New Foreign Trade Policy 2023 | Key Highlights and Innovative Approaches for Export Promotion and Ease of Doing Business

- Blog|GST & Customs|

- 4 Min Read

- By Taxmann

- |

- Last Updated on 17 May, 2023

Table of Contents

1. Foreign Trade Policy 2015-20

2. New Foreign Trade Policy 2023

3. New FTP Approach

4. Key FTP Highlights

R.K Jain's Foreign Trade Policy 2023 incorporates the Foreign Trade Policy 2023 and Notifications, Public Notices, Forms and Allied Act & Rules. It is an imprint edition of the Foreign Trade Policy 2023. It also includes a glossary of terms for Foreign Trade Policy & Customs.

1. Foreign Trade Policy 2015-20

FTP 2015-20 which was to end on 31.3.2020 was extended due to the COVID pandemic and volatile geo-political scenario till 31.03.2023.

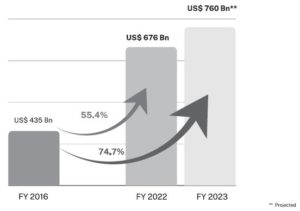

India has reached record high Export Performance in Merchandise and Services Exports during this period. India’s Merchandise and Services exports are expected to exceed USD 760 Billion in FY 2022-23. FTP 2015-20 contributed to this illustrious export performance.

2. New Foreign Trade Policy 2023

- Policy changes were being undertaken since 2015 even without announcement of a new FTP responding dynamically to the emerging situations.

- The Foreign Trade Policy 2023 is being announced to provide the policy continuity and a responsive framework.

- Subsequent revision(s) in the FTP shall be done as and when required and shall not linked to any date.

- Continuous feedback from Trade and Industry to streamline processes and update Policy & procedures.

3. New FTP Approach

- From Incentives to Tax Remission

- Greater Trade facilitation through technology, automation and continuous process re-engineering

- Export promotion through collaboration: Exporters, States, Districts

- Focus on Emerging Areas – E-Commerce Exports, Developing Districts as Export Hubs, Streamlining SCOMET policy et al.

4. Key FTP Highlights

4.1 Ease of doing business, reduction in transaction cost and e-initiatives

4.1.1 Online approvals without physical interface

- Automatic approval of various permissions under Foreign Trade Policy based on process simplification and technology implementation.

- Reduction in processing time and immediate approval of applications under automatic route for exporters—

| Permission type | Current processing time | Automatic route processing time |

| Advance authorization issuance | 3 to 7 days | 1 day |

| EPCG issuance | 3 to 7 days | 1 day |

| Revalidation of authorizations | 3 days to 1 month | 1 day |

| Extension of Export Obligation period | 3 days to 1 month | 1 day |

4.1.2 Reduction in user charges for MSMEs under AA and EPCG

-

- Application fee being reduced for Advance Authorization and EPCG Schemes.

- Will benefit 55-60% of exporters who are MSMEs.

- Fee structure as shown below—

(In Rupees)

| Licence Value in Rupees | User charges for non-MSMEs | Reduced User charges for MSMEs |

| Up to 1 crore | 1 per 1,000 | 100 |

| 1 crore to 10 crores | 1 per 1,000 | 5,000 |

| Above 10 crores | Cap at 1,00,000 | 5,000 |

4.1.3 E-Certificate of Origin

- Revamp of the e-Certificate of Origin platform proposed to provide for self-certification of CoOs as well as automatic approval of CoOs, where feasible.

- Initiatives for electronic exchange of CoO data with partner countries envisaged.

4.1.4 Paperless filing of export obligation discharge applications

- All authorisation redemption applications to be paperless – This is in addition to application process for issuance being already paperless. With this, the entire lifecycle of the authorization shall become paperless.

4.2 Export promotion initiatives

4.2.1 Status Holder Export Thresholds Rationalised

Export performance threshold for Recognition of Exporters as Status Holders rationalized. Enabling more exporters to achieve higher status and reduced transaction cost for exports.

(In USD Million)

| Status House Category | Existing Export Performance Threshold | Revised Export Performance Threshold |

| One Star | 3 | 3 |

| Two Star | 25 | 15 |

| Three Star | 100 | 50 |

| Four Star | 500 | 200 |

| Five Star | 2000 | 800 |

4.2.2 Merchanting trade reform

To boost merchanting activities from India – Merchanting trade involving shipment of goods from one foreign country to another foreign country without touching Indian ports, involving an Indian intermediary is allowed subject to compliance with RBI guidelines, except for goods/items in the CITES and SCOMET list.

4.2.3 Rupee payment to be accepted under FTP Schemes

- Effective step towards internationalization of Rupee.

- FTP benefits extended for rupee realizations through special Vostro accounts setup as per RBI circular issued on 11 July, 2022.

4.2.4 Towns of Export Excellence

- Four new towns of export excellence declared.

| Town of Export Excellence | Product Category |

| Faridabad | Apparel |

| Moradabad | Handicrafts |

| Mirzapur | Handmade Carpet and Dari |

| Varanasi | Handloom & Handicraft |

- These 4 new towns of export excellence (TEE) are in addition to the already existing 39 towns of export excellence.

- This scheme gives thrust to cluster based economic development.

- TEEs are industrial clusters that are recognized based on their export performance.

- Recognition to these industrial clusters is granted with a view to maximize their potential and enable them to move up the value chain and to tap new markets.

- Benefits under TEE Scheme are:

Recognition

- Helps in getting recognition/credibility attached to industrial units of the region/town while exploring/expanding into newer markets.

- Puts such industrial units/town on the global stage.

MAI Scheme

- Recognized associations of units are provided financial assistance under Market Access Initiative Scheme on priority basis, for export promotion projects for marketing, capacity building and technological services.

- Through this scheme such units can get financial assistance to visit various trade exhibitions/fairs for exploring more marketing avenues.

Common Service Provider facility

- Common Service Providers in TEE are entitled for Authorisation under EPCG Scheme which can help in increasing the competitiveness of the cluster and provide enabling environment.

- This arrangement gives facility to exporters to not own all the infrastructure for conversion from inputs to final export products.

4.3 Districts as Export Hubs initiative

4.3.1 States and Districts as partners in export promotion

- Districts as Export Hubs aims to boost India’s foreign trade by decentralizing export promotion.

- Bring a greater level of awareness and commitment regarding exports at the district level.

- Identification of products/services in all the districts.

- Create institutional mechanisms at the State and District level to strategize exports (State Export Promotion Committee & District Export Promotion Committee).

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA