Recent Events in GST – Impact on Business & Industry

- Blog|GST & Customs|

- 9 Min Read

- By Taxmann

- |

- Last Updated on 19 September, 2023

Table of Content

- Taxability of Shares Held in a Subsidiary Company by the Holding Company

- Taxability of Services Provided by Distinct Persons

- ITC Related Issues

- Warranty Supplies

- GST on Online Gaming

- Taxability of User Development Fee (UDF)

1. Taxability of Shares Held in a Subsidiary Company by the Holding Company

Welcome clarification issued in terms of the taxability of holding shares by the holding company in a subsidiary company. It is now clarified that this cannot be treated as a supply of services by the holding company to the subsidiary company and cannot be subjected to GST.

- Securities (including shares ) are considered neither goods nor services under the GST Law.

- Purchase or sale of shares or securities is neither a supply of goods nor a supply of services.

- Inclusion of SAC entry 997171 in the service classification scheme, which refers to “services provided by holding companies, i.e., holding securities of (or other equity interests in) companies and enterprises for the purpose of owning a controlling interest” does not automatically imply the provision of service by the holding company to the subsidiary company unless the actual supply of service takes place.

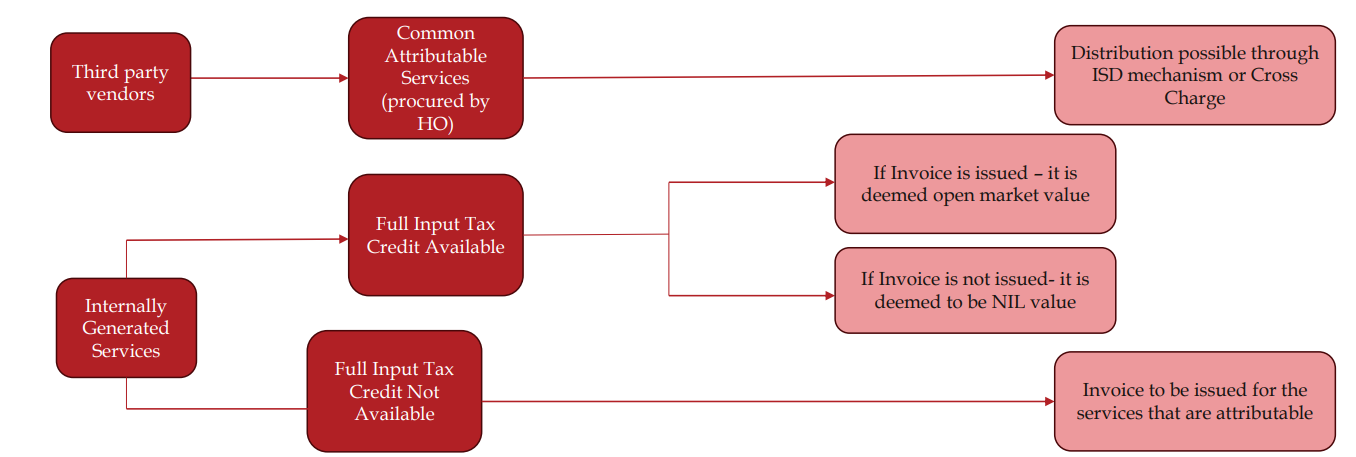

2. Taxability of Services Provided by Distinct Persons

3. ITC Related Issues

- Corporate Social Responsibility (CSR) – ITC shall not be available in respect of goods or services, or both received by a taxable person, which are used or intended to be used for compliances with CSR provisions provided under the Company’s Act. New provision inserted under Section 17 (5) and effective from October 1, 2023

- (fa) goods or services or both received by a taxable person, which are used or intended to be used for activities relating to his obligations under corporate social responsibility referred to in section 135 of the Companies Act, 2013.

- Differing view taken by various Advance Rulings on this specific issue in the past.

- No ITC available on account of delay in availment – ITC is ineligible where there is a delay in filing GSTR 3B beyond the time prescribed under Section 16 (4) of the CGST Act, 2017.

- Thirumalakonda Plywoods vs. Assistant Commissioner (State Tax), High Court of Andhra Pradesh at Amaravati

- In terms of Section 16(2)(c) of the CGST Act, a registered person is not entitled to avail ITC in respect of any supply, unless tax charged in respect of such supply has been actually paid to the Government.

- Constitutional validity of Section 16 (2) (c) and restriction prescribed in Rule 36(4)? Several writ petitions currently pending on this matter, some of which among others are Delhi High Court (in Bharti Telemedia), Gujarat High Court (in Society for Tax Analysis and Research), Delhi High Court (in Instakart),

- In respect of an identical provision under erstwhile Delhi VAT Act, Delhi High Court in the case of On Quest Merchandising India (P.) Ltd., v. Government of NCT of Delhi [2017] 87 taxmann.com 179/64 GST 623/[2018] 10 GSTL 182 (Delhi) held that a bona fide purchaser cannot be saddled with a liability on account of a defaulting seller. On this account, Section 9(2)(g) of DVAT was held to be violative of Article 14 of the Constitution. This judgment was upheld by Supreme Court in 2022 (60) GSTL 215 (SC).

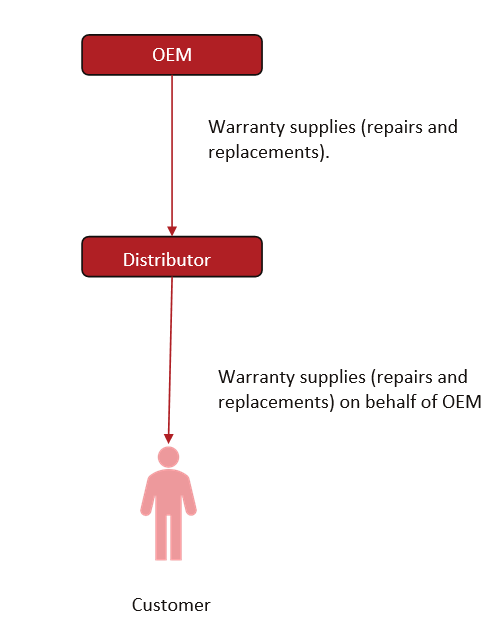

4. Warranty Supplies

4.1 Levy of VAT

- Supreme Court in Tata Motors Ltd.v. Deputy Commissioner of Commercial Taxes (SPL) [(2023) 6 Centax 139 (SC)]: Credit notes issued by manufacturers to the dealers, forms a consideration for spare parts replaced in automobiles covered by warranties, which is leviable to VAT. Basis of arriving at the above conclusion:

- Elements of sale are essentially present: agreement to sell between the parties, transfer of property in goods and monetary consideration.

- Equated the transaction with a situation where manufacturer would have procured such spare part to be replaced from open market, wherein appropriate sales tax would have been paid.

- In terms of definition of ‘sale’, ‘consideration’ as well as ‘credit note’, in order to constitute sale, consideration need not be in monetary form.

- Above position will not be applicable in cases where fulfilment of warranty happens through spare parts supplied by the manufacturer.

4.2 Clarification

| Sl. No | Query | Clarification vide the Circular |

| 1. | Warranty services provided without consideration. Will GST be levied? | No GST leviable for supplies made without consideration. Value of original supply of goods (provided along with warranty) by the manufacturer to the customer includes the likely cost of replacement of parts and/or repair services to be incurred during the warranty period on which tax would have already been paid at the time of original supply of goods. |

| 2. | Warranty services made with additional consideration. GST implication? | GST will be payable on such supplies with respect to such additional consideration. |

| 3. | Whether OEM needs to reverse ITC in respect of such replacement of parts or repair services provided with no consideration. | Since the original supply of goods includes the likely cost of replacement of goods and/or repair services, these supplies cannot be considered as exempt supply and thus, no ITC reversal is required. |

| Sl. No | Query | Clarification vide the Circular |

| 1. | Warranty services provided by distributor without consideration. Will GST be levied? | No GST leviable for supplies made without consideration. |

| 2. | Warranty services made with additional consideration by the distributor GST implication? | GST will be payable on such supplies with respect to such additional consideration. |

| 3 | Where the distributor provides repair service, in addition to replacement of parts to the customer without any consideration, but charges the manufacturer for such repair services either by way of issue of tax invoice or a debit note, whether GST would be payable on such activity by the distributor? | GST would be payable on such provision of service by the distributor to the manufacturer and the manufacturer would be entitled to avail the input tax credit of the same, subject to other conditions of CGST Act. |

| Sl. No | Clarification vide the Circular | |

| 1 | In a scenario where the Distributor replaces the part(s) to the customer under warranty either by using his stock or by purchasing from a third party and charges the consideration for the part(s) so replaced from the manufacturer, by issuance of a tax invoice, for the said supply made by him to the manufacturer. | |

| GST Implication? | GST would be payable by the distributor on the said supply by him to the manufacturer and the manufacturer would be entitled to avail the input tax credit of the same, subject to other conditions of CGST Act. In such case, no reversal of input tax credit by the distributor is required in respect of the same. | |

| 2. | Distributor raises requisition to OEM for parts and OEM provides parts for such replacement and no separate consideration is charged by the OEM | |

| GST Implication? | Supply of parts from OEM to Distributor not liable to GST and OEM is eligible to claim ITC. | |

| 3. | Distributor replaces part out of the supply already received by him and OEM issues a Credit Note in respect of the parts so replaced subject to section 34 (2) | |

| GST Implication? | GST liability to be adjusted by the OEM and consequent ITC reversal to be undertaken by the Distributor. | |

| 4. | Whether GST would be payable on the extended warranty provided to the customer at the time of original supply? | Consideration for such extended warranty becomes a part of the value of the composite supply, the principal supply being the supply of goods and GST would be payable accordingly. |

| 5. | Whether GST would be payable on the extended warranty provided to the customer any time after the original supply? | GST would be payable, depending on the nature of contract i.e., whether the extended warranty is only for goods or for services or for composite supply involving goods and services. |

5. GST on Online Gaming

5.1 Karnataka High Court Judgement

5.1.1 Revenue’s Position

Tax chargeable @ 28% on face value of each contest

- Wagering in online games amounts to betting and gambling

- Amounts wagered by Users in online games over the Platform are in the nature of supply of actionable claims

- Actionable claims in relation to betting and gambling attracts 28% GST, on the face value of each contest

5.1.2 Gameskraft’s Position

Tax chargeable @ 18% on Gross Gaming Revenue

- Gameskraft’s platform pre-dominantly offers online ‘Rummy’, which contributes for more than 90% of total revenue earned by Gameskraft

- ‘Rummy’ has been held to be a game of skill by the Supreme Court and multiple High Courts in the past

- Being a game of skill, it cannot be equated with betting or gambling which attract higher tax under GST

- Platform Fee charged by Gameskraft, which forms the Gross Gaming Revenue for the Platform, is appropriately subjected to GST @ 18%

5.1.3 Karnataka High Court

Upholds the position of Gameskraft

- Upon review of several judicial precedents, Court noted that nature of ‘Rummy’ is judicially settled to be a game of skill

- Staking on games of skill do not change the nature of such games into betting/gambling/wagering

- Under GST laws, only activities relating to lottery, betting and gambling attracts higher rate of tax @ 28%, on the face value of contest

- SCN proposing to demand a whooping amount of more than INR 21,000 Cr. was accordingly quashed

5.2 Recent Recommendations by the GST Council

Recommendations by GST Council: Issues relating to taxability of online gaming operators was long pending before GST Council, which had constituted a GoM, in 2021, to recommend on the rate of tax and valuation, for taxing online games. As the GoM could not arrive at a consensus, the matter was left to be decided by the GST Council itself. Recently, GST Council recommended the following in relation to online games:

- GST @ 28% is to be levied on activities qualifying as ‘Online Money Gaming’: effectively removing the distinction between games of skill and games of chance

- Deposits made by a User with the platform will attract the above levy

Consequent amendments under GST:

- ‘Online Money Gaming’ means a game where money/VDA deposits are made with an expectation of return in money/money’s worth/VDA

- ‘Specified Actionable Claims’ are made taxable, which now includes ‘Online Money Games’ in addition to ‘betting’, ‘gambling’, ‘lottery’, ‘casions’ and ‘horse racing’.

- Online gaming operator is deemed to be the supplier of such actionable claims

- Deposits made at the initial stage would attract the levy and any subsequent refunds of such deposits (even without staking on an online game) would not entitle for an adjustment of GST

- Specific provisions relating to compulsory registration for non-resident gaming operators and special powers for blocking of their Platforms in case of GST non-compliance

5.3 Way Forward

- Retrospectivity: Revenue officials have indicated that the current set of proposals and amendments are only clarificatory in nature.

- Effective Date: State Governments are yet to pass amendments in the respective State assemblies to effectuate the amendments. It was indicated by Hon. Finance Minister that the intent is to implement the amendments with effect from 01st October 2023.

- Government is yet to notify the amendments. Possibility of enforcing this from a retrospective date remains a looming risk.

- Irrespective, Revenue Authorities are continuing to issue SCNs to gaming operators. Challenge on retrospectivity ground is likely to crop up in coming times.

- Revenue SLP against Gameskraft judgment: Interim stay of the High Court judgment by Supreme Court – Impact for industry?

- Possible options for gaming operators: At the outset, a challenge to the new provisions is very likely as soon as the amendments are implemented. Be that as it may, as on date, gaming operators are considering below options:

- Innovating new operating models to reduce tax exposure

- Reduction in fixed operating costs through substantial reduce in work-force, marketing budgets, etc.

- Remain viable for a 6-month period when GST Council is set to review the amendments and its impact on the industry

6. Taxability of User Development Fee (UDF)

6.1 Service Tax

- Supreme Court in the case of DIAL, Central GST, Delhi-III v. Delhi International Airport Ltd. [(2023) 6 Centax 199 /[2023] 74 G.S.T.L. 129 (SC)]: Upheld the position that UDF, which is charged and collected on every flight ticket from the consumers, is not leviable to Service Tax. Basis for the said findings:

- UDF is a statutory exaction and not fees or tariffs, collected in terms of Section 22A of the Airports Authority of India Act, 1994

- No consequential service provided to the consumers on account of charging of UDF

- UDF’s are collected in escrow account, not within the control of the collection agencies like MIAL, DIAL, HIAL

- spendings from the escrow account are monitored and regulated by law

- Revenue’s Contention: UDF collected is used for funding and financing specific renovation, maintenance, development and upgradation of airports and consequently pertains to services offered to the passengers. Consequently, it is taxable as ‘airport service’

- Principle of nexus with the service: In the case of Bhayana Builders [2018 (1) SCR 1128], SC held that in the absence of any nexus with the service rendered, an amount charged, or value of goods or services provided with a consideration, would not be a taxing incident

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA