[Analysis] Detailed Impact Analysis of Supreme Court’s Judgement on Electoral Bonds

- Blog|Company Law|Income Tax|

- 15 Min Read

- By Taxmann

- |

- Last Updated on 5 June, 2024

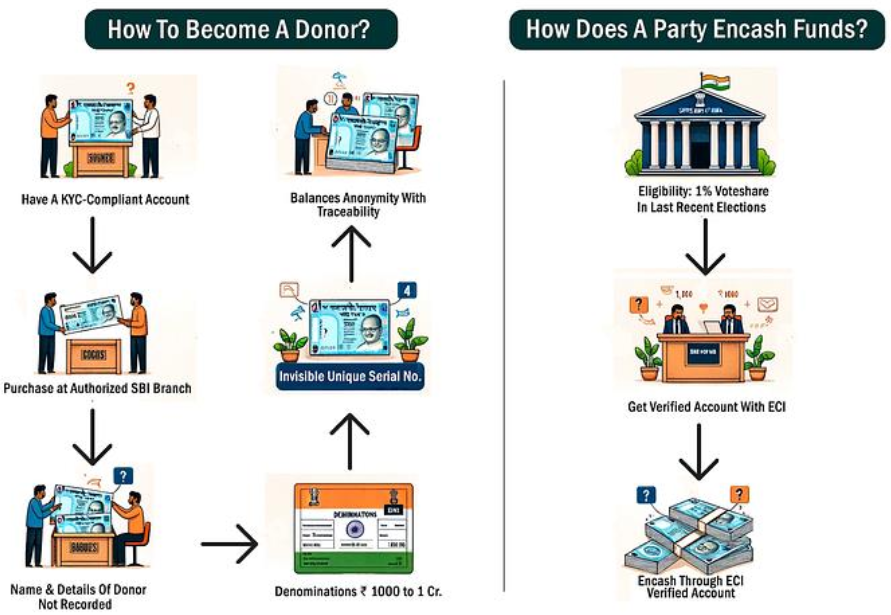

Electoral Bonds are financial instruments in India that citizens or corporations can use to donate funds to political parties. These bonds were introduced by the Government of India in 2018 as a means to promote transparency in political funding. Here are key features of Electoral Bonds: – Issuer: Electoral Bonds can only be issued by the State Bank of India (SBI). – Denominations: They are available in denominations of ₹1,000, ₹10,000, ₹1 lakh, ₹10 lakh, and ₹1 crore. – Validity: Each bond is valid for 15 days from the date of issuance. It must be redeemed within this period. – Eligibility: Only a political party registered under Section 29A of the Representation of the People Act, 1951, and securing at least 1% of the votes polled in the last General Election to the House of the People or the Legislative Assembly, is eligible to receive Electoral Bonds. Donors can be individuals, companies, or associations of persons. – Redemption: The bonds can be redeemed only by eligible political parties through a designated bank account. – Anonymity: The donor's identity remains anonymous, but the receiving political party must disclose the amount received. – Transparency: Though aimed at increasing transparency, the anonymity of donors has raised concerns regarding the potential for undisclosed funding and influence. – Tax Exemptions: Donations through Electoral Bonds are tax-deductible for donors, and political parties receiving these funds are exempt from paying income tax on the donations. Electoral Bonds were introduced to curb black money in political funding, but they have been a subject of debate and criticism regarding their impact on transparency and accountability in the political funding process.

By Nipun P. Singhvi – Practicing Advocate, Kumar Pal Mehta – Company Secretary and Sunil Maloo – Chartered Accountant

Table of Contents

- Fact of the Case

- Major Amendments Under Finance Act 2017

- Issues

- Some Interesting Fact About Electoral Bond

- Key Features of Electoral Bonds

- How Electoral Bond Work?

- Amendment Under Companies Act, 2013

- Amendment Under Income Tax Act

- Amendments under Representation of the People Act 1951 and Reserve Bank of India Act, 1934

- Objections by RBI and ECI

- Submission of Petitioners

- Discussion on Important Judgements

- Impact Analysis of the Judgement

1. Fact of the Case

- Case Background

-

- The case involved the Electoral Bond Scheme (‘EBS’) introduced by the government.

- The EBS allowed anonymous political contributions through electoral bonds.

- Court’s Decision

- On February 15, 2024, the Supreme Court declared the Electoral Bond Scheme unconstitutional; and

- The amendments made to relevant laws (Section 29C of the RPA, Section 182(3) of the Companies Act, and Section 13A(b) of the IT Act) to implement this scheme were also held unconstitutional.

2. Major Amendments Under Finance Act 2017

- Section 135 of the Finance Act 2017 and Section 31 of the RBI Act;

- Section 137 of the Finance Act 2017 and Section 29C of the RP Act;

- Section 11 of the Finance Act 2017 and Section 13A of the IT Act;

- Section 154 of the Finance Act 2017 and Section 182 of the Companies Act;

3. Issues

- The petitioners have instituted proceedings under Article 32 of the Constitution challenging the constitutional validity of the Electoral Bond Scheme, which introduced anonymous financial contributions to political parties.

- The petitioners have also challenged the provisions of the Finance Act 2017, which, among other things, amended the provisions of the Reserve Bank of India Act 1934, the Representation of the People Act 1951, the Income Tax Act 1961, and the Companies Act 2013. Mainly petitioner has challenge introduction of the finance act as a money bill under article 110 of the constitution.

(This issue is referred to larger bench to seven judge bench and is pending adjudication)

Unlimited Corporate Funding to Political Parties – Whether unlimited corporate funding to political parties, as envisaged by the amendment to Section 182(1) of the Companies Act infringes the principle of free and fair elections and violates Article 14 of the Constitution?

Non-Disclosure of Information on Voluntary Contributions – Whether the non-disclosure of information on voluntary contributions to political parties under the Electoral Bond Scheme and the amendments to Section 29C of the RPA, Section 182(3) of the Companies Act and Section 13A(b) of the IT Act are violative of the right to information of citizens under Article 19(1)(a) of the Constitution?

4. Some Interesting Fact About Electoral Bond

- Total Value of Electoral Bond sold for Rs 9208.23 Crore

- 95 % of Electoral Bonds are purchased by Corporate

- India is First Country who has introduced concept of electoral Bond

- Majority of Bonds issued are in Denomination of Rs 1 Crore

5. Key Features of Electoral Bonds

Eligibility to Purchase Bonds

- Citizens of India or entities incorporated or established in India can purchase electoral bonds.

- Eligible entities include individuals, Hindu undivided families, companies, firms, associations of persons, artificial juridical persons, and agencies controlled by such entities.

- Individuals can buy bonds singly or jointly with others.

Encashment by Political Parties

- Only eligible political parties can encash electoral bonds.

- Eligible parties must be registered under Section 29A of the Representation of the People Act.

- They should have secured at least one percent of the votes polled in the last general election to the House of the People or the Legislative Assembly of the State.

- Encashment is allowed only through a bank account with an authorized bank (State Bank of India is the authorized bank).

KYC Compliance

- Buyers of electoral bonds must comply with Know Your Customer (KYC) norms.

- The authorized bank may request additional KYC documents if necessary.

Payment Methods

- Payments for bond issuance are accepted in Indian rupees through demand drafts, cheques, Electronic Clearing System, or direct debit.

- Cheques or demand drafts must be drawn in favor of the issuing bank at the place of issue.

Denominations

- Bonds are issued in denominations of Rs 1,000, Rs 10,000, Rs 1 lakh, Rs 10 lakh, and Rs 1 crore.

Validity Period

- Bonds are valid for fifteen days from the date of issue.

- If not encashed within fifteen days, they are deposited with the Prime Minister’s Relief Fund.

Application Process

- Buyers can apply for electoral bonds using the specified format (Annexure II of the Scheme).

- The issuing branch verifies requirements and issues the bond.

- Applications not meeting KYC compliance or scheme requirements are rejected.

Confidentiality

- Information provided by buyers is treated as confidential by the authorized bank.

- Disclosure is allowed only when demanded by a competent court or upon registration of a criminal case.

Availability

- Bonds are available for purchase for ten days on a quarterly basis (January, April, July, and October).

- An additional thirty-day availability period is specified during General Elections to the House of People.

Interest and Charges

- No interest is payable on the bond.

- No commission, brokerage, or other charges apply to bond purchases.

6. How Electoral Bond Work?

Image Source – PPGF (Policy, Politics and Governance Foundation)

7. Amendment Under Companies Act, 2013

7.1 Journey of Political Contribution Law

- CAA, 1960: Introduction of Political Contribution by Section 293A

- CAA, 1969: Amended Section 293A to ban contributions

- CAA, 1985: Amended Section 293A to permit contributions and define political purpose

- CA, 2013: Introduced Section 182 with enhance limit of 7.5%

- Finance Act, 2017: Introduced unlimited Political Contribution and no disclosure

7.2 Legislative History of Political Contribution under Companies Act

(The Companies Act 1956 when they were enacted did not regulate contributions to political parties by companies and individuals.)

1960: The Companies (Amendment) Act 1960

- Introduced Section 293A to regulate political contributions by companies.

- Limits: Contributions cannot exceed INR 25,000 or 5% of average net profits of the past three financial years, whichever is greater.

- Disclosure: Amounts contributed, and recipient details must be included in profit and loss accounts.

- Penalties: Fine up to INR 5,000 for non-compliance.

1969: The Companies (Amendment) Act 1969

- Amended Section 293A to ban contributions to political parties and for political purposes.

- Penalties: Fine up to INR 5,000 for companies, imprisonment up to three years and fines for defaulting officers

1985: The Companies (Amendment) Act 1985

- Amended Section 293A to permit contributions to political parties and for political purposes again.

- Defined “political purpose” to include indirect support activities.

- Additional restrictions: Companies must be in existence for over three years. Contributions require Board of Directors’ resolution.

- Stricter penalties: Fines up to three times the contribution amount, imprisonment up to three years for defaulting officers.

2013: The Companies Act 2013, Section 182

- Incorporated provisions of Section 293-A (as amended in 1985).

- Contributions allowed by companies (except government companies and those less than three years old).

- Conditions:

-

- Aggregate contributions capped at 7.5% of average net profits of the last three financial years.

- Requires Board of Directors’ resolution for contributions.

- Disclosure: Amounts and recipient party details must be included in the profit and loss account.

- Increased penalties: Fines extendable to five times the contribution amount.

2017: The Finance Act, 2017

- Removed the cap on corporate political funding.

- Amended disclosure requirements to only report total contributions without specifying individual recipients.

- Introduced Sub-section 3A

- Contributions to political parties must be via cheque, bank draft, or electronic clearing system.

- Allowed contributions through instruments issued under any notified scheme for political contributions.

7.3 Section 182. Prohibitions and Restrictions Regarding Political Contributions (Pre and Post Finance Act, 2013)

(1) Notwithstanding anything contained in any other provision of this Act, a company, other than a Government company and a company which has been in existence for less than three financial years, may contribute any amount directly or indirectly to any political party:

Provided that the amount referred to in sub-section (1) or, as the case may be, the aggregate of the amount which may be so contributed by the company in any financial year shall not exceed seven and a half per cent. of its average net profits during the three immediately preceding financial years:

Provided further that no such contribution shall be made by a company unless a resolution authorising the making of such contribution is passed at a meeting of the Board of Directors and such resolution shall, subject to the other provisions of this section, be deemed to be justification in law for the making and the acceptance of the contribution authorised by it.

182 (3) Every company shall disclose in its profit and loss account any amount or amounts contributed by it to any political party during the financial year to which that account relates, giving particulars of the total amount contributed and the name of the party to which such amount has been contributed.

(3) Every company shall disclose in its profit and loss account the total amount contributed by it under this section during the financial year to which the account relates.

(3A) Notwithstanding anything contained in sub-section (1), the contribution under this section shall not be made except by an account payee cheque drawn on a bank or an account payee bank draft or use of electronic clearing system through a bank account:

Provided that a company may make contribution through any instrument, issued pursuant to any scheme notified under any law for the time being in force, for contribution to the political parties.

8. Amendment Under Income Tax Act

8.1 History of Political Funding in Income Tax Law

Pre-2017 Framework:

- Political parties were required to maintain records of contributions above Rs. 20,000.

- No restrictions on cash donations.

- Exemption from income tax under Section 13A of the Income Tax Act, 1961, provided certain conditions were met.

8.2 Impact of Amendment by Finance Act 2017 Qua Political Parties

Section 13A

- Income of political parties is exempt from income tax if they:

-

- Maintain proper books of accounts and Record contributions above Rs. 20,000 with details of the donor except paid through electoral bond.

- Audit accounts annually.

- Post-2017: No donations above Rs. 2,000 are allowed in cash; must be through cheque, draft, electronic means, or electoral bonds.

- Political parties must file income tax returns under Section 139(4B).

Modes of Payment of Donations

- Account payee cheque or draft.

- Electronic clearing system.

- Electoral bonds.

- Cash donations up to Rs. 2,000.

8.3 Provisions of Income Tax Act Qua Donor Assessee

Section 80GGB

- Indian companies can claim deductions for contributions to political parties or electoral trusts.

- No deduction for cash contributions.

Section 80GGC

- Any person (excluding local authorities and certain government funded entities) can claim deductions for contributions to political parties or electoral trusts.

- No deduction for cash contributions.

8.4 Compliance Requirements

- Filing of Return by Political Party: Mandatory filing of income tax returns under Section 139(4B) if income exceeds the non-taxable limit without considering Section 13A exemptions.

- Reporting by Tax Auditors of Donors: Auditors must report claims under Sections 80GGB and 80GGC.

- Submission of Report under Section 29C of the Representation of the People Act, 1951: The treasurer or authorized person must submit a report u/s 29C of Representation of People Act.

9. Amendments under Representation of the People Act 1951 and Reserve Bank of India Act, 1934

9.1 Section 29-C of the Representation of the People Act 1951

29-C. Declaration of donation received by the political parties.—

- The treasurer of the political party or any other person authorised by the political party in this behalf shall, in each financial year, prepare a report in respect of the following, namely:

-

- the contribution in excess of twenty thousand rupees received by such political party from any person in that financial year;

- the contribution in excess of twenty thousand rupees received by such political party from companies other than Government companies in that financial year.

Provided that nothing contained in this sub-section shall apply to the contributions received by way of an electoral bond.

Explanation.— For the purposes of this sub-section, “electoral bond” means a bond referred to in the Explanation to sub-section (3) of Section 31 of the Reserve Bank of India Act, 1934 (2 of 1934).

9.2 Section 31 of the Reserve Bank of India Act, 1934

Section 31. Issue of demand bills and notes.—

- …………………………………………………

- …………………………………………………

- Notwithstanding anything contained in this section, the Central Government may authorise any scheduled bank to issue electoral bond.

Explanation.— For the purposes of this sub-section, “electoral bond” means a bond issued by any scheduled bank under the scheme as may be notified by the Central Government.

10. Objections by RBI and ECI

2 Jan. 2017

RBI’s Initial Objections (January 2, 2017) Key Points:

- Non-sovereign entities issuing bearer instruments

- Undermining faith in banknotes.

- Impact on the Prevention of Money Laundering Act (PMLA) principles.

- Alternative methods available (cheque, demand draft, electronic payments).

30 Jan. 2017

Finance Ministry’s Response (January 30, 2017) Key Points:

- Purpose of electoral bonds misunderstood by RBI.

- Ensuring donations from tax-paid money.

- Time limit for redeeming bonds counters currency use concern.

4 Aug. 2017

RBI’s Recommendations (August 4, 2017) – Safeguards Suggested:

- Maximum tenure of fifteen days for bonds.

- Bonds in multiples of specific amounts.

- Purchase from KYC compliant accounts.

- Redemption only into designated political party accounts.

- Limited sale periods.

- Issuance only at RBI, Mumbai.

14 Sep. 2017

RBI’s Objections to Draft Scheme (September 14, 2017) Concerns:

- Credibility impact if commercial banks issue bonds.

- Risk of shell companies and money laundering.

- Preference for electronic issuance.

27 Sep. 2017

RBI Central Board’s Reservations (September 27, 2017) Key Points:

- Issuance of currency as a monopolistic function.

- Risks of money laundering and transaction anonymity.

- Forgery and counterfeiting risks.

- Potential misuse by aggregators.

10.1 Election Commission of India Objections

ECI’s Objections (May 26, 2017) Concerns:

- Impact on transparency of political funding.

- Exclusion of electoral bond donations from mandatory reporting.

- Potential violations of donation rules (e.g., from government companies, foreign sources).

ECI’s Recommendations on Companies Act Amendments Key Points:

- Need for companies to declare party-wise contributions.

- Reintroduction of cap on corporate donations.

- Concerns over unlimited corporate funding leading to black money use.

11. Submission of Petitioners

- No Rational Basis for Electoral Bonds since the objective of EBS is to Enhance transparency in electoral funding whereas in Contradiction Cash donations still allowed.

- Ignored Objections of Authorities such as Reserve Bank of India (RBI) and Election Commission of India (ECI).

- Unconstitutionality of the Scheme since:

-

- Non-disclosure Mandate: Defeats transparency provisions in RPA and Companies Act

- Article 19(1)(a): Violates voters’ right to information on political funding

- Article 21: Promotes corruption and quid pro quo, hindering investigations by agencies like CBI and ED

- Violation of Shareholders’ Rights: Lack of transparency on political donations prevents disclosure to shareholders.

- Subversion of Democracy: Disproportionate funding for ruling parties undermines free and fair elections.

- The Presumption of Constitutionality should not apply to laws altering electoral ground rules. Reason: Legislature’s validity stems from free and fair elections.

- Corporates are not citizens and hence they lack Article 19(1)(a) rights.

- Elected officials may prioritize donor wishes over voter interests, leading to quid pro quo.

- Information Asymmetry as Voters lack information on donations; Central Government has access via State Bank of India. In fact, Ruling party at the center received 57% of total contributions.

- Section 182(3) Amendment Issues

-

- Loss-making companies contributing

- Unlimited contributions leading to policy influence

- Lack of disclosure to shareholders

- Violation of Right to Information since Informed voter necessary for democracy (ADR, PUCL cases).

- The Court has to balance between the possibility of victimization on the disclosure of information and the infringement of the right to know.

11.1 Democracy vs. Corporate Democracy

- Large scale corruption and quid pro quo arrangements: Non-disclosure of information about political funding allows corporations to make undisclosed contributions, fostering corruption and quid pro quo deals, where political favors are exchanged for financial support.

- Capture of democracy by wealthy interests: Wealthy individuals and corporations can use their financial power to influence political outcomes, effectively capturing the democratic process.

- Infringement of ‘one person-one vote’ principle: Corporate influence can overpower the collective voice of the general populace. When a few wealthy entities can exert disproportionate influence over political decisions, the principle of ‘one person-one vote’ is compromised, as economic wealth dictates political power rather than individual votes.

11.2 Governance vs. Corporate Governance

- Permits donations by loss-making companies

- Removes the control of shareholders over the decisions of the Board:

- Permits unlimited contributions by corporates, thereby abrogating democratic principle.

- Article 25 (Right to Conscience):

-

- Governance: Shareholders should know and approve political funding.

- Corporate Governance: Essential for informed and ethical investment decisions.

- Article 19(1)(g) (Right to Business):

-

- Governance: Non-disclosure hampers informed exit from investments.

- Corporate Governance: Transparency is crucial for shareholder confidence and decision

11.3 Electoral Bond Scheme and Foreign Influence

- The Electoral Bond Scheme permits Indian companies, even those with undisclosed foreign ownership, to purchase electoral bonds.

- This contradicts Indian laws that distinguish foreign-owned companies.

Example: A company with substantial foreign ownership can buy electoral bonds without transparency, potentially influencing Indian elections without proper scrutiny.

11.4 Corporate Democracy Submission

Public Scrutiny of Listed Companies:

- Publicly listed companies need transparency as they raise funds publicly.

- Shareholders deserve to know how their investments are used.

Violation of Shareholders’ Right to Information:

- Removing disclosure of political contributions violates shareholders’ right to information under Article 19(1)(a).

- Shareholders need this information for informed investment decisions.

Shareholder Consent for Company Contributions:

- Companies shouldn’t contribute to politics without majority or three-fourths shareholder consent.

- Ensures democratic decision-making within the company.

Denial of Shareholders’ Right to Choice:

- Non-disclosure denies shareholders the right to choose investments based on political affiliations.

- Prevents informed investment decisions, violating their rights under Article 21.

12. Discussion on Important Judgements

12.1 Right to Privacy [Donors] vs. Right to Information [Voters]

Subramaniam Swamy vs. Union Of India

- Section 499 and 450 of IPC – Defamation should be struck down

- Right to freedom of Speech vs. Right to Reputation

- Article 19 Vs Article 21

Right to freedom cannot include Right to Defame someone

Doctrine of Non-Arbitrariness

Ajay Hansia Vs Khalib Mujib Seheravardi: (1981) 1 SCC 722

- wherever therefore there is arbitrariness in State action whether it be of the legislature or of the executive or of an authority under Article 12, Article 14 immediately springs up and strikes down.

Indian Express Newspapers (Bombay) (P.) Ltd. v. Union of India [2008] 300 ITR 351 (Bombay)/[2008] 214 CTR 479 (Bombay), laid down the test of manifest arbitrariness with respect to subordinate legislation. It was held that a subordinate legislation does not carry the same degree of immunity enjoyed by a statute passed by a competent legislature.

In McDowell (supra),

Court held that a legislation can be invalidated on only two grounds:

First, the lack of legislative competence; and

Second, on the violation of any fundamental rights guaranteed in Part III of the Constitution or of any other constitutional provision.

In Natural Resources Allocation, In Re Special Reference No. 1 of 2012, a Constitution Bench of this Court referred to McDowell (supra) to observe that a law may not be struck down as arbitrary without a constitutional infirmity.

Thus, it was held that a mere finding of arbitrariness was not sufficient to invalidate a legislation. The Court has to enquire whether the legislation contravened any other constitutional provision or principle.

12.2 Shayara Bano v. Union of India

The provision provides that the personal law of the Muslims, that is Shariat, will be applicable in matters relating to marriage, dissolution of marriage and talaq.

Justice R F Nariman, speaking for the majority, held that Triple Talaq is manifestly arbitrary because it allows a Muslim man to capriciously and whimsically break a marital tie without any attempt at reconciliation to save it.

Para 188.

Justice Nariman traced the evolution of non-arbitrariness jurisprudence in India to observe that McDowells (supra) failed to consider two binding precedents, namely, Ajay Hasia (supra) and K R Lakshmanan (supra).

This Court further observed that McDowells (supra) did not notice Maneka Gandhi v. Union of India,193 where this Court held that substantive due process is a part of Article 21 which has to be read along with Articles 14 and 19 of the Constitution.

Therefore, Justice Nariman held that arbitrariness of a legislation is a facet of unreasonableness in Articles 19(2) to (6) and therefore arbitrariness can also be used as a standard to strike down legislation under Article 14. It held McDowells (supra) to be per incuriam and bad in law.

12.3 Navtej Singh Johar v. Union of India

Justice Nariman, in the concurring opinion, observed that Section 377 is manifestly arbitrary for penalizing “consensual gay sex”.

Justice Nariman faulted the provision for

(a) not distinguishing between consensual and non-consensual sex for the purpose of criminalization; and

(b) criminalizing sexual activity between two persons of the same gender

Justice Indu Malhotra observed that the provision is manifestly arbitrary because the basis of criminalization is the sexual orientation of a person which is not a “rationale principle”

12.4 Joseph Shine v. Union of India

- The validity of Section 497 of the Indian Penal Code was challenged.

- Section 497 penalized a man who has sexual intercourse with a woman who is and whom he knows or has a reason to believe to be the wife of another man, without the “consent and connivance of that man” for the offence of

- adultery.

- Justice Nariman observed that the provision has paternalistic undertones because the provision does not penalize a married man for having sexual intercourse with a married woman if he obtains her husband’s consent.

13. Impact Analysis of the Judgement

13.1 Quid pro quo Arrangement

13.2 Unlimited Donation

- Electoral bonds data | 55 firms’ purchase exceeded 7.5% cap in 2022-24.

- Five firms in 2023-24 and eight in 2022-23 which made political contributions through bonds beyond the original 7.5% cap had negative or zero net profits.

13.3 Donation by Newly Incorporated Companies

13.4 Non disclosure of Political Contribution in Financial Statements

13.5 CBI in Action

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA