[Opinion] RBI notifies revised regulatory framework on Overseas Investment

- Blog|News|FEMA & Banking|

- 12 Min Read

- By Taxmann

- |

- Last Updated on 26 August, 2022

[2022] 141 taxmann.com 402 (Article)

Segregates the regulatory and the operational part in OI rules and regulations respectively.

Investments by Indian entities outside India is a very common phenomenon and several companies have presence outside India by virtue of forming a Joint Venture (‘JV‘) and Wholly Owned Subsidiaries (‘WOS‘). With the enforcement of amendment proposed in Finance Act, 2015 in October, 2019 powers vested with Central Government (CG) and Reserve Bank of India (RBI) with respect to permissible Capital Account Transaction were revisited. Power to frame rules relating to Non-Debt instruments (‘NDI‘) were vested with CG and to frame regulations relating to debt instruments were vested with RBI. The scope of NDI inter alia covers all investment in equity instruments in incorporated entities: public, private, listed and unlisted; acquisition, sale or dealing directly in immoveable property.

RBI, with effect from August 22, 2022 has combined erstwhile FEMA (Transfer or Issue of Foreign Security) Regulations, 2004 (‘erstwhile ODI regulations‘) and FEMA (Acquisition and Transfer of immovable property outside India) Regulations, 2015 into FEMA (Overseas Investment) Rules, 2022 (‘OI Rules‘) and FEMA (Overseas Investment) Regulations, 2022 (‘OI Regulations‘) and the erstwhile regulations stand superseded. The draft rules and regulations were rolled out for public comments on August 9, 2021. Our article on the draft regulatory framework is available on our website. RBI has also issued the compiled FEMA (Overseas Investment) Directions, 2022 (‘OI Directions‘) covering the OI Rules and OI Regulations grouping the requirements under three categories viz. General provisions, Specific provisions and Other operational instructions to the AD Banks. It also provides for certain compliance requirements from the erstwhile ODI Master Directions, not covered in OI Rules or Regulations.

Overseas Investments are prohibited unless made in accordance with the FEMA Act, OI Rules and OI Regulations. The investments already made in accordance with the erstwhile ODI Regulations will be deemed to have been made under OI Rules and Regulations. This article provides an overview of the notified rules and regulations and the broad amendments as compared to the erstwhile norms.

OI Rules v/s OI Regulations

OI Rules provides the regulatory framework for making of overseas investment covering the permissions, conditions for making overseas investment, restrictions from making Overseas Direct Investment (‘ODI‘), pricing guidelines, transfer, liquidation and restructuring of ODI. While the OI Rules have been framed by CG, however, the same will be administered by the RBI as per Rule 3 (1).

OI Regulations, on the other hand, provides only the operational part covering conditions for undertaking Financial Commitment (‘FC‘), other than by investment in equity capital, consideration in case of acquisition or transfer of equity capital of a Foreign Entity (‘FE‘), mode of payment, obligations of Persons Resident in India (‘PRII‘), reporting requirements, consequence of delay in reporting and restrictions on further FC/ transfer.

Non-applicability of OI Rules and Regulations (Rule 4)

1. Investments made by a financial institution in an IFSC. The draft OI Rules provided for exclusion of any investment made in IFSC, however the OI Rules prescribes the conditions for investment in IFSC vide Schedule V to OI Rules);

2. Acquisition or transfer of any investment outside India made out of Resident Foreign Currency Account (draft rules provided for exception only in case of acquisition of an immoveable property outside India by an individual from a person resident outside India. However, Para A.5 of erstwhile ODI Master Directions exempted purchase/ acquisition of securities out of the funds held in the RFC account);

3. Acquisition or transfer of any investment outside India made out of foreign currency resources held outside India by a person who is employed in India for a specific duration irrespective of length thereof or for a specific job or assignment, duration of which does not exceed three years; or

4. Acquisition or transfer of any investment outside India made in accordance with Section 6(4) of FEMA Act i.e. where the investment in the foreign security or any immovable property situated outside India was acquired when the person was resident outside India or inherited from a person who was resident outside India.

Further, the erstwhile ODI Master Directions provided general permission for purchase/acquisition of securities by a person resident in India as bonus shares on existing holding of foreign currency shares and also for rights shares against holding of shares in accordance with provisions of law. The OI Rules cover the same under Rule 7.

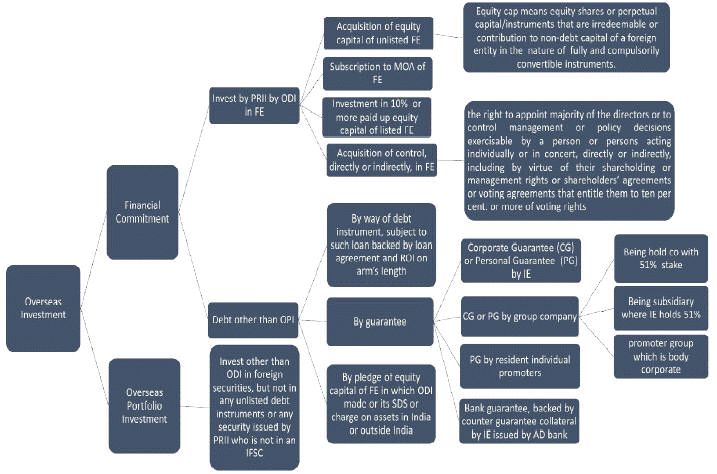

Components of Overseas Investment (Rule 2)

Under the erstwhile ODI regulations, effective till August 21, 2022, there was a concept of direct investment outside India in JV and WOS that excluded portfolio investment and FC. OI Rules combine the two to define FC and separately define the term Overseas Portfolio Investment (‘OPI‘). Overseas Investment (‘OI‘) is FC + OPI. The classification as ODI depends on the nature of instruments in which investment is made, the nature of the entity in which investment is made and whether control has been acquired or not. The diagram below provides a snapshot of the same.

ODI in an unlisted foreign entity may or may not result in control. However, ODI in a listed foreign entity will result in control as holding of 10% or more of the paid-up equity capital of the listed foreign entity will entitle to 10% or more of voting rights in the said entity.

ODI v/s OPI

OPI means investment in foreign securities that is not ODI and excludes investment in any unlisted debt instruments or any security issued by a person resident in India who is not in an IFSC. The classification is relevant as Schedule I and II to the ODI Rules provides for the manner in which ODI and OPI can be made by an Indian Entity. The limits for OPI and ODI are different. In case of ODI by IE, the limit for FC in all FEs taken together is 400 % of the net worth as on the date of the last audited balance sheet, while in case of OPI the limit is 50% of the net worth as on the date of the last audited balance sheet. The limit of FC does not include capitalization of retained earnings but includes utilization of balances in the EEFC a/c., utilization of the amount raised by issue of ADR, GDR and stock swap and utilization of ECB proceeds. This was excluded under the erstwhile regime and in order to ensure smooth transition, as indicated in the OI Directions. FC through such resources after the date of notification will be reckoned towards FC limit. Limits for investment by resident individual is pegged to the limit under the Liberalized Remittance Scheme (‘LRS‘). Further, the limit for investment by mutual funds, venture funds etc are similar to erstwhile regime.

A listed IE is eligible to make OPI within the aforesaid limit, while an unlisted IE is eligible to make OPI only towards rights issue or bonus issue by FE, capitalization of any amount due, swap of securities and schemes of arrangement.

Restriction on layers of subsidiary (Rule 19)

RBI FAQs on erstwhile ODI Regulations prohibited an India Party to set up an Indian subsidiary(ies) through its foreign WOS or JV and also prohibited an IP to acquire a WOS or invest in JV that already had direct/indirect investment in India under the automatic route. In such cases, the IPs were required to approach the Reserve Bank for prior approval through their AD Banks which were considered on a case to case basis, depending on the merits of the case.

Under the present OI Rules, the prohibition is applicable only where it results in a structure with more than two layers of subsidiaries. The exemption is provided to the entities covered under Rule 2 (2) of Companies (Restriction on Number of Layers) Rules, 2017. The OI Rules seems to have diluted the stringent norms under the erstwhile provisions.

Investment in debt instruments by Indian Entity (IE) (Reg. 3)

The distinction between debt and non-debt instruments as provided in Rule 5 of the OI Rules is relevant as OI Regulations provide for conditions to be complied by an Indian entity while investing in any debt instrument. The components of non-debt instruments are the same as defined under FEMA (Non-Debt Instruments) Rules, 2019. Debt instrument means government bonds, corporate bonds, all tranches of securitisation structure which are not equity tranche, borrowings by firms through loans and depository receipts whose underlying securities are debt securities.

The underlying conditions for investing in debt instruments of an FE, as provided in Reg. 3 of OI Regulations, is that the entity should be eligible to make ODI and should have made ODI in the foreign entity and the entity should have acquired control in such foreign entity at the time of making such financial commitment.

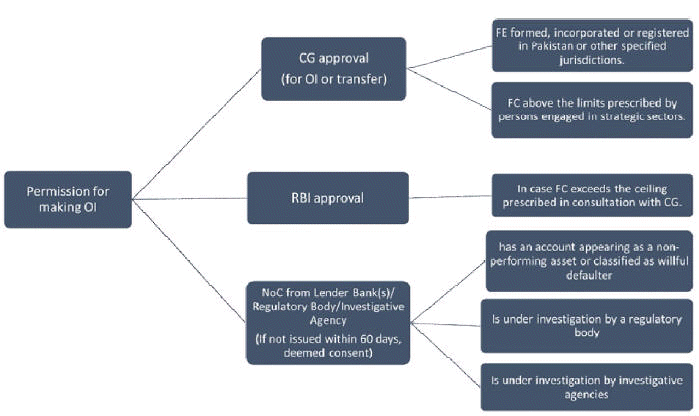

Approval requirement (Rule 9, 10)

The OI Rules provide for investments that will require prior approval of CG, RBI and NOC from lender banks/ regulatory bodies etc. The Erstwhile ODI Regulations only mandated prior approval of RBI in case eligibility conditions stipulated were not met by the Indian party or resident individual.

The erstwhile ODI Master Directions prohibited an Indian Party from making direct investment in countries identified by Financial Action Task Force (‘FATF’) as ‘non co-operative countries and territories’ as per the list available on FATF website or as notified by RBI. The OI Rules do not expressly provide for such prohibition, however, empowers the CG to advise countries or jurisdictions where overseas investment shall not be made.

Further, as provided in the erstwhile ODI Master Directions for prior approval of RBI for any FC exceeding USD 1 billion or its equivalent in a financial year even when the total FC of the Indian Party was within the eligible limit under automatic route (i.e. within 400% of the net worth as per the last audited balance sheet), the requirement continues under the current regime as well.

Procedure for seeking approval of RBI has been provided in the OI Directions.

Approval requirement has been dispensed for deferred payment of consideration, investment/ disinvestment by PRII under investigation by any investigative agency/ regulatory body, issuance of corporate guarantee to or on behalf of second or subsequent step down subsidiary and write-off on account of disinvestment.

The concept of ‘deemed consent’ in case of NOCs upon expiry of sixty days from the date of application may be a cause of concern for the lenders/ banks/ regulatory agencies etc.

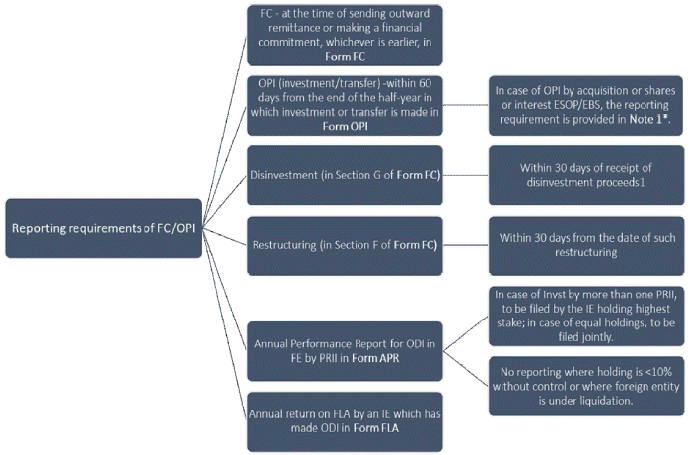

Reporting requirements (Reg. 10)

The OI Regulations provide for various reporting requirements for FC and OPI including in case of disinvestment and restructuring. Reporting is very crucial as the OI Rules provide for prohibition on further FC or transfer to continue until any delay in reporting is regularized with payment of Late Submission Fees (‘LSF’) for an amount and in the manner as provided in the OI Directions. LSF amount is levied per return and the maximum amount for LSF will be limited to 100% of amount involved in the delayed reporting. The erstwhile ODI regulations restricted only in case of non-filing of Form APR. The format of forms have been provided in the Master Directions on Reporting under FEMA Act. Incomplete filing will be considered as non-submission.

Note 1: In case of OPI by way of acquisition of shares or interest under Employee Stock Ownership Plan or Employee Benefits Scheme, the reporting is required to be done by the office in India or branch of an overseas entity or a subsidiary in India of an overseas entity or the Indian entity in which the overseas entity has direct or indirect equity holding, where the resident individual is an employee or director.

Further, as per the OI Directions, similar to the requirement under the erstwhile regime, evidence of investment that classify as ODI is required to be submitted within a period of six months to the AD Bank.

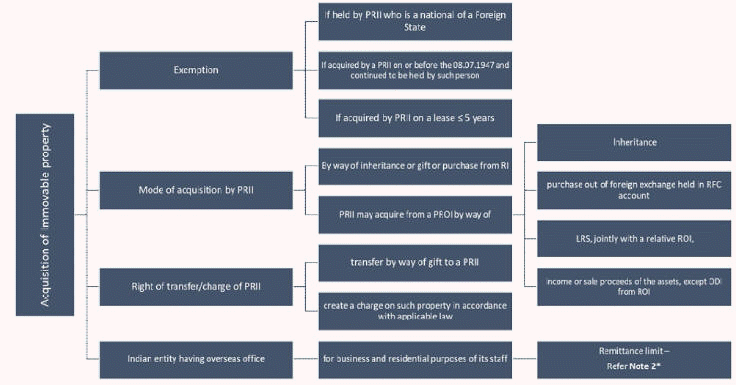

Acquisition and transfer of immovable property outside India (Rule 21)

-

- Restriction on acquisition of immovable property outside India will not apply in case the same is acquired on lease by PRII for a period not exceeding 5 years. Manner of transfer of immovable properties also prescribed.

- Source of funds for acquiring immovable property outside India to include limits under Liberalised Remittance Scheme (LRS) and out of income/ sale proceeds of the assets, other than ODI, acquired overseas.

Note 2: In case of acquisition by Indian entity, the existing limits for remittance towards initial and recurring expenses remain intact, as provided below:

-

- Initial expense – higher of 15% of the average annual turnover during last 2 years or 25% of the net worth of the IE;

- Recurring expense – 10% of the average annual turnover during last 2 years

Other key amendments notified

-

- Prohibition for making ODI, in addition to FE engaged in real estate activity, extended to gambling activity of any kind and dealing with financial products linked to the Indian rupee without specific approval of RBI.

- The OI Rules permit an IE not engaged in financial services activity in India to make ODI in an FE, which is directly or indirectly engaged in financial services activity, except banking or insurance, subject to the condition that such IE has posted net profits during the preceding three financial years. With respect to insurance, an IE not engaged in the insurance sector can make ODI in general and health insurance where such insurance business is supporting the core activity undertaken overseas by such an IE. The erstwhile provisions permitted only regulated entities in financial service activity to invest in JV or WOS outside India.

- In case of ODI in start-ups, investment cannot be made out of borrowed funds. Necessary certification is to be provided to the AD Bank from statutory auditors or chartered accountants of IE.

- In case of disinvestment of ODI by a PRII, the transferor must have held investment for atleast 1 year from the date of making OI (erstwhile ODI Master Directions provided for the overseas concern to have been in operation for at least one full year and submission of APR together with the audited accounts for that year to RBI);

- In case of pledge or charge in favor of an overseas lender, the lender should be from a country or jurisdiction in which FC is permitted under OI Rules.

- The OI Rules permit acquisition or transfer by way of deferred payment. The period of deferment to be decided upfront. In case of acquisition, the deferred part of the consideration in case of acquisition of equity capital of an FE by a PRII will be treated as a non-fund based commitment. Subsequent payments to be reported in Form FC as conversion of non-fund based commitment to equity.

- In case of restructuring, under the erstwhile regime, RBI approval was required for an unlisted IE for restructuring the balance sheet of the overseas entity involving write off of upto 25% of the investment. In case of listed IE, the same was permitted upto 25% of the investment under automatic route. The present OI Rules, restructuring of the balance sheet is permitted for FE which has been incurring losses for the previous two years as evidenced by its last audited balance sheets, compliance has been ensured for reporting and documentation and the diminution in the total value of the outstanding dues after such restructuring does not exceed the proportionate amount of the accumulated losses. Prerequisite is a certification for the diminution in value on an arm’s length basis by a registered valuer as per the Companies Act, 2013 (18 of 2013) or corresponding valuer registered with the regulatory authority or certified public accountant in the host jurisdiction, dated not more than six months before the date of the transaction shall be submitted to the designated AD bank. The requirement of certificate will apply only where the amount of corresponding original investment is more than USD 10 million or in the case where the amount of such diminution exceeds twenty per cent of the total value of the outstanding dues towards the Indian entity or investor.

- Limit of FC upto 400% of net worth not applicable to FC made by “Maharatna” PSUs or “Navratna” PSUs or subsidiaries of such PSUs in foreign entities outside India engaged in strategic sectors. Strategic sectors defined to include energy and natural resources sectors such as Oil, Gas, Coal and Mineral Ores, submarine cable systems, start ups and any other sector that may be advised by CG.

- Definition of net worth has been aligned with Companies Act, 2013.

- Bonafide activity defined to mean such business activity permissible under any law in force in India and the host country or host jurisdiction, as the case may be.

- AD Banks to put in place a board approved policy, within 2 months from the date of the OI Directions i.e. by October 22, 2022 inter alia providing documents to be taken by the AD Bank, method of valuation to be taken into consideration, scenarios when valuation will not be insisted for etc.

Amendments proposed but not notified

-

- ODI in technology ventures through an Overseas Technology Fund (OTF) permitted for listed IE with minimum net worth of Rs. 500 crore, for the purpose of investing in overseas technology startups engaged in an activity which is in alignment with the core business of such IE.

- Permissible range of 5% of the fair value arrived on an arm’s length basis as per any internationally accepted pricing methodology for valuation duly certified by a registered valuer as per the Companies Act 2013; or similar valuer registered with the regulatory authority in the host jurisdiction to the satisfaction of the AD bank provided along with period of validity of valuation certificate upto 6 months before the date of the transaction.

Concluding remarks

The new regime for OI, substituted after 18 years of the erstwhile regime, is more clear and elaborate and covers conditions for investments overseas by IE, resident individual and entities other than the IE and the individuals. Certain compliance requirements have been liberalized, where approval requirements have been done away with as discussed in above paragraphs; at the same time consequence of delayed reporting has been made more stringent. Most of the amendments proposed in the draft rules and regulations have been notified except for very few. IEs are required to take note of the components of the existing investments and the reporting compliances ensured. Those funding the OI through EEFC a/c, ADR/ GDR proceeds, ECB proceeds will be required to take note of the deletion of the carve out effective from August 22, 2022. There exists some lack of clarity on restriction on layers of subsidiaries, which RBI may consider to clarify in its FAQs.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA