APR, FCGPR (B), FLA Returns, Form OPI, evidence of investment or any other return which does not capture flows or any other periodical reporting | 7500 |

| 2. | Form ODI-Part I, Form ODI-Part III, Form FC, or any other return which captures flows or returns which capture reporting of non-fund based transactions or any other transactional reporting | [7500 + (0.025% × A × n)] |

“n” is the number of years of delay in submission rounded upwards to the nearest month and expressed up to 2 decimal points.

“A” is the amount involved in the delayed reporting.

- Maximum LSF: 100% of amount involved

- LSF Payment within 30 days

5.5 Disinvestment

Where the disinvestment by a person resident in India pertains to ODI:

- the transferor, in case of full disinvestment other than by way of liquidation, shall not have any dues outstanding for receipt, which such transferor is entitled to receive from the foreign entity as an investor in equity capital and debt;

- the transferor, in case of any disinvestment, must have stayed invested for at least 1 year from the date of making the ODI.

Disinvestment by the Indian party from its JV/WOS abroad may be by way of:

- transfer/sale of equity shares

- liquidation of the JV/WOS abroad.

- Merger/Amalgamation of the JV/WOS abroad.

Modes of Disinvestment: An Indian Party may disinvest from JV/WOS either

- without write off or

- with write off

subject to the compliance of some conditions.

Conditions for automatic route for disinvestment

- No write off of investment

- No outstanding dues such as dividend, royalty, technical know-how from JV/ WOS

- Sale after 1 full year of operations and APR for said year has been submitted

- Indian party is not under investigation in India

- Shares sold on a Stock Exchange or if unlisted, share price not less than value certified by CA/CPA based on the latest audited balance sheet

Party to report disinvestment through AD bank within 30 days

5.6 Multiple Choice Questions

1. As per FEM (OI) RULES, 2022, the total financial commitment of the Indian party in JV/WOS shall not exceed……….of the Indian Party as on the date of the last audited balance sheet:

A. 400% of the net worth

B. 50% of the total assets

C. 400% of the total assets

D. 50% of the net worth

Answer: A

2. In the case of disinvestment (selling ODI), what are the two main conditions the transferor must meet?

A. No outstanding dues from the foreign entity and holding the investment for at least one year.

B. Transfer the shares at a specific price and report the transaction to the authorities.

C. Obtain prior approval from the Central Government and transfer through an authorized bank.

D. None of the above.

Answer: A

5.7 Case Study

1. Mr. X a Person Resident in India wants to purchase an immovable property in Dubai for US $ 15,00,000 payable on Installment basis in 6 years under LRS scheme.

Questions:

- Whether Mr. X can purchase the property outside India as per FEMA law?

- What if he has already purchased property on installment basis.

Note: As per A.P. (DIR Series) Circular No.32 dated September 04, 2013 Resident individuals are permitted to make remittances for acquiring immovable property on installment basis only for those contracts which were entered into on or before the date of the circular, i.e., August 14, 2013, subject to satisfaction of the genuineness of the transactions by the AD bank.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA

ODI investment done in a foreign company where india and the foreign company country has DTAA, when company is voluntarily struck off and after stiking off the company the retained earnings when transferred back to share holder in India, will that be treated as section 2(22) dividend income or long term capital gains ( share held for more than 7 years ) , does section 2(22) apply to foreign company transferring its retinaed earnings to share holders in india