[Opinion] Various Important Reconciliations under GST Annual Returns – GST Audit Series

- Blog|News|GST & Customs|

- 2 Min Read

- By Taxmann

- |

- Last Updated on 2 January, 2023

[2022] 145 taxmann.com 626 (Article)

Introduction

In any accounting system, there is a need to see that all transactions are accounted completely, accurately and in a timely manner. Under GST, the need to capture the transactions which constitute a “supply” and exclude those which are not supply, is an added requirement. The eligibility of ITC is subject to prescribed conditions. There is a need to pay GST under reverse charge mechanism and then claim the ITC. Compliances like these would require a mandatory reconciliation exercise. The reconciliation statements would be useful for finalisation of books of account, filing of GSTR-9 and GSTR-9C. Various benefits for the auditee by having the reconciliation statements are as follows:

(a) Identification of the excess or short payment of taxes

(b) Identification of missed out or duplicated credits

(c) Identification of wrong type of credits claimed such as CGST/ SGST claimed as IGST or vice versa

(d) Identification of expenses on which GST under RCM not paid or excess paid

(e) Ensuring satisfaction of condition of suppliers compliance to claim input tax credit.

(f) Increase in confidence of the department and statutory auditors with good systems such reconciliation

(g) Facilitates smooth filing of GST annual return and self-certification

(h) Ensures that export benefits are not missed out.

The above are only indicative benefits. There are many more. With the advent of technology, it is possible for the auditee to prepare the reconciliation much faster and with more efficiency involving lesser time. Few reconciliation statements which would be useful for regular GST compliance and filing of Form 9 & 9C are discussed hereunder:

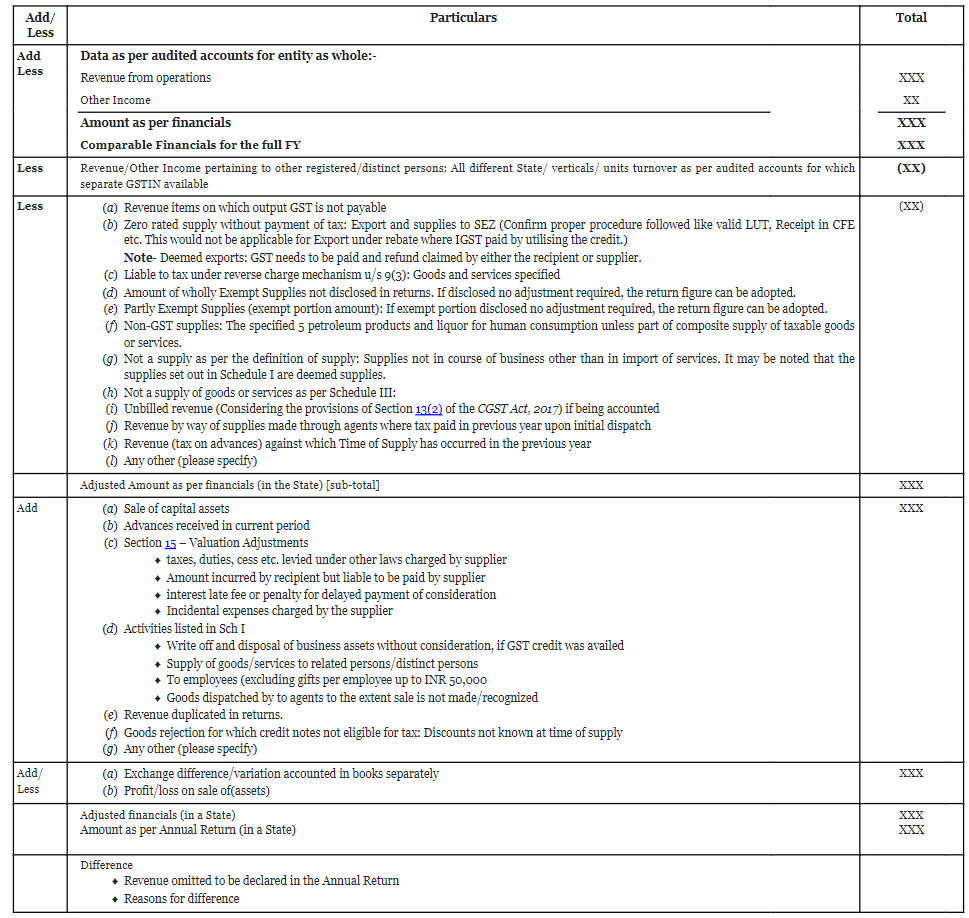

Reconciliation of supply (after considering the returns) on which output tax is payable

In this outwards supply (simple) reconciliation, the interpretation of few aspects required for arriving at the due taxes have not been considered. Some of them are enumerated hereunder:

- Incorrect exemption or incorrect classification leading to no GST payment.

- Incorrect rate adopted leading to short/excess payment of taxes.

- Application of concept of composite, non-composite, or mixed supply

- Whether the IGST or CGST and SGST should have been charged?

- The need to apply the proper valuation under Section 15.

Click Here To Read The Full Article

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA