Understanding Section 56(2)(viib) & Various Nuances of Valuation Aspects

- Blog|Income Tax|

- 6 Min Read

- By Taxmann

- |

- Last Updated on 14 August, 2023

Table of Contents

- Background – 56(2)(viib)

- Explanation to Section 56(2)(viib)

- Rule 11UA(2)

- Recent updates which may impact future valuation exercise

- Analysis of Judicial Precedents

- Practical challenges and factors to be considered to avoid litigation and controversy

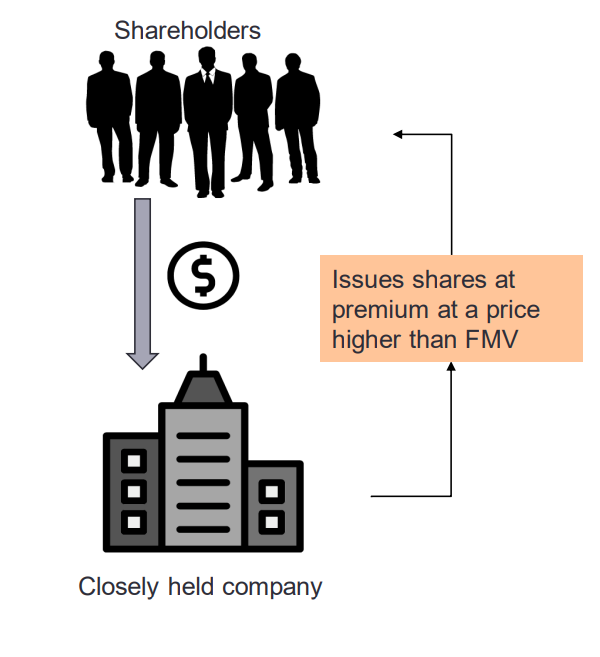

1. Background – 56(2)(viib)

- Introduced by Finance Act, 2012

- Objective to to tax excessive share premium received unjustifiably by private companies on issue of shares without carrying underlying value.

- An anti-abuse measure to prevent generation and circulation of unaccounted money received in garb of share premium.

- Taxes the consideration or premium above fair market value (“FMV”) (determined in prescribed manner) on issue of shares in the hands of the closely held company.

2. Explanation to Section 56(2)(viib)

- Section 56(2)(viib) provides that:

- where an closely held company1 (“CHC”);

- receives any consideration from any person, whether resident or non-resident;

- for the issue of shares in excess of the fair market value;

- determined under Rule 11UA(2)

- such excess amount shall be chargeable to tax under the head ‘Income from Other Sources’.

- However, there are exceptions for companies where,

- Company receives consideration from venture capital company or a venture capital fund or a specified fund2; or

- CHC receives consideration from specified entities notified under Notification 29 of 2023 dated 24 May 2023; or

- Company receiving consideration is a startup company recognised by Department for Promotion of Industry and Internal Trade (DPIIT) vide notification dated 19 February 2019.

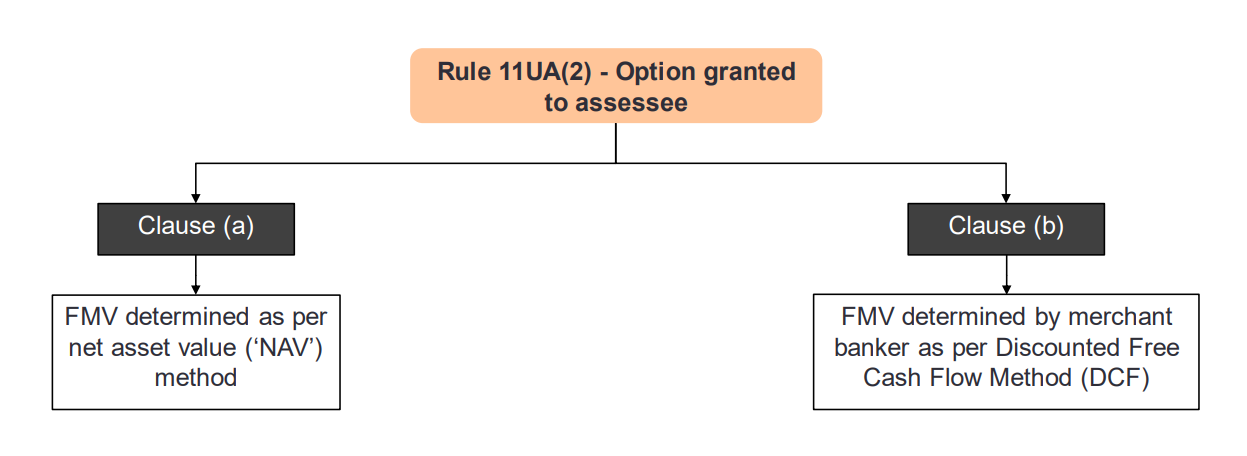

3. Rule 11UA(2)

- Rule 11UA(2) provides determination of FMV of unquoted equity shares issued by closely held companies as provided under section 56(2)(viib) of the Act.

- Taxpayer can select any option to determine value of shares mentioned under the rule e., clause (a) or clause (b) of sub-rule (2) to Rule 11UA.

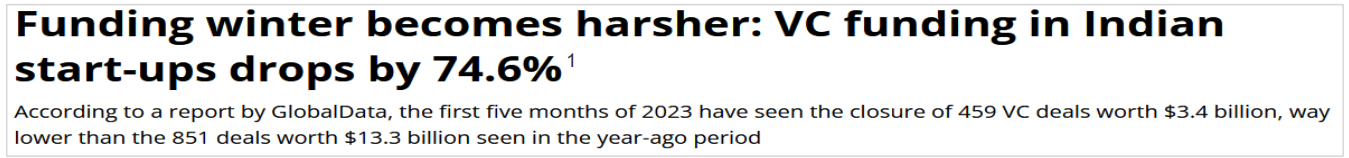

4. Recent updates which may impact future valuation exercise

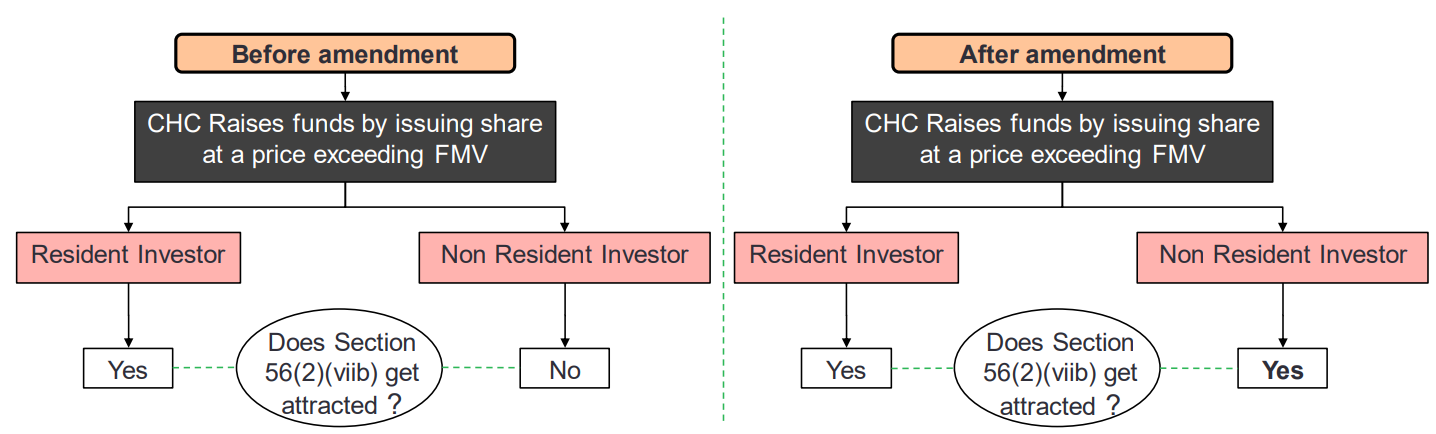

4.1 Amendment made in Finance Act, 2023

- Finance Act, 2023 brings into account the consideration received from non-resident under the ambit of section 56(2)(viib) of the Act.

- Before effect of amendment, CHC could raise funds at a price exceeding FMV from Non-resident. However, 56(2)(viib) will be attracted in case CHC receives consideration at a price exceeding FMV from resident as well as non-resident.

4.2 Impact of Angel tax on Startup companies

- CHC will have to pay tax on funding raised from foreign funds and non-resident investors on difference between issue price and the FMV of shares issued;

- It will impact industry of angel investing by non-resident investors;

- The proposed expansion of Angel Tax can potentially further slow down investments, or even force startups to flip outside India.

4.3 The changes proposed in the draft rule by CBDT

The CBDT has requested the stakeholders to provide suggestions/comments on the draft Rule 11UA which are given below:

- 5 new valuation methods for non-resident investors viz.

- Comparable Company Multiple Method

- Probability Weighted Expected Return Method

- Option Pricing Method

- Milestone Analysis Method

- Replacement Cost Methods

- The price at which shares are issued to the notified entity can be treated as FMV for others

- Merchant Banker’s report shouldn’t be older than 90 days

- 10% Safe harbor limit introduced

4.4 Income Tax Rules and FEMA

- The FEMA valuation norms provide for the minimum floor for bringing in funds from abroad.

- The Income Tax provisions, on the contrary, prescribe a ceiling limit (maximum of FMV) for proceeds received by an Indian company towards issue of shares to enjoy tax exemption.

- Therefore, if the valuation done under FEMA regulations exceeds the fair value as per Income Tax laws, one can expect scrutiny from the tax department.

- Since the share valuation methodology under both regulations are not aligned, there exists an inherent task in satisfying the requirement under both regulations.

- Going forward, we can expect companies to have a more robust mechanism for valuation of shares in order to satisfy the valuation rules both under FEMA and Income tax.

4.5 Income Tax Rules and Provisions of Companies Act

- Section 62(1)(c) read with Rule 13 of Companies (Share Capital and Debenture) Rules 2014 provides as under:

“The price of shares or other securities to be issued on preferential basis shall not be less than the price determined on the basis of valuation report of a registered valuer.”

- Income tax provisions provides that shares should not be issued at a value which is higher than the prescribed valuation (i.e., valuation as per NAV method or value arrived by merchant banker e., as per DCF method).

- Accordingly, compliance with both the regulations needs to be Share valuation methodology under both the laws are not aligned and hence difficulty may arise in satisfying the requirement under both the regulations.

5. Analysis of Judicial Precedents

5.1 CIT vs. VVA Hotels (P.) Ltd [2020] 122 taxmann.com 106/[2021] 276 Taxman 330 (Mad.)

Facts of the case

- Assessee issued shares at premium and, accordingly, received share premium of certain amount

- Assessee determined FMV of shares issued at premium on basis of discount cash flow (DCF)

- Assessing Officer (AO) changed same to net value added (NVA) method on ground that assessee’s actual revenue varied from its projected revenue

- Accordingly, difference in valuation of shares was assessed as income from other sources under section 56(2)(viib) in hands of assessee

Decision

- Tribunal upon consideration of facts noted that variation between value of projected revenue and actual revenue of assessee was marginal

- There was no material to hold that assessee’s projected sales revenue was fabricated

- Further noted that Assessing Officer did not point out any flaw in method of calculation of value of shares

- Impugned change of method of valuation of shares and subsequent additions made under section 56(2)(viib) was unjustified and same were to be set aside

5.2 Brio Bliss Life Science (P.) Ltd. v. ITO [2023] 149 taxmann.com 89/200 ITD 167 (Chennai-Trib.)

Facts of the case

- Assessee had received share premium for allotment of equities

- Assessee had followed Discounted Cash Flow (DCF) method for determination of share price

- AO made additions towards excess premium received on the ground that the assessee could not justify valuation of shares under DCF method with necessary financials

- Excess consideration received over and above the face value had been added as income of the assessee

Decision

- AO completely erred in arriving at a conclusion that DCF method followed by the assessee was incorrect only on the basis of one element, difference in projected financials and actual performance

- Further, projected free cash flow considered by the assessee need not be equal to the actual performance of the company

- AO is free to examine method followed by the assessee, however, he does not have power to change method followed by the assessee

5.3 Agro Portfolio (P.) Ltd. V. ITO [2018] 94 taxmann.com 112/171 ITD 74 (Delhi – Trib.)

Facts of the case

- Assessee allotted 3,15,000 equity shares of face value of Rs. 10 each at a premium of Rs. 40 per share

- FMV of the share was determined at Rs. 50 on the basis of Discounted Cash Flow Method, which was done by one Merchant Banker

- AO rejected the valuation report of the said Merchant Banker and determined the value of shares at INR 60 each. Amount of INR 1.27 cr (40.40*3,15,000) per share was added to the assessee’s income

Decision

- Merchant bankers solely relied upon an assumed without independent verification, the truthfulness accuracy and completeness of the information and the financial data provided by the company

- Paper book which clearly establishes that no independent enquiry is caused by merchant banker to verify the truth or otherwise the figures furnished by the assessee at least on test basis

- Merchant banker had only applied formula to the data provided by the assessee

- In the result, the appeal of the assessee is dismissed

6. Practical challenges and factors to be considered to avoid litigation and controversy

6.1 Practical challenges while conducting valuation exercise

Clawback clause under second proviso to section 56(2)(viiib)

- Indian entity being an eligible start up which has obtained funding by issuance of shares at premium has to comply with the conditions of notification GSR 127(E) issued by Department for Promotion of Industry and Internal Trade dated 19 February 2019. Otherwise,

- Consideration received for issuance of shares exceeding the fair market value shall be deemed to be income of the previous year in which failure to comply with the conditions has taken place;

- Such income shall be deemed to be under reported income.

Other challenges

- Obligation of valuer to verify assumptions provided by the management;

- Valuations standards issued by ICAI to be considered for valuation under Income Tax Act

- Scope Limitation – Valuer can relies on management representations…

- Comparison of projected cashflows vs. actual cashflows

6.2 Aspects to be taken care of to avoid litigation and controversy

- While valuing the shares, entities should carry out extensive research and seek help from a management consultant for preparing an Information Memorandum

- Following pointers to be analysed to carry out industry analysis:

- Capacity utilisation in manufacturing industry; and/or

- Per day average footfall in retail industry; and/or

- Average daily rate in the hospital

- Documentation to support the projections should be robust and be undertaken in a very scientific manner

- Other factors to be looked out:

- Director/investor’s experience;

- Industry analysis of the management consultants;

- Understanding of the sector expansion; and

- Scaling

- a company not being a company in which the public are substantially interested

- AIF Category I and AIF category II regulated by SEBI or IFSCA

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

Source:

Source:

CA | CS | CMA

CA | CS | CMA

Hi,

This has ref to the inclusion of Valuation of CCPS in the 11UA amendment:

As regards the amendment on 27th Sep, 2023 to Rule 11UA, does the new amendment relating to Valuation of CCPS apply only to start-ups (as few articles have suggested) or does it apply to existing companies as well?

I ask this because till date, CCPS by unlisted private companies were valued at Face Value if the terms of CCPS clearly stated the ratio of conversion and the fact that the conversion to equity would be at the book value determined at the time of conversion.

Can an existing unlisted private company continue the earlier practice of issuing CCPS at Face Value or does it have to follow the valuation mechanism for CCPS as per 11UA amendment?

The amended Rule 11UA provides explicit guidance on computing the FMV of CCPS, thus same has to be followed.