[Opinion] Tax turmoil on Social Welfare Fund and its aftermath!

- News|Blog|Income Tax|

- 3 Min Read

- By Taxmann

- |

- Last Updated on 5 January, 2023

CA Simarjot Singh & CA Shubham Bansal – [2022] 145 taxmann.com 636 (Article)

We have noticed that some employers deduct the contribution of employees towards Provident funds, superannuation funds, and other social security funds but do not deposit these contributions within the specified time. For the employees, this means a loss of interest or income. In cases where an employer later becomes financially unviable, non-deposit results in a permanent loss for the employees. In order to ensure that employees’ contributions are deposited on time, I reiterate that the late deposit of employee’s contribution by the employer will not be allowed as deduction to the employer.

Speech of Nirmala Sitharaman

Minister of Finance

February 01, 2021

1. Backdrop to social welfare funds & its treatment under Income tax

With the intention to provide financial stability and social security to the employees, various welfare fund schemes have been introduced by the Government of India from time to time. Many such schemes casts responsibility on the employers to deposit the contribution into the fund in a fiduciary capacity. In the said contribution, employers are required to make a part payment out of their own pocket and balance to collect from the employees to deposit in the said fund. To ensure that the employers pay the contribution received from the employees into the fund in timely manner, the provisions of the Income tax Act, 1961 (‘the Act’) were amended w.e.f. April 01, 1988 to provide that such contribution is a deemed income of the employer and if the same is not paid within the timelines prescribed under the Act, then employer shall be liable to pay tax on such income. As a consequence, the employers shall firstly pay tax on the deemed income and then statutorily also required to deposit such contribution to the fund under the respective statutes. However, if the contribution is made on timely manner then the deduction of such employees contribution is allowed against the deemed income to the employers.

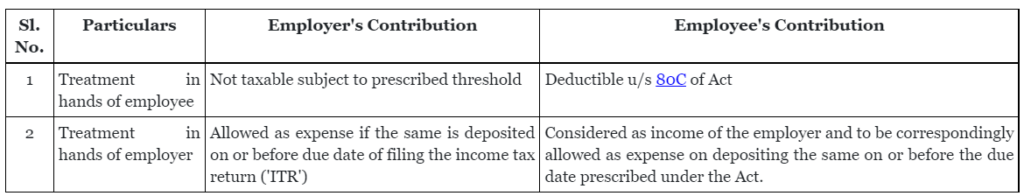

We have briefly captured below the treatment of the employer’s contribution and employee’s contribution to the provident fund, for ease of understanding as follows:-

The judiciary in the past had occasion to adjudicate in various cases that if the contribution received from the employee is deposited in the fund before the due date of filing ITR by the employer then no tax needs to be paid by the employer on the funds collected. However, government of India had expressed its concern vide Finance Bill, 2021, in providing the leeway to the employers to deposit the contribution by the due date of filing ITR as against the due date provided under the respective statues.

To overcome the mismatch of the principles highlighted in the judicial precedents and the concern of the government, the Finance Act, 2021 has amended the provisions of the Act to clarify that the provision of section 43B does not apply and deemed to never have been applied for the purposes of determining the due date of employees contribution. Accordingly, if the employee contribution is not deposited by the due date prescribed under the specified statutes then the employer needs to pay tax on such contribution under the Act. The said amendments were made effective from AY 2021-22 by the Finance Bill,2021.

It is worth noting that finance bill, 2021 has declared that the amendment shall be effective from April 01, 2021. However, the provisions of the Act had clarified that the amendment is brought in to “remove the doubts” and such amendment is “clarificatory in nature”. This has led to the controversy on the amendment being prospective or retrospective in nature.

2. Judicial Interpretation on effective date of the aforesaid amendment

On account of controversy around amendment being prospective or retrospective in nature, the Appellate Tribunal in the case of Crescent Roadways (P.) Ltd. v. Dy. CIT [IT Appeal No. 1952 (Hyd.) of 2018, dated 1-7-2021] and Insta Exhibitions (P.) Ltd. v. Addl. CIT [IT Appeal No 6941 (Delhi) of 2017, dated 3-8-2021] has held that the amendments are operative prospectively basis the effective date of amendment as provided under notes on clauses to Finance Bill, 2021.

Click Here To Read The Full Article

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA