Supreme Court of India Interpreting the Application of MFN Clause in Context of India’s Tax Treaties

- Blog|International Tax|

- 4 Min Read

- By Taxmann

- |

- Last Updated on 28 October, 2023

Table of Contents

- Most Favoured Nation Clause

- Introduction to the Judgement

- Snapshot of the Judgement

- Practical challenges

- Way Forward

1. Most Favoured Nation Clause

1.1 A Snapshot

India has entered into a Double Taxation Avoidance Agreements (‘DTAA’) with several countries; Most Favoured Nation Clause (‘MFN’) included in protocol.

As per MFN, if India, in a separate DTAA with a third country (which is an OECD member), agrees for a lower or limited scope of taxation, that beneficial tax treatment will apply to India’s original treaty partner.

1.2 Scope of MFN

- Restricting rate of tax and/or scope of taxing royalties, fees for technical services, dividend, interest.

- Restricting taxability of business profit (i.e., relaxing limitation on deductibility of executive and general administration).

- Restricting taxability of profits from air transport and shipping operations.

- Favorable or effective arrangement of exchange of information.

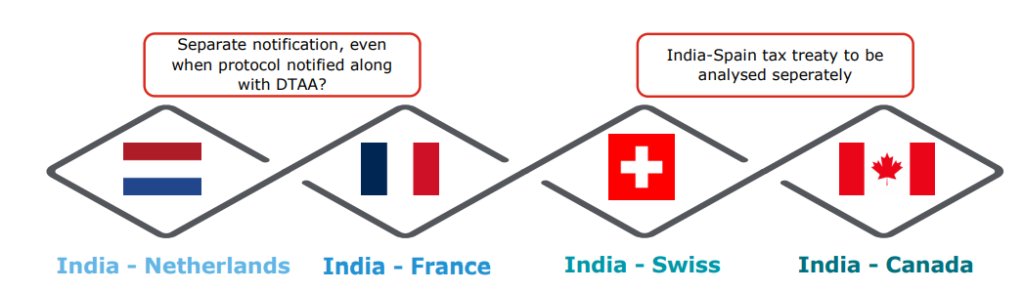

1.3 Indian DTAAs [with MFN clause]

- Belgium

- Finland

- France

- Hungary

- Netherlands

- Spain

- Sweden

- Swiss Confederation

- United Kingdom

- Nepal

- Philippines

- Luxembourg

- Saudi Arabia

1.4 Application of MFN vis-à-vis dividend income

1989: India-Netherlands agreed for MFN – Source state allowed to tax dividend at 10%

2005: India entered DTAA with Slovenia

2010: Slovenia became OECD member – Source state allowed to tax dividend at 5%

Slovenia became OECD member subsequently, MFN still applies?

2012: Netherlands issued a decree – Decree mentions that lower tax rate of 5% on dividend from India-Slovenia DTAA applies to India-Netherlands MFN

2020: Indian tax department defined MFN

(a) No separate notification and

(b) Slovenia not OECD country at time of signing DTAA with India

2021: Hon’ble Delhi High Court granted relief to taxpayer

2022: CBDT issued MFN circular

2023: Supreme Court verdict

2. Introduction to the Judgement

2.1 Story so far!

Vis-à-vis FTS income (Steria India)

- AAR (2011) – [Favour of Revenue]

- High Court (2016) – [Favour of taxpayer]

Vis-à-vis dividend income (Concentrix Services Netherlands BV, Optum Global Solutions International BV and Nestle SA)

- Income-tax authorities (2020/2021) – [Favour of Revenue]

- High Court (2021) – [Favour of taxpayer]

2.2 CBDT Circular no 3/2022 [February 2022] MFN clause and its application in context of Indian tax treaties

- Third country which includes the lower tax rate/restricted scope, should be an OECD member country on the date of the signing of its tax treaty with India.

- A notification under Section 90 of the Income-tax law is mandatory for Protocol/MFN to apply.

- Unilateral decree/bulletin/publication do not represent understanding of the treaty partners on applicability of the MFN clause.

3. Snapshot of the Judgement

3.1 Principle laid down

Held in favour of revenue department, as follows:

Notification under Section 90(1) mandatory for a court, authority or tribunal to give effect to a DTAA/protocol (including MFN) which effects the provisions of Indian tax law

“…..If after the signature of this convention under any Convention or Agreement between India and a third State which is a member of the OECD….

Interpretation of expression “is”; third-party country to be an OECD member at the time of entering the DTAA with India. The fact that the third-party country becomes an OECD member subsequently does not automatically result in application of MFN.

4. Practical challenges

4.1 Vis-à-vis Foreign Taxpayers

Before Apex Court judgement

- MFN clause applied automatically

- FTS income not offered to tax by taking shelter from the “make available” clause under MFN

- Dividend income offered at 5%

- Interest on income-tax refund claimed exempt

- No return of income filed in India where no tax payable in India pursuant to MFN

Post Apex Court judgement

- MFN cannot be applied automatically unless notified

- FTS/interest income on refund now taxable in India even though benefit of MFN available until MFN is notified

- Dividend income to be offered without taking benefit of MFN

Vis-à-vis past

- Order to apply retrospective or prospective?

- Risk of re-opening past positions? Can this be a change in opinion?

- Risk of re-opening past where assessment or reassessment is closed? Can this be a change in opinion?

- Should claim be withdrawn in open assessments?

- Penalty implications for past positions?

- Provision required to be in books for past taxes?

Vis-à-vis present and future

- Advocacy measure?

- Position to be adopted in return of income? i.e., offer income to tax without MFN benefit or wait for advocacy measure

- Alternate cash repatriation strategies from India?

- File return of income absence MFN clause?

- Will home country give credit of entire tax paid in India or limit as per the MFN clause?

4.2 Vis-à-vis Resident Taxpayers

Before Apex Court judgement

- MFN clause applied automatically

- Tax withholding as per MFN clause; for example, dividend income taxed at 5%, FTS income not subject to tax withholding taking shelter of “make available” clause

Post Apex Court judgement

- MFN cannot be applied automatically unless notified

- Indian resident payers to now withhold taxes without providing the benefit of MFN (until notified)

Vis-à-vis past

- Judgement to apply retrospective or prospective?

- Risk of re-opening past positions – disallowance of expenses for non-tax withholding? Can this be a change in opinion?

- Should claim be withdrawn in open assessments

- Penalty implications for past positions?

- Provision required to be in books for past taxes?

Vis-à-vis present and future

- Advocacy measure?

- Should Indian payers begin withholding tax in the absence of MFN notification?

- Excess tax cost pursuant to withholding? Will it be borne by Indian payer or non-resident payee? Impact on grossed up contracts?

5. Way Forward

5.1 Next steps

“MNCs may face INR 11,000 cr retro tax demand on dividend income”

“We were awaiting the Supreme Court order so there will be review of tax positions in many cases”

- Financial impact of previous years position.

- Position to be adopted for FY 2022-23 and going forward.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA