Practical Issues in E-way Bill, Detention of Vehicles and its Recent Court Rulings

- Blog|GST & Customs|

- 21 Min Read

- By Taxmann

- |

- Last Updated on 30 June, 2023

Table of Contents

- Section–68 (Chapter XIV: Inspection Search Seizure and Arrest)

- Section–129 (Chapter XIX: Offences & Penalties)

- Understanding Various Methods of Generating E-way Bill

- Case Studies

- No Intent to Evade and Events beyond control of taxpayer

- Order Not Issued Within Specified Time Limit

- Address Wrongly Mentioned

- Natural Justice and Minor Invoice Issue

- Part B Not Updated Timely

- In Job Work Value in Inward Journey is Less Than While Sending

- GSTR-1 and GSTR-3B Not Filed

- Judgements Against the Assessee

1. Section–68 (Chapter XIV: Inspection Search Seizure and Arrest)

1.1 Inspection of Goods in Movement

- The Government may require the person in charge of a conveyance carrying any consignment of goods of value exceeding such amount as may be specified to carry with him such documents and such devices as may be prescribed.

- The details of documents required to be carried under sub-section (1) shall be validated in such manner as may be prescribed.

- Where any conveyance referred to in sub-section (1) is intercepted by the proper officer at any place, he may require the person in charge of the said conveyance to produce the documents prescribed under the said subsection and devices for verification, and the said person shall be liable to produce the documents and devices and also allow the inspection of goods.

2. Section–129 (Chapter XIX: Offences & Penalties)

2.1 Detention, Seizure & Release of Goods and Conveyances in Transit

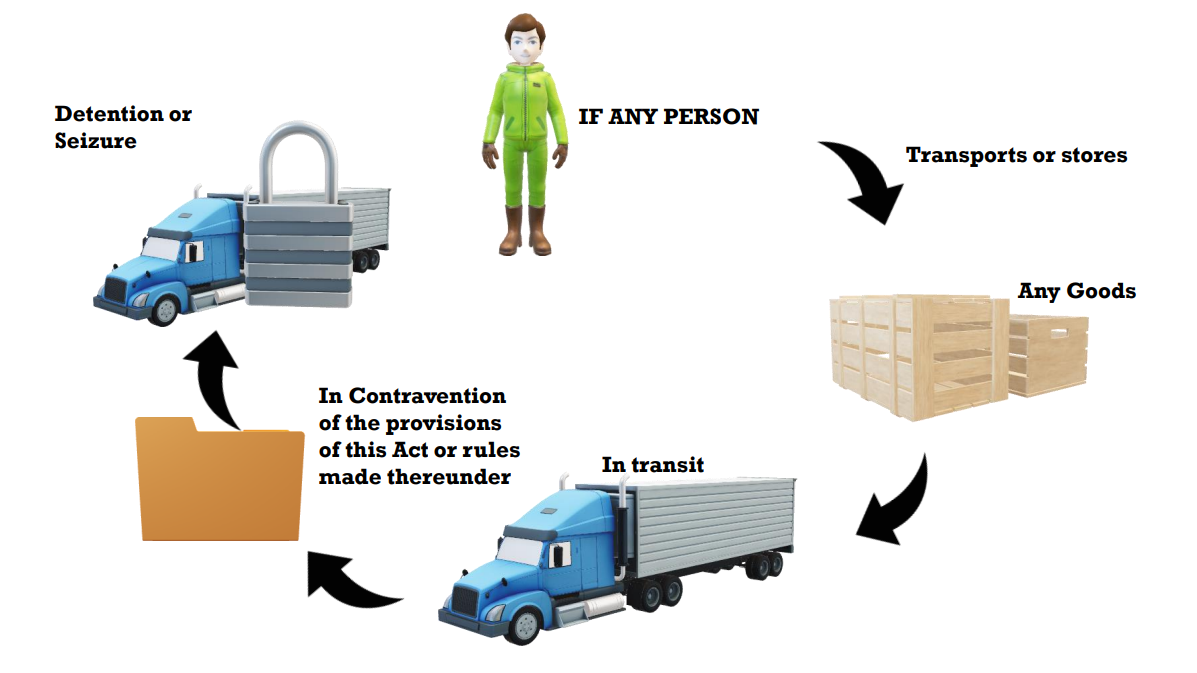

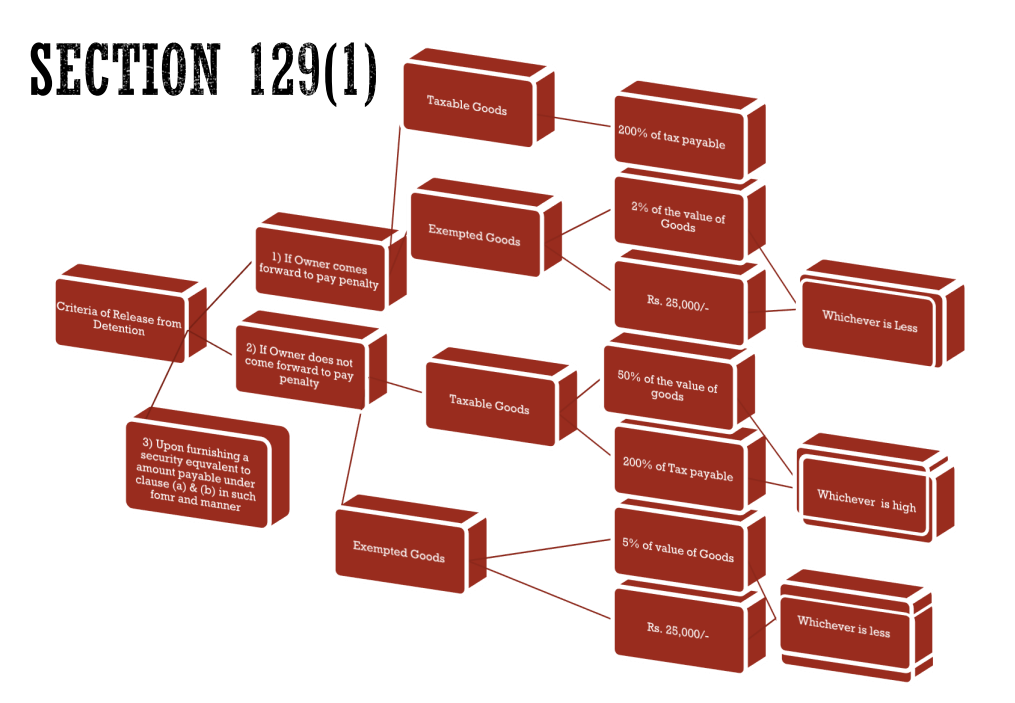

Notwithstanding anything contained in this Act, where any person transports any goods or stores any goods while they are in transit in contravention of the provisions of this Act or the rules made thereunder, all such goods and conveyance used as a means of transport for carrying the said goods and documents relating to such goods and conveyance shall be liable to detention or seizure and after detention or seizure, shall be released.

| FORM MOV | Purpose of Issuance |

| FORM MOV-01 | Statement of the Owner/Driver/Person in Charge of the Goods and Conveyance |

| FORM MOV-02 | Order for Physical Verification/Inspection of the Conveyance, Goods and Documents |

| FORM MOV-03 | Order of Extension of Time for Inspection Beyond Three Working Days |

| FORM MOV-04 | Physical Verification Report |

| FORM MOV-05 | Release Order |

| FORM MOV-06 | Order of Detention |

| FORM MOV-07 | Notice Under Section 129(3) |

| FORM MOV-08 | Bond for Provisional Release of Goods and Conveyance |

| FORM MOV-09 | Order of Demand of Tax and Penalty |

2.2 Section 129(2)

- The provisions of sub-section (6) of section 67 shall, mutatis mutandis, apply for detention and seizure of goods and conveyances which defines itself the goods which are seized under sub section(2) shall be released on a provisional basis upon an execution of a bond and furnishing a security of such a manner in form of applicable tax, penalty payable as the case maybe.

2.3 Section 67

- (2) Where the proper officer, not below the rank of Joint Commissioner, either pursuant to an inspection carried out under sub-section (1) or otherwise, has reasons to believe that any goods liable to confiscation or any documents or books or things, which in his opinion shall be useful for or relevant to any proceedings under this Act, are secreted in any place, he may authorise in writing any other officer of central tax to search and seize or may himself search and seize such goods, documents or books or things.

- (6) The goods so seized under sub-section (2) shall be released, on a provisional basis, upon execution of a bond and furnishing of a security, in such manner and of such quantum, respectively, as may be prescribed or on payment of applicable tax, interest and penalty payable, as the case may be.

2.4 Section 129(3)

2.4.1 Before Amendment

- The proper officer detaining or seizing goods or conveyances shall issue a notice specifying the tax and penalty payable and thereafter, pass an order for payment of tax and penalty under clause (a) or clause (b) or clause (c).

2.4.2 After Amendment

- The proper officer detaining or seizing goods or conveyance shall issue a notice within seven days of such detention or seizure, specifying the penalty payable, and thereafter, pass an order within a period of seven days from the date of service of such notice, for payment of penalty under clause (a) or clause (b) of sub section (1).

2.5 Section 129(4)

2.5.1 Before Amendment

“No tax , interest or penalty shall be determined under sub section (3) without giving the person concerned an opportunity of being heard”

2.5.2 After Amendment

“No penalty shall be determined under section (3) without giving the person concerned an opportunity of being heard”.

2.6 Section 129(5)

- On payment of amount referred in sub section (1), all proceedings in respect of the notice specified in sub section(3) shall be deemed to be concluded

2.7 Section 129(6)

2.7.1 Before Amendment

- Where the person transporting any goods or the owner of the goods fails to pay the amount of tax and penalty as provided in sub-section (1) within fourteen days of such detention or seizure, further proceedings shall be initiated in accordance with the provisions of section 130

- Provided that where the detained or seized goods are perishable or hazardous in nature or are likely to depreciate in value with passage of time, the said period of seven days may be reduced by the proper officer

2.7.2 After Amendment

- Where the person transporting any goods or the owner of the goods fails to pay the amount of penalty under sub-section (1) within fifteen days from the date of receipt of the copy of the order passed under sub-section (3), the goods or conveyance so detained or seized shall be liable to be sold or disposed of otherwise in such manner and within the said time as may be prescribed, to recover the penalty payable under sub-section (3)

- Provided that the conveyance shall be released on payment by the transporter of the penalty under sub-section (3) or one lakh rupees whichever is less

- Provided further that where the detained or seized goods are perishable or hazardous in nature or are likely to depreciate in value with passage of time, the said period of fifteen days may be reduced by the proper officer.

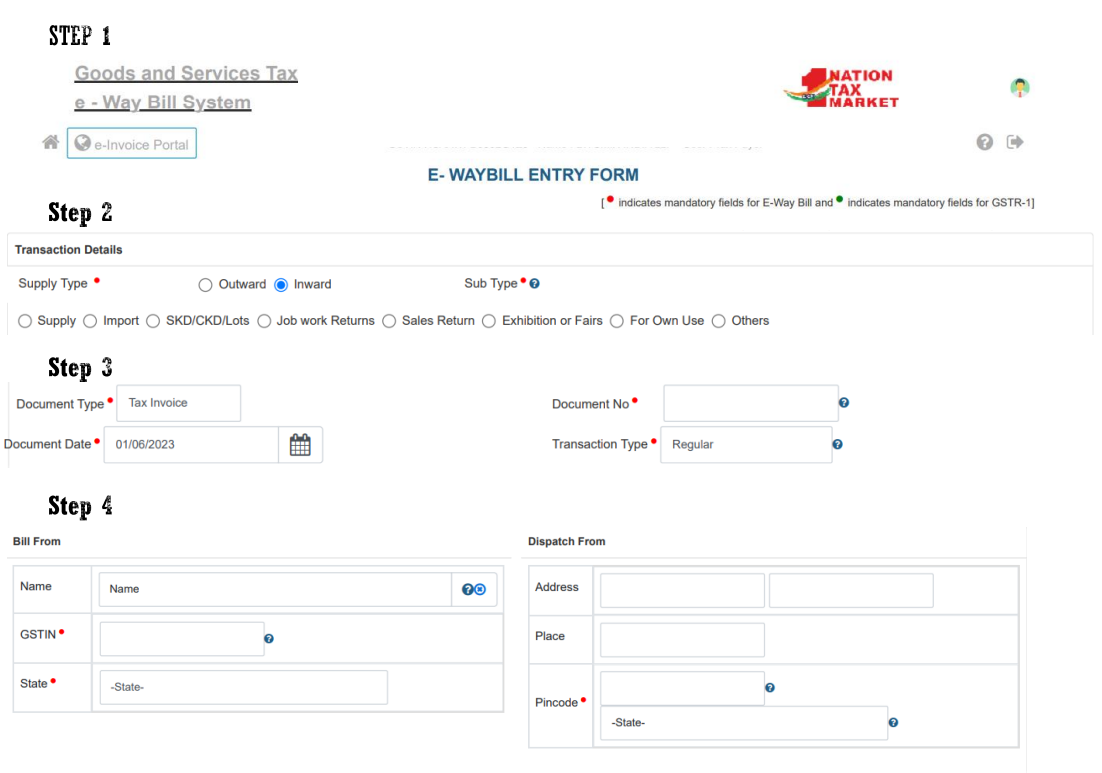

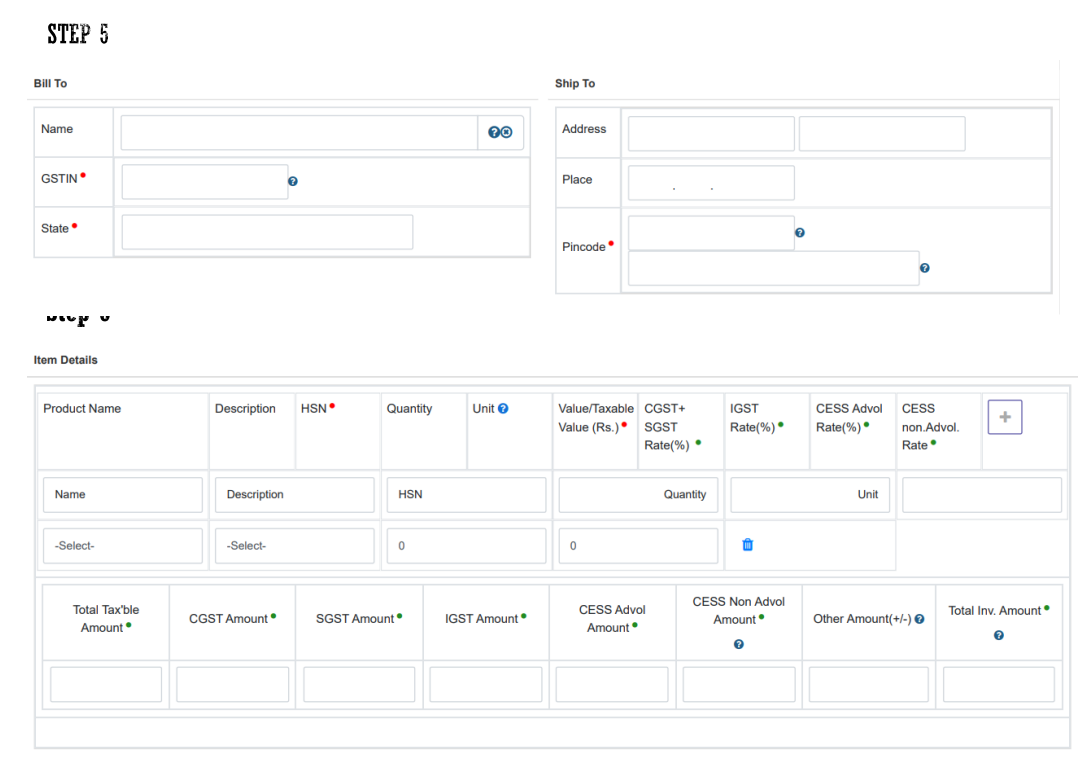

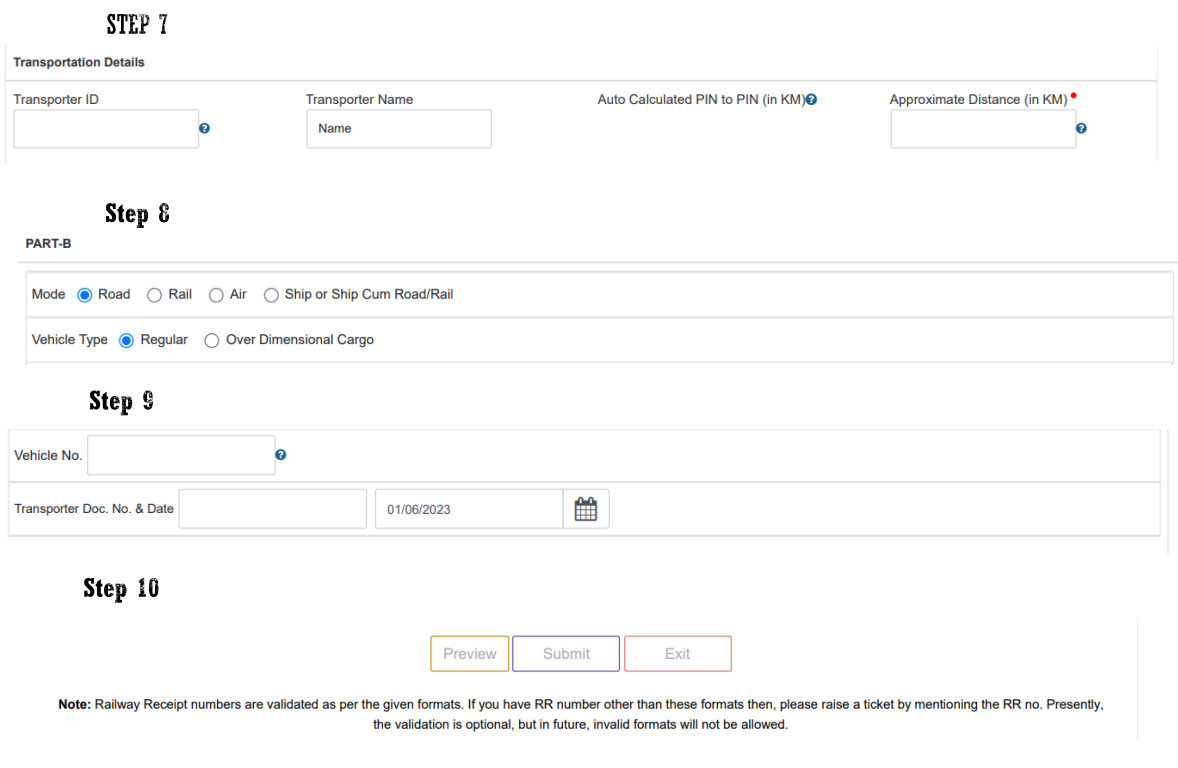

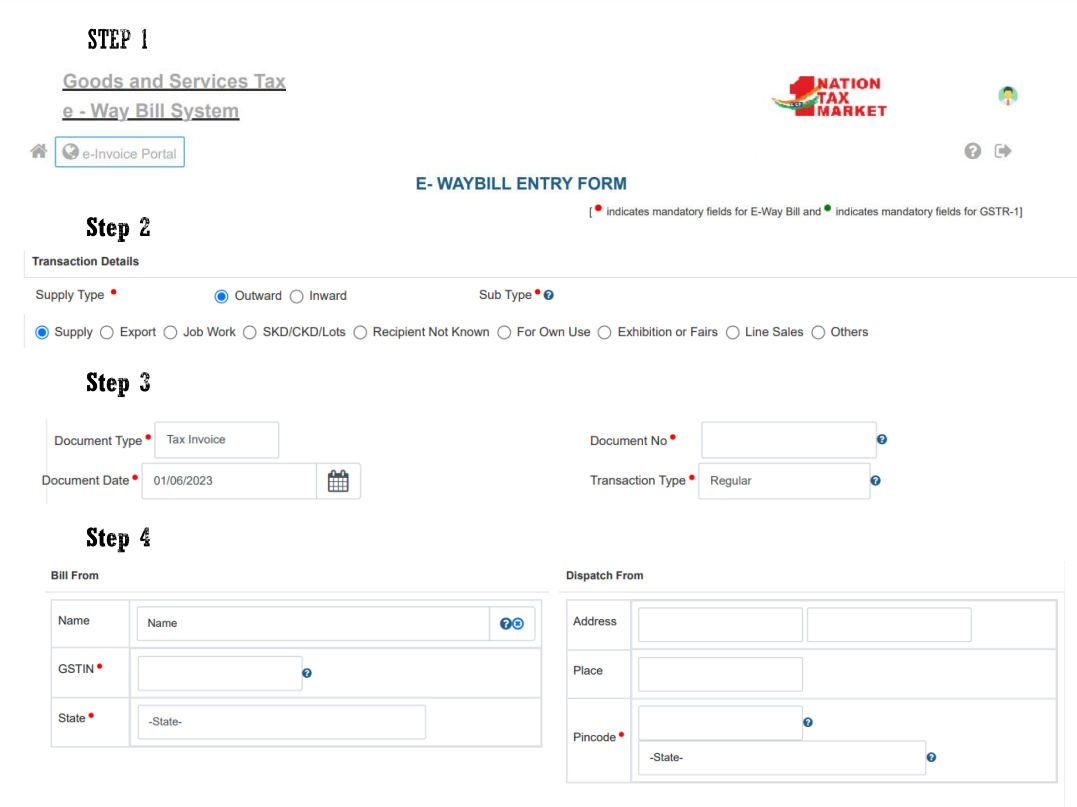

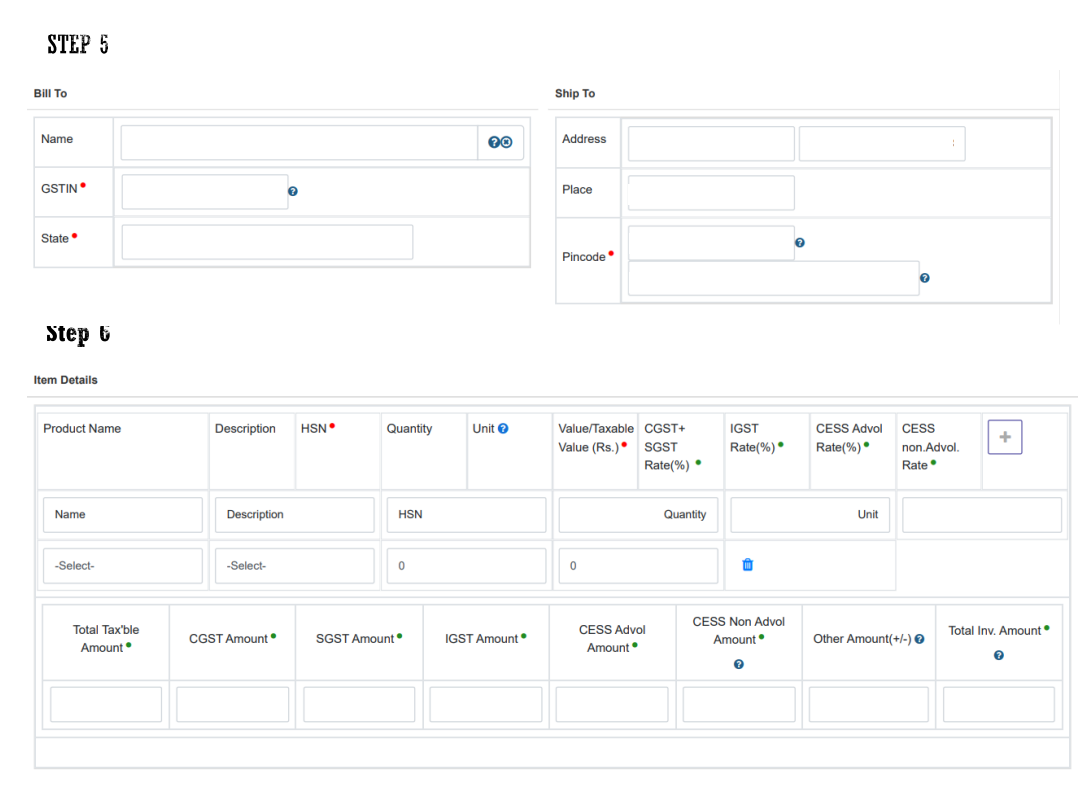

3. Understanding Various Methods of Generating E-way Bill

3.1 Inward Supply Type

3.2 Outward Supply Type

4. Case Studies

4.1 Case Study 1

Truck carrying cement from Assam to Kolkata bearing the required documents with E-Way Bill duly generated. The vehicle is stopped for checking by Mobile Squad of Department. Now while generating E-Way Bill some mistakes have been committed as follows:

a) Name of recipient wrongly written

b) Invoice Number wrongly written

c) Quantity wrongly given

d) Value wrongly given in E-Way Bill, but is correct in invoice

e) Value wrongly given in invoice, but is correct in E-Way Bill

Circular No. 64/38/2018-GST dated 14-9-2018

- Further, in case a consignment of goods is accompanied with an invoice or any other specified document and also an e-way bill, proceedings under section 129 of the CGST Act may not be initiated, inter alia, in the following situations:

(a) Spelling mistakes in the name of the consignor or the consignee but the GSTIN, wherever applicable, is correct;

(b) Error in the pin-code but the address of the consignor and the consignee mentioned is correct, subject to the condition that the error in the PIN code should not have the effect of increasing the validity period of the e-way bill;

(c) Error in the address of the consignee to the extent that the locality and other details of the consignee are correct;

(d) Error in one or two digits of the document number mentioned in the e-way bill;

(e) Error in 4 or 6 digit level of HSN where the first 2 digits of HSN are correct and the rate of tax mentioned is correct;

(f) Error in one or two digits/characters of the vehicle number.

- In case of the above situations, penalty to the tune of Rs. 500/- each under section 125 of the CGST Act and the respective State GST Act should be imposed (Rs. 1000/- under the IGST Act) in FORM GST DRC-07 for every consignment. A record of all such consignments where proceedings under section 129 of the CGST Act have not been invoked in view of the situations listed in paragraph 5 above shall be sent by the proper officer tohis controlling officer on a weekly basis.

Gist of Circular No. 64/38/2018-GST dated 14-9-2018

- Spelling mistakes

- Error in the pin-code Error in the address

- Error in one or two digits of the document number mentioned in the e-way bill

- Error in 4 or 6 digit level of HSN where the first 2 digits of HSN are correct and the rate of tax mentioned is correct

- Error in one or two digits/characters of the vehicle number

Penalty to the tune of Rs. 500/- each under section 125 of the CGST Act and the respective State GST Act should be imposed (Rs.1000/- under the IGST Act) in FORM GST DRC-07 for every consignment.

4.2 Case Study 2

- Truck carrying cement from Assam to Kolkata bearing the required documents with E-Way Bill duly generated. E-Way Bill generated on 01-04- 2023 and valid till 04-04-2023. On 03-04-2023, the vehicle stops due to some minor accident mid-way and need to be repaired. The driver did not inform about the same and the E-Way Bill could not be extended within 8 hours from the date of expiry i.e. upto 8 AM of 05-04-2023. The vehicle is repaired on 06-04-2023. How to move the same to its destination?

4.3 Case Study 3

- Truck carrying cement from Assam to Kolkata bearing the required documents with E-Way Bill duly generated. E-Way Bill generated on 01-04- 2023 and valid till 04-04-2023. On 03-04-2023, the vehicle stops due to some minor accident mid-way and need to be repaired. The driver did not inform about the same and the E-Way Bill could not be extended within 8 hours from the date of expiry i.e. upto 8 AM of 05-04-2023. The vehicle is repaired on 06-04-2023 and is in the parking lot i.e. not moving. Can it be detained?

4.4 Case Study 4

- Truck carrying cement from Assam to Kolkata bearing the required documents with E-Way Bill duly generated. E-Way Bill generated on 01-04- 2023 and valid till 04-04-2023. On 04-04-2023 at 10 PM, the vehicle stops near the destination due to some minor accident mid-way and need to be repaired. Since it was late night, the E-Way Bill could not be extended within 8 hours i.e. by 8 AM on 05-04-2023. At around 6 AM the vehicle was detained by the authorities. Can it be detained?

Reference 1

The Hon’ble Madhya Pradesh High Court in the case of Daya Shanker Singh v. State of Madhya Pradesh, [2022] 142 taxmann.com 266/65 GSTL 12/94 GST 233 (Madhya Pradesh) held as under

“Mere delay of 4:30 hours appeared to be bona fide and fraudulent intent and negligence on part of petitioner was not established. Punishment should commensurate to breach legislative mandate of sub-section (1) of section 126 of Central Goods and Services Tax Act, 2017. Hence, penalty imposed on petitioner was to be set aside.”

Reference 2

Shree Govind Alloys (P.) Ltd. vs. State of Gujarat, [2023] 148 taxmann.com 382 (Gujarat)

- Expiry of E-Way Bill 41 hours before due to truck having remained in non-motorable condition. Goods seized without there being any allegation of evasion of tax with fraudulent intent or negligence on part of petitioner. Demand of tax and penalty under section129(3) was not sustainable [Section 129 of Central Goods and Services Tax Act, 2017/Gujarat Goods and Services Tax Act, 2017][Paras 3, 9 and 10][In favour of assessee]

Reference 3

BI Agro Oils Ltd. vs. State of U.P., [2023] 149 taxmann.com 434 (Allahabad)

- Seizure and penalty order was passed on the ground that documents do not relate to goods intercepted – Petitioner contended that goods were damaged and brought back and thereafter properly packed and supplied through same invoice and e-way bill – HELD: Seizing authority had to establish by evidence that e-way bill was being reused but there was no evidence produced by such authority – Impugned order was to be set aside [Section 129 of Central Goods and Services Tax Act, 2017/Uttar Pradesh Goods and Services Tax Act, 2017][Paras 3, 4 and 5]

Reference 4

Shiv Scrap Sales v. State of U.P., [2023] 146 taxmann.com 397/96 GST 262/70 GSTL 456 (Allahabad)

- Petitioner-dealer alleged mixed scrap was being transported to dealers at different places along with valid tax invoices and e-way bills but goods were seized in transit without assigning any reason – Authority had passed detention order and seized goods in transit for non-existence of purchaser firm and for carrying fake invoice by driver – Notice was issued in name of driver while goods belonged to petitioner – HELD : Since Authority could not prove validity of seizure order, petition was to be disposed by directing petitioner to approach competent officer [Section 129 of Central Goods and Services Tax Act, 2017/Uttar Pradesh Goods and Services TaxAct, 2017] [Paras 6 and 7]

Reference 5

S.R. Sales v. State of U.P., [2023] 147 taxmann.com 543/96 GST 822/71 GSTL 364 (Allahabad)

- Goods were detained on presumption that goods which were claimed to be transported from Karnataka to UP were actually brought from Nagpur into UP. Information that goods were brought from Karnataka into UP and trucks were changed twice was provided for and same was evident from e-way bill. Presumption drawn by authorities could not be accepted without any material on record. Argument put forth was merely based on presumption without any valid material on record. Proceedings were initiated solely on presumption. Impugned orders were to be set aside [Section 129 of Central Goods and Services Tax Act, 2017/Uttar Pradesh Goods and Services Tax Act, 2017] [Para 8]

Reference 6

Karan Singh v. State of West Bengal, [2023] 147 taxmann.com 431/71 GSTL 11/96 GST 596 (Calcutta)[31-01-2023]

- Vehicle carrying goods had clutchplate problem and was sent for servicing – E-way Bill relating to consignment in question was expired in midnight, and goods were detained early next morning on ground of expiry of E-way Bill

HELD: Mere delay of 4:30 hours appeared to be bona fide Fraudulent intent and negligence on part of petitioner was not established – Punishment should commensurate to breach legislative mandate of sub-section (1) of section 126 of Central Goods and Services Tax Act, 2017 – Hence, penalty imposed on petitioner was to be set aside – [Section 129 of Central Goods and Services Tax Act, 2017/Madhya Pradesh Goods and Services Tax Act, 2017] [Paras 21 and 25 to 28]

4.5 Case Study 5

- Goods Imported from US in ship by ABC Ltd. Goods landed at Mundhra Port, Gujarat. Bill of Entry is generated and applicable customs duty is GST is also paid on RCM basis at the time of import itself. Goods cannot be transported in one vehicle due to its quantity.

-

- How to generate E-Way Bill?

- Who will be the consignor of goods in such a scenario?

- Does the party in US have any such liability in such cases?

Reference 1

Robbins Tunnelling and Trenchless Technology (India) (P.) Ltd. v. State of M.P, [2021] 133 taxmann.com 164 (Madhya Pradesh)

The Hon’ble Madhya Pradesh High Court held that where assessee imported goods from USA and its clearing agent, while sending goods from Custom Station to assessee’s place of business, entered erroneous name and address of recipient in e-waybill, tax and penalty levied by lower authorities were to be quashed.

Reference 2

Synergy Fertichem (P.) Ltd. v. State of Gujarat, [2020] 116 taxmann.com 221 (Gujarat)

The Gujarat High Court held that where Competent Authority detained goods of assessee in transit and vehicle on ground that goods were not accompanied by E-Way Bill, said authority was to be directed to release goods forthwith as tax had already been paid on goods at time of import.

Reference 3

The Hon’ble High Court of Kerala in ABCO Trades (P.) Ltd. v. Assistant State Tax Officer

Consignment of goods meant for stock transfer could not be detained under section 129 on basis that e-way bill showed consignee as an unregistered person.

4.6 Case Study 6

- Truck carrying cement from Assam to Kolkata bearing the required documents with E-Way Bill duly generated. E-Way Bill generated on 01-04-2023 and valid till 04-04-2023. On the way when the E-Way Bill is not expired, the vehicle is stopped. The Proper Officer alleges that valuation of goods is not as per the provisions of the Act and thus the goods are liable for detention and payment of applicable penalty. What to do?

Reference 1

The Hon’ble Chattisgarh High Court in K.P. Sugandh Ltd. v. State of Chhattisgarh, [2020] 122 taxmann.com 291/38 GSTL 317 (Chhattisgarh) held as under

Given the said facts and circumstances of the case, this Court is of the opinion that under-valuation of a good in the invoice cannot be a ground for detention of the goods and vehicle for a proceeding to be drawn under section 129 of the Central Goods and Service Tax Act, 2017 read with Rule 138 of the Central Goods and Service Tax Rules, 2017. In view of the aforesaid the impugned order Annexure P/1 i.e. the order passed under section 129 and the order of demand of tax and penalty both being unsustainable deserves to be and is accordingly set-aside/quashed. The respondents are forthwith directed to release the goods belonging to the petitioners based on the invoice bill as well as the e-way bill.

Reference 2

Radha Fragrance vs. Union of India, [2023] 148 taxmann.com 431 (Allahabad)

30 Cartoons each of Pan Masala sent to the two dealers while 60 Cartoons of Tobacco sent to two dealers. Huge amount of Pan Masala and Tobacco transported grossly undervaluing goods, without downloading mandatory E-Way bill – In garb of technicalities, no benefit can be given to dealer who intentionally undervalued his goods to escape from eyes of law – Further one of consignees not in business of trading but doing business as ‘Works Contract and Suppliers of Services’ – Thus action of State Authorities in detaining goods and imposing tax and penalty needs no interference of this Court [Section 130 of Central Goods and Services Tax Act, 2017/Uttar Pradesh Goods and Services Tax Act, 2017][Paras 17, 22, 25 and 26][In favour of revenue]

Reference 3

In Bajrang Enterprise Versus State Of Gujarat

Gujarat High Court it was held that undervaluation cannot be a ground for the seizure of the goods in transit by inspecting authorities if otherwise all other aspects are in order.

Reference 4

Alfa Group v. Asstt. State Tax Officer – [2020] 113 taxmann.com 222 (Kerala)

There is no provision under the GST Act which mandates that the goods shall not be sold at prices below the MRP declared thereon. In my view when the statutory scheme of the GST Act is such as to facilitate a free movement of goods, after self assessment by the assessees concerned, the respondents cannot resort to an arbitrary and statutorily unwarranted detention of goods in the course of transportation. Such action on the part of department officers can erode public confidence in the system of tax administration in our country and, as a consequence, the country’s economy itself.

5. No Intent to Evade and Events beyond control of taxpayer

Reference 1

In Assistant Commissioner (ST) v. Satyam Shivam Papers (P.) Ltd., [2022] 134 taxmann.com 241/57 GSTL 97/90 GST 479 (SC), The Apex Court held as under:

Goods were kept in house of a relative for 16 days by officer and not in designated place for safe keeping. High Court set aside order levying tax and penalty and imposed costs of Rs. 10,000 on concerned officer. It was held by the Hon’ble Apex Court that inference by officer that petitioner was attempting to evade tax was baseless. Intent in keeping goods in private place was questionable. High Court meticulously and correctly examined and found that there was no fault or intent to evade tax. Goods in question could not be taken to destination within time for reasons beyond control of respondent-taxpayer on account of traffic blockage due to agitation. State alone remains responsible for not providing smooth passage of traffic. No question of law relating to operation and effect of section 129 was involved in instant case. Considering department’s conduct and harassment faced by taxpayer, costs of Rs. 59,000 was imposed in addition to costs of Rs. 10,000 imposed by High Court [Section 129 of Central Goods and Services Tax Act,2017/Telangana Goods and Services Tax Act, 2017] [Paras 8 and 9]

Reference 2

Varun Beverages Ltd. v. State of U.P., [2023] 147 taxmann.com 341/71 GSTL 4/96 GST 587 (Allahabad)

Wrong vehicle number mentioned in e-way bill was to be considered as human error and same was covered under C.B.I.C. Circular Nos. 41/15/2018-GST dated 13-4-2018 and 49/23/2018-GST dated 21-6- 2018 – In instant case, there was Stock transfer which was not disputed. No evidence was placed by department to prove that there was any intention on part of dealer to evade tax. Further, discrepancy in description of vehicle in e-way bill was minor. Orders for detention and penalty were to be set aside [Section 129 of Central Goods and Services Tax Act,2017/Uttar Pradesh Goods and Services Tax Act, 2017] [Paras 7, 8, 9 and 10]

Reference 3

Orson Holdings Company Ltd. v. Union of India [2023] 147 taxmann.com 71/71 GSTL 144/97 GST 161 (Gujarat)

E-way bill expired 48 hours prior to detention of goods. Petitioner company situated at Howrah, West Bengal and place of delivery was a distant place being Jamnagar, Gujarat – No ill-intent on part of petitioner to use expired e-Way bill was established. Impugned order was to be quashed. Penalty recovered from petitioner was to be refunded along with interest [Section 129 of Central Goods and Services Tax Act, 2017] [Paras 7, 9 and 11] [In favour of assessee]

Reference 4

Rumki Biswas. v. Senior Joint Commissioner, Commercial Taxes [2023] 148 taxmann.com 359 (Cal.)

Part A of e-way bill was generated on 22-3-2022 and part B was generated on 24-3-2022 – However, part A of e-way bill dated 22-3-2022 was cancelled, since goods were not loaded into vehicle and new part A of e-way bill was generated – At time of interception, driver was found to be carrying part B of e-way bill in respect of which part A was cancelled – Prima facie, this could be considered to be a bona fide error and would not tantamount to intention to evade payment of duty or with a view to clandestinely move certain goods – However, appellate authority was required to establish bona fides of appellant and to prove that there was no wilful intention to evade payment of duty barring imposition of penalty – Appellate authority having not adequately dealt with this aspect, matter was to be remanded to appellate authority

6. Order Not Issued Within Specified Time Limit

Reference 1

Deepam Roadways v. Dy. State Tax Officer [2023] 147 taxmann.com 35/70 GSTL 337/96 GST 360 (Madras)

Orders on detention and demand of penalty were not sustainable when same was not passed within seven days from date of issuance of notice; goods and conveyance were to be released. Department had issued notice within seven days from date of detention of goods and conveyance but had failed to pass an order within seven days from date of issuing such notice. Department was to be directed to release both goods and conveyance – Impugned orders were to be quashed [Section 129 of Central Goods and Services Tax Act, 2017/Tamil Nadu Goods and Services Tax Act, 2017] [Paras 5 and 7] [In favour of assessee]

7. Address Wrongly Mentioned

Reference 1

M.R Traders v. Asstt. State Tax Officer [2020] 116 taxmann.com 37/80 GST 287 (Kerala)

Competent Authority detained goods of assessee in transit from head office to branch office as well as vehicle on ground that address shown in invoice was different from address shown in E- way Bill – He further issued on assessee a notice under section 129(3) specifying amount of tax and penalty payable for release of goods and vehicle – Assessee filed writ petition seeking relief in this regard – Whether Competent Authority was to be directed to release goods and vehicle on assessee furnishing bank guarantee for amount shown in notice – Held, yes [Para 3][In favour of assessee]

8. Natural Justice and Minor Invoice Issue

Reference 1

Premium Traders v. State of U.P. [2022] 143 taxmann.com 149/94 GST 945/64 GSTL 436 (Allahabad)

GSTIN number was not clearly printed over invoice due to less ink in cartridge and when goods were intercepted, clear copy of invoice, on which GSTIN number was clearly printed, was provided to revenue. Undisputedly, invoice accompanied with goods in question were issued by petitioner-trader. Revenue committed manifest error of law by not affording opportunity of hearing to petitioner despite persuasion made by them. Thus, impugned detention order was passed by revenue in breach of principles of natural justice and same was to be set aside [Section 129 of Central Goods and Services Tax Act, 2017/Uttar Pradesh Goods and Services TaxAct, 2017] [Paras 3 and 5] [In favour of assessee]

9. Part B Not Updated Timely

Reference 1

Suraj Hitech (P.) Ltd. v. Asstt. State Tax Officer, Kochi, [2021] 123 taxmann.com 320 (Kerala)

Competent Authority by an order dated 18-11-2020 passed under section 129 detained goods of assessee under transport on ground that Part B of e-way bill was not updated or generated at time of inspection of goods on 6-11-2020. Whether as it was evident from record that e-way bill had already been updated on 8-11-2020 by filing Part B thereof and defects did not exist on date of passing of order of detention, i.e., on 18-11-2020, detention could not be said to be justified for purpose of section 129 – Held, yes.Whether impugned order dated 18-11-2020 deserved to be quashed – Held, yes. Whether Competent Authority was to be directed to release detained goods – Held, yes [Para 2]

10. In Job Work Value in Inward Journey is Less Than While Sending

Reference 1

P.H. Muhammad Kunju and Brothers v. Asstt. State Tax Officer, Palakkad [2021] 124

taxmann.com 299/45 GSTL 123 (Kerala)

Assessee sent 15490 kgs MS plates from its business premises located in Ernakulam to job worker’s premises located in Salem for purpose of job work – Competent Authority detained aforesaid MS plates during return journey from job worker’s premises to assessee’s premises for reason that value shown in e-way bill that accompanied MS plates on its return journey was only Rs. 3,469; whereas consignment of MS plates that was sent for job work was valued at Rs. 8.27 lacs – Whether value shown in e-way bill on return journey had to correspond with value shown in invoice raised by job worker – Held, yes – Whether as rate of Rs. 3,469 shown in both e-way bill and invoice raised by job worker was actual consideration paid to job worker for job work done on goods sent to him by assessee and further in e-way bill as also job work invoice quantity of goods was correctly shown as 15490 kgs and description of goods was also shown as MS plates, detention of MS plates in question was wholly unjustified – Held, yes – Whether Competent Authority was to be directed to release MS plates to assessee – Held, yes [Para 3]

11. GSTR-1 and GSTR-3B Not Filed

Reference 1

- In Relcon Foundations (P.) Ltd. v. Asstt. State Tax Officer – [2019] 112 taxmann.com 255/31 GSTL 397 (Kerala) it was held that non-filing of GSTR-3B and GSTR-1 cannot be a ground for detention under Section 129. It was also held that non-filing could not be ground for confiscation of goods u/s. 130.

12. Judgements Against the Assessee

Reference 1

Ashok and Sons (HUF) v. Jt. Commissioner, State Tax [2023] 147 taxmann.com 582/97 GST 19/72 GSTL 15 (Calcutta)

Vehicle suffered from breakdown and it was detained on ground that e-way bill expired – Authority demanded tax and imposed penalty -Petitioner contended that there was no intention to evade tax as same was paid and tax authority in originating State had no jurisdiction when goods were meant for inter-State supply – Department argued that petitioner’s consignment was found lying within territory of originating State when e-waybill had expired and they did not extend e-way bill and driver did not produce document to prove vehicle had mechanical defect – HELD: Authority was lawfully permitted to impose penalty under section129 as well as demand tax as goods were found to be detained in territory of State – Petition dismissed[Section 129 of Central Goods and Services Tax Act, 2017/West Bengal Goods and Services Tax Act, 2017].

Reference 2: Apprehension whether vehicle could cross toll within short time

New Royal Ferrous and Non-Ferrous Trading Corporation v. Dy. State Tax Officer, [2023] 148 taxmann.com 245/97 GST 487 (Madras)

E-way bill was generated at 9:56 p.m. on 3-12-2022 at Tiruvannamalai but movement of vehicle was noticed on same day at 10:56 p.m. at Thoppur Toll – Question arose as to whether vehicle could have crossed Thoppur Toll within one hour of declaration of e-way bill – On writ, HELD: Determination of question raised are all matters turning on facts – Hence, High Court would not interfere with impugned notice – Petitioner should respond to notice and respondent would consider same after affording opportunity to petitioner

Reference 3: Part-B not updated

Sterile India (P.) Ltd. v. Union of India, [2023] 149 taxmann.com 5/97 GST 605 (Punjab & Haryana)

E-way bills along with tax invoices and delivery challans were produced by driver – However, Part-B of E-Way bill was not entered – Authorities not required to establish intention to evade payment of tax for detaining goods under section 129 of CGST/SGST Act,2017 – Goods being intercepted during transit and documents accompanying goods being not incompliance with provisions of GST Act, authorities were within their power to detain goods and demand payment of tax and 100 per cent penalty thereunder – Payment under section 129(3) having been made, proceedings in respect to notice deemed to have been concluded.

Reference 4: Description wrongly given

Shrimali Industries (P.) Ltd. v. State of Rajasthan, [2022] 143 taxmann.com 438/[2023] 69 GSTL 47 (Rajasthan)

Goods and vehicle were detained for misdeclaration of goods as description of goods given in document was different from goods transported – Writ petition had been filed to quash order detaining goods and conveyance and show cause notice issued – HELD: Goods were shown as aluminium scrap in documents while goods transported were brand new aluminium sections – Petitioner tried to evade payment of tax as tax rate of goods in transit was higher than tax rate of goods mentioned in documents – Detention of such mis-declared goods by department was correct – Writ jurisdiction could not be invoked for quashing show cause notice – Appeal could be preferred by petitioner under section 107 – Writ petition was not maintainable and same was to be dismissed

Reference 5: No Movement in Toll Booths

Sonali Metal Industries LLP v. State Tax Officer (Intelligence), [2022] 143 taxmann.com 297/94 GST 947 (Madras)

Officer called information from toll booths from Assam to point of destination i.e., Coimbatore to test claim of petitioner that goods originated from Guwahati – Toll booths enroute between Guwahati and Telangana did not indicate any movement of vehicle in question in that sector and records of movement were available only from Telangana onwards – This led to suspicion that point of origination of goods is Telangana and not Guwahati as claimed and, hence, notice was issued proposing penalty – HELD: Petitioner could very well have produced toll receipts or any other information/material in its possession to disprove suspicion – Consideration of such information, if at all, would involve an examination of disputed facts – Hence, writ petition was to be dismissed as petitioner had an efficacious, alternate remedy provided to approach Appellate Authority

Reference 6: Original Invoice Not Produced

Shameer Chinganam Poyil vs. Assistant State Tax Officer, [2020] 114 taxmann.com 475 (Kerala) [12-11-2019]

Competent Authority detained goods of assessee under transport as well as vehicle on ground that original invoice was not produced by driver of vehicle – Assessee filed writ petition contending that original of invoice was shown to check post authorities in electronic format, therefore, there was no justification for detention – Revenue, on other hand submitted, that in terms of rule 138A, invoice had necessarily to be produced in documentary format and in instant case invoice was not produced – Whether absence of an invoice could be a valid ground for detention under section 129- Held, yes – Whether detention of goods under transport was justified – Held, yes – Whether Competent Authority was to be directed to release goods on assessee furnishing bank guarantee for tax and penalty amount determined in detention order – Held, yes

Reference 7: Invoice not serially numbered

Devices Distributors v. Assistant State Tax Officer, [2020] 118 taxmann.com 136 (Kerala)

Assessee was a distributor of home appliances of various brands – In course of transportation of goods, revenue officers found that tax invoices did not bear continuous invoice numbers and, thus, they suspected that invoices bearing serial numbers that fell between numbers on invoices produced at time of transportation, could have been used for transportation of other goods that had not been brought to notice of Department – Accordingly, detaining authority passed a detention order in respect of goods in question – Whether, entertainment of doubt by authority could not be a justification for detaining goods in question, especially when they were admittedly accompanied with tax invoices and E-Way Bills as required by rule 46 of 2017 Rules – Held, yes – Whether even otherwise, doubt entertained by respondents were in respect of goods that might have been transported under cover of invoices that numerically fell between numbers shown in invoices in question, pertained to goods other than those that were actually detained, impugned detention could not be regarded justified under section 129 – Held, yes – Whether, therefore, respondents were to be directed to release goods detained by them – Held, yes

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA