Understand Schedule FA in ITR Forms and Implications under the Black Money Law

- Blog|Income Tax|

- 20 Min Read

- By Taxmann

- |

- Last Updated on 19 January, 2024

Table of Contents

- Introduction

- Applicability of Disclosure Requirement

- Reporting under Schedule FA

- Key Issues

- Penalty & Imprisonment

- Jurisprudence

1. Introduction

- Schedule FA addressing the disclosure of foreign assets, was introduced as an integral component of the Income Tax Return Form (ITR) from the Assessment Year 2012-13.

- Schedule FA was introduced through the amended ITR forms for AY 2012-13 which is relevant for FY 2011-12.

- As a part of the income tax filing process, Schedule FA requires taxpayers to disclose details about their investments, including stocks, mutual funds, and other financial instruments.

- It enables the Income Tax Department to consider the data for analyzing the risk parameters for the assessee.

2. Applicability of Disclosure Requirement

- The reporting requirement of foreign assets in Schedule FA, applies to all residents &

Individuals & HUF who are R&OR. - Fourth proviso to Section 139(1): A person, being a resident other than not ordinarily resident holding overseas assets is mandatorily required to file their income tax return irrespective of their total income in the following two scenarios:

-

- Who holds any assets located outside India (including any financial interest in any entity) as a beneficial owner or otherwise or as a signing authority in any account located outside India

- Is a beneficiary of any asset (including any financial interest in any entity) located outside India

Beneficial Owner: in respect of an asset means an individual who has provided, directly or indirectly, consideration for the asset for the immediate or future benefit, direct or indirect, of himself or any other person.

Beneficiary: in respect of an asset means an individual who derives benefit from the asset during the previous year and the consideration for such asset has been provided by any person other than such beneficiary.

- Fifth proviso to Section 139(1): The mandatory ITR filing requirement would not apply to an individual being a beneficiary of any assets (including any financial interest in any entity) located outside India, where, income if any arising from such assets is includible in the income of the beneficial owner or legal owner.

- Foreign citizen who qualifies as R&OR would also be required to disclose all their foreign assets in Schedule FA. However, a note below Schedule FA provides relaxations for certain foreign citizens as below:

“In case of an individual, not being an Indian citizen, who is in India on a business, employment or student visa, an asset acquired during any previous year in which he was non-resident is not mandatory to be reported in this schedule if no income is derived from that asset during the current previous year.”

- Thus, the exclusion for disclosure of foreign assets in the case of foreign citizens will be applicable if all the below mentioned conditions are fulfilled:

-

- Person is a foreign citizen

- Has come to India on a business/employment/student visa

- Foreign assets was acquired when he was NR of India

- No income is derived from such foreign assets during PY

3. Reporting under Schedule FA

- Currently, Schedule FA encompasses 10 tables, each demanding comprehensive information related to various foreign assets and income particulars

| Sr. No | Table No. | Particulars |

| 1 | A1 | Details of foreign Depositary Account held (including any beneficial interest). |

| 2 | A2 | Details of foreign Custodial Account held (including any beneficial interest). |

| 3 | A3 | Details of foreign Equity and Debt Interest held in any entity (including any beneficial interest. |

| 4 | A4 | Details of foreign Cash value insurance contract or Annuity contract held (including any beneficial interest). |

| 5 | B | Details of financial interest in any entity held (including any beneficial interest). |

| 6 | C | Details of immovable property held(including any beneficial interest). |

| 7 | D | Details of any other capital asset held (including any beneficial interest). |

| 8 | E | Details of account(s) in which you are a signing authority held (including any beneficial interest). |

| 9 | F | Detail of trusts created under the law of a country outside India, in which you are a

trustee, beneficiary, or settlor. |

| 10 | G | Details of any other income derived from any source outside India which is not included in Table A to Table F Above. |

- Extract of Table A1 – Details of Foreign Depository Account held (including any beneficial interest) at any time during the calendar year ending as on 31st day of December 2022.

|

Sr. No |

Country Name | Country Code | Name of Financial institution (FI) | Address of FI |

ZIP Code |

|

1 |

2 | 3 | 4 | 5 |

6 |

|

1 |

USA | 1 | J P Morgan Chase, BANK | XXXX, USA |

99999 |

| A/c No. | Status | A/c opening date | Peak Balance during the period | Closing Balance |

Gross Interest paid/credited to the account during the period |

|

7 |

8 | 9 | 10 | 11 |

12 |

|

UXXX391 – USD |

Owner | 29-10-2021 | 3,19,18,576/- | 1,96,294/- |

22,799/- |

- The term depository account is defined in Rule 114F as under:

“Depository account” includes any commercial, checking, savings, time, or thrift account, or an account that is evidenced by a certificate of deposit, thrift certificate, investment certificate, certificate of indebtedness, or other similar instrument maintained by a financial institution in the ordinary course of a banking or similar business and also an amount held by an insurance company pursuant to a guaranteed investment contract or similar agreement to pay or credit interest thereon.

- Extract of Table A2 – Details of Foreign Custodial Account held (including any beneficial interest) at any time during the calendar year ending as on 31st day of December 2022.

| Sr. No | Country Name | Country Code | Name of Financial institution (FI) | Address of FI | ZIP Code |

| 1 | 2 | 3 | 4 | 5 | 6 |

| 1 | USA | 1 | Interactive Broker | XXX, USA | 99999 |

| A/c No. | Status | A/c opening date | Peak Balance during the period | Closing Balance |

Gross Interest paid/credited to the account during the period |

| 7 | 8 | 9 | 10 | 11 | 12 |

| XXX-4444 | Beneficial Owner | 15-05-2022 | 8,72,468/- | 8,59,805/- | 511/- |

- The term custodial and custodial institution is defined in Rule 114F as under:

-

- “Custodial account” means an account (other than an insurance contract or annuity contract) for the benefit of another person that holds one or more financial assets”.

- “Custodial institution” means any entity that holds, as a substantial portion of its business, financial assets for the account of others and where its income attributable to the holding of financial assets and related financial services equals or exceeds twenty percent of its gross income during the three financial years preceding the year in which determination is made or the period during which the entity has been in existence, whichever is less.

- Extract of Table A3 – Details of Foreign Equity and Debt Interest held (including any beneficial interest) at any time during the calendar year ending as on 31st day of December 2022.

|

Sr. No |

Country Name | Country Code | Name of Entity | Address of Entity | ZIP Code | Nature of entity |

| 1 | 2 | 3 | 4 | 5 | 6 |

7 |

|

1 |

Singapore | 65 | XXX Pte Ltd | XXX, Singapore | 99999 |

Private Limited Company |

|

Date of Acquiring the interest |

Initial value of the investment | Peak value of investment during the period | Closing value | Total Gross Interest paid/credited with respect to the holding during the period | Total Gross proceeds from sale or redemption of investment during the period |

| 8 | 9 | 10 | 11 | 12 |

13 |

|

12-12-2014 |

2,90,488/- | 3,76,108/- | 3,01,773/- | 0 |

0 |

- Extract of Table A4 – Details of Foreign Cash Value Insurance Contract or Annuity Contract held (including any beneficial interest) at any time during the calendar year ending as on 31st day of December 2022.

|

Sr. No |

Country Name | Country Code | Name of Financial institution (FI) | Address of FI |

| 1 | 2 | 3 | 4 |

5 |

|

1 |

United Kingdom | XX | AVIVA, UK |

XXX, UK |

|

ZIP Code |

Date of

Contract |

The cash value or surrender value of contract |

Total Gross Interest paid/credited with respect to contract during the period |

|

6 |

7 | 8 |

9 |

|

99999 |

19-08-2020 | 2,81,70,009/- |

1,81,725/- |

The terms insurance contract, annuity contract, cash value insurance contract are defined in Explanation to Rule 114F as under:

- “Insurance contract” means a contract (other than an annuity contract) under which the issuer agrees to pay an amount upon the occurrence of a specified contingency involving mortality, morbidity, accident, liability, or property risk;

- “Annuity contract” means a contract under which the issuer agrees to make payments for a period of time determined in whole or in part by reference to the life expectancy of one or more individuals;

- “Cash value insurance contract” means an insurance contract (other than an indemnity reinsurance contract between two insurance companies) that has a cash value and in case of a U.S. reportable account such value is greater than an amount equivalent to fifty thousand U.S. dollars.

- “Cash value” means the greater of —

-

- the amount that the policyholder is entitled to receive upon surrender or termination of the contract (determined without reduction for any surrender charge or policy loan); and

- the amount the policyholder can borrow under or with regard to the contract,…

- Extract of Table B – Details of Foreign Interest in any entity held (including any beneficial interest) at any time during the calendar year ending as on 31st day of December 2022.

|

Sr. No |

Country Name and code | ZIP Code | Nature of entity | Name and address of entity | Nature of Interest |

Date since held |

|

1 |

2 | 2a | 3 | 4 | 5 | 6 |

| 1 | USA (1) | 99999 | Private Limited Co. | ABC Inc., XXX, USA | Beneficial Owner |

16-08-2014 |

|

Total Investment (at cost) in rupees |

Income accrued from such Interest | Nature of Income |

Income Taxable and offered in this terms |

||

|

Amount |

Schedule where offered |

Item Number of schedule |

|||

|

7 |

8 | 9 | 10 | 11 | 12 |

| 10,82,956/- | NIL | NIL | 0 | No income during the year |

NA |

For the purposes of disclosure in table B, financial interest would include, but would not be limited to, any of the following cases:-

- the resident assessee is the owner of record or holder of legal title of any financial account, irrespective of whether he is the beneficiary or not.

- the owner of record or holder of title is one of the following:-

-

- an agent, nominee, attorney or a person acting in some other capacity on behalf of the resident assessee with respect to the entity;

- a corporation in which the resident assessee owns, directly or indirectly, any share or voting power;

- a partnership in which the resident assessee owns, directly or indirectly, an interest in partnership profits or an interest in partnership capital;

- a trust of which the resident assessee has beneficial or ownership interest.

- any other entity in which the resident assessee owns, directly or indirectly, any voting power or equity interest or assets or interest in profits.

- Extract of Table C – Details of Immovable property held(including any beneficial interest) at any time during the calendar year ending as on 31st day of December 2022.

| Sr. No | Country Name and code | Zip Code | Address of the property | Ownership: Direct/Beneficial owner/Beneficiary | Date since acquisition | Total Investment (at cost) (in INR) |

| 1 | 2 | 2a | 3 | 4 | 5 | 6 |

| 1 | United Kingdom (44) | 99999 | XXX, UK | Direct | 30-06-2018 | 1,75,00,000/- |

|

Income derived from the property |

Nature of Income | Income taxable and offered in this return | ||

| Amount | Schedule where offered |

Item number of schedule |

||

| 7 | 8 | 9 | 10 | 11 |

| 8,00,000/- | Rent | 8,00,000/- | House Property | XX |

- Extract of Table D – Details of any other Capital Asset held (including any beneficial interest) at any time during the calendar year ending as on 31st day of December 2022.

| Sr. No | Country Name and code | Zip Code | Nature of asset | Ownership: Direct/Beneficial owner/Beneficiary | Date since acquisition | Total Investment (at cost) (in INR) |

| 1 | 2 | 2b | 3 | 4 | 5 | 6 |

| 1 | USA (1) | 99999 | XX Growth ETF | Direct | 29-09-2016 | 22,35,729/- |

|

Income derived from the asset |

Nature of Income | Income taxable and offered in this return | ||

| Amount | Schedule where offered |

Item number of schedule |

||

| 7 | 8 | 9 | 10 | 11 |

| 7,448/- | Dividend | 7,448/- | Other Sources | XX |

- Extract of Table E – Details of account(s) in which you have signing authority held (including any beneficial interest) at any time during the calendar year ending as on 31st day of December 2022 and which has not been included in A to D above.

| Sr. No | Name of the Institution in which the account is held | Address of the Institution | Country name and code | ZIP code | Name of the account holder | Account Number |

| 1 | 2a | 3 | 3a | 3b | 4 | 5 |

| 1 | DBS Bank | XXX, Temasek, | Singapore | 99999 | DE PTE | XXX-42XX85- |

| Singapore | (65) | Ltd | 4922 |

| Peak Balance/Investment during the year (in rupees) | Whether income accrued is taxable in your hands? | If (7) is yes, Income Accrued in the account | If (7) is yes, income offered in this return | ||

| Amount | Schedule where offered | Item Number of schedule | |||

| 6 | 7 | 8 | 9 | 10 | 11 |

| 10,82,956/- | No | 0 | 0 | No income during the year | NA |

- Extract of Table F – Details of trusts, created under the laws of a country outside India, in which you are a trustee, beneficiary or settlor.

| Sr. No | Country name and code | ZIP code | Name and address of the trust | Name and address of the trustees | Name and address of the Settlor | Name and address of Beneficiaries |

| 1 | 2a | 2b | 3 | 4 | 5 | 6 |

| 1 | USA (44) | 99999 | XXX Trust, New Jersey, USA | Mr. XXX, USA | Mrs. XXX, USA |

Mr. XXX, India |

| Date since position held | Whether income derived is taxable in your hands? | If (8) is yes, Income derived from the trust | If (8) is yes, income offered in this return | ||

| Amount | Schedule where offered | Item Number of schedule | |||

| 7 | 8 | 9 | 10 | 11 | 12 |

| 29-10-2020 | No | 0 | 0 | No income during the year | NA |

- Extract of Table G – Details of any other income derived from any source outside India which is not included in, (i) items A to F above and, (ii) income under the head business or profession.

| Sr. No | Country Name and code | ZIP code | Name and address of the person from whom derived | Income derived |

| (1) | (2) | (2b) | (3) | (4) |

| 1 | United Kingdom (44) | 99999 | XXX Ltd, UK | 15,404/- |

|

Nature of Income |

Whether taxable in your hands ? | If (6) is yes, Income offered in this return | ||

| Amount | Schedule where offered | Item number of schedule | ||

| (5) | (6) | (7) | (8) | (9) |

| Directors Fees | Yes | 15,404/- | Other Sources | XXX |

General Instructions

- The data in Schedule FA is required to be filled up for a particular calendar year.

- For the purpose of this Schedule, the rate of exchange for conversion of the peak balance or value of investment or the amount of foreign sourced income in Indian currency shall be the “telegraphic transfer buying rate” of the foreign currency as on the date of peak balance in the account or on the date of investment or the closing date of the accounting period.

- Telegraphic transfer buying rate means the rate or rates of exchange adopted by SBI.

4. Key Issues

4.1 Key issues – CY v/s FY

Relevant extract of schedule IFOS in ITR for FY 2022-23:

|

Particulars |

Amt (in Rs.) |

| 1. Income from other sources: | |

| A. Director’s fees |

800,000/- |

Relevant extract of Table G of schedule FA:

|

Country Name and code |

Name and address of the person from whom derived | Nature of Income | Income derived |

Income offered in the return |

|

United Kingdom (44) |

London Ltd., UK | Director’s fees | 500,000/- |

500,000/- |

Issue: Disparity between the details presented in the ITR (based on income earned during the particular financial year) v/s the information to be filled in Schedule FA based on the Calendar year.

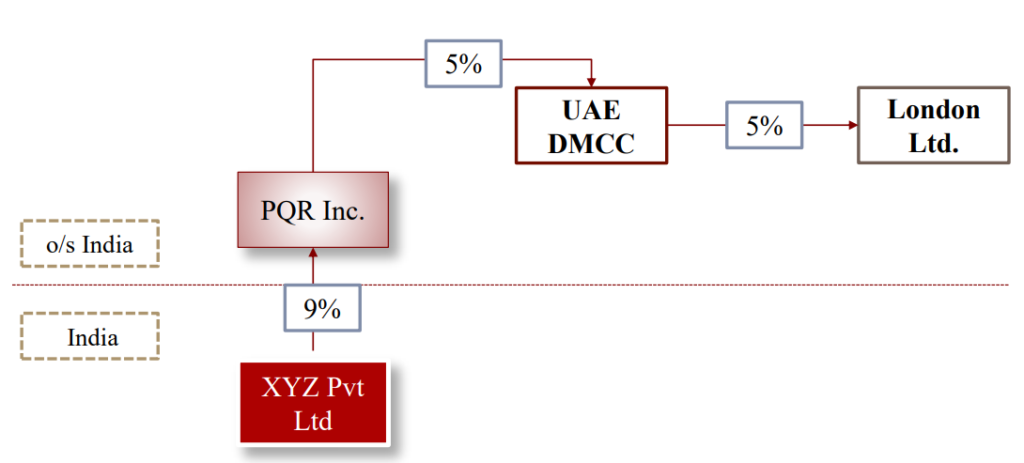

4.2 Key Issues – Indirect Shareholding

Issues:

- Is reporting in Schedule FA limited to XYZ Pvt Ltd.’s investment in PQR Inc., or is reporting of indirect shareholding also necessary?

- If yes, how many layers would XYZ Pvt Ltd be required to report?

4.3 Key issues – ESOP

Mr. NM, an employee of an Indian company was awarded employee stock options of the overseas parent company viz. JLN Ltd. The ESOP schedule is tabled below for easy reference:

|

Description |

Date |

| Grant date |

01/01/2021 |

|

Vesting date |

01/01/2023 |

| Exercise date |

01/01/2024 |

Issues:

- Whether the reporting in Schedule FA required in case ESOPs are granted but not yet vested?

- Whether the reporting in Schedule FA required in case ESOPs are vested but not yet exercised?

4.4 Key issues – Inadvertent Mistakes

Relevant extract of actual reporting made in Table A2 of Schedule FA:

|

Sr. No |

Country Name | Name of Financial institution(FI) | Address of FI | ZIP Code |

Status |

|

1 |

USA | JP Morgan Chase Broker | XXX, Columbus, OH 43218-2051 | 99999 |

Owner |

Relevant extract of correct reporting to be made in Table A2 of Schedule FA:

|

Sr. No |

Country Name | Name of Financial institution(FI) | Address of FI | ZIP Code |

Status |

|

1 |

USA | JP Morgan Chase Broker | XXX, Columbus, OH 43218-2051 | 99999 |

Beneficial Owner |

Issues:

- Whether this will tantamount to reporting inaccurate particulars of foreign assets and thus, AO can levy a penalty u/s 43 of BMA?

- Whether return filed u/s 139(8A) of ITA can cure the defect?

4.5 Key issues – Mismatch Table Reporting

- Mr India has invested in the multiple listed shares in Nasdaq, Luxembourg, etc.

- Mr India understands that such investments are required to be disclosed under Schedule FA in Table A3 – Details of Foreign Equity and Debt Interest held (including any beneficial interest) at any time during the calendar year.

- Mr India encountered some problems in retrieving the peak balances of a handful of the shares. As a result, because Table A3 of Schedule FA mandatorily requires peak balance reporting, Mr. India reported all of these shares under Table D – Details of any other Capital Asset held (including any beneficial interest) at any time during the calendar year that does not require disclosure of peak balance.

Issue:

- Whether this will tantamount to reporting inaccurate particulars of foreign assets and thus, AO can levy a penalty u/s 43 of BMA?

4.6 Other Points for Deliberation

- Are foreign assets required to be disclosed in Schedule AL as well as in the unlisted securities details in ITR apart from Schedule FA?

- Whether the minor is required to disclose his/her foreign assets in Schedule FA?

- Whether the market value or cost have to be considered for the calculation of peak balance?

- Whether the indirect investment made in a foreign company through an Indian company is also required to be disclosed in Schedule FA?

- Whether for calculation of peak balance for a brokerage account, the underlying shares and securities balance is also required to be considered?

5. Penalty & Imprisonment

5.1 Penalty

As per section 42, where any person being R&OR as per section 6 of ITA, who is required to furnish their return of his income for any PY u/s 139 (1) of ITA, and who at any time during the PY:

- Held any asset (including financial interest in any entity) located o/s India as a beneficial owner or otherwise; or

- Was a beneficiary of any asset (including financial interest in any entity) located o/s India

- Had any income from a source located o/s India.

fails to provide the return regarding foreign income and assets, the AO may direct such person to pay a penalty of Rs. 10 Lakh

As per section 43, where any person being R&OR as per section 6 of ITA, who has filed the return as per section 139 of ITA, and fails to provide a piece of information or has provided inaccurate particulars about an asset (including financial interest in any entity) located outside India and any time during the PY:-

- Held by him as a beneficial owner or;

- In respect of which he was a beneficiary or;

- Had any income from a source located o/s India

fails to provide a piece of information/has provided inaccurate particulars about the assets located o/s India, AO may direct such person to pay a penalty of Rs. 10 Lakh.

Note: The penalty provisions u/s 42 and 43 shall not apply where the assets located Outside India, which include one or more bank accounts having a sum < to 500,000 at any time during the P.Y.

5.2 Imprisonment

Section 49 – Punishment for failure to furnish return in relation to foreign income & asset:

- If a person, being a resident other than R&NOR held any asset (including financial interest in any entity) located outside India as a beneficial owner or otherwise or a beneficiary of such asset or had income from a source outside India, willfully fails to furnish return of income within due time u/s 139(1) of ITA, punishable with imprisonment for a term ≥ 6 months ≤ 7 years with fine.

- Not applicable if return is furnished before the expiry of AY.

Section 50 – Punishment for failure to furnish in return information about an asset (including financial interest in any entity) located outside India:

- If a person, being a resident other than R&NOR, willfully fails to furnish in return (filed u/s 139(1), (4) & (5) of ITA) any income from source o/s India or any information relating to asset (incl. financial interest in any entity) located o/s India held by him as beneficial owner/ otherwise/beneficiary, punishable with imprisonment for a term ≥ 6 months ≤ 7 years with fine.

Summary for penalty & imprisonment is tabulated below for easy of reference:

| Section | Description | Penalty/ Imprisonment |

| Section 42 | fails to provide the return regarding foreign income and assets | A penalty of Rs. 10 Lakh |

| Section 43 | fails to provide a piece of information/has provided inaccurate particulars about the assets located o/s India | A penalty of Rs. 10 Lakh |

| Section 49 | failure to furnish return in relation to foreign income & asset | imprisonment for a term ≥ 6 months ≤ 7 years with fine |

| Section 50 | for failure to furnish in return information about an asset (including financial interest in any entity) located outside India | imprisonment for a term ≥ 6 months ≤ 7 years with fine |

No Penalty for non-disclosure of signing authority in Table E of Schedule FA

6. Jurisprudence

6.1 Leena Gandhi Tiwari v/s Addl. CIT, ITAT Mumbai Bench BMA [BMA No. 1/MUM/2022]

Facts

- AO received information from the investigation wing that the assessee was a signatory to a foreign bank account which may not have been disclosed to the Income-tax authorities. Consequently, AO after conducting a search at the premises of the assessee imposed a penalty under section 43 on the ground that the assessee was a signatory of a foreign bank account which was not disclosed in the return of income.

- On appeal, the Commissioner (Appeals) deleted the impugned penalty.

Issue

- Whether penalty u/s 43 of BMA should be levied or not?

Held

- When it comes to examining any failure on the part of the assessee in not disclosing a foreign bank account, what is to be seen is the return filed under section 153A and it is that return which, is to be ‘construed as one filed under section 139(1) and the provisions of the Income-tax Act will apply to the same accordingly.

- Original return filed under section 139(1) stands substituted by the subsequent income tax return filed under section 153A.

- Thus, non-disclosure of the foreign asset in the original return filed under section 139 could not be put against the assessee when the said disclosure was admittedly made in the return filed under section 153A.

- The total amount involved was relatively small considering the tax exposure and status of the assessee/persons involved. The money in the said account did not belong to the assessee, was never used by the assessee, and is part of the legacy left behind by her father. The entire money has been brought to tax in the hands of the assessee’s late mother.

- Even before the bank account was detected by the revenue authorities, the entire balance in the said account, as per instruction of the assessee’s late mother was donated to a charity of the global repute.

- In these circumstances, the plea that such a lapse of non-disclosure is only an inadvertent mistake and that conscious non-disclosure or any mens rea in the non-disclosure is completely contrary to human probabilities does merit acceptance.

- The assessee and her husband were signatories to the said bank account because, the actual owner her mother, had health issues and she was not in a position to travel abroad.

- Penalty under section 43 of BMA comes into play only when the aggregate value of these assets exceeds Rs. 5 Lakh. The unambiguous intent of the legislature thus is to exclude trivial cases of lases which can be attributed to a reasonable cause.

- Section 43 provides that AO ‘may’ impose the penalty. The use of the expression ‘may’ signifies that the penalty is not to be imposed in all cases of lapses and that there is no cause and effect relationship simpliciter between the lapse and the penalty.

- The bonafide actions of the taxpayers must, therefore, be excluded from the application of provisions of such stringent legislation as the BMA.

- In this light, and keeping in mind the object of the BMA, a penalty for non-disclosure of the bank account in question would not be justified.

6.2 Tejal Ashish Mehta v/s Addl. CIT, ITAT Mumbai [BMA No. 5/MUM/2022 (AY 2016-17)]

Facts

- The assessee, an Indian resident failed to disclose life insurance policy held outside India in Schedule FA to the return of income.

- Thus, AO levied penalty u/s 43 of BMA.

- CIT(A) deleted the penalty placing reliance on the decision of Tribunal in the case of Addl. CIT vs. Leena Gandhi Tiwari in BMA No.1/Mum/2022 decided on 29/03/2022.

Issue

- Whether penalty u/s 43 of BMA should be levied or not?

Contention & Held

- The ld. Departmental Representative submitted that the CIT(A) failed to take note of Circular No. 13 of 2015 dated 06/07/2015, wherein it was clarified while answering Question No. 18 that disclosure of foreign assets in Schedule FA is mandatory.

- No exceptions have been provided under the Act for not levying a penalty.

- Assessee submitted the assessee declared surrender value of policy under section 59 of the Act and paid 30% tax and 30% penalty thereon under one time compliance scheme. After declaration of the said policy, the assessee in F.Y. 2015- 16 surrendered the policy and the receipts therefrom were declared in the return of income in Schedule EI.

- Further, it was submitted that the non-disclosure of insurance policy in Schedule- FA was out of bonafide belief that the insurance policy has since been surrendered and it is no more in existence.

- It was held that it is an undisputed fact that by the end of F.Y. 2015-16 the foreign asset ceases to exists as the assessee surrendered the said policy and the maturity amount of policy was duly reflected in ITR.

- Bonafide mistake in not disclosing foreign asset in Schedule FA is a reasonable cause for deleting penalty in the given circumstances. Hence, appeal by revenue is dismissed.

6.3 Ocean Diving Centre Ltd. v/s CIT, ITAT Mumbai Bench; Naik Business Services Pvt. Ltd. v/s CIT, ITAT Mumbai Bench. [BMA No. 22/MUM/2023]

Facts

- The assessee being a domestic company resident in India had invested in a foreign entity.

- However, the same though disclosed in audited financials, was not disclosed in Schedule FA of ITR. Further, the same was disclosed in Schedule A – BS in the ITR filed.

- Thus, penalty u/s 43 of BMA was levied.

Issue

- Whether penalty u/s 43 of BMA should be levied or not?

Held

- It is not in controversy that the assessee has not disclosed the information qua investment in a foreign entity in Schedule FA but disclosed the same in its balance sheet and Schedule part-A-BS under “Non-Current Investments” attached with the return of income filed for the AY under consideration.

- No doubt the AO is empowered to impose the penalty as discretion is vested with him by using the word ‘May’ in the provisions.

- Discretion is required to be exercised judicially and under the Judicial canons of law and in a reasonable and justified manner to impart justice, by considering all the relevant circumstances and in case the assessee is able to discharge its burden for reasonable cause, then the discretion against the Assessee has to be used cautiously and consciously.

The Apex Court in M/s Hindustan Steel Ltd. v/s State of Orissa (1972) 83 ITR 26(SC) also reminded that an order imposing a penalty for failure to carry out, a statutory obligation is the result of a quasi-criminal proceeding, and penalty will not ordinarily be imposed unless the party obliged either acted deliberately in defiance of law or was guilty of conduct contumacious or dishonest, or acted in conscious disregard of its obligation. - Assessee admittedly duly recorded and disclosed the investment in a foreign entity in its audited balance sheet and also furnished such information under non-current investments, hence, we are in concurrence with the claim of the assessee that the assessee has directly or indirectly complied with the statutory provisions and therefore, the case of the assessee does not fall under the rigorous provisions of section 43 of BMA.

6.4 Krishna Das Agarwal v/s DDIT/ADIT (Inv.), ITAT Jaipur Bench; [BMA Nos. 01 to 05 (JP) of 2022]

Facts

- The assessee along with a group of persons incorporated a company, APFZE in UAE. APFZE could not continue its business in UAE after some point in time and thus, it started to invest its surplus funds in some investment products in UAE.

- Relevant disclosure was made in the original return of income filed for the AY 2018-19 and 2019-20; also he revised the return for AY 2017-18 and made due disclosure about the financial interest in APFZE.

- Search action was conducted at the premises of the assessee in July 2018 whereby certain documents concerning the banking transactions of APFZE were found.

- Based on the search, an addition to the tune of Rs. 146 crores including the transactions undertaken by APFZE was added in the hands of the assessee.

- On appeal, the Commissioner (Appeals) deleted substantial additions.

Issue

- Whether addition to be made in the hands of assessee for the financial transactions

undertaken by the APFZE?

Held

- APFZE invested its own money and resources in the UAE to earn dividends, interest, and gains, which cannot be taxed in the hands of the assessee in any manner.

- Further, the place of effective management of the said foreign company APFZE is also situated outside India.

- The taxability thereof in the hands of the assessee is not in consonance with the Act. More so, when there is no iota of evidence that any funds belonged to and/or pertained to the appellant in his individual capacity found during the search except the statement of the assessee. Nor is there any evidence to show that any income of the appellant was taken abroad and was omitted to be taxed in India. Therefore, the taxability of any amount in the hands of the appellant will be unconstitutional and, hence, illegal.

- Therefore, considering the facts and circumstances discussed above and various evidences produced by the assessee, the non-resident foreign company APFZE based in UAE is a separate legal entity, and all the funds/investments, etc., belong to the company and no tax liability can be fastened on the assessee.

- Assessee clearly does not fall within the ambit of the term ‘beneficial owner’ as he is not the provider of the consideration of the asset.

- The non-resident company is a separate legal entity and the non-resident company owns these assets and investments beneficially and, therefore, the dividend pertains to the non-resident company and cannot be taxed in the hands of the assessee.

- The assessee submitted detailed evidence in support of his claim that credits of Rs. 19 crores appearing in the accounts belong to a non-resident company and not to the assessee and that too in the nature of a liability. This is a loan standing in the name of the non-resident company and a major portion of the loan has been repaid by the non-resident company.

- Thus, it proves that the loans were taken by the non-resident company and not relatable to the assessee. In these circumstances, the addition made in the hands of the assessee is uncalled for.

6.5 Shobha Harish Thawani v/s JCIT, ITAT Mumbai Bench; [BMA Nos. 01 to 03/Mum/2023]

Facts

- The assessee along with her husband has made a joint investment in Global Dynamic Opportunity Fund Ltd and the assessee’s share in the said investment is 40%.

- Assessee had declared interest income from the foreign investment in AY 2016-17 and the said asset has been sold and capital gain is offered to tax in AY 2019-20.

- Assessee however did not disclose the foreign asset while filing the return of income for AY 2016-17 to A.Y. 2018-19 under schedule FA.

- Thus, AO levied a penalty towards the non-disclosure under section 43 of BMA for each of the assessment years.

- CIT(A) after considering the submissions of the assessee, upheld the penalty levied by AO.

Issue

- Whether penalty u/s 43 of BMA should be levied or not?

Held

- It is apparent from the language of section 43 that the disclosure requirement is not only for the undisclosed asset but any asset held by the assessee as a beneficial owner or otherwise. Given this, the argument that the penalty under section can be levied only with respect to undisclosed assets is not tenable.

- The alternate plea of the assessee is that the non-disclosure of the foreign asset in Schedule FA of the return is an inadvertent bonafide error and therefore does not warrant a levy of penalty. In this regard, it is noticed that, though the assessee claims that the non-reporting is a bonafide mistake, there is nothing on record in support of the said claim.

- Assessee failed to substantiate that AO has exercised his discretion extravagantly.

- AO after examining the facts of the case, formed his opinion to levy a penalty.

- AO exercised his discretion judiciously.

- No material is brought before us to show that AO levied a penalty under section 43 of BMA in an arbitrary and unjustified manner.

- The provisions of section 43 do not provide any room not to levy a penalty even if the foreign asset is disclosed in books since the penalty is levied only towards nondisclosure of foreign assets in schedule FA.

- In the light of these discussions we see no infirmity in the order of CIT(A) confirming the levy of penalty under section 43 of BMA for non-disclosure of foreign assets.

6.6 Nirmal Bhanwarlal Jain v/s CIT(A)-51 & DDIT/ ADIT (Inv), ITAT Mumbai Bench; [BMA Nos. 13 to 15/Mum/2023]

Facts

- The assessee has made investments in offshore mutual fund Global Dynamic Opportunities Fund Ltd. (‘GDOF’) based in Mauritius. The assessee had made investments in offshore fund in his own name and in the name of his Childrens.

- Assessee had disclosed investments in his own name in Schedule FA. However, instead of Rs. 5,50,44,320/-, the assessee has disclosed investment of Rs. 3,91,04,805/- only.

- Further, the assessee in his return of income Schedule FA has failed to report investments made in the name of his children/minor children.

- Separate return of income for the Childrens are not filed and thus, the disclosure of foreign assets are not made therein.

- CIT(A) levied penalty u/s 43 of BMA.

Issue

- Whether penalty u/s 43 of BMA should be levied or not?

Held

- A perusal of the provisions of section 43 would show that where the assessee in his return of income filed under section 139(1) or 139(4) or 139(5) fails to furnish information or furnish inaccurate particulars of investments outside India, the assessee is liable for penalty under the said section.

- The assessee had made investments in his own name, as well as, in the name of his children including minor children. Though the assessee has disclosed investments in his own name in Schedule FA, the amount of investment mentioned against assessee’s own name is not accurate. Instead of Rs. 5,50,44,320/-, the assessee has disclosed investment of Rs. 3,91,04,805/- only. Thus, there is furnishing of inaccurate particulars of investments in assessee’s own name and non-reporting of investments in the name of children.

- Section 43 of BMA may appear to be relentless, but a plain reading of section leaves no scope of gateway to delete penalty even if overseas investments are made from known sources, but not reported in Schedule FA of return of income.

- Appeal of assessee, hence, dismissed.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA

How to update schedule FA in previous ITRs due to an honest mistake of missing filling it before?

An assessee may file a revised return for any previous year at any time 3 months before the expiry of the relevant assessment year or before completion of the assessment, whichever is earlier. Thus, the last date to file the revised return is 31st December of the relevant Assessment Year. If the time limit to file a revised return expires, you can file a condonation request for updation in your previously filed ITR.

Hi,

I was not aware of declaring FA. have employee share purchase plan where i invested from last 3 years where my company listed in France. this was not declared in ITR but always added perquisite for the shares given at discount. Is there a way to update old ITR to add information on FA if no tax liabilities?

I will declare these in next return and show the proceeds and pay tax if i sell any shares.

is this ok or has to do any rectification past of ITR? as all past ITR are submitted and approved not sure if there is a way to add this information

kindly suggest

I am employed at London UK. is I declare the salary received in schedule FA as tax already deducted there? and some part of amount transfer to my indian account . Please advise

When Foreign Assets is to be disclosed in Schedule AL, whether it should be taken as declared in Sch FA (31st Dec) or Foreign Assets as held 31st March.

For schedule AL, what will be the value of Foreign Stock (whether Cost or Closing Market Value)

For Schedule AL, what will the rate of conversion for Foreign Stocks (at the date of acquisition or closing date)

For the purpose of Schedule AL, assets and liabilities as on 31st March have to be declared in the ITR. Further, for this schedule, disclosure of assets shall be made and reported at their cost price to the assessee.

Presently, making the investments, purchase property, open accounts in bank, financial institutions or with Depositories as joint holder with spouse and or children become common. But the problem is that who will be liable to disclose it in their ITRs all or the one who make or arrange funds from on account or source.

As a general rule the person who arrange the funds from own account and earned the income. But the problem is arised when the reporting authorities reported the transaction at all joint holders PANs and on non-verification the department issued notices and initiated penalty and or prosecution under the law.

In such circumstances, to save from unnecessary litigation, harassment and cost of litigation, I think all should declare its in their ITR in a manner:

1. the one, who contribute the funds from own source or account wholly or in proportionate , declare all necessary details under relevant column of the Schedule FA in their ITR with the status ‘Beneficial owner’

2. Those who don’t participate in making contribution or funds from own source, but represent the account as joint holder, declare necessary details such as particulars of the account, country, entity, with NIl value with the status ‘owner’

3. Or to resolve this difficulties, the CBDT, Ministry of Finance Government of India should include/add the ‘joint holder, under status / ownership column of schedule FA or the ITR and other relevant schedule part of the ITR.