Shareholder Activism – Driving Transparency and Corporate Governance

- Blog|Company Law|

- 12 Min Read

- By Taxmann

- |

- Last Updated on 27 March, 2025

Shareholder Activism is when shareholders leverage their ownership in a company to influence its policies and decisions. By engaging with management—through voting, meetings, and other strategic actions—shareholders aim to enhance transparency, accountability, and ultimately the firm’s long-term value.

Table of Contents

Check out Taxmann's Corporate Governance – UGCF | NEP which is is comprehensively aligned with the NEP-based B.Com. curriculum and offers a rigorous and practical exploration of corporate governance principles and frameworks across Indian and global domains. From analysing landmark corporate failures (Enron, Satyam, Kingfisher) to illustrating legal regulations (Companies Act, 2013; SEBI LODR, 2015), it underscores the pivotal role of robust governance in averting crises. Engaging case studies and research-backed discussions provide a 360-degree view of corporate ethics, board structures, and emerging issues like insider trading and shareholder activism. Each of the eleven chapters includes end-of-chapter questions, references, and previous years' questions to reinforce learning.

1. Shareholder Activism

1.1 Introduction

Increasingly worldover, the shareholders influence the management in governing the company. Greater shareholder involvement in corporate governance is considered necessary to ensure transparency and accountability in organisations. Such involvement is called shareholder activism.

1.2 Definition

According to E. Sjöström (2008),

“Shareholder activism refers to the active influence on firm policy and practices through the use of ownership position.”

1.3 Features

- Shareholder activism can be through different types of ownership position it can be minority shareholders; institutional investors (insurance companies, development banks, private equity funds and hedge funds); or labour unions.

- Shareholder activism may range from financial reasons such as dissatisfaction with corporate financial results, disapproval of financing structure, to non-financial reasons, e.g. adoption of environmentally friendly policies; the constitution of Board of Directors to meet their good governance expectation; and investment in or disinvestment from certain countries.

- Regulatory support is important for its effectiveness.

- Proxy battles, shareholder resolutions, litigation and publicity campaigns are some of the forms shareholder activism can take.

1.4 Advantages

The increased involvement of shareholders in the company’s affairs results in many advantages. Some of them are listed below –

- Reduces agency problem between the management and shareholders – Shareholder activism results in closely monitoring action of corporate management. This helps the shareholders to trust the decisions made by management. The agency problem, thus, gets reduced.

- Creating shareholder value – Activism by the shareholders has become a very significant way through which shareholders are able to influence the management of underperforming companies to step up the company’s performance and create shareholder value.

- Sharpens the company’s strategy – Shareholders have access to timely and accurate information since they are involved in decision making They, especially the institutional investors, can actively provide expert guidance to company on policy matters and improving upon its strategy.

- Improves corporate governance – Shareholder activism helps in enforcing accountability and transparency of decisions made by This results in better corporate governance which, in turn, can prevent corporate failure and promote corporate sustainability in the long run.

Thus, shareholder activism helps the organisation as well as the investors.

1.5 Disadvantages

It has been argued by some people that shareholder activism is detrimental to corporate values because of the following reasons –

- It undermines Board authority – Bainbridge (2002) has argued that shareholder activism results in erosion of the Board’s authority. Some (majority) shareholders may use their power to further their interests at the cost of (minority) others.

- Informational asymmetry and lack of expertise – Lipton and Rosenblum (1991) contend that shareholders do not have time and expertise to gather information, nor do they have complete access to sensitive financial and non-financial information of the Hence, options proposed by shareholders will lack substance and insight.

- Short-termism – It is argued that some shareholders might push decisions that may result in short-term gain for them but damage the long-term value of the corporation.

- Ignore stakeholders – Good corporate governance principles emphasise the furtherance of interest of all the stakeholders, including sharehold While shareholder activism’s basic assumption is that shareholders involve themselves in affairs of the corporate to protect their interest.

A keen interest from institutional investors and focus on long-term growth of corporations by shareholders will mitigate the disadvantages of shareholder activism.

1.6 Shareholder Activism in India

The Companies Act, 2013 and certain regulatory changes introduced by SEBI have ushered a new era of corporate governance in India. Shareholder activism, an important aspect related to corporate governance, has taken the form of institutional shareholder activism as well as minority shareholder activism in India. According to a BNP Paribas Asia Strategy Report released in September 2014, the incidences of shareholder activism in India was more than that in other Asian country since year 20001.

Shareholder activism is coming of age in India. Minority shareholders have successfully opposed resolutions regarding increased remuneration for key personnel, related party transactions, and the reappointment of directors. For example, shareholders of Eicher Motors Limited, KRBL Limited, Max Financial, and Sobha Realty voted against special resolutions aimed at raising the remuneration of top executives. Additionally, in September 2023, shareholders of Godfrey Phillips India rejected the company’s proposal for a related party transaction to annually export unmanufactured tobacco worth up to ` 1,000 crore to Philip Morris2.

Ways of Participation in Shareholder Activism in India3

There are several ways available to shareholders to participate in shareholder activism. Some of these are as follows –

- Interaction with the Board – Shareholders can regularly express their concerns by engaging with the Board either at AGMs or EGMs, fostering awareness of shareholder issues. This interaction helps build rapport and goodwill between shareholders and Board members, which can facilitate the resolution of disputes.

- Right to requisition an EGM – According to section 100 of the Act, 2013, shareholders have a right to requisition the convening of an EGM to discuss specific matters. In a recent case, Zee Entertainment Enterprises Private Limited (“Zee”), a publicly traded company declined to schedule a shareholders’ meeting in response to a requisition notice from Invesco, an institutional investor, regarding the appointment of independent directors. The Bombay High Court held that failing to call the requisitioned meeting would undermine shareholders’ democracy as a consequence of the restrictive behaviour of the Board. Zee was ordered to convene the meeting.

- Utilising the Stakeholders Relationship Committee – Publicly traded companies or those with more than 1,000 shareholders, debenture holders, deposit holders, or other security holders must establish a Stakeholders Relationship Committee to address security holder grievances. This Committee provides shareholders with a platform to voice their concerns.

- Making public announcements – When issues cannot be resolved privately, shareholders have the option to publicly express their grievances, which can place pressure on the Board. Cyrus Mistry, a key shareholder in Tata Sons through his family’s company, Shapoorji Pallonji Group, which owns around 18.4% of Tata Sons, was unexpectedly ousted as Chairman in 2016. After his removal, Mistry raised concerns about the company’s governance through an open letter to the Board, which quickly became public. In this letter, he highlighted issues with corporate governance and questionable business decisions. The public nature of these revelations garnered significant media attention, putting pressure on the Tata Sons board and raising alarm among stakeholders. This situation led to a drawn-out legal dispute, with Mistry alleging oppression and mismanagement, citing his role as a major shareholder [Tata Sons vs. Cyrus Mistry (2016)].

- Approaching the National Company Law Tribunal – Shareholders may file a claim with the National Company Law Tribunal (NCLT) for oppression or mismanagement, arguing that the company’s affairs are being conducted in a manner detrimental to the interests of its members. In Fortis Healthcare vs. Singh Brothers (2018), shareholders of Fortis Healthcare filed cases against promoters Malvinder Singh and Shivinder Singh, alleging mismanagement of company funds and diversion of resources to related parties. They approached the NCLT to protect their interests and rectify the company’s affairs, resulting into a legal investigation of Fortis Healthcare’s financial transactions.

- Making an application to the Serious Fraud Investigation Office (SFIO) – If shareholders suspect serious mismanagement potentially involving fraud, they can notify the Central Government, which may instruct the Serious Fraud Investigation Office to conduct an investigation. In 2018, IL&FS, a prominent infrastructure development and finance firm, faced a severe financial crisis revealed fraud and mismanagement of funds, due to weak corporate governance. Shareholders and creditors expressed their concern about the company’s deteriorating financial situation, prompting the Central Government to order an investigation by SFIO. The ensuing inquiry revealed substantial financial irregularities and mismanagement, ultimately leading to a significant restructuring of the company.

- Acting as per proxy advisory firm’s advice – Proxy advisory firm’s advice the shareholders on various issues based on their For example, they advise the shareholders as to how to vote on various corporate matters, including board elections and executive compensation. Institutional Investor Advisory Services (IiAS) and Institutional Shareholder Services (ISS) recently recommended that shareholders vote against the appointment of Anant Ambani to the board of Reliance Industries Ltd. (RIL). They cited his young age of 28 years as a reason for opposing his non-executive director position, noting that it did not conform to their voting guidelines. In contrast, they endorsed the appointments of his older siblings, Isha and Akash, both 31 years of age4.

Besides the above, ways individual motivation to be a vigilant shareholder may lead to improvement in corporate governance.

The role played by Mr Arvind Gupta as a ‘shareholder and stakeholder activist’ in unearthing ICICI scam is the best example of explaining how a single shareholder can make a difference.

1.7 Important Changes Introduced by the Companies Act, 2013

The Companies Act, 2013 has pushed shareholder activism introducing various regulations –

- Introduction of electronic voting – E-voting was made mandatory in 2013 for certain classes of This has resulted in greater retail investor participation as physical presence in a general meeting is no longer required and voting can be done from any location.

- Class action suits – On June 1, 2016, the Ministry of Corporate Affairs (MCA), notified section 245 of the Companies Act, 2013, which contains provisions related to class action suits in India. It has given minority shareholders the confidence to raise voice against company if a situation demands so.

- Approval of related party transactions – An ordinary resolution is required to approve or disapprove related party transactions, and the promoters/directors interested in the transaction are ineligible to Thus, the minority or public shareholders can play a decisive role in approving or disapproving related party transactions now.

- Small shareholders director – Section 151 of the Companies Act, 2013 requires listed companies to appoint at least one director elected by small shareholders5.

The recent changes in regulations have certainly given the desired push to shareholder activism. In 2014 minority shareholders of Tata Motors did not give consent to the proposed executive compensation package for some of the company’s directors as the company reported a net loss for the year. In the same year, minority shareholders of Siemens rejected the initial offer, and it was forced to raise the offer price at which it wanted to buy out the metal technologies business of its listed Indian subsidiary. These examples and many more such instances are testimonials to rising shareholder activism in India.

2. Class Action Suits

2.1 Introduction

Class action lawsuits, which originated in the U.S., have been used by millions of Americans and Europeans successfully since long. Such lawsuits have been brought against the Government or Corporates to claim compensation for damages and/or injuries caused by defective products, environmental disasters, employment discrimination, securities fraud, false advertising or any other discriminative or manipulative business practices.

2.2 Definition

“A class action is a type of lawsuit in which one or several persons sue on behalf of a larger group of persons, referred to as the class6.”

The common features of class action suits are as follows –

- The issue in dispute is such that a large number of individuals have been made to suffer or have been wronged in a similar manner by the defendant.

- The number of persons affected by the wrong is large and, therefore, it is impracticable for all of them to appear before the court together.

2.3 Advantages of Class Action Suits

- Streamlines the litigation process – Class action lawsuits streamline the process by allowing shareholders to bring their claims to a single court. This is particularly beneficial in a vast country like India, where shareholders may be spread across various Companies can avoid defending multiple lawsuits in different states, while shareholders gain stronger collective representation.

- Lowers the cost of litigation – The financial burden of litigation is divided among all shareholders involved, making it more This is especially important in India, where high litigation costs often deter individuals from filing suits. Shareholders with limited financial means can collectively hold companies accountable without bearing the full cost alone.

- Uniformity in legal decisions – Class actions ensure that all shareholders receive the same treatment and avoid the inconsistency that could arise from multiple courts issuing conflicting rulings.

- Strengthened negotiating position – Companies often prefer settling class action lawsuits rather than waiting for a court verdict. With the collective bargaining power of shareholders, settlements tend to be larger than those achieved in individual lawsuits.

- Boosts shareholders’ awareness and activism – Class action lawsuits attract more media coverage and public attention than individual cases, which increases awareness among shareholders and motivates them to assert their rights.

- Deter companies – Although the primary goal of class actions is not to punish companies, they do serve as a financial deterrent. Large settlements can impose significant costs on companies, encouraging them to act more responsibly in the future. For example, if Satyam Tech had faced a class action suit in India like it did in the U.S., it might have deterred similar corporate misconduct.

- Increases judicial efficiency – In a country like India, where backlog of legal cases in courts is a serious matter of concern, class actions save valuable time and reduces their burden.

2.4 Disadvantages of Class Action Suits

Some of the disadvantages of class action suits include –

- Delay in resolution – In case of a class action lawsuit, it takes time to build a consensus among The procedural complexities result in longer time in resolution of class actions as compared to conventional cases.

- Lack of control – These suits are representative by their very The representative parties only have authority to agree to a settlement or take any other decision. Aggrieved party has no control.

- Limited forms of compensation – Compensation in class action suits is, generally, limited to pecuniary No other form of relief, such as employment in the entity, is not available to the plaintiffs.

- Litigation financing – In the United States and elsewhere, class action movement has been boosted by third-party funding and contingency fees, which allow plaintiff lawyers to take the risk of litigation while ensuring windfall profits in the event of a success. There is absence of similar regulation in India and lawyers cannot get contingent or success fees.

To ensure mitigation of these problems, law in many countries requires an option to be given to members to opt out of settlement.

2.5 Class Action Suits in India

- Class action suits and Satyam – Satyam scam, which broke out in 2009, brought many corporate governance issues in the One of these was the need for regulations related to class action lawsuits. Indian investors of Satyam were not successful in taking a legal recourse while company’s U.S. investors filed class action suit against the company and its auditors.

- First class action suit– Interestingly, Department of Consumer Affairs under the Ministry of Consumer Affairs, Food & Public Distribution filed a class action suit against Nestle recently citing the Consumer Protection Act, 1986. It is the first instance of such a case in India.

- Section 245 of the Act – This section empowers members or depositors of a company to file a class action suit if they believe that the company’s affairs are being conducted in a manner detrimental to their interests. It allows them to collectively bring a lawsuit against –

-

- the company,

- its directors,

- auditors, or

- other relevant parties such as experts, advisors, or

Eligibility for Filing

-

-

- For companies with share capital, at least 100 members or 10% of the total number of members, whichever is less, can initiate a suit.

- For unlisted companies, members holding at least 5% of the issued share capital can file.

-

-

-

- For companies without share capital, at least 1/5th of the total number of members is required.

-

Process of Filing

-

-

- The suit must be filed in the National Company Law Tribunal (NCLT) and must specify the grounds for action and the relief Upon admission, the NCLT issues public notice to all affected parties.

-

Deterrence to Frivolous Litigation

Sub-section (8) of Section 245 of the Companies Act, 2013 states that if the Tribunal finds an application filed by members or depositors to be frivolous or vexatious, it can reject the application:

-

-

- The Tribunal must record its reasons for rejection in writing.

- The Tribunal must order the applicant to pay costs to the opposite party, not exceeding ` 1,00,000.

-

- Reimbursement of legal expenses – The company can reimburse expenses incurred for pursuing class-action suits under Sections 37 and 245 of the Act by debenture-holders, members, or depositors and sanctioned by the National Company Law Tribunal out of Investor Education and Protection Fund.

Two separate class action suits are subjudice at present: one filed by some shareholders of Jindal Poly Films Ltd. against promoter B. C. Jindal Group; and the other filed by minority shareholders of ICICI Securities Ltd. against the company and its promoter, ICICI Bank Ltd. The future of corporate governance in India may largely depend on the jurisprudence established while resolving these issues.

3. Institutional Investors

3.1 Introduction

Institutional investors are key players in the governance mechanism of a corporation. They hold significant stake and voting power which can potentially influence company’s decisions and promote good governance practices. Their sheer voting power allow them to act as stewards of good governance, ensuring transparency, and thereby contributing to overall market stability.

3.2 Definition and Types

NASDAQ defined institutional investors as:

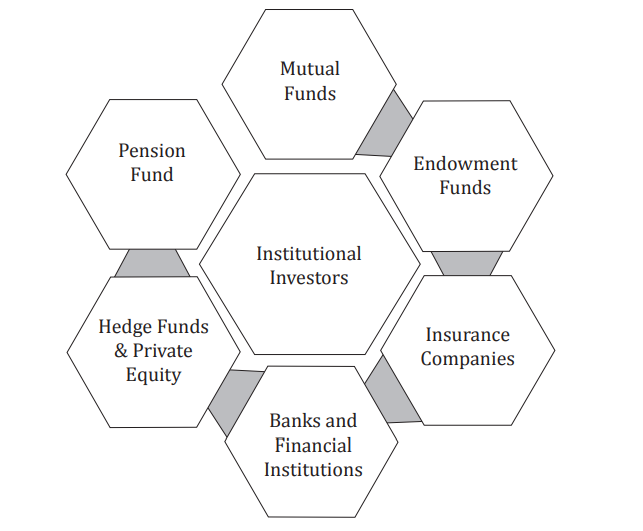

“Organisations that invest, including insurance companies, depository institutions, pension funds, investment companies, mutual funds, and endowment funds7.”

Griffin (1993) defined institutional investors as:

“Institutions which have as their primary role the professional investment and management of any fund established for the purpose of pooling monies paid by individual investors and invested in financial and non-financial assets8”.

In simple words, institutional investors are organisations that pool large sums of money and invest it on behalf of their clients or members. These include mutual funds, insurance companies, pension funds, Foreign Institutional Investors (FIIs), banks, and other financial institutions. The primary goal of institutional investors is to maximise the returns for their clients or beneficiary members while maintaining a long-term view of corporate performance and sustainability.

For instance, LIC is the largest institutional investor in India. As of June 2024, LIC has invested in stocks of 282 companies, the value of whichwas estimated at ` 15 trillion. The total Asset Under Management (AUM) of LIC stood at ` 53.59 trillion by end of June 20249.

In India, institutional investors can be broadly classified into two types –

- Domestic Institutional Investors (DIIs) – These include Indian mutual funds, insurance companies like LIC, pension funds such as Employees’ Pension Fund (EPF), and domestic financial institutions such as

- Foreign Institutional Investors (FIIs) – These include foreign hedge funds, private equity funds, foreign pension funds, and others that invest in Indian For example, KKR is a global investment firm having invested $190 Billion as private equity in companies across the globe by the end of September 202410. Such firms are FIIs for Indian companies.

Types of Institutional Investors

- BNP’s report mentioned six instances in India, four in Japan since 2000, two in China and one in Thailand

- https://iclg.com/practice-areas/corporate-governance-laws-and-regulations/india

- https://www.barandbench.com/law-firms/view-point/shareholder-activism-in-india

- https://indianexpress.com/article/explained/everyday-explainers/proxy-advisory-firms-oppose-anant-ambani-appointment-8990115/

- Small shareholders for this purpose means shareholder holding shares of nominal value of not more than twenty thousand rupees or such other sum as may be prescribed.

- https://www.lieffcabraser.com/about-us/class-action-faq/

- https://www.nasdaq.com/glossary/i/institutional-investors

- https://www.austlii.edu.au/au/journals/JCULRev/1996/4.pdf

- https://www.business-standard.com/companies/news/lic-to-invest-around-rs-1-30-trillion-in-stock-market-in-fy25-md-ceo-124081100292_1.html

- https://www.kkr.com/ accessed on October 28,

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA