[Practical Case Study] Taxation of Undisclosed Income – Key Provisions Under Sections 68 to 69D

- Blog|Income Tax|

- 12 Min Read

- By Taxmann

- |

- Last Updated on 24 October, 2024

The taxation of undisclosed income under Section 68 of the Income-tax Act, 1961, applies when an assessee offers no or unsatisfactory explanation regarding any sum found credited in their books of account. If the source or nature of the credited amount is not satisfactorily explained, the sum is treated as income and added to the assessee’s taxable income. Section 68 is designed to address unexplained cash credits, ensuring that any unaccounted money or funds are properly taxed, preventing misuse of the financial system for concealing income.

Table of Content

- Legislative Scheme for Taxation of Undisclosed Income

- How to Handle Taxability of Share Capital Receipts as Unexplained Cash Credits u/s 68?

- Case Study on Addition of Share Capital Money/Premium Receipts as Unexplained Cash Credit u/s 68

Checkout Taxmann's Faceless Assessment Appeals & Penalty Ready Reckoner with Practical Guide to Handling Income Tax Notices which provides a comprehensive guide to the faceless taxation regime under the Income-tax Act, 1961, featuring in-depth coverage of faceless assessments, appeals, and penalties. It includes practical guides, real-time case studies, and illustrative tools like infographics and tables to simplify complex processes. The key features include detailed instructions on handling notices, personal hearings via video conferencing, overcoming technical challenges, and a comparative analysis of traditional versus faceless procedures.

1. Legislative Scheme for Taxation of Undisclosed Income

Sections 68 to 69D of the Income-tax Act, 1961 (‘the Act’) deal with additions to total income in respect of undisclosed income (other than undisclosed foreign income and undisclosed foreign assets). For ready reference and comparative analysis, the legislative provisions of these sections are tabulated below for a birds’ eye view of the legislative scheme for taxation of undisclosed income.

| S. No. | Particulars | Section 68 | Section 69 | Section 69A | Section 69B | Section 69C |

| 1. | Applicability | Assessee offers no/unsatisfactory explanation about the nature and source of any sum found credited in books of account maintained by the assessee. | Assessee offers no/unsatisfactory explanation about the nature and source of investments made, which are not recorded in the books of account, if any, maintained by the assessee. | Assessee offers no/unsatisfactory explanation about the nature and source of acquisition of money, bullion, Jewellery or other valuable article or thing, for which he is found to be the owner, and which is not recorded in books of account, if any, maintained by the assessee | Assessee offers no/unsatisfactory explanation about the excess amount expended by the assessee on making investments or acquiring ownership of any money, bullion, Jewellery or any other valuable article than recorded by him in the books of account maintained by the assessee | Assessee offers no/unsatisfactory explanation about the source of any expenditure, or part thereof, incurred by the assessee |

| 2. | Requirement of Maintenance of Books of Account | Mandatory | Not mandatory, as the expression, if any, is used | Not mandatory, as the expression, if any, is used | Mandatory | Not mandatory |

| 3. | Year of Applicability | In the financial year when the subject matter ‘sum’ is Credited in the Books of Account | In the financial year in which such investments are made by the assessee | In the financial year in which such money, bullion, Jewellery, or any other valuable article is acquired | In the financial year in which such excess expenditure is incurred in making investments or acquiring such money, bullion, Jewellery, or any other valuable article, than recorded in the Books of Account | In the financial year in which such expenditure is incurred |

| 4. | Burden of Proof | On the assessee, as credit is in his books of account | The condition precedent i.e., making of investments by the assessee has to be established by the AO | The condition precedent i.e., acquisition of unrecorded money, bullion, Jewellery or other valuable article by the assessee has to be established by the AO | The condition precedent i.e., excess of expenditure by the assessee has to be established by the AO | The condition precedent i.e., incurring of the unrecorded expenditure has to be established by the AO |

2. How to Handle Taxability of Share Capital Receipts as Unexplained Cash Credits u/s 68?

All businesses need capital infusion to get started, develop and grow. The receipt of share capital money is a capital receipt and not a revenue receipt, and as such is outside the purview of taxability, in general. However, in the Income-tax Act, there is one special section 68, which contains the enabling legislative provisions for the taxability of mala fide or unexplained share capital money receipts, wherein the taxpayer’s own unaccounted money is routed back in its books of account, disguised as share capital money receipts. The need and justifiability of curbing such malpractices can’t be undermined in any manner. However, at the same time, a bona fide share capital money receipt, can’t be considered as unexplained cash credit u/s 68 of the Act.

The receipt of share capital money/share premium money is one of the most common selection criteria of scrutiny consideration under CASS and as such the assessees in receipt of such share capital/share premium money, in any particular assessment year, are bound to get scrutiny notices and requisitions.

2.1 Establishment of Identity, Creditworthiness & Genuineness

On receipt of such scrutiny notice, the assessee is required to explain the nature and source of receipts of such share capital/share premium money and to establish the identity, and creditworthiness of the investor entities and genuineness of such receipts in order to discharge its statutory onus under section 68 of the Income-tax Act.

Identity: In order to establish the Identity of the Investor Entity, the under-mentioned records and documents should be submitted and placed on record before the AO:

- Copy of PAN Card of the Investor Entity;

- DocumentaryEvidence of Address of the Investor Entity;

- Master Data Sheet downloaded from the official site of MCA, showing the active status and reflecting CIN No. and all other particulars of the investor entity.

- Copy of Memorandum of Association & Articles of Association of Investor Entity.

- Copy of GSTIN Certificate, if any.

Genuineness: In order to establish the Genuineness of the Receipts of Share Capital/Share Premium money by the assessee company from the Investor Entity, the under-mentioned records and documents should be submitted before the AO:

- Copy of Confirmation from theInvestor Entity;

- Copies of Share Certificates;

- Certified Copy of Board Resolution of the assessee company, duly authorizing the subscription in the share capital by the investor entity;

- Copy of Allotment Letter;

- Copy of PAS 3 Return filed with ROC, duly evidencing the allotment of shares to the investor entity;

- Copiesof Share Valuation Report under section 56(2)(viib) read with Rule 11UA(2)(a) of Income Tax Rules;

- Copy of the Bank Statement of the investor entity duly reflecting the investment in share capital of the assessee company;

- Copy of Audited Balance Sheet of the investor entity, duly reflecting the investment in the share capital of the appellant company.

Creditworthiness: In order to establish the Creditworthiness of the Investor Entity, the under-mentioned records and documents should be furnished before the AO

- Copy of the Bank Statement of the investor entity duly evidencing the availability of sufficient funds at the time of making investments in the share capital of assessee company;

- Copy of Audited Balance Sheet of the investor entity, duly evidencing the availability of sufficient funds in the form of share capital, reserves, and surplus, net worth and borrowings, for making investment in the share capital of the assessee company;

- Copy of ITR of the investor entity.

2.1.1RecentCase Law on Taxability of Share Capital Money

Case Name: PCIT Agson Global (P.) Ltd.

Case Citation: [2022] 134 taxmann.com 256 (Delhi)

Forum: Delhi High Court

Head Note: Section 68 of the Income-tax Act, 1961 – Cash credits (Share capital money) – Assessment years 2012-13 to 2017-18 – Assessee-company received share capital and share premium money from several investors – Assessing Officer made addition in respect of same on account of unaccounted income under section 68 on basis of recorded statement of managing director of assessee-company – Whether since assessee placed sufficient documentary evidence to establish that money which assessee had paid to investors was routed back to it in form of share capital/share premium and identity, creditworthiness and genuineness of investors was proved, there was no justification to make addition under section 68 – Held, yes [Paras 11.4, 11.5 and 14.4] [In favour of assessee]

2.2 Discharge of statutory onus of establishing source of source as per proviso to section 68

The Finance Act, 2012 has inserted the first proviso to section 68 w.e.f. 1.4.2013, to mandate the establishment of source of share application money, share capital money or the share premium money, in order to discharge the burden of establishing the identity and creditworthiness of such share subscribers and genuineness of such receipts of share application/share capital/share premium receipts, as has been explained in detail, in the case study, discussed above, in paragraph No. 6.1.

However, the onus of establishing the source of source in cases of receipts of unsecured loans and borrowings, was still not specifically stipulated in section 68, and as such in numerous judgments of the hon’ble High Courts, including the hon’ble Delhi High Court judgments in the cases of ‘CIT v. Shiv Dhooti Pearls & Investments v. CIT [2015] 64 taxmann.com 329 (Delhi); CIT v. Vrindavan Farms in ITA No. 71/2015; CIT v. Value Capital Services Ltd. [2008] 307 ITR 334 (Delhi), it was held that in case of unsecured loans and borrowings, the establishment of the source of source was not required

Thus, with a view to overcome and nullify such numerous judgments, the Finance Act, 2022 has added a second proviso to section 68, so as to provide that the nature and source of any sum, whether in the form of loan or borrowing, or any other liability credited in the books of an assessee shall be treated as explained only if the source of funds is also explained in the hands of the creditor or entry provider. However, this additional onus of proof of satisfactorily explaining the source in the hands of the creditor, would not apply if the creditor is a well-regulated entity, i.e., it is a Venture Capital Fund, Venture Capital Company registered with SEBI.

This amendment has taken effect from 1st April, 2023 and accordingly applies in relation to the assessment year 2023-24 and subsequent assessment years.

Thus, it has now become mandatory to explain the source of the source in the cases of unsecured loans and borrowings also, in order to establish the identity, creditworthiness and genuineness parameters under section 68 of the Income-tax Act.

In order to discharge the above statutory onus of the two provisos to section 68, the investor party or the lender should be requested to provide confirmations duly confirming the fact of subscription in the share capital of the assessee or the advancement of loan, as the case may be and they should also fully explain the nature and source of making investment in the share capital of the assessee or the unsecured loan as the case may be. The investor or the lender should also be requested to furnish their bank statement duly reflecting the source of their investment or the unsecured loan, and copies of audited financial ledgers, balance sheets and ITR, to be placed before the AO. The Ld. AO should be asked to send notice under section 133(6) of the Act, for independent confirmation, to the investor entity, in case the assessee finds it difficult to obtain such records and documents directly.

2.3 Key takeaways from significant judicial pronouncements on taxability of share capital receipts as unexplained cash credit u/s 68

A. Can addiction u/s 68 be made on the presumption by the AO that since the assessee has received share capital money at a premium, so the same has to be his unaccounted money routed back in his books of account?

The hon’ble Delhi High Court in its judgment in the case of MOD Creations (P) Ltd. v. ITO [354 ITR 282 (Del)], has addressed this important question very aptly and has held that,

“A mere bald assertion by the A.O. that the credits were a circular route adopted by the appellant company to plough back its own undisclosed income into its accounts, can be of no avail. The AO was required to prove this allegation. An allegation by itself which is based on assumption will not pass muster in law. The revenue authorities would be required to bridge the gap between the suspicions and proof in order to bring home this allegation”.

The addition made solely on the basis of surmises and conjectures and not on any corroborative and supporting material evidence are liable to be quashed.

- Uma Charan Shaw & Co. v. CIT 37 ITR 271 (SC)

- Omar Salay Mohammad Sait v. CIT 37 ITR 151 (SC)

- Dhirajlal Girdharilal v. CIT, Bombay 26 ITR 736 (SC)

- Lal Chand Bhagat Ambica Ram v. CIT 37 ITR 288 (SC)

- CIT v. Calcutta Discount Company Ltd. 91 ITR 8 (SC)

B. Can addition u/s 68 be made by the AO just on the basis of low returned incomes of the investors?

JCIT v. M/s Shalimar Housing & Finance Ltd. ITA No. 4079/Mum/2019

“17. The grievance of the assessing officer is that these companies do not have substantial income and hence are not capable of giving loans. He has also expressed doubt about the position of reserves and fund position without brining on record any cogent material from any further enquiry made by bench. We find that the funds position of the companies as noted by the ld. CIT(A) is quite capable of granting loans. The adverse inference drawn from the financial statement of lending companies is only a surmise by the assessing officer without making any enquiry. In this regard, we note that the honourable jurisdictional High Court in the case of Pr. CIT v. Veedhata Tower Pvt. Ltd., order dated 21.04.2018 has held that when all the necessary details of the fund provider was available with the assessing officer, he was free to make the necessary enquiry and addition under section 68 in the hands of the recipient were unjustified. Furthermore, assessee has also paid interest to the lenders. It has also deducted tax at source. Loan have been duly repaid, some part has been repaid even in the present assessment year. In these circumstances, in our considered opinion assessee has discharged the onus. The assessing officer has not brought on record any cogent material to make the addition as unproved cash credit. Hence, the addition made by the assessing officer is not sustainable.”

C. Candirectors’ or any third-party statements alone can be formed the basis of making additions u/s 68?

It is a well-settled legal proposition that the statements recorded during survey proceedings u/s 133A and or search u/s 132(4) have no evidentiary value alone in the absence of any corroborative evidence substantiating the same & as such, the additions made solely on the basis of such statements are non-sustainable in the eyes of the law.

- Pullangode Rubber Produce Ltd. v. State of Kerala 91 ITR 18 (Supreme Court)

- Dismissal of Revenue’s SLP by the Hon’ble Supreme Court in the case of CIT S. Khader Khan Son 254 CTR 228 (SC);

- CIT S. Khader Khan Son reported in (2008) 300 ITR 157 (Madras High Court);

- Avinash Kumar Setia DCIT Central Circle 17, New Delhi in I.T.A. No. 1787/DEL/2014 dt. 28.4.2016 (ITAT Delhi);

- MaheshOhri v. ACIT in [2013] 35 taxmann.com 301 (Delhi-Trib) IT Appeal No. 4109/Del/09 Dt. 8.3.2013 (ITAT Delhi);

- TDI Marketing (P) Ltd ACIT (2008) 28 SOT 215 (Delhi High Court)

- CBDT Instruction No. 286/2/2003 IT(Inv.) dt. 10.3.2003

D. Can addition u/s 68 be made on the sole basis of issue of shares at a high premium?

The Hon’ble Delhi High Court, dt. 16.4.2015, in the case of: CIT (Central) III (Appellant) v. Anshika Consultants Pvt Ltd in ITA No. 467/2014 (Respondent No. 1); Flex International Pvt. Ltd. in ITA No. 470/2014 (Respondent No. 2); Apporva Extrusion Pvt. Ltd. in ITA No. 518/2014 (Respondent No. 3); Anshika Investment Pvt. Ltd. in ITA No. 523/2014 (Respondent No. 4); A.R. Leasing Pvt. Ltd. in ITA No. 524/2014 (Respondent No. 5), has held that:

“Section 68 of the Act, doesn’t in any way, restricts or prohibits, the issue of shares at a premium. The main crux of the addition u/s 68 of the Act rests upon the fact that whether the credits are satisfactorily explained or they remained unexplained. Therefore, in the context of section 68, for any seized document or material to be considered as an incriminating document/material, it is an essential & necessary condition that the said seized document/material must unhide the fact of routing back of the unaccounted money of the appellant company in its own books of account. The mere fact of issue of shares at a certain premium by the appellant company to the respective investor companies have no relevance or bearing, whatsoever, in the context of addition u/s 68 of the Act.”

3. Case Study on Addition of Share Capital Money/Premium Receipts as Unexplained Cash Credit u/s 68

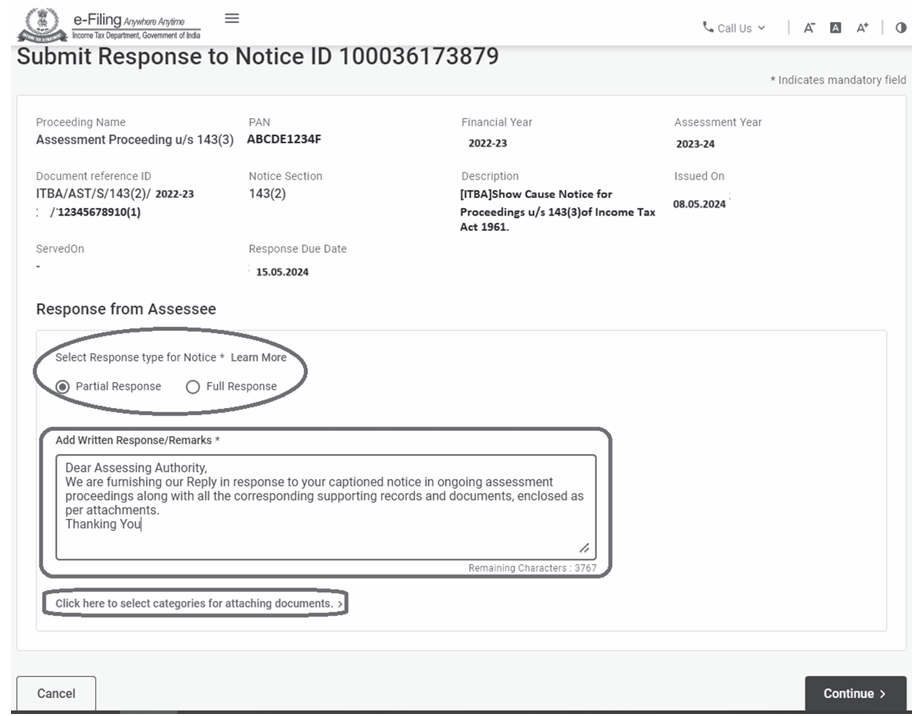

In this Case Study, the assessee is in receipt of a Show Cause Notice proposing a variation in the returned income on account of considering the receipts of share capital and share premium as unexplained cash credits in the hands of the assessee u/s 68 of the Act. The valuation of share premium receipts has also been challenged u/s 56(2)(viib) of the Act

Suggested Submission: The suggested assessment submission incorporating all the relevant and updated legal precedents, in order to represent and tackle this commonly recurring issue in an effective and efficient way, is being shared for the benefit and ready reference of Readers.

S M MOHANKA & ASSOCIATES

Dated: May 15, 2024

To

The Assessing Authority

National Faceless Assessment Centre New Delhi

Subject: Reply in Response to Show Cause Notice in Respect of Ongoing Faceless Assessment Proceedings for AY 2023-24.

Reference: Your Show Cause Notice dated 08.05.2024 Dear Assessing Authority,

This is in reference to the captioned Show Cause Notice, in respect of ongoing faceless assessment proceedings for AY 2023-24, requiring the assessee company to show cause as to why the variation to the returned income of the assessee company, in the form of addition of its receipts of share capital and share premium u/s 68 read with section 56(2)(viib) of the Act, should not be done.

In the captioned show cause notice, the assessee company has been required to show cause as to why the receipts of share capital and share premium money from the investor company M/s PQR Pvt Ltd. should not be considered as unexplained cash credits under section 68 of the Income-tax Act.

In this regard, in continuation with our earlier furnished written submissions along with all the corresponding supporting records and documents, we further submit as under:

During the FY 2022-23, presently under consideration, the assessee company has received share capital money of ` 50 lakhs and share premium money of ` 150 lakhs from the investor entity M/s PQR Pvt Ltd. towards subscription of its 5,00,000 equity shares of face value of ` 10 each at a premium of ` 30 each.

Establishment of Identity, Creditworthiness & Genuineness Parameters in relation to the receipt of Share Capital/Share Premium money by the assessee company:

The complete details of the Share Capital Money and the Share Premium Amount received by the assessee company during the FY 2022-23, presently under consideration, is being tabulated as under:

| Name of Investor Entity | No. of Shares | Share Capital Money | Share Premium Amount | Total | PAN of Inves- tor Entity | Address of Investor Entity |

| PQR Pvt Ltd | 5,00,000 | 50,00,000 | 1,50,00,000 | 2,00,00,000 | AAACB5678Z | Y-123, DEF Nagar, New Delhi 1100XX |

Identity: In order to establish the Identity of the Investor Entity, the under-mentioned records and documents are being enclosed as per attachments and are being placed on record:

- Copy of PAN Card of the Investor Entity;

- DocumentaryEvidence of Address of the Investor Entity;

- Master Data Sheet downloaded from the official site of MCA, showing the active status and reflecting CIN No. and all other particulars of the investor entity.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

CA | CS | CMA

CA | CS | CMA