[Analysis] Input Service Distributor (ISD) vs Cross Charge – Mechanism | Post Amendment by Finance Act, 2024

- Blog|GST & Customs|

- 15 Min Read

- By Taxmann

- |

- Last Updated on 2 September, 2024

By CA Naresh K. Sheth – Partner [Indirect Tax Division] | M/s. Jayantilal D Thakkar and Associates LLP

Table of Contents

- Cross Charge

- Input Service Distributor (ISD) – Mechanism

- Position Post Amendment by Finance Act, 2024

1. Cross Charge

1.1 Cross Charge – The Concept

- Two or more registered entities of same legal entity (whether or not in same State or Union Territory) are regarded as distinct persons – [Section 25(4) & (5) of CGST Act]

- Cross charge is not defined under GST law. It is a popular term used for charge by Head Office to Branch Offices (Distinct entities) and vice versa

- Following provisions read together, triggers the Cross Charge:

- Section 9 of CGST Act levies tax on ‘supply’ made by taxable person

- Section 7(1)(c) deems activities listed in Schedule I to CGST Act to be supply even if made without consideration

- Entry 2 of Schedule I to CGST Act provides that supply of goods or services made between distinct persons, in the course or furtherance of business shall be treated as supply even if made without consideration

- Internally generated services:

- Accounting services

- IT system management services

- CEO/CFO/CS services

- Compliance services

- HR services

- Brand name/Logo

- Marketing services

- External services (without GST)

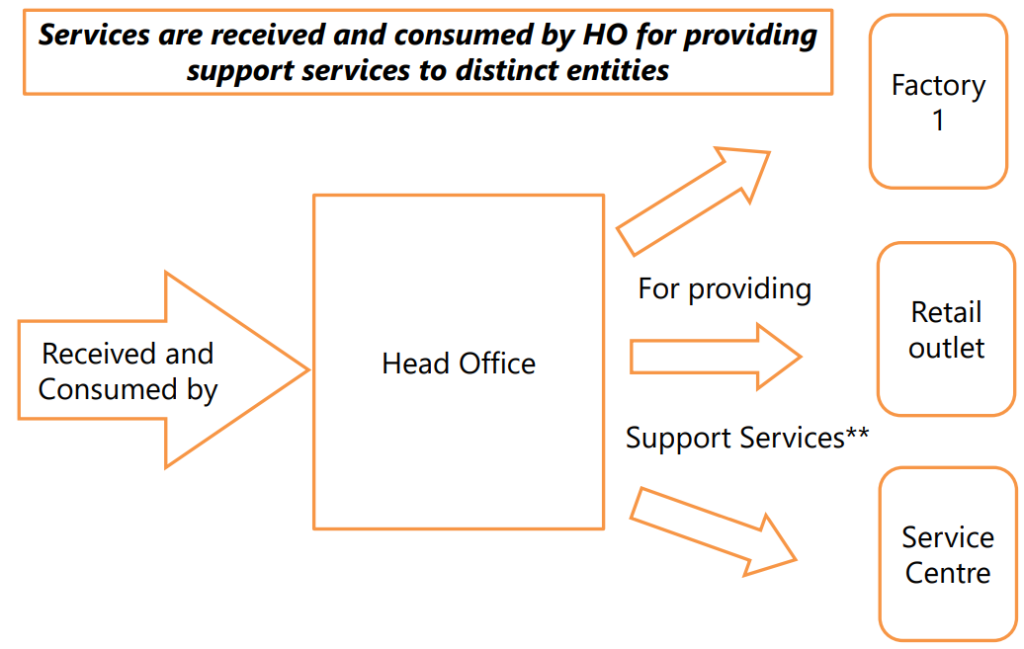

- In the case of multi-locational entities having separate registrations in same/different States/Union Territories (‘distinct entities’), HO performs the following functions for whole entity including branch offices:

| Accounting services | IT system management services | Procurement services | Brand name & logo usage |

| Human Resources | Compliance | IT consultancy support | CEO/CFO services |

These are treated as deemed supply under Schedule I of CGST Act and is liable to GST.

- Rule 28 of CGST Rules prescribes value of supply between distinct person as under:

-

- Open market value (‘OMV’) of supply;

- Where open market value is not available, value of supply of like kind and quality;

- If value is not determined under (i) and (ii) above, be the value as determined by application of Rule 30 and 31 of CGST Rules in that order;

[2nd proviso – Provided where recipient is eligible for full ITC, value declared in invoice deemed to be OMV]

1.2 Cross Charge – Issues

- Whether employee cost is to be included for deciding the value for cross charge to the distinct entities. Following Advance Ruling Authorities held that employee cost should be included for determining cross charge value:

-

- Columbia Asia Hospitals (P.) Ltd., In re [2018] 100 taxmann.com 501 (AAAR-KAR.)

- Cummins India Ltd., In re [2022] 134 taxmann.com 342 (AAAR-MAHARASHTRA.)

The above-referred controversy is set right by CBIC Circular No. 199/11/2023-GST dt. 17-07-2023 wherein it is clarified at point no. 3 of the table given in para 3 as under:

“In respect of internally generated services provided by the HO to BOs, the cost of salary of employees of the HO, involved in providing the said services to the BOs, is not mandatorily required to be included while computing the taxable value of the supply of such services, even in cases where full input tax credit is not available to the concerned BO.”

- How to interpret the phrase ‘recipient is eligible to full ITC’?:

-

- Where the distinct person deals exclusively in taxable supplies;

- Where the distinct person deals exclusively in exempt supplies;

- Where distinct person deals with taxable as well as exempt supplies;

- Where distinct person is SEZ unit having 100% export turnover;

- Where distinct person is EOU having 100% export turnover;

2. Input Service Distributor (ISD) – Mechanism

2.1 Relevance of ISD Mechanism

- Concept of ISD was introduced in Central Excise Regime to enable business entity to avail CENVAT Credit of services procured by centralized location and to distribute the credit to various factories registered under separate Excise Registration

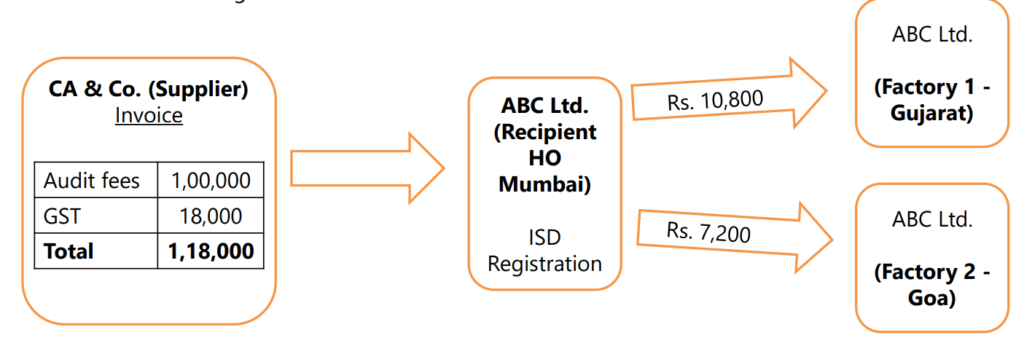

- A business entity may have multiple registrations in GST Regime and hence a necessity to ensure proper distribution of tax credits taken by centralized/Head office among various registrations

- GST, being a destination-based consumption tax, the revenue accrues and flows to the consumption state and Input Tax Credit (ITC) should travel along with tax revenue to consumption state

- Consumption state getting tax revenue should bear the burden of ITC and not the state in which centralized office of entity is procuring services and receiving the tax invoices from vendors

- Multi-locational entities usually have centralized accounting and/or centralized payment system wherein, Head office receives and accounts for invoices for services consumed by its distinct entities having separate registration

- ISD facilitates the transfer of ITC from centralised office receiving the tax invoices for services to the offices consuming said services

- In the absence of ISD Mechanism:

-

- Centralized/Head office cannot claim ITC as corresponding input services are not used by it exclusively for its own business; and

- Distinct entities receiving the services cannot claim ITC as vendor’s invoices are not in their name

- ITC Distribution through ISD Mechanism:

- ISD mechanism enables ITC to travel from Maharashtra (HO location) to service consumption units in Gujarat and Goa

2.2 ISD – Legal Framework

| Sr. No. | Relevant Section/Rule | Particulars |

| 1. | Section 2(61) of CGST Act | Definition of Input Service Distributor (ISD) |

| 2. | Section 24 (viii) of CGST Act | Compulsory Registration for Input Service Distributor (ISD) |

| 3. | Section 25(4) & (5) of CGST Act | Multiple registrations are deemed to be distinct persons |

| 4. | Proviso to Rule 8(1) of CGST Rules | Separate Application to be done for ISD Registration even for assessee who has regular registration as supplier |

| 5. | Rule 36(1) of CGST Rules | Allows ISD to avail ITC based on invoices issued by supplier u/s 31 of CGST Act |

| 6. | Rule 36(1) of CGST Rules | Allows separate registration of establishment of same business entity to take credit based on invoices or debit notes issued by ISD. |

| 7. | Rule 54 of CGST Rules | Prescribes details to be furnished in invoice issued by ISD |

| 8. | Section 20 of CGST Act | Provides manner of distribution of ITC by ISD |

| 9. | Rule 39 of CGST Rules | Prescribes procedure for distribution of ITC by ISD |

| 10. | Section 39(4) of CGST Act | ISD return to be filed on monthly basis on or before 13th of next month |

| 11. | Rule 65 of CGST Rules | Prescribes form and manner of submission of ISD returns |

| 12. | Section 21 of CGST Act | Provides for recovery of excess credit distributed to any unit along with interest and proceedings under Section 73 or 74 of the CGST Act |

| 13. | Section 122(ix) of CGST Act | Provides for penalty for improper availment or distribution of ITC by ISD |

2.3 Definition of Input Service Distributor [Section 2(61)]

![Definition of Input Service Distributor [Section 2(61)]](https://www.taxmann.com/post/wp-content/uploads/2024/09/Capture-3-1024x505.png)

2.4 ISD – Salient Features

- ISD is relevant for multi-locational entities having separate GST Registration in a different state/Union Territory (UT) or in the same state/UT for following:

-

- Factories

- Depos

- Retail Outlets

- Branch

- Divisions

- Service Outlets

- ISD mechanism cannot be used for transfer of credit to holding company, subsidiary company, group entities, related parties as they have different PAN

- ISD can be used only for transfer of ITC pertaining to Input Services including activities listed in Schedule II of CGST Act as deemed services

- ISD Registration cannot avail and distribute ITC pertaining to:

-

- Input Goods; and

- Capital Goods

- Section 24 of the CGST Act mandates an ISD to obtain a separate registration which is different from normal registration taken as a supplier and recipient of goods and services u/s 22 of CGST Act

- ISD is neither a supplier nor recipient of goods/services

- ISD is solely used for availing and distributing common ITC amongst distinct persons and such distinct persons can utilize such ITC to discharge its output liability

2.5 Availment of ITC by ISD

- ISD can avail the ITC based on:

-

- Invoices issued by the supplier of services u/s 31 of CGST Act

- Debit Notes issued by supplier of services u/s 34 of CGST Act

- ITC transferred from regular registration in the same state under Rule 54(1A)(a)

- ISD will be able to avail ITC only on invoices appearing in its GSTR-2A/2B

- Vendors providing common services used by HO and distinct persons should raise the invoice on ISD

- In case where vendor provides services exclusively used by a distinct person, he may raise invoice directly on the distinct person or on ISD. If invoice is raised on ISD, ITC will be distributed to said distinct person only

2.6 Manner of Distribution of Credit by ISD – Section 20(1)

| Scenario | Category of Input Tax | Nature of tax to be distributed/Nature of ITC to be availed by recipient |

| Where ISD and recipient both are located in same State/Union Territory (UT) | Integrated Tax* | Integrated Tax* |

| Central Tax* | Central Tax* | |

| State/Union Territory Tax | State Tax/Union Territory Tax | |

| Where ISD and recipient both are located in different States/Union Territories (UT) | Integrated Tax | Integrated Tax |

| Central Tax | Integrated Tax | |

| State/Union Territory Tax | Integrated Tax |

* Section 20 permits distribution of IGST as IGST or CGST. Similarly, it permits distribution of CGST as CGST or IGST where ISD and recipient are in the same State/UT. However, Rule 39(1)(e) provides for distribution of IGST as IGST only. Similarly, Rule 39(1)(f) provides for distribution of CGST as CGST only

2.7 Conditions/Restrictions for Distribution of ITC – Section 20(2)

- Credit should be distributed through prescribed document containing prescribed details [ISD invoice prescribed u/r 54(1) of CGST Rules]

- Amount of credit distributed should not exceed Amount of credit available

- Credit of input services attributable to a recipient to be distributed only to that recipient

- Credit of input services attributable to more than one recipient/all recipients to be distributed on Pro rata basis i.e. = Turnover (T/O) of individual unit/Aggregate T/O of all units During the Relevant Period

- Meaning of turnover:

Taxable supplies + Exempt supplies.

Exclusion – Supplies liable to tax under RCM and CGST, SGST, UTGST, IGST and Cess

- Meaning of relevant period:

| Scenario | Relevant period |

| Recipients of the credit have turnover in their States/Union Territories in Preceding Financial Year | Preceding Financial year |

| Some/all recipients of credit do not have any Turnover in their States/Union Territories in Preceding Financial Year | Last quarter for which details of such turnover of all the recipients are available, previous to the month during which credit is to be distributed |

2.8 ISD – Documentation

- Recipient units can take ITC based on ISD invoice issued by the ISD u/r 54(1) of CGST Rules

- ISD Invoice should contain the following particulars:

-

- Name, address and Goods and Service Tax Identification Number (GSTIN) of the Input Service Distributor

- A consecutive serial number not exceeding 16 characters

- Date of issue

- Name, address and GSTIN of the recipient to whom the credit is distributed

- Amount of credit distributed

- Signature or digital signature of the Input Service Distributor or his Authorised representative

- Reduction of ITC on account of Credit Note (‘CN’):

-

- Supplier/vendor issues CN to ISD for sales return/short or non-provision of service

- ISD shall issue ISD-CN to operational units

- ITC on account of ISD-CN shall be reduced in same proportion in which the credit was distributed on original invoice

- ITC shall be reduced from the amount to be distributed in the month in which CN is included in Form GSTR-6

- Where ITC to be reduced exceeds ITC to be distributed for a particular unit, difference shall be added to the output liability of the recipient unit

2.9 ITC Distribution by ISD – Other Relevant Points

- ITC should be distributed on monthly basis

- ITC available for distribution in a month should be distributed in the same month

- Details of distribution to be furnished in Form No. GSTR-6 on or before 13th day of subsequent month

- A ‘Nil return’ must be filed even if no ITC is available for distribution in the month

- Late fee of Rs. 50 per day is payable for delay in filing of Form GSTR-6

- ISD to identify the blocked credits and ineligible credit and separately distribute eligible ITC and ineligible ITC.

- Credit needs to be distributed among all units whether it is:

-

- Taxable unit

- Non-taxable unit

- Fully exempt unit

- Export-oriented unit

- SEZ

- ITC wrongly distributed to a particular recipient or ITC distributed in wrong proportion:

-

- Issue ISD-CN to the recipient to whom it was wrongly distributed/excess distributed

- Issue ISD invoice to recipient to whom it actually pertains to whom it was short distributed

- Export-oriented unit can use the ISD credit:

-

- To pay IGST on export with payment of tax

- To discharge its liability on domestic transactions

- Claim refund of ISD Credit as part of unutilised ITC

- SEZ Unit can use the ISD Credit:

-

- To pay IGST on export with payment of tax

- To discharge its liability on domestic transactions

- Claim refund of ISD Credit as part of unutilized ITC [Britannia Industries Ltd. vs. Union of India [2020] 122 taxmann.com 32 (Guj.)

- ISD Credit distributed to non-taxable unit or fully exempt unit shall become a cost to the entity

- Recovery of credit distributed in excess [Section 21]

-

- Same can be recovered from such recipient along with interest u/s 73 or 74 of the Act

- Penalty for taking or distributing ITC in contravention of Section 20 [Section 122(1)(ix)]

-

- Higher of Rs. 10,000/- or amount of ITC availed or ITC distributed irregularly

2.10 ISD – Some Issues

- Whether ISD mechanism applies only to those services which are exclusively used by distinct entities or also to common services used by distinct entities for which invoices are received and accounted for by Centralised Office?

-

- ITC in respect of services exclusively used by distinct entities can be routed through ISD and same should be distributed only to such distinct entities

Whether ITC in respect of following common services used by distinct entities should necessarily be distributed to all such distinct entities or it can be cross charged?

| Audit services | Tax consultant services | Legal services |

| Banking services | HO Rent | Security Services at HO |

| Royalty for IPR | Advertising services | Software services |

| Telephone services | Staff insurance | Recruitment services |

- Based on the following reasoning, GST authorities may take a view that ISD is mandatory and not optional:

- Above services are common services used by distinct entities and hence credit thereof should be transferred to respective distinct entities through ISD mechanism

- ITC thereof cannot be availed by HO or centralized office

- Section 24(viii) of CGST Act mandates compulsory registration for ISD irrespective of turnover

- Rule 39(1) starts with the words “The input service distributor shall distribute the input tax credit”. The word ‘shall’ denote compulsion

- Haryana AAR in case of Tata Sia Airlines Ltd., In re [2021] 124 taxmann.com 93 (AAR-HARYANA) held that ISD is mandatory

- Maharashtra AAR in case of Cummins India Limited, In re [2019] 103 taxmann.com 126 (AAR-MAHARASHTRA) held that ISD is mandatory

- The statute specifically provides for option wherever there is a legislative intent to grant an option to taxpayer. Such option has not been specifically granted in respect of ISD

- Treating ISD Registration as optional will make the provision redundant. It is settled legal principle that no provision should be treated as superfluous or redundant [Supreme Court in case of UOI vs Braj Nandan Singh [Civil Appeal No. 4406 of 2005, Dt. 19/10/2005]

- Based on the following reasoning, a strong view emerges that ISD is optional and not mandatory:

-

- Prior to amendment brough by Finance Act, 2024, section 20(2) of CGST Act read as under:

‘(2) The input service distributor may distribute the credit subject to following conditions’ - HO is a separate entity under GST Legislation. It consumes common services to provide support services to its distinct entities. The business of the HO is to run and support the branches. Hence the credit thereof should be taken by HO and it need not be distributed through ISD to distinct entities

- CBIC, in its FAQ on Banking, Insurance and Stock Broker Services, has clarified that HO has an option to either cross charge the services or to raise an ISD invoice

- GST Council in its 50th meeting clarified that there is no intent in the present provision of CGST Act to make ISD mechanism mandatory and accordingly it may be clarified through the circular

- CBIC in its Circular No. 199/11/2023-GST dated 17.07.2023 has clarified that as per the present provisions of CGST Act and CGST Rules, it is not mandatory for HO to distribute ITC by ISD mechanism

- CBIC Circulars are binding on the tax authorities

- Prior to amendment brough by Finance Act, 2024, section 20(2) of CGST Act read as under:

- Section 20(2) of CGST Act is amended by Finance Act, 2024 and amended provision reads as under:

‘(2) The input service distributor shall distribute the credit..’

Amended provision will be effective from the date to be notified. Hence, inference can be drawn that ISD is optional till the amendment is notified. - Whether ISD can avail credit in respect of tax paid under RCM?

-

- ISD is defined u/s 2(61) to mean office receiving tax invoice issued u/s 31 of CGST Act by the supplier wherein GST is charged.

- In case of RCM, supplier does not issue the tax invoice u/s 31 of CGST Act and charge GST in invoice

- Section 9(3) of CGST Act casts an obligation on recipient of goods/services to pay tax under RCM. As ISD is not the recipient of goods/services, it cannot make RCM payment

- Section 9(4) of CGST Act casts an obligation on registered person receiving specified goods/services to pay tax under RCM. ISD registration does not make an assessee a “registered person” for the purpose of payment of GST under RCM.

- GSTR-6 does not provide any space for showing details of inward supplies on which payment is to be made under RCM

- RCM liability for common expenses may be accounted for and discharged by the normal registration of HO and thereafter such ITC may be transferred to ISD under Rule 54(1A)(a)

- The Finance Act, 2024 has amended the definition of ISD u/s 2(61) of CGST Act. It has also amended Section 20(1) of CGST Act to enable ISD to distribute ITC on RCM payments. However, this amendments are yet to be notified and will be effective from date to be notified.

- Can ISD take ITC of invoices of a particular FY on or after 30th November succeeding said Financial year?

-

- Section 16(4) applies to a registered person

- Section 2(94) defines registered person to mean a person registered u/s 25 of CGST Act

- ISD is registered u/s 25 r.w. section 24 of CGST Act

- Hence, ISD is bound by time limit prescribed by section 16(4) for taking the ITC in respect of an invoice

- In case where payment to vendor is delayed beyond 180 days whether ITC is to be reversed by ISD or distinct entity to which such ITC was distributed?

-

- Proviso to section 16(2) applies to recipient

- Section 2(93) defines recipient to mean person liable to pay consideration

- HO (ISD registration) is person liable to pay consideration

- Hence, it appears that ISD needs to reverse such ITC

- ISD will have to raise ISD-CN on the distinct entities for recovery of excess credit distributed on this account

- How to distribute the credit through ISD mechanism in following case:

-

- Business entity is having its registered office and ISD registration in Maharashtra

- It has marketing and administrative office at Gurgaon, Haryana

- Gurgaon office premises is on lease

- Lessor is based in Gurgaon is instructed to raise invoice on ISD

- Lessor charges CGST & SGST on the lease rental

- Whether ISD and cross charge can be used interchangeably?

- Business Entity has a registered unit in state (other than state in which ISD is registered) exclusively dealing in exempt supply. Whether business entity can cancel the GST registration and avoid distribution of ITC on this unit?

3. Position Post Amendment by Finance Act, 2024

3.1 Amendment by Finance Act, 2024

- Finance Act, 2024 has made substantive amendment relating to ISD provisions

- Definition of ‘Input Service Distributor’ u/s 2(61) of CGST Act is amended to allow distribution of ITC of invoices in respect of services liable to RCM u/s 9(3) and 9(4) of CGST Act

- Section 20 of CGST Act is amended to make ISD provisions mandatory by replacing the word ‘may’ by ‘shall’

- Section 20(1) of CGST Act is amended to allow ISD to distribute ITC in respect of payment made under RCM

- Above provisions are yet to be notified

- Once notified, ISD mechanism will become mandatory in addition to the requirement of cross charge. In short, both ISD distribution and cross charge will operate simultaneously

3.2 Applicability of Cross Charge and ISD Post Amendment

- Cross charge and ISD are two different concepts:

-

- Cross charge is a charge of tax on deemed supply made by HO/centralized office to its distinct entities

- ISD is meant for distribution of common ITC of invoices received by HO amongst the distinct entities

- Inference can be drawn from Circular No. 199/11/2023-GST dt. 17-07-2023 as to when ITC is to be distributed through ISD or when cross charge is to be done

- When cross charge is to be done?

-

- Entry 2 of Sch. I provides that supply of goods or services between distinct person is liable to GST even though made without consideration

- Cross charge is attracted on supply of goods or services to distinct persons

- Cross charge would be for internal transactions between HO and distinct persons

- When credit is to be distributed through ISD?

-

- ISD is defined u/s 2(61) of CGST Act to mean an office of supplier of goods or services which receives invoices for input services for the purpose of distributing the same to its distinct persons

- ISD comes into play when HO receives invoices in for input services pertaining to one or more distinct persons

- ISD is applicable for supplies procured from external vendors and invoices are received by centralized office

3.3 External Services and Internally Generated Services

- For the sake of simplicity in understanding, transactions between distinct persons into following buckets:

-

- External services at entity level – Procuring input services (common to all the units/distinct persons) from external/third party suppliers [These are also referred to as ‘common input services’]

- Internal transactions – Activities performed by HO for entity as a whole benefitting its branches, divisions, units etc. having separate GSTIN

External expenses at entity level

- Audit fees

- Fees of income tax consultants

- Advocate fees

- Advertisement services

- Banking services

Internal transactions

- IT, HR & admin support

- Payroll processing

- Salary of CEO, CFO & topmanagement

3.4 Way Forward

- Once the amendment made by Finance Act, 2024 in section 2(61) and section 20 of CGST Act are notified, it will be necessary for business entities to go for ISD as well as Cross Charge

- Multi locational business entity (having multiple registrations) should identify the services to be cross charged and services which are to be routed through ISD

| Internally generated services and external common services procured without GST | Cross Charge |

| Input services are just procured by HO (and not used/consumed) which is pertaining to all the units | ISD |

- Obtain ISD Registration at earliest

- Intimate (through PO/work order) ISD registration number to vendors supplying services for which ITC distribution is to be done through ISD

- Regular GST registration should not be given to vendors for services for which ITC distribution is to be done through ISD

- The ERP systems and documentation needs to be modified suitably

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA