Taxation of Unit Linked Insurance Plan (ULIPs)

- Blog|Income Tax|

- 6 Min Read

- By Taxmann

- |

- Last Updated on 23 December, 2023

Table of Contents

1. Introduction

In an effort to make insurance policies a bit more lucrative in terms of rate of return, the concept of Unit-Linked Insurance Policy (ULIP) was introduced. In this, the amount of premium gets diverted part towards life insurance, while a major portion is towards investment in the stock market directly or indirectly. ULIP is being used as an instrument to save taxes or to avoid taxes and is treated similar to a Life Insurance Policy from years.

While investing in any instrument there are two main aspects viz, risk and return. When one takes a life insurance policy, only the risk aspect is covered; ignoring the return factor. As against while investing in equity, bonds, etc. the emphasis is on the return by incurring risk. Thus, both are entirely contrary instruments. ULIP as an investment tool covers both risk as well as return. It has two components viz, ‘Unit’ which signifies Mutual Fund, i.e., investment in the same shall result in returns as the money is invested in the stock market and the second component being ‘insurance cover’ as the same is linked to an insurance plan; thus, it has a risk cover too. Although ULIP covers both risk coverage and return, it is predominantly considered as a life insurance policy. The tax benefits of such an investment tool and how to invest in the same have been discussed here.

2. What is ULIP Plan?

Unit-Linked Insurance Policy (ULIP) is a multi-faceted life insurance product, having the features of both life insurance and investment. It includes regular premium payments by the policyholder, part of which is utilized to provide life insurance coverage and the remaining is diverted towards investment in the stock market by clubbing assets received from other policyholders, similar to mutual funds. Thus, investing in ULIP provides one with financial security against contingencies along with fulfilling the long-term goal of wealth creation.

3. Benefits of ULIP

1. Transparency

All the details viz, charge structure, value of investment, and expected returns for the complete period of policy are shared well in advance. Also the annual account statement and quarterly investment portfolio along with the daily NAV reporting helps one stay well-informed about the investment portfolio.

2. Flexibility

ULIPs offer one to choose among the different investment options available varying from high, medium and low-risk investments, depending upon the risk-taking appetite of an individual.

ULIPs also offer flexibility in choosing the sum assured or the premium depending upon one’s requirement. Option of purchasing top-ups and the same being entitled to deduction under section 80C and 10D is an additional benefit to increase the investment in ULIP.

3. Tax Benefits

ULIPs enjoy exemption of the premiums paid up to an amount of Rs. 2,50,000 towards the policy under section 80C subject to the maximum limit of Rs. 1,50,000 of the Income-tax Act.

4. Spread of Risk

ULIPs help one gain the advantage of market-linked growth, without any actual participation in the stock market, but with an additional benefit of life-cover.

5. Liquidity when required

ULIPs have a lock-in-period of 5 years, but in case of contingencies, there is an option of partial withdrawal, wherein funds are allowed to be withdrawn up to a limit not exceeding 20% of the fund value without incurring any tax liability.

6. Disciplined and Regular Savings

ULIPs develop a regular saving habit, beneficial in the long run, as it builds a corpus for future requirements of an individual.

4. Taxation of ULIP

Taxation of ULIP is similar to taxation of Life Insurance Policy. The various taxation provisions include the following –

4.1 Section 10(10D) of Income Tax Act, 1961

It provides for income-tax exemption on the sum received under a life insurance policy/ULIP, including any sum allocated by way of bonus on such policy subject to certain exclusions.

The Finance Act, 2021 amended the aforesaid section of the Act by inserting fourth to seventh provisos.

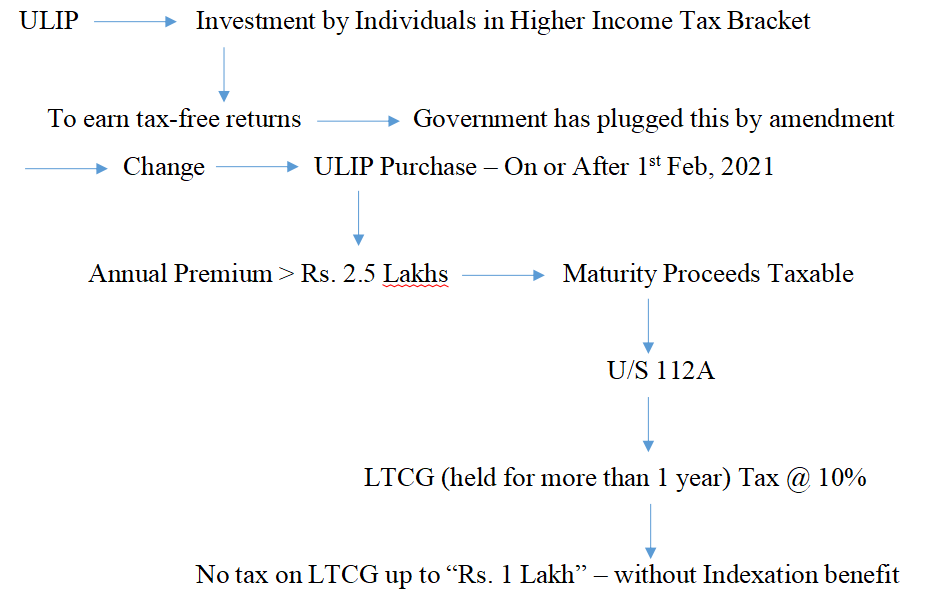

- With effect from 01.02.2021, the sum received under a Unit Linked Insurance Policy (ULIP), issued on or after 01.02.2021, shall not be exempt under the said clause if the amount of premium payable for any of the previous years during the term of such policy exceeds Rs. 2,50,000.

- If premium is payable for more than one ULIP, issued on or after 01.02.2021, the exemption under the said clause shall be available only with respect to such policies where the aggregate premium does not exceed Rs. 2,50,000for any of the previous years during the term of any of those policies.

- The fourth and fifth provisos shall not apply in case of sum received on death of the person.

- If any difficulty arises in giving effect to the provisions of this clause, the Board may, with the previous approval of the Central Government, issue guidelines for the purpose of removing the difficulty and every guideline issued by the Board under this proviso shall be laid before each House of Parliament, and shall be binding on the income-tax authorities and the assessee.

- The taxation of ULIP prior to amendment via Finance Act, 2021 is presented below:

ULIP Taxation -> Maturity Proceeds – > Exempt u/s 10(10D)

- The taxation of ULIP post amendment via Finance Act, 2021 is presented here with the help of a flowchart:

4.2 Section 45(1B) – Computation of Capital Gains

Where any person receives at any time during any previous year,

- any amount under a unit linked insurance policy,

- to which exemption under clause (10D) of section 10 does not apply on account of the applicability of the fourth and fifth proviso thereof, including the amount allocated by way of bonus on such policy, then,

- any profits or gains arising from receipt of such amount by such person shall be chargeable to income-tax under the head “Capital gains” and

- shall be deemed to be the income of such person of the previous year in which such amount was received and the income taxable shall be calculated in such manner as may be prescribed.

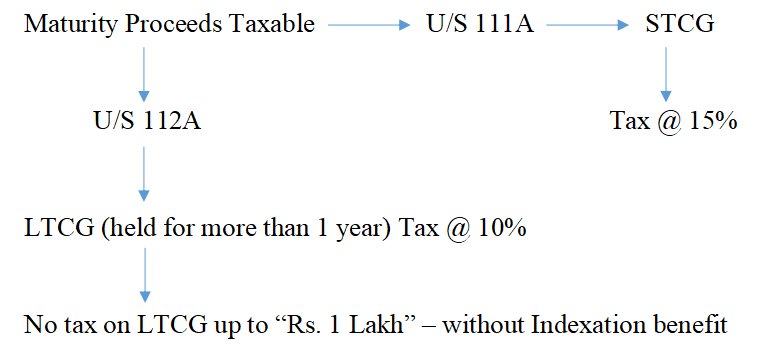

Capital gains tax shall be applicable on ULIPs similar to tax on all equity-oriented investments i.e., ULIPs are at par with stocks/mutual funds. However, no tax is imposed in case of sum received on death of an individual. The tax rates applicable on ULIPs are as follows:

| Capital Gains | Period of Holding | Tax Rate |

| Long-term capital gain | More than 12 months |

|

| Short-term capital gain | Less than or equal to 12 months | 15% on overall gains |

- Capital Gain Taxability on ULIPs can be understood with the help of flowchart:

4.3 Rule 8AD – The Prescribed Manner of Calculating Taxable Income

4.3 Rule 8AD – The Prescribed Manner of Calculating Taxable Income

- Where the amount is received for the first time under the specified unit-linked insurance policy, the capital gains arising from receipt of such amount by such person during the previous year in which such amount is received shall be calculated in accordance with the formula: –

| Particulars | Amount |

| A (amount received for the first time under a specified ULIP) | xxxx |

| B (aggregate of the premium paid till the date of receipt) | (xxx) |

| Taxable Income (A – B) | xxx |

or,

- C – D

Where,

C = the amount received under a specified unit-linked insurance policy during the previous year, at any time after the receipt of the amount as referred to in clause (i) above, including the amount allocated by way of bonus on such policy excluding the amount that has already been considered for calculation of taxable amount under this sub-rule during the earlier previous year or years.

D = the aggregate of the premium paid during the term of the specified unit-linked insurance policy till the date of receipt of the amount as referred to in “C” as reduced by the premium that has already been considered for calculation of taxable amount under this sub-rule during the earlier previous year or years.

The manner of calculating taxable income can be understood with the help of an example:

Mr A invested a sum of Rs. 4,00,000 p.a. in ULIP from 01.04.2021 for a period of 10 years. Mr A received a sum of Rs. 45,70,000 on 21.12.2028 for such policy. On 31.03.2031 he again received a sum of Rs. 30,00,000 from such policy.

| Particulars | Amount (Rs.) |

| Annual Premium (More than Rs. 2,50,000) | 4,00,000 |

| Withdrawal amount on 21.12.2028 | 45,70,000 |

| Annual Premium paid up to 01.04.2028 (starting from 01.04.2021) – 4,00,000 * 8 years | 32,00,000 |

| Long-term Capital Gain in F.Y. 2028-29 (LTCG @ 10% u/s 112A) | 13,70,000 |

| Maturity Amount on 31.03.2031 | 30,00,000 |

| Remaining Premium Paid for 2 years (from 01.04.2029 to 01.04.2030) – 4,00,000 * 2 years | 8,00,000 |

| Long-term Capital Gain in F.Y. 2030-31 (LTCG @ 10% u/s 112A) | 22,00,000 |

5. Conclusion

Investing in ULIPs enables one get an opportunity to secure one’s future along with availing the tax benefits. The plans being flexible, provide an option to the policyholder of switching between different funds available, owing to his/her investment objectives and market fluctuations. It offers tax-saving investment benefits as well as tax-free fund withdrawals at the time of maturity or partial withdrawals during the lock-in-period in case of uncertain situations. Owing to the dual benefits of long-term savings and financial protection that ULIPs offer, they are popularly known as market-linked insurance plans, thus, making them an attractive and beneficial option for investing.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

2 thoughts on “Taxation of Unit Linked Insurance Plan (ULIPs)”

Comments are closed.

CA | CS | CMA

CA | CS | CMA

If a ULIP is purchased in 2017 , foreclosed after 3 years, premium of 3L and sum received after 5 years, then whether the proceeds will be treated under 10(10D)? What taxes will be levid? and under what slabs?

Hi, It should continue to be exempt if conditions of Section 10(10D) are satisfied.