[Analysis] Financial Guarantee Contract – Accounting Treatment under Ind AS and AS Frameworks

- Blog|Advisory|Account & Audit|

- 6 Min Read

- By Taxmann

- |

- Last Updated on 8 November, 2024

A Financial Guarantee Contract (FGC) is an agreement where one party, known as the guarantor, promises to fulfil the payment obligations of a borrower or debtor in the event of default. This contract safeguards lenders, ensuring that they will receive payment even if the original debtor cannot meet their obligations. FGCs are typically classified as financial liabilities under accounting standards, such as Ind AS 109, where they are recognised at fair value upon issuance. Depending on the arrangement, FGCs may involve premiums or be provided at no charge, especially in cases between related parties, like parent and subsidiary companies.

Table of Contents

- Financial Guarantee Contracts under Ind AS Framework

- Financial Guarantee Contracts under the AS framework

- Conclusion

A Financial Guarantee Contract (FGC) is a formal agreement where one entity, the issuer, promises to fulfil the payment obligations of a specified debtor should they default. This agreement serves as a safety net for lenders or creditors, ensuring reimbursement in cases of non-payment. This document elaborates on the treatment of financial guarantees under Indian Accounting Standards (Ind AS) and Accounting Standards (AS).

1. Financial Guarantee Contracts under Ind AS Framework

Treatment of Financial Guarantee Contracts under Ind AS within the Ind AS framework, financial guarantee contracts are classified as financial liabilities. According to Ind AS 109, which governs financial instruments, a financial guarantee is a contract that imposes a financial obligation to either deliver cash or another financial asset or swap financial assets under specific conditions. Essentially, an FGC represents a unique form of financial liability where the issuer commits to cover a debt obligation of another party in instances of default.

Types of Financial Guarantee Contracts:

- Financial Guarantees to Related Parties – This category includes guarantees provided to entities like associated companies, subsidiaries, or holding companies where the guarantor does not receive a premium. An example is a parent company issuing a guarantee for a loan taken by its subsidiary.

- Financial Guarantees to Unrelated Parties – These guarantees involve a premium paid to the guarantor. For instance, a company might issue a financial guarantee on behalf of a purchaser to a seller and receive a premium in return.

Regardless of these distinctions, both financial guarantees types are classified as liabilities under Ind AS 109.

1.1 Initial Recognition of Financial Guarantee Contracts

Upon issuance, financial guarantee contracts are initially recognised at their fair value. When these guarantees are issued to unrelated parties, such as in an arms-length transaction, the fair value is typically equivalent to the premium received for issuing the guarantee. However, Ind AS 109 does not specify a formula for calculating the fair value of financial guarantee contracts (FGCs) provided to related parties.

To address this gap, the Ind AS Transition Facilitation Group (ITFG) has proposed several methods for estimating the fair value of financial guarantees issued to related parties:

- Approach 1 – One method could involve determining what an unrelated, independent third party would charge for a similar guarantee.

- Approach 2 – Another method might estimate the fair value based on the present value of the difference in interest or other similar cash flows that would occur if the loan were not guaranteed.

- Approach 3 – A further method may calculate the fair value by estimating the present value of the probability-weighted expected cash flows that could arise from the guarantee.

1.2 Subsequent Recognition of Financial Guarantee Contracts

After initial recognition, the issuer of the financial guarantee contract (FGC) must measure it at the higher of:

- The amount is determined based on lifetime expected credit losses. This measurement reflects any significant increase in credit risk, indicating a higher likelihood of the debtor defaulting since the FGC was first recognised.

- The initially recognised amount (i.e., fair value) is adjusted for the cumulative amount of income recognised under the principles of Ind AS 115, where applicable.

If the carrying amount of the FGC exceeds its initially recognised value, any excess is recognised as an impairment loss.

1.3 Presentation of Financial Guarantee Contracts under the Ind AS framework

Under the Ind AS framework, specifically Schedule III, financial guarantee contracts are categorised and presented as “Other Financial Liabilities” on the balance sheet within the larger grouping of “Financial Liabilities.” This section also encompasses contingent considerations, derivative contracts, and financial guarantees. The categorisation aids in clear financial reporting and ensures stakeholders have a detailed view of the entity’s financial commitments. The discussion also includes a case study involving a parent company that issued a financial guarantee to a bank on behalf of its subsidiary, illustrating the practical application of these accounting principles.

2. Financial Guarantee Contracts under the AS framework

In the Accounting Standards (AS) framework, no specific standard exclusively addresses financial instruments such as financial guarantees. However, these guarantees are generally treated under AS 29, Provisions, Contingent Liabilities, and Contingent Assets. Under AS 29, a contingent liability is defined in two ways:

- A possible obligation that arises from past events, the existence of which will be confirmed only by the occurrence (or non-occurrence) of one or more uncertain future events not wholly within the control of the entity.

- A present obligation that arises from past events but is not recognised because:

-

- It is not probable that an outflow of resources embodying economic benefits will be required to settle the obligation; or

- The amount of the obligation cannot be measured with sufficient reliability.

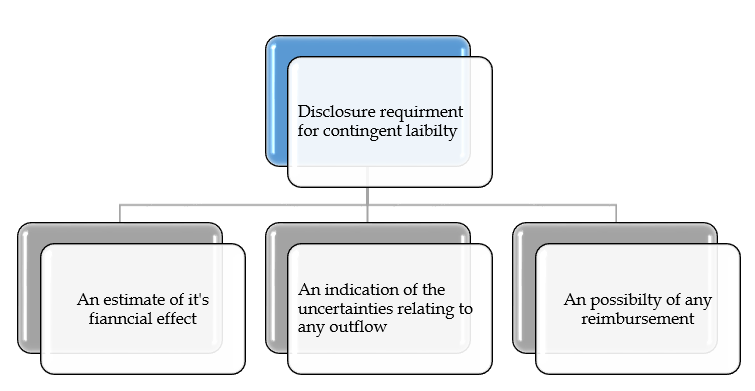

Given that a financial guarantee’s enactment depends on the uncertain event of a debtor’s default, it is classified as a contingent liability under AS 29. Such liabilities are not recognised on the balance sheet. Instead, they are disclosed in the notes to the financial statements unless the probability of the obligation becoming a reality is deemed remote. This ensures transparency and provides stakeholders with a clear understanding of potential financial impacts that may not yet have been realised.

2.1 Recognition of the contingent liability

are not recognised on the balance sheet within the financial statements; however, they must be disclosed in the notes unless the probability of resource outflow is deemed remote. Should the chance of an outflow be considered more likely than remote, the entity is required to provide a concise description of the nature of each contingent liability in the notes to the financial statements, along with any information available about the potential financial impact.

For Example:

“Company A” (the parent company) offers a financial guarantee to a bank for a loan taken by its subsidiary, “Company B.” This arrangement stipulates that should “Company B” fail to repay the loan, “Company A” would be obliged to fulfil the payment obligations.

Under the Accounting Standards (AS) framework, this arrangement positions “Company A” in relation to the financial guarantee as follows:

- Possible Obligation – The guarantee creates a potential obligation for “Company A,” as there exists a scenario in which “Company A” might have to pay if “Company B” defaults.

- Uncertain Event – The requirement for “Company A” to make any payment is contingent upon whether “Company B” defaults on the loan, a future event filled with uncertainty. The obligation will only materialise if and when “Company B” fails to meet its repayment responsibilities.

- Not Within Company A’s Control – The potential default by “Company B” is beyond “Company A’s” direct control. For instance, despite potential financial support or interventions from “Company A,” it cannot guarantee the financial solvency of “Company B” or ensure its loan repayments.

Although no monetary transfer has occurred yet, “Company A” must acknowledge the potential obligation arising from the financial guarantee. This recognition categorises the guarantee as a contingent liability—a potential obligation triggered by an uncertain future event not entirely within the company’s control.

3. Conclusion

Financial Guarantee Contracts (FGCs) are addressed distinctively under the Indian Accounting Standards (Ind AS) and Accounting Standards (AS) frameworks. In the Ind AS 109 context, FGCs are categorised as financial liabilities, where they are initially recognised at fair value. Their subsequent measurement takes into account expected credit losses or retains the initial fair value, with impairment losses recognised if deemed necessary. Conversely, under the AS framework, FGCs are treated as contingent liabilities. They are not recorded on the balance sheet but must be disclosed in the financial statement notes unless the likelihood of an outflow of resources is considered remote.

Both accounting frameworks are designed to reflect potential obligations stemming from financial guarantees transparently. However, they diverge in their approaches to the recognition and measurement of these obligations, tailored to align with their respective underlying principles and standards. This ensures that financial statements provide a comprehensive view of an entity’s financial health and obligations.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA