Understanding the Valuation under FEMA

- Blog|FEMA & Banking|

- 4 Min Read

- By Taxmann

- |

- Last Updated on 5 February, 2024

Niki Shah – Partner | SN & Co.

Table of Contents

- Overview Fema

- Foreign Direct Investment

- Transfer of Shares

- Transfer of Shares from Non-resident to Resident

- FC-TRS is not Required

- Bird’s Eye View

- Downstream Investments

- Overseas Direct Investment

- Outbound Investments

- Disinvestment in JV/WOS

- Applicability at a Glance

1. Overview FEMA

- Consolidate and amend the law relating to foreign exchange

- Facilitating external trade and payments

- Promoting the orderly development and maintenance of foreign exchange market in India

- 49 sections under FEMA Act

- FEM (Non-debt Instruments) Rules, 2019

2. Foreign Direct Investment

When does transaction affect – Inflow of money by investment by a NonResident on a repatriable basis in capital instruments of an Indian company or by issue of shares.

Valuation Certificate – To be taken from a Chartered Accountant or SEBI registered Merchant Banker or Practicing Cost Accountant.

Methodology – For Listed Cos. price worked out in accordance with the relevant SEBI guidelines. For Unlisted Cos. internationally accepted pricing methodology.

Pricing Guidelines – Issue of Shares by Indian Cos- Price should not be less than Fair Value.

The valuation certificate should not be more than 90 days old as on the date of allotment/transfer of shares.

3. Transfer of Shares

Transfer of shares must be reported in Form FC-TRS to RBI

Transaction Affects – When the transfer of shares is made by way of sale between a person resident in india to non resident.

Pricing Guidelines – Transfer of shares by Indian cos – price should not be less than fair value.

Valuation Certificate – To be taken from a Chartered Accountant or SEBI registered merchant banker or practising cost accountant.

Methodology –

- For listed cos. – Price worked out in accordance with the relevant SEBI guidelines.

- For unlisted cos. – Internationally accepted pricing methodology.

FC-TRS should be filed within 60 days of receipt/remittance of sale consideration

4. Transfer of Shares from Non-resident to Resident

If shares are transferred by Non-resident to person Resident in India must be reported in Form FC-TRS to RBI

When does transaction affect – Shares are transferred between a person Resident outside India to Resident in India.

Pricing Guidelines – Transfer of Shares from a non-resident to resident – Price should not be more than Fair Value.

Valuation Certificate – To be taken from Chartered Accountant or SEBI registered Merchant Banker.

Methodology –

- For Listed Cos. – price worked out in accordance with the SEBI guidelines

- For Unlisted Cos. – Internationally accepted pricing methodology

5. FC-TRS is not Required

In Case of

- Transfer of shares from Non-Resident holding shares on non repatriable basis to a Resident and vice versa

- Transfer of Shares from a person Resident outside India holding on a repatriable basis to a person resident outside India

- A transfer of shares by way of Gift

6. Bird’s Eye View

Valuation norms for Issuance/transfer of shares in an Indian Company

|

Nature |

Listed Company |

Unlisted Company |

| Issue by an Indian Company | Price should not be < the price as per SEBI guidelines | Price should not be < the Fair Value worked out by a CA |

| Transfer from R-NR | Price should not be < the price as per SEBI guidelines | Price should not be < the Fair Value worked out by a CA |

| Transfer from NR-R | Price should not be > the price as per SEBI guidelines | Price should not be > the Fair Value worked out by a CA |

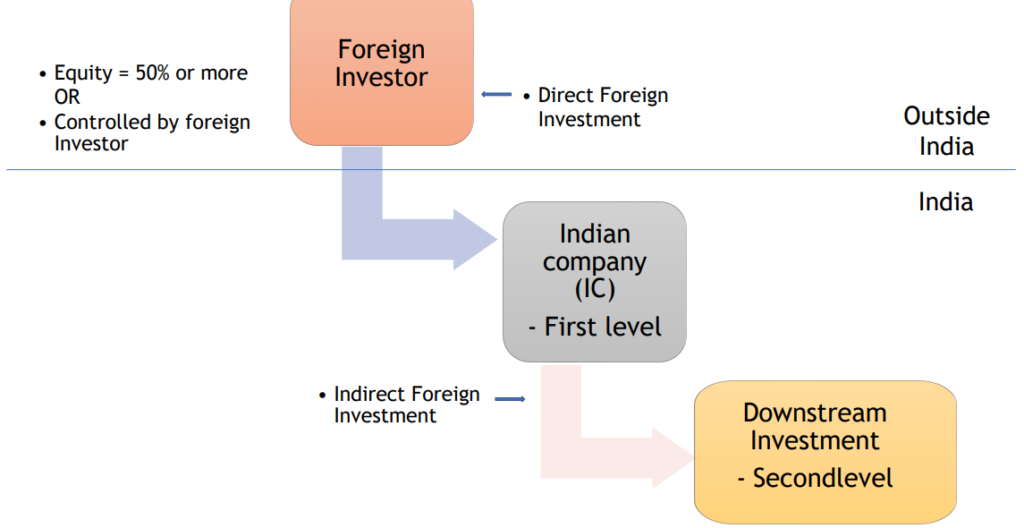

7. Downstream Investments

- Indirect foreign investment is often referred to as “Downstream Investment (DI) under FEMA.

- If an Indian company receiving any FDI and that FDI is used for the purpose of investing in the capital instrument in any other Indian company.

- Investor company has to make reporting in FORM DI for such Downstream Investment.

- Reporting- First level Indian company making DI has to do reporting.

- If the investee company makes any DI and so forth, the onus of making reporting for DI shall also remain on first level Indian company.

Ex- Walmart-> (77%) Flipkart-> Supermart (Grocery delivery startup) - Issue/transfer/pricing/valuation of shares shall be in accordance with SEBI/RBI guidelines.

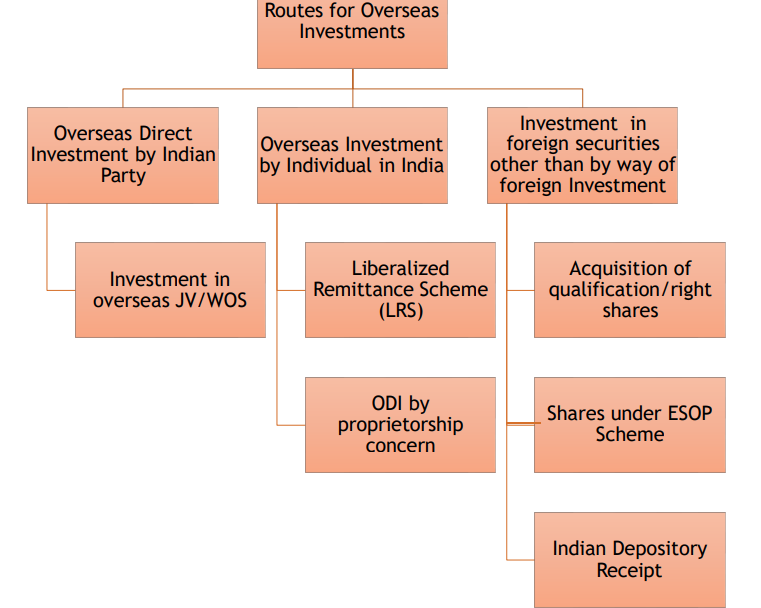

8. Overseas Direct Investment

ODI stands for Investment by way of

- Contribution to the capital or subscription to the memorandum of a foreign entity Or

- by way of purchase of existing shares of a foreign entity. Either in Joint Venture or Wholly Owned Subsidiary by market purchase or private placement.

- ODI can be by way of funds, capitalisation of receivable within realisable time period, swap of securities due to merger, demerger, amalgamation, liquidation.

- ODI upto 400% of net worth of Indian entity is permitted.

When does transaction affects – When an Resident forms JV or WOS outside India OR Acquires or transfer stake in a foreign entity.

Valuation Certificate –

- No Valuation is required for newly set-up company outside India.

- Existing Venture from SEBI registered Merchant Banker or a Chartered Accountant.

Methodology – Internationally accepted pricing methodology.

Pricing Guidelines – Share price should not be more than the Fair Value.

9. Outbound Investments

10. Disinvestment in JV/WOS

Transfer by way of sale of Shares of a JV/WOS outside India

If Listed Shares – Transfer should be through Stock Exchange

If Unlisted Shares – Price should not be less than the Fair Value

Valuation Certificate – From Chartered Accountant OR Certified Public Accountant

Outstanding Dues – By way of dividend, technical know-how fees, royalty, consultancy, commission or other entitlements and/or export proceeds from the JV/WOS

11. Applicability at a Glance

|

Particulars |

Registered Valuer | Merchant Banker (SEBI Registered) | Chartered Accountant |

Cost Accountant |

|

| Issue of Shares | |||||

| Companies Act 2013 | ✔ |

✘ |

✘ |

✘ |

|

| Income Tax Act 1961 |

✘ |

✔ (DCF) |

✔ (NAV) |

✘ |

|

| FEMA, 1999 |

✘ |

✔ | ✔ | ✔ | |

| SEBI laws | ✔ | ✔ |

✘ |

✘ |

|

| Transfer of Shares | |||||

| Companies Act 2013 |

✘ |

✘ |

✘ |

✘ |

|

| Income Tax Act 1961 |

✘ |

✔ | ✔ |

✘ |

|

| FEMA,1999 |

✘ |

✔ | ✔ | ✔ | |

| SEBI Laws |

✘ |

✔ | ✔ |

✘ |

|

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA