Analysis of Circulars Issued Post 53rd GST Council Meeting – Taxability | Place of Supply | ITC

- Blog|GST & Customs|

- 11 Min Read

- By Taxmann

- |

- Last Updated on 24 July, 2024

By Kishore Kumar – Leader & Karishma Malhan – Manager | Taxmann’s Advisory & Research (Indirect-tax)

Table of Contents

- Circular on Taxability

- Circular on Place of Supply

- Circular on Time of Supply

- Circular on Input Tax Credit

- Other Miscellaneous Issues

- Areas to Watch

1. Circular on Taxability

1.1 Valuation of services imported from related person

1.1.1 Circular No. 210/4/2024-GST

- Services imported from related person or from overseas establishments in course or furtherance of business without consideration is supply [Schedule I]

- Valuation of such supplies is determined as per Rule 28 of the CGST Rules

- Second Proviso deems value declared on invoice as OMV, where recipient is eligible for full ITC

- Circular No. 199/11/2023-GST clarified that Nil value can be deemed as value of supply where no invoice is issued in case of domestic transactions between distinct persons

1.1.2 Clarification

- Circular No. 199/11/2023-GST is also applicable on overseas transactions

- Value declared on self-invoice would be deemed as OMV of supplies by foreign affiliate to related domestic entity

- Nil rate can be adopted as OMV where no self-invoice is issued

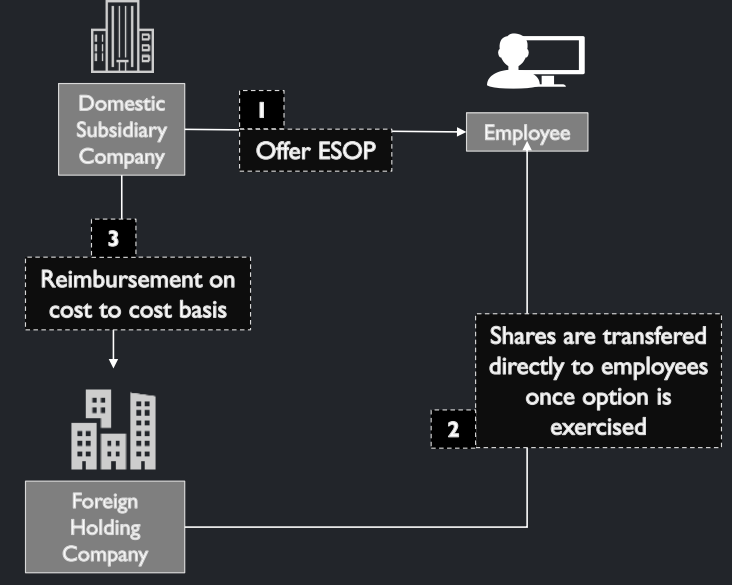

1.2 Taxability of Securities by Foreign Entity under ESOPs

1.2.1 Circular No. 213/7/2024-GST

1.2.2 Clarification

- Fundamental essence of issuance of ESOPs/SSP/RSU is allocation of securities and GST is not leviable on transfer of securities

- ESOP is part of compensation package by employer to employee as per employment contract and thus, no GST is leviable as per Schedule III

- Reimbursement on cost to cost basis is not leviable to GST

- Any additional fee, markup, or commission charged by foreign entity is liable to GST under RCM as import of service

1.3 Taxability on related party loans

1.3.1 Circular No. 218/12/2024-GST

- Banks/Financial Institutions generally charge administrative cost for processing loan application

- Processing activties involves carrying out thorough credit assessment of borrower to identify and evaluate the risks involved

- However, loan extended to related entity does not involve any such processing activity

- Some independent lenders may also waive off administrative charges in full

1.3.2 Clarification

- No deemed supply of services related to processing, facilitating, or administering the loan where no separate consideration is charged

- Any fee or consideration charged over and above interest or discount, in the nature of processing fee/administrative charges/service fee/loan granting charges, etc. will be chargeable to GST

1.4 Taxability of warranty and extended warranty

1.4.1 Circular No. 216/10/2024-GST

Taxability of Extended Warranty

- Extended Warranty after sale of goods is supply of services

- Taxability where Extended Warranty is offered by supplier other than original supplier:

-

- Cannot be treated as part of a composite supply with the goods

- Such supply is considered as separate transaction distinct from original supply of goods and should qualify as supply of service

Issues not Specifically Covered under Circular 195/07/2023-GST

- Scenarios where distributor replaces parts/goods out of his own stock & gets replenishment of the said parts/goods from manufacturer through delivery challan

- No GST is payable and no ITC reversal required

- CBIC specifically clarified that Circular No. 195/07/2023-GST will also apply to goods and not just any parts of the goods

1.5 Taxability of salvage value in motor vehicle insurance

1.5.1 Circular No. 215/9/2024-GST

| Scenario | Clarification |

| Salvage value is reduced from settlement amount |

|

| No reduction of salvage value |

|

2. Circular on Place of Supply

2.1 Supplies made to unregistered persons

2.1.1 Circular No. 209/3/2024-GST

- Specific provision inserted for supplies made to unregistered person, w.e.f. 01-10-2023.

- POS shall be address of recipient as recorded in invoice

- Where address of recipient is not available, POS shall be the location of supplier.

- Name of State deemed as recording of the address.

[Section 10(1)(c) of IGST Act]

2.1.2 Clarification

- Where delivery address is different from billing address for supplies made to unregistered person

- Example – Supplies made through ECO

- CBIC clarified – POS shall be address of delivery

2.2 Custodial services by Banks to FPIs

2.2.1 Circular No. 220/14/2024-GST

- Indian Banks provide custodial services to FPIs, which primarily involves safe keeping of securities

- Specific provision: POS for services by Banks and financial insitutions to ‘account holders’ is location of service provider

[Section 13(8)(a) of IGST Act]

- Residual provision: Services to non-account holders is covered under residual clause, POS is location of service recipient

[Section 13(2) of IGST Act]

- Ambiguity existed whether custodial services are covered under specific provision for place of supply or residual provision

2.2.2 Clarification

- Custodial Services provided by banks or financial institutions to FPIs are not to be treated as services provided to ‘account holder’

- This is substatiated vide CBEC clarifications as per Service Tax Education Guide as well as FAQs dated 27-12-2023

- Impact: Banks and financial insitutions would be able to claim benefit of zero rated supply as POS will be outside India subject to other conditions being fulfilled

3. Circular on Time of Supply

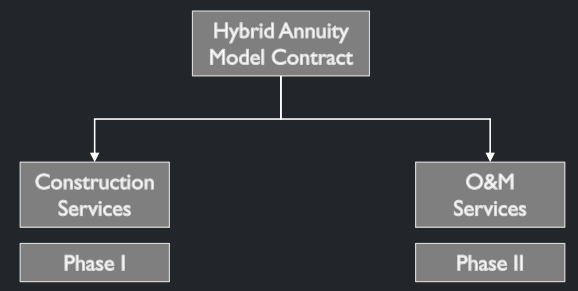

3.1 Annuity payment in HAM Contract for Highway Development

3.1.1 Circular No. 221/15/2024-GST

- In HAM Contract, Part payment is made by NHAI to concessionaire in Construction phase

- Remaining payment is received over O&M Phase in installments upon completion of specified event recognized in contract

- Time of supply of services is earlier of:

-

- Date of issue of invoice

- Date of receipt of payment

- Date of provision of service (where invoice is not issued in time)

[Section 13(2) of the CGST Act]

- Time limit for issuing invoice for continuous supply of services:

-

- Upto due date of payment as per contract

- Upto time when supplier receives payment

- Upto date of completion of event as per contract terms

[Section 31(5) of the CGST Act]

3.1.2 Clarification

- HAM contract is single contract for both construction services and O&M services

- Payment terms are staggered in a manner that concessionaire is accountable for O&M

- Contract needs to be looked at holistically and cannot be artificially split into two separate contracts for construction and O&M

- Supplies under HAM model is continuous supply of services as service is provided for over 3 months with periodic payment obligations

[Section 2(33) of the CGST Act]

- Concessionaire would be liable to pay GST on earlier of:

-

- Date of issuance of invoice (where invoice is issued in time)

- Receipt of payment

- Where the invoice is not issued within time limits, time of supply would be earlier of:

-

- Date of receipt of payment or

- Date of provision of service, which would be due date of payment as per the contract

- Taxable value would also include any interest included in installments

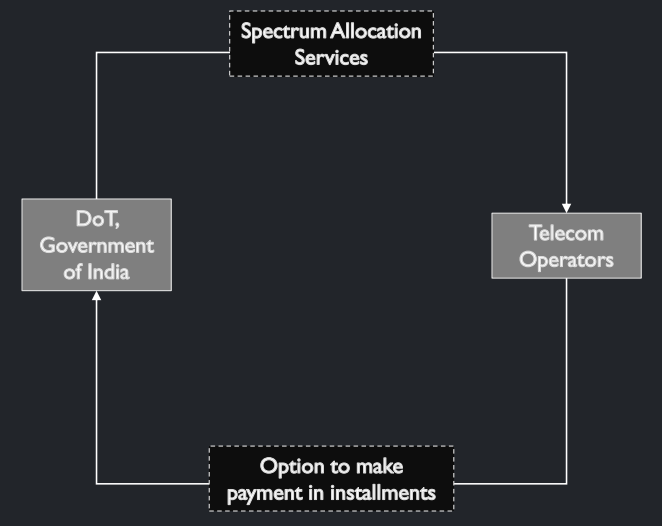

3.2 Spectrum licence fee paid by telecom operators

3.2.1 Circular No. 222/16/2024-GST

- GST on supply of spectrum allocation services is payable by Telecom Operators under RCM

- Installment option available with Telecom operators as per Frequency Assignment Letter (FAL)

- Considered as continuous supply of service since services provided continuously for over 3 months

- Time of supply of services in case of RCM is earlier of:

- Payment date entered in books/debited in books

- Date immediately following 60 days from date of issuing invoice or any other document

[Section 13(3) of the CGST Act]

- Treating FAL as akin to any other document for time of supply purpose, Department raised demand of interest on installment payment after 60 days from date of issue of FAL

3.2.2 Clarification

- Telecom operators will be liable to issue tax invoice on or before such Due date of payment as per contract

- Where full upfront payment is made, TOS would be earlier of actual date of payment or due date of payment

- In case where deferred payment, GST will be payable as and when the payments are due or made

- Clarification would be equally relevant for service of allocation of other natural resources also

4. Circular on Input Tax Credit

4.1 Time limit to avail ITC on RCM supplies

4.1.1 Circular No. 211/5/2024-GST

- Time limit to avail ITC on invoice and debit note is earlier of November 30th of the subsequent year or annual return date

[Section 16(4) of the CGST Act]

- On RCM supplies made by unregistered person, self-invoice is issued by recipient

[Section 31(3)(f) of the CGST Act]

- Ambiguities existed when RCM supply is not initially identified, but later, self-invoice is issued and GST is paid in subsequent years by registered recipient

4.1.2 Clarification

- Time limit will be considered from the FY in which self-invoice is issued

- Time limit will NOT be considered from the year in which services are received

- However, interest shall be payable on such delayed payment

- This may also be subject to penalties under Section 122 of CGST Act

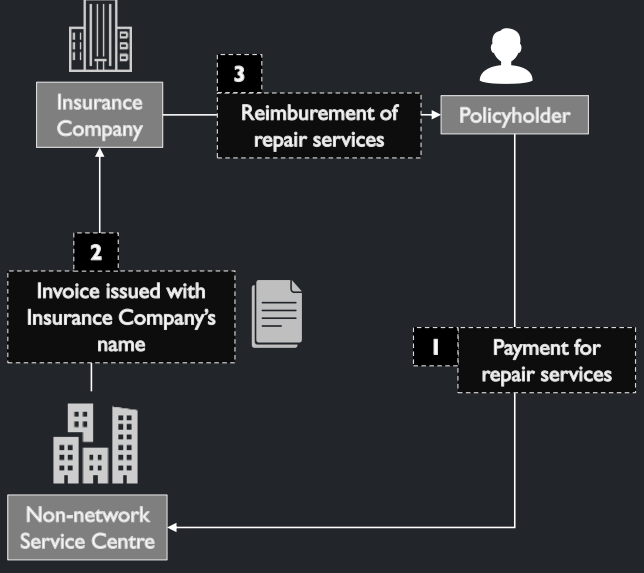

4.2 ITC on repair expenses reimbursed by Insurance Company

4.2.1 Circular No. 217/11/2024-GST

4.2.2 Clarification on motor vehicle repair insurance

- Insurance company is liable to pay for approved repair cost as insurance claim and thus, is considered as ‘recipient’ and payment made is considered as ‘consideration’ for the supplies

- ITC on Motor vehicle repair services received by insurance company is not barred as per Section 17(5)(ab)

- Insurance company is eligible to claim ITC on amount reimbursed for motor vehicle repair

- For ITC eligibility, invoice must be in name of insurance company and not policyholder

- ITC will be available only to extent of reimbursement of approved claim cost

4.3 ITC reversal of excluded Insurance Premium in Rule 32(4)

4.3.1 Circular No. 214/8/2024-GST

- Rule 32(4) of CGST Rules provides manner of determining value of supply of providing life insurance cover services

- Premium allocated for investment/savings is generally reduced from gross premium charged from policyholder

- Amount towards risk is considered for taxability under GST

- Department denied ITC attributable to insurance amount not included in taxable value as per Rule 32(4) considering it as exempt/nontaxable supply in terms of Section 17(2)

4.3.2 Clarification

- Services of providing life insurance cover is neither nil-rated nor ‘exempt supply’ or ‘non-taxable supply’

- Just because some amount of consideration is not included in value of taxable supply, it cannot be said that such portion becomes attributable to non-taxable or exempt supply

- No requirement for reversal on input tax credit under Section 17(2)

4.4 ITC on ducts and manholes used in OFC network

4.4.1 Circular No. 219/13/2024-GST

- Ducts and manholes are basic components for optical fiber cable (OFC) network used in providing telecommunication services

- ITC is blocked on goods and works contract services used for construction of immovable property (other than plant and machinery)

- ‘Plant and machinery’ means apparatus, equipment, and machinery fixed to earth by foundation or structural support that are used for making outward supply of goods or services or both and includes such foundation and structural supports Excludes land, building or any other civil structures; telecommunication towers; and pipelines laid outside the factory premises

4.4.2 Clarification

- Ducts and manholes are used as part of OFC network for making outward supply of transmission of telecommunication signals from one point to another

- It appears that ducts and manholes are covered under definition of ‘plant and machinery’

- Not covered under specific exclusions as per definition of plant and machinery

- ITC on ducts and manholes can be availed without restriction of Section 17(5)(c) and Section 17(5)(d) of the CGST Act

5. Other Miscellaneous Issues

5.1 New Certification requirement for Post-Sales discounts

5.1.1 Circular No. 212/6/2024-GST

- Post Sales discount can be reduced from value of supply based on following conditions:

-

- Discount is established as per agreement on or before time of supply

- It is linked to relevant invoices

- ITC attributable to discount is reversed by recipient

[Section 15(3)(b) of the CGST Act]

- Credit note under GST can only be issued once all the above conditions are satisfied

5.1.2 Clarification

- New mechanism for supplier to obtain certification from recipient as an evidence of ITC reversal by recipient

| Where tax amounts is upto Rs. 5,00,000 | Recipient’s undertaking/ certificate confirming ITC reversal |

| Where tax amount exceeds Rs. 5,00,000 | CA/CMA Certification certifying the ITC reversal |

- Certificate should contain – Details of credit notes, Relevant invoice numbers, ITC reversal amount and Details of DRC-03 or return through which ITC is reversed, UDIN

- Taxpayer may provide such evidence for past cases also

5.2 Monetary Limits Prescribed for Departmental Appeals

5.2.1 Circular No. 207/1/2024-GST

- CBIC prescribed monetary limits for filing Departmental appeals

| Appellate Forum | Monetary Limit (amount in Rs.) |

| GSTAT | 20 lakhs |

| High Court | 1 Crore |

| Supreme Court | 2 Crores |

- Circular provides manner of determining the monetary limits

- Prescribed monetary limits not to apply in certain cases

- Section 120 of CGST Act empowers CBIC to fix monetary limits for filing of appeal or applications by tax authorities based on GST Council recommendation.

- Not filing departmental appeal based on monetary limits does not preclude officers from appealing similar issues or question of law.

- Party involved cannot argue that officer agreed to a decision on disputed issue simply because appeal was not filed.

5.2.2 Manner of determining the monetary limits

| Dispute pertains to | Amount to be considered |

| Tax demand | Aggregate amount of disputed tax |

| Interest or penalty or late fee | Amount of Interest, Penalty or Late Fee, as the case maybe |

| Interest, penalty and late fee (without any disputed tax amount) | Aggregate amount of interest, penalty and late fees |

| Erroneous Refund Demand | Disputed Refund Amount |

| Composite order disposing multiple appeals/demand notice | Total amount of tax/interest/penalty/late fee Not on amount involved in individual appeal or demand notice |

| Note: Monetary limit shall be applied on the disputed amount of tax, interest, penalty and late fee | |

5.2.3 Prescribed monetary limits not to apply in certain cases

- Provision ultra vires to the Constitution of India

- Rules/regulations held ultra vires to parent act

- Order, notification, instruction, or circular held ultra vires to GST Acts

- Following matters recurring in nature and/or involves interpretation of GST law

-

- Valuation

- Classification

- Refunds

- Place of Supply or

- Any other issue

- Where strictures or adverse comments passed against Government/Department or their officers

- Any other case necessary as per CBIC in interest of justice or revenue

5.3 Special Procedure for Tobacco Manufacturers

5.3.1 Circular No. 208/2/2024-GST

Where make, model number and machine number is not available

- Make and model numbers is optional field and year of purchase may be declared as make number.

- Machine number field is mandatory and manufacturer can assign numeric number to machine and enter it in Table 6.

- Where multiple machines are used for packing, details of machines used for final packing is to be furnished.

Where MRP is not available

- Sale price of the goods so manufactured may be entered where there is no MRP of package.

Where Electricity Consumption Rating is not available

- Certification of Chartered Engineer may be furnished.

- Qualification and eligibility of Chartered Engineer – Practicing Chartered Engineer having practice certificate from the Institute of Engineers India

Applicability of Special Procedure

- Not applicable to SEZ manufacturing units.

- Not applicable on manual seamer/sealer being used for packing operations.

- Not applicable on manual packing operations such as those in cases of post-harvest packing of tobacco leaves.

- Special procedure is applicable to all persons involved in manufacturing process including a job worker and contract manufacturer.

- Where job worker/contract manufacturer is not registered, then principal manufacturer will be liable to comply with special procedure.

6. Areas to Watch

6.1 Key GST Council Recommendations

Insertion of Section 128A

- Amnesty Scheme by way of waiver of interest and penalty for demands notices under Section 73.

- This waiver applies to cases where taxpayers pay full tax demand by 31-03-2025 for the financial years 2017-18, 2018-19, and 2019-20.

- The waiver is not to be extended in the cases of erroneous refunds.

- Retrospective amendment under Section 16(4) where time limit for availing ITC for FY 2017-18 till FY 2020-21 deemed as 30-11-2021.

- Rule 28 to be amended retrospectively to clarify that deeming value for Corporate Guarantee would not apply where recipient is eligible for Full ITC and export of services.

- Demand paid in DRC-03 recommended to be accepted as pre-deposit for filing appeal.

Insertion of Section 11A

- Granting powers to Government to not recover duties not levied or short levied due to general common trade practice.

- Litigations related to ITC under section 16 or 17 of the CGST Act may not be covered within the scope of the said provisions.

- GST refund restrictions to be applicable for all zero rated supplies with or without payment of tax where goods are subject to export duty.

- Insertion of new Form GSTR1A to facilitate the taxpayers to amend the details in Form GSTR-1.

Insertion of Section 74A

- Common time limit for issuance of demand notices and orders under Section 73 and 74 of the CGST Act for FY 2024-25 onwards.

- Also, the time limit for availing the benefit of a reduced penalty to be increased from 30 days to 60 days.

- Time limit for availing the benefit of reduced penalty to be increased from 30 days to 60 days.

- Interest under Section 50 would not arise on delayed filing of return on the amount is available in ECL on the due date of filing and the amount is debited while filing the said return.

- Exemption to accommodation services upto Rs. 20,000/- per month per person.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA