Understanding the Recent Developments in Financial Reporting

- Blog|Account & Audit|

- 9 Min Read

- By Taxmann

- |

- Last Updated on 30 October, 2023

Table of Contents

- Supplier Finance Arrangements – Proposed Amendments to Ind AS 7 and Ind AS 107

- Pillar Two Taxes – Proposed Amendment to Ind AS 12

- Amendments in Ind AS

- Amendments to Ind AS 1 and Ind AS 8

1. Supplier Finance Arrangements – Proposed Amendments to Ind AS 7 and Ind AS 107

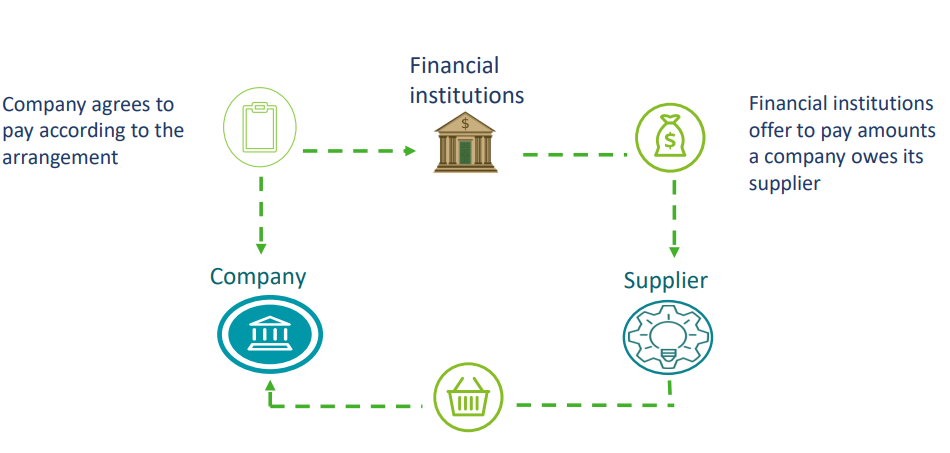

1.1 Scope – What is a Supplier Finance Arrangement

These arrangements provide the company with extended payment terms, or the company’s suppliers with early payment terms, compared to the related invoice payment due date

Scope excludes:

- arrangements that finance receivables or inventory

- arrangements that are solely credit enhancements or used to settle directly with a supplier the amounts owed

1.2 What is the issue?*

- How does a company present liabilities to which supplier finance arrangements relate?

- What information about supplier finance arrangements is a company required to disclose in the financial statements?

- Investors’ information requirements

- Current standards allow for a variety of treatments on balance sheet depending on circumstances

- Current disclosures around liquidity risk and non-cash transfers on cash flow statement

- Targeted project on improving disclosures

- Balance sheet adjustments for effects of such arrangements

- Impact on liquidity risk

- Adjustments to operating cash flows

* Based on IASB activities

1.3 Proposed disclosures

Objective: To enable users to assess the effects of supplier finance arrangements on the entity’s liabilities and cash flows and on the entity’s exposure to liquidity risk

Entity required to disclose in aggregate for its supplier finance arrangements:

(a) the terms and conditions of each supplier finance arrangement (separate disclosure of arrangements that have dissimilar terms and conditions)

(b) as at the beginning and end of the reporting period;

i) the carrying amount of financial liabilities recognised in the entity’s balance sheet that are part of a supplier finance arrangement and the line item(s) in which they are presented;

ii) the carrying amount of the financial liabilities, and associated line items, disclosed under i) for which suppliers have already received payment from these finance providers;

iii) the range of payment due dates of financial liabilities disclosed under i); and

iv) the range of payment due dates of trade payables that do not form part of a supplier finance arrangement

(c) the type and effect of non-cash changes in the carrying amounts of the financial liabilities disclosed under (b)(i).

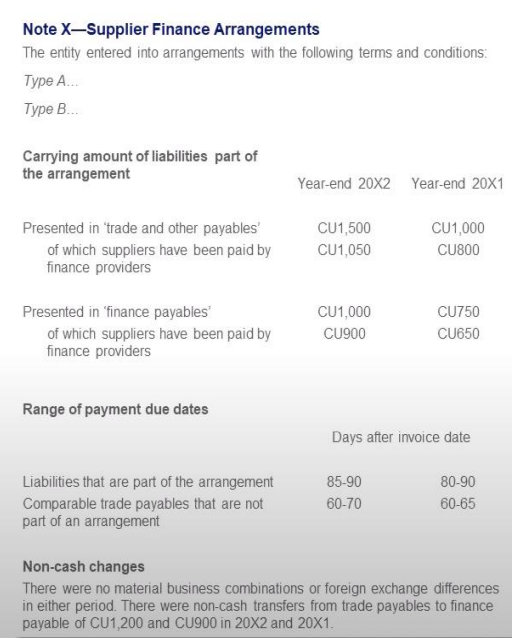

1.4 Illustrative example – disclosure requirements*

This example is provided for illustrative purposes only. The example is simplified and reflects assumptions that may not apply in all circumstances

Level of aggregation

Aggregate disclosure for all supplier arrangements but this aggregate if required information about

- terms and conditions

- range of payment due dates and

- non-cash changes

* Source: IASB webcast

1.5 Effective date and transition

Assume a company with 31 March and will reporting date and 30 June as interim reporting date

Periods before 1 April 2024: An entity is not required to disclose comparative information for any periods presented before 1 April 2024

1 April 2024 – Effective date: An entity is not required to disclose amount suppliers have been paid by finance providers and ranges of payment due dates at 1 April 2024

30 June 2024 – Interim period: An entity is not required to disclose the information required by the amendments for any interim periods in 2024-25

31 March 2025 – First annual period: First annual reporting an entity applies the amendments

2. Pillar Two Taxes – Proposed Amendment to Ind AS 12

2.1 Pillar Two – Overview

About OECD Pillar Two

OECD Applicability

- Pillar 2 rules apply to multinational group

- With global revenues exceeding €750 million threshold in any 2 fiscal years out of prior 4 fiscal years

- Global Minimum Tax Rate at 15%

Key OECD Rules

- Main rule – Income inclusion rule – Large multinational groups pay a minimum level of tax in each country in which they operate – Group revenues of €750 million + 15% rate

- Backstop rule – Undertaxed payments rule

- Domestic Top-Up Tax – Qualified Domestic Minimum Top-up Tax – Domestic Law

2.2 High-Level Calculation Mechanism

| Entities In scope | Entities/Income Not In Scope |

|

MNE’s with consolidated revenue of EUR 750m and more |

Taxpayers with no foreign presence or having less than EUR 750m in consolidated revenue |

| Government entities | |

| International organizations | |

| Non-profit organizations | |

| Entities that are Excluded Entities are not subject to GloBE rules | |

| Entities with definition of pension, investment or real estate fund – these are excluded even if the MNE group subject to the globe rules control these entities | |

| Qualifying shipping income |

Step 1: Entities within scope

Identify groups within scope and the location of each constituent entity within the group

Step 2: GloBE Income

Determine Income of each Constituent Entity

Step 3: Covered Taxes

Determine tax attributable to Income of Constituent Entity

Step 4: Effective Tax Rate and Top Up Tax

Calculate the Effective Tax Rate of all Constituent Entities located in same jurisdiction and determine resulting top up tax

Step 5: IIR and UTPR

Impose Top-up tax under IIR or UTPR in accordance with agreed rule order

Step 6: Additional rules (mergers/acquisition, transition rules etc.)

Additional rules to be applied if its applicable

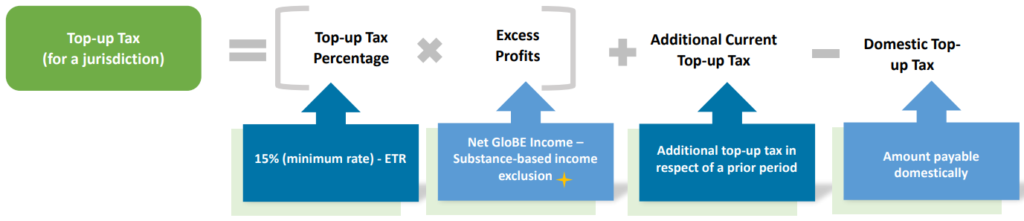

2.3 Computation of Top-up Tax

Amount of top-up tax of each LTCE post aggregating its net income and adjusted covered taxes with those of other constituent entity located in the same jurisdiction to determine the ETR and Top-up Tax Percentage for each jurisdiction

|

Substance-based income exclusion of a fixed return on |

|

| Payroll | Payroll: 10% (to be reduced to 5% over the years). Includes salaries, health insurance, pension contributions, employment taxes and employer social security contributions. Eligible employees include independent contractors. |

| *Net Book Value of Tangible assets | Tangible assets: 8% (to be reduced to 5%). Includes property, plant and equipment, and natural resources |

* Net Book Value of Tangible Assets means the average of the beginning and end values of Tangible Assets after considering accumulated depreciation, depletion, and impairment, as recorded in the financial statements.

Jurisdictional ETR

Adjusted Covered Taxes for all Constituent Entities in the jurisdiction (Covered Taxes)

Net GloBE Income for all Constituent Entities in the jurisdiction (GloBE Income)

2.4 Safe Harbours and Penalty Relief

During the transition period the Top-up Tax in a jurisdiction for a Fiscal Year shall be deemed to be zero where one of the following tests are satisfied:

A. De minimis test: If the MNE Group reports Total Revenue of less than EUR 10 million and Profit (Loss) before Income Tax of less than EUR 1 million in such jurisdiction on its Qualified CbC Report for the Fiscal Year; or

B. ETR test: If the MNE Group has a Simplified ETR that is equal to or greater than the Transition Rate in such jurisdiction for the Fiscal Year; or

C. Routine profits test: If the MNE Group’s Profit (Loss) before Income Tax in such jurisdiction is equal to or less than the Substance-based Income Exclusion amount, for constituent entities resident in that jurisdiction under the CbCR, as calculated under the GloBE Rules.

The terms set out above have the following definitions:

- Transition Period: The safe harbour is also limited to a transitional period that applies to Fiscal Years beginning on or before 31/12/2026 but not including a Fiscal Year that ends after 30/6/2028

- Simplified ETR is calculated by dividing the jurisdiction’s Simplified Covered Taxes by its Profit (Loss) before Income Tax as reported on the MNE Group’s Qualified CbC Report

- Simplified Covered Taxes is a jurisdiction’s income tax expense as reported on the MNE Group’s Qualified Financial Statements, after eliminating any taxes that are not Covered Taxes and uncertain tax positions reported in the MNE Group’s Qualified Financial Statements

- Transition Period covers all of the Fiscal Years beginning on or before 31/12/2026 but not including a Fiscal Year that ends after 30/6/2028

- Transition Rate means:

-

- 15% for Fiscal Years beginning in 2023 and 2024;

- 16% for Fiscal Years beginning in 2025; and

- 17% for Fiscal Years beginning in 2026.

2.5 Pillar two taxes – Proposed relief under Ind AS 12

Pillar Two Model Rules – Accounting challenges

- Is top-up tax in the scope of Ind AS 12 Income Taxes?

- Do the rules create additional temporary differences?

- If yes

-

- How to account for its deferred tax impacts?

- Do the existing temporary differences in relation to deferred tax recognised require remeasurement?

- What should be the rate for measuring the deferred tax impacts?

Mandatory relief from deferred tax accounting

To address the accounting concerns, Ind AS 12 is proposed to be amended:

- provide a temporary mandatory relief from deferred tax accounting for top-up tax;

– entity should neither recognise nor disclose information about deferred tax

related to top-up tax

- require a disclosure that the relief has been applied; and

- require new disclosures compensating for the potential loss of information resulting from the relief.

The relief will be effective immediately and apply retrospectively in accordance with Ind AS 8 Accounting Policies, Changes in Accounting Estimates and Errors

It will apply until it is either removed or made permanent

2.6 Pillar Two Taxes – Proposed New Disclosures

Once tax law is enacted or substantively enacted but before top-up tax is effective

- Information that is known or can be reasonably estimated and that helps users of its financial statements to understand its exposure to Pillar Two income taxes at the reporting date

- Information does not need to reflect all the specific requirements in the legislation – entities can provide an indicative range

- Disclosures may include quantitative and qualitative information

-

- Qualitative information: How the entity is affected by Pillar Two legislation and the main jurisdictions in which exposure might exist

- Quantitative information: The proportion of profits that may be subject to Pillar Two income taxes and the average effective tax rate applicable to those profits, or how the average effective tax rate would have changed if Pillar Two legislation had been in effect

- If information is not known or reasonably estimable at the reporting date, then an entity discloses a statement to that effect and information about its progress in assessing its exposure

After top-up tax is effective

- Current tax expense related to top-up tax

- Disclosure requirements (other than the disclosure on applying the relief) will apply for annual reporting periods beginning on or after 1 April 2023

- No disclosures (other than the disclosure on applying the relief) will be required in interim periods ending on or before 31 March 2024

3. Amendments in Ind AS

Amendments in Ind AS effective for Annual reporting periods beginning on or after 1 April 2023

- Disclosure of Accounting Policies

- Definition of Accounting Estimates

- Deferred Tax related to Assets and Liabilities arising from a Single Transaction

- Editorial Corrections in Ind AS

4. Amendments to Ind AS 1 and Ind AS 8

4.1 Ind AS 1 – Disclosure of Accounting Policies

Accounting policy information is material if, when considered together with other information included in an entity’s financial statements, it can reasonably be expected to influence decisions that the primary users of general purpose financial statements make on the basis of those financial statements

- Converged with corresponding amendments to IAS 1 issued by IASB

- IASB also amended IFRS Practice Statement 2 by including guidance and two additional examples to explain and demonstrate the application of the ‘four-step materiality process’ to accounting policy information

Amendments apply to annual reporting periods beginning on or after 1 April 2023

Consequential amendments made to other Ind ASs

Amendments to Ind AS 1 Presentation of Financial Statements

Intended to help preparers in deciding which accounting policies to disclose in their financial statements by:

- Requiring companies to disclose their material accounting policies rather than their significant accounting policies

- Adding guidance on how entities apply the concept of materiality in making decisions about accounting policy disclosures

-

- Accounting policy information related to immaterial transactions, other events or conditions is itself immaterial and as such need not be disclosed

- Accounting policy information may be material because of its nature, even if the related amounts are immaterial

- Not all accounting policy information relating to material transactions, other events or conditions is itself material

- Accounting policy information is material if users would need it to understand other material information in the financial statements

- If an entity discloses immaterial accounting policy information, such information should not obscure material accounting policy information

- Conclusion that accounting policy information is immaterial does not affect the related disclosure requirements in other standards

Examples of circumstances in which an entity is likely to consider accounting policy information to be material

- A change of accounting policy results in a material change to the information in the financial statements

- A choice of accounting policy is permitted by Ind AS

- An entity develops an accounting policy in accordance with Ind AS 8 Accounting Policies, Changes in Accounting Estimates and Errors in the absence of an Ind AS that specifically applies

- Application of accounting policy requires significant judgements or assumptions (disclosed in accordance with paragraphs 122 and 125)

- It is difficult to understand material transactions, other events or conditions because they require complex accounting, e.g. when more than one Ind AS is applied to a class of material transactions

The list of examples is not exhaustive, but can help an entity to determine whether accounting policy information is material or not

4.2 Amendments to Ind AS 8 – Accounting Estimate Gets A Definition

Accounting estimates are

“monetary amounts in financial statements that are subject to measurement uncertainty”

The definition together with clarifications will help in addressing gap and reducing diversity

- Applicable for annual reporting periods beginning on or after 1 April 2023

- Apply the amendments to changes in accounting estimates and changes in accounting policies that occur on or after the beginning of the first annual reporting period in which it applies the amendments

- Converged with corresponding amendments to IAS 8 issued by IASB

Accounting Estimate

Definition of a change in accounting estimates deleted and definition of accounting estimates introduced

- Amendments clarify relationship between accounting policies and accounting estimates by specifying that a company develops an accounting estimate to achieve the objective set out by an accounting policy

- An entity uses measurement techniques and inputs to develop an accounting estimate

- Not all estimates will meet the definition of an accounting estimate, but rather may refer to inputs used in developing accounting estimates

Clarifications on accounting estimates

- Change in accounting estimate that results from new information or new developments is not correction of an error

- The effects of a change in an input or a measurement technique used to develop an accounting estimate are changes in accounting estimates if they do not result from the correction of prior period errors

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA