Acquisition & Transfer of Immovable Property under FEMA Regulations – Guidelines | Practical Strategies | Case Studies

- Blog|FEMA & Banking|

- 8 Min Read

- By Taxmann

- |

- Last Updated on 17 June, 2024

Acquisition and transfer of immovable property in India by non-residents and foreign entities are regulated under the Foreign Exchange Management Act (FEMA) and related regulations. Under FEMA regulations, non-residents acquire and transfer immovable property in India, which involves specific guidelines, restrictions, and compliance requirements. NRIs and OCIs enjoy relatively more freedom in property transactions compared to foreign citizens of non-Indian origin and foreign entities. Compliance with FEMA regulations is crucial to ensure legal property transactions and avoid penalties.

By CA. Niki Shah – Partner | SN & Co.

Table of Contents

- In the News!

- NRI – Definition Under FEMA

- Immovable Property in India

- Immovable Property Outside India

- Case Studies

1. In the News!

Synopsis:

- Navigating property purchases in Dubai can be a regulatory maze for Indians due to foreign exchange laws.

- Deals offering easy payment plans with instalments over years may violate FEMA.

- However, transactions involving ‘instalments’ create obligations in foreign exchange, potentially breaching FEMA rules.

The transaction involving purchase of immovable property on deferred payment basis is not permitted without prior approval of RBI as it creates obligation in foreign exchange.

2. NRI – Definition Under FEMA

NRI means

“a person resident outside India who is a citizen of India”

“an individual resident outside India who is a citizen of India”

- FEM (Borrowing & Lending) Regulations, 2018

- FEM (Deposit) Regulations, 2016

- FEM (Remittance of Assets) Regulations, 2016

- FEM (Permissible Capital Account Transactions) Regulations, 2000

- FEM (NDI) Rules, 2019

- FEM (Debt Instruments) Regulations, 2019

3. Immovable Property in India

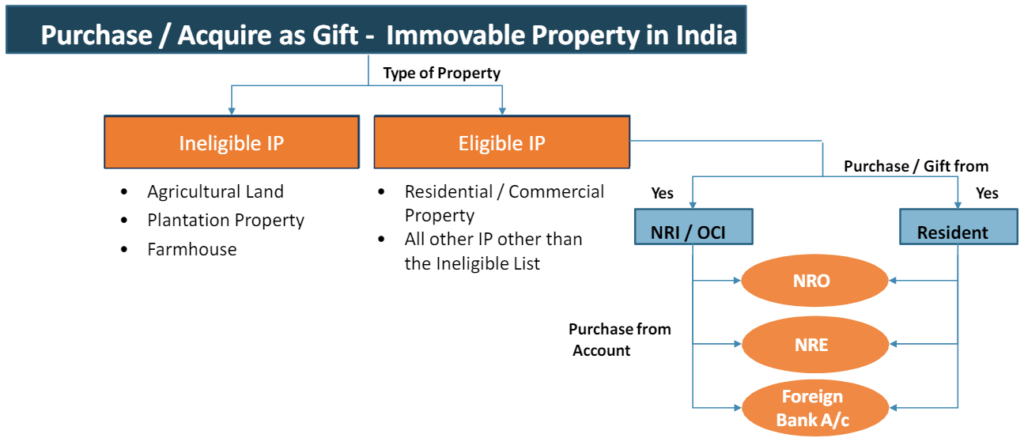

3.1 Acquisition and Transfer Rights of NRI and OCI

- Purchase by providing consideration ( IP other than agricultural land or farmhouse or plantation property

- Transfer any I.P in India to Resident

- Transfer any I.P other than agricultural land or farmhouse or plantation property to NRI or OCI

- Acquire any I.P through inheritance from either PROI or Resident

- Acquire as Gift from Resident or NRI or OCI [1]

[1] Who in any case is a relative as defined under section 2(77) of Companies Act

3.2 Purchase of Immovable Property by NRI

Points to be noted:

- Gift can only be received from relative as defined in section 2(77) of Cos Act 2013

- Purchase of IP is not allowed by way of Traveller’s Cheque or Foreign Currency notes or by any other mode other than permitted

3.3 Gift of Immovable Property to NRI

Case: Gifting to NRI

- Resident Purchases flat worth ₹ 10 Crore

- Wants to gift flat to NRI son

- Whether LRS limits will apply or only NDI rules

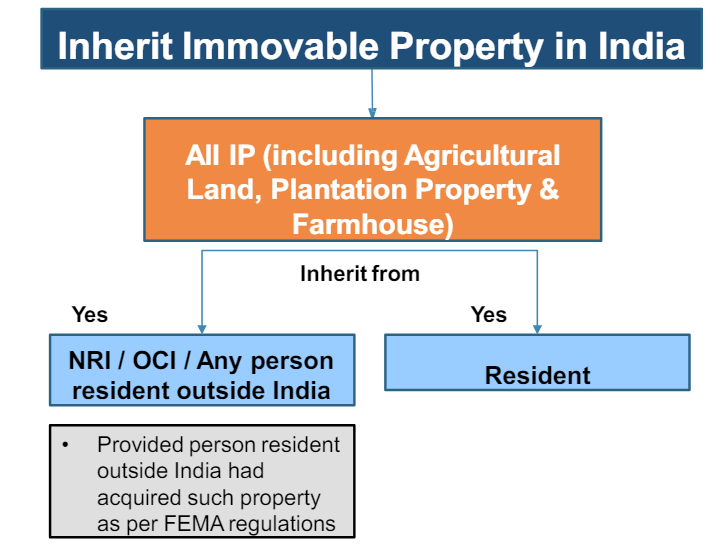

3.4 Inheritance of Immovable Property by NRI/OCI

NRI/OCIs can hold agricultural land received from inheritance or acquired when they were resident but cannot undertake agricultural activities on the same

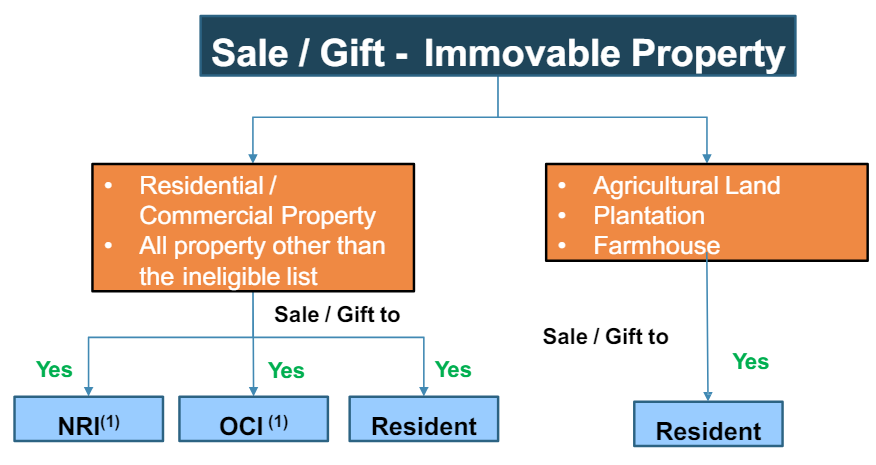

3.5 Sale/Gift of Immovable Property by NRI/OCI

(1) Gift can only be received from relative as defined in section 2(77) of Cos Act 2013

3.6 How an NRI & OCI Acquire Immovable Property in India

|

Action on Property |

Resident | NRI |

OCI |

| Purchase* |

✓ |

✓ |

✓ |

| Acquire as gift* |

✓ |

✓ |

✓ |

| Acquire any I.P as inheritance |

✓ |

✓ |

✓ |

| Sell agriculture land to |

✓ |

✗ |

✗ |

| Gift* |

✓ |

✓ |

✓ |

| Gift (agriculture land) to |

✓ |

✗ |

✗ |

*other than agricultural land/farmhouse/plantation

3.7 Joint Acquisition by the Spouse of a NRI or OCI

- Spouse of NRI/OCI who is PROI and not NRI/OCI can acquire only one IP (other than agricultural land, farm house or plantation property)

- Jointly with her NRI/OCI spouse

- Acquisition formalities remain the same as for NRIs/OCIs

- Marriage should be registered and should have subsisted for at least 2 years prior to date of acquisition

- The non-resident spouse must not be otherwise prohibited from such acquisition

3.8 Immovable Property in India for Permitted Activity

Permitted Activity

- PROI who has branch office, project office or other place of business in India can acquire IP in India.

- The IP can be used only for, or incidental to, carrying on of permitted activity.

- Liaison Office cannot buy IP Liaison office can take property only on lease (up to 5 years or up to the RBI approval date)

- Form IPI to be filed with RBI within 90 days of acquisition

- PROI can transfer such property by way of mortgage to an AD as a security for any borrowing

3.9 Payment/Repatriation

Payment for Acquisition

- Out of funds received in India through normal banking channels by way of inward remittance from any place outside India or

- By debit to his NRE/FCNR (B)/NRO account

- Payments cannot be made by traveller’s cheque or by foreign currency notes or by other mode except those specifically mentioned above

Repatriation of Sale Proceeds

- Property acquired by way of Sec 6(5) or his successor cannot repatriate outside India the sale proceeds of such immovable property without the prior permission of the RBI

- Sale of IP (other than agricultural land/farm house/plantation property) in India by a NRI/OCI provided:

-

- IP acquired by the seller in accordance with FEMA

- Amount for acquisition of IP has been paid in foreign exchange through normal banking channels or funds held in NRE Account or FCNR Account

- In the case of residential property, the repatriation of sale proceeds is restricted to not more than two such properties

NRI/OCIs have life time limit of repatriation from sale of two residential properties

Section 6(5) of FEMA states that a person resident outside India may hold, own, transfer or invest in any immovable property situated in India if such property was acquired, held or owned by such person when he was resident in India or inherited from a person who was resident in India

3.10 Case 1 – Buying Agricultural Land by NRI

Facts of the case

- Mr X, NRI wants to purchase agricultural land on outskirts of Sanand

- Mr X’s father as well as grand father are all farmers holding agricultural land in Sanand

- Mr X has transferred funds from US to his NRE A/c for purchasing above agricultural land

Questions

- Whether it is permissible for Mr X to purchase agricultural land from NRE A/c?

- Would answer be different if NRO A/c is utilised to purchase agricultural land?

- What to do incase wrongly purchased?

3.11 Case 2 – Acquisition of an Agricultural Land for Cultivation Purpose in India by a Foreign Nationals Without the Prior RBI Approval

Facts of the case

- Applicants: British citizens and UK residents.

- Joint acquisition of immovable property in Goa, India of Rs. 10,00,000.

- Property: Residential house and coconut cultivation.

- No prior RBI approval obtained at the time of acquisition.

Questions

- What will be the course of action and Compliance required to be done?

- Power of RBI to compound offence committed at the time of FERA?

3.12 Case 3 – Self Valuation or RBI Valuation

Facts of the case

- Non-resident French citizens acquired a plot in Kerala without RBI permission on 16th May 2005; land cost: Rs. 15,00,000; construction cost: Rs. 85,00,000.

- Built a residential building on the plot.

- Advised by RBI to sell the property to a PRI within 6 months; sold on 19th April 2017 for Rs. 75,00,000 to an Indian company.

- Applicants’ valuation report: Rs. 84,91,000; RBI’s valuation report: Rs. 1,28,75,000.

- RBI calculated undue gains as Rs. 28,75,000 (RBI valuation minus purchase and construction cost).

Questions

- What will be the course of action and Compliance required to be done?

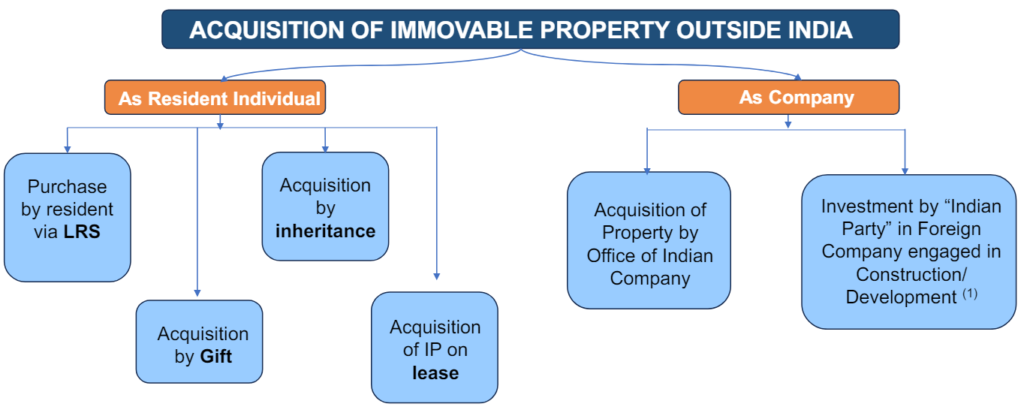

4. Immovable Property Outside India

4.1 Investment in Immovable Property Outside India

Issues

- Investment in foreign entities involved in Real Estate Business is prohibited Notification No. 120- Regulation 5(2).

- Whether ODI in an entity which is engaged only in leasing of a property abroad permissible?

(1) Investment in Real Estate sector not allowed

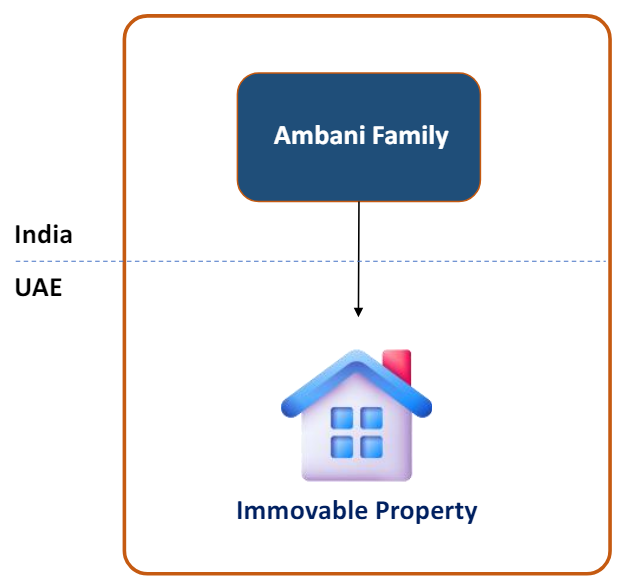

4.2 Case Study 1 – Investment in Immovable Property Abroad under LRS

Facts

- Ambani family intends to purchase immovable property in UAE.

- Property investment is of $1 Million

Queries

- Can multiple family members invest together?

Answer

- Ambani Family can jointly purchase property – 4 family members can remit funds of USD 250,000 to invest 1M USD

- Property has to be in joint name

- Ownership needs to be in proportion to investment made

- Family Members covered No definition for family members

Facts

- Ambani family intends to purchase immovable property in UAE

- Property investment is of $1 Million

Queries

- Can property be purchased on instalment basis?

- Can property be purchased under EMI or mortgage loan?

Answer

- Installments

-

- LRS does not envisage extension of fund and non-fund based facilities by the AD banks to their resident individual customers to facilitate remittances for capital account transactions under LRS.

- However, AD banks may extend fund and non-fund based facilities to resident individuals to facilitate current account remittances under the Scheme.

- Loans

-

- Individuals cannot enter into a loan agreement overseas.

- (Refer Compounding Order dated 19.07.19 in case of Mr Dharmpal Agarwal).

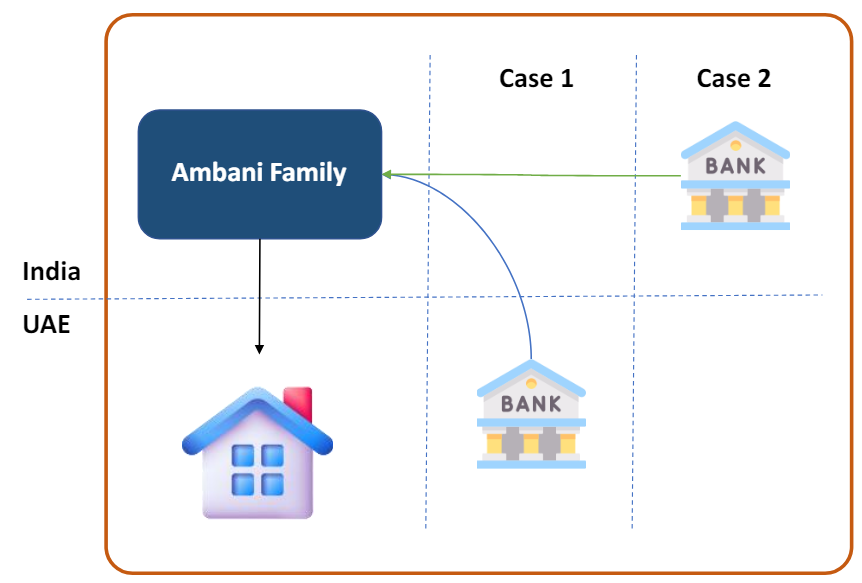

4.3 Case Study 2 – Investment in Immovable Property Abroad under LRS through Company

Facts

- Mr A, Mr B and Mr C incorporate a Co. in UAE through LRS

- ABC Co. purchases immovable property in UAE

Queries

- Can property be purchased through company under LRS?

Answer

- This type of transaction is out of the purview of Rule 21, therefore not allowed without prior RBI approval

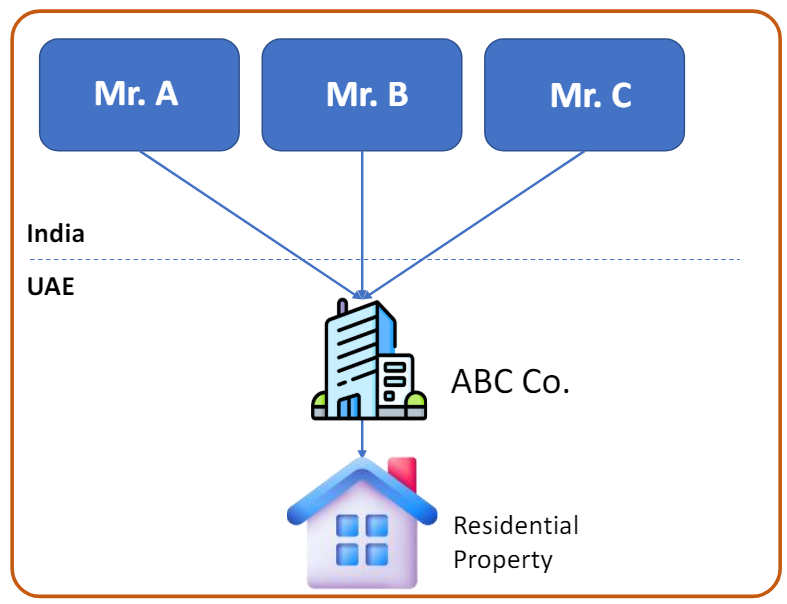

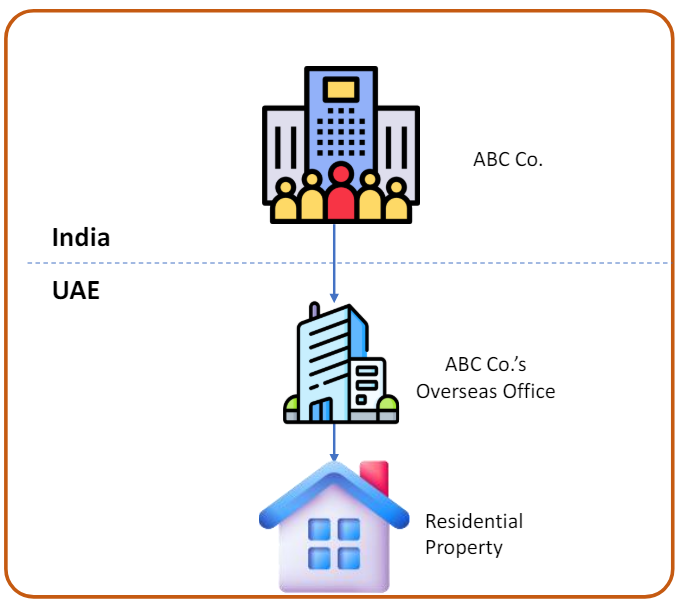

4.4 Case Study 3 – Investment in Immovable Property Abroad through Overseas Office of Indian Entity

Facts

- ABC Pvt Ltd incorporated in India has an overseas office in UAE.

- Can that overseas office purchases immovable property in UAE?

Queries

- Can property be purchased through the branch office?

Answer

- Overseas branches of an Indian company can acquire IP for its business including residence of its staff within the limits for initial & recurring expenses as follows:

-

- Upto 15% of average annual sales/turnover of the Indian party during last two financial years or

- Up to 25% of the net worth, whichever is higher for initial set up

- Up to 10% of the average annual sales/income or turnover during last two financial years towards recurring expenses

4.5 Immovable Property Outside India – Returning Indian

Section 6(4) Definition:

A person resident in India (person covered) may hold, own, transfer or invest in (transaction permitted) foreign currency, foreign security or any immovable property situated outside India (assets specified)

if such currency, security or property was:

- acquired, held or owned by such person when he was resident outside India or

- inherited from a person who was resident outside India

Common Doubts

- Is he needed to bring funds back to India on sale of such IP?

- Can he retain incomes earned on such property outside India? Can Returning Indian convert such IP to another asset?

Current Scenario

- Retain funds abroad on sale of assets

- Retain income earned on such assets abroad

- Reinvest the sale proceeds into new assets abroad

5. Case Studies

5.1 Whether Immovable Property Can be Acquired on Installment Basis?

Facts of the case

- Joint acquisition of a residential property in Singapore by the applicant and others, all resident individuals.

- Total cost of the property: SG$ 3,032,320.

- Part of the cost met through remittances under LRS.

- Remaining amount paid by a loan from OCBC Bank, Singapore in 2015.

- Loan and interest repayments (EMIs) made from lease rental proceeds.

- No gains made from overseas loans for property acquisition.

Questions

- What will be the course of action and Compliance required to be done?

- Whether immovable property can be acquired abroad on an installment basis?

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA

Greetings,

Could you please share an email of a consultant from your company with whom I could discuss a specific issue concerning acquisition of IP.