[Analysis] UAE Corporate Tax – Navigating Intra-group Services and Transfer Pricing

- Blog|Transfer Pricing|

- 16 Min Read

- By Taxmann

- |

- Last Updated on 17 October, 2024

The UAE Transfer Pricing (TP) regulations, established under Cabinet Decision No. 44 of 2022, set out comprehensive guidelines for businesses on pricing transactions between related and connected parties to adhere to the "arm's length" principle. These regulations are part of the UAE's efforts to align with international tax compliance standards, specifically the OECD guidelines. Companies engaged in both cross-border and certain domestic transactions must maintain detailed documentation, including a Master File, Local File, and potentially a Country-by-Country Report for larger multinationals. The regulations aim to prevent tax avoidance and ensure tax transparency, requiring businesses to reassess and possibly adjust their transfer pricing practices to avoid substantial penalties for non-compliance. The Federal Tax Authority provides additional guidance on implementation, making it crucial for affected businesses to seek expert advice to navigate these requirements effectively.

BY CA Ajit Jain – Partner | AJMS LG & CA Darshika Agrawal – Consultant & Tax Advisor

Table of Contents

- Tax Base Erosion

- UAE TP Regulations – Historical Background

- UAE TP Regulations – Regulations & Guides

- UAE TP Regulations

- Applicability of TP Regulations

- Related Parties – Article 35

- Intra-group Services

- Transfer Pricing Methods

- Low Value Adding Intra-group Services

- Selection of Most Appropriate Method

- Arm’s Length Application – Five Comparability Factors

- Developing a Robust TP Policy and Documentation

- Case Study

- Key Takeaways

1. Tax Base Erosion

- Revenue Loss: Tax base erosion costs governments an estimated $240 billion annually

- Economic Distortion: Over $1 trillion is held in offshore financial centers

- Global Impact: Developing countries lose around $100 billion a year due to tax base erosion

- Compliance Challenges: More than 60% of tax authorities report difficulties in addressing profit shifting

- International Cooperation: The OECD’s BEPS initiative has been endorsed by over 135 countries

2. UAE TP Regulations – Historical Background

- 2019: UAE joined the OECD/G20 Inclusive Framework on Base Erosion and Profit Shifting (BEPS)

- 2019: UAE introduced Economic Substance Regulations (ESR)

- 2020: UAE introduced Country-by-Country Reporting (CbCR) requirements

- 2022: UAE announced the introduction of Federal Corporate Tax including transfer pricing

- 2022: Ministry of Finance (MoF) released public consultation documents on proposed Corporate Tax law

- 2023: UAE Cabinet approved the Federal Decree-Law on Taxation of Corporations and Businesses

- 2023 onwards: Businesses in the UAE are required to comply with the new TP regulations, transfer pricing documentation in line with OECD BEPS Action 13 recommendations

3. UAE TP Regulations – Regulations & Guides

- UAE Corporate Tax Law (Decree-Law No. 47 of 2022): Chapter VII Article 34 to Article 36

- Decision No. 97 of 2023 Requirements for Maintaining Transfer Pricing Documentation

- Cabinet Resolution No. 44 of 2020 on the Requirements for Country-by-Country Reporting

- FTA Transfer Pricing Guidelines October 2023

4. UAE TP Regulations

- Article 34 establishes the Arm’s Length Principle, which mandates that transactions between related parties must be conducted under conditions that would apply if the parties were independent entities dealing at arm’s length.

- Article 35 provides a clear definition of related parties and control relationships.

- Article 36 addresses payments to connected persons, stipulating that such payments must adhere to the arm’s length standard.

- Article 55 mandates the maintenance of detailed transfer pricing documentation. Businesses must prepare and keep both a master file and a local file, as prescribed.

4.1 UAE TP Regulations – ALP

Article 34(2) of the CT Law states that:

“A transaction or arrangement between Related Parties meets the arm’s length standard if the results of the transaction or arrangement are consistent with the results that would have been realized if Persons who were not Related Parties had engaged in a similar transaction or arrangement under similar circumstances.”

5. Applicability of TP Regulations

- Associated Person: Natural Person (Individual) and Juridical person (established legal entity)

- Transactions and arrangement between related parties or connected person

- Transfer pricing regulations applicable to all the persons including entities claiming small business relief, exempted entities, qualifying free zones

- Transfer pricing documentation (local file and master file) not applicable to exempted entities and entities claiming small business relief

| Entity | Taxable Person | Exempted Person | Qualifying Free Zone Person | Entity Claiming Small Business Relief |

| Arm’s length principle | Yes | Yes | Yes | Yes |

| Transfer Pricing documentation (Local file & master file) | Yes | No | Yes | No |

Exempt person:

- Govt entity

- Govt controlled entity

- Extractive business

- Non-extractive natural resource business

6. Related Parties – Article 35

Related Parties under UAE Corporate Tax Law

Article 35 defines Related Parties as associated Persons based on a specified degree of association:

Pre-existing relationship through:

- Kinship (for natural persons)

- Ownership

- Control

Residency status in the UAE is not a determining factor for Related Party classification

6.1 Related Parties – Article 35 (1) (a) to (f)

- Fourth Degree of Kinship

- Parent/Subsidiary/Branches

- Entities under common Control

- Partners in Unincorporated Partnership

- Permanent Establishment

- Exempt and non-exempt business activities of the same group

6.2 Forth Degree of Kinship – Article 35 (1) (a)

Two or more natural persons who are related within the fourth degree of kinship or affiliation, including by way of adoption or guardianship.

- 1st Degree: Parents, children, and those of spouse.

- 2nd Degree: Adds grandparents, grandchildren, siblings, and those of spouse.

- 3rd Degree: Further includes great-grandparents, great-grandchildren, uncles, aunts, nieces, nephews, and those of spouse.

- 4th Degree: Adds great-great-grandparents, great-great-grandchildren, grand uncles/aunts, grandnieces/nephews, first cousins, and those of spouse.

Two natural persons related within fourth degree kinship:

Example: Company owned by brother paying royalties to company owned by sister.

Two natural persons related by adoption:

Example: Adopted son’s company providing services to adoptive mother’s business.

Two natural persons related by guardianship:

Example: Guardian’s firm managing investment portfolio of their ward and charging fees.

6.3 Ownership Interest and Control – Natural Person and Juridical Person [Article 35 (1) (b)]

For the purposes of this Decree-Law, “Related Parties” means any of the following:

A natural person and a juridical person where:

- The natural person or one or more Related Parties of the natural person are shareholders in the juridical person, and the natural person, alone or together with its Related Parties, directly or indirectly owns a 50% (fifty percent) or greater ownership interest in the juridical person; or

- The natural person, alone or together with its Related Parties, directly or indirectly Controls the juridical person.

6.4 Ownership Interest and Control – Juridical Person [Article 35 (1) (c)]

For the purposes of this Decree-Law, “Related Parties” means any of the following:

Two or more juridical persons where:

- One juridical person, alone or together with its Related Parties, directly or indirectly owns a 50% (fifty percent) or greater ownership interest in the other juridical person;

- One juridical person, alone or together with its Related Parties, directly or indirectly Controls the other juridical person; or

- Any Person, alone or together with its Related Parties, directly or indirectly owns a 50% (fifty percent) or greater ownership interest in or Controls such two or more juridical persons;

6.5 Ownership Interest and Control – Natural Person [Article 35 (1) (b)]

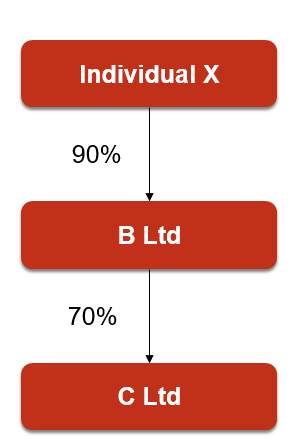

![Ownership Interest and Control - Natural Person [Article 35 (1) (b)]](https://www.taxmann.com/post/wp-content/uploads/2024/09/Screenshot-2024-09-17-154746.png)

- Company A and Company B are related to each other

- Individual A and Company are related to each other

- Individual B and Company are related to each other

Individual X B Ltd and C Ltd are related parties

6.6 Ownership Interest – Juridical Person [Article 35 (1) (c)]

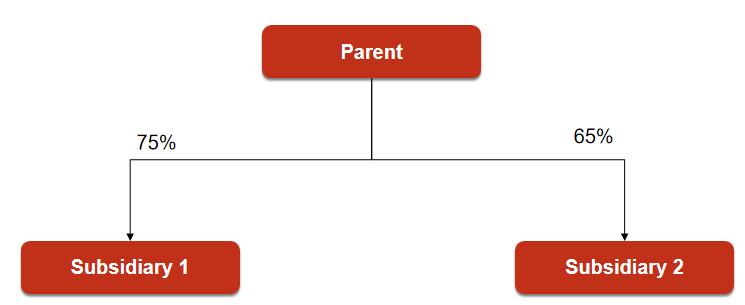

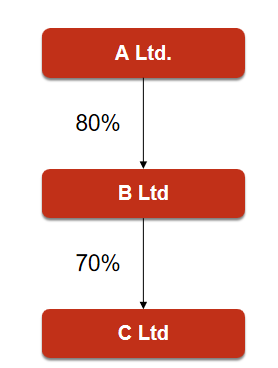

Subsidiary 1 and Subsidiary 2 are related

Parents and both subsidiaries are related

A, B and C are related parties

Ownership should be more than 50%. Whether direct or indirect. Whether one or more entities

6.7 Control: Control – [Article 35 (1)]

- Exercise 50% or more of the voting rights of another person

- Determine the composition of 50% or more of the Board of directors of another person

- Receives 50% or more of the profits of another person

- Exercise significant influence over the conduct of the business and affairs of another person

6.8 Control: Significant Influence – [Article 35 (1)]

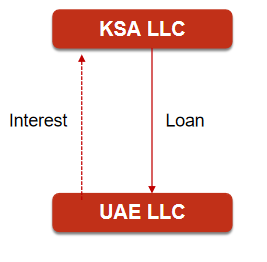

- Loan Constitutes 50% or more of the Total Capital

- Entitlement to Profit Share of 50% or more

- Entitlement to Profit Share of 50% or more

Responsible for:

- Management of day-to-day operations

- Development of strategies, and

- Formulation of the key market decisions

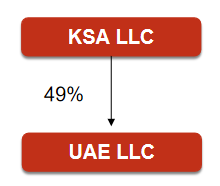

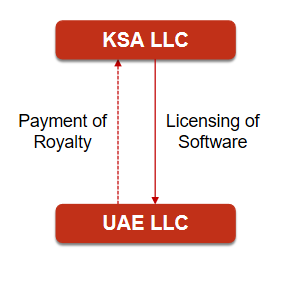

KSA LLC and UAE LLC are related to each other

KSA LLC is entitled to 50% of Profits of XYZ LLC

The loan constitutes 50% of the total capital of UAE LLC

6.9 Permanent Establishment – [Article 35 (1) (d)]

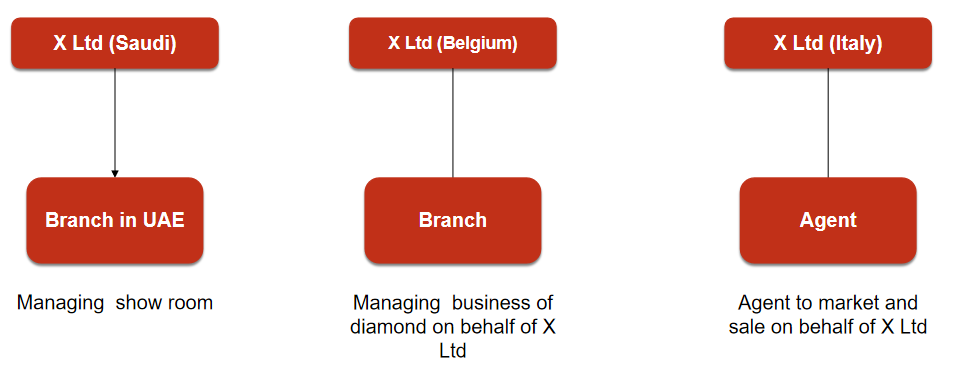

Branches, Agent in UAE are related parties to its parent/parent/principal entities. Transfer pricing regulations are applicable

6.10 Payment to Connected Persons – Article 36

Any payment made to “Connected Persons” is not deductible if:

- Not occurred wholly and exclusively for the business; and

- Not at market value/arm’s length.

- Individual with direct/indirect ownership interest or control

- Director or Officer

- Related to owner/director/officer to the fourth degree of kinship

- Partners in unincorporated partnership

- Related Party of any of these [Article 35 (1)]

6.11 Connected Persons – Article 36 (Exemption)

Article 36(6) specifies the categories of Taxable Persons where the deduction of payments or benefits provided to their Connected Persons is not restricted to the Arm’s Length Price. These Taxable Persons would include any of the following:

- A Taxable Person whose shares are traded on a recognised stock exchange;

- A Taxable Person that is subject to the regulatory oversight of a competent authority in the UAE; and

- Any other Person as may be determined in a decision to be issued by the Cabinet.

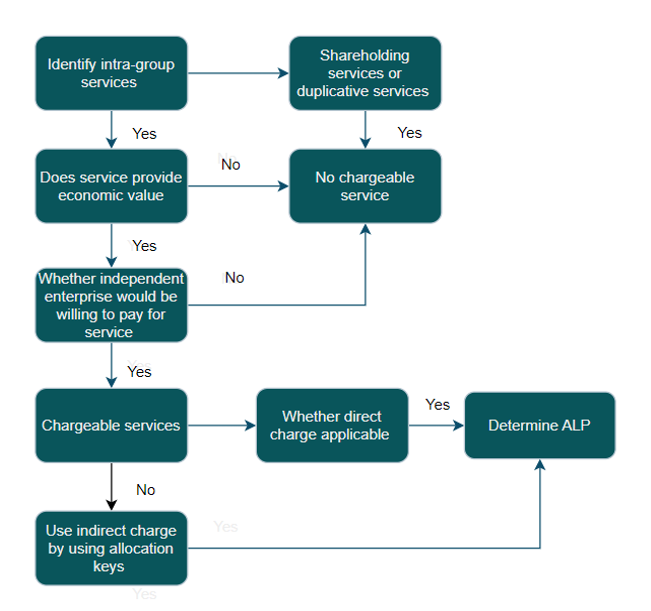

7. Intra-group Services

- Service should provide the related party with economic or commercial value that enhances its commercial position.

- One of the tests is to determine whether a third party would be willing to pay for the same service that the related party has received.

- For an intra-group service fee to be arm’s length, prove with verifiable evidence that services received are adequately charged.

7.1 Intra-group services – Arm’s length analysis

- Whether intra-group services rendered

- Type of intra-group services

- Services which do not justify the intra-group charge

- Functional analysis

- Direct vs Indirect charge and allocation keys

- Identification of cost base

- Section of most appropriate method

- Low value adding intra-group services

- Pass through cost

7.2 Benefits of Intra-group Services

- Cost efficiency: By availing intra-group services from specialized entities within the group, UAE entities can benefit from economies of scale and cost savings compared to outsourcing services to third parties.

- Access to expertise: UAE entities can leverage the specialized knowledge and expertise of other group entities in areas such as IT, marketing, or R&D, without having to develop these capabilities in-house.

- Flexibility and scalability: Intra-group service arrangements can be more easily adapted to the changing needs of the UAE entity, providing greater flexibility and scalability compared to third-party contracts.

- Alignment with group strategy: By availing intra-group services, UAE entities can ensure alignment with the overall group strategy and benefit from a unified approach across the organization.

- Reduced administrative burden: By availing intra-group services, UAE entities can streamline their operations and reduce the administrative burden associated with managing multiple external service providers.

- Improved service quality: Intra-group service providers have a deep understanding of the group’s business and can tailor their services to meet the specific needs of the UAE entity, resulting in higher-quality services.

7.3 Types of Intra-group Services

- Management services

- Technical services

- R&D services

- Marketing support services

- Sourcing support services

- Procurement services

- Business support services

- Low value adding support services

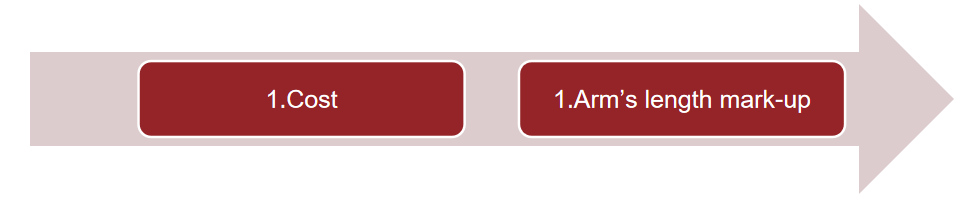

7.4 Pricing an Intra-group Service

Was an intra-group service rendered?

What is an arm’s length charge?

7.5 Was an Intra-group Services Rendered

- The benefit test entails that an intercompany service can be acknowledged, when it is expected to benefit the entity receiving the service.

- A service benefits an entity when

- the activity performed adds economic or commercial value for group member(s)

- for which an independent enterprise would have been willing to pay (to a third party), or

- In case an independent third party would perform the activity in house. If an entity would not be willing to pay for the activity, or perform the activity itself, the activity should not be considered an intercompany service based on the arm’s length principle.

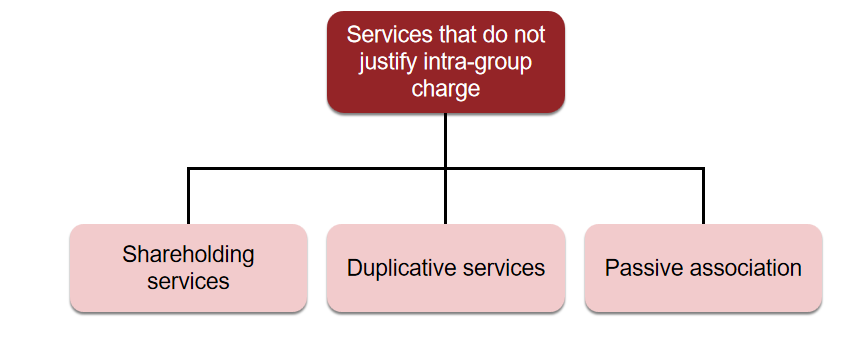

7.6 Services that do not justify intra-group charge

7.6.1 Shareholding services

Shareholder activities are activities undertaken to provide an economic benefit only to the shareholder company (ultimate parent company or any other shareholder such as an intermediary holding company, depending on the facts of the case) in its capacity of shareholder

- Preparation and filing of reports of the parent company

- Appointment and remuneration of parent company directors

- Meetings of the parent company’s board of directors

- Parent company’s preparation and filing of consolidated financial reports,

- Raising funds used to acquire share capital in subsidiary companies.

7.6.2 Duplicative services

Duplicative services

- Services provided to an associate that has already incurred costs for the same activity

- Usually not chargeable, determined case-by-case

When Duplication May Be Justified

- Independent party would pay for duplicated service in similar circumstances

- e.g. Obtaining a second opinion to minimize non-compliance risk

Avoiding Mischaracterization of Duplication

- Services with same name but at different levels (group, regional, local) are not duplicative

- e.g. Group-level strategic marketing vs subsidiary’s local market analysis

Acceptable Duplication

- May occur during transition phases like centralization of a function

- Parallels outsourcing to third party with temporary overlap

Evaluating Duplicative Services

- Conduct thorough functional analysis

- Determine if the duplicated activity provides a benefit that meets the arm’s length standard

- Absent a benefit, the duplicated service fails the benefit test and is not chargeable

Passive association

7.6.3 Passive association

Benefits arising from mere membership in an MNE group, without active intervention. Not a chargeable service within the MNE group

Examples

- Discounts from suppliers hoping for future group sales

- Improved credit rating due to group membership

Contrast: Active interventions (e.g., formal guarantees) are chargeable

Incidental Benefits:

- May arise from services primarily benefiting one entity

- Chargeable only if independent parties would pay for them

Importance: Distinguishes between passive benefits and active, chargeable services in transfer pricing

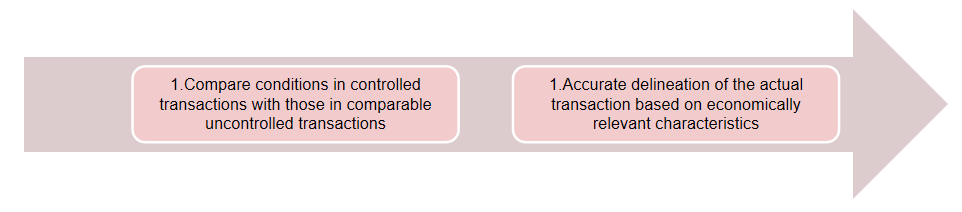

7.7 Application of Arm’s Length Principle

Four Key Steps:

- Identify Related Parties, Connected Persons, relevant transactions, and perform comparability analysis

- Perform Functional Analysis

- Select the most appropriate transfer pricing method

- Determine the arm’s length price

Comparability analysis: Heart of the arm’s length principle

7.8 Functional analysis

- Conducted to determine appropriate arm’s length service charges for transfer pricing

- Value of service to recipient and what an independent party would pay

- Routine/admin services: compensate at cost plus small markup

- Unique/high-value services: can command prices with significant profit

- Functional analysis examines:

- Functions performed, assets used, risks borne by service provider

- Involvement and use of the services by the recipient

- Economic benefit to recipient

- Reliability of available comparables

- More complex analysis if services tied to know-how or intangibles

Example: Functional analysis of marketing services

- Analyze activities, skills, time of provider’s staff

- Assets used (premises, equipment)

- Intangibles (ad firm knowledge, customer lists, know-how)

- Risks in predicting campaign outcomes

7.9 Direct and Indirect Charge Method

Direct Charge

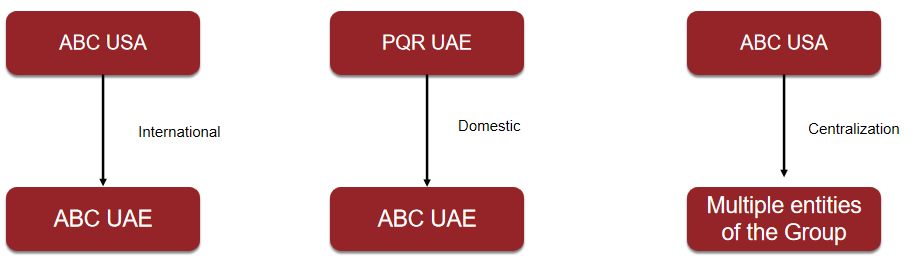

- ABC Group: Multinational company with subsidiaries in UAE (ABC UAE) and UK (ABC UK)

- ABC UK provides specialized IT services to ABC UAE

- Services directly charged to ABC UAE at arm’s length prices

(a) Based on time spent by ABC UK’s IT professionals

(b) Prevailing market rates for similar services in the UAE

- Preferred method when service provider renders similar services to both related and independent parties

Indirect Charge

- XYZ Group: Multinational company with a subsidiary in UAE (XYZ UAE) and global headquarters in the US (XYZ US)

- XYZ US provides centralized marketing services to all group entities, including XYZ UAE

- Costs of marketing services allocated to group entities (along with mark-up) based on allocation keys

(a) Allocation keys: Revenue, headcount, or other relevant metrics

(b) XYZ UAE’s share of costs determined based on its proportion of the allocation key

7.10 Determination of the cost base

Pool Costs: Aggregate annual costs for each service category across the Group Include direct, indirect, and allocated operating expenses

Refine Pool:

- Exclude costs benefiting only the performing entity

- Remove shareholder activity costs

- Eliminate costs for services between specific entities

Allocate Remaining Costs:

- Use appropriate allocation keys linked to expected benefits

- Examples: Headcount for HR services, User count for IT services

Key Considerations:

- Ensure consistency in allocation methods

- Document rationale for chosen allocation keys

- Review and adjust annually for changing business conditions

7.11 Allocation Keys

Proxies for estimating proportional share of expected benefits from intra-group services Allocate costs/value of services within MNE group after satisfying benefit test

Key Requirements

- Measurable, Relevant to service type , Consistently applied, Well-documented

Common Examples

- Sales, profit, units produced/sold , Employees, salaries, IT users, Capital, operating expenses

Service-Specific Keys:

- IT: Number of PCs, HR: Number of employees , Marketing: Sales to independent customers

Considerations:

- Nature of services and their use, avoid keys significantly affected by other intra-group transactions

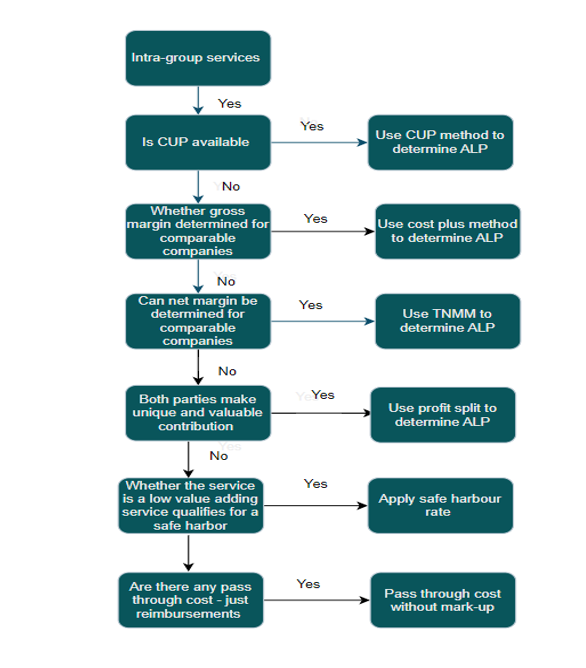

Intra-group services

8. Transfer Pricing Methods

8.1 CUP

- Compare prices and not cost or mark-up;

- If reliable internal or external comparables available, the preferred method;

- Difficult to apply in practice.

8.2 CPM

- One-sided analysis;

- Compare gross services profit mark-up charged between independent parties;

- Cost base includes direct costs and indirect costs.

8.3 TNMM

- Alternative when cost plus is difficult to apply;

- Compare net profit margin on costs;

- Cost base includes direct costs and indirect costs.

8.4 PSM

- Two-sided analysis;

- Splits profit from a controlled transaction.

- Highly integrated transactions & sharing of risks;

- Unique & valuable contributions to the value chain by more than one entity.

9. Low value adding intra-group services

In general, low value-adding intra-group services should meet the following criteria:

- The services are of a supportive nature;

- They are not part of the core business of the MNE Group (i.e. not creating the profit earning activities or contributing to economically significant activities of the MNE Group);

- They do not require the use of unique and valuable intangibles and do not lead to the creation of unique and valuable intangibles; and

- The services do not involve the assumption or control of substantial or significant risk by the service provider and do not give rise to the creation of significant risk for the service provider

Certain low value-adding intra-group services may be charged out at a cost-plus 5% mark-up without the need for a detailed benchmarking analysis

9.1 Low Value-adding Services

WOULD QUALIFY

- Accounting & Auditing

- HR

- Regulatory issues

- Internal & external communications & PR support

- IT (when not part of principal activities)

- Legal services

- Tax support

- Administrative & clerical support

WOULD NOT QUALIFY

- R&D

- Manufacturing

- Sales, Marketing & Distribution

- Financial transactions

- Exploration or extraction

- Purchasing of raw materials

- Insurance

- Corporate senior management

10. Selection of Most Appropriate Method

11. Arm’s Length Application – Five Comparability Factors

| Comparability Factors | Description | Example |

| Characteristics of property and services

|

Evaluate the degree of similarity between the controlled transaction and uncontrolled comparables in terms of the goods or services involved. Consider factors such as physical characteristics, quality, and functional attributes. | If the controlled transaction involves IT support services, ensure that uncontrolled comparables also involve similar technical support services with comparable complexity and skill requirements. |

| Functional analysis

|

Assess and compare the functions performed, assets used, and risks assumed by the parties involved in the controlled and uncontrolled transactions. Understanding the value drivers and contributions of each party is crucial. | Compare the functions performed by the service provider in a controlled transaction (e.g., a shared service center providing accounting services) with uncontrolled comparables.

|

| Economic circumstances

|

Consider the economic environment in which the transactions take place. Factors such as market conditions, industry trends, and the economic cycle can influence prices and profitability. Adjustments may be needed to account for differences in economic circumstances. | When analyzing management consulting services provided during an economic downturn, compare them with uncontrolled consulting engagements conducted under similar economic conditions |

| Business Strategies

|

Evaluate the overall business strategies pursued by the entities involved. Understand how these strategies may impact pricing decisions and whether they differ between the controlled and uncontrolled transactions. | If the controlled entity provides R&D services as part of a group-wide innovation strategy, ensure that comparables also engage in similar long-term research activities |

| Contractual terms

|

Contractual terms play a pivotal role in transfer pricing, defining how risks and responsibilities are divided between associated enterprises. These terms, whether explicit or implicit, are crucial for determining an arm’s length price and are often inferred from communications when no formal contract exists. | For intra-group marketing services, examine how performance metrics, service level agreements, and risk allocation in the controlled transaction compare to those in contracts between independent marketing agencies and their clients. |

12. Developing a Robust TP Policy and Documentation

- Align transfer pricing policy with UAE’s specific requirements and global best practices

- Tailor policy to the nature and complexity of intra-group services

- Determine appropriate pricing methods (e.g., CUP, cost-plus, TNMM)

- Consider UAE’s preference for local comparables and prescriptive approach

- Develop comprehensive documentation package – Local file and Master file

- Contemporaneous documentation to demonstrate arm’s length nature of transactions

- Maintain robust evidence to support transfer pricing positions

- Intercompany agreements, invoices, and proof of services rendered

- Benchmarking studies and functional analysis to justify pricing

- Regularly review and update policy and documentation

- Keep pace with evolving UAE transfer pricing landscape and business changes

- Proactively address potential gaps and inconsistencies

13. Case Study

Global Tech Solutions (GTS) is a multinational enterprise with operations in countries A, B, C, and D.

Group Structure and Services:

- GTS Parent Co. (Country A): Provides management, R&D, and IT services

- GTS Manufacturing (Country B): Produces high-tech products

- GTS Distribution (Country C): Handles sales and marketing

- GTS Support (Country D): Provides customer support and back-office services

Intra-group Services for FY2023:

- Management services from Parent Co. to all subsidiaries

- R&D services from Parent Co. to Manufacturing

- IT services from Parent Co. to all subsidiaries

- Marketing strategy services from Distribution to Manufacturing and Support

- Back-office services from Support to all group members

Financial Information (in millions USD):

- Parent Co.: Revenue $500, Operating Profit $150

- Manufacturing: Revenue $800, Operating Profit $120

- Distribution: Revenue $1,000, Operating Profit $80

- Support: Revenue $200, Operating Profit $20

Task

Determine appropriate transfer pricing methodologies and calculate arm’s length charges for each service, considering the benefit test, charging approaches, and potential use of safe harbors.

| Service Type | Method | Total Cost | Markup/Return | Allocation Key | Charge Details |

| Management Services | Cost Plus | $50M | 10% | Operating Profit | Total: $55M, Manufacturing: $16.5M, Distribution: $20.6M, Support: $3.4M, Parent: $14.5M |

| R&D Services | Profit Split (Residual Analysis) | $100M | 10% Routine | Residual Profit Split | $110M + 60% of residual profit |

| IT Services

|

TNMM (Net Cost Plus) |

$30M | 8% | Headcount | Total: $32.4M, Manufacturing: $12.96M, Distribution: $9.72M, Support: $3.24M, Parent: $6.48M |

| Marketing Strategy | CUP (internal comparable) | N/A | N/A | 80% to Manufacturing, 20% to Support | Manufacturing: $12M, Support: $3M |

| Back-office Services | Safe Harbor for low value-adding | $25M | 5% | Revenue | Total: $26.25M, Parent: $10.5M, Manufacturing: $8.4M, Distribution: $5.25M, Support: $2.1M |

| Category | Details |

| Benefit Test | All services pass as they provide economic value. Example: R&D services boost product development. |

| Charging Approaches | Direct charging for R&D and Marketing. Indirect charging (allocation keys) for Management, IT, and Back-office. |

| Transfer Pricing Methods

|

|

| Documentation Requirements

|

|

| Key Takeaways |

|

14. Key Takeaways

- Benefit Test and Payment Willingness: Taxpayers should evaluate if intra-group services rendered pass the benefit test and willingness to pay test to determine chargeability.

- Non-chargeable Services: Services such as shareholder activities, duplicative services, and passive association do not qualify for an arm’s length charge.

- Documentation Importance: Maintaining detailed transfer pricing documentation is crucial for compliance and reducing dispute risks.

- Allocation Keys for Charging: Use relevant metrics like revenue or headcount for indirect charging of intra-group services when direct charging isn’t possible.

- Local Compliance: Policies should adhere to UAE’s transfer pricing requirements, use local comparables, and incorporate low value-adding services for simplified compliance.

- Policy Review: Regular updates to transfer pricing policies and documentation are necessary to reflect changes in regulations and business dynamics in the UAE.

- Functional Analysis: Conduct a thorough functional analysis, considering factors like allocation keys and the global value chain to establish arm’s length prices.

Resources for Further Learning and Guidance

- UAE Corporate Tax Law (Decree-Law No. 47 of 2022): Chapter VII Article 34 to Article 36

- Decision No. 97 of 2023 Requirements for Maintaining Transfer Pricing Documentation

- Cabinet Resolution No. 44 of 2020 on the Requirements for Country-by-Country Reporting

- FTA Transfer Pricing Guidelines October 2023

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

CA | CS | CMA

CA | CS | CMA