Tax Audit | Detailed Analysis of Clause 13 and Clause 14 | As per the Guidance Note issued by the ICAI

- Blog|Tax Audit Week|Account & Audit|

- 7 Min Read

- By Taxmann

- |

- Last Updated on 22 September, 2023

Income-tax law requires the assessee to get his books of accounts audited in pursuance of the requirement under Section 44AB of The Income Tax Act, 1961. The Chartered Accountant conducting the tax audit is required to give his findings, observations, etc., in the form of an audit report at the e-filing portal of Income-tax in Form No. 3CA/3CB and 3CD. In this story, we would discuss the reporting requirement of clauses 13 and 14, which are contained in Part B of Form 3CD.

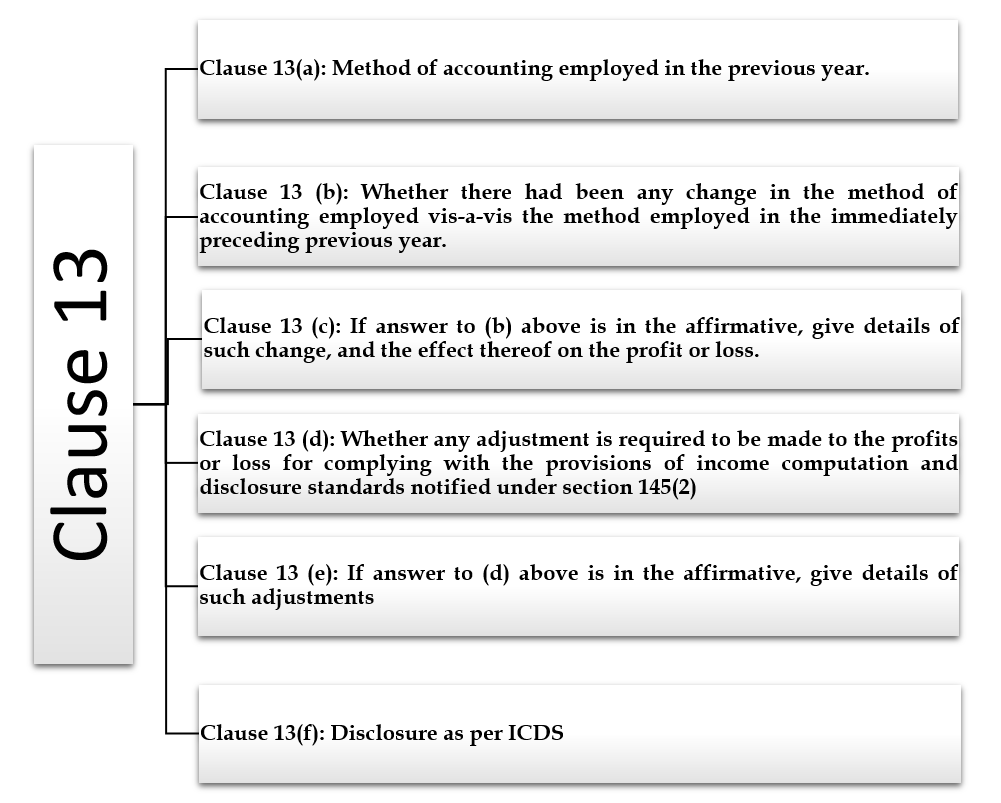

1. Clause 13

1.1 Clause 13 (a): Method of accounting employed in the previous year

In this clause, the assessee is required to report the method of accounting, whether it follows cash or mercantile basis of accounting. Moreover, as per the provision specified in the Companies Act 2013, the company must follow a mercantile basis of accounting.

1.2 Clause 13 (b): Whether there had been any change in the method of accounting employed vis-a-vis the method employed in the immediately preceding previous year

For reporting under this clause, the auditor is required to compare the method of accounting employed in the previous year with the preceding previous year to find out if there had been any change in the method of accounting employed. Accordingly, details for the same shall be furnished by selecting yes or no.

1.3 Clause 13 (c): If the answer to (b) above is in the affirmative, give details of such change and the effect thereof on the profit or loss

If the effect of changes in the method of accounting is quantifiable then, such changes in profit or loss are required to be furnished.

| Serial Number | Particulars | Increase in profit (Rs.) | Decrease in profit (Rs.) |

If the effect of changes in the method of accounting is not quantifiable, appropriate facts need to be disclosed.

1.4 Clause 13 (d): Whether any adjustment is required to be made to the profits or loss for complying with the provisions of income computation and disclosure standards notified under section 145(2)

Auditor has to report whether any adjustment is required on profit and loss as per Income Computation and Disclosure Standards (ICDS) notified u/s 145(2). Further, ICDS is applicable only in case, assessee follows the mercantile basis of accounting.

For the assessee following the cash basis of accounting, provisions of clauses 13(d), 13(e), and 13(f) will not apply.

1.5 Clause 13 (e): If the answer to (d) above is in the affirmative, give details of such adjustments

This clause requires ICDS-wise reporting of the adjustments in profit or loss for ICDS compliance, showing a clear increase/decrease in profits as well as the overall net effect of such adjustments.

| ICDS No | Name of the ICDS | Increase in profit (Rs.) | Decrease in profit (Rs.) | Net effect (Rs.) |

| ICDS I | Accounting Policies | |||

| ICDS II | Valuation of Inventories | |||

| ICDS III | Construction Contracts | |||

| ICDS IV | Revenue Recognition | |||

| ICDS V | Tangible Fixed Assets | |||

| ICDS VI | Changes in Foreign Exchange Rates | |||

| ICDS VII | Governments Grants | |||

| ICDS VIII | Securities | |||

| ICDS IX | Borrowing Costs | |||

| ICDS X | Provisions, Contingent Liabilities and Contingent Assets | |||

| Total |

1.6 Clause 13(f): Disclosure as per ICDS

| ICDS Number | ICDS Name | Disclosure |

| ICDS I | Accounting Policies | The assessee is required to disclose all the significant accounting policies which are adopted by him. In case the assessee does not follow the fundamental accounting assumption, the fact needs to be disclosed. |

| ICDS II | Valuation of Inventories | Accounting Policies adopted by assessee for measurement of inventories, including the cost formulae used. Where standard costing has been used as a measurement of cost, details of such inventories and a confirmation of the fact that standard cost approximates the actual cost need to be appropriately disclosed along with the total carrying amount of inventories and its classification appropriate to a person. |

| ICDS III | Construction Contracts | This disclosure requirement is applicable to the assessee engaged in any construction contracts.

Disclosure about the amount of contract revenue recognized as revenue in the period along with the methods used to determine the stage of completion of contracts in progress. In the case of contracts in progress, its stage of completion is determined. For this, an assessee is required to disclose the following on reporting date:

|

| ICDS IV | Revenue Recognition | In the case of the sale of goods, an assessee is required to disclose the total amount of revenue not recognized in books during the previous year on the grounds of uncertainty about its collection along with the nature of uncertainty.

For the assessee providing services, disclosure is to be given for the amount of revenue recognized from services provided during the previous year. Where the assessee has any service in progress, the method used to determine its stage of completion needs to be appropriately disclosed. Further, at the end of the previous year, an assessee should disclose the following;

|

| ICDS V | Tangible Fixed Assets | In this, the assessee has to provide the following disclosures:

|

| ICDS VII | Governments Grants | Disclosure, in this case, is made about the nature and extent of Government Grants recognized and not recognized during the previous year by way of deduction from the actual cost of the asset or assets or from the written down value of a block of assets.

Nature and extent of Government grants recognized and not recognized during the previous year as income. |

| ICDS IX | Borrowing Costs | Borrowing cost capitalized during the PY and accounting policy used for borrowing cost. |

| ICDS X | Provisions, Contingent Liabilities and Contingent Assets | In this, the assessee has to report the following for each class of provisions:

Following disclosures shall be given for each class of assets and related income recognized:

|

2. Clause 14

2.1 Clause 14(a) – Method of valuation of closing stock employed in the previous year

(a) Method of valuation should be given for each type of inventories, which shall include:

- Raw material

- Work in progress

- Finished goods

- Consumables

- Maintenance Supplies

- Stock in trade

- Loose tools

(b) Actual Cost of inventory shall include:

- Purchase cost, expenses directly related to purchases and duties and taxes (credit not available).

- Service costs such as labour cost and other costs directly related to service.

- Cost of conversion shall include cost directly related to the production of inventories and includes cost incurred in bringing the inventory to present location.

Net realizable value (NRV) is the value of an asset that can be realized upon the sale of an asset, less a reasonable estimate of the costs associated with the sale of an asset.

Method of valuation of closing stock can be based on FIFO method/Weighted average cost method/Specific identification method.

Closing Stock should be valued at actual cost or NRV, whichever is lower. It should be ensured that the method of valuation of stock is appropriate and complies with principles of AS 2 (or IND AS 2). If the method of valuation is not appropriate, then a suitable qualification in the Tax audit report is required in Form 3CB.

2.2 Clause 14(b)

In case of deviation from the method of valuation prescribed under section 145A and the effect thereof on the profit or loss, please furnish,

| Serial number | Particulars | Increase in profit (Rs.) | Decrease in profit (Rs.) |

The auditor should ensure that any deviation from the method of valuation as prescribed under section 145A is appropriately disclosed, and the effect thereof on the profit/loss is also indicated.

Section 145A follows the inclusive method, i.e., any tax, duty, cess or fee actually paid or incurred on inputs should be added to the cost of inputs (raw materials, stores etc.), and if paid or incurred on the sale of goods, it should be added to the sales if not already added in the books of account. Any tax, duty, cess or fee actually paid or incurred on the inventory (finished goods, work-in-progress, raw materials, etc.) should be added to the inventories, if not already added while valuing the inventory in the accounts.

This section has been amended with retrospective effect from AY 2017-18 to give effect to ICDS. The amended section covers not only goods but services and securities too. As the assessee follows accounting as per AS 2/IND AS 2 (i.e. exclusive method), adjustments are required as per section 145A (i.e. inclusive method).

Following the exclusive method or inclusive method would not impact the profits of the entity.

Section 145A allows change in method of valuation in the following cases:

- Adoption of different policies is required by statute.

- The change would result in better presentation of financial statements of the enterprise.

Dive Deeper:

Detailed Analysis of Clause 9 to 12

Detailed Analysis of Clause 15 and Clause 16

Detailed Analysis of Clause 17 to Clause 19

Detailed Analysis of Clause 20 and Clause 21

Detailed Analysis of Clause 22 to Clause 25

Detailed Analysis of Clause 26 to Clause 29

Detailed Analysis of Clause 30 to Clause 30C

Detailed Analysis of Clause 31

Detailed Analysis of Clause 32 to Clause 34

Detailed analysis of Clause 35 to Clause 38

Detailed Analysis of Clause 39 to Clause 41

Detailed Analysis of Clause 42 and Clause 43

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA