[Opinion] GST Implications on Issuance of Vouchers

- Blog|News|GST & Customs|

- 3 Min Read

- By Taxmann

- |

- Last Updated on 14 March, 2023

CA Sri Harsha – [2023] 148 taxmann.com 175 (Article)

The recent judgment of Karnataka High Court in the matter of Premier Sales Promotion (P.) Ltd. v. Union of India (for brevity ‘Premier Sales’) is an interesting development qua the taxability of the vouchers. The vouchers have occupied a prominent place under the erstwhile indirect taxation regime. There are occasions where the vouchers are tried and failed to be taxed as ‘goods’ for the purposes of state and other similar levies.

Under the GST regime, one can find mention about the ‘vouchers’. The legislature has defined the ‘voucher’ and there exists other provisions namely time of supply and valuation qua vouchers. This is a stark difference when compared with the previous regime. Though appreciable, there is still a lot, to be covered with respect to the taxability of ‘voucher’.

In this article, we shall try to examine certain issues that surround the taxability of ‘voucher’. In order to explore the various issues, we need to first understand what a ‘voucher’ is?

Vouchers and Types

The ‘voucher’ is defined vide section 2(118) of CT Act to mean an instrument where there is an obligation to accept it as consideration or part consideration for supply of goods or services or both and where the goods or services or both to be supplied or the identities of their potential suppliers are either indicated on the instrument itself or in related documentation, including the terms and conditions of use of such instrument.

Hence, from the above, it boils down, that we can call an instrument as a ‘voucher’ only if the following two conditions are satisfied; where there is an obligation to accept it as consideration or part consideration for supply and where the goods/services/both to be supplied/identities of potential suppliers are indicated.

The first condition that is acceptance of instrument towards consideration, whether in whole or in part does not present any issue and can be said to be satisfied. The second condition that in order for an instrument to qualify as vouchers, there should be the identification of the goods or services or both to be supplied or identities of potential suppliers are available either on the instrument itself or in related documentation, including the terms and conditions, presents a challenge.

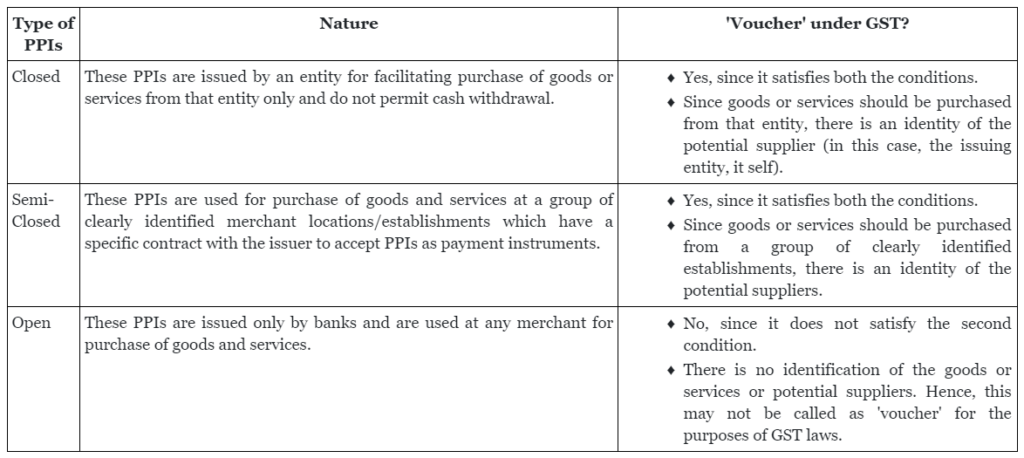

Not all vouchers may have an identity qua the goods or services or the potential suppliers. RBI classifies the pre-paid payment instruments (PPIs) into three categories; closed system PPIs, semi-closed system PPIs and open system PPIs. Let us see, whether which of the above PPIs qualify as ‘voucher’ under the GST laws.

From the above, we understand that there are certain type of PPIs, that is ‘Open System PPIs’ which do not qualify as ‘voucher’ as per the definition available in CT Act. We shall understand the tax implications on issuance of such type of vouchers at appropriate place. Further, since the closed system PPIs are not regulated by RBI, as these instruments cannot be used for payments or settlement for third party services, the implications of this non-regulation by RBI also has a potential of creating taxation issues, which we shall deal at appropriate place.

Now, let us proceed to examine, the tax implications on issuance of semi-closed PPIs, which satisfy the definition of ‘voucher’ under GST laws. In order to understand the tax implications, we need to first agree upon, as to, whether a ‘voucher’ can be called as ‘goods’ or ‘service’? This is important because, under the GST laws, there exists a separate legislative treatment for goods and services.

Click Here To Read The Full Article

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA