[Analysis] GST on Hotel Accommodation Services – Rates | Tax Implications | ITC Eligibility

- Blog|GST & Customs|

- 13 Min Read

- By Taxmann

- |

- Last Updated on 7 November, 2024

GST on hotel accommodation services refers to the Goods and Services Tax applied to room tariffs based on the actual transaction value. The applicable rates are tiered: no GST for tariffs up to ₹1000 per night, 12% for tariffs between ₹1001 and ₹7500, and 18% for tariffs above ₹7500. These rates have been revised several times since GST's introduction in 2017. Unlike the pre-GST regime, hotels can now avail input tax credit (ITC), which allows them to offset the tax paid on inputs against the tax payable on the final service.

By Rahul Pansari – Lead [Indirect Tax] | Aeka Advisors India LLP

Table of Content

1. Industry Overview

- In 2023, the direct contribution of tourism & hospitality industry to India’s GDP was over 231 billion U.S. dollars

- Market size is estimated at USD 247.31 billion in 2024 and is expected to reach USD 475.37 billion by 2029

- International tourist arrivals are expected to reach 30.5 million by 2028

- According to WTTC, over the next decade, India’s Travel & Tourism’s GDP is expected to grow at an average of 7.1% annually.

2. Hotel Sector

2.1 Revenue streams of Hotel industry

2.1.1 Accommodation services

- Room tariff

- Additional bed charges

- Early check in charges

- Late checkout charges

2.1.2 Food and Beverages

- Dine-in at restaurant

- In-room dining and minibar

- Takeaway/delivery of food

- Outdoor catering

- Sale of cocktail/liquor

2.1.3 Miscellaneous Income

- Spa and fitness center

- Banquet hall/Business center

- Laundry services

- Events such as New Year eve, Christmas, Sunday brunch, etc.

- Transport facilities

2.2 Journey So Far

Pre- GST regime

- Service tax on room stay at 9% (abated)

- State luxury charge based on declared tariff

1st July 2017 to 26th July 2018

- Rate determination based on slabs of ‘declared tariffs’ of the room

From 27th July 2018

Based on actual transaction value

- Upto 999 – Exempt

- 1000-2499 – 12%

- 2500 – 7499 – 18%

- >=7500 – 28%

W.e.f 1st October 2019

Based on actual transaction value

- Upto 1000 – Exempt

- 1001 – 7500 – 12%

- More than 7500 – 18%

W.e.f 18th July 2022

Based on actual transaction value

- Upto 7500 – 12%

- More than 7500 – 18%

- ITC available under GST regime unlike pre- GST regime

- July 2018- Significant relaxation to industry change in mechanism of rate determination

- Multiple changes in rates

- Explained with illustration in ensuing slides

2.3 Illustration – Tax rates across various time periods

| Tariff per night (Declared/Actual) | Pre-GST | Under GST (Till 26th July, 2018) | 27th July, 2018 to 30th Sept, 2019 | From 1st Oct, 2019 | |||

| Till 30th June, 2017 | Rate | Amount | Rate | Amount | Rate | Amount | |

| Declared Tariff | 8000 | 8000 | Irrelevant | Irrelevant | |||

| Room tariff (Actual value charged) | 7000 | 7000 | 7000 | 7000 | |||

| Luxury charge on stay (say 10%) | 700 | ||||||

| Service Tax 9% (with abatement of 40%) | 630 | ||||||

| GST (Actual value charged * Rate) | 28% | 1960 | 18% | 1260 | 12% | 840 | |

| Total Bill | 8330 | 8960 | 8260 | 7840 | |||

| Whether Input tax credit allowed | Not allowed | ITC can be availed under GST regime | |||||

- Challenges in determining the declared tariff due to dynamic and demand/tariff-based pricing techniques

- No law requiring hotels to publish “declared tariff” unlike luxury tax regime

- During Assessments or investigation for periods till July 2018, how to substantiate the correctness of GST rate adopted by hotels?

2.4 Issues

2.4.1 Taxability – Classification and Value

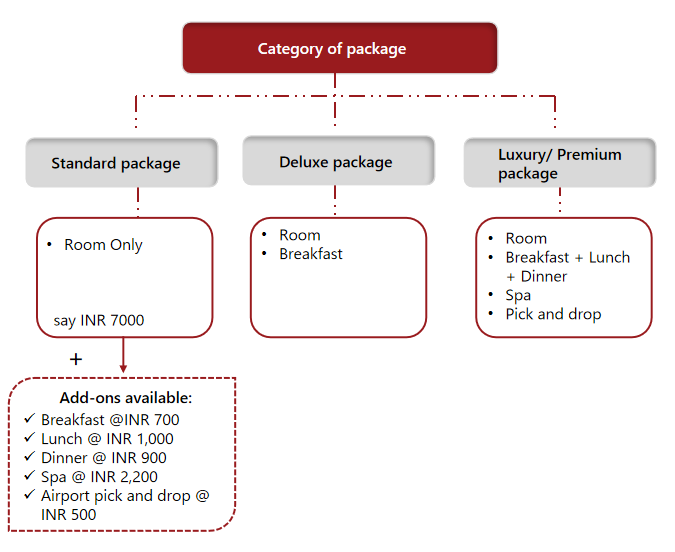

What will be the tax implication on such breakfast, lunch, dinner, spa, pick and drop services provided along with hotel accommodation?

- Composite Supply

- Mixed Supply

- Individual Supply

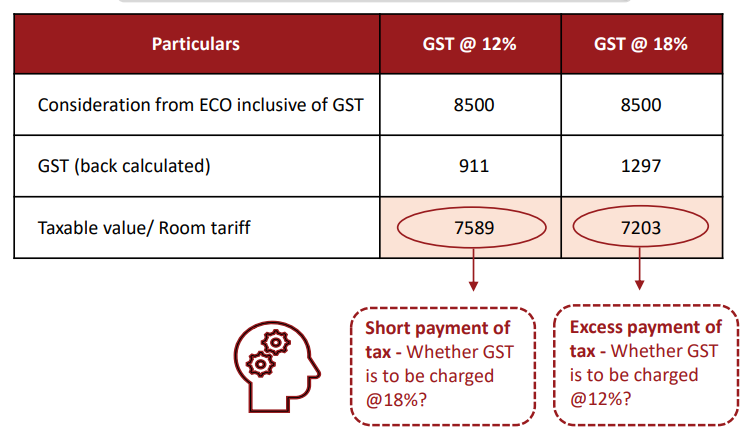

2.4.2 Influence of pricing strategies on tax outcomes

- Room tariff is decided by Hotel sales team and communicated to ECO

- Tariff is inclusive of the GST amount

- GST rate to be charged in the below specific scenario where tariff is between INR 8400 to 8851

Inclusive Pricing

| Particulars | GST @ 12% | GST @ 18% |

| Room tariff (Base value) | 7500 | 7501 |

| GST | 900 | 1350 |

| Invoice Amount | 8400 | 8851 |

Sales team should be sensitized on such pricing issues to avoid practical challenges

2.4.3 Taxability – Early check-in and Late check-out

Illustration

| Particulars | Rate per day | Applicable Tax rate |

| Early check-in charges | 500 | ? |

| Day-1 Room tariff | 7200 | 12% |

| Day-2 Room tariff | 7900 | 18% |

| Late check-out charges | 950 | ? |

Possible Views

Whether it is a composite supply?

- Proportionately tax the said charges basis rates of Day 1 and Day 2 both

- Tag the early check-in charges with the first day’s rate and late check-out with the last day

- Apply the highest tax rate of that booking

- Standalone supply of time share usage rights – whether exempt before 18th July 2022?

Facts

- Early check-in and Late check-out facility provided on payment of additional charges

- Late check-out charges are generally accounted for different room night in hotel’s accounting system

Practical issues

- Whether the same has to be clubbed with the subsequent/preceding day’s tariff?

- Whether it qualifies as supply of time share usage rights by way of accommodation?

- For determination of rate, whether the charges would increase the value of supply?

- In case of multi-days booking liable to different GST rates, which rate shall be considered on these charges?

2.4.4 Impact of declared tariff on rate of GST

| Particulars | Day – 1 | Day – 2 | Day – 3 |

| Declared Tariff | 7000 | 8000 | 7200 |

| GST on restaurant service | 5% | ? | ? |

| Availability ITC | No | ? | ? |

Notification 20/2019 Central tax (Rate) dated 30th September 2019

- Supply of ‘restaurant service’ other than at ‘specified premises’ – GST @ 5% (Without ITC)

- Supply of ‘restaurant service’ at ‘specified premises’ – GST @ 18% (With ITC)

‘Declared tariff’ means charges for all amenities provided in the unit of accommodation (given on rent for stay) like furniture, air conditioner, refrigerators or any other amenities, but without excluding any discount offered on the published charges for such unit.

‘Specified premises’ means premises providing ‘hotel accommodation’ services having declared tariff of any unit of accommodation above INR 7500 per unit per day or equivalent.

Where declared tariff fluctuates on daily or periodical basis, should the GST rate and availability of ITC also vary?

Practical challenges in complying with Section 18(1) and Section 18(4), along with Rule 40 and Rule 44, concerning the availment and reversal of input tax credit when transitioning from exempt to taxable supplies, and vice versa, from taxable to exempt supplies

2.4.5 No show/Cancellation

Scenarios

- Scenario I – Advance (non-refundable) is paid and no show/no prior intimation of cancellation

- Scenario II – Prior intimation of cancellation – Cancellation fee is being charged (lump sum or as a % of room tariff)

- Cancellation fee are the charges for the costs involved in making arrangements for the intended supply and the costs involved in cancellation of the supply

- Hence, should also be assessed at the same rate as applicable to the service contract

Issues

- Taxability – whether these amounts will be liable to GST?

- Classification – whether it is a hotel service (HSN 9963) or agreeing to tolerate the act (HSN 9997) or any other category?

- Rate – what is the rate applicable?

M/s Lemon Tree Hotel vs. Comm (2019-VIL-789-CESTAT-DEL-ST)

M/S. EIH LTD. vs. COMMISSIONER OF CGST, MUMBAI (2023 (5) TMI 808 – CESTAT MUMBAI)

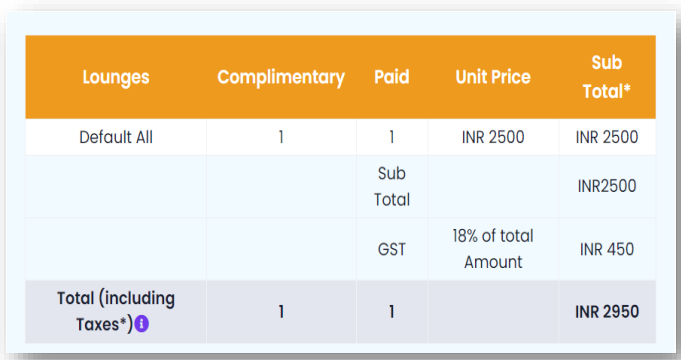

2.4.6. Taxability of Airport lounge

Key services offered in Airport lounge

- Comfortable seating and recliners @ 18%

- Complimentary food and drinks @ 5%

- Free Wi-Fi and charging stations @ 18%

- Business workstations and printers @ 18%

- Entertainment, TV, Games @18%/28%

- Private shower and restrooms @ Nil

2.4.7 Other issues

- Classification for hotel rooms purchased in bulk by a tour operator and sold to individual customers – accommodation service or tour operator service (996311 vs 998552) – contrary advance ruling

- Conferences hosted by hotels where the charges are calculated on a per-plate basis

- ITC eligibility on goods & services used for construction of hotel – Pending before Supreme Court

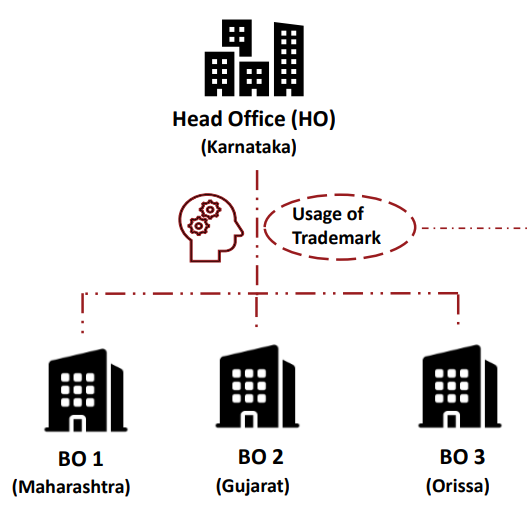

- Usage of Brand – by head office to the branches in other state/franchisee units

- Loyalty Programs

3. Food & Beverages (F&B) Sector

3.1 Journey so far

1st July, 2017

- Non-Ac restaurants – 12%

- AC restaurants – 18%

- Restaurants serving liquor – 18%

- Outdoor catering – 18%

– With ITC

15th Nov, 2017

- Restaurants – 5% (without ITC)

- Restaurants in hotel >7500 – 18% (with ITC)

- Outdoor catering – 18% (with ITC)

27th July, 2018

- Food supply to institutions under contract on regular basis – 5% (without ITC) – Explanation inserted

- Event based or occasional catering – 18% (with ITC)

1st Oct, 2019

- Rationalization of tariff entries

- Restaurant and outdoor catering (in specified premises) – 18% with ITC

- Other than specified premises – 5% without ITC

‘Specified premises’ means premises providing ‘hotel accommodation’ services having declared tariff of any unit of accommodation above INR 7500 per unit per day or equivalent.

3.2 Classification

Entry 6 (b) of Schedule II

6. Composite supply

The following composite supplies shall be treated as a supply of services, namely:-

a) ………; and

b) supply, by way of or as part of any service or in any other manner whatsoever, of goods, being food or any other article for human consumption or any drink (other than alcoholic liquor for human consumption), where such supply or service is for cash, deferred payment or other valuable consideration.

Definition of restaurant service as per Rate notification

‘Restaurant service’ means

- Supply of goods, being food or any other article for human consumption or any drink,

- by way of or as part of any service

- provided by a restaurant, eating joint including mess, canteen,

- whether for consumption on or away from the premises where such food or any other article for human consumption or drink is supplied.

3.3 Taxability of Cloud Kitchen

Restaurant

Includes:

- Restaurant space and furniture

- Air-conditioning

- Well-trained waiters

- Linen, cutlery and crockery, music…

Cloud Kitchen

Includes:

- Supply of food

- Takeaway services

- Door delivery services

High Court of Madras (W.P. Nos. 13469 of 2020) in the case of Anjappar Chettinad A/C Restaurant

“Restaurants provide a number of services normally in combination with the meal and/or beverage for a consolidated charge. These services relate to the use of restaurant space and furniture, air-conditioning, well-trained waiters, linen, cutlery and crockery, music, live or otherwise, or a dance floor……..

In the case of take-away or food parcels, the aforesaid attributes are conspicuous by their absence….. provision of food and drink to be taken-away in parcels by restaurants tantamount to the sale of food and drink and does not attract service tax under the Act.”

Circular No. 164 /20 /2021-GST dated 06th October, 2021

- The explanatory notes to the classification of service state that “restaurant service” includes services provided by Restaurants, Cafes and similar eating facilities including takeaway services, room services and door delivery of food.

- Takeaway services and door delivery services for consumption of food are also considered as restaurant service.

3.4 Issues

3.4.1 Consumable pre-packaged goods

Supply of pre-packaged goods

- Restaurant premise

- Takeaway counters

- Advance Ruling in case of M/s. Kundan Misthan Bhandar, Uttarakhand [2019 (24) G.S.T.L. 94 (App A.A.R. – GST)].

- Gujarat High Court judgement in case of HRPL Restaurants Pvt. Ltd, (2023) 4 Centax 410 (A.A.R. – GST – Guj.)

Taxability – depends upon the intention of parties, nature of outlet and element of service involved

- Whether that will be considered as supply of “goods” or supply of “services”?

- Whether the Tax treatment would differ in case:

-

- These items are consumed in premise of the restaurant

- Takeaway by customers

- Examples

-

- Restaurant supplying biryani (5%) and cold drink (28%+12%)

- Sweet shop selling namkeens, chocolates etc. through takeaway counter (Goods vs Service)?

3.4.2 GST on Trademark Usage

- Old issue in a new industry

- Whether Trademark is registered for a single state or for the company as a whole?

- Given there is no concept of distinct person in The Trade Marks Act, whether the deeming fiction of GST Law can be applied?

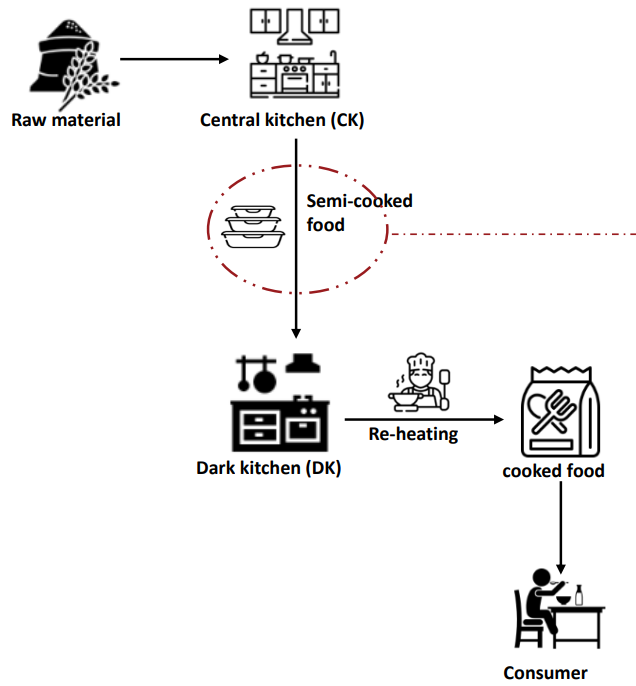

3.4.3 Transactions between CK and DK

Supply of goods?

GST @ 0%/5%/12%/18% (With ITC)

or

Supply of restaurant services?

GST @ 5% (Without ITC)

Multi-state restaurant chains should evaluate appropriate structure to avoid the GST leakage

3.4.4 Discounts through Dineout/Gold

Invoice

| Particulars | Amount |

| Taxable value | 1200 |

| GST @ 5% | 60 |

| Total Amount | 1260 |

Actual Payment

| Particulars | Amount |

| Invoice Amount | 1260 |

| Discount @ 25% (Borne by restaurant) | 315 |

| Net payment | 945 |

- Whether the benefit of GST adjustment on discount can be claimed?

- Practical challenges in disclosing on-invoice discount

- Can credit note be issued?

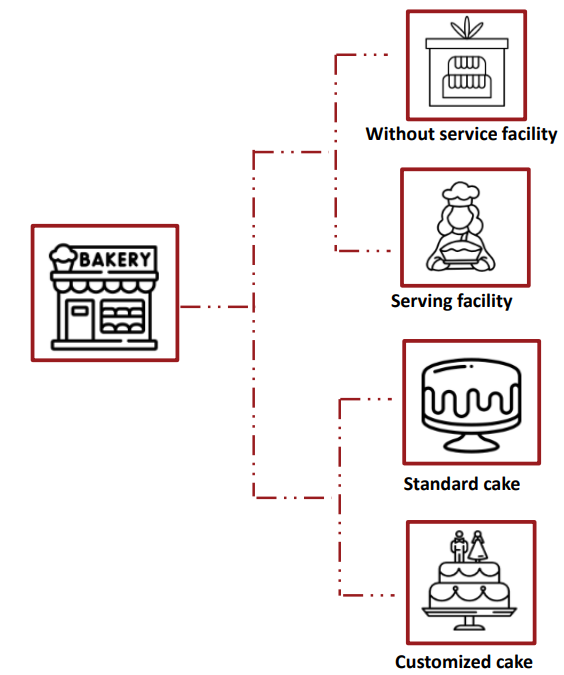

3.4.5 Bakery supplies

Supply of goods?

| HSN | Description | Rate | ITC |

| 1905 | Pastry, cakes, biscuits and other bakers | 18% | Available |

OR

Supply of restaurant services?

| HSN | Description | Rate | ITC |

| 9963 | Supply of ‘restaurant service’ other than at ‘specified premises’ | 5% | Not Available |

3.4.6 Packaging charge on ECO supplies

Invoice

| Particulars | Amount |

| Food & beverages (restaurant services) | 50 |

| Packaging charges | 40 |

| Taxable Amount | 540 |

| GST @ 5% | 27 |

| Invoice Amount | 567 |

Who is liable to pay GST on packaging charges?

- Restaurant owner

- E-commerce operator

Legal Extract:

Section 9 (5) of CGST Act: ………. all the provisions of this Act shall apply to such electronic commerce operator as if he is the supplier liable for paying the tax in relation to the supply of such services

Notification 17/2017 – Central tax (Rate)

Notified services inter alia include: supply of restaurant service other than the services supplied by restaurant, eating joints etc. located at specified premises

3.4.7 Service charges on alcohol supply

| Particulars | Amount |

| Pizza | 1500 |

| Alcohol | 1000 |

| Taxable Amount | 2500 |

| GST @ 5% on food | 75 |

| VAT @ 30% on alcohol | 300 |

| Total | 2875 |

| Service charge @ 10% on 2500 | 250 |

| Tax on service charge | ? GST or VAT |

- Whether the service charges shall be taxable at State VAT (as levied on alcohol supply) or GST?

- Whether it will be required to proportionate the service charges attributable to food and alcohol?

- Whether split invoicing model needs to be followed?

-

- Alcohol invoice is issued separately – with applicable state VAT

- Food invoice is issued separately with service charges – applicable GST

3.4.8 Free pizza? What’s the catch?

Issue

- Many eateries provide one free pizza after purchase on certain no. of pizzas.

- Is GST applicable on one pizza which is provided free of cost?

Mechanics

- On purchase of every pizza 100 reward points is added to the customer’s account

- Once customer orders 6 pizzas 600 reward points are accumulated into his account which makes him eligible to claim one free pizza.

- Although no consideration is charged from the customer for the free pizza. However, whether GST still needs to be charged on redemption of loyalty points?

3.4.9 Other Complex Issues

- Stock transfers of kitchen equipment and other assets – Additional GST loss?

- An all-inclusive package for food, drinks, music, and entertainment events hosted by restaurants on Christmas, New Year etc. till September 30, 2021

- Can the restaurant claim input tax credit on the raw materials and services used for

-

- complimentary breakfasts and

- meals included with accommodation packages? Practical difficulty wrt the segregation of value

- Taxability of bundled supply of food with cake at single price/as an add-on

- Treatment of wastage/ inedible food for restaurants in specified premises (who are entitled to claim ITC)

4. Co-living Sector

4.1 Relevant law and Journey so far

1st July, 2017

- Residential dwelling for use as a residence – exempt from GST

- Accommodation services <1000 per day by hotel, guest house, club or campsite – exempt from GST

18th July, 2022

- Residential dwelling for use as a residence by registered person – GST liability under RCM

- Accommodation services <7500 per day by hotel, guest house, club or campsite – GST @12%

15th July, 2024

- Residential dwelling for use as a residence by registered person – GST liability under RCM

- Accommodation services having value of supply upto INR 20,000 p.m. per person and supplied for a continuous period of 90 days is exempt from GST

- Accommodation services <7500 per day by hotel, guest house, club or campsite – GST @12%

Karnataka High Court | Taghar Vasudev Ambrish | 2022 (2) TMI 780 dtd 07‐02‐2022

Held that hostels serve as long-term residences for students, classifying the stay as residential in nature. Consequently, such services fall under the category of residential dwellings and are exempt from GST

Madras High Court | Thai Mookambikaa Ladies Hostel | 2024 (3) TMI 127 dtd 22‐03‐2024

This ruling reaffirmed that hostel services offered to girl students and working women are classifiable as residential dwellings, making them exempt from GST under entry 12 of Notification No. 12/2017

4.2 Current Implications and Issues

Notification No. 04/2024 CTR dated 12th July, 2024

A separate entry 12 A introduced in Notification No. 12/2017- CTR 28.06.2017 under heading 9963 to exempt accommodation services having value of supply of accommodation up to Rs. 20,000/- per month per person subject to the condition that the accommodation service is supplied for a minimum continuous period of 90 days

Clear demarcation in entry 12 of the afore-mentioned notification to exclude accommodation services from the purview of renting of residential dwelling

- While the High Court decisions in cases like Taghar Vasudev Ambrish and Thai Mookambikaa Ladies Hostel have clarified that hostel accommodations used by students are exempt from GST, the amendment introduce a new layer of complexity

- Where building owners have opted for the exemption, would they be required to discharge GST on the entire rent/deposit collected where tenants vacate the premises within 90 days of start of service?

- Can the limit of 20,000/- per month be levied for each bed rented out, or is it for a room as a whole?

- What would be the implications where one person takes 3 rooms on rent where individually the per room rent is under 20,000 per month, but in totality exceeds 20,000 per month?

- Does the rate of 20,000 per month refer only to the rate for renting of bed or the all inclusive price for renting of bed plus food and maintenance?

- Where a supplier of accommodation services charges GST from the beginning of the rental period, but the tenant stays for a period exceeding 90 days, can the supplier avail the benefit of GST exemption post 90 days? Further, can the supplier claim a refund of the GST paid for the first 90 days?

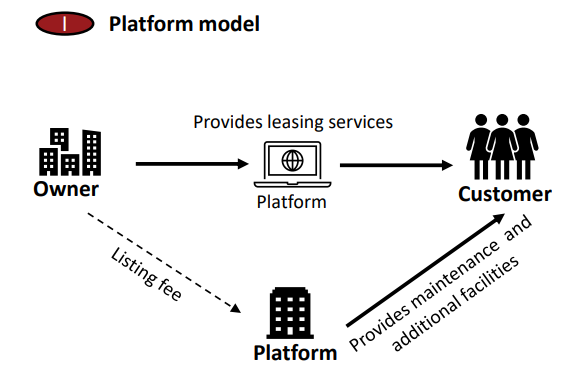

4.3 Typical models adopted in the industry

- Owner to customer –

-

- View I – Owner provides residential dwelling services to the customers. Exempt?

- View II – Owner is providing hostel accommodation services to customers. Exemption can be claimed under Entry 12A subject to its provisions

- Platform to customer: Services provided by Platform shall be taxable at applicable rates

- Can the Platform be construed as an e-commerce operator and accordingly the TCS provisions u/s Section 52 of the CGST Act, arise?

- Renting Vs accommodation: Would the Owner be required to obtain a GST registration and discharge GST on the services provided to the customer where the rent charged per month per person is in excess of 20,000?

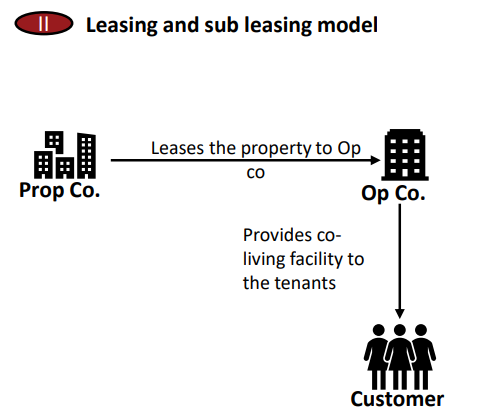

- Prop co to Op Co – If the Op Co. is a registered entity, then GST would be applicable under reverse charge mechanism and Op Co. would be required to pay GST

- Op Co to customer –

-

- Accommodation services having value of supply upto INR 20,000 p.m. and supplied for a continuous period of 90 days is exempt from GST

- Therefore, the GST paid under RCM becomes a cost to Op Co.

- If the Op. Co. is an unregistered entity and is engaged in leasing of rooms below ₹20,000 p.m., is it required to obtain a GST registration solely for the purpose of payment of GST under reverse charge?

- If the Op Co. leases certain rooms for less than ₹20,000 p.m. per person and others exceeding this value, GST registration and RCM obligations arise in the hands of Op. Co.. Is there a way to mitigate this additional GST cost on rooms below ₹20,000 p.m?

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

CA | CS | CMA

CA | CS | CMA