Acquisition of Immovable Property Outside India under FEMA

- Blog|FEMA & Banking|

- 19 Min Read

- By Taxmann

- |

- Last Updated on 15 July, 2024

The acquisition of immovable property outside India under the Foreign Exchange Management Act (FEMA) refers to the process where residents are permitted to buy or obtain property abroad through various means such as purchase, inheritance, or as a gift. This is subject to the regulations and limits set by the Reserve Bank of India, including compliance with the Liberalized Remittance Scheme (LRS), which allows remittance up to USD 250,000 per financial year for such acquisitions.

Table of Contents

- Introduction

- Section 6(4)

- Acquisition to be in Accordance With the Rules

- No Restriction in Certain Cases

- Acquisition by Indian Entities

- Acquisition of Immovable Property Outside India by a Resident Individual

- Limit of Making Remittance for Acquisition of Immovable Property

- Creation of Charge on Immovable Property Held Outside India by Indian Entity

- Mode of Payment

- Tainted Acquisition

- Disclosure of Foreign Assets in ITR

- Undisclosed Assets Held Outside India

Check out Taxmann's FEMA Practice Manual which simplifies the fundamentals of FEMA and provides comprehensive coverage of its laws and regulations. It offers detailed commentary on various sections, rules, and regulations, providing a complete guide to foreign investment provisions. It is ideal for professionals, CFOs, and AD banks and includes practical examples, user-friendly explanations, and up-to-date amendments. This book is essential for effectively managing Foreign Exchange law in India.

1. Introduction

Earlier the Acquisition of immovable property outside India was regulated under FEM (Acquisition and Transfer of Immovable Property Outside India) Regulations, 2015, effective from 22 August 2022 FEM (Acquisition and Transfer of Immovable Property Outside India) Regulations, 2015 has been superseded by Foreign Exchange Management (Overseas Investment) Rules, 2022. Accordingly, now the Acquisition of immovable property is regulated under Foreign Exchange Management (Overseas Investment) Rules, 2022.

2. Section 6(4)

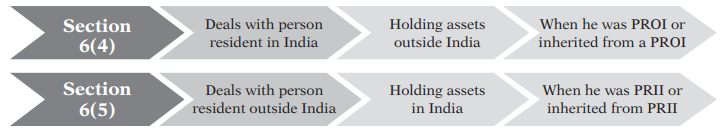

In terms of section 6(4) of FEMA, 1999 in terms of which a person resident in India may hold, own, transfer or invest in foreign currency, foreign security or any immovable property situated outside India if such currency, security or property was acquired, held or owned by such person when he was resident outside India or inherited from a person who was resident outside India.

Section 6(4) of FEMA, 1999 covers the following transactions:

- Foreign currency accounts opened and maintained by such a person when he was resident outside India;

- Income earned through employment or business or vocation outside India taken up or commenced while such person was resident outside India, or from investments made while such person was resident outside India, or from gift or inheritance received while such a person was resident outside India;

- Foreign exchange including any income arising therefrom, and conversion or replacement or accrual to the same, held outside India by a person resident in India acquired by way of inheritance from a person resident outside India.

- A person resident in India may freely utilise all their eligible assets abroad as well as income on such assets or sale proceeds thereof received after their return to India for making any payments or to make any fresh investments abroad without approval of Reserve Bank, provided the cost of such investments and/or any subsequent payments received there for are met exclusively out of funds forming part of eligible assets held by them and the transaction is not in contravention to extant FEMA provisions.

3. Acquisition to be in Accordance With the Rules

The acquisition of immovable property outside India by a Person Resident in India [PRII] can be done by following the Rules as specified in Foreign Exchange Management (Overseas Investment) Rules, 2022.

Rule 21 of the Foreign Exchange Management (Overseas Investment) Rules, 2022 specifies that:

“Save as otherwise provided in the Act or this rule, no person resident in India shall acquire or transfer any immovable property situated outside India without general or special permission of the Reserve Bank”.

4. No Restriction in Certain Cases

There are no restrictions with regard to holding of immovable property outside India in the following cases:

- Held by a person resident in India who is a national of a foreign State;

- Acquired by a person resident in India on or before the 8th day of July, 1947 and continued to be held by such person with the permission of the Reserve Bank;

- Acquired by a person resident in India on a lease not exceeding five years under the Act.

4.1 Manner of acquiring immovable property outside India

- a person resident in India may acquire immovable property outside India by way of inheritance or gift or purchase from a person resident in India who has acquired such property as per the foreign exchange provisions in force at the time of such acquisition;

- a person resident in India may acquire immovable property outside India from a person resident outside India–

-

- by way of inheritance;

- by way of purchase out of foreign exchange held in RFC account;

- by way of purchase out of the remittances sent under the Liberalized Remittance Scheme instituted by the Reserve Bank:

Provided that such remittances under the Liberalized Remittance Scheme may be consolidated in respect of relatives if such relatives, being persons resident in India, comply with the terms and conditions of the Scheme; - jointly with a relative who is a person resident outside India;

- out of the income or sale proceeds of the assets, other than ODI, acquired overseas under the provisions of the Act;

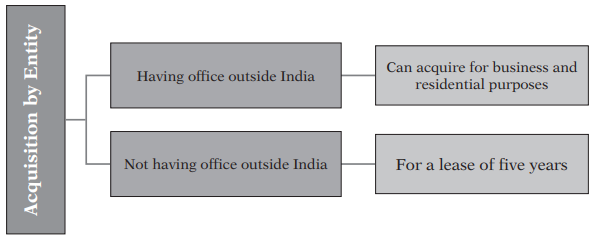

5. Acquisition by Indian Entities

The limits specified in FEM (Acquisition and Transfer of Immovable Property Outside India) Regulations, 2015 have been restored, which are:

(a) For initial expenses

The limit of remittance is 15% of the average annual sales/income or turnover of the Indian entity during the last two financial years or up to 25% of the net worth, whichever is higher.

(b) For recurring expenses

10% of the average annual sales/income or turnover during the last two financial years.

An entity which does not have office outside India cannot acquire property outside India. It can only take property on lease for a period upto 5 years

6. Acquisition of Immovable Property Outside India by a Resident Individual

- a person resident in India may acquire immovable property outside India by way of inheritance or gift or purchase from a person resident in India who has acquired such property as per the foreign exchange provisions in force at the time of such acquisition;

- a person resident in India may acquire immovable property outside India from a person resident outside India–

-

- by way of inheritance;

- by way of purchase out of foreign exchange held in RFC account;

- by way of purchase out of the remittances sent under the Liberalized Remittance Scheme instituted by the Reserve Bank:

Provided that such remittances under the Liberalized Remittance Scheme may be consolidated in respect of relatives if such relatives, being persons resident in India, comply with the terms and conditions of the Scheme; - jointly with a relative who is a person resident outside India;

- out of the income or sale proceeds of the assets, other than ODI, acquired overseas under the provisions of the Act;

The Rule provides for acquisition of immovable property by Person Resident in India [PRII] from person resident in India as well as person resident outside India

The Rule provides for acquisition of immovable property by PRII from

From person resident in India

- May acquire immovable property outside India by way of inheritance or gift or purchase from a person resident in India who has acquired such property as per the foreign exchange provisions in force at the time of such acquisition;

From a person resident outside India

- By way of inheritance;

- By way of purchase out of foreign exchange held in RFC account;

- By of purchase out of the remittances sent under the Liberalised Remittance Scheme instituted by the Reserve Bank;

- Out of the income or sale proceeds of the assets, other than ODI, acquired overseas under the provisions of the Act;

7. Limit of Making Remittance for Acquisition of Immovable Property

A Resident Individual can remit upto the limit of Liberalised Remittance Scheme [LRS] for acquisition of immovable property outside India.

Under the Liberalised Remittance Scheme, all resident individuals, including minors, are allowed to freely remit up to USD 2,50,000 per financial year (April – March) for any permissible current or capital account transaction or a combination of both. In case of remitter being a minor, the LRS declaration form must be countersigned by the minor’s natural guardian. There is no specific restriction with regard to that RI who is minor cannot acquire property outside India.

Remittances under the LRS can be consolidated in respect of close family members subject to the individual family members complying with the terms and conditions of the Scheme. However, clubbing is permitted by other family members if they are the co-owners of the property.

Further, a resident cannot gift to another resident, in foreign currency, for the credit of the latter’s foreign currency account held abroad under LRS.

A resident individual can remit Upto the limit of LRS. Erstwhile it was regulated under LRS not regulated under ODI.

After notification of new OI rules, on 23rd August and 24th August the RBI made consequent amendments in the LRS as well. LRS was aligned with the provisions contained in Foreign Exchange Management (Overseas Investment) Rules, 2022, Foreign Exchange Management (Overseas Investment) Regulations, 2022 and Foreign Exchange Management (Overseas Investment) Directions, 2022.

7.1 Prior to modification

The permissible capital account transactions by an individual under LRS are:

“(ii) purchase of property abroad;

(iii) making investments abroad- acquisition and holding shares of both listed and unlisted overseas company or debt instruments; acquisition of qualification shares of an overseas company for holding the post of Director; acquisition of shares of a foreign company towards professional services rendered or in lieu of Director’s remuneration; investment in units of Mutual Funds, Venture Capital Funds, unrated debt securities, promissory notes;

setting up Wholly Owned Subsidiaries and Joint Ventures (with effect from August 5, 2013) outside India for bona fide business subject to the terms & conditions stipulated in Notification FEMA263/RB-2013 dated March 5, 2013;”

7.2 To align the LRS with New OI regime, it has been replaced with

The permissible capital account transactions by an individual under LRS are:

- opening of foreign currency account abroad with a bank;

- acquisition of immovable property abroad, Overseas Direct Investment (ODI) and Overseas Portfolio Investment (OPI), in accordance with the provisions contained in Foreign Exchange Management (Overseas Investment) Rules, 2022, Foreign Exchange Management (Overseas Investment) Regulations, 2022 and Foreign Exchange Management (Overseas Investment) Directions, 2022;

extending loans including loans in Indian Rupees to Non-resident Indians (NRIs) who are relatives as defined in Companies Act, 2013.

7.3 Transfer of immovable property outside India

A person resident in India who has acquired any immovable property outside India in accordance with the foreign exchange provisions in force at the time of such acquisition may:

- transfer such property by way of gift to a person resident in India who is eligible to acquire such property under these rules or by way of sale;

- create a charge on such property in accordance with the Act or the rules or regulations made thereunder or directions issued by the Reserve Bank from time to time.

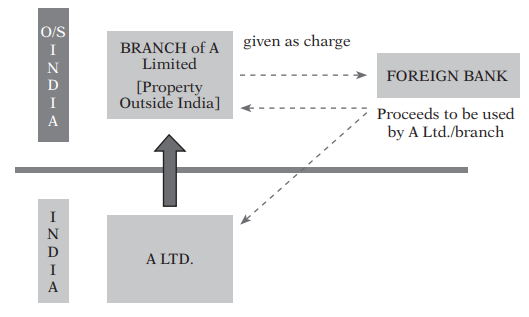

8. Creation of Charge on Immovable Property Held Outside India by Indian Entity

Rule 21 of the OI Rules, 2022 says that a person resident in India who has acquired any immovable property outside India in accordance with the foreign exchange provisions in force at the time of such acquisition may create a charge on such property in accordance with the Act or the rules or regulations made thereunder or directions issued by the Reserve Bank from time to time. However, how such a charge can be created and in what situation it is allowed to be created is not clear.

For example

- A Limited, a company incorporated in

- It has a branch office in

- It has acquired an office [an immovable property or say a warehouse] in Germany for its branch office

Now the question is can A limited put this office as charge for availing of loan outside India to a Bank outside India to the benefit of branch office of A limited or A limited.

Let us try to evaluate this

As per the RBIs Master direction on ECB updated as on Sept. 30, 2022 FED Master Direction No. 5/2018-19 AD Category I banks are permitted to allow creation/cancellation of charge on immovable assets, movable assets, financial securities and issue of corporate and/or personal guarantees in favour of overseas lender/security trustee, to secure the ECB to be raised/raised by the borrower, subject to satisfying themselves that:

- the underlying ECB is in compliance with the extant ECB guidelines,

- there exists a security clause in the Loan Agreement requiring the ECB borrower to create/cancel charge, in favour of overseas lender/security trustee, on immovable assets/movable assets/financial securities/issuance of corporate and/or personal guarantee, and

- No objection certificate, as applicable, from the existing lenders in India has been obtained in case of creation of charge.

Once the aforesaid stipulations are met, the AD Category I bank may permit creation of charge on immovable assets, movable assets, financial securities and issue of corporate and/or personal guarantees, during the currency of the ECB with security co-terminating with underlying ECB, subject to the following:

Creation of Charge on Immovable Assets: The arrangement shall be subject to the following:

- Such security shall be subject to provisions contained in the Foreign Exchange Management (Acquisition and Transfer of Immovable Property in India) Regulations, 2017, as amended from time to time.

- The permission should not be construed as a permission to acquire immovable asset (property) in India, by the overseas lender/security trustee.

- In the event of enforcement/invocation of the charge, the immovable asset/property will have to be sold only to a person resident in India and the sale proceeds shall be repatriated to liquidate the outstanding ECB.

Thus RBIs Master direction on ECB includes charge created on property in India and nothing is specifically specified for immovable property outside India.

Also, Regulation 6 of Foreign Exchange Management (Overseas Investment) Regulations, 2022 which provides for Financial commitment by an Indian entity [summarised below] by way of charge does not provide specifically for creation of charge on immovable property outside India wherein the asset is held by Indian entity through its branch office [and not by FE/SDS]

|

Security by Indian entity |

In whose favour | Facility availed |

Amount reckoned towards financial commitment |

| (A) Pledge the equity capital of the foreign entity/its SDS outside India. | AD bank or a public financial institution in India or an overseas lender. | Fund/non-fund based facilities for Indian entity. | Nil |

| Fund/non-fund based facilities for any foreign entity/its SDSs outside India. | The value of the pledge or the amount of the facility, whichever is less. | ||

| A debenture trustee registered with SEBI in India. | Fund/non-fund based facilities for Indian entity. | Nil | |

| (B) Create charge on its assets (other than A above) in India [including the assets of its group company or associate company, promoter and/or director] | AD bank or a public financial institution in India or an overseas lender. | Fund/non-fund based facility for any foreign entity/its SDS outside India. | The value of charge or the amount of the facility, whichever is less. |

| Overseas or Indian lender. | Fund/non-fund based facilities for Indian entity. | Nil | |

| (C) Create charge on the assets outside India of the foreign entity/ its SDS outside India. | An AD bank in India or a public financial Institution in India. | Fund/non-fund based facility for any foreign entity/its SDS outside India. | The value of the charge or the amount of the facility, whichever is less. |

| Fund/non-fund based facility for Indian entity. | Nil | ||

| A debenture trustee registered with SEBI in India. | Fund based facilities for Indian entity. | Nil |

It seems that the charge can be created on immovable property held through the FE/SDS only.

More clarity is needed with regard to creation of charge on immovable property held outside India [held in the name of its branch office] by Indian entity. Similar clarity is also sought for creation of charge on immovable property held outside India by RI.

9. Mode of Payment

- A resident can purchase immovable property outside India out of foreign exchange held in his/her Resident Foreign Currency (RFC) account.

- A resident can acquire immovable property outside India jointly with a relative, who is a person resident outside India, provided there is no outflow of funds from India.

- A resident individual can send remittances under LRS (Liberalised Remittance Scheme) for purchasing immovable property outside India.

10. Tainted Acquisition

The holding of any investment in immovable property or transfer thereof in any manner shall not be permitted if the initial investment in immovable property was not permitted under the Act.

Where the assest were acquired by showing overseas investment, the same came under investigation by ED. Here is the press release dated 31st March 2022 on the same.

Enforcement Directorate has seized assets worth ₹ 216.40 Crore of a Chennai based company Southern Agrifurane Industries Pvt. Ltd. [SAIPL] and its promoter/director MGM Maran (former chairman of Tamilnad Mercantile Bank Limited) and MGM Anand, under the provisions of Foreign Exchange Management Act (FEMA), 1999.

The seized assets are in the form of land and buildings owned by SAIPL in Tamilnadu and Telangana; Shares owned by MGM Maran in Tamilnad Mercantile Bank Limited (representing 3.31% shares of TMB, which has filed Draft Red Hearing Prospectus for IPO recently); shares of Indian companies SAIPL, MGM Entertainment Pvt. Ltd. and Anand Transport Pvt. Ltd. owned by MGM Anand.

SAIPL is found to have siphoned off Indian Funds of ₹ 216.40 Crores aboard under the garb of Overseas Direct Investments [ODI] by way of False Declarations to its AD Bank as well as by way of structuring transactions in a manner so as to send outward remittances without any bona fides and with sole objective to remove funds from India in the name of ODI without there being any genuine business reasons for the Indian company SAIPL. Such funds have been diverted outside Indian under the garb of ODI with an intention to escape the clutches of Indian laws.

By this way, the company siphoned off around 85% of its entire net worth abroad. ED issued a notice to AD bank and upon receiving the notice the AD bank conducted an Internal Investigation in the matter and based on the findings, recommended the case to be concluded as ‘Fraud’. Also, MGM Maran has surrendered the Indian Passport on 21-12-2016 and taken ‘Cyprus Passport’ to become Cyprus Citizen. In case of MGM Maran in another FEMA investigation, MGM Maran remained to- tally non-compliant to the proceedings and did not attend ED office even once in spite of multiple summons and did not submit any of his foreign assets details, resulting into another Seizure order of his Indian Assets worth ₹ 293 Crore in the month of December 2021.

11. Disclosure of Foreign Assets in ITR

The resident taxpayer (resident but ordinarily resident) has to mandatorily give all the information about the foreign assets, account, etc., in Schedule FA of the Income Tax Return [ITR] in a specified format of ITR. The taxpayer shall provide the details for other foreign assets or accounts held at any time during the relevant accounting period. The nature of foreign assets or accounts can be foreign depository accounts, foreign custodian accounts, immovable property outside India, any other capital asset outside India, foreign cash value insurance contract, or an annuity contract any other income derived from a foreign source. It also includes the details of trust created outside India in which the taxpayer is a beneficiary or settlor and financial interest in any entity outside India.

Schedule FA of ITR:

- This schedule is to be filled up by a resident assessee. It need not be filled up by a ‘not ordinarily resident’ or a ‘non-resident’. Mention the details of foreign bank accounts, financial interest in any entity, details of immovable property or other assets located outside India. This also includes details of any account located outside India in which the assessee has signing authority, details of trusts created outside India in which you are settlor, beneficiary or trustee. Under all the heads mention income generated/derived from the amount of income taxable in your hands and offered in the return is to be filled out under respective columns. Item G includes any other income which has been derived from any source outside India and which has not been included in the items A to F and under the head business of profession in the return.

- This schedule is to be filled in all cases where the resident assessee is a beneficial owner, beneficiary or legal owner.

For this purpose,—

- Beneficial owner in respect of an asset means an individual who has provided, directly or indirectly, consideration for the asset and where such asset is held for the immediate or future benefit, direct or indirect, of himself or any other person.

- Beneficiary in respect of an asset means an individual who derives benefit from the asset during the previous year and where the consideration for such asset has been provided by any person other than such Where the assessee is both a legal owner and a beneficial owner, mention legal owner in the column of ownership.

(A) The peak balance in the bank account during the year is to be filled up after converting the same into Indian currency.

(B) Financial interest would include, but would not be limited to, any of the following:-

- if the resident assessee is the owner of record or holder of legal title of any financial account, irrespective of whether he is the beneficiary or not.

- if the owner of record or holder of title is one of the following:-

-

- an agent, nominee, attorney or a person acting in some other capacity on behalf of the resident assessee with respect to the entity.

- a corporation in which the resident owns, directly or indirectly, any share or voting

- a partnership in which the resident assessee owns, directly or indirectly, an interest in partnership profits or an interest in partnership capital.

- a trust of which the resident has beneficial or ownership

- any other entity in which the resident owns, directly or indirectly, any voting power or equity interest or assets or interest in profits.

- the total investment in col. (5) of part (B) has to be filled up as investment at cost held during the year after converting it into Indian currency.

(C) The total investment in col. (5) of part (C) has to be filled up as investment at cost in immovable property held during the year after converting it into Indian currency.

(D) The total investment in (5) of part (D) has to be filled up as peak investment (at cost) held during the year after converting it into Indian currency. Capital Assets include financial assets which are not included in part (B) but shall not include stock-in-trade and business assets which are included in the Balance Set.

(E) The details of peak balance/investment in the accounts in which you have signing authority and which has not been included in Part (A) to Part (D) mentioned above has to be filled up as peak investment/balance held during the year after converting it into Indian currency.

(F) The details of trusts under the laws of a country outside India in which you are a trustee has to be filled up.

- For the purpose of this Schedule, the rate of exchange for the calculation of the value in rupees of such asset situated outside India shall be the telegraphic transfer buying rate of such currency as on the date of peak balance in the bank account or on the date of investment.

Explanation.— For the purposes of this Schedule, “telegraphic transfer buying rate”, in relation to a foreign currency, means the rate or rates of exchange adopted by the State Bank of India constituted under the State Bank of India Act, 1955 (23 of 1955), for buying such currency, having regard to the guidelines specified from time to time by the Reserve Bank of India for buying such currency, where such currency is made available to that bank through a telegraphic transfer.

12. Undisclosed Assets Held Outside India

The Government has enacted the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax, 2015 (‘Black Money Act’) on May 26, 2015 to address issue of undisclosed assets held abroad by persons resident in India. It provides for separate taxation of income and assets acquired abroad from income not disclosed but chargeable to tax in India. ‘Black Money Act’ is an Act to make provisions to deal with the problem of the black money that is undisclosed foreign income and assets, the procedure for dealing with such income and assets and to provide for imposition of tax on any undisclosed foreign income and asset held outside India and for matters connected therewith or incidental thereto.

As per section 3 of Black Money Act there shall be charged on every assessee for every assessment year commencing on or after 1st day of April, 2016, subject to the provisions of this Act, a tax in respect of his total undisclosed foreign income and assets of the previous year at the rate of 30 (thirty)% of such undisclosed income and asset. An undisclosed asset located outside India shall be charged to tax on its value in the previous year in which such asset come to the notice of the Assessing Officer.

12.1 Undisclosed asset located outside India

Undisclosed asset located outside India is defined to mean an asset (including financial interest in any entity) located outside India, held by the assessee in his name or in respect of which he is a beneficial owner, and he has no explanation about the source of investment in such asset or the explanation given by him is in the opinion of the Assessing Officer unsatisfactory and “undisclosed foreign income and asset” means the total amount of undisclosed income of an assessee from a source located outside India and the value of an undisclosed asset located outside India, referred to in section 4, and computed in the manner laid down in section 5 as per section 2(12) of the Black Money Act.

4. Scope of total undisclosed foreign income and asset.

(1) Subject to the provisions of this Act, the total undisclosed foreign income and asset of any previous year of an assessee shall be,—

- the income from a source located outside India, which has not been disclosed in the return of income furnished within the time specified in Explanation 2 to sub-section (1) or under sub-section (4) or sub-section (5) of section 139 of the Income-tax Act;

- the income, from a source located outside India, in respect of which a return is required to be furnished under section 139 of the Income-tax Act but no return of income has been furnished within the time specified in Explanation 2 to sub-section (1) or under sub-section (4) or sub-section (5) of section 139 of the said Act; and

- the value of an undisclosed asset located outside

(2) Notwithstanding anything contained in sub-section (1), any variation made in the income from a source outside India in the assessment or reassessment of the total income of any previous year, of the assessee under the Income-tax Act in accordance with the provisions of section 29 to section 43C or section 57 to section 59 or section 92C of the said Act shall not be included in the total un- disclosed foreign income.

(3) The income included in the total undisclosed foreign income and asset under this Act shall not form part of the total income under the Income-tax Act.

5. Computation of total undisclosed foreign income and asset.

(1) In computing the total undisclosed foreign income and asset of any previous year of an assessee,—

- no deduction in respect of any expenditure or allowance or set off of any loss shall be allowed to the assessee, whether or not it is allowable in accordance with the provisions of the Income-tax Act;

- any income,—

-

- which has been assessed to tax for any assessment year under the Income-tax Act prior to the assessment year to which this Act applies; or

- which is assessable or has been assessed to tax for any assessment year under this Act,

shall be reduced from the value of the undisclosed asset located outside India, if, the assessee furnishes evidence to the satisfaction of the Assessing Officer that the asset has been acquired from the income which has been assessed or is assessable, as the case may be, to tax.

(2) The amount of deduction referred to in clause (ii) of sub-section (1) in case of an immovable property shall be the amount which bears to the value of the asset as on the first day of the financial year in which it comes to the notice of the Assessing Officer, the same proportion as the assessable or assessed foreign income bears to the total cost of the asset.

12.2 Black Money Act and FEMA

Black Money Act was introduced in 2015 while introduction of the act a window of sometime was given to residents to disclose their assets for certain time here is the relevant notification: https://www.rbi.org.in/Scripts/NotificationUser.aspxId=10051&Mode=0

- The Government of India has enacted the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 (Black Money Act) on May 26, 2015 to address the issue of undisclosed assets held abroad. It provides for separate taxation of income and assets acquired abroad from income not disclosed but chargeable to tax in India.

- To effectively deal with assets held abroad by persons resident in India in violation of the Foreign Exchange Management Act, 1999 (FEMA) for which declarations have been made and taxes and penalties have been paid under the provisions of the Black Money Act, Reserve Bank has issued the Foreign Exchange Management (Regularization of Assets held Abroad by a Person Resident in India) Regulations, 2015 notified though Notification No. FEMA 348/2015-RB dated September 25, 2015 vide S.R. No. 738(E) dated September 25, 2015.

- Accordingly, it is clarified that:

-

- No proceedings shall lie under the Foreign Exchange Management Act, 1999 (FEMA) against the declarant with respect to an asset held abroad for which taxes and penalties under the provisions of Black Money Act have been paid.

- No permission under FEMA will be required to dispose of the asset so declared and bring back the proceeds to India through banking channels within 180 days from the date of declaration.

- In case the declarant wishes to hold the asset so declared, she/he may apply to the Reserve Bank of India within 180 days from the date of declaration if such permission is necessary as on date of application. Such applications will be dealt by the Reserve Bank of India as per extant regulations. In case such permission is not granted, the asset will have to be disposed of within 180 days from the date of receipt of the communication from the Reserve Bank conveying refusal of permission or within such extended period as may be permitted by the Reserve Bank and proceeds brought back to India immediately through the banking channel.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA