Understanding and Preparing Financial Statements with Adjustments | Step-by-Step Guide

- Blog|Account & Audit|

- 20 Min Read

- By Taxmann

- |

- Last Updated on 18 January, 2024

Table of contents

Check out Taxmann's Accounting for Management which is an amended & updated self-study book specifically for 'would-be managers' in simple language with illustrations, detailed examples, graded problems & exercises etc., for MBA/MMS/PGDM programs, etc.

On the basis of trial balance the financial statements are prepared and the trial balance, as we know, is prepared from the ledger accounts. However, the procedure is not so straight forward. Because of accrual concept, matching concept and some decisions made at the end of the year, the figures disclosed by the trial balance are to be readjusted before preparing financial statements. Let us take a few examples.

1. Need for Adjustments

Suppose, a firm follows accounting year from April to March. The period under consideration is, say, April 20×1 to March 20×2. The firm must be paying salaries to its employees every month. When the salaries are paid for a month a journal entry is passed and then posted to the salaries account in ledger. Usually, the salaries are paid on the first or second day of the next month. That means, the salaries for the month of March 20×2 will be paid in April 20×2. The entry of salary payments will be made only when it is paid. That means, the salaries for March 20×2 will be entered in the books in April 20×2 when the actual payment is made. Here, the problem is that the salary payment pertains to the accounting year 20×1-x2 (March 20×2 belongs to this accounting year) whereas, in the books it will be recorded in the accounting year 20×2-x3 (because the payment is made in April 20×2 which belongs to 20×2-x3 accounting year).

As per the accrual system the time of payment is not important. Here, the important factor is that since the salaries belong to the accounting year 20×1-x2 they should be considered in the financial statements in this year only, even if the payment is made in the next accounting year. Since in 20×1-x2 there are no entries in the books for the salaries of March 20×2 a special entry will have to be passed to incorporate the March 20×2 salaries in the financial statements of 20×1-x2. By passing this special entry the salaries account shall be readjusted before it is shown in the financial statements. This adjustment is needed because of accrual system or concept of accounting.

We have already discussed how the closing stock is brought into the books of account at the end of the year because of matching concept. Till that time no record or entry is available in the books regarding closing stock. Please refer to the discussion on matching concept in the third chapter. There we have discussed an example of allocating the total cost of a machine over a period of 10 years to income statement. This is done by passing some special entries at the end of the year while preparing financial statements. By passing these entries the fixed assets accounts are adjusted and then shown in the financial statements.

The third requirement of showing adjustment entries in the books of account is that some decisions are made or implemented as per the policy of the firm for which the adjustment entries are passed. For example, if a customer has not paid his dues for a long time and the firm has given up the hope of recovering that money from the customer then the firm may decide to treat this as a loss on account of bad debts. To give effect to this decision the firm will have to make some special adjustment entries.

Thus, the point should be clear that at the end of the year before preparing financial statements some adjustment entries are required to be passed to adjust some of the accounts. This is mainly due to the following three reasons —

A. because of accrual system or concept

B. because of matching concept

C. because of making or implementing certain decisions.

There are two methods of taking care of these adjustments after they are brought into the books of account by passing adjustment entries :

A. They are shown in the financial statements as additional items of adjustments. For example, salaries for eleven months would come from the trial balance and the salaries for the twelfth month (which are still payable) would be shown as a separate item and be shown in the financial statements as addition to the eleven months’ salaries.

B. The second method is that the figures of the trial balance are readjusted by the adjustment entries and an adjusted trial balance is prepared. This adjusted trial balance takes care of both, the original balances of the ledger accounts and the adjustment entries. In this case there is no need to show the adjustments separately in the financial statements.

We shall discuss both the methods. However, the method of preparing adjusted trial balance is more practical and followed in real life. Therefore, we shall give more emphasis to the second method of preparing the adjusted trial balance before preparing the financial statements.

Dive Deeper:

Know all about the Financial Statements of Companies

2. Some Common Adjustments

We shall now discuss different types of adjustments which may occur at the end of the year, their meaning, the entries required to make the adjustments and their treatment in the financial statements.

1. Outstanding Expenses – The outstanding expenses are those expenses, which become due in the current accounting year but their payment is made in the next accounting year. The example of salary payment discussed earlier is an example of outstanding expenses.

The effect of outstanding expenses is twofold. On the one hand they are treated as the expenses for the current year because they have become due or have accrued during current year and on the other hand the expenses have not yet been paid, they remain payable at the end of the year therefore, they have to be treated as liabilities.

To continue with the example of salaries, suppose if the salaries account in the ledger shows a balance of say ` 44,500. This is the total amount of salaries paid (for eleven months) and obviously does not include the twelfth month’s salaries because the payment has not been made for the last month’s salaries before 31st March. Now suppose, if the amount of last month’s (March 20×2) salaries comes to ` 4,800. This will be paid in April 20×2 i.e., in the next accounting year but we shall consider these salary expenses during 20×1-x2 year. That means, the total amount of salaries we shall show in the income statement is ` 49,300 which includes 11 months’ salaries (` 44,500) given by the salaries account in ledger and salaries for the twelfth month, ` 4,800. In a nutshell what we have done is we have increased the salary expenses from ` 44,500 to ` 49,300 to take care of full year’s salaries.

From the view point of passing the adjustment entry we should know that one effect of this adjustment is that the concerned expense account’s (in this case it is the salaries account) balance increases and therefore, the account has to be debited. The other effect is that the twelfth month’s salaries remain payable at the end of the year because these will be paid next year, therefore, the account of outstanding salaries will be classified as the liability account. We know that the liability account is credited. Thus, the adjustment journal entry would be —

Salaries a/c

Dr.

To Outstanding salaries a/c

(Being outstanding salaries for the March 20×2 brought into the books)

After passing the adjustment entry if the trial balance is adjusted the figure for salaries will change from ` 44,500 to ` 49,300 which will appear in the profit and loss account. If the trial balance is not adjusted then the twelfth month’s salaries would be shown in the profit and loss account debit side as an additional item as under :

| To salaries | 44,500 |

| + outstanding salaries | 4,800 |

| 49,300 |

Whether the trial balance is adjusted or not, in either of the cases the outstanding salaries (` 4,800) being a liability for the firm would appear in the liability side in the balance sheet.

We discussed this adjustment by taking the example of salaries account. The same rules would apply and the same procedure be followed for any other outstanding expense. Only the account head will change depending on which item of expense is outstanding. For example, in case of wages it will be ‘Outstanding Wages’ account, in case of rent it will be ‘Outstanding Rent’ account, so on and so forth.

2. Prepaid Expenses – The prepaid expenses are exactly opposite in nature to the outstanding expenses. These are the expenses paid in the current year but they are not due in current year or services against these expenses will be received in the next accounting year. In simple terms we can say that the expenses incurred in advance are the prepaid expenses.

Suppose, a firm is finalising its accounts for the year April 20×1 to March 20×2. On 1st January 20×2 the firm pays an insurance premium of ` 2,400 for the period January 1 to December 31, 20×2. Here, when we compare the accounting year with the period for which the insurance premium has been paid, we find that only the first 3 months of the premium period fall in the current accounting year and the remaining 9 months fall in the next accounting year.

Since the premium of ` 2,400 has been paid, naturally the full amount will be reflected by the insurance premium account in the ledger. But out of ` 2,400 the premium for 3 months only should be considered as current year’s expenses and the remaining 9 month’s premium should be considered as expenses in the next accounting year. That means, the premium for 9 months would be treated this year as prepaid or paid in advance.

The firm is supposed to receive some services in future against prepaid expenses therefore, the prepaid expenses are considered as assets of the firm. Being an asset account prepaid expense account is debited in the adjustment journal entry.

Out of ` 2400 when we defer `1800 (premium for 9 months) to the next year then it means that this year we shall consider ` 600. Thus, the expense amount has reduced from ` 2400 to ` 600. We know that the reduction in the expenses is credited. Therefore, the adjustment journal entry for prepaid insurance premium would be —

Prepaid insurance premium a/c

Dr.

To Insurance premium a/c

(Being prepaid insurance premium deferred to the next accounting year)

If the trial balance is adjusted after the entry the revised figure for the insurance premium would be ` 600 which will also appear in the profit & loss account. If the trial balance is not adjusted then the item would appear in the profit & loss account debit side as under

| To Insurance premium | 2,400 |

| Less prepaid insurance premium | 1800 |

| 600 |

In either case, `1,800 would appear in the assets side in the balance sheet as the prepaid insurance premium.

We discussed about the insurance premium as an example, however the same procedure will be followed for any item of expense paid in advance.

3. Accrued Income – An income which is due in the current accounting year but has not been received and will be received in the next accounting year is known as accrued income. Such accrued income should be treated as current year’s income though it has not been received. Suppose, the item under consideration is interest received. By the amount of accrued interest, the balance of interest received account would be increased. Therefore, by the amount of accrued interest the interest received account would be credited.

Since, accrued income will be received in future it is considered as an asset in the current accounting year, therefore, the accrued income account would be debited. If the item under consideration is interest received the adjustment entry would be as under:

Accrued Interest a/c

Dr.

To Interest received a/c

(Being interest accrued but not received in the current year)

If the trial balance is adjusted after the entry, the balance of interest received account will increase which will appear in the profit and loss account. If the trial balance is not adjusted then the items would appear in the profit and loss account credit side as under :

| By Interest received | —— |

| Add-Accrued interest | —— |

In either of the cases the accrued income appears in the asset side in the balance sheet.

4. Unaccrued/Pre-received Income – An income which is due in the next accounting year but received in the current accounting year is known as the unaccrued income. In other words, an income received in advance is an unaccrued income. Since, the income has been received, it is reflected in the ledger account. But it pertains to the next accounting year therefore, we defer this income from the current year to the next year.

Suppose, if the item under consideration is commission received, then the amount of unaccrued commission will be transferred to the next year from the commission received account. Thus, the balance of commission received account will reduce, therefore, in the adjustment journal entry commission received account would be debited.

When the income is received in advance the firm is supposed to provide services in future against that income to some outside parties. Therefore, the income received in advance is treated as a liability of the firm and hence, the account of unaccrued income is credited in the adjustment journal entry. If we are taking the example of unaccrued commission, the entry would be as under:

Commission received a/c

Dr.

To unaccrued/pre-received commission a/c

If the adjusted trial balance is prepared after this entry the commission received account would appear at the reduced level in the trial balance as well as in the profit and loss account.

If the adjusted trial balance is not prepared then the items would appear in the credit side of profit and loss account as under:

| By commission received | —— |

| Less-Unaccrued/pre-received commission | —— |

In either of the cases, unaccrued/pre-received income appears in the liabilities side in the balance sheet.

To feel absolutely comfortable with the debit/credit aspects of the four adjustments discussed so far and the adjustments still to be discussed the students are advised to once again review the section on trial balance in chapter 5 and the discussion which follows the illustrations on trial balance.

5. Bad Debts – The meaning of bad debts is known to us. When a firm fails to recover money from its customers, the loss is known as bad debts. Students should be clear about the difference between bad debts and discount. The discount is willingly offered as an incentive to the customers to induce them to make early payments, whereas, bad debts are the losses which occur when a firm fails to collect the dues from the customers in spite of all the efforts made to collect those dues.

During an accounting year, any time, if a firm decides to consider an amount as bad debts because of no hopes of receiving that money then immediately the following entry can be passed —

Bad debts a/c

Dr.

To Sundry Debtors’ a/c

(Being unrecoverable money written off as bad debts loss)

The bad debts account is a loss account therefore, it has been debited. The loss of bad debts reduces the value of the asset (debtors) therefore, the debtors account has been credited.

If this entry is passed sometime during the year (not at the end of the year as a result of the decision made at the end of the year) then automatically it is posted to the respective ledger accounts and then reflected in the trial balance. Thus, there is no need to treat this as a special year end adjustment. The only thing which remains is that like other expenses and losses, the balance of bad debts account is transferred to profit and loss account and the account is closed down. The required entry is as under:

Profit and loss a/c

Dr.

To Bad debts a/c

(Being the balance of bad debts transferred to P and L a/c)

However, if the decision is made to write off some receivables as bad debts at the end of the year then it has to be viewed as an year end adjustment, because first time the loss is brought into the books and that would change the balances of some of the accounts.

The entries required to take care of this adjustment are the same two entries which we have discussed. However, now in addition to the loss of bad debts shown in the debit side of profit and loss account the same loss is shown in the balance sheet as a subtraction from the debtors as under —

| Sundry debtors | 25,500 |

| Less Bad debts | 400 |

| 25,100 |

The aforesaid balance sheet treatment is required if the trial balance is not adjusted after passing the entry. If the trial balance is adjusted then the debtors would appear in the trial balance at the reduced value (i.e., after deducting bad debts) and therefore, there is no need to deduct bad debts loss again from debtors in the balance sheet.

In any case, the treatment in the profit and loss account remains unaffected i.e., the loss of bad debts is debited to the profit and loss account.

6. Provision for Bad and Doubtful Debts – We know the meaning of bad debts. In the third chapter as part of ‘conservatism concept’ we have discussed the meaning of provision for bad and doubtful debts. Once again we shall repeat here and take an example to understand the adjustment.

Suppose, we are finalising books for the year 20×0-x1 (i.e., April 20×0 to March 20×1). In the trial balance the sundry debtors stand at ` 55,000. All these debtors are expected to pay their dues in the next accounting year i.e., 20×1-x2. Here, the firm anticipates that some of the debtors may not pay their dues fully. The firm estimates the loss, of say, ` 1000. We must keep in mind that this is an estimated loss and not a confirmed loss. If the loss and its amount is confirmed, there is no need to create any provision, rather straightaway it can be considered as bad debts loss. But here, since the loss is estimated and not confirmed and exact, a provision will have to be created called ‘provision for bad and doubtful debts’. This provision is created from the profit and loss account of 20×0-x1. To create the provision the following adjustment entry would be passed

| Profit & Loss a/c Dr. | 1,000 | |

| To Provision for bad and doubtful debts a/c | 1,000 | |

| (Being provision created for the anticipated | ||

| loss on account of bad and doubtful debts) |

When the above entry is passed, there will be a debit posting in the profit and loss account and there will be a credit balance in the provision account. The meaning is that ` 1000 have been transferred from profit and loss account to provision for bad and doubtful debts account.

The purpose of this provision is to take care of a future estimated loss which will come to our knowledge in the next year (i.e., 20×1-x2). Therefore, the balance of this provision account is carried forward to the next year alongwith assets and liabilities (The provision account is a liability account because it is used to meet a future loss or liability). Next year when the debtors of 20×0-x1 pay their dues we come to know that actually we have lost, say, ` 800 on account of debtors of 20×0-x1. Since in 20×0-x1 we have created the provision of ` 1000 to meet this loss therefore, there is a balance of `1000 in the provision account. In 20×1-x2 when we come to know about this loss of ` 800, we need not show this loss in the profit and loss of 20×1-x2 because the loss is not on account of the debtors of 20×1-x2 but it is on account of the debtors of 20×0-x1 and to meet the loss the provision is available. Therefore, the loss of ` 800 would be met out of the provision of ` 1000. To accomplish this the following entries would be passed in 20×1-x2 —

| (i) | Bad debts a/c | Dr. | 800 | |

| To Sundry debtors a/c | 800 |

(Being the loss on account of bad debts)

This entry is passed to record the loss of bad debts.

The next entry would be passed as under to adjust the loss against the provision

| (ii) | Provision for bad & doubtful debts a/c | Dr. | 800 | |

| To Bad debts a/c | 800 |

(Being loss of bad debts adjusted against the provision account)

Going back to 20×0-x1, in addition to this provision of ` 1,000 being shown in the debit side of profit and loss account the same amount is shown as a deduction from sundry debtors in the balance sheet as under:

| Sundry debtors | 55,000 |

| Less – Provision for bad and doubtful debts | 1000 |

| 54,000 |

The meaning is not that the debtors have reduced by ` 1,000. But the meaning is that the debtors of ` 55,000 are subject to an anticipated loss of ` 1,000. Therefore, the complete balance of ` 55,000 in debtors account and ` 1,000 in provision account will be carried forward to 20×1-x2.

A question might have come to the minds of students that why a provision should be created in 20×0-x1 and then loss is adjusted in 20×1-x2 against the provision. Why not straightaway the loss of ` 800 debited to profit and loss account in 20×1-x2 when we know about the actual loss? The answer is that though we come to know about the loss in 20×1-x2, the loss is on account of the sales for 20×0-x1 and not on account of the sales of 20×1-x2. Therefore, the burden of loss should be on the profit & loss account of 20×0-x1 and not on the profit and loss account of 20×1-x2. This is according to the matching concept.

The discussion on the provision for bad and doubtful debts gives us the conceptual clarity about the meaning and purpose of this adjustment. But the actual accounting of this adjustment is much more complicated. To understand the complete accounting of this adjustment and its treatment in the financial statements we shall take up a few small problems and some comprehensive illustrations in this chapter on the upcoming pages.

7. Provision for Discount on Debtors – We have already discussed the difference between discount and bad debts. Sometimes, like the provision for bad and doubtful debts the provision for discount on debtors may have to be created. Let us take an example. Suppose, at the end of 20×0-x1 there are sundry debtors of ` 4,80,000. They will pay their dues in the next year i.e., 20×1-x2. To some of them the firm might have offered that if they pay their dues within a certain time period, they shall be entitled to get a discount of 1% or 2%. The amount of such discount comes to, say ` 2,000, we know that this amount of discount is not confirmed because the offer of discount is conditional. Thus, this is not a confirmed but an anticipated and estimated expense. The actual amount of discount offered will come to our knowledge only next year, i.e., in 20×1-x2. Therefore, a provision will be created in 20×0-x1. When the actual amount of discount comes to our knowledge it is adjusted against the provision account. The entire procedure and all the entries required for this adjustment are exactly like those of provision for bad and doubtful debts. The only difference is in the accounts involved. Instead of bad debts account here it would be ‘discount on debtors account. And instead of provision for bad and doubtful debts account here, it would be ‘provision for discount on debtors account’. Everything else remains the same.

For this adjustment also we shall take up a few illustrations to understand the complete accounting and the treatment in financial statements.

8. Reserve for Discount on Creditors – A firm can offer discount to its customers or debtors. Likewise, it can also get an offer of discount from its suppliers or creditors. Let us understand the adjustment with the help of an example. Suppose, at the end of 20×0-x1 sundry creditors stand at ` 3,60,000 in the books. The firm will pay to all of them in the next accounting year i.e., 20×1-x2. Some of these creditors might have given offers to the firm that if the payment is made before a particular date then the firm will get a discount of, say, 1% or 2%. The amount of such discount comes to, say, ` 2,400. This amount of discount is conditional and therefore, cannot be treated as a confirmed and exact income in 20×0-x1. The amount of confirmed and exact income will come to our knowledge only in the next year. Let us say it is ` 2000.

Therefore, using the same logic which we have discussed in the provision for bad and doubtful debts and provision for discount on debtors, here we shall create a reserve for discount on creditors in 20×0-x1. This will be carried down to 20×1-x2. In 20×1-x2 when the actual amount of discount received becomes known to us then that amount would be set off against the reserve created. The entire logic and procedure remain the same as in adjustment number 6 and 7. But adjustment numbers 6 and 7 deal with the estimated loss whereas this adjustment deals with the estimated income. Accordingly, there would be changes in the entries. In 20×0-x1 when the reserve is created the following entry would be passed.

| Reserve for discount on creditors’ a/c Dr. | 2,400 | |

| To Profit and loss a/c | 2,400 |

(Being reserve for discount on creditors created)

Because of this entry the reserve for discount on creditors will appear in the credit side of profit and loss account. In the balance sheet of 20×0-x1 the amount of reserve for discount will be shown as the deduction from sundry creditors as under —

| Sundry creditors | 3,60,000 |

| Less: Reserve for discount | 2,400 |

| 3,57,600 |

The full balance of sundry creditors i.e., ` 3,60,000 and the balance of reserve account i.e., ` 2400 will be carried down to 20×1-x2. In 20×1-x2 the following two entries would be passed,

(i) To record the receipt of discount

| Sundry creditors a/c | Dr. | 2,000 | |

| To Discount received a/c | 2,000 | ||

| (Being discount received from creditors) | |||

(ii) To set off this discount against the reserve account

| Discount received a/c Dr. | 2,000 | |

| To Reserve for discount on | ||

| creditors a/c | 2,000 |

(Being discount received from creditors is adjusted against the reserve account)

The students should be careful to use the proper terminology. For bad debts and discount on debtors we create ‘provision’ because these are anticipated and estimated losses. Whereas for the discount on creditors we create ‘reserve’ because this is an anticipated and estimated income. It is wrong to say, ‘reserve for bad and doubtful debts’ and ‘reserve for discount on debtors’. For these two we create provision and not reserve. We shall have somewhat detailed discussion on reserves and provisions later in the book.

9. Depreciation – In the third chapter under matching concept and going concern concept we have discussed that when a business firm buys some long term or fixed asset like plant, machinery, building, furniture etc., then these assets remain with the firm for a long time and give benefits to the firm for a number of years. Therefore, the total cost of these assets is allocated over their useful life. Based on such allocation a part of the total cost of the asset is shown in the income statement every year and the balance value, known as the ‘Written down value’ of asset, is shown in the balance sheet. The allocated part of the total cost which is shown in the income statement is called “depreciation”.

Here, we are limiting ourselves only to those points which are directly relevant to the financial statements. There are two important methods to find out the amount of depreciation to be shown every year in the income statement.

A. Straight Line Method

B. Reducing Balance Method

or

Written Down Value Method

Under straight line method the amount of depreciation remains constant throughout the life of the asset. Under Written Down Value method the amount of depreciation reduces every year.

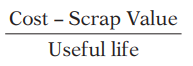

Under straight line method the amount of depreciation is calculated using the following information —

(i) Cost of the asset

(ii) Estimated useful life of the asset

(iii) Estimated scrap or residual value of the asset when its useful life gets over.

The above three figures are put in to the following formula to find out the amount of depreciation –

Suppose, a machine is purchased for ` 1,00,000. Its economic life is 10 years and its estimated scrap value is ` 10,000. The depreciation of this machine would be as under —

![]()

` 9,000 would be the amount of depreciation every year for 10 years.

It is also possible to calculate the depreciation based on a fixed percentage rate. For example, after buying a machine for ` 50,000 the firm decides to charge depreciation at 10% per annum on straight line method.

Here, 10% of ` 50,000 is ` 5,000. Therefore, every year ` 5,000 will be the amount of depreciation. However, this percentage rate of 10% is derived using the same information i.e., original cost, scrap value and estimated useful life of the machine.

Under written down value method the amount of depreciation is calculated every year on the balance book value of the asset therefore, the amount of depreciation reduces every year. For example, a machine is purchased for ` 60,000 and depreciation is to be charged at 10% per annum on reducing balance method. In the first year the depreciation would be 10% of 60,000 i.e., ` 6,000. In the second year it would be 10% of ` 54,000 (60,000 cost less 6,000 depreciation of first year) i.e., 5,400. In the third year it would be 10% of ` 48,600 (54,000 book value less 5,400 depreciation of second year) i.e., ` 4,860. Thus, every year the amount of depreciation reduces.

The amount of depreciation calculated (Using any method) is shown as an expense in the debit side of profit and loss account as under:

PROFIT & LOSS A/C (Dr. side)

| ` | |

| To Depreciation on | |

| Machinery | — |

| Furniture | — |

| Building | — |

In the balance sheet the total accumulated amount of depreciation till date is subtracted from the original cost of the asset as under:-

BALANCE SHEET (asset side)

| ` | |||

| Machinery | — | ||

| Less – Accumulated Depreciation | — | ||

| — | |||

| Furniture | — | ||

| Less – Accumulated Depreciation | — | ||

| — | |||

| Building | — | ||

| Less – Accumulated Depreciation | — | ||

| — | |||

Note – Accumulated depreciation is also called provision for depreciation.

This treatment in the profit and loss account and balance sheet is on the basis of the following journal entries :

(i) Depreciation a/c

Dr.

To Provision for depreciation a/c

[Being depreciation charged on ……..

(here the name of the asset will be written)]

Depreciation is an expense therefore, the account is debited and because by the amount of depreciation the value of the concerned asset reduces, therefore, the provision for depreciation account is credited.

(ii) Like other expenses the depreciation account is closed down by transferring it to the profit and loss account –

Profit and Loss a/c

Dr.

To Depreciation a/c

(Being depreciation transferred to the P and L a/c)

Students should refer to the ‘Accounting for Property Plant & Equipment and Depreciation’ for the complete and detailed discussion on depreciation accounting.

The above adjustments which we discussed are the usual and routine adjustments. There can be few more adjustments. In fact, an adjustment is nothing but any transaction or event to be accommodated in the books of account at the end of the year while finalising the books and preparing financial statements. In our illustrations on financial statements as and when we get any new adjustment we shall explain that.

| IMPORTANT POINTS TO NOTE AT THIS STAGE |

| 1. At the end of the year while finalising the books of account, some adjustments are required to be made.

2. The adjustments are required mainly because of three reasons : (a) to follow the accrual concept (b) to follow the matching concept (c) to implement some decisions made at the end of the year. 3. After passing adjustment entries the trial balance figures can be readjusted or the adjustments can be shown directly in the financial statements. The method of preparing adjusted trial balance is more practical. 4. Like any other accounting transaction the adjustment entries also have two effects-one debit and one credit. Usually, one effect is felt in the income statement and one in the balance sheet. 5. For every adjustment a journal entry is required to take care of both the aspects of the adjustments. |

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA