Understand Non-Resident Indians (NRIs) Taxation | Filing Income Tax Returns in India

- Blog|Income Tax|

- 6 Min Read

- By Taxmann

- |

- Last Updated on 8 May, 2024

What is the taxation of Non-Resident Indians (NRIs) in India? The taxation of Non-Resident Indians (NRIs) in India is determined based on their residential status for tax purposes and the nature of the income earned. Here are the key points: – Residential Status: An individual's tax liability in India largely depends on their residential status, which is categorized as 'Resident' or 'Non-Resident'. The status is determined by the number of days they stay in India during a given financial year. – Taxed Income: NRIs are taxed only on the income that is earned or accrued in India. This includes salaries received in India, income from house properties situated in India, capital gains on transfer of assets located in India, and income from fixed deposits or interest on savings bank accounts in India. – Income Earned Abroad: Income that is earned outside India is not taxable for NRIs. However, if an NRI has a business in India that is controlled from abroad, that income will be taxable in India. – Special Provisions: The Income Tax Act provides certain special provisions for NRIs, such as lower deduction of tax at source (TDS) on investments and exemptions available on long-term capital gains from securities. – Double Taxation Avoidance Agreement (DTAA): India has DTAAs with several countries to avoid double taxation of income that is taxed in both India and another country. NRIs can benefit from these agreements by either obtaining a tax credit or being taxed at a reduced rate in India. It's important for NRIs to be aware of these tax regulations to ensure compliance and optimize their tax obligations in India.

Table of Contents

- Who is a Non-Resident Indian (NRI)?

- Criteria for NRIs to File Income-tax Return

- Incomes Included in the Threshold Limit of Rs. 2.5 Lakh

- Treatment of Exempt Income for Slab Calculation

- Treatment of Tax Deductions in Slab Calculation

- Threshold Level of Income for NRI Senior Citizens

- Benefits of Filing Tax Returns (Even if NRIs Annual Income is less than Rs. 2.5/3 Lakh)

- Special Provisions for NRIs Non-Filing of Tax Returns

- Conclusion

Taxes are among the major sources of government’s revenue. There are two components of any tax structure viz, direct and indirect taxes. In India, taxes are levied on the citizens of the country or any income earned in the country. The provisions of income in India earned both by the citizens of the country or Non-Resident Indians (NRIs) are governed by the Income-tax Act, 1961. However, there is a huge difference between the income tax rules and regulations applicable to resident and non-resident Indians. Requirements for filing Income-tax Returns and various other provisions as prescribed in the Income-tax Act concerning the Non-Resident Indians (NRIs) are discussed here.

1. Who is a Non-Resident Indian (NRI)?

The Income-tax Act, 1961, defines a Non-Resident as the person who is not a resident. The Act defines a person to be a Resident of India if any of the following 6 conditions are fulfilled –

|

List of Conditions to become Resident in India on Priority Basis |

||||||

| Particulars | Purpose Based | Other than Purposes 1, 2 & 3 | Deemed Resident | |||

| Priority | 1 | 2 | 3 | 4 | 5 | 6 |

| Citizenship | Indian | Indian or PIO* | Indian or PIO | Not Relevant | Indian | |

|

Purpose during the year |

Leaving India for the purpose of employment or as a member of crew of Indian ship | Being outside India, comes on a VISIT |

Not Relevant |

|||

|

Income Limit |

Not Applicable | <= 15 Lakhs India sourced Incomes | > 15 Lakhs India sourced Incomes | Not Applicable | > 15 Lakhs India sourced Incomes | |

| No. of days stay in India during the year | 182 days or more | 120 days or more | 182 days or more | 60 days or more |

Not Relevant |

|

| No. of days stay in India during preceding 4 years | Not Applicable | 365 days or more | Not Applicable | 365 days or more | Not Applicable | |

| Resident in a country outside India | Not Applicable |

No |

||||

| Note: If one satisfies all conditions in any one column, he/she would be a Resident in India for that year. | ||||||

*PIO – Person of Indian Origin

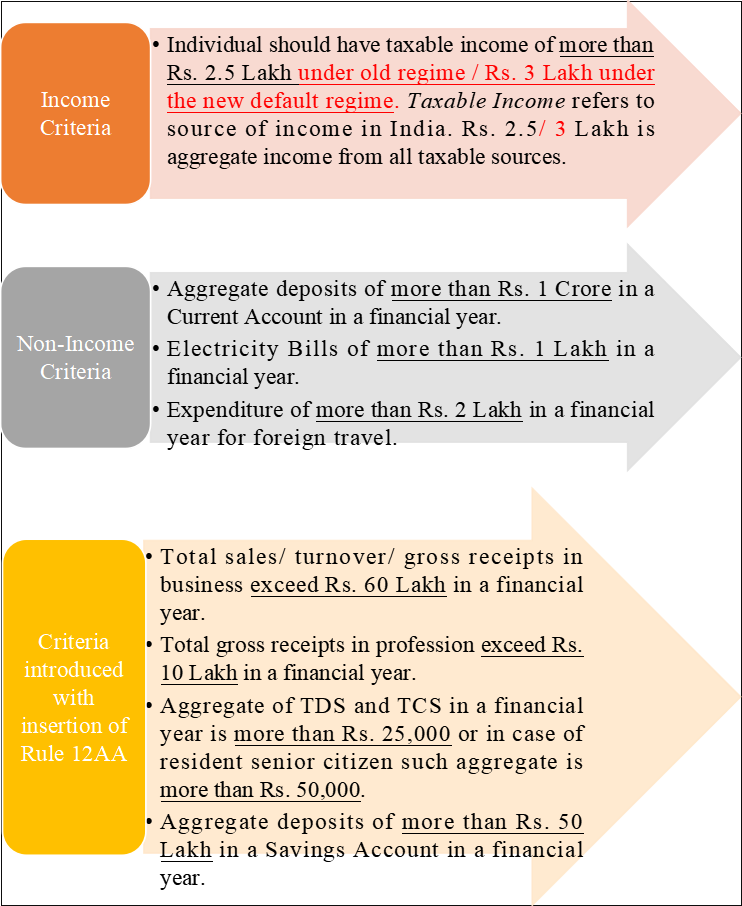

2. Criteria for NRIs to File Income-tax Return

For an NRI to file Income-tax Return in India, the following are the criteria:

3. Incomes Included in the Threshold Limit of Rs. 2.5 Lakh

For the purpose of calculating the total threshold limit of Rs. 2.5/3 Lakh, any income which is received/accrued/ sourced/earned in India shall attract tax in India in case of an NRI. Any income derived by an NRI in India which is in the form of the following:

- Salary

- Income from Business/Profession

- Rental/Lease Income

- Interest/Dividend Income from Shares/Mutual Fund/Bank

- Capital Gains from sale of Shares/Mutual Fund/Property etc.

shall be considered for the purpose of taxation.

For instance, rent received by an NRI for a property situated in India and salary received for any service rendered by an NRI in India shall be considered for computation of total threshold limit of Rs. 2.5/3 Lakh.

4. Treatment of Exempt Income for Slab Calculation

While computing the threshold limit of Rs. 2.5/3 Lakh of an NRI the following incomes shall not be included:

- Exempt Income of NRIs not to be clubbed with Income chargeable to tax.

- Interest Income from Non-Residential External (NRE)/Foreign Currency Non-Resident (FCNR) Account.

- All exemptions to NRI Notified by Government.

For instance, Interest Income of NRI from NRE Fixed Deposits (FDs) (Exempt Income) is Rs. 1.5 Lakh, all other income taxable in India is Rs. 1.5 Lakh. These two incomes need not be added for the purpose of computation of the threshold limit. The NRI is not required to file Return of Income, since, taxable income of Rs. 1.5 Lakh is below the threshold limit of Rs. 2.5/3 Lakh.

5. Treatment of Tax Deductions in Slab Calculation

When an NRI invests his/her income in such instruments in respect of which tax deductions are available, the threshold limit shall be computed as below:

- Threshold limit of Rs. 2.5/3 Lakh is before applying for eligible deductions.

- Eligible tax deductions apply only when NRI files his/her tax return.

Thus, excluding these deductions, if an NRI’s taxable income is more than Rs. 2.5/3 Lakh, he/she should file the tax return in order to claim the tax deductions.

For instance, total taxable income of NRI is Rs. 3.5 Lakh, Rs. 1.5 Lakh is the total amount of tax deduction. Since, the NRI’s total income exceeds the threshold limit of Rs. 2.5/3 Lakh, he/she is required to file his/her return of income in India and can claim tax deduction of Rs. 1.5 Lakh and save himself/herself from paying any tax on the total income.

6. Threshold Level of Income for NRI Senior Citizens

- Threshold limit of Rs. 2.5/3 Lakh applies to all category of NRI Senior Citizens.

- No special slab relaxations are applicable to any category of NRI Senior Citizens.

7. Benefits of Filing Tax Returns (Even if NRIs Annual Income is less than Rs. 2.5/3 Lakh)

- One can claim TDS Refund.

- Losses if any can be carried forward for future offset.

- Will prove one’s tax status in India.

- One can claim exemptions if any under DTAA#.

So, an NRI can reap the aforesaid benefits, if he/she files the return of income in India even if the total income is below threshold limit.

#DTAA – Double Taxation Avoidance Agreement

8. Special Provisions for NRIs Non-Filing of Tax Returns

NRIs need not file tax returns in India in the following special circumstances:

- The only source of income should be from investment income.

- Investment Income should be from Indian Company’s Securities viz, Interest/Dividend Income from such securities and Capital Gain from sale of such securities.

- Source of invested amount should be Convertible Foreign Exchange i.e., amount of money remitted from outside India.

- Applicable TDS is fully deducted by Income Payer.

9. Conclusion

Taxation rules in India vary quite significantly for NRIs as compared to those applicable to resident Indians. It is crucial to understand the taxation provisions applicable to NRIs as specified in the Income-tax Act, 1961, to avoid the risk of double taxation when one is earning income in India as well as in other countries. Understanding the tax policies applicable to NRIs helps one determine his/her residential status and avail the tax benefits accordingly. Thus, an NRI must have clarity on each and every aspect of taxation applicable to him/her in India.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA

This blog provides valuable insights into NRI taxation and income tax filing in India. A must-read for NRIs looking to stay compliant with tax regulations!