[Analysis] New Compounding Regime under FEMA – Rules | Directions | PRAVAAH Portal

- Blog|FEMA & Banking|

- 7 Min Read

- By Taxmann

- |

- Last Updated on 18 October, 2024

The New Compounding Regime under the Foreign Exchange Management Act (FEMA) are the revised provisions for the compounding of contraventions under FEMA, introduced by the Reserve Bank of India (RBI). Compounding refers to the process of voluntarily admitting the contravention, pleading guilty, and seeking redressal without going into litigation. This regime is part of RBI’s broader goal to facilitate compliance and manage contraventions under FEMA more effectively while ensuring that the foreign exchange market functions smoothly and without disruptions.

Table of Contents

- Compounding Proceedings Rules and Directions

- Key Changes in Rules & Directions

- Key Changes in Compounding Application Forms and Process

- PRAVAAH Portal for Compounding Application

By CA. Harshal Bhuta – Partner | P.R. Bhuta & Co.

1. Compounding Proceedings Rules and Directions

- Foreign Exchange (Compounding Proceeding) Rules, 2042, Dated 12th September 2024, Under Notification No. G.S.R 566 (E) issued by the Ministry of Finance

- Direction and FAQs – Compounding of Contraventions Dated 1st October 2024 issued by RBI

2. Key Changes in Rules & Directions

2.1 RBI Compounding Procedure

- Filing of compounding application (Physical or Online)

- Examination of application by RBI

- Calling of additional information, record, documents by Compounding Authority

- Issue of compounding order by RBI

- Adjudging amount of compounding fee

- Compounding hearing (Physical or Online)

- Payment of compounding fee by DD or NEFT or other permissible electronic/online payment mode)

- Issue of certificate by RBI denoting compliance with compounding order

2.2 Power to compound by RBI

- Contravention of any provisions of FEMA Act, 1999 except Sec 3(a) & 37A of the Act.

- In cases where the sum involved in such contravention is:

| Designation | Monetary Limit | |

| Erstwhile Foreign Exchange (Compounding Proceeding) Rules, 2000 | New Foreign Exchange (Compounding Proceeding) Rules, 2024 | |

| Assistant General Manager (‘AGM’) of RBI | Up to Rs 10 Lakh | Up to Rs. 60 Lakh |

| Deputy General Manager (‘DGM’) of RBI | Up to Rs 40 Lakh | Up to Rs. 2.5 Crore |

| General Manager (‘GM’) of RBI | Up to Rs 1Crore | Up to Rs. 5 Crore |

| Chief General Manager (‘CGM’) of RBI | Above Rs 1Crore | Above Rs. 5 Crore |

2.3 Compounding Application Fees & Mode of Payment

Erstwhile Foreign Exchange (Compounding Proceeding) Rules, 2000

- An application for compounding any contravention was required to be submitted to RBI in the form along with a fee of Rs. 5,000/- (inclusive of taxes) and other prescribed required documents.

- Application fees were required to be paid solely by demand draft (‘DD’).

New Foreign Exchange (Compounding Proceeding) Rules, 2024

- An application for compounding any contravention must be submitted to RBI in the prescribed form, along with a fee of Rs. 10,000/- (exclusive of taxes) and other prescribed required documents.

- Now, in addition to DD, application fees can also be paid through National Electronic Fund Transfer (‘NEFT’) or other approved electronic/ online payment methods.

2.4 Contraventions not to be Compounded in Certain Cases

Erstwhile Foreign Exchange (Compounding Proceeding) Rules, 2000

- No contravention shall be compounded if an appeal has been filed under section 17 or section 19 of the Act.

- No such provision.

New Foreign Exchange (Compounding Proceeding) Rules, 2024

- Now, if the Adjudicating Authority has already passed an order imposing a penalty under section 13 of the Act, then such contravention shall not be compounded by RBI.

- Now, if the compounding authority believes that the contravention involved requires further investigation by ED to determine the amount of contravention under Section 13 of the Act, then such contravention shall not be compounded by RBI.

2.5 Delegation of Powers

Erstwhile Master Direction – Compounding of Contraventions Under FEMA,1999

- Kochi and Panaji Regional RBI Offices were permitted to compound the contraventions only if the sum involved was < Rs. 1 Cr, in case the office is headed by an officer below the rank of CGM.

- No explicit clarification was given about the jurisdiction of Regional Offices (RO) for submitting compounding applications related to foreign investment contraventions.

New Direction – Compounding of Contraventions Under FEMA,1999

- Now, both the Kochi and Panaji regional offices of RBI can compound the contraventions without any monetary limit, regardless of the officer’s rank

- A clarification has been provided stating that the jurisdiction for compounding applications concerning foreign investments will be based on the location of the registered office of the investee Indian company.

2.6 Indicative List of Administrative Actions

Erstwhile Master Direction – Compounding of Contraventions Under FEMA,1999

- An indicative list of what will be construed as completion of administrative action was not provided.

New Direction – Compounding of Contraventions Under FEMA, 1999

- Administrative action means actions necessary concerning the transactions involved in contravention and shall include such corrective action that shall be undertaken by the applicant to bring the transaction involved in compliance with FEMA.

- An Indicative list of the administrative action has been provided which includes:

-

- Obtaining necessary approvals/permissions from relevant authorities;

- Unwinding/reversing the transaction;

- Repatriating the receivable due;

- Compliance with pricing guidelines or submission of valuation certificate;

- Compliance with reporting requirements;

- Any other corrective action as may be required.

2.7 Computation Matrix

|

Type of contravention |

Formula |

| 1] Reporting Contraventions

A) FEMA 20/ FEMA 20(R)/FEMA 395 B) FEMA 3/ FEMA 3(R) C) FEMA 120/ FEMA 400 D) Any other reporting contraventions (except those in Row 2 below and of LO/BO/PO) |

Fixed amount: Rs10,000/- (applied once for each contravention in a compounding application) +

Variable amount as under: |

| E) Reporting contraventions by LO/BO/PO

|

As above, subject to ceiling of Rs.2 lakhs. In case of Project Office, the amount imposed shall be calculated on 10% of total project cost. |

| 2] AAC/APR/FLAR/Share certificate delays In case of non-submission/delayed submission of APR/share certificates (FEMA 120/FEMA 400) or AAC (FEMA 22/FEMA 22(R)) or FCGPR (B) or FLA Returns- FEMA 20/FEMA 20(R)/FEMA 120/FEMA 395/FEMA 400 |

Rs. 10,000/- per AAC/APR/FCGPR (B)/FLA Return delayed. Delayed receipt of share certificate – Rs. 10,000/- per year, the total amount being subject to ceiling of 300% of the amount invested |

| 3] A] Allotment/Refunds Non-allotment of shares or allotment/refund after the stipulated Period for Foreign InvestmentB] LO/BO/PO (Other than reporting contraventions mentioned in Para 1(v) above) |

Rs. 30,000/- + given percentage: 1st year: 0.30% 1-2 years: 0.35% 2-3 years: 0.40% 3-4 years: 0.45% 4-5 years: 0.50% >5 years: 0.75% (For project offices the amount of contravention shall be deemed to be 10% of the cost of project) |

| 4] Any Contravention pertaining to issuance of any guarantee (other than reporting contraventions)

|

Rs. 5,00,000/- + given percentage: 1st year: 0.050% 1-2 years: 0.055% 2-3 years: 0.060% 3-4 years: 0.065% 4-5 years: 0.070% >5 years: 0.075% In case the contravention includes issue of guarantees for raising loans which are invested back into India, the amount imposed may be trebled |

| 5] All other non reporting contraventions | Rs. 50,000/- + given percentage: 1st year: 0.50% 1-2 years: 0.55% |

| 5] (Contd.) | 2-3 years: 0.60% 3-4 years: 0.65% 4-5 years: 0.70% > 5 years: 0.75% |

Further points to be noted:

Erstwhile Master Direction – Compounding of Contraventions Under FEMA,1999

- If an applicant who has previously been compounded applies for compounding again for a similar contravention, the compounding fee may be increased by 50%.

New Direction – Compounding of Contraventions Under FEMA,1999

- If an applicant, against whom a compounding order was previously issued but the compounding amount remains unpaid, and re-applies for compounding concerning the same transaction, the revised compounding amount may be increased by 50% of the previously determined compounding amount, provided it does not exceed 300% of the contravention amount

3. Key Changes in Compounding Application Forms and Process

3.1 Changes in Compounding Application Form

Erstwhile Foreign Exchange (Compounding Proceeding) Rules, 2000

- Earlier, only the name of the adjudicating authority before whom the case was pending was required to be mentioned.

- No such field.

- Earlier, only the nature of the contravention according to Section 13(1) was required to be mentioned.

New Foreign Exchange (Compounding Proceeding) Rules, 2024

- Now, additional details are required to be mentioned such as:

-

- The notice issuance date,

- Whether the contravention falls under Section 37A or Section 3(a),

- Whether an adjudication order has been passed.

- The applicant is now required to state whether any compounding order was passed previously. If yes, the following details are required such as:

-

- The application date,

- The contravention details,

- Order date and payment confirmation from the Reserve Bank.

- Now, additional details are required to be mentioned such as:

-

- The relevant Act,

- The applicable Rules and Regulations,

- Notifications issued,

- Order issued under the authority of the Act,

- Condition under which the RBI granted the authorization,

- Previous compounding orders (if any)

3.2 Documentation & Payment

|

Particulars

|

Erstwhile Master Direction – Compounding of Contraventions Under FEMA, 1999 | New Direction – Compounding of Contraventions Under FEMA, 1999 |

| Prerequisite Documentation | Latest audited balance sheet was required to be submitted. | Latest audited balance sheet is not required to be submitted. |

| Online Payment Confirmation

|

No obligation as payment was only accepted via DD.

|

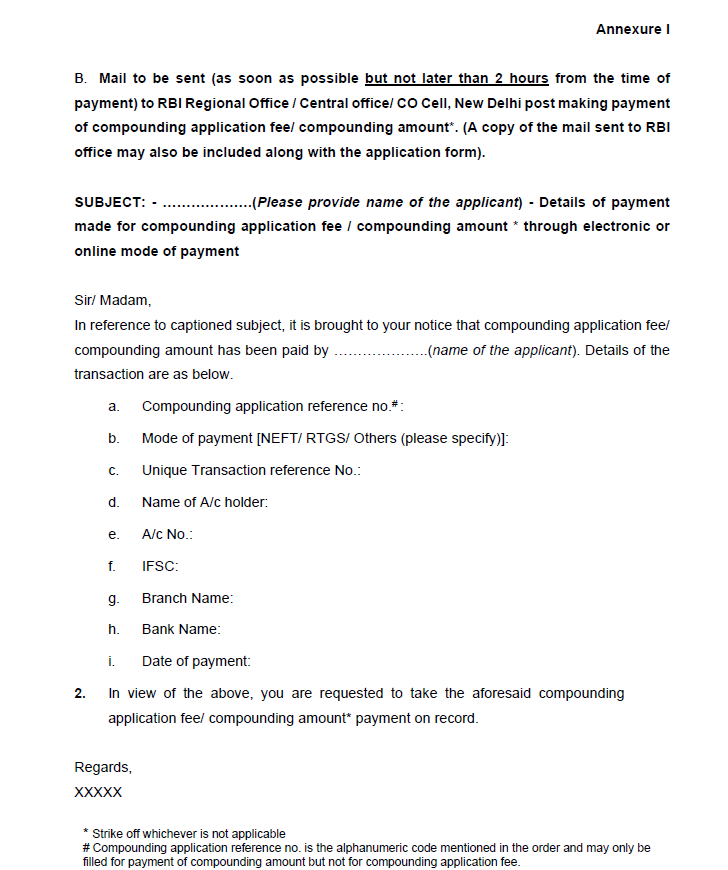

For online payment mode, confirmation is now required to be emailed to the respective RO in the specified template within 2 hours of the transactions. |

| Application Fees – return of compounding application | Rs. 5,000/- application fee was to be refunded to the applicant.

|

Now, the Rs. 10,000/- application fee will not be refunded if an application is returned. However, it will be adjusted in case the compounding application is resubmitted. |

4. PRAVAAH Portal for Compounding Application

4.1 PRAAVAH Portal

- The RBI recently launched the PRAAVAH Portal for streamlined online applications for regulatory approvals.

- The PRAVAAH portal, introduced by the RBI, aims to simplify the online application for regulatory approvals, providing individuals and entities with a streamlined platform. This initiative is set to enhance the efficiency of the RBI’s processes for granting regulatory approvals and clearances.

- Key Process includes below:

-

- Submit the application online on the portal

- Track and monitor the status of the application/reference

- Respond to any clarification or query from RBI regarding the application/reference

- Receive a decision from the Reserve Bank in a time-bound manner

- Current issues encountered while filing the application on the Pravaah Portal

-

- Pravaah registration must be completed in one step. If the login ID is created but the application is not submitted, it will be treated as if the registration process is incomplete.

- While saving a draft application, it becomes non-editable, indicating a technical glitch that prevents any further modifications.

- Currently, online payments can only be made through NEFT, as the form does not have an option to enter DD details.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA