Understanding the Presumptive Tax Regime u/s 44AD for eligible Businesses

- Blog|Income Tax|

- 10 Min Read

- By Taxmann

- |

- Last Updated on 13 April, 2023

Table of Contents

- Presumptive taxation regime of Section 44AD of the Act?

- Which assessees are eligible to opt for the scheme under section 44AD?

- Which assessees are barred from availing section 44AD scheme?

- Disqualification incurred by opting out of section 44AD before availing it for 6 consecutive previous years

Check out Taxmann's Tax Audit which provides a clause-wise detailed commentary on provisions relating to Tax Audit and clauses of Form 3CA, 3CB and 3CD, along with Guidance Notes issued by ICAI & Tax Audit Reckoner.

1. Presumptive taxation regime of Section 44AD of the Act

The objective of section 44AD of the Act is to provide a presumptive income scheme for small taxpayers to lower compliance costs for them and to reduce the administrative burden on the tax machinery.

The following features of section 44AD may be noted:

- In the case of an “eligible assessee” engaged in an “eligible business”, the profits and gains from such business shall be deemed to be 8% of the total turnover or gross receipts (6% in case of turnover or gross receipts realised digitally/through banking channels on or before the due date for filing ITR u/s 139(1) on account of such eligible business.

- It must be noted that ‘eligible assessee’ needs to opt for section 44AD for the entire turnover of his ‘eligible business’ if he opts for section 44AD. He cannot, for instance, opt for section 44AD for only digital turnover portion of his turnover.

- The rate of 8 per cent (6% in case of digital turnover) is comprehensive. All deductions under sections 30 to 38 of the Act including depreciation, will be deemed to have been already allowed and no further deduction will be allowed under these sections. The written down value will be calculated, where necessary, as if depreciation as applicable has been allowed.

[For amendments by Finance Act, 2023 to section 44AD w.e.f. A.Y. 2024-25]

In Oopal Diamond v. ACIT [2022] 144 taxmann.com 184 (Mumbai – Trib.), it was held that in view of Task Force Report [See Report of the Task Group for Diamond Sector to make India an “International Trading Hub For Rough Diamonds”, February 2013, published by the Union the Ministry of Commerce and Industry], Net Profit addition for purchases from tainted party is not to exceed 1.5% to 4.5% range in case of diamond manufacturers. The Tribunal held as under:

- Where the assessee was a manufacturer and trader of diamonds and had made purchases from certain parties who were treated as tainted dealers as per information gathered from the search carried out in the entities of Shri Bhawarlal Jain and Group but the sales made out of these purchases were not doubted by the AO, CIT(A) was justified in reducing the 5% net profit addition made by AO in respect of these purchases to 3% as the 3% addition is in line with Benign Assessment Procedure recommended in the report of Task Force for Diamond Sector which recommended Net Profit presumptive margin of 1.5% to 4.5% for diamond manufacturers and 1.5% to 3% for diamond traders.

- We find that the Tribunal has been consistently taking the stand by estimating the profit element on the basis of reliance placed on the aforesaid report of the Task Force. In the instant case, the assessee is engaged in the business of both trading as well as manufacturing of diamonds. Considering the same, the ld. CIT(A) was duly justified in estimating the profit percentage at 3%. In other words, the estimation of profit percentage at 3% by the ld. CIT(A) is just and fair and does not require any interference. Accordingly, ground No. 2 raised by the assessee is dismissed.

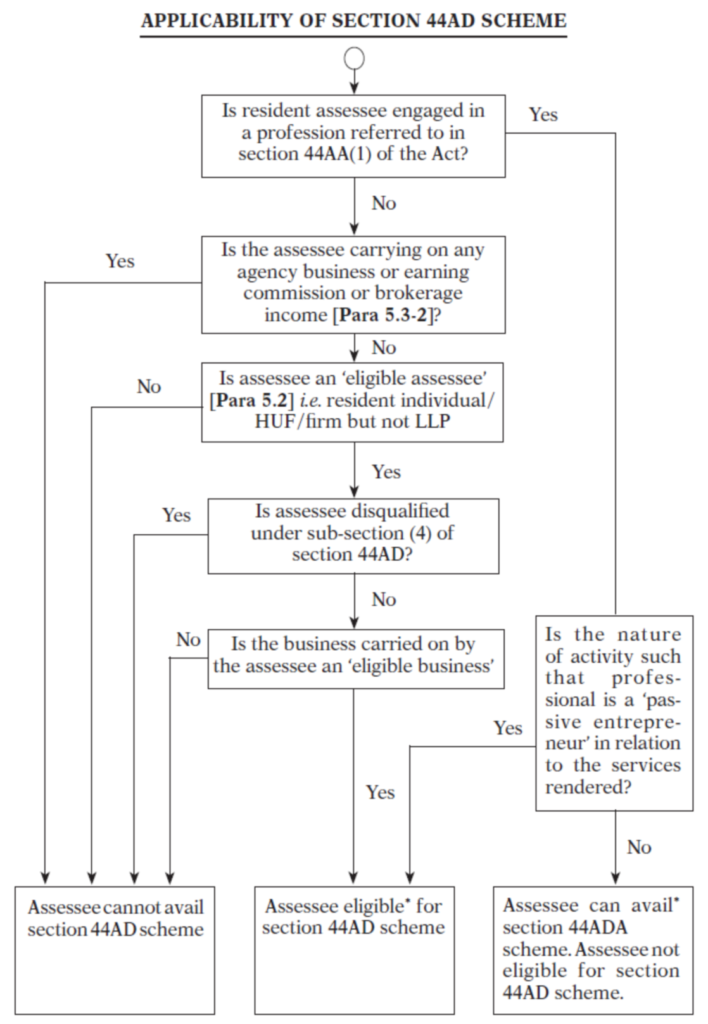

The following flowchart explains who can opt for the presumptive taxation scheme under section 44AD.

2. Which assessees are eligible to opt for the scheme under section 44AD?

Assessee should be an “eligible assessee” within the meaning of clause (a) of the Explanation to section 44AD. According to the said clause (a), “eligible assessee” means:

- An individual, HUF or firm

- Who is resident and

- Who has not claimed deduction under sections 10A, 10AA, 10B, 10BA of the Act or deduction under any provisions of Chapter VIA of the Act under the heading “C-Deductions in respect of certain incomes”.

Also, assessee should not be barred from availing the section 44AD Scheme

Where assessee was not carrying on any business independently but was only a partner in a firm, interest and salary received by assessee could not be construed as business income under section 28(v) and accordingly, assessee’s claim of estimating income on presumptive basis under section 44AD with respect to interest and remuneration earned from partnership firm had rightly been denied. [Anandkumar v. ACIT [2020] 122 taxmann.com 252 (Madras)]

2.1 Section 44AD can be availed only by individuals, HUFs and firms

The benefit of section 44AD can be availed only by resident individuals, Hindu Undivided Families and firms. Section 2(23) of the Act defines “firm” to include Limited Liability Partnerships (LLPs) registered under the Limited Liability Partnership Act, 2008 (LLP Act, 2008). However, clause (a) of the Explanation to section 44AD bars LLPs from availing the benefit of section 44AD. Clause (a) uses the words “but not a “limited liability partnership firm” as defined under clause (n) of sub-section (1) of the Limited Liability Partnership Act, 2008 (6 of 2009)”.

Thus, only general partnership firms within the meaning of Indian Partnership Act, 1932 can avail the benefit of section 44AD. LLPs cannot avail the benefit of section 44AD.

2.2 Non-residents are not eligible assessees and cannot avail benefit of section 44AD

Section 44AD benefit is available only to residents. Non-residents cannot avail section 44AD.

2.3 Not claimed any deduction under Part C of Chapter VIA-A of the Act or under section 10A, 10AA, 10B or 10BA

No deduction is admissible under section 10BA with effect from Assessment Year 2010-11. Likewise, no deduction is admissible under section 10A or 10B with effect from Assessment Year 2012-13. Section 10AA contains “Special provisions in respect of newly established Units in Special Economic Zones”. Part C of Chapter VI-A under the heading “C-Deductions in respect of certain incomes” comprises sections 80HH to 80RRB (both inclusive). Most of these sections in Chapter VIA-C either legally or practically do not apply to small businesses. Many of these sections are past their “sunset clause” date and hence deductions under them are not legally admissible. SUGAM ITR-4 form is prescribed for filing ITRs of assessees who opt for section 44AD. In ITR-4, there is no column for claiming any deduction under Chapter VIA-C.

3. Which assessees are barred from availing section 44AD scheme?

Section 44AD(6) of the Act provides that the provisions of section 44AD shall not apply to:

(i) a person carrying on profession as referred to in sub-section (1) of section 44AA of the Act

(ii) a person earning income in the nature of commission or brokerage

(iii) a person carrying on agency business.

Sub-section (4) of section 44AD provides restrictions against opting in and opting out at will. Sub-section (4) provides that where an eligible assessee declares profit of 8% or more (6% or more in case of digital turnover) in accordance with section 44AD for Assessment Year 2017-18 or any subsequent assessment year, he should declare 8% or more (6% or more in case of digital turnover) for next 5 consecutive assessment years also before opting out of section 44AD by declaring lower than 8% (lower than 6% for digital turnover) for any year. Where assessee opts out in violation of sub-section (4) i.e. before declaring profit of 8% or more (6% or more in case of digital turnover) for 6 consecutive years, he shall be barred from availing section 44AD scheme for next 5 consecutive assessment years.

3.1 Which are the professions referred to in section 44AA(1) [Section 44AD(6)(i)]

A person carrying on a profession referred to in section 44AA(1) of the Act cannot avail section 44AD in respect of either the profession or for that matter in respect of any “eligible business” carried on by him. Under section 44AA(1) of the Act, the following professions have been notified so far:

- Accountancy

- Architectural

- Authorised Representative

- Company Secretary

- Engineering

- Film artists – Art Director (including Assistant Director), Cameraman, Dance Director (including Assistant Dance Director), Dialogue writer, Director (including Assistant Director), Dress Designer, Editor, Lyricist, Music Director (including Assistant Music Director), Screenplay writer, Singer, Story writer

- Interior Decoration

- Information Technology

- Legal

- Medical

- Technical Consultancy

The following implications of clause (i) of section 44AD(6) may be noted:

- The exclusion applies not merely to the profession referred to in section 44AA(1) but to the person carrying on such profession.

- This means, for example, if a doctor [a profession referred to in section 44AA(1)] has a business of pharmacy shop as well, it goes without saying that he would not be able to claim section 44AD for his medical practice1.

- What is further important is that he would also not be able to opt for presumptive taxation under section 44AD for his pharmacy shop business.

- On the other hand, if his pharmacy shop business is carried on by a partnership firm (not being an LLP), the firm can avail section 44AD in respect of that business as the doctor and firm are distinct ‘persons’ with separate PAN numbers as far as the Income-tax Act, 1961 is concerned.

- The person barred is the person carrying on profession referred to in section 44AA(1) – i.e., the doctor. The firm carrying on pharmacy business is a distinct and separate person and the bar does not apply to the firm.

- Likewise a partnership firm selling law books having a lawyer as a partner is not barred from availing section 44AD since the bar in section 44AD(6) applies to the lawyer and not to the firm which is a separate entity for income-tax purposes.

- If profession carried on is one that is not covered by section 44AA(1) of the Act (e.g. teaching, authorship), the person carrying on the same can avail the presumptive income scheme under section 44AD in respect of that profession and also in respect of any other eligible business.

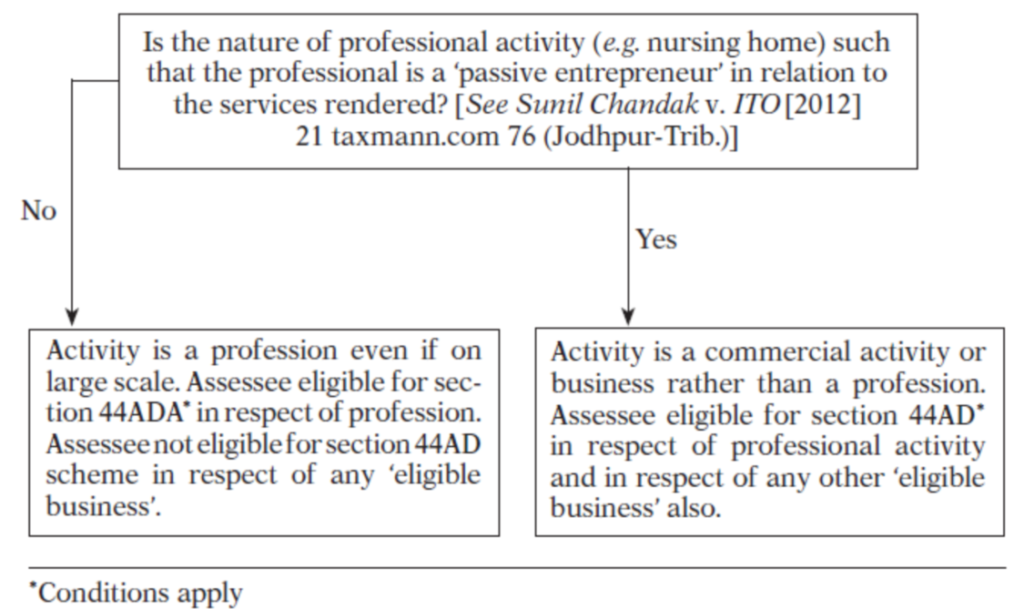

It must be noted that the activity of a professional doctor/lawyer/architect etc. would still be a profession and not be a business even if it is carried out on a large scale by hiring other doctors/lawyers etc. unless the doctor/lawyer becomes a passive entrepreneur in relation to the services.

In Sunil Chandak v. ITO [2012] 21 taxmann.com 76/136 ITD 324 (Jodh. - Trib.), the Tribunal dealt with this issue in great detail. The ITAT laid down the following propositions:

- Even if a doctor carries out his activities on a large scale by hiring other doctors in his nursing home, his activity will be ‘profession’ and not ‘business’ unless he becomes a passive entrepreneur in relation to services.

- The fact that physicians/doctors have been hired is not relevant.

- What is relevant and crucial is the nature of the services rendered by them (hired doctors), whether facilitative or substantially so, or on independent, standalone basis, or substantially so. It is only in the latter case that the nursing home acquires the character of a business enterprise.

- A lawyer or an architect, say, may keep juniors or even experienced lawyers or architects, to assist him, or to be able to increase the capacity or manage efficiently the volume or range of services, i.e., impact positively the quality and quantum of work/professional output. The same would be essentially a question of size, i.e., make it a law firm or a solicitor firm as against an individual lawyer or solicitor, and not impinge on the character of the services. The question is not even of capital, which again plays a dormant role.

- Where, however, the lawyers employed or hired are specialists in their respective areas of practice, engaged with a view to broaden the horizons of the professional services being offered, the firm, though only a law firm as far as the clients are concerned, its proprietor could be said to be carrying out trade or commerce, inasmuch as his function in relation to those services is only passive, of an entrepreneur, managing the affairs, much in the same manner as a non-professional would.

- A business is characterized by a much higher level of risk in comparison to profession.

- By undertaking to invest capital, entailing financial risk as where it is borrowed at a cost, and arranging for a gamut of services, the promoter assumes a level of business risk not warranted by the exercise of profession, in as much as he is trading or leveraging on the professional ability of those employed or hired to successfully run a particular segment of the business, if not the whole of it, and not merely to act as assistants or facilitators working under a stable, supervised and, thus, controlled, conditions.

If the doctor conducts activities of his nursing home on large scale by hiring other doctors to the extent he becomes a passive entrepreneur, he could no longer be said to be “carrying on a profession” within the meaning of section 44AD(6)(i) or “engaged in a profession” to use the words of section 44ADA. In such a case, the doctor would not be eligible for presumptive scheme under section 44ADA but would be eligible for the presumptive scheme under section 44AD.

Applicability of Presumptive Income Scheme Under Sections 44AD/44ADA to Resident Assessee Engaged in Profession Referred to in Section 44AA(1)

3.2 Whether a person earning commission or brokerage income [Section 44AD(6)(ii)] can avail section 44AD scheme for his other business activities?

A person earning income in the nature of commission or brokerage cannot opt for presumptive taxation under section 44AD not only in respect of his activities giving rise to commission or brokerage income but also in respect of other ‘eligible business’. If an individual is carrying on his commission or brokerage activities in individual proprietary name but is a partner in a firm carrying on ‘eligible business’, the firm is not barred from availing section 44AD as it is a separate entity with separate PAN for tax purposes. It is also important to note that mere earning of commission or brokerage income disqualifies a person from opting for section 44AD even if he has ceased carrying on the activities giving rise to the income and these are results of his past efforts.

4. Disqualification incurred by opting out of section 44AD before availing it for 6 consecutive previous years

Sub-section (4) of section 44AD provides as under:

- Where an eligible assessee declares profit for any previous year in accordance with the provisions of this section.

- Then in any of the next 5 assessment years relevant to the previous year succeeding such previous year, he opts out of section 44AD by declaring profit not in accordance with section 44AD – i.e. he declares profit less than 8% (less than 6% in case of digital turnover) or he declares a loss.

*Conditions apply.

-

- With effect from assessment year 2017-18, the doctor can opt for presumptive income scheme for his medical practice under section 44ADA.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA

What if actual profit is more than 8% in case the return is filed under 44AD ?. Should we declare actual profit or 8% as per the law ?.

Ethically yes, actual profit should be declared but practically things may vary on the ground of non-maintenance of books.

As per section 44AD, the assessee should mention 8%/6% of turnover as minimum profit. However, if the actual profit is more than the prescribed % then the assessee can declare actual profit in his income tax return.

Hi,

Can business of teaching and income from it will be eligible for presumptive taxation u/s 44AD?

Thanks for this great article.

If the profession carried on by the assessee is one that is not covered by section 44AA(1) of the Act, the person carrying on the same can avail the presumptive income scheme under section 44AD in respect of that profession and also in respect of any other eligible business.

Can a pilot show their income under section 44AD, since he is not covered under section 44AA and further where it has been written that the actual profit must be shown, can we just simply pay6/8% of the gross receipts?

“No, presumptive scheme under section 44AD can be claimed by an eligible assessee only if he is engaged in an eligible business. Eligible business is defined under this section as any business except the business of plying, hiring or leasing goods carriages referred to in section 44AE; and whose total turnover or gross receipts in the previous year does not exceed an amount of Rs. 2 Crore.

A Pilot, being a profession, is not eligible to claim presumptive scheme under section 44AD.”

What is the threshold limit u/S 44AD for Service providers e.g. Manpower Supply, Renting of Machinery etc.?

Any business carried out by the eligible assessees is eligible for Section 44AD if turnover or gross receipts from such business in the financial year does not exceed Rs. 2 crores. However, the limit of Rs. 2 crores shall be increased to Rs. 3 crores if the amount or aggregate of the amount of cash received during the previous year does not exceed 5% of the total turnover or gross receipts of such year.

Can a salaried person who also earns additional income from freelance teaching qualify for presumptive taxation under Section 44AD?