[Opinion] RoC punishes company & directors for operating a partnership firm after its takeover

- Blog|News|Company Law|

- 4 Min Read

- By Taxmann

- |

- Last Updated on 30 January, 2023

[2023] 146 taxmann.com 494 (Article)

1. The brief details of this case

This is a classic case decided by the Registrar of Companies/Adjudication Officer of Gujarat, and Dara & Nagar Haveli on 17th January 2023 in respect of M/s Aegis Lifesciences Private Limited.

Aegis Lifesciences Partnership concern has been conducting its business operations in the line of manufacturing & exporting all major types of Haemostats – made of Absorbable Gelatin, Oxidized Regenerated Cellulose (ORC) and medical grade PVA sponges since 2008. M/s Aegis Lifesciences Private Limited was incorporated in the year 2019 with the object of covert/acquiring/takeover of the existing business, assets and liabilities of M/s Aegis Lifesciences Partnership concern which was run by seven partners. Upon the incorporation of the Aegis Lifesciences Private Limited, the company took over the business of the Aegis Lifesciences Partnership concern by following the due procedure of the law.

As per the provisions of the Companies Act 2013, the company is subjected to the provisions of the Companies Act along with the terms and conditions of the Memorandum and Association of the company which are binding on the company. The members of the company are bound to adhere to the covenants of these documents as if they respectively had been signed by the company by each member and all members on their part to adhere to all the provisions of the Memorandum o Association and Articles of Association of the company.

It was found by the Registrar of Companies that the company in question has been conducting its operations and doing the business and also simultaneously conducting the business of the partnership firm which has been taken over already by the company by using the same GSTN number. Carrying on business and continuing the operations of the company and as well as partnership firm even after the takeover amounts to activities being carried out for a fraudulent and unlawful purpose and also a breach of main object no. 1 of the company’s objectives of its MOA, as stated under clause 3A of the company’s Memorandum and Articles of Association. Obviously, the above is in violation of the provisions of the Companies Act 2013 and the Registrar of Companies has proceeded against the company and its directors as they are liable for the violation and were penalized under the provisions of the Companies Act 2013.

Let us go through the relevant case law on the above subject to understand the matter in detail.

2. Relevant provisions under the Companies Act 2013 relating to this case

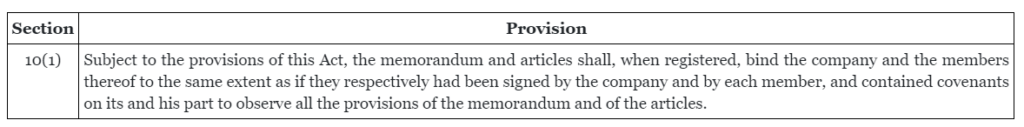

Section 10(1) is the relevant provisions relating to this case which is reproduced below.

Section 10 Effect of Memorandum and Articles (effective from 1st April 2014 as amended from time to time).

3. Penal provisions for default/non-compliance

Section 450 of the Companies Act 2013 is the relevant provision relating to penalties. The relevant section is produced below:-

Section 450 – Punishment where no specific penalty or punishment is provided (effective from 12th September 2013)

If a company or any officer of a company or any other person contravenes any of the provisions of this Act or the rules made thereunder, or any condition, limitation or restriction subject to which any approval, sanction, consent, confirmation, recognition, direction or exemption in relation to any matter has been accorded, given or granted, and for which no penalty or punishment is provided elsewhere in this Act, the company and every officer of the company who is in default or such other person shall be liable to a penalty of ten thousand rupees, and in case of continuing contravention, with a further penalty of one thousand rupees for each day after the first during which the contravention continues, subject to a maximum of two lakh rupees in case of a company and fifty thousand rupees in case of an officer who is in default or any other person.

4. Consequences of default/non-compliance

To understand the consequences of any default while complying with the provisions of section 10(1) of the Companies Act 2013 relating to non-adherence of the covenants of the Memorandum and Articles of Association of the company, let us go through the decided case law by the Registrar of Companies, Gujarat, Dara & Nagar Havelion this matter on 17th January 2023 in respect of M/s Aegis Lifesciences Private Limited of Ahmedabad.

5. The relevant case law

The relevant case law is the adjudication order passed on 17th January 2023 by the Registrar of Companies, Gujarat, and Dara & Nagar Haveli- order in the matter of adjudication of penalty under section 454(3) of the companies (Adjudication of Penalties) Rules 2014 for violation of section 10 of the Companies Act 2013 in the matter of M/s. Aegis Lifesciences Private Limited.

Click Here To Read The Full Article

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA