[Opinion] RoC penalties on Company & its Directors for failing to disclose required financial information

- Blog|News|Company Law|

- 3 Min Read

- By Taxmann

- |

- Last Updated on 4 January, 2023

[2023] 146 taxmann.com 47 (Article)

1. Annual Financial statement

Each and every company incorporated under the Companies Act 1956/2013, is required to present a financial statement (annual report) to the shareholders along with the board’s report to its shareholders at the annual general meeting and thereafter, they are required to file the same with the Registrar of Companies within the specified time period. The annual filing of the financial statements is the most important means of communication by the board of directors of a company with its shareholders.

2. The framework of the Companies Act 2013 on this matter

As per the provisions of the Companies Act 2013, the financial statement is required to be accompanied by the auditor’s report issued by the statutory auditors and also with a board’s report prepared by the board of directors of the company.

The financial statements are required to have the relevant notes/schedules that are required to be accompanied by the financial statements are often as important as the financial statements themselves. The notes and schedules could provide critical information not found on the balance sheet, profit and loss account, cash flow statement or statement of changes in equity.

One of the mandatory requirements amongst others while preparing the financial statement is the disclosure of significant accounting policies of the company as required as per the Accounting Standard. This disclosure is very important since the company’s state of affairs and of the profit or loss can be significantly affected by the accounting policies followed in the preparation and presentation of the financial statements. The accounting policies followed vary from company to company. Disclosure of significant accounting policies followed is necessary if the view presented is to be properly appreciated

2.1 At this stage we can summarize

We could summarize that the financial statements which are prepared, presented, and adopted by the members at the annual general meeting are required to be filed with the Registrar of Companies along with the board’s report and other mandatory enclosures/attachments. The financial statements need to disclose the significant accounting policies adopted by the company and the financial statements need to accompany the required notes and schedules and these are mandatory requirements.

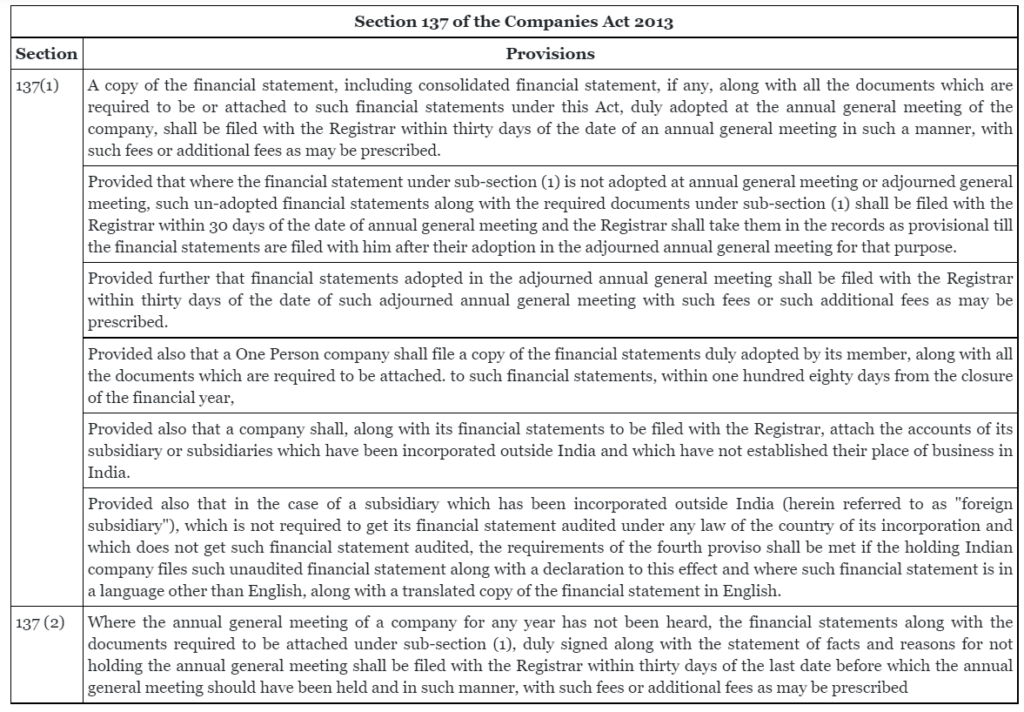

3. Provisions of the Companies Act, 2013 on the filing of financial statements along with auditors’ report

Section 137 (1) of the Companies Act 2013 relating to a copy of the financial statement to be filed with the Registrar read with section 134 (2) of the Companies Act 2013 under the heading financial statement, board report etc., are the relevant sections which are reproduced below.

4. Penal provisions in case of any violation/default

Sub-section (3) of section 137 provides for a penalty for any violation/default committed by the company. As per 137(3) of the Companies Act 2013, if a company fails to file the copy of the financial statements under sub-section (1) or sub-section (2), as the case may be, before the expiry of the period specified therein, the company shall be liable to a penalty of ten thousand rupees and in case of continuing failure, with a further penalty of one hundred rupees for each day during which such failure continues, subject to a maximum of two lakh rupees, and the managing director and the chief financial officer of the company, if any, and, in the absence of the managing director and the chief financial officer, any other director who is charged by the board with the responsibility of complying with the provisions of this section, and, in the absence of any such director, all the directors of the company, shall be liable to a penalty of ten thousand rupees and in case of continuing failure, with further penalty of one hundred rupees for each day after the first during which such failure continues, subject to o maximum of fifty thousand rupees.

Click Here To Read The Full Article

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA