Case Study on Issue of Long-Term Capital Gains on Sale of Penny Stocks under section 10(38) under Faceless Assessment

- Blog|Income Tax|

- 12 Min Read

- By Taxmann

- |

- Last Updated on 27 December, 2022

The claim of exemption of long-term capital gains on sale of penny stocks under section 10(38) of the Act, is one of the most common and regular scrutiny criteria under CASS, now-a-days. The Capital Market Regulatory Body SEBI have identified 108 odd scrips of listed companies in which unfair trade practices and price rigging were done. The assessing authorities taking cognizance of such adverse scrips based on the reports of investigation wing and the purported statements by entry operators concerning the misuse of the mechanism of exemption of long-term capital gain on sale of penny stocks in routing back of the ‘unaccounted/on money’ in the books under the disguise of exempt long term capital gains on sale of such penny stocks, are issuing scrutiny notices and requisitions to the assessees.

On receipt of the assessment notice or requisition in this regard, the assessee is required to establish the authenticity and genuineness of such long-term capital gains on sale of penny stocks, by filing and placing on record electronically all the relevant statutory records and documents like broker contract notes, purchase and sale bills, bank statements, DP statements, Demat holding statements etc. evidencing the execution of the sale and purchase transactions of such penny stocks through proper and authenticated banking channels, in recognised stock exchange, after payment of applicable securities transaction tax (STT).

However, now-a-days, the assessing authorities, somehow tend to down-play these documentary evidence and are more inclined towards the substance of such transactions rather than the form.

Therefore, it is advisable for the assessees and the tax practitioners to differentiate their respective cases with the routine penny stock cases by highlighting peculiar facts like the fact that the assessee is a regular investor in capital market and not a one-time adventurer and as such has done the investments in such penny stocks as a pure investor only and this fact can be established by filing the details of his share trading in immediately preceding and succeeding assessment years. Also, the subsequent regulatory status/subsequent SEBI favourable orders allowing the continuation of trading in scrips of such penny stocks or exonerating the participating entities from any unfair trade practices should also be filed and placed on record, if applicable.

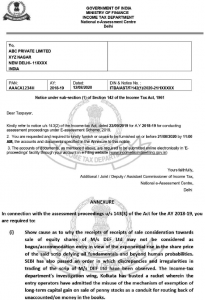

The Real-time scrutiny notice/requisition/show cause notice under section 143(2)/142(1) of the Act, concerning the issue of claim of exemption of long-term capital gains on sale of penny stocks under section 10(38) of the Act, are being reproduced for ready reference of the worthy readers.

The assessee is required to file his ‘e-responses/submissions’ to such notices and requisitions under section 143(2)/142(1) of the Act and attach the relevant supporting records and documents as attachments exactly in the same manner as has already been discussed in detail in paragraph No. 3.4.1 of Chapter No. 3.

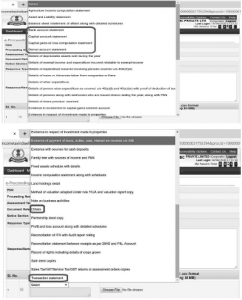

The Specimen of an ideal ‘e-response’ to the Scrutiny Notice/Requisition/Questionnaire/Show Cause Notice under section 142(1)/143(2) of the Act, on the issue of exemption of long-term capital gain on sale of penny stocks is reproduced below for the ready reference of the worthy readers.

ABC & COMPANY

CHARTERED ACCOUNTANTS

Tax Chambers, New Delhi – 1100XX,

Tel.: 011-12345678, Fax: 011-87654321

E-mail: abc@taxchambers.com

September 24, 2019

The ACIT (e-Verification)

Prescribed Income Tax Authority,

New Delhi

In the Matter of: M/s ABC Pvt. Ltd. (hereinafter referred to as ‘the assessee company’)

PAN:AAACA1234H; Address: XYZ Nagar, New Delhi, India

Subject: Submission w.r.t. Notice under section 143(2) for A.Y. 2018-19.

Dear Sir,

This is in reference to the captioned Notice under section 143(2) of the Act, dated 22-8-2020 for the AY 2018-19, and the subsequent requisitions wherein the assessee company has been required to furnish its reply in substantiation and corroboration of its claim of exemption of long-term capital gains on the sale of shares of a listed company M/s DEF Ltd.

In this regard it is respectfully submitted that during the FY 2017-18 corresponding to the AY 2018-19, presently under consideration, the assessee has earned a Long-Term Capital Gain of Rs. 56,00,000 on sale of equity shares of M/s DEF Ltd., duly listed on a recognised stock exchange.

The assessee has made the payments for the purchase of the equity shares of M/s DEF Ltd., to a recognised stock broker, duly registered with SEBI, through proper and authenticated banking channels, and has sold the said shares on recognised stock exchange, after a period of one year, after payment of the applicable Securities Transaction Tax (STT), and has thereby earned the completely genuine and authentic Long Term Capital Gains on such shares, which as per provisions of section 10(38) of the Income-tax Act, are to be considered as exempt income.

In order to establish the authenticity and genuineness of the said Long-Term Capital Gains of Rs. 56,00,000 it is respectfully submitted as under:

-

- That the assessee has applied for the allotment of shares to M/s DLF Ltd. company, by making a share application and making the payment towards purchase of shares via RTGS amounting to Rs. 5,00,000 on 1-2-2012.

- The copy of the corresponding share application form and the bank statement is being filed and placed on record as per attachment.

- The Company vide its allotment advice dt. 27-02-2012 allotted 50,000 equity shares of face value of Rs. 10 each to the assessee in physical form.

- The assessee got the shares dematted with JKL Securities Ltd. on 1-2-2013. Copy of Demat account is being filed and placed on record.

- The assessee sold these shares on 24-04-2017, on NSE platform, through the SEBI registered stock broker M/s JKL Securities Ltd.

- The shares were sold through a recognised and SEBI registered stock broker and corresponding broker bills, contract notes and statement of sale of shares are being filed and placed on record, as per attachments.

- All the payments towards sale consideration are received through account payee cheques/RTGS and duly reflected in the bank account of the assessee and copies of corresponding bank statements are being filed and placed on record.

- STT was duly charged by the share broker which is reflected in the bills received from the broker and copies of the same are being submitted and placed on record.

- As per mechanism and working of stock exchange either seller places bid for sale of shares giving number of shares to be sold and the rate at which the shares are to be sold. Purchasers also places bid for purchase of shares giving number of shares to be purchased and the rate at which he is ready to purchase the shares. When the prices of the seller and the purchaser matches the transaction is confirmed by the system of the stock exchange. Purchaser and seller do not know each other.

- After completion of the transaction as stated above purchase price is debited to the share broker of the purchaser which in turn recovers the same from the purchaser after adding the STT and other charges. Likewise, sale consideration of shares is credited to the account of the broker of the seller of shares which in turn credits the same to the account of the seller after deducting STT and other charges.

- It may be seen from the above that the purchaser and seller are not in a position to know each other. Any person having shares of a company can sell those shares and any person interested in purchase of shares can purchase the shares at the rate at which bids of sale is floating in the system. No human intervention is possible in the whole exercise of purchase/sale of shares as stated above.

- The assessee is a genuine and regular investor and has sold the shares through the mechanism of a recognised stock exchange. There is no evidence that the purchaser was related to the assessee or even in know of the assessee.

- The company M/s DEF Limited in trading of whose shares the assessee earned Long Term Capital Gain is a dividend paying company and has declared a dividend of Rs. 2 per equity share for F.Y. 2017-18. Copy of the dividend warrants from the company in this regard is also enclosed.

Therefore, from the above stated factual propositions, it is crystal clear and duly evident that:

-

- All the above stated transactions of purchase and sale of equity shares of M/s DEF Ltd. has been fully and duly accounted for in the Books of Account, Audited Financial Statements and ITR by the assessee, and all the transactions are fully and duly reflected in the bank statements of the assessee.

- All the said share transactions have been done through recognised Stock Broker, duly registered with SEBI. The copies of the Broker Contract Notes and Statement of Purchase & Sale of Shares, Settlement Accounts with the Brokers, D-Mat A/c, containing complete details in relation to each sale & purchase transaction of shares as above, viz. contract note No., quantity, scrip name, price per unit, scrip-wise transactions, date of transactions, amounts of sale & purchase, holding etc. are being duly produced and placed on record, before the ld. assessing authority.

- All the said transactions of purchase and sale of shares have been executed through recognised stock exchange, after payment of applicable Securities Transaction Tax (STT).

- Nothing at all, had been brought and placed on record, by the Ld. AO, to show any nexus, whatsoever, between the assessee and the alleged accommodation entry operators.

- In the entire purported statement of one alleged entry operator, no-where, the said person had admitted that he had any connection or nexus, with the assessee or more specifically, he had provided any accommodation entries to the assessee.

Therefore, there is no lawful basis, whatsoever, to consider the said genuine and authentic Long-Term Capital Gain income of the assessee, as a sham or bogus transaction and the statutory onus, as casted upon the assessee, by numerous binding judicial pronouncements of the Hon’ble ITATs and High Courts, regarding the establishment of authenticity and genuineness of the said share transactions and the resultant long-term capital gain, had been fully and completely discharged by the assessee.

It is respectfully submitted that a mere presumption on the basis of conjectures, surmises and premises that in the guise of long-term capital gain income, assessee’s own unaccounted income/on-money, had been routed in its books of account, and without bringing on record any corroborating material or evidence, to substantiate the source and generation of ‘on-money’ by the assessee, is in contravention of the well settled and established position of Law.

The mere presumption that since the assessee had earned long term capital gain, which is exempt as per law, therefore, the assessee must have earned some on-money/unaccounted income, is not at all in conformity with the established legal jurisprudence in this regard.

The jurisdictional Hon’ble Delhi High Court, in the case of Mod. Creations (P.) Ltd. v. ITO [2011] 13 taxmann.com 114/202 Taxman 10 (Mag.) has categorically held as under:

“14…. A bald assertion by the A.O. that the credits were a circular route adopted by the assessee to plough back its own undisclosed income into its accounts, can be of no avail. The revenue was required to prove this allegation. An allegation by itself which is based on assumption will not pass muster in law. The revenue would be required to bridge the gap between the suspicions and proof in order to bring home this allegation.”

Therefore, the statutory onus, as casted upon the assessee by numerous binding judicial pronouncements of the Hon’ble ITATs and High Courts, regarding the establishment of authenticity and genuineness of the said share transactions and the resultant long term capital gain, stands fully and completely discharged and as such there is no lawful basis, whatsoever, to justify the pre-meditated presumption of considering the fully lawful exempt long term capital gain being earned by the assessee as accommodation/bogus/sham entries, without bringing any cogent material on record, and without establishing any nexus of the assessee, with the so called alleged entry operators.

Reliance in this regard is placed upon the numerous binding judicial pronouncements, as under:

- Principal CIT Prem Pal Gandhi [2018] 94 taxmann.com 156 (Punj. &Har.);

- Principal CIT Hitesh Gandhi in ITA No. 18/2017, dated 16-2-2017(Punj. &Har.);

- Shikha Dhawan v. ITO, in ITA No. 3035/Delhi/2018, dated 27-06-2018 (Delhi – Trib.);

- Meenu Goel ITO[2018] 94 taxmann.com 158 (Delhi – Trib.);

- Nidhi Goyal ITOin ITA No. 6882/Delhi/2017, dated 12-03-2018;

- ACIT v. Kamal Kishore Aggarwal & Sons in ITA No. 2504/Delhi/2011, dated 18-9-2015;

- CIT Mahesh Chandra G. Vakil [2013] 40 taxmann.com 326/[2014] 220 Taxman 166 (Mag.) (Guj.);

- CIT v. Sunita Khemka in ITA Nos. 714 to 718/Kol./2011, dated 28-10-2015 (Kol.);

- Tekchand Rambhiya HUF v. ITO in ITA No. 960/Mum/2012, dated 16-9-2015 (Mum. – ITAT);

- CIT Smt. Sumitra Devi [2014] 49 taxmann.com 37/[2015] 229 Taxman 67 (Raj.).

Further, the ld. assessing authority is also requested to provide the assessee with an appropriate and suitable opportunity of cross examination of all the so-called alleged entry operators and to provide with the copies of all the alleged materials, evidences or records on the basis of which adverse inference is proposed to be drawn against the assessee.

Reliance in this regard is placed upon the recent landmark judgment of the Hon’ble Supreme Court of India in the case of Andaman Timber Industries v. CCE [2015] 62 taxmann.com 3/52 GST 355, wherein it has been categorically held by the Hon’ble Apex Court that,

“Not allowing the assessee to cross-examine the witnesses by the Adjudicating Authority though the statements of those witnesses were made the basis of the impugned order is a serious flaw which makes the order nullity inasmuch as it amounted to violation of principles of natural justice because of which the assessee was adversely affected. It is to be borne in mind that the order of the Commissioner was based upon the statements given by the aforesaid two witnesses. Even when the assessee disputed the correctness of the statements and wanted to cross-examine, the Adjudicating Authority did not grant this opportunity to the assessee. It would be pertinent to note that in the impugned order passed by the Adjudicating Authority he has specifically mentioned that such an opportunity was sought by the assessee. However, no such opportunity was granted and the aforesaid plea is not even dealt with by the Adjudicating Authority. As far as the Tribunal is concerned, we find that rejection of this plea is totally untenable. The Tribunal has simply stated that cross-examination of the said dealers could not have brought out any material which would not be in possession of the assessee themselves to explain as to why their ex-factory prices remain static. It was not for the Tribunal to have guess work as to for what purposes the assessee wanted to cross-examine those dealers and what extraction the assessee wanted from them”.

Otherwise also, it is a cardinal principle and well settled Trite Rule of Law, that no adverse inference can be drawn upon any purported statement of any third party, which has been recorded behind the back of the assessee company, without giving the assessee, a lawful opportunity of cross examination of the said third party.

The assessing authority’s kind attention is also drawn to an important fact of this case which distinguishes the assessee’s case with that of the other routine penny stock cases that the assessee is a regular investor in capital market and not a one-time adventurer and as such has done the investments in such penny stocks as a pure investor only. In order to establish this fact, the complete details of the assessee’s share trading in immediately preceding and succeeding assessment years, along with all the corresponding documentary evidences and records are being filed and placed on record as attachments.

Further, the Hon’ble SEBI after passing an interim order concerning the irregularities in the trading of the scrip of M/s DEF Ltd., has conducted comprehensive and thorough investigations and has passed an elaborate final order completely exonerating the assessee from any involvement in any unfair or irregular trade practice concerning the said trading in said scrip. Therefore, the sole basis and the entire edifice on the basis of which apprehensions and doubts have been raised by the assessing authority against the assessee has virtually become non-existing now after the passing of the final order by the SEBI completely exonerating the assessee.

Therefore, in view of the above stated factual propositions and legal precedents, the statutory onus, as casted upon the assessee by numerous binding judicial pronouncements of the Hon’ble ITATs and High Courts, regarding the establishment of authenticity and genuineness of the said share transactions and the resultant long term capital gain, stands fully and completely discharged and as such there is no lawful basis, whatsoever, to justify the pre-meditated presumption of considering the fully lawful exempt long-term capital gain being of Rs. 56,00,000 being earned by the assessee during the AY 2018-19 as accommodation/bogus/sham entries, in the absence of any cogent and reliable material and without establishing any nexus of the assessee, with the so-called alleged entry operators.

Thanking You.

Yours Sincerely

For ABC & Company

Chartered Accountants

—sd—

(Authorised Counsel of the Assessee Company)

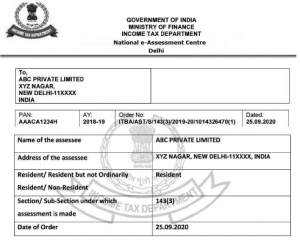

Passing of the Final Assessment Order by NeAC

The NeAC forwards the ‘e-Responses’ of the assessee to the Show Cause Notice to the Regional Assessment Unit which in turn after taking due cognizance of all the e-responses of the assessee passes the revised assessment order. In the new Faceless Assessment Scheme, 2019, the assessee is not having any ‘by-default’ right of personal hearing and the assessee may only request for a personal hearing by way of video conferencing/telephony, in case of disagreement with the additions/disallowances proposed in the draft assessment order. The Chief Commissioner or the Director General, ReAC, may approve such request for personal hearing, if he is of the opinion that the case falls in the list of specified circumstances as notified by CBDT. The circumstances where the request of the assessee for personal hearing via video conferencing may be approved are yet to be notified by CBDT. The regional assessment unit after taking cognizance of the inputs from such personal hearing as provided to it by NeAC, again passes the final assessmentorder, which is uploaded by NeAC in the registered ‘e-Filing’ account of the assessee, within the time barring limitation period of completion of assessments under section 143(3) of the Act, which can be seen and downloaded by the assessee from the main window under the tab‘e-proceedings’.

The NeAC also transfers the final assessment order and all the assessment records to the file of jurisdictional AO for imposition of penalty if any and recovery of outstanding income tax demand, if any.

A specimen of the final assessment order passed by NeAC under section 143(3) of the Act is reproduced as under for ready reference:

ASSESSMENT ORDER

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA